Global Medical Carts Market By Type (Emergency Carts, Procedure Carts, Anesthesia Carts, and Other Carts), By Product (Medical Storage Columns, Wall-Mounted Workstations, Mobile Computing Carts, Medication Carts, and Others), By Material (Metal, Plastic, and Others), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 12785

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Medical Carts Market size is expected to be worth around USD 7.1 Billion by 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

Medical carts are mobile storage and transport units used in healthcare settings to store and transport medical supplies, equipment, and medications. Medical carts are essential for healthcare professionals, as they allow for efficient and safe storage and transportation of essential medical supplies and equipment. The COVID-19 pandemic has driven increased demand for medical equipment, changes in infection control protocols, and the need for new features and capabilities.

Key Takeaways

- Market Growth: Expected to reach USD 7.1 billion by 2033, growing at a CAGR of 12.7% from USD 2.1 billion in 2023.

- Driving Factors: Healthcare solutions, technology advancements, and rising healthcare expenditure propel market demand.

- Restraints: High costs, maintenance needs, and security issues hinder market expansion.

- Growth Opportunities: Point-of-care testing, mobile integration, and expanding healthcare facilities offer growth prospects.

- Trending Factors: Adoption of EMRs, barcode scanning, RFID tracking, and telemedicine capabilities drives market trends.

- Dominant Types: Emergency carts lead, meeting critical care needs with a 30.7% market share.

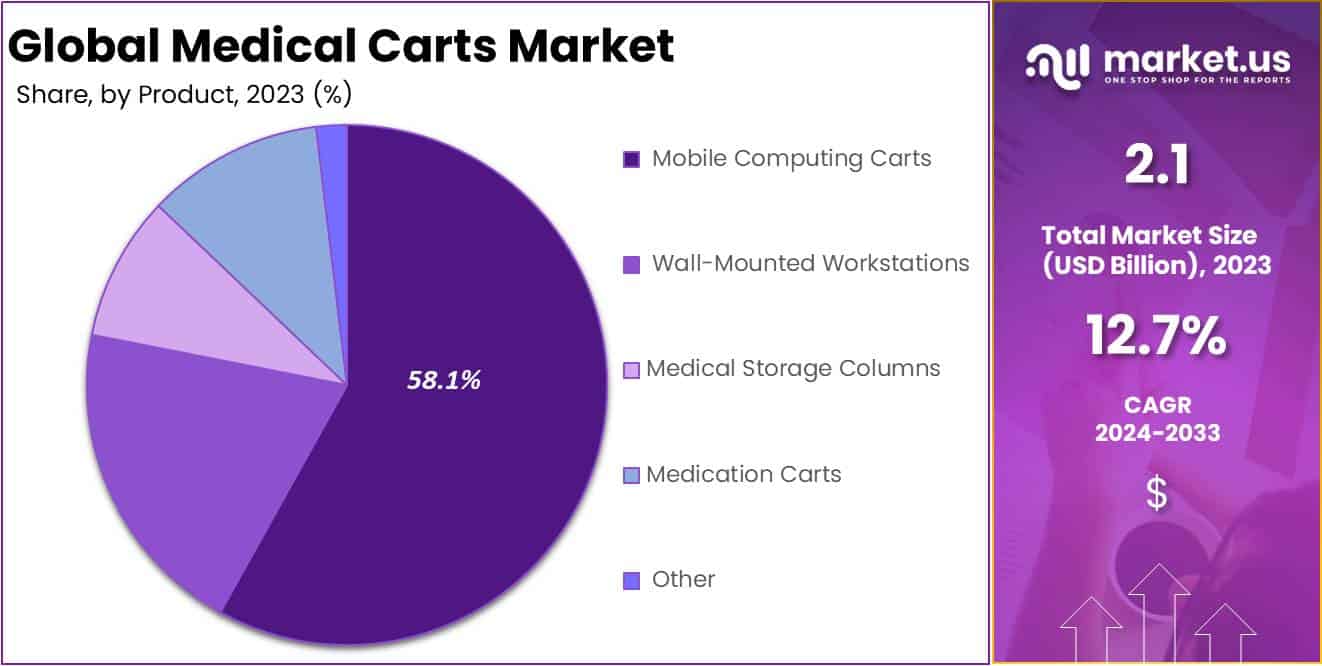

- Popular Products: Mobile computing carts hold 58.1% market share, favored for clinical mobility.

- Material Preference: Metal carts dominate with 48.2% market share due to durability and resistance.

- End-User Landscape: Hospitals account for 37% market share, driving diverse cart demands.

- Regional Insights: North America leads with 45.7% revenue share; Europe shows fastest growth, driven by healthcare expenditure.

Driving Factors

Healthcare Solutions, Advancement in Technology, and Increasing Healthcare Expenditure are Major Drivers for Medical Carts Market.

Medical carts offer a mobile and efficient solution for healthcare professionals to access and manage medical equipment and patient information at the point of care. This has led to an increased demand for medical carts in hospitals, clinics, and other healthcare facilities. Medical carts are becoming more advanced and sophisticated, incorporating technologies such as RFID tracking, electronic medical records (EMRs), and telemedicine capabilities. These advancements are driving the demand for medical carts in healthcare facilities, as they help to improve workflow efficiency and patient care.

The aging population is increasing, and this demographic requires more healthcare services. Medical carts are a convenient and efficient way to provide care to elderly patients, who may have mobility issues or require frequent medication administration. Healthcare expenditures are increasing globally, and healthcare providers are looking for ways to improve efficiency and reduce costs. Medical carts can help to reduce the time and resources needed for healthcare tasks, making them a cost-effective solution for healthcare providers.

Restraining Factors

High Costs, Required Regular Maintenance, and Security Concerns are Some Major Restraints for Medical Carts Market.

Medical carts can be expensive, especially those with advanced technology and customization options. This can be a significant barrier for smaller healthcare facilities with limited budgets. Medical carts require regular maintenance and repair, which can be time-consuming and costly. This can also add to the total cost of ownership for healthcare facilities.

Medical carts often contain sensitive patient information and expensive medical equipment, making them vulnerable to theft and unauthorized access. This can be a significant concern for healthcare providers and may limit the adoption of medical carts in some settings. There are no standard guidelines or regulations for medical carts, which can lead to inconsistencies in design and functionality. This can make it difficult for healthcare providers to compare and select the most suitable medical carts for their needs.

Growth Opportunities

Point of Care Testing, Mobile Technology, and Expanding Healthcare Facilities Can Create Opportunities for Medical Cart Manufacturers.

Point-of-care testing allows healthcare providers to quickly diagnose and treat patients at the point of care. Medical carts market growth equipped with point-of-care testing capabilities are becoming increasingly popular, as they provide a convenient and efficient way to perform diagnostic tests and deliver treatments. Mobile technology is advancing rapidly, with new features and functionalities being added regularly. Medical carts that incorporate the latest mobile technology can help to improve workflow efficiency and patient care, providing a significant opportunity for manufacturers.

Healthcare facilities are expanding globally, creating new opportunities for medical cart manufacturers. As new hospitals, clinics, and other healthcare facilities are built, there will be a growing demand for medical carts to support patient care and workflow efficiency. Patient-centered care is becoming increasingly important in healthcare, with a growing focus on patient experience and satisfaction. Medical carts that are designed with patient comfort and safety in mind can help to improve patient satisfaction, providing an opportunity for manufacturers to differentiate themselves in the market.

Trending Factors

Electronic Medical Records, Barcode Scanning, RFID Tracking, Telemedicine Become Trending Nowadays.

Medical carts market trends are becoming increasingly sophisticated, incorporating technologies such as electronic medical records (EMRs), barcode scanning, RFID tracking, and telemedicine capabilities. These technologies help to improve workflow efficiency, patient care, and patient safety. As healthcare providers move towards more decentralized care, there is a growing demand for lightweight and mobile medical carts that can be easily moved around a facility or transported between locations.

Medical cart market trends demonstrate an increasing need for advanced and technologically equipped carts in healthcare facilities, to allow easy access to supplies, equipment and patient records while improving staff efficiency and convenience. Integration of electronic health records (EHR) systems as well as mobile platforms for healthcare professionals have contributed to medical cart adoption; due to increasing emphasis on infection control measures an antimicrobial material construction trend for carts has emerged as well.

Infection prevention and control is a top priority in healthcare, and medical carts play an important role in maintaining a clean and safe environment. Medical cart manufacturers are incorporating antimicrobial materials, touchless controls, and other features to help prevent the spread of infections. Sustainability is becoming increasingly important in healthcare, and medical cart manufacturers are taking steps to reduce their environmental impact. This includes using eco-friendly materials, designing carts for longer lifecycles, and offering recycling or repurposing programs.

Type Analysis

The Emergency Carts Segments Accounted as Dominator in the Medical Carts Market During the Forecasted Period.

The type segment is categorized as emergency carts, procedure carts, anesthesia carts, and other carts. Among these segments, the emergency carts are dominated the medical carts market with the largest market share 30.7%, and the highest CAGR of 8.5% in 2023. They are designed to provide quick and easy access to emergency supplies and equipment in critical care settings, such as emergency departments and intensive care units. Emergency carts typically include a range of emergency supplies and equipment, such as defibrillators, oxygen tanks, and medications.

Medical cart market share has seen steady expansion over time as hospitals and healthcare facilities recognize its value in managing equipment efficiently and organizing it correctly. Medical carts serve an essential function in healthcare facilities by helping healthcare workers transport supplies such as medications or equipment quickly from one place to the next.

Procedure carts are expected to grow fastest in the type segment in the medical carts market. Procedure carts are designed for use in surgical and diagnostic procedures. They are typically equipped with drawers and shelves for storing medical supplies and equipment.

Product Analysis

The Mobile Computing Cart Segment Holds the Majority Share in the Medical Carts Market During the Forecasted Period.

The product segment is categorized as medical storage columns, wall-mounted workstations, mobile computing carts, medication carts, and others. Among these segments, the mobile computing cart segment is dominated with the largest market share 58.1% in 2023. Mobile computing carts can be especially useful in clinical settings where healthcare professionals need to move around frequently, such as hospitals, clinics, and long-term care facilities.

The medical storage columns segment is the fastest-growing segment in the forecasted period. The medical storage columns segment is the fastest-growing segment in 2023 for the medical carts market. Medical storage columns are a type of medical cart designed to provide additional storage space for medical supplies, medications, and equipment. They are a popular choice among healthcare providers due to their compact design and ability to maximize storage capacity in small spaces.

Material Analysis

The Metal Segment is Dominator in Material Segment and Accounted Highest Revenue in Material Segment in 2023.

Based on material, the market for medical carts is segmented into metal, plastic, and other. Among these segments, the metal segment is dominant with the largest market share 48.2%, and the highest CAGR of 49.9% in 2023. Medical carts are constructed primarily with metal materials, such as stainless steel, aluminum, or steel alloys. Metal medical carts are known for their durability, strength, and resistance to wear and tear, making them a popular choice in healthcare settings where carts are subject to frequent use and movement.

The medical cart segment is expected to generate the highest revenue in the forecasted period. Medical carts are constructed primarily with plastic materials, such as high-density polyethylene (HDPE), polypropylene (PP), or acrylonitrile butadiene styrene (ABS). Plastic medical carts are known for their lightweight design, easy maneuverability, and low maintenance, making them a popular choice in healthcare settings where carts are frequently moved around.

End-User Analysis

The Hospital Segment Dominates and Accounted Highest Revenue in End-User Segment in Medical Carts Market.

Based on end-user, the market for medical carts is segmented into hospital ambulatory surgical centers, diagnostic centers, nursing homes, home care settings, and other end-user. Among these end-user, hospital segments dominate with the largest market share 37% and the highest CAGR 5.6% in 2023 Hospitals are the largest end-user group for medical carts, and they require a wide range of medical cart types to meet their diverse needs. Medical carts used in hospitals are designed to provide a centralized location for storing and transporting medical supplies, equipment, and medications.

The ambulatory surgical center’s segment is expected to be the fastest-growing end-user segment in the medical carts market owing to the wide range of surgical procedures. The ambulatory surgical center’s segment is accounted as the fastest growing segment in the end-user for medical carts market. Ambulatory surgical centers are medical facilities that specialize in providing outpatient surgical procedures to patients who do not require hospitalization. These centers typically have the necessary equipment and facilities to perform a wide range of surgical procedures, from minor to complex.

Key Market Segments

Based on Type

- Emergency Carts

- Procedure Carts

- Anesthesia Carts

- Other Carts

Based on Product

- Medical Storage Columns

- Wall-Mounted Workstations

- Mobile Computing Carts

- Medication Carts

- Other

Based on Material

- Metal

- Plastic

- Other

Based on End-User

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Nursing Homes

- Homecare Settings

- Other End-User

Regional Analysis

In 2023, North America accounted for 45.7% Revenue Share in 2023 for Medical Carts Market and holds USD 0.95 Billion market value for the year.

North America is estimated to be the most lucrative market in the global medical carts market, with the largest market share 45.7% in 2023. The United States is the major contributor. The region’s dominance is due to the well-established healthcare infrastructure, high healthcare spending, and technological advancements in the healthcare sector. The region is witnessing increased adoption of mobile carts and advanced technology-enabled carts.

Europe is estimated the fastest-growing region in the forecasted period medical carts market. Europe is the second-largest market for medical carts. The market is driven by factors such as increasing healthcare expenditure, a growing geriatric population, and a rise in chronic diseases. The region has strict regulations on medical devices, and manufacturers must comply with European Union (EU) regulations before selling their products in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The medical carts market is highly competitive, with several key players competing for market share. The key players in the market are focused on developing innovative products that meet the changing needs of healthcare providers, such as mobile and lightweight carts, and those with advanced technology-enabled features. Ergotron holds a significant share of the medical carts market, with a strong presence in North America and Europe. The company offers a range of medical carts that are designed for different healthcare settings, including hospitals, clinics, and long-term care facilities.

Market Key Players

Listed below are some of the most prominent medical cart industry players.

- Ergotron, Inc.

- ITD GmbH

- Capsa Healthcare

- Harloff Company

- Waterloo Healthcare

- Midmark Corporation

- AFC Industries, Inc.

- Jaco, Inc.

- Alimed, Inc.

- Advantech Co. Ltd.

- Other

Recent Developments

- In December 2023, ITD GmbH made a significant move by acquiring a majority stake in German medical furniture manufacturer Schmidtberger Medizintechnik. This strategic move not only broadens its product range but also expands its presence in new geographic regions.

- In November 2023, Advantech Co. Ltd. joined the fray, revealing the “WISE-5550” medical cart PC. This device is tailored for secure and dependable data access and processing right at the point of care.

- In October 2023, Following suit, Midmark Corporation partnered with Meditech to seamlessly integrate their EMR system with Midmark’s “Passport” medication dispensing cart, aiming to streamline medication management processes.

- In August 2023, Harloff Company introduced the “Harloff Guardian Pro Max” medical cart, which boasts an upgraded antimicrobial surface and improved ease of movement.

Report Scope:

Report Features Description Market Value (2023) USD 2.1 Bn Forecast Revenue (2033) USD 7.1 Bn CAGR (2024-2033) 12.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Emergency Carts, Procedure Carts, Anesthesia Carts, Other Carts), By Product (Medical Storage Columns, Wall-Mounted Workstations, Mobile Computing Carts, Other), By Material (Metal, Plastic, Other), By End-User (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers, Nursing Homes, Homecare Settings, Other End-User) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ergotron, Inc., ITD GmbH, Capsa Healthcare, Harloff Company, Waterloo Healthcare, Midmark Corporation, AFC Industries, Inc., Jaco, Inc., Alimed, Inc., Advantech Co. Ltd., Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Medical Carts market in 2023?The Medical Carts market size is USD 2.1 Billion in 2023.

What is the projected CAGR at which the Medical Carts market is expected to grow at?The Medical Carts market is expected to grow at a CAGR of 12.7% (2024-2033).

List the segments encompassed in this report on the Medical Carts market?Market.US has segmented the Medical Carts market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Emergency Carts, Procedure Carts, Anesthesia Carts, Other Carts. By Product the market has been segmented into Medical Storage Columns, Wall-Mounted Workstations, Mobile Computing Carts, Medication Carts, Other. By Material the market has been segmented into Metal, Plastic, Other. By End-User the market has been segmented into Hospitals, Ambulatory Surgical Centers, Diagnostic Centers, Nursing Homes, Homecare Settings, Other End-User.

List the key industry players of the Medical Carts market?Ergotron Inc., ITD GmbH, Capsa Healthcare, Harloff Company, Waterloo Healthcare, Midmark Corporation, AFC Industries Inc., Jaco Inc., Alimed Inc., Advantech Co. Ltd., Other Key Players

Which region is more appealing for vendors employed in the Medical Carts market?Europe is expected to account for the highest revenue share of 45.7% and boasting an impressive market value of USD 0.95 Billion. Therefore, the Medical Carts industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Medical Carts?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Medical Carts Market.

-

-

- Ergotron, Inc.

- ITD GmbH

- Capsa Healthcare

- Harloff Company

- Waterloo Healthcare

- Midmark Corporation

- AFC Industries, Inc.

- Jaco, Inc.

- Alimed, Inc.

- Advantech Co. Ltd.

- Other