Medical Aesthetics Market By Product Type (Energy-based, Non-energy-based, and Others), By Application (Body Contouring & Cellulite Reduction, Skin Resurfacing & Tightening, Breast Augmentation, Hair & Tattoo Removal, and Others), By End-user (Hospitals, Specialty Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 105581

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

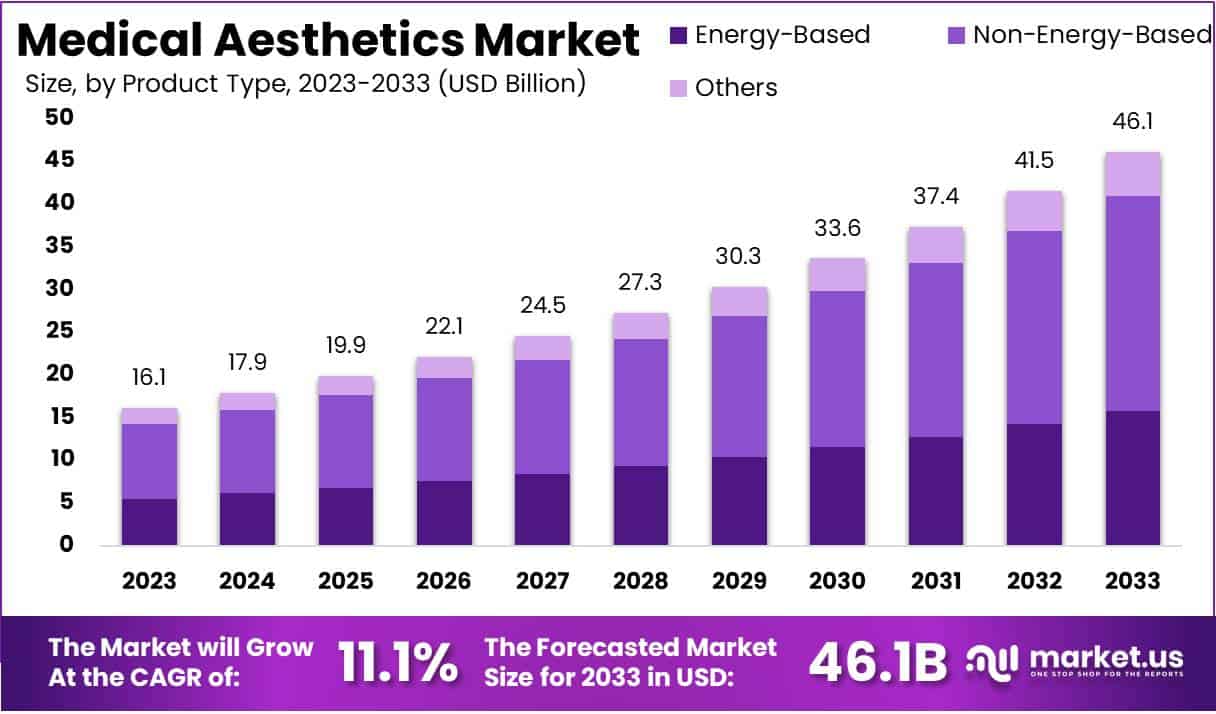

The Medical Aesthetics Market size is expected to be worth around USD 46.1 billion by 2033 from USD 16.1 billion in 2023, growing at a CAGR of 11.1% during the forecast period 2024 to 2033.

In recent years, the demand for medical aesthetic solutions has surged due to a growing desire for prolonged youthfulness, the influence of social media, and advancements in technology. Celebrity endorsements and the promotion of aesthetic treatments by beauticians and medical professionals have further fueled this trend.

The COVID-19 pandemic also played a significant role in increasing the number of cosmetic procedures, with the American Academy of Facial Plastic and Reconstructive Surgery reporting a 10% rise in such surgeries during the pandemic. Medical aesthetics, a well-established branch of modern medicine, focuses on enhancing cosmetic appearance without the need for traditional surgery. These treatments are commonly used for anti-aging purposes, such as reducing fine lines, tightening sagging skin, and rejuvenating the skin.

In addition, medical aesthetics can address issues like excess fat, cellulite, unwanted hair, and spider veins. According to the International Society of Aesthetic Plastic Surgery (ISAPS), over 15 million invasive and 19 million non-invasive aesthetic procedures were performed globally in 2022. While women make up nearly 90% of the clientele, these treatments are becoming increasingly popular among men as well.

Key Takeaways

- In 2023, the market for Medical Aesthetics generated a revenue of USD 16.1 billion, with a CAGR of 11.1%, and is expected to reach USD 46.1 billion by the year 2033.

- The product type segment is divided into energy-based, non-energy-based, and others, with non-energy-based taking the lead in 2023 with a market share of 54.5%.

- Considering application, the market is divided into body contouring & cellulite reduction, skin resurfacing & tightening, breast augmentation, hair & tattoo removal, and others. Among these, skin resurfacing & tightening held a significant share of 38.7%.

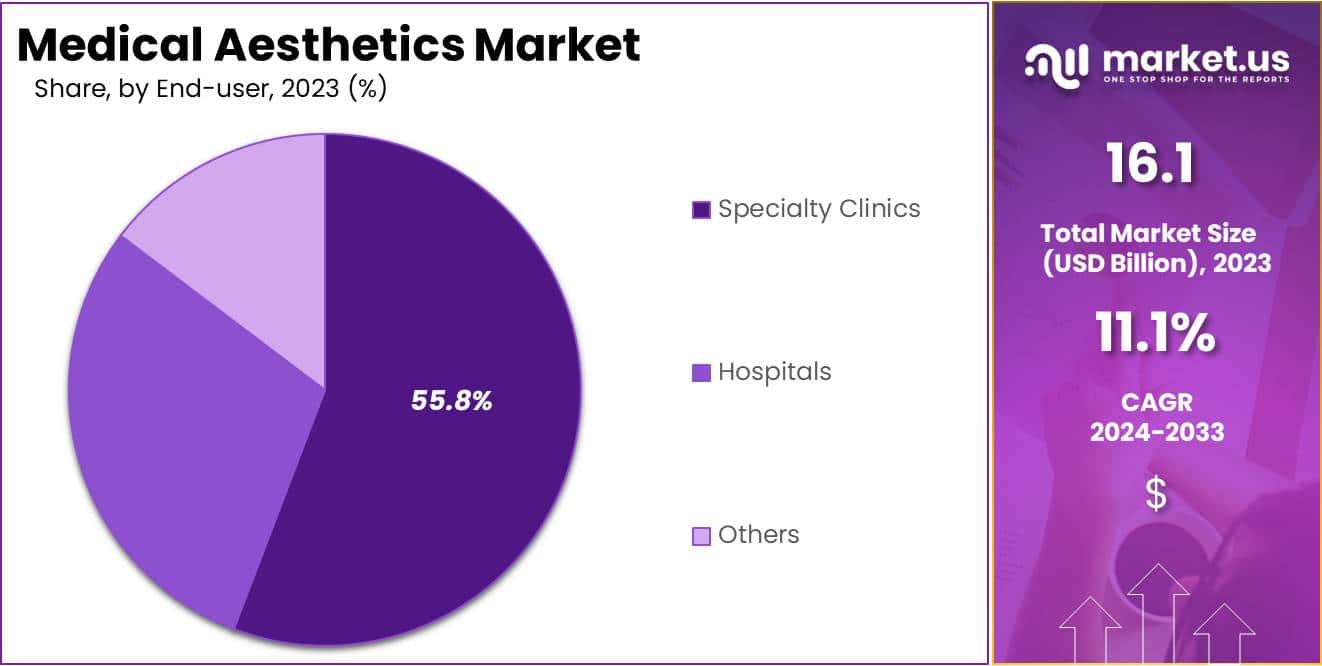

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, specialty clinics, and others. The specialty clinics sector stands out as the dominant player, holding the largest revenue share of 55.8% in the Medical Aesthetics market.

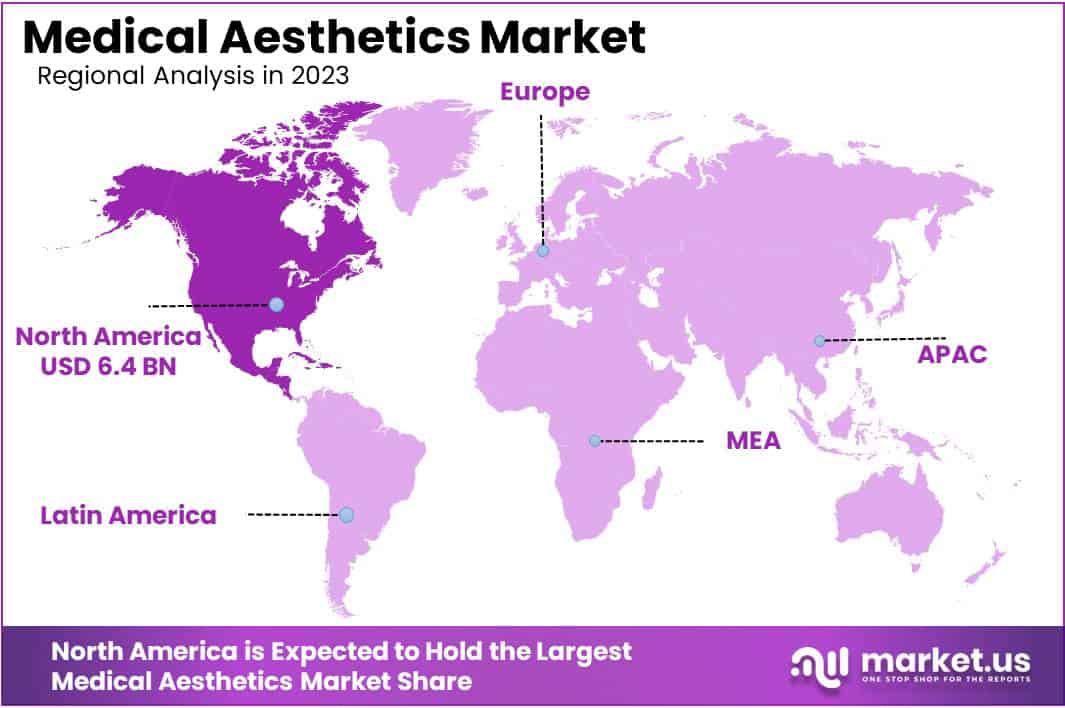

- North America led the market by securing a market share of 39.8% in 2023.

Product Type Analysis

The non-energy-based segment led in 2023, claiming a market share of 54.5% owing to the rising demand for minimally invasive and non-surgical cosmetic procedures. Treatments such as dermal fillers, botulinum toxin injections, and microdermabrasion fall within this category, and their growing popularity is driven by shorter recovery times and fewer complications compared to surgical procedures.

The increasing awareness of aesthetic treatments and the desire for natural-looking results are likely to boost demand in this segment. Additionally, advancements in product formulations and techniques are expected to improve treatment efficacy and safety, further propelling the growth of non-energy-based aesthetic procedures.

Application Analysis

Skin resurfacing & tightening held a significant share of 38.7% due to the increasing desire for youthful, rejuvenated skin. Non-invasive treatments such as chemical peels, microdermabrasion, and laser therapies are gaining popularity for their ability to reduce wrinkles, fine lines, and scars without extensive recovery times.

The growing aging population, coupled with advancements in skin resurfacing technologies, is expected to drive demand in this segment. Additionally, the rise of social media and beauty standards emphasizing flawless skin likely contributes to the growing interest in skin-tightening procedures, further fueling market growth.

End-user Analysis

The specialty clinics segment had a tremendous growth rate, with a revenue share of 55.8% owing to the rising number of clinics specializing in cosmetic and dermatological treatments. These clinics often provide personalized care and access to the latest technologies, making them a preferred choice for patients seeking aesthetic procedures.

The growing trend of minimally invasive treatments, which require less downtime and specialized expertise, is anticipated to boost demand for specialty clinics. Additionally, the increasing availability of skilled practitioners and tailored treatment plans at these facilities is likely to contribute to the segment’s expansion, enhancing patient satisfaction and driving market growth.

Key Market Segments

By Product Type

- Energy-based

- Non-energy-based

- Others

By Application

- Body Contouring & Cellulite Reduction

- Skin Resurfacing & Tightening

- Breast Augmentation

- Hair & Tattoo Removal

- Others

By End-user

- Hospitals

- Specialty Clinics

- Others

Drivers

Increase in Demand for Home-based Aesthetic Procedures

Increasing demand for home-based aesthetic procedures drives growth in the medical aesthetics market. Consumers seek convenient and cost-effective solutions for skin treatments, which has led to a surge in home-use devices. As per the British Skin Foundation in 2023, 60% of people in the U.K. suffer from a skin condition, and 20% of children have eczema.

This rising demand for at-home treatments encourages the adoption of advanced devices that address these issues. For instance, LightStim launched the Elipsa in July 2022, offering dual treatment options for acne and wrinkles through LED-based technology. Such innovations are projected to expand the market by providing users with effective and accessible aesthetic treatments at home.

Restraints

High Cost of Devices

Rising costs of devices significantly impede the growth of the medical aesthetics market. High-tech equipment, such as laser systems, radiofrequency devices, and LED-based technologies, often come with substantial price tags, which limits accessibility for both clinics and consumers. Smaller aesthetic practices, particularly in developing regions, find it challenging to invest in such expensive devices.

This financial barrier also restricts the availability of advanced aesthetic treatments, hampering market expansion. The elevated costs of maintenance, training, and operational requirements further exacerbate the issue, making it difficult for the market to grow at an optimal pace, especially in price-sensitive regions.

Opportunities

Surging Demand for Dermal Filler-based Treatment and Botulinum Toxin

Rising demand for dermal filler-based treatments and botulinum toxin procedures offers a lucrative opportunity for the medical aesthetics market. The popularity of minimally invasive cosmetic procedures continues to surge, with products such as BELOTERO BALANCE + Lidocaine, launched by Merz Pharma in February 2021, catering to this growing trend.

BELOTERO BALANCE offers precise treatment for etched-in lines, enhanced by the lidocaine formulation for improved patient comfort. According to the International Society of Aesthetic Plastic Surgery, 1,370,495 botulinum toxin procedures were performed on men worldwide in 2022. This increasing demand for non-surgical aesthetic solutions is anticipated to drive further advancements and growth in the global medical aesthetics market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the medical aesthetics market, shaping its growth and challenges. Economic downturns may lead to reduced consumer spending on non-essential treatments, affecting the demand for aesthetic procedures. Geopolitical tensions and trade restrictions can disrupt the supply chain, leading to delays in the availability of aesthetic devices and increased production costs.

However, rising disposable incomes in emerging markets create opportunities for growth as more people seek cosmetic enhancements. Additionally, government initiatives supporting healthcare and wellness sectors further drive demand. Despite challenges, the market shows promise due to increasing awareness of aesthetic treatments and technological advancements.

Latest Trends

Surging Trend of Partnerships and Collaborations

Rising partnerships and collaborations are driving growth in the medical aesthetics market. Companies are increasingly joining forces to expand their product portfolios and global reach. For instance, in July 2023, Reveal Lasers acquired NEOconcepts to enhance its offerings in facial aesthetic devices. These partnerships are anticipated to improve the distribution of aesthetic products and devices across various regions.

Growing collaboration between key players is projected to accelerate innovation and improve market penetration, ensuring a broader range of treatment options for consumers. As more firms pursue strategic alliances, the medical aesthetics industry is likely to experience sustained growth and technological advancement.

Regional Analysis

North America is leading the Medical Aesthetics Market

North America dominated the market with the highest revenue share of 39.8% owing to a combination of technological advancements, increasing consumer demand for cosmetic procedures, and a growing focus on self-image and personal wellness. The approval of innovative products by regulatory bodies has significantly enhanced treatment options for patients.

For example, in January 2021, Mentor Worldwide LLC received U.S. FDA approval for the MENTOR MemoryGel BOOST breast implant, specifically for breast augmentation in women aged 22 and older. Additionally, in May 2023, the FDA approved SKINVIVE by JUVÉDERM by Allergan, which aims to improve cheek smoothness, reflecting the growing trend of minimally invasive treatments.

Other notable advancements include the July 2022 clearance of Apyx Medical’s Renuvion device for aesthetic procedures to enhance the appearance of lax skin and the March 2021 launch of Bausch Health Companies Inc.’s Clear + Brilliant Touch laser, providing customizable treatments. These developments underscore the increasing acceptance and adoption of aesthetic procedures among diverse demographic groups.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising disposable incomes and increasing urbanization. Countries like India and China are expected to lead this growth, fueled by a burgeoning middle class and growing awareness of cosmetic treatments.

For instance, in December 2021, Kaya launched CoolSculpting in India, targeting its expanding uber-urban client base seeking precision in body contouring and physical enhancement. As consumers increasingly prioritize self-care and aesthetic improvements, demand for non-invasive and minimally invasive procedures is likely to rise.

Furthermore, advancements in technology and the introduction of innovative products will likely enhance treatment outcomes and safety, encouraging broader adoption. The combination of cultural shifts toward aesthetic acceptance and enhanced access to medical aesthetics services is anticipated to drive robust market growth in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Medical Aesthetics market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the medical aesthetics market focus on expanding their product portfolios by introducing innovative, minimally invasive treatments such as injectables and laser therapies.

They collaborate with dermatologists and plastic surgeons to enhance treatment outcomes and gain clinical support. Companies invest heavily in research and development to create advanced devices and solutions that meet evolving consumer demands. Strategic marketing campaigns and partnerships with beauty clinics help expand their reach to a broader customer base. Additionally, many players target emerging markets, where increasing disposable income fuels demand for aesthetic procedures.

Top Key Players in the Medical Aesthetics Market

- Sisram Medical Ltd.

- Merz Pharma

- LUBEX

- Johnson & Johnson Hologic Inc.

- Galderma

- Cutera Inc.

- Bausch Health Companies Inc.

- Allergen Aesthetics

- AbbVie Inc.

Recent Developments

- In November 2023, LUBEX introduced the Sapphire ice-cooling hair removal device, designed for home use. This launch is relevant to the medical aesthetics market as it caters to the growing demand for at-home aesthetic treatments, providing consumers with an accessible and convenient option for hair removal, a trend that is reshaping the market.

- In March 2023, Galderma launched “FACE by Galderma,” an augmented reality (AR) tool that allows both aesthetic professionals and patients to visualize injectable treatment results before the actual procedure. This innovation is significant for the medical aesthetics market as it enhances the treatment planning process, improving patient confidence and satisfaction with personalized aesthetic solutions.

- In August 2022, AbbVie Inc. introduced SkinMedica Firm & Tone Lotion for Body, the first product from its professional-grade skincare line designed to prevent and address visible signs of aging on the body. This product launch is important for the medical aesthetics market by expanding non-invasive skincare options for body treatments, a growing segment of the market.

- In December 2021, Allergan Aesthetics, a division of AbbVie, acquired Soliton, Inc., a medical technology company specializing in non-invasive body contouring treatments. This acquisition supports the growth of the medical aesthetics market by strengthening Allergan’s portfolio with innovative body contouring solutions, catering to the increasing demand for non-invasive treatments.

- In March 2021, Bausch Health Companies Inc. and its Solta Medical business launched the Clear + Brilliant Touch laser in the U.S., a next-generation product that offers customized treatments for patients of all ages and skin types. This advancement is relevant to the medical aesthetics market as it broadens the range of laser treatments available, increasing options for patients seeking personalized skin rejuvenation solutions.

Report Scope

Report Features Description Market Value (2023) USD 16.1 billion Forecast Revenue (2033) USD 46.1 billion CAGR (2024-2033) 11.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Energy-based, Non-energy-based, and Others), By Application (Body Contouring & Cellulite Reduction, Skin Resurfacing & Tightening, Breast Augmentation, Hair & Tattoo Removal, and Others), By End-user (Hospitals, Specialty Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sisram Medical Ltd., Merz Pharma, LUBEX, Johnson & Johnson Hologic Inc., Galderma, Cutera Inc., Bausch Health Companies Inc., Allergen Aesthetics, and AbbVie Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sisram Medical Ltd.

- Merz Pharma

- LUBEX

- Johnson & Johnson Hologic Inc.

- Galderma

- Cutera Inc.

- Bausch Health Companies Inc.

- Allergen Aesthetics

- AbbVie Inc.