Global Medical Device Analytical Testing Outsourcing Market By Services (Material Characterization, Bioburden Testing, Extractable and Leachable, Physical Testing, Sterility Testing and Others), By Therapeutic Areas (Cardiology, Diagnostic Imaging, Orthopedic, Drug Delivery, Endoscopy and Others), By End-user (Hospitals, Clinics and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176500

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

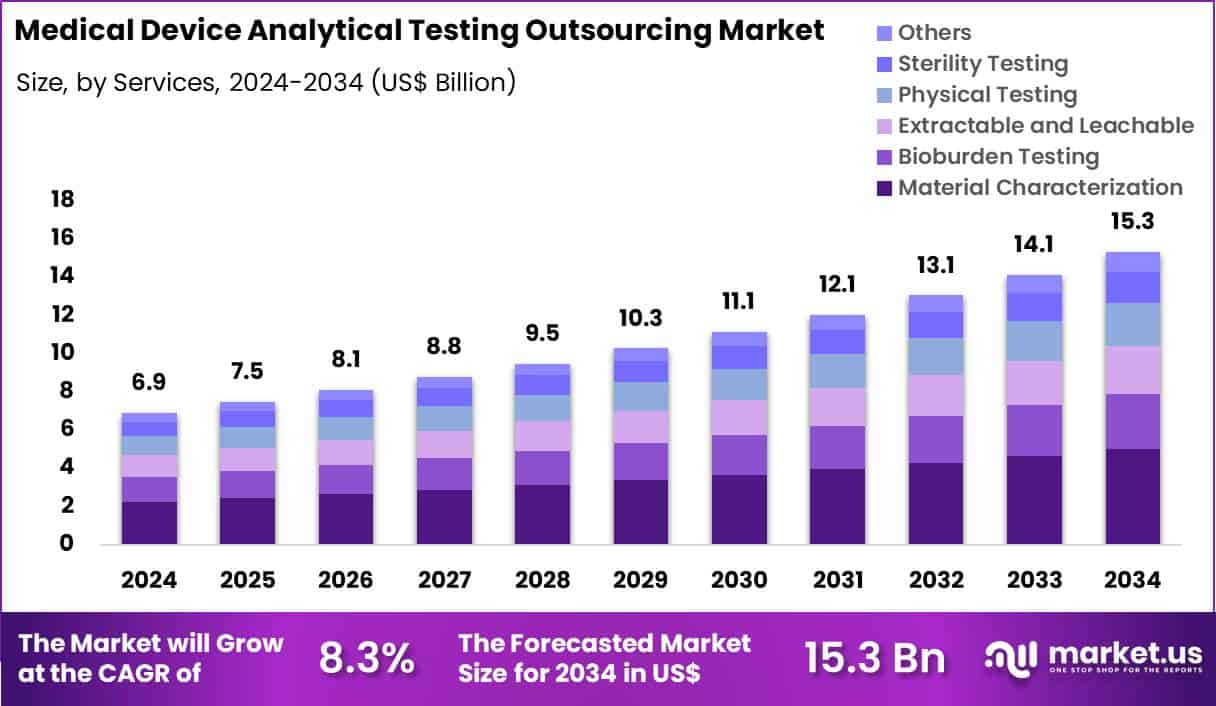

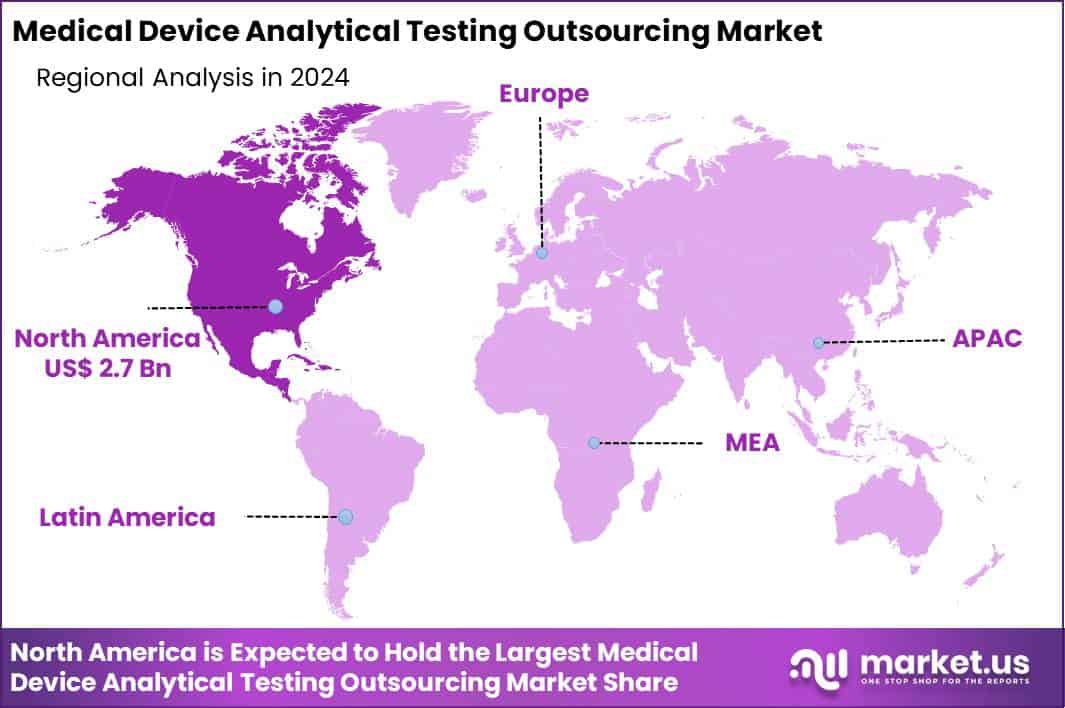

Global Medical Device Analytical Testing Outsourcing Market size is expected to be worth around US$ 15.3 Billion by 2034 from US$ 6.9 Billion in 2024, growing at a CAGR of 8.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.4% share with a revenue of US$ 2.7 Billion.

Increasing regulatory demands and the need for specialized expertise propel medical device companies to outsource analytical testing to contract laboratories that deliver precise material characterization and biocompatibility assessments. These services enable thorough extractables and leachables testing for implantable devices like stents and pacemakers, ensuring safety by identifying potential chemical migrations under simulated use conditions.

Outsourcing partners conduct mechanical and fatigue testing for orthopedic implants, verifying durability and load-bearing capacity to meet performance standards. Laboratories apply these solutions to validate sterility and endotoxin levels in surgical instruments, preventing infections in operating room applications.

Companies also utilize outsourced chromatography and spectroscopy for polymer analysis in catheters and tubing, confirming composition and purity for vascular and urinary applications. This approach supports accelerated product development cycles while maintaining compliance with international quality norms.

Contract testing organizations seize opportunities to integrate advanced robotics and automation in high-throughput testing, expanding applications in rapid prototyping validation for wearable monitors and diagnostic sensors. Developers advance AI-driven data analysis platforms that enhance predictive modeling for device degradation, broadening utility in long-term implantable electronics like neurostimulators.

These innovations facilitate customized testing protocols for bioresorbable scaffolds in tissue engineering, optimizing dissolution rates and biocompatibility. Opportunities emerge in sustainable testing methods that reduce chemical waste, appealing to eco-conscious manufacturers of minimally invasive tools.

Companies invest in multi-modal imaging techniques for failure analysis in cardiac valves and joint prosthetics, improving root-cause identification. Recent trends emphasize collaborative ecosystems where outsourcing partners co-develop testing frameworks, positioning the market for seamless integration with digital twins and real-world evidence in device lifecycle management.

Key Takeaways

- In 2024, the market generated a revenue of US$ 6.9 Billion, with a CAGR of 8.3%, and is expected to reach US$ 15.3 Billion by the year 2034.

- The services segment is divided into material characterization, bioburden testing, extractable and leachable, physical testing, sterility testing and others, with material characterization taking the lead with a market share of 32.8%.

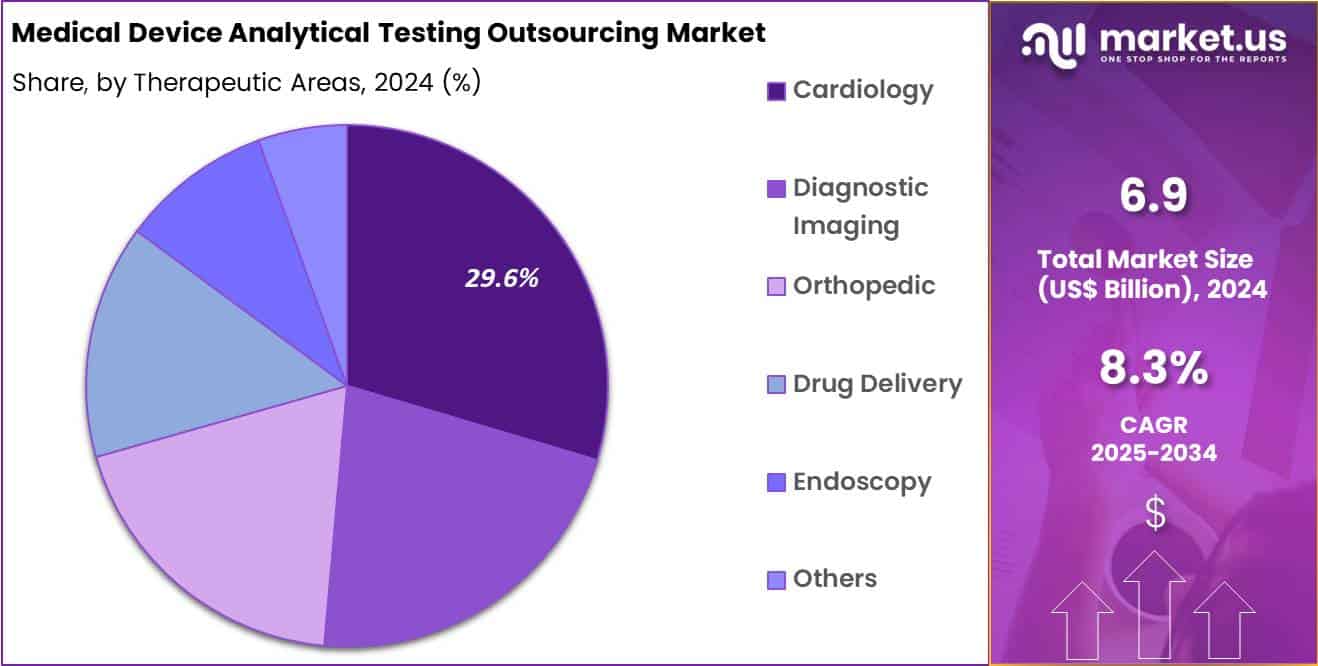

- Considering therapeutic areas, the market is divided into cardiology, diagnostic imaging, orthopedic, drug delivery, endoscopy and others. Among these, cardiology held a significant share of 29.6%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 47.9% in the market.

- North America led the market by securing a market share of 39.4%.

Services Analysis

Material characterization contributed 32.8% of growth within services and led the medical device analytical testing outsourcing market due to rising complexity in device materials and design. Device manufacturers increasingly use advanced polymers, alloys, and composites that require detailed chemical and physical analysis to meet performance and safety expectations.

Outsourced laboratories provide specialized instrumentation and expertise that accelerate development timelines. Early-stage material validation supports faster iteration and reduces downstream regulatory risk, which drives sustained demand for characterization services.

Growth strengthens as regulatory authorities emphasize material safety, consistency, and traceability across device lifecycles. Manufacturers outsource characterization to manage cost and access accredited testing capabilities. Expansion of combination devices increases the need for deeper material understanding. Global device launches require harmonized testing documentation, further increasing outsourcing volumes. The segment is expected to remain dominant as innovation in device materials continues to intensify.

Therapeutic Area Analysis

Cardiology generated 29.6% of growth within therapeutic areas and emerged as the leading segment due to high innovation intensity and strict safety requirements for cardiovascular devices. Products such as stents, catheters, valves, and implantable monitors require extensive analytical testing to validate material integrity and performance. Rising prevalence of cardiovascular disease increases device development activity, which elevates testing demand. Manufacturers prioritize outsourcing to ensure compliance while maintaining rapid commercialization.

Frequent design updates and next-generation cardiac devices drive repeated testing cycles. Regulatory scrutiny remains particularly high for cardiology products, reinforcing reliance on specialized external laboratories. Clinical risk considerations push manufacturers toward thorough analytical validation. Growth in minimally invasive cardiac procedures also supports new device introductions. The segment is projected to maintain leadership as cardiology remains a core focus of medical device innovation.

End-User Analysis

Hospitals accounted for 47.9% of growth within end-user and dominated the medical device analytical testing outsourcing market due to their role in device evaluation, procurement, and clinical validation. Hospitals participate in pilot testing and post-market surveillance that require analytical support for safety and performance verification.

Teaching hospitals and large health systems collaborate closely with manufacturers during development and validation phases. This involvement increases demand for outsourced analytical testing linked to clinical use conditions.

Expansion of hospital-based research programs further supports growth. Hospitals emphasize patient safety and regulatory compliance, which aligns with rigorous testing requirements. Adoption of advanced devices increases the need for material and performance verification. Collaboration between hospitals and testing laboratories strengthens outsourcing relationships. The segment is anticipated to remain a primary growth driver as hospitals continue to influence device adoption and validation pathways.

Key Market Segments

By Services

- Material Characterization

- Bioburden Testing

- Extractable and Leachable

- Physical Testing

- Sterility Testing

- Others

By Therapeutic Areas

- Cardiology

- Diagnostic Imaging

- Drug Delivery

- Endoscopy

- Orthopedic

- Others

By End-user

- Hospitals

- Clinics

- Others

Drivers

Increasing number of medical device submissions is driving the market.

The escalating volume of medical device submissions globally has substantially boosted the need for outsourced analytical testing to ensure compliance with rigorous regulatory standards. Enhanced innovation in device design and functionality contributes to higher submission rates, requiring specialized testing for materials and biocompatibility.

According to the U.S. Food and Drug Administration’s Center for Devices and Radiological Health, over 20,700 premarket submissions were received in 2024, an increase of 1,600 from the previous year. This surge highlights the pressure on manufacturers to validate product safety and efficacy through external expertise. Outsourcing allows companies to leverage advanced laboratories without internal infrastructure investments.

Healthcare providers benefit from faster market entry of verified devices, improving patient outcomes. The correlation between submission growth and testing demands further accelerates reliance on specialized service providers. Government agencies prioritize thorough evaluations to mitigate risks in clinical applications. Key firms are expanding capacities to accommodate this rising workload. This driver supports sustained collaboration between regulators and outsourcing entities for efficient approvals.

Restraints

Stringent data privacy regulations are restraining the market.

The rigorous enforcement of data protection laws worldwide complicates the sharing of sensitive analytical data in outsourcing arrangements for medical device testing. Compliance with frameworks like HIPAA and GDPR requires robust security measures, increasing operational complexities for service providers. Smaller firms often lack the resources to implement advanced encryption and auditing systems needed for international collaborations.

Regulatory audits demand detailed documentation, prolonging contract negotiations and setup timelines. In sectors with proprietary formulations, concerns over intellectual property leakage deter full outsourcing adoption. Providers must invest in certified platforms, elevating service fees for clients. This restraint limits market accessibility in regions with evolving privacy statutes.

Industry associations advocate for standardized protocols to ease these burdens. Despite efficiency gains, privacy hurdles impede seamless global partnerships. Addressing these through technology integrations is crucial for overcoming market limitations.

Opportunities

Rising revenues in testing services is creating growth opportunities.

The upward trajectory in earnings from comprehensive testing services signals potential for expanded outsourcing in medical device analytical evaluations. Bolstered financial performance enables investments in cutting-edge equipment for precise material and performance assessments. SGS reported group sales of CHF 6,794 million in 2024, reflecting a 2.6% increase from the prior year. This increment underscores sustained demand that extends to specialized device validations across regions.

Cooperative ventures with device innovators facilitate tailored protocols for emerging technologies. The considerable procedural foundation in regulated markets magnifies prospects for service diversification. Policy advancements in quality assurance reimbursement strengthen laboratory enhancements.

Foremost corporations initiate geographic extensions to harness economic advancements. This opportunity harmonizes with endeavors to heighten benchmarks in device certification. Concentrated evolutions can produce remarkable strides in compliance efficiencies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions shape the medical device analytical testing outsourcing market through R&D budgets, funding cycles, and cost discipline across device developers. Inflation and higher interest rates tighten cash flow for startups and mid sized firms, which delays testing schedules and extends validation timelines.

Geopolitical tensions disrupt access to specialty chemicals, reference materials, and calibrated equipment, increasing lead time risk for laboratories. Current US tariffs on imported instruments, consumables, and replacement parts raise operating costs for testing providers, which pressures margins and pricing negotiations. These factors strain capacity planning and challenge smaller labs with limited scale.

On the positive side, trade friction pushes clients toward outsourcing to avoid capital spend and to access compliant, ready infrastructure. Regulatory complexity and faster innovation cycles sustain demand for expert testing partners. With automation, method harmonization, and closer client collaboration, the market can convert uncertainty into steady, resilient growth.

Latest Trends

Integration of artificial intelligence in analytical processes is a recent trend in the market.

In 2024, the incorporation of AI algorithms has advanced predictive modeling in medical device material testing for enhanced accuracy. These systems analyze vast datasets to identify potential failure modes in biocompatibility assessments. Providers focused on machine learning integrations to automate routine validations, reducing human error.

Clinical simulations benefited from AI-driven scenario predictions for device performance under varied conditions. Evaluations in 2024 confirmed improved throughput in high-volume testing environments. The trend accommodates escalating demands for rapid regulatory submissions in innovative sectors.

Supervisory endorsements for AI-assisted tools have hastened their dissemination. Sector alliances hone models for superior pattern recognition in test results. These progressions seek to diminish analysis durations while upholding precision standards. This shift establishes AI as integral to modern outsourcing workflows.

Regional Analysis

North America is leading the Medical Device Analytical Testing Outsourcing Market

North America holds a 39.4% share of the global Medical Device Analytical Testing Outsourcing market, demonstrating robust expansion in 2024 driven by intensified regulatory demands and a surge in innovative device development requiring specialized validation services.

Leading providers such as Eurofins Scientific and Charles River Laboratories have augmented their capabilities with state-of-the-art labs for biocompatibility and sterility assessments, enabling manufacturers to comply with evolving FDA standards while focusing on core R&D activities. The region’s concentration of medtech hubs has fostered strategic partnerships that optimize supply chains for extractables and leachables testing, crucial for implantable and wearable technologies.

Health agencies have emphasized traceability in material characterizations, prompting firms to outsource complex analytics to mitigate risks in product recalls. Escalating complexities in device designs, including AI-integrated diagnostics, have necessitated external expertise in performance evaluations to expedite market clearances. Cooperative frameworks among stakeholders have streamlined protocols for microbiological and chemical analyses, enhancing overall efficiency.

Additionally, cost pressures amid economic fluctuations have encouraged delegation of non-core testing functions to certified third parties. The FDA’s Center for Devices and Radiological Health received over 20,700 medical device submissions in 2024, underscoring the heightened activity fueling outsourcing needs.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts anticipate substantial development in the device validation services arena across Asia Pacific throughout the forecast period, since regulators intensify oversight to align with global benchmarks for safety and efficacy. Corporations in China and India enhance infrastructure with automated platforms for physicochemical assays, while experts in South Korea adapt methodologies to accommodate hybrid electronics in prosthetics.

Facilities in Malaysia integrate cybersecurity evaluations into routine checks, addressing vulnerabilities in connected health tools. Backers in Vietnam allocate resources to accredit local labs for accelerated biocompatibility verifications, supporting export ambitions. Leaders in Indonesia enforce compliance audits that compel producers to engage external auditors for impartial residue analyses.

Physicians in Thailand leverage outsourced data to refine implant durability studies, advancing patient-centric innovations. Enterprises in the Philippines forge alliances that introduce high-throughput screening for contaminants, elevating regional standards. The NMPA approved 65 innovative medical devices in 2024, marking a 6.6% rise from 2023 and signaling accelerating sector momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the medical device analytical testing outsourcing market focus on expanding high-complexity laboratory capabilities and broadening assay portfolios to support diverse regulatory requirements and evolving material science needs from implantables to diagnostics. They invest significantly in cutting-edge technologies such as spectroscopy, chromatography, and biocompatibility testing platforms that yield faster turnaround and deeper insight for device developers.

Firms also cultivate long-term partnerships with OEMs by embedding quality management systems and comprehensive reporting tools that reduce compliance risk and accelerate submission timelines. Geographic expansion into Asia Pacific and Latin America strengthens their service footprint and captures demand from rapidly growing medtech hubs.

Intertek Group plc exemplifies a global assurance provider with deep expertise in analytical testing, certification services, and regulatory consulting that supports complex device characterization and performance verification. The company advances its growth agenda through disciplined capital allocation, strategic acquisitions that add specialized capabilities, and a customer-centric service model that aligns operational excellence with client development cycles.

Top Key Players

- Eurofins Scientific

- SGS

- Intertek Group

- TÜV SÜD

- Charles River Laboratories

- WuXi AppTec

- NAMSA

- Nelson Labs

- Pace Analytical Services

- Medistri

Recent Developments

- In October 2024, SGS expanded its operations in Lincolnshire, Illinois, to strengthen its biopharmaceutical testing services. The site upgrade included the addition of advanced laboratory instruments and new testing capabilities, enabling faster development timelines and improved regulatory support for pharmaceutical clients.

- In September 2024, Pace Life Sciences strengthened its analytical services footprint through the acquisition of Catalent’s Analytical Services Laboratory located in Research Triangle Park. The transaction broadened Pace’s expertise in small molecule analysis and extended its service reach across biopharma and pharmaceutical customers in the US.

Report Scope

Report Features Description Market Value (2024) US$ 6.9 Billion Forecast Revenue (2034) US$ 15.3 Billion CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Services (Material Characterization, Bioburden Testing, Extractable and Leachable, Physical Testing, Sterility Testing and Others), By Therapeutic Areas (Cardiology, Diagnostic Imaging, Orthopedic, Drug Delivery, Endoscopy and Others), By End-user (Hospitals, Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Eurofins Scientific, SGS, Intertek Group, TÜV SÜD, Charles River Laboratories, WuXi AppTec, NAMSA, Nelson Labs, Pace Analytical Services, Medistri Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Device Analytical Testing Outsourcing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Medical Device Analytical Testing Outsourcing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Eurofins Scientific

- SGS

- Intertek Group

- TÜV SÜD

- Charles River Laboratories

- WuXi AppTec

- NAMSA

- Nelson Labs

- Pace Analytical Services

- Medistri