Medical Imaging Market By Product Type (X-ray Devices (Radiography, Mammography, and Fluoroscopy), Computed Tomography (Mid end slice CT, Low end slice CT, High end slice CT, and Cone beam CT), Ultrasound (Cart/Trolley Based, Compact, and Handheld), Magnetic Resonance Imaging (Open System, and Closed System), Nuclear Imaging (SPECT, and PET)), By Application (Orthopedics, Oncology, Neurology, Gynecology, Gastroenterology, Cardiology, and Others), By End-user (Hospitals & Clinics, Diagnostics Imaging Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 11771

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

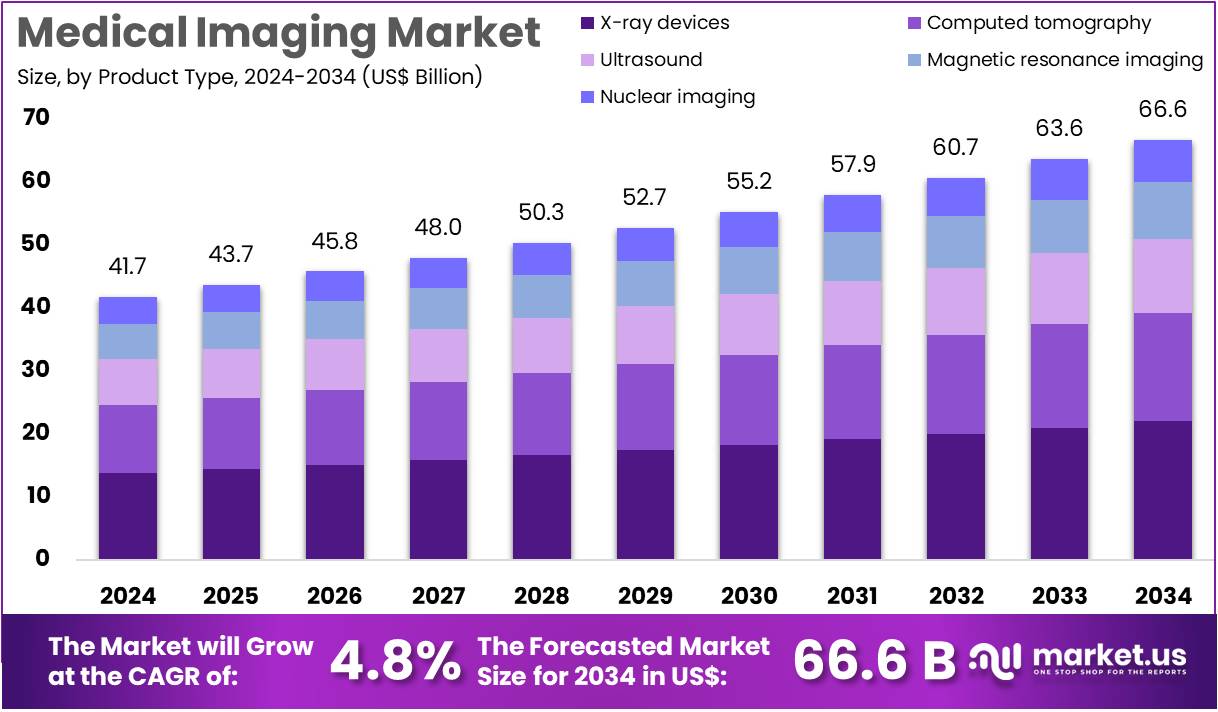

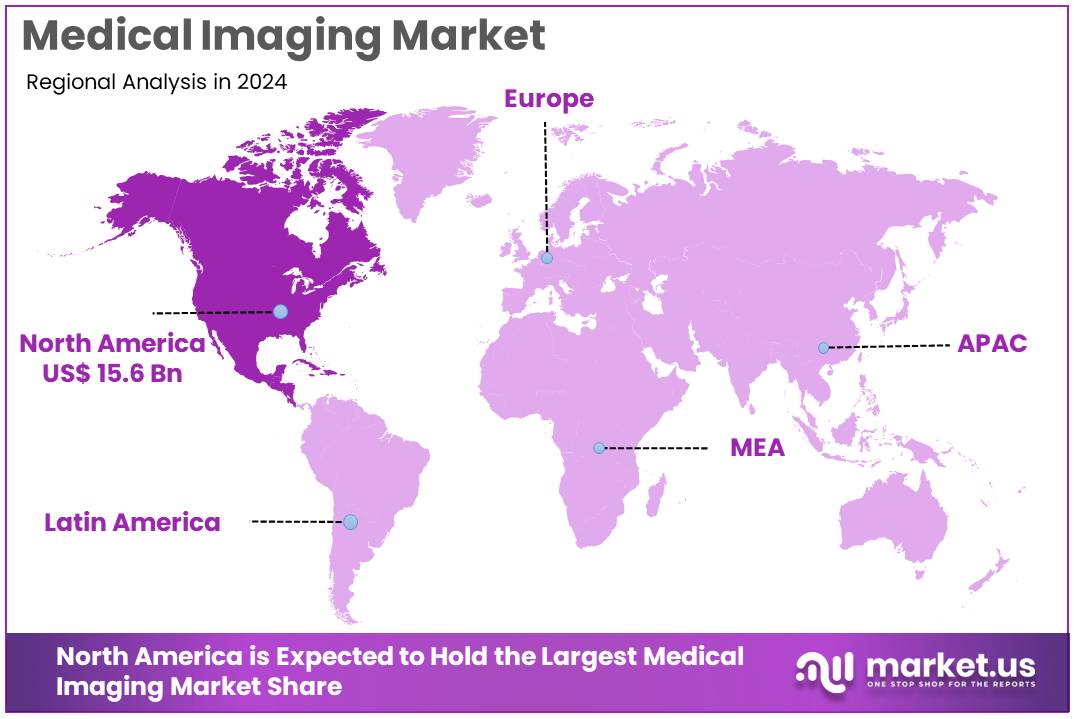

The Medical Imaging Market Size is expected to be worth around US$ 66.6 billion by 2034 from US$ 41.7 billion in 2024, growing at a CAGR of 4.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.5% share and holds US$ 15.6 Billion market value for the year.

Rising prevalence of chronic diseases is driving the growth of the medical imaging market, as healthcare providers increasingly prioritize advanced diagnostics for timely interventions. Clinicians are deploying MRI systems for neurological applications, enabling precise brain mapping to guide treatments for conditions such as epilepsy. The rising burden of oncology cases is also fueling demand, with software enhancements for PET-CT scans playing a key role in tumor staging and radiotherapy planning.

Hospitals are utilizing ultrasound for cardiovascular assessments, allowing real-time monitoring of heart valve function to inform surgical decisions. In November 2023, Canon Medical Systems introduced the Aquilion ONE / INSIGHT Edition and Aquilion Serve SP at RSNA 2023, which offer faster CT scans with superior image quality. According to the WHO, non-communicable diseases account for 41 million deaths annually, highlighting the urgent need for robust imaging solutions across a variety of clinical applications.

Growing integration of artificial intelligence (AI) is creating significant opportunities in the medical imaging market. Innovators are developing AI algorithms to enhance mammography analysis, leading to improved breast cancer detection rates in screening programs. Research institutions are also leveraging imaging platforms for orthopedic studies, where 3D joint models are reconstructed to optimize prosthetic designs.

Opportunities are emerging in telemedicine as well, where cloud-based imaging supports remote consultations for lung disease evaluations. In February 2023, GE Healthcare acquired Caption Health, integrating AI-driven ultrasound tools to streamline interpretation and accelerate early disease detection. By August 2024, the FDA had cleared 950 AI-enabled medical devices, underscoring the transformative potential of these technologies to expand imaging applications.

Recent trends in the medical imaging market focus on high-throughput systems and interoperability to streamline diagnostic workflows. Developers are prioritizing cloud integrations for real-time image sharing, which aids multidisciplinary reviews, particularly in liver cancer diagnostics. In May 2023, Philips launched the CT 3500, a high-end system designed for routine radiology and high-volume screening, improving efficiency for large patient cohorts.

Additionally, portable ultrasound devices are gaining popularity for point-of-care applications, such as emergency trauma assessments. A recent survey noted a 27% increase in demand for AI-integrated imaging solutions in 2023, reflecting a shift toward precision-driven diagnostics. These advancements signal a dynamic evolution in the market toward scalable, interconnected imaging ecosystems that enhance diagnostic accuracy and operational efficiency.

Key Takeaways

- In 2024, the market generated a revenue of US$ 41.7 billion, with a CAGR of 4.8%, and is expected to reach US$ 66.6 billion by the year 2034.

- The product type segment is divided into x-ray devices, computed tomography, ultrasound, magnetic resonance imaging, nuclear imaging, with x-ray devices taking the lead in 2023 with a market share of 33.1%.

- Considering application, the market is divided into orthopedics, oncology, neurology, gynecology, gastroenterology, cardiology, and others. Among these, orthopedics held a significant share of 22.9%.

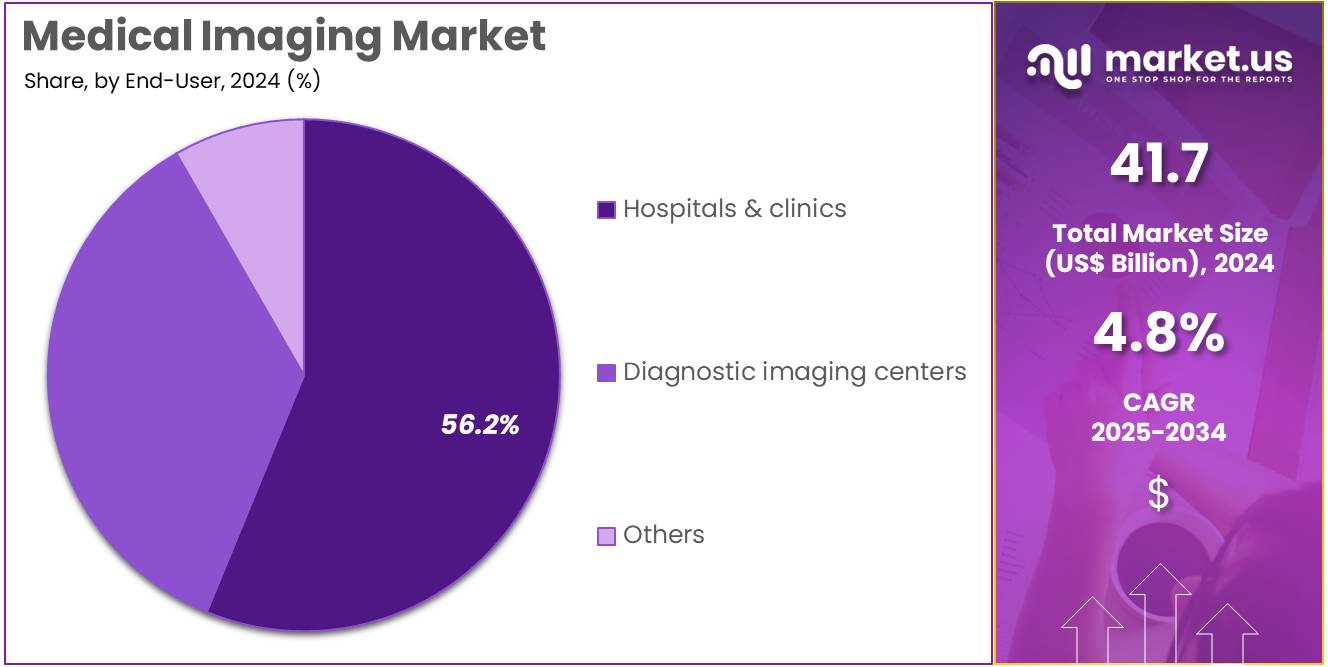

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, diagnostics imaging centers, and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 56.2% in the market.

- North America led the market by securing a market share of 37.5% in 2023.

Product Type Analysis

X-ray devices hold the largest share at 33.1% in the medical imaging market and are expected to continue growing due to their wide applicability, cost-effectiveness, and ease of use. X-ray imaging is critical in diagnosing a variety of conditions, including bone fractures, infections, and cardiovascular diseases. The segment is projected to experience growth due to the increasing prevalence of chronic conditions and trauma, where X-ray devices are a first-line diagnostic tool.

Additionally, technological advancements in digital X-ray systems, which offer higher image resolution and reduced radiation exposure, are likely to fuel demand. Furthermore, X-ray imaging remains essential for routine checkups and screening programs, especially in underserved regions where access to more advanced imaging technologies may be limited. The continued adoption of mobile and portable X-ray systems is expected to support growth, particularly in emergency care, elderly care, and rural healthcare settings, where mobility and convenience are key.

Application Analysis

Orthopedics holds a 22.9% share of the market and is anticipated to continue growing due to the rising incidence of musculoskeletal disorders, particularly among aging populations. As the global population ages, the demand for orthopedic imaging is expected to increase significantly. X-ray and MRI devices are commonly used in diagnosing conditions such as fractures, arthritis, joint replacements, and spinal disorders, making orthopedics a key application area.

The rise in sports injuries, along with the growing number of surgeries related to joint replacement, is likely to contribute to this growth. In addition, advancements in imaging technologies, such as high-resolution MRI and 3D imaging systems, are improving diagnostic accuracy in orthopedics, driving increased adoption. Increased awareness of preventive care and the availability of minimally invasive orthopedic procedures are also expected to spur demand for advanced imaging systems in this segment, further supporting market expansion.

End-User Analysis

Hospitals and clinics represent the largest share at 56.2% in the end-user segment and are expected to remain the dominant force in the medical imaging market. The increasing number of hospitals and outpatient clinics, driven by healthcare infrastructure expansion, is anticipated to propel this growth. Hospitals and clinics serve as the primary hubs for diagnostic imaging, where technologies like X-ray, CT scans, MRI, and ultrasound are routinely used for patient diagnosis and monitoring.

The growing prevalence of chronic diseases, such as cancer, cardiovascular diseases, and neurological conditions, is expected to drive an increased need for imaging services in these healthcare settings. Additionally, hospitals are adopting advanced imaging solutions with higher precision and faster turnaround times to improve patient care and operational efficiency. The integration of digital imaging systems and advancements in telemedicine are further expected to fuel the growth of this segment, as healthcare providers continue to enhance patient diagnostics and treatment outcomes.

Key Market Segments

By Product Type

- X-ray Devices

- Radiography

- Mammography

- Fluoroscopy

- Computed Tomography

- Mid end slice CT

- Low end slice CT

- High end slice CT

- Cone beam CT

- Ultrasound

- Cart/Trolley Based

- Compact

- Handheld

- Magnetic Resonance Imaging

- Open System

- Closed System

- Nuclear Imaging

- SPECT

- PET

By Application

- Orthopedics

- Oncology

- Neurology

- Gynecology

- Gastroenterology

- Cardiology

- Others

By End-user

- Hospitals & Clinics

- Diagnostics Imaging Centers

- Others

Drivers

Rising Prevalence of Chronic Diseases Driving the Market

The global increase in chronic diseases, particularly cancer and cardiovascular disorders, is a key driver for the medical imaging market. These conditions require advanced diagnostic tools for early detection, staging, and treatment planning. Technologies such as CT scans, MRI, and PET scans are crucial for identifying subtle pathologies and improving patient outcomes. The demand for imaging equipment grows significantly as early detection plays a critical role in managing these diseases.

For instance, cancer diagnoses continue to surge, with approximately 20 million new cases reported globally in 2022, according to the World Health Organization’s (WHO) International Agency for Research on Cancer (IARC). Additionally, there were 53.5 million cancer survivors requiring ongoing monitoring, driving the continuous need for imaging technologies. The aging population, which is more prone to chronic diseases, further fuels the growth of this market.

Restraints

High Costs of Advanced Imaging Equipment Restraining the Market

The high upfront and maintenance costs of advanced medical imaging equipment, such as high-end MRI and CT scanners, present a major constraint on the market, especially in developing countries and smaller healthcare facilities. The substantial capital required to purchase and maintain these systems creates barriers for clinics and hospitals with limited budgets, leading to unequal access to advanced diagnostics. In addition to the initial cost, hospitals face expensive installation, facility requirements, and annual service contracts, making these systems less accessible in resource-constrained environments.

Rising inflation and stagnant reimbursement rates have only worsened the financial pressure on hospitals, with the American Hospital Association (AHA) reporting a significant gap between rising inflation and modest increases in Medicare inpatient payments. This disparity affects hospitals’ ability to invest in modern imaging technologies, slowing the replacement of outdated equipment and hindering overall market growth.

Opportunities

Integration of Artificial Intelligence (AI) Creating Growth Opportunities

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into medical imaging workflows offers significant growth potential by improving diagnostic accuracy, efficiency, and patient throughput. AI-powered solutions enhance every stage of the imaging process—from image acquisition to automated analysis and reporting—allowing radiologists to streamline their workload and focus on complex cases. These technologies can assist in detecting critical issues such as hemorrhages and embolisms, speeding up diagnosis and improving patient care.

The rapid regulatory adoption of AI-enabled medical devices, with the FDA approving 235 such devices by 2024, underscores the growing potential of AI in radiology. This development is creating opportunities for both traditional imaging companies and new entrants in the software industry to collaborate and innovate, leading to an expanded ecosystem of AI-driven solutions in the medical imaging market.

Impact of Macroeconomic / Geopolitical Factors

Rising interest rates and volatile raw material costs strain radiology system providers, diverting funds from advanced scanner deployments to maintenance amid tight hospital budgets. U.S.-China trade tensions and African mineral disruptions limit rare earth magnet supplies, slowing high-volume diagnostic output and extending multinational project timelines. Innovative firms counter by developing software-driven imaging solutions, enhancing efficiency and targeting point-of-care markets.

Growing non-communicable disease rates drive public health investments into hybrid modalities, boosting cloud analytics subscriptions. The U.S. Department of Commerce’s Section 232 investigation, launched September 2, 2025, signals potential tariffs on Asian-sourced transducers, pressuring community hospital budgets and delaying joint ventures with Far East suppliers. These probes create uncertainty, occasionally stalling elective imaging expansions. Strategic companies leverage domestic content credits to build U.S. fabrication hubs, advancing photon-counting technology and fostering systems integration expertise.

Latest Trends

Photon-Counting CT Adoption is a recent trend creating growth opportunities

The increasing clinical adoption of Photon-Counting Computed Tomography (PCCT) represents a pivotal shift in the medical imaging market, moving from detector-based energy integration to a photon-counting approach. This trend is driven by PCCT’s superior ability to differentiate tissues, reduce image noise, and lower radiation exposure, making it especially valuable in complex fields like oncology and cardiology.

Unlike conventional scanners that measure total X-ray energy, PCCT counts individual photons, providing rich spectral data that allows clinicians to distinguish between materials more precisely than ever before. This technological leap enables the creation of high-resolution, low-dose scans, which translates directly into enhanced diagnostic confidence. The commercial availability of PCCT systems has been accelerating since the first US Food and Drug Administration (FDA) clearance in late 2021.

Demonstrating real-world clinical use, one major industry player reported that by the end of 2024, more than one million patients worldwide had already been scanned using their commercially available photon-counting CT system. This figure, provided by a key manufacturer, underscores the rapid real-world integration and clinical trust in this advanced imaging technology over a short time span. Furthermore, research trials published in March 2024 have shown that PCCT can reduce radiation exposure by up to 45% compared to conventional CT, without compromising image quality, which highlights a major advantage for patient safety.

Regional Analysis

North America is leading the Medical Imaging Market

In 2024, North America dominated the global medical imaging market with a 37.5% share, supported by substantial federal allocations enhancing research and development in diagnostic technologies to address escalating demands from cardiovascular and neurodegenerative conditions. Institutions upgraded to hybrid scanners combining CT and PET functionalities, permitting detailed perfusion mapping that informs interventional strategies with greater specificity. The integration of predictive algorithms minimized scan artifacts, elevating throughput in ambulatory centers serving diverse urban demographics.

Policy directives from the Department of Health and Human Services prioritized equitable deployment in community hospitals, countering disparities in rural diagnostic access. Advancements in photon-counting detectors expanded spectral capabilities, facilitating material differentiation for precise kidney stone composition analysis. Financial mechanisms through the Affordable Care Act expansions encouraged preventive screenings, amplifying utilization rates among at-risk cohorts.

Strategic alliances among equipment suppliers and clinical networks optimized maintenance protocols, ensuring operational continuity during high-volume periods. These enhancements affirmed the area’s forefront position in evolving radiological paradigms. The National Institute of Biomedical Imaging and Bioengineering’s budget advanced from $422 million in fiscal year 2022 to $440.6 million in fiscal year 2024, directing resources toward innovative imaging modalities and computational tools.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Authorities in Asia Pacific anticipate the medical imaging sector to intensify during the forecast period, as strategic outlays fortify diagnostic capacities to mitigate burdens from respiratory and hepatic ailments in expansive territories. Ministries in Indonesia and Vietnam designate capital for procuring low-radiation modalities, outfitting district facilities to conduct routine thoracic evaluations amid pollution-related escalations.

Equipment conglomerates engage with sovereign funds to localize assembly lines, projecting diminished lead times for maintenance in archipelago logistics. Policy frameworks in Malaysia and Thailand emphasize workforce certification programs, preparing technicians to operate advanced consoles for musculoskeletal assessments. Beijing’s directives integrate quantum-enhanced probes into tertiary workflows, estimating superior contrast resolution for vascular anomalies.

Seoul’s initiatives likely incorporate haptic feedback systems, augmenting procedural guidance in interventional suites. Coalition efforts across the subcontinent promote shared repositories, streamlining image exchange for cross-referral consultations. These undertakings underpin a framework for distributed, high-fidelity visualization networks. India’s Production Linked Incentive scheme for medical devices committed Rs 3,420 crore from 2020 through 2026, with progressive disbursements supporting component fabrication for radiographic and tomographic apparatuses during 2022-2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key entities in the diagnostic visualization domain advance their positions by developing multimodal systems that fuse technologies like ultrasound with AI for real-time guidance in interventional procedures. They initiate collaborative ventures with biotechnology enterprises to co-engineer contrast agents and software, expediting product validation and entry into specialized therapeutic areas. Organizations direct considerable capital toward modular hardware designs that facilitate upgrades without full replacements, reducing costs for end-users and encouraging repeat business.

Executives emphasize talent acquisition from data science fields to build in-house capabilities for cloud-based image sharing, supporting telemedicine growth. They cultivate presence in untapped territories across Africa and Southeast Asia by forming joint operations with regional distributors, leveraging government health initiatives. Furthermore, they establish performance-linked agreements with providers, incorporating predictive maintenance to minimize downtime and reinforce operational partnerships.

Siemens Healthineers AG, rooted in 1847 and independently structured since 2018 with headquarters in Erlangen, Germany, engineers sophisticated diagnostic equipment and laboratory automation for international medical institutions. The enterprise supplies an array of modalities, from computed tomography to molecular imaging, augmented by informatics platforms for data-driven insights.

Siemens Healthineers focuses on sustainable engineering practices, embedding energy-efficient components to align with environmental mandates. CEO Bernd Montag commands a multinational operation spanning more than 70 nations, steering toward value-based care models. The corporation liaises with research bodies to refine protocols for early disease identification, elevating clinical standards. Siemens Healthineers upholds its vanguard status via disciplined portfolio management and adaptive responses to sector evolutions.

Top Key Players in the Medical Imaging Market

- Siemens Healthineers

- Samsung Medison Co., Ltd.

- PerkinElmer Inc.

- Mindray Medical International

- Koninklijke Philips N.V.

- Koning Corporation

- Konica Minolta

- Hitachi

- GE Healthcare

- FUJIFILM VisualSonics Inc.

- Carestream Health

- Canon Medical Systems Corporation

Recent Developments

- In March 2024: GE Healthcare unveiled SonoSAMTrack1, a research-focused ultrasound model powered by NVIDIA technology. Designed for precise segmentation of anatomical structures and lesions, this model—along with its simplified variant, SonoSAMLite—enhances the accuracy and efficiency of ultrasound diagnostics, driving advancements in the medical imaging market by improving workflow and image interpretation.

- In January 2024: Canon introduced Aplio me, a lightweight and portable shared-service ultrasound system. Its flexibility and high efficiency make it suitable for both small clinics and large hospitals, supporting broader adoption of ultrasound technology and boosting demand within the medical imaging market for versatile, user-friendly solutions.

- In January 2024: Canon Medical Systems partnered with Olympus Corporation to co-develop Endoscopic Ultrasound (EUS) systems. Canon focuses on manufacturing the diagnostic ultrasound component while Olympus manages sales, providing advanced EUS imaging capabilities. This collaboration strengthens the market by integrating high-quality ultrasound technology with endoscopic procedures, expanding clinical applications.

Report Scope

Report Features Description Market Value (2024) US$ 41.7 billion Forecast Revenue (2034) US$ 66.6 billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (X-ray Devices (Radiography, Mammography, and Fluoroscopy), Computed Tomography (Mid end slice CT, Low end slice CT, High end slice CT, and Cone beam CT), Ultrasound (Cart/Trolley Based, Compact, and Handheld), Magnetic Resonance Imaging (Open System, and Closed System), Nuclear Imaging (SPECT, and PET)), By Application (Orthopedics, Oncology, Neurology, Gynecology, Gastroenterology, Cardiology, and Others), By End-user (Hospitals & Clinics, Diagnostics Imaging Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers, Samsung Medison Co., Ltd., PerkinElmer Inc., Mindray Medical International, Koninklijke Philips N.V., Koning Corporation, Konica Minolta, Hitachi, GE Healthcare, FUJIFILM VisualSonics Inc., Carestream Health, Canon Medical Systems Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens Healthineers

- Samsung Medison Co., Ltd.

- PerkinElmer Inc.

- Mindray Medical International

- Koninklijke Philips N.V.

- Koning Corporation

- Konica Minolta

- Hitachi

- GE Healthcare

- FUJIFILM VisualSonics Inc.

- Carestream Health

- Canon Medical Systems Corporation