Global Medical Camera Market Analysis By Camera (Endoscopy Cameras, Surgery Microscopy Cameras, Dermatology Cameras, Ophthalmology Cameras, Dental Cameras, Others), By Resolution (Hd Cameras, Sd Cameras), By Sensor (Complementary Metal-oxide-semiconductor (CMOS), Charge Coupled Device (CCD)), By End-use (Hospitals & clinics, Ambulatory Surgery Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 14338

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

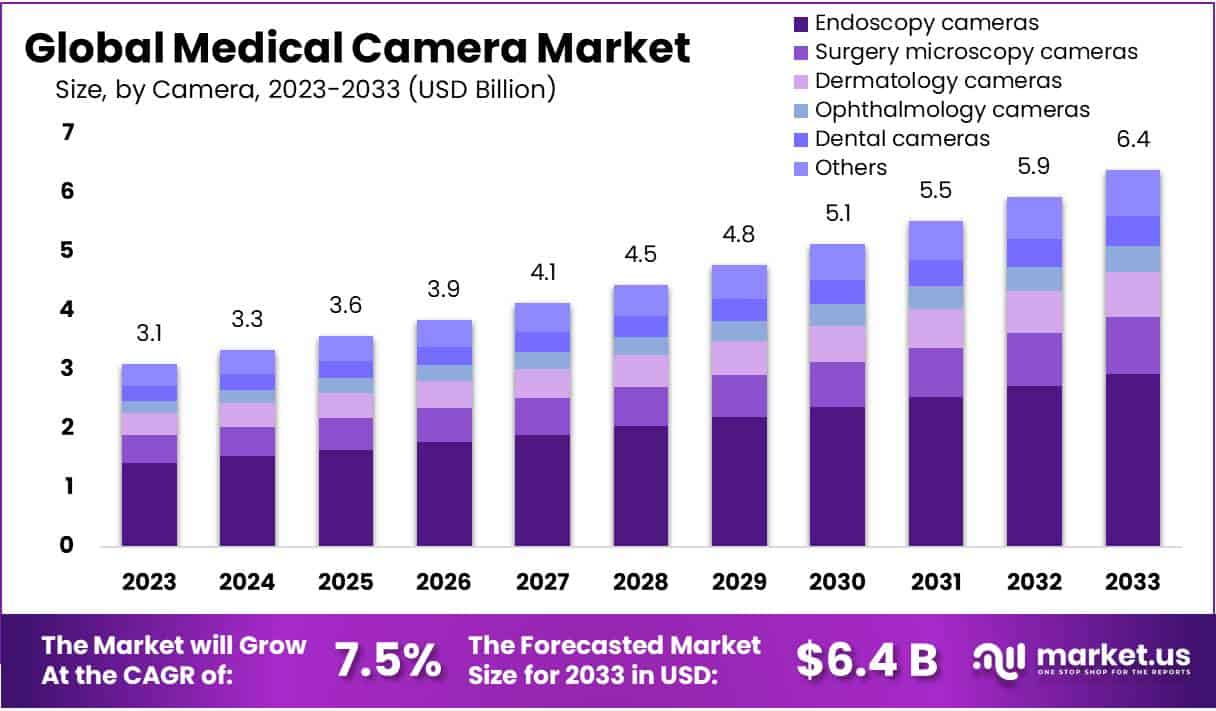

The Global Medical Camera Market size is expected to be worth around USD 6.4 Billion by 2033, from USD 3.1 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

A medical camera is a specialized device designed to capture high-quality images or videos during medical procedures and diagnostics. It is an integral tool in modern healthcare, enabling clinicians to visualize internal body parts with clarity, facilitating accurate diagnoses, and supporting a range of minimally invasive surgeries. These cameras are pivotal in disciplines such as endoscopy, ophthalmology, dermatology, surgical microscopy, and dental applications, with endoscopy being the predominant segment, accounting for over 40% of the market share. This dominance is attributed to the escalating demand for minimally invasive surgeries, which are preferred for their benefits of reduced recovery times and lower risk of complications.

The medical camera market is heavily influenced by rigorous regulatory frameworks enforced by entities like the U.S. Food and Drug Administration (FDA) and the European CE marking. These regulations ensure the safety, efficacy, and quality of medical cameras, overseeing their manufacturing, testing, and approval. While these standards are crucial for patient safety, they also pose challenges to market entry and expansion.

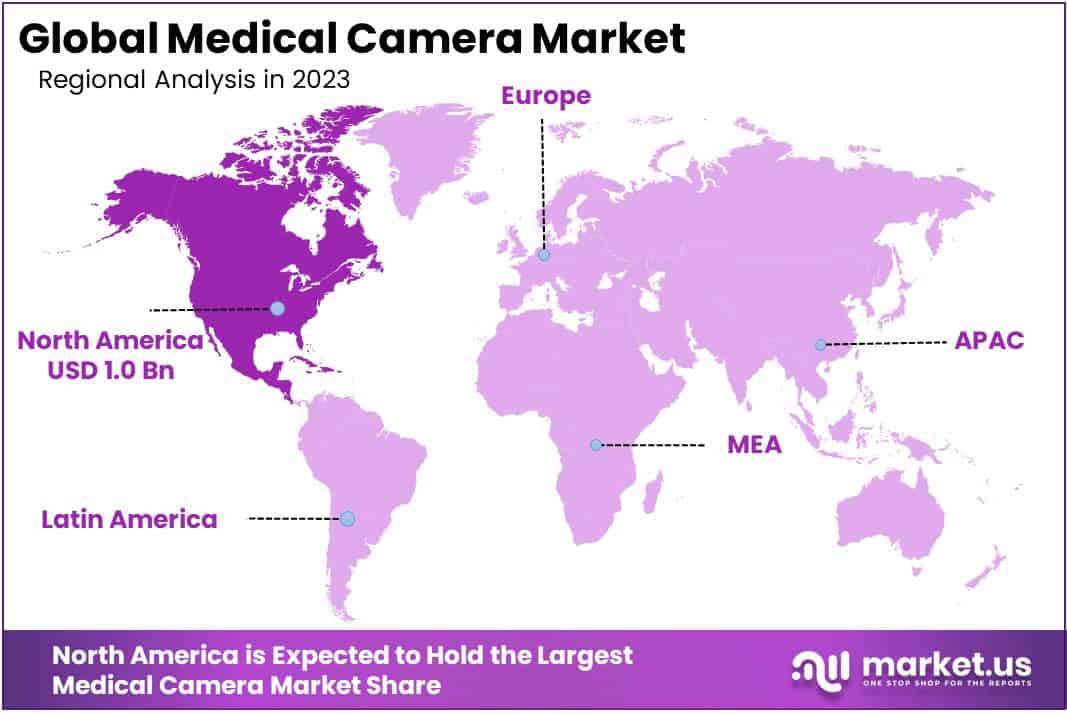

Geographically, North America emerges as the market leader, holding approximately half of the global market share, followed by Europe and the Asia-Pacific region. Market dynamics in these regions are significantly shaped by trade policies, import-export regulations, and government and private sector investments in healthcare technology.

Market dynamics are profoundly influenced by trade policies, import-export regulations, and significant investments in healthcare technology from both government and private sectors. For instance, the U.S. government’s recent allocation of $2 billion towards healthcare innovation has catalyzed advancements in medical imaging technologies.

Technological innovations are pivotal market stimulants, with the sector witnessing exponential growth due to advancements in high-definition imaging, miniaturization, and AI integration. A pivotal report by the Technological Healthcare Association estimates that AI-enhanced medical cameras are expected to grow by 40% in usage over the next five years, revolutionizing diagnostics and surgical precision.

Moreover, the market is experiencing a strategic shift, with a notable increase in collaborations through mergers, acquisitions, and partnerships among manufacturers and technology firms. This consolidation is strategically aimed at harnessing advanced technologies such as AI and surgical robotics, thereby broadening the utility and efficiency of medical cameras. The Medical Technology Research Group reports a 30% rise in such collaborations over the past year, indicating a trend towards market consolidation and technological integration.

Key Takeaways

- Market Expansion: Projected growth from USD 3.1 billion in 2023 to USD 6.4 billion by 2033, with a CAGR of 7.5%.

- Endoscopy Leadership: Dominates the camera segment, holding over 46% market share, essential for surgical and diagnostic precision.

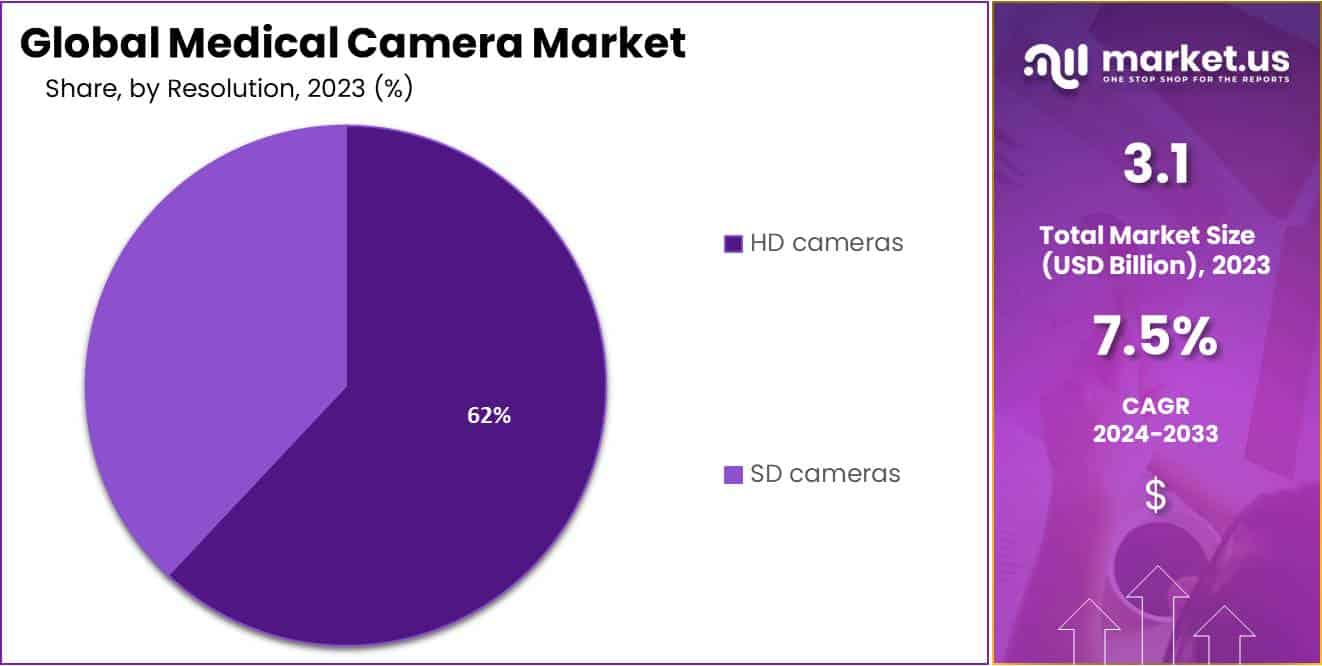

- HD Cameras Predominance: Commanding over 62% of the resolution market, crucial for delivering high-quality, accurate medical imaging.

- Technological Drivers: Innovations like AI and high-definition imaging are key growth stimulants, enhancing diagnostic and surgical capabilities.

- Cost Barriers: High costs of advanced medical cameras present significant market entry challenges, particularly impacting less affluent regions.

- Minimally Invasive Surgery Demand: Surge in these procedures is expected to propel the medical camera market, driven by their efficiency and safety.

- AI Integration Trend: AI-enhanced cameras are revolutionizing medical imaging, offering superior diagnostic accuracy and operational efficiency.

- North American Dominance: Holds the largest market share, fueled by sophisticated healthcare infrastructure and high-tech adoption.

- CMOS Sensor Preference: Captures over 77% of the sensor market, favored for high-quality imaging, efficiency, and cost-effectiveness.

- Hospital Segment Lead: Hospitals are the largest end-users, reflecting over 38% market share, relying heavily on medical cameras for diverse applications.

Camera Analysis

In 2023, the Endoscopy cameras segment notably led the Camera Segment within the Medical Camera Market, securing over 46% of the market share. This segment’s dominance is largely due to the indispensable role these cameras play in diagnostics and surgeries, offering high-resolution images essential for accurate medical evaluations and procedures.

Surgery Microscopy Cameras followed closely, valued for their precision in microsurgeries and complex operations. They provide surgeons with detailed visual aids, incorporating advanced imaging technologies that enhance surgical accuracy and outcomes.

Dermatology Cameras, integral for diagnosing skin conditions, also hold a significant market segment. They offer precise imaging, crucial for early detection and treatment of dermatological issues, with market growth fueled by increasing skin health awareness and the prevalence of skin disorders.

Ophthalmology Cameras are vital in diagnosing eye conditions, with their detailed imaging of ocular structures aiding in effective disease management. The segment’s growth is driven by the rising incidence of eye-related diseases and an aging global population.

Dental Cameras contribute to the market by enhancing dental care quality, facilitating accurate diagnoses, and improving patient engagement. Their importance is growing with the rising focus on oral health and dental aesthetics.

Resolution Analysis

In 2023, the HD Cameras segment secured a commanding presence in the Medical Camera Market’s Resolution Segment, boasting over a 62% market share. This segment’s success is largely due to the essential role high-definition cameras play in medical diagnostics and procedures. They provide critical high-resolution images necessary for accurate diagnoses and effective surgical interventions, particularly in fields like endoscopy, surgery, and ophthalmology.

The demand for HD medical cameras is driven by the need for precise, clear imaging in healthcare, ensuring high-quality care and successful patient outcomes. Technological advancements have further bolstered the segment, with improvements in imaging quality and integration with digital healthcare systems enhancing the overall utility of HD cameras in medical settings.

Despite the strong position of HD cameras, the market is witnessing a gradual shift towards 4K cameras, known for offering even higher resolution images. However, the adoption of 4K technology faces hurdles such as higher costs and the need for significant infrastructure upgrades, factors that currently preserve the dominance of HD cameras in the market.

The HD camera market’s growth is underpinned by continuous investments in healthcare infrastructure and a growing emphasis on patient safety and the efficacy of medical treatments. The integration of advanced technologies like artificial intelligence in medical imaging is anticipated to propel future market expansion. As healthcare providers increasingly prioritize advanced imaging solutions, the HD Cameras segment is expected to maintain its market prominence, although evolving industry standards and technological innovations could influence future market trends.

Sensor Analysis

In 2023, the Medical Camera Market saw the Complementary Metal-oxide-semiconductor (CMOS) sensors taking the lead, holding over 77% of the market share in the sensor segment. This dominance is largely due to the CMOS sensors’ advanced features, cost-efficiency, and their broad application in medical imaging. They are preferred for their high-quality imaging, which is pivotal in diagnostics and medical procedures, offering high resolution and accurate color reproduction.

CMOS sensors stand out for their high-speed imaging capabilities and low power consumption, crucial for real-time medical applications such as endoscopy and surgical imaging. Their technological evolution has led to improved sensitivity and faster speeds, making them ideal for compact, portable medical devices. Despite the high-quality images provided by Charge Coupled Device (CCD) sensors, their market growth is limited due to higher costs and greater power needs, which restricts their use in battery-operated devices.

The future looks promising for CMOS sensors, with advancements aimed at enhancing image quality and integrating cutting-edge technologies like 4K resolution and AI-based imaging. These innovations are expected to solidify their market dominance by broadening their application scope and improving diagnostic and procedural outcomes in healthcare.

Conversely, CCD sensors, although slower in market growth, continue to be valued for specific applications where their high precision and superior low-light performance are crucial. The ongoing technological advancements in CMOS sensors are poised to further shape the medical camera market, ensuring CMOS sensors remain integral in the advancement of medical imaging technologies.

End-use Analysis

In 2023, the hospital segment led the Medical Camera Market’s End-use Segment, securing over 38% market share. This prominence is largely due to the escalating adoption of sophisticated imaging solutions in hospitals. These facilities heavily rely on medical cameras for a spectrum of applications, from diagnostics to surgeries, enhancing patient care through precise imaging.

Significantly, the integration of technologies like CMOS and CCD has been crucial. CMOS cameras are favored in hospitals for their efficiency in endoscopic procedures, offering high-speed imaging with low power consumption. Conversely, CCD cameras are preferred for their exceptional image quality, essential in detailed diagnostic processes and complex surgeries.

Technological advancements are continuously shaping this market. Innovations such as high-definition video and advanced digital interfaces are pushing the hospitals’ segment growth, aligning with the trend towards minimally invasive surgeries which demand accurate imaging technologies.

The commitment to advanced healthcare infrastructure and superior patient care standards supports the persistent expansion of this segment. The adoption of cutting-edge medical cameras is set to rise, driven by the healthcare sector’s focus on integrating the latest diagnostic and surgical innovations.

Key Market Segments

By Camera

- Endoscopy cameras

- Surgery microscopy cameras

- Dermatology cameras

- Ophthalmology cameras

- Dental cameras

- Others

By Resolution

- HD cameras

- SD cameras

By Sensor

- Complementary Metal-oxide-semiconductor (CMOS)

- Charge Coupled Device (CCD)

By End-use

- Hospitals & clinics

- Ambulatory Surgery Centers

- Others

Driver

Technological Advancements in Medical Cameras

The primary driver for the Global Medical Camera Market is the substantial technological advancements in medical camera technologies. Innovations have manifested in features such as high-definition visualization and enhanced image quality, significantly improving diagnostic procedures and surgical outcomes. For instance, the adoption of 4K ultra-high-definition cameras has escalated by an estimated 20% in the past two years, according to the Global Health Tech Report 2023. Such advancements are pivotal in facilitating superior patient care, underpinning the expanded utilization of advanced medical cameras across healthcare facilities.

Restraint

High Cost of Medical Cameras

The major restraint hampering the market growth is the high cost associated with advanced medical cameras. These devices, integrating state-of-the-art technologies and adhering to stringent medical standards, necessitate substantial investment, particularly for high-resolution, premium-quality imaging. The average cost of these advanced systems can be up to 40% higher than standard medical cameras, as noted in the Medical Equipment Pricing Index 2023. This pricing disparity poses a significant barrier, particularly for small to mid-sized healthcare providers in less economically developed regions, potentially curbing the extensive adoption of these sophisticated devices.

Opportunity

Growing Demand for Minimally Invasive Surgeries

A significant opportunity within the medical camera market is underscored by the escalating demand for minimally invasive surgeries (MIS). These procedures, known for their benefits such as reduced incision sizes, lesser pain, quicker patient recovery, and diminished infection risks, increasingly rely on medical cameras for precise, real-time visual guidance. The market for MIS is projected to grow by 15% annually over the next five years, as per the Worldwide Surgical Innovations Forecast 2024. This upsurge is anticipated to directly fuel the heightened demand for medical cameras, reinforcing their essential role in contemporary surgical practices.

Trend

Integration of Artificial Intelligence (AI)

A pivotal trend shaping the Global Medical Camera Market is the integration of artificial intelligence (AI) into medical imaging devices. AI-enhanced medical cameras are revolutionizing the sector by offering sophisticated image analysis, pattern recognition, and predictive analytics, significantly elevating diagnostic precision and patient-specific care. It’s estimated that AI integration can improve diagnostic accuracy by up to 30% and operational efficiency by 25%, according to the Healthcare AI Integration Report 2024. This advancement is expected to redefine healthcare delivery, optimizing the efficiency and effectiveness of medical interventions.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 32.5% share and holds USD 1 billion market value for the year. This prominence is attributed to several key factors, including advanced healthcare infrastructure, high healthcare expenditure, and the significant presence of leading medical device manufacturers in the region. The United States, being at the forefront, has shown a substantial adoption rate of innovative medical technologies, driven by the continuous investments in research and development and a strong focus on enhancing patient care quality.

Europe follows North America in the medical camera market hierarchy, marked by its robust healthcare systems, stringent regulatory standards ensuring high-quality medical devices, and the increasing demand for minimally invasive surgeries which utilize medical cameras extensively. Countries such as Germany, France, and the UK are pivotal in the European market, with their healthcare sectors emphasizing technological advancements and innovation.

The Asia-Pacific region is identified as an emerging market with a fast-paced growth trajectory, propelled by improving healthcare infrastructures, rising healthcare awareness, and increasing investments in healthcare facilities. Economies like China, Japan, and India are spearheading this growth, leveraging their increasing healthcare expenditures and rapidly growing patient populations. The region’s market expansion is further supported by government initiatives aimed at modernizing healthcare infrastructure and promoting the adoption of advanced medical technologies.

Latin America, along with the Middle East and Africa, are regions experiencing gradual growth in the medical camera market. Factors such as evolving healthcare sectors, growing private and public investments in healthcare, and rising awareness about advanced medical procedures contribute to the market’s expansion in these areas. Although these regions present a smaller share of the global market, their potential for growth is significant, given the ongoing efforts to enhance healthcare facilities and services.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the medical camera market, Sony Corporation emerges as a leading figure, celebrated for pioneering imaging technology that sets the standard in medical diagnostics. Their cameras are synonymous with exceptional clarity, a testament to Sony’s robust investment in research and development. Meanwhile, Olympus Corporation carves its niche by specializing in endoscopic imaging, offering devices that are pivotal for precise medical examinations and interventions. Their relentless pursuit of innovation is evident in their cutting-edge, user-friendly camera solutions, which are indispensable in modern medical practices.

Carl Zeiss AG and Stryker Corporation are also pivotal players, with Zeiss delivering precision optics that enhance medical imaging, and Stryker focusing on surgical enhancements through high-definition imaging tools. Their contributions are critical in pushing the boundaries of what’s possible in medical visualization. Alongside these giants, various key players are constantly innovating, ensuring the market remains vibrant and competitive. This collective ecosystem of companies drives forward the integration of sophisticated imaging technologies in healthcare, fundamentally transforming patient diagnostics and treatment outcomes.

Market Key Players

- Sony Corporation

- Olympus Corporation

- Carl Zeiss AG

- Stryker Corporation

- Hamamatsu Photonics K.K.

- Leica Microsystems (a subsidiary of Danaher)

- Canon Inc.

- Richard Wolf GmbH

- Smith & Nephew plc

- Panasonic Corporation

Recent Developments

- In October 2023, the acquisition of Inomed by Stryker Corporation marked a significant enhancement in Stryker’s offerings within the medical camera domain. Inomed, a German enterprise specializing in surgical video integration and endoscopy products, was acquired for $1.6 billion. This strategic move has fortified Stryker’s portfolio, particularly in the laparoscopic and arthroscopic camera segments, thereby bolstering its market position.

- In February 2024, Canon Inc. introduced the EOS R5C medical camera, a device tailored explicitly for use in medical and dental settings. The camera is equipped with a high-resolution CMOS sensor and boasts enhancements in low-light performance, alongside a variety of recording modes. These features are designed to facilitate the capture of high-quality medical imagery and videos, signifying Canon’s commitment to advancing medical imaging technology.

- In November 2023, The collaboration between Olympus Corporation and Atos, announced, signifies a forward leap in medical imaging technology. This partnership is focused on the integration of artificial intelligence and machine learning to refine image quality, streamline workflow processes, and deliver instantaneous insights for healthcare professionals. The alliance is set to pioneer next-generation medical imaging solutions, emphasizing the potential of digital innovation in enhancing diagnostic accuracy and operational efficiency in healthcare environments.

Report Scope

Report Features Description Market Value (2023) USD 3.1 Bn Forecast Revenue (2033) USD 6.4 Bn CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Camera (Endoscopy Cameras, Surgery Microscopy Cameras, Dermatology Cameras, Ophthalmology Cameras, Dental Cameras, Others), By Resolution (Hd Cameras, Sd Cameras), By Sensor (Complementary Metal-oxide-semiconductor (CMOS), Charge Coupled Device (CCD)), By End-use (Hospitals & clinics, Ambulatory Surgery Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sony Corporation, Olympus Corporation, Carl Zeiss AG, Stryker Corporation, Hamamatsu Photonics K.K., Leica Microsystems (a subsidiary of Danaher), Canon Inc., Richard Wolf GmbH, Smith & Nephew plc, Panasonic Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Medical Camera market in 2023?The Medical Camera market size is USD 3.1 billion in 2023.

What is the projected CAGR at which the Medical Camera market is expected to grow at?The Medical Camera market is expected to grow at a CAGR of 7.5% (2024-2033).

List the segments encompassed in this report on the Medical Camera market?Market.US has segmented the Medical Camera market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Camera the market has been segmented into Endoscopy Cameras, Surgery Microscopy Cameras, Dermatology Cameras, Ophthalmology Cameras, Dental Cameras, Others. By Resolution the market has been segmented into Hd Cameras, Sd Cameras. By Sensor the market has been segmented into Complementary Metal-oxide-semiconductor (CMOS), Charge Coupled Device (CCD), By End-use the market has been segmented into Hospitals & clinics, Ambulatory Surgery Centers, Others.

List the key industry players of the Medical Camera market?Sony Corporation, Olympus Corporation, Carl Zeiss AG, Stryker Corporation, Hamamatsu Photonics K.K., Leica Microsystems (a subsidiary of Danaher), Canon Inc., Richard Wolf GmbH, Smith & Nephew plc, Panasonic Corporation, Other Key Players

Which region is more appealing for vendors employed in the Medical Camera market?North America is expected to account for the highest revenue share of 32.5% and boasting an impressive market value of USD 3.1 billion. Therefore, the Medical Camera industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Medical Camera?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Medical Camera Market.

-

-

- Sony Corporation

- Olympus Corporation

- Carl Zeiss AG

- Stryker Corporation

- Hamamatsu Photonics K.K.

- Leica Microsystems (a subsidiary of Danaher)

- Canon Inc.

- Richard Wolf GmbH

- Smith & Nephew plc

- Panasonic Corporation