Global Medical Cyclotrons Market Product Type-(Cyclotron 10-12 MeV, Cyclotron 16-18 MeV, Cyclotron 19-24 MeV, Cyclotron 24 MeV & above)End-User-( Hospitals, Pharmaceutical Companies, Spcialzed Clincs) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 15475

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

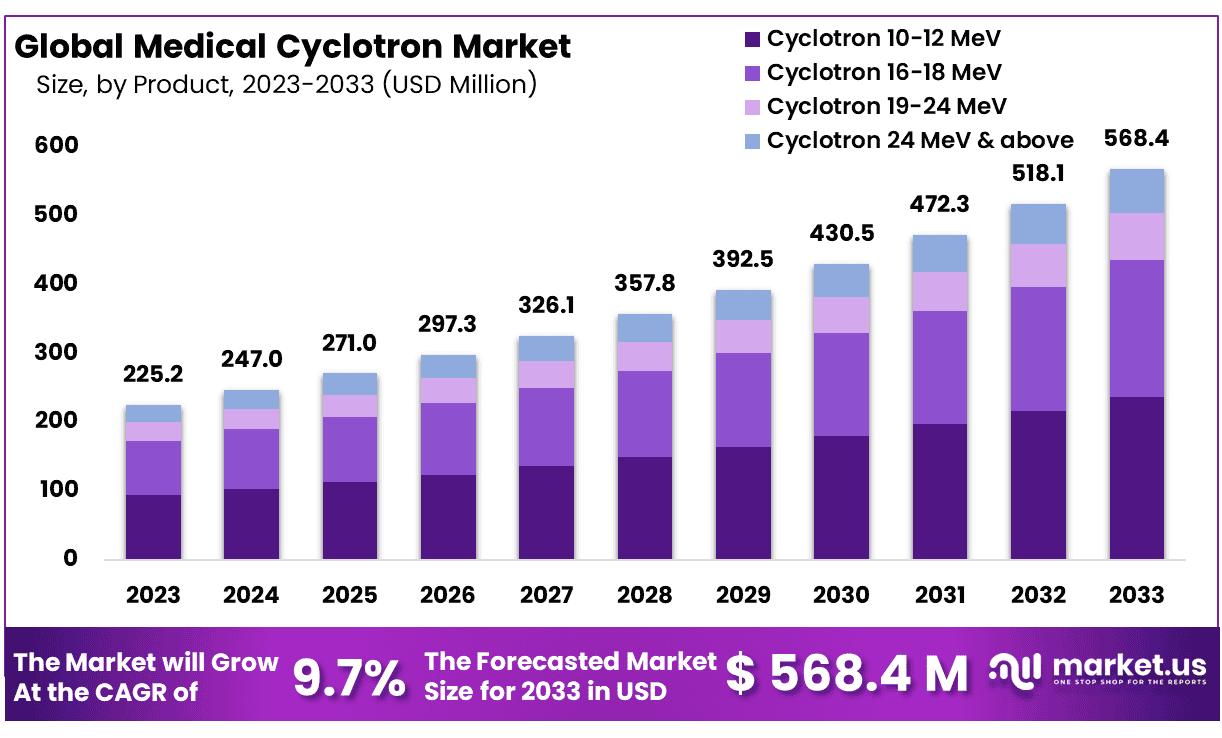

The Global Medical Cyclotron Market size is expected to be worth around USD 568.4 Million by 2033 from USD 225.2 Million in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

Medical Cyclotrons stand out as widely-used accelerators designed to produce radioisotopes, which are radioactive atoms essential for medical imaging and research purposes. A key application area for cyclotrons involves crafting short-lived radiotracers with a deficit of neutrons, particularly for use in emission tomography, notably positron emission tomography (PET).

Globally, medical cyclotrons play a crucial role in generating essential medical isotopes like Fluorine-18 and Carbon-11. A notable advantage of cyclotrons lies in their ability to produce relatively less radioactive waste compared to larger nuclear reactors.

The increasing embrace of PET medical accelerators for cancer treatment and diagnosis is expected to drive the demand for medical cyclotrons. As awareness about cancer grows, there is a parallel rise in the number of nuclear scans conducted. This surge in demand for nuclear scans, coupled with heightened cancer awareness, is projected to propel the global medical cyclotron market. Furthermore, advancements in medical imaging technologies, particularly in the realm of PET, are anticipated to contribute significantly to the expansion of the market.

Key Takeaways

- Market Size & Growth: Medical Cyclotron Market size is expected to be worth around USD 568.4 Million by 2032 from USD 225.2 Million in 2023, growing at a CAGR of 9.7%

- Product Analysis: The market is dominate by cyclotrons between 16-18 MeV, which accounted for over 56% of total market revenue in 2023

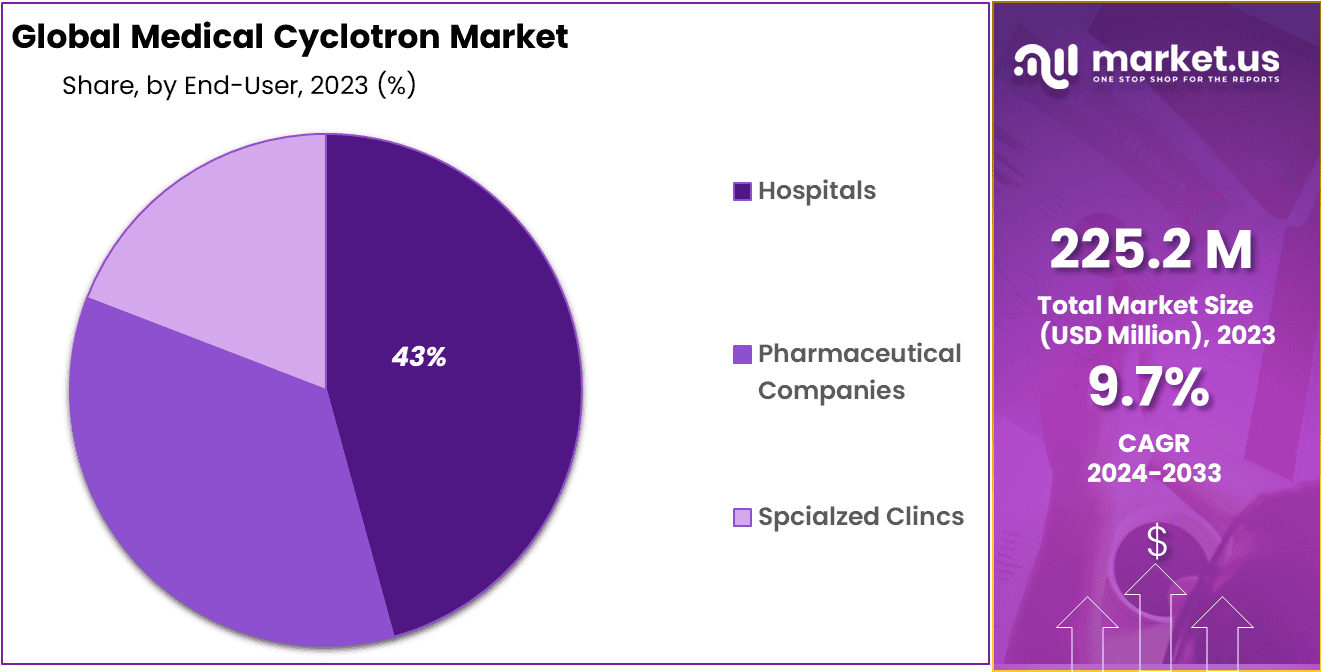

- End-Use Analysis: The hospitals segmet dominate by 43% of total market revenue in 2023

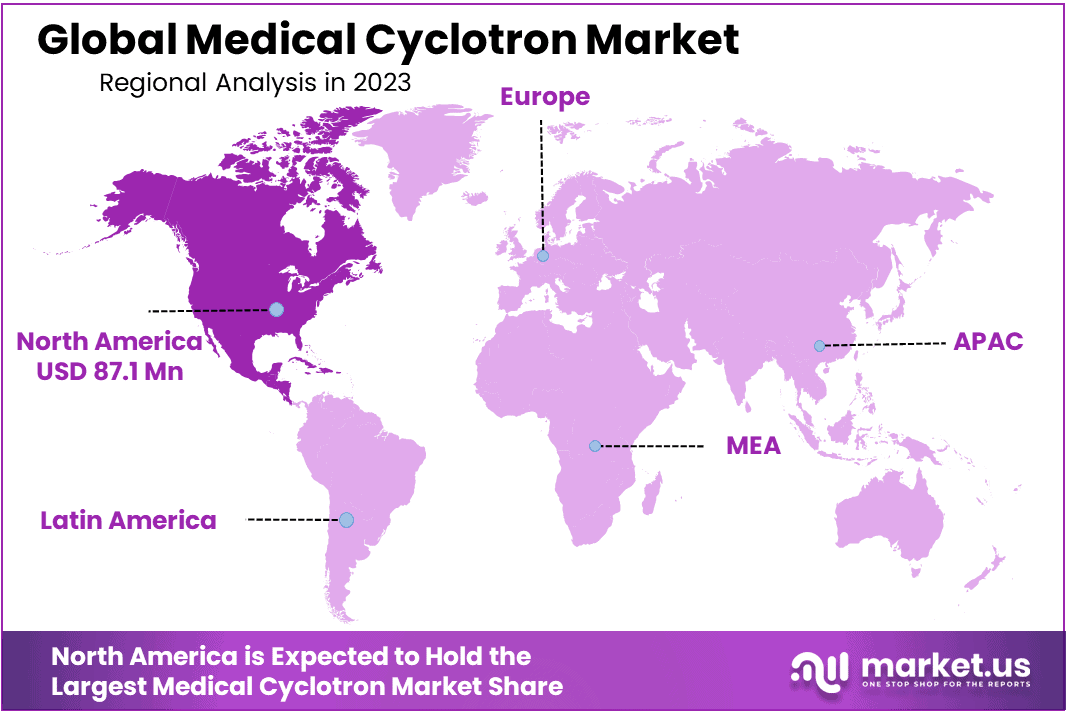

- Regional Analysis: North American region accounted for 38.7% and and holding a USD 87.1 Million value for the Market of the revenue share of the global market

- Regulatory Considerations: The medical cyclotron market is influenced by regulatory frameworks governing the approval and production of radioisotopes.

- Investments in Research and Development: Companies in the medical cyclotron sector are investing in research and development to stay competitive and address evolving market needs.

By Product Analysis

The market can be divided into four segments based on product: Cyclotron 10-12 MeV, Cyclotron 16-18 MeV, Cyclotron 19-24 MeV, Cyclotron 24 MeV & above. The market is dominate by cyclotrons between 16-18 MeV, which accounted for over 56% of total market revenue in 2023. This segment’s growth can be attributed to the rising demand for nuclear scans and the growing prevalence of cancer. A significant share of the market is also held by cyclotrons with a range between 10-12 MeV. They are used in hospitals and diagnostic centers that perform nuclear scans.

The cyclotrons that are in the 10-12 MeV range are smaller than other particle accelerators. There are two options available for healthcare professionals: shielded and unshielded. Dual-particle capability is provided by these devices, which are capable of absorbing dual-target radiations such as a proton beam current between 60 mA and 130 mA or a deuteron beam current between 60 mA and 60 mA. The Asia Pacific is home to the most cyclotrons within the 16-18 MeV range, due to the higher demand for nuclear scans at hospitals and diagnostic centers.

The demand for medical cyclotrons will rise due to the increasing acceptance of PET-associated medical accelerators in the diagnosis and treatment of cancer. The demand for nuclear scans is increasing due to increased awareness of cancer. The global medical cyclotron market is expected to grow due to increased demand for nuclear scans, and an increase in awareness about cancer.

By End-User Analysis

The hospitals segmet dominate by 43% of total market revenue in 2023. Medical Cyclotron Market data indicates a range of end users that contribute significantly to its widespread adoption. Healthcare facilities and clinics primarily rely on medical cyclotrons for producing radioisotopes needed for imaging procedures like PET scans.

Research institutions and laboratories play a pivotal role in driving innovation, discovering novel applications, and expanding medical cyclotrons capabilities for scientific experiments and studies. Pharmaceutical and biotech firms use accelerators for producing radioisotopes necessary for drug research as well as creating diagnostic and therapeutic agents.

Specialized cancer treatment centers at the forefront of precision medicine rely heavily on medical cyclotrons as both diagnostic and therapeutic tools in providing cancer care services. Radiopharmaceutical production facilities play a crucial role in meeting public health initiatives by creating reliable supplies of radiopharmaceuticals for disease diagnosis, surveillance and research efforts. Cyclotrons play an integral part in supporting government institutions’ public health efforts through supporting disease surveillance, diagnosis and research programs.

Kеу Маrkеt Ѕеgmеntѕ

Product Type

- Cyclotron 10-12 MeV

- Cyclotron 16-18 MeV

- Cyclotron 19-24 MeV

- Cyclotron 24 MeV & above

End-User

- Hospitals

- Pharmaceutical Companies

- Spcialzed Clincs

Driver

An Increase in Cancer

Cancer incidence has become one of the primary drivers behind growth of the Medical Cyclotron Market. As incidence rises, diagnostic tools like PET scanners become increasingly necessary and depend on radioisotope production by medical cyclotrons for diagnosis purposes.

Enhancements in Cancer Diagnosis and Treatment

The market is being propelled forward by increased emphasis on advanced diagnostic and treatment modalities within oncology , such as PET scans. Cyclotrons play an essential part in producing radioisotopes like Fluorine-18 that enable accurate cancer diagnoses, helping with patient management decisions as well as overall care outcomes in cancer care settings. This technological advance aligns perfectly with overall goal of improving patient care outcomes for cancer care services.

Trend

In-House Radiopharmaceutical Manufacturing

One trend within the Medical Cyclotron Market is integration of cyclotron systems by healthcare institutions and radiopharmaceutical production facilities into in-house manufacturing processes for radiopharmaceuticals production facilities, leading to more streamlined and continuous radiopharmaceutical production operations while decreasing external supplier dependency while creating more reliable supply chains.

Expanded Research and Development on Radiopharmaceuticals

A growing trend toward intensified research and development for radiopharmaceuticals can be found within medical cyclotron systems being utilized not just for diagnostics purposes but also therapeutic ones – creating novel radiopharmaceuticals suitable for non-cancer diseases outside oncology.

Restraints

Initial Costs Associated with Cyclotron Installations

Initial costs associated with installing and maintaining medical cyclotrons pose an obstacle to market expansion, deterring smaller healthcare facilities with restricted budgets from adopting this technology.

Limited Access in Developing Regions

Lack of accessibility is one of the main impediments to wide-scale adoption of medical cyclotrons in certain geographical locations, creating barriers which prevent access to advanced diagnostic and therapeutic options in some places. High costs and technical requirements often prevent widespread implementation limiting treatment possibilities within those particular locales.

Opportunity

Diversifying Applications in Neurology and Cardiology

One exciting prospect lies in expanding medical cyclotron applications beyond oncology, specifically neurology and cardiology imaging and treatment using radioisotopes produced from medical cyclotrons – opening new possibilities for market expansion and market diversification.

Technological Advances for Compact Cyclotrons

Technological advancements offer potential to develop smaller and cost-efficient cyclotrons systems; their advancement can address cost issues more directly and make medical cyclotrons more available in smaller healthcare settings with limited resources.

Regional Analysis

In 2023, the North American region accounted for 38.7% and and holding a USD 87.1 Million value for the Market of the revenue share of the global market. Due to the increasing demand for nuclear scans, and the growing number of cancer patients, the region will continue to dominate the market throughout the forecast period. The region’s market is also growing due to increased investments in healthcare infrastructure, the shutting down of nuclear reactors, and the increasing demand for cost-effective solutions.

Over the forecast period, the European market will experience a CAGR in excess of 11.3%. Europe is expected to have the second-largest volume share during the forecast period. Due to high cancer prevalence, rising awareness about nuclear scans, and increasing awareness, the region will continue to be a major market player.

The International Atomic Energy Agency is an international regulatory body that allows the installation of particle accelerators. The IAEA has strict regulations that must be followed when installing these devices in any European nation. These clearly defined regulatory guidelines are important to ensure patient safety around radioactive devices.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

A few players dominate the market: IBA, GE Healthcare, Siemens Medical Solutions USA, Inc., Advanced Cyclotron Systems, Sumitomo Heavy Industries, Ltd., and TeamBest (Best Medical International, Inc.).

Due to the oligopoly of the market, there is intense competition among existing players. Manufacturers are faced with high market entry barriers, strict regulatory compliance, and higher manufacturing costs.There are very few companies that have a greater market share than others. TeamBest, however, is developing a product that has a 400 MeV capacity for particle therapy with heavy Ions. This will allow for a better diagnosis and treatment of the disease.

Кеу Рlауеrѕ

- IBA Radiopharma Solutions

- GE Healthcare

- Siemens Medical Solutions USA, Inc.

- Advanced Cyclotron Systems

- Sumitomo Heavy Industries

- TeamBest inc.

Recent Developments

- Advancements in Cyclotron Technology: Newer developments in cyclotron technology aim to boost efficiency, reliability and production capacity while manufacturers look at innovations that enhance isotope production while cutting costs and increasing performance of these cyclotron systems.

- Growing Demand for Radiopharmaceuticals: With cancer and cardiovascular diseases on the rise, diagnostic imaging procedures such as PET scans have seen increased popularity – prompting increased need for reliable sources of radioisotopes produced from medical cyclotrons.

- Focus on Compact and High-Yield Cyclotrons: There has been an emerging trend toward developing small yet high yield cyclotrons suitable for smaller facilities like hospitals or imaging centers that enable on-site production of radiopharmaceuticals, eliminating transportation needs while increasing accessibility. This allows on-site radiopharmaceutical production while decreasing transportation needs while improving accessibility.

- Partnerships and Collaborations: Companies operating within the medical cyclotron market often engage in partnerships or collaborations with pharmaceutical firms, research institutions, healthcare providers and pharmaceutical manufacturers in order to enhance product offerings, expand market presence and expedite R&D initiatives.

Report Scope

Report Features Description Market Value (2023) USD 568.4 Million Forecast Revenue (2033) USD 225.2 Million CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type-(Cyclotron 10-12 MeV, Cyclotron 16-18 MeV, Cyclotron 19-24 MeV, Cyclotron 24 MeV & above)End-User-( Hospitals, Pharmaceutical Companies, Spcialzed Clincs) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape IBA Radiopharma Solutions, GE Healthcare, Siemens Medical Solutions USA, Inc., Advanced Cyclotron Systems, Sumitomo Heavy Industries, TeamBest inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBA Radiopharma Solutions

- GE Healthcare

- Siemens Medical Solutions USA, Inc.

- Advanced Cyclotron Systems

- Sumitomo Heavy Industries

- TeamBest inc.