Global Medical 3D Printing Market Analysis By Component (System, Materials, Services), By Technology (Droplet Deposition, Photopolymerization, Laser Beam Melting, Electronic Beam Melting, Laminated Object Manufacturing, Others), By Application (External Wearable Devices, Clinical Study Devices, Implants, Tissue Engineering), By End-Users (Hospitals, Ambulatory Surgical Centres, Academic Institutions, CROs, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 54684

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

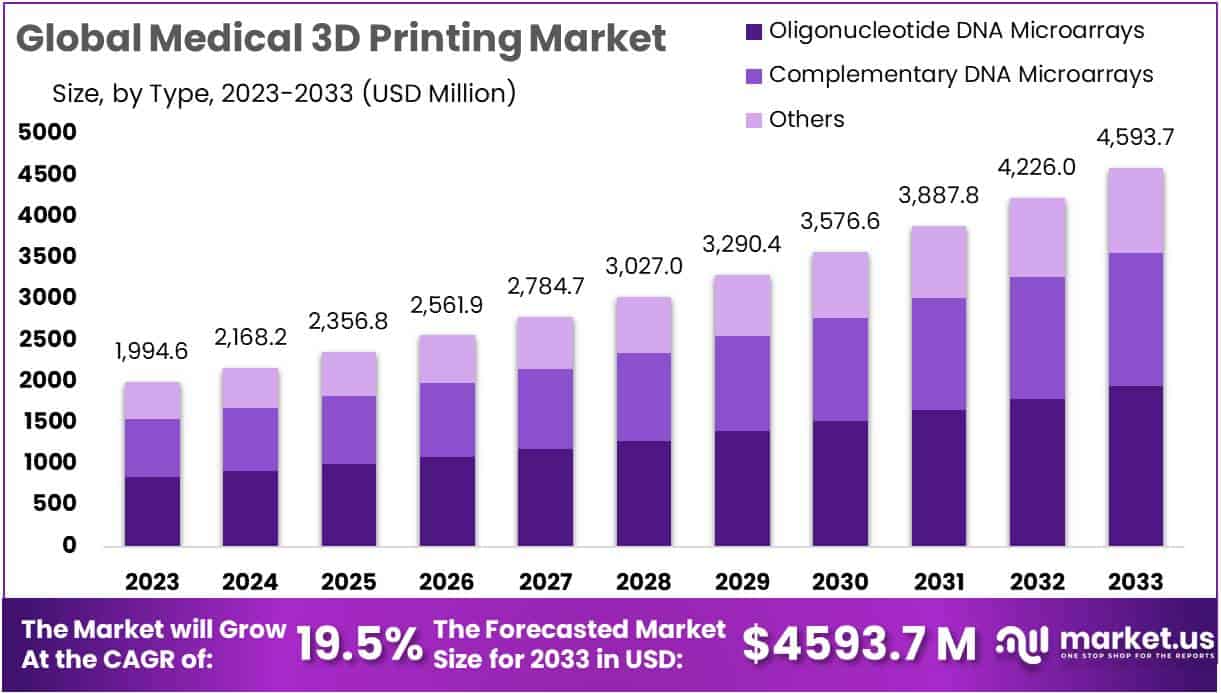

The Global Medical 3D Printing Market size is expected to be worth around USD 4593.7 Million by 2033, from USD 1994.6 Million in 2023, growing at a CAGR of 19.5% during the forecast period from 2024 to 2033.

Medical 3D Printing, a revolutionary technology, stands at the forefront of healthcare innovation, offering a novel approach to the creation of prosthetic limbs, orthotic devices, dental implants, surgical instruments, and anatomical models. Defined as the process of creating three-dimensional medical devices and tools through additive manufacturing techniques, this technology enables the production of complex, customized solutions tailored to individual patient needs.

The Medical 3D Printing market is witnessing a significant phase of growth, largely driven by its application in the fields of prosthetics and orthotics, among others. This expansion is further enhanced by the technology’s utility in dentistry, surgical planning, and the creation of bespoke implants, marking a transformative phase in personalized healthcare solutions. The sector’s growth trajectory is underscored by advancements in 3D printing technologies, positioning it as a pivotal element in the advancement of patient-specific treatment methodologies and the enhancement of clinical outcomes within the healthcare sector.

The role of regulatory agencies, including the FDA in the United States, MHRA in the United Kingdom, and NMPA in China, is critical in ensuring the safety and effectiveness of 3D-printed medical devices. Although global trade data for these products is nascent, projections suggest a marked increase in the international trade of medical 3D printing products, with a forecasted annual growth rate of 20% by 2025. This projection is supported by technological progress and regulatory frameworks, indicating the sector’s vast potential for further expansion and innovation.

The demand for personalized medical solutions is on the rise, propelled by an aging global population, which is anticipated to reach 2 billion by 2050 according to the World Health Organization. This demographic shift is a significant driver of the medical 3D printing market, which is projected to achieve a value of $6.9 billion by 2028. The advancements in printing technology and biocompatible materials are central to this growth, offering revolutionary patient care solutions that are both adaptable and efficient.

Government initiatives are also playing a crucial role in stimulating the industry’s growth through research and development funding, tax incentives for companies, and the establishment of supportive regulatory frameworks. Notable financial commitments, such as Johnson & Johnson’s acquisition of Auris Health and the Chinese government’s investment of $1.4 billion into a national 3D printing hub, highlight the economic and clinical promise of the medical 3D printing sector.

Key Takeaways

- Market Size: Projected market worth by 2033 is USD 4593.7 million, growing at a CAGR of 19.5% from 2024 to 2033.

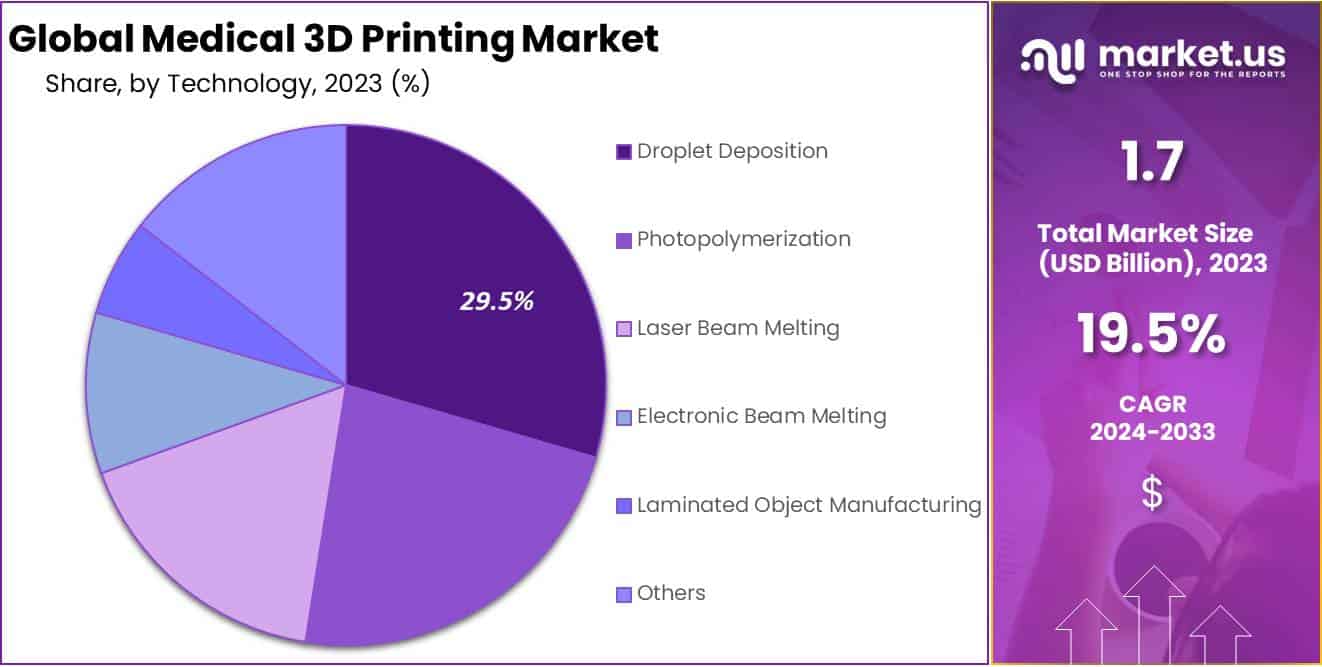

- Dominant Technology: Droplet Deposition segment held over 29.5% market share in 2023.

- Leading Application: External Wearable Devices segment captured over 39.2% market share in 2023.

- Primary End-User: Hospitals segment dominated with over 46.3% market share in 2023.

- Growth Driver: Advancements in Bioprinting Technologies projected global spending to reach $23 billion by 2022.

- Market Restraint: Regulatory and Ethical Challenges cause delays and increased costs in product development.

- Significant Trend: Integration of Artificial Intelligence (AI) and Machine Learning (ML) driving more efficient production processes.

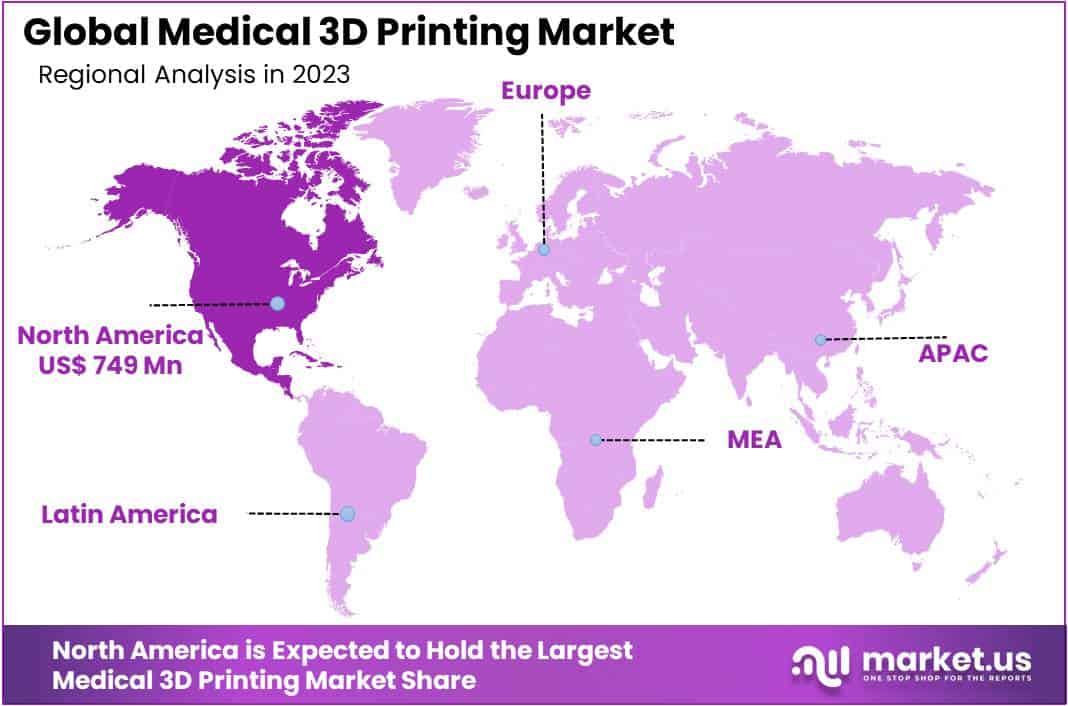

- Regional Dominance: North America held over 44.1% market share in 2023, followed by Europe and Asia-Pacific exhibiting high growth potential.

Component Analysis

In 2023, the System segment held a dominant market position in the Component Segment of the Medical 3D Printing Market, capturing more than a 52.6% share. This prominence can be attributed to the increasing adoption of 3D printing systems in healthcare institutions for a variety of applications, including the creation of patient-specific models for preoperative planning and the fabrication of custom medical devices and implants. The demand for these systems has been driven by their ability to reduce the risk of surgical complications, enhance procedural accuracy, and tailor treatments to individual patient needs, thereby improving clinical outcomes.

Materials and Services segments also contributed significantly to the market, albeit to a lesser extent compared to Systems. The Materials segment’s growth is propelled by the ongoing development of biocompatible materials that can be utilized for patient-specific implants and prosthetics, which are gaining traction due to their improved compatibility and performance. On the other hand, the Services segment has seen an upsurge due to the growing outsourcing of 3D printing needs by healthcare providers, aiming to leverage the expertise of specialized service providers to reduce costs and improve efficiency.

However, the high cost of 3D printing systems and materials, along with the need for specialized training to operate these systems, poses challenges to market growth. Despite these obstacles, the benefits offered by medical 3D printing, such as customized healthcare solutions and advancements in medical research, are anticipated to drive the market forward.

The future trajectory of the Medical 3D Printing Market is likely to be influenced by ongoing research and innovation, aimed at expanding the applications of 3D printing in medicine. Collaborations between healthcare providers and 3D printing technology companies are expected to play a crucial role in this growth, facilitating the development of new applications and the integration of 3D printing into standard medical practice.

Technology Analysis

In 2023, the Droplet Deposition segment held a dominant market position in the Technology Segment of the Medical 3D Printing Market, capturing more than a 29.5% share. This significant market share can be attributed to the advanced capabilities of droplet deposition technologies, including Fused Deposition Modeling (FDM), Material Jetting, and Binder Jetting, which are extensively utilized in the creation of medical models, surgical guides, prosthetics, and implants. The versatility and precision of droplet deposition methods have facilitated their adoption across various medical applications, contributing to their leading position in the market.

The growth of the Droplet Deposition segment is further bolstered by continuous technological advancements that enhance printing resolution, speed, and material compatibility. These improvements have expanded the application range of medical 3D printing, enabling the production of more complex and personalized medical devices. Additionally, the increasing focus on patient-specific solutions in healthcare is driving demand for droplet deposition-based 3D printing technologies, as they offer the flexibility required for customizing medical products to individual patient needs.

Moreover, regulatory approvals for 3D-printed medical devices produced using droplet deposition technologies have been increasing, providing a significant boost to the segment’s growth. These regulatory milestones underscore the safety, efficacy, and reliability of droplet deposition 3D printed products, encouraging their adoption among healthcare providers and patients alike.

However, the segment faces challenges such as high initial investment costs and the need for skilled operators, which may restrain its growth to some extent. Despite these challenges, strategic collaborations, and investments in research and development are anticipated to propel the advancement of droplet deposition technologies, thereby sustaining their dominance in the Medical 3D Printing Market.

Application Analysis

In 2023, the External Wearable Devices segment held a dominant market position in the Application Segment of the Medical 3D Printing Market, capturing more than a 39.2% share. This prominence is attributed to the increasing demand for personalized medical devices, including orthopedic and dental devices, that offer enhanced patient comfort and improved clinical outcomes. The adoption of 3D printing technology in the production of these devices facilitates customization to the individual’s physiological requirements, thereby enhancing the efficacy and functionality of the wearable medical devices.

The growth in this segment is further bolstered by technological advancements in 3D printing materials and methods, which have significantly expanded the possibilities for creating complex wearable medical devices at a reduced cost and time. Innovations such as biocompatible materials have paved the way for the development of devices that can be worn over extended periods without causing adverse reactions, thus increasing patient adherence and treatment effectiveness.

Moreover, the rising prevalence of chronic diseases that require continuous monitoring and the global shift towards preventive healthcare have escalated the demand for external wearable devices. This trend is anticipated to continue, as these devices play a crucial role in monitoring health conditions in real-time, offering a proactive approach to disease management.

The regulatory landscape also plays a critical role in shaping the market dynamics of the External Wearable Devices segment. Regulatory approvals for 3D printed medical devices have become more streamlined, with regulatory bodies recognizing the potential of 3D printing in improving patient care. This regulatory support is expected to encourage further innovations and investments in the sector, driving the market growth.

End-Users Analysis

In 2023, the Hospitals segment held a dominant market position in the End-Users Segment of the Medical 3D Printing Market, capturing more than a 46.3% share. This prominent market share can be attributed to the escalating adoption of 3D printing technologies within hospitals for a broad spectrum of applications, including but not limited to, the fabrication of patient-specific implants, prosthetics, and anatomical models for pre-surgical planning and education. The integration of 3D printing technologies has significantly enhanced the precision and customization of medical care, thereby driving demand within this sector.

The substantial growth of the Hospitals segment is further bolstered by continuous advancements in 3D printing technologies, including the development of new materials suited for medical use and the enhancement of printing capabilities to accommodate complex medical applications. Moreover, governmental and regulatory support for innovative medical solutions has played a crucial role in fostering the integration of 3D printing in healthcare institutions.

Looking forward, the Hospitals segment is anticipated to maintain its leading position in the market, driven by ongoing technological advancements and increasing recognition of the benefits of personalized medicine. The expansion of 3D printing applications, such as in the creation of bio-printed tissues and organs for research and transplantation, presents significant growth opportunities for this segment.

In contrast, other end-user segments such as dental clinics, academic institutions, and research facilities also contribute to the Medical 3D Printing Market but to a lesser extent compared to hospitals. These sectors are expected to exhibit steady growth, propelled by the adoption of 3D printing for dental implants, educational models, and research prototypes, respectively.

Key Market Segments

Component

- System

- Materials

- Services

Technology

- Droplet Deposition

- Photopolymerization

- Laser Beam Melting

- Electronic Beam Melting

- Laminated Object Manufacturing

- Others

Application

- External Wearable Devices

- Clinical Study Devices

- Implants

- Tissue Engineering

End-Users

- Hospitals

- Ambulatory Surgical Centres

- Academic Institutions

- CROs

- Others

Drivers

Advancements in Bioprinting Technologies

The expansion of the Medical 3D Printing Market is significantly propelled by remarkable advancements in bioprinting technologies. These technological innovations have revolutionized the capability to fabricate complex biological structures, such as organs and tissues, tailored to the individual medical requirements of patients. According to a report by the International Data Corporation (IDC), the global spending on 3D printing, including bioprinting, is projected to reach $23 billion by 2022. This surge is indicative of the growing adoption of 3D printing technologies in healthcare, underlined by a compound annual growth rate (CAGR) of over 21% during the forecast period.

The integration of bioprinting in medical practices not only enhances personalized medicine by providing custom solutions but also significantly improves surgical planning and regenerative medicine. This, in turn, stimulates demand across various healthcare sectors, highlighting the pivotal role of bioprinting technologies as a driving force behind the market’s growth.

Restraints

Regulatory and Ethical Challenges

The Medical 3D Printing Market encounters significant restraints due to regulatory and ethical challenges, which are pivotal in ensuring the safety, efficacy, and ethical boundaries of produced materials and devices. Regulatory bodies, such as the U.S. Food and Drug Administration (FDA), necessitate rigorous approval processes for 3D-printed medical devices and biological materials. According to FDA data, over 100 3D-printed medical devices have received approval, highlighting the stringent scrutiny applied to these innovations. This rigorous approval process, while ensuring patient safety, can extend development timelines and increase costs, potentially hindering market growth.

Ethical considerations, particularly concerning the bioprinting of human tissues and organs, further complicate research and application. These ethical dilemmas not only provoke public debate but also may result in additional regulatory guidelines, slowing the pace of market advancement. Hence, while these challenges guarantee the reliability and moral integrity of medical 3D printing, they also act as substantial barriers to rapid market growth.

Opportunities

Expanding Applications in Prosthetics and Dental Sectors

The expanding applications of medical 3D printing in the prosthetics and dental sectors represent a significant opportunity for market growth. This technology enables the production of custom-fitted prosthetics and dental implants, which markedly improves patient outcomes by enhancing both comfort and functionality. According to a report by the American Hospital Association, the use of 3D printing in dental applications is projected to grow at a compound annual growth rate (CAGR) of 17.5% from 2021 to 2026, highlighting its increasing acceptance and application.

Similarly, the prosthetics sector is witnessing a surge in demand for personalized solutions, with the market expected to reach $2.4 billion by 2025, as reported by the Global Prosthetics and Orthotics Market Analysis. The ability to tailor medical devices precisely to the individual needs of patients not only underscores the technological advancement but also opens new avenues for market penetration and expansion, further fueled by growing consumer awareness and acceptance of these innovative solutions.

Trends

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Global Medical 3D Printing Market represents a significant trend, marking a shift towards more intelligent and autonomous production ecosystems. These technologies are at the forefront of transforming design and manufacturing processes, enabling the creation of medical devices and components with unprecedented efficiency and precision. Through the application of AI and ML algorithms, 3D printing parameters can be optimized in real-time.

This not only allows for the prediction and mitigation of potential flaws but also enhances the overall quality of the printed products. A report by the International Data Corporation (IDC) forecasts that spending on 3D printing technologies in the healthcare sector is expected to grow at a compound annual growth rate (CAGR) of 21.1% through 2022. This growth can be attributed to the integration of AI and ML, which underlines a move towards more streamlined, efficient, and higher-quality production processes in the medical 3D printing market.

Regional Analysis

In 2023, North America held a dominant market position in the Medical 3D Printing Market, capturing more than a 44.1% share and securing a market value of USD 749 million for the year. This prominence can be attributed to several key factors, including substantial investments in healthcare infrastructure, a strong emphasis on research and development within the medical and technological sectors, and a rapidly growing demand for personalized medical solutions among the population. The region’s robust regulatory framework, which supports innovation while ensuring safety and efficacy in medical products, has further catalyzed the adoption of 3D printing technologies in medical applications.

Europe emerged as the second-largest market, demonstrating significant growth driven by increasing healthcare expenditure, rising awareness regarding the benefits of 3D printing in medical applications, and strong government support for healthcare innovation. The integration of 3D printing technologies in European healthcare systems has been further facilitated by collaborations between leading market players and healthcare institutions, aiming to explore novel medical solutions and enhance patient care.

The Asia-Pacific region is identified as a rapidly evolving market with a high growth potential, primarily due to its expanding healthcare infrastructure, rising disposable incomes, and increasing investments in healthcare technology by emerging economies such as China and India. The region’s market growth is propelled by the escalating demand for advanced healthcare services and the growing adoption of cutting-edge technologies in medical procedures and treatments.

Latin America and the Middle East & Africa (MEA) regions, while holding smaller shares in the global market, are anticipated to witness moderate growth over the forecast period. This growth is expected to be driven by gradual improvements in healthcare infrastructure, rising healthcare awareness, and increasing government initiatives aimed at adopting advanced healthcare technologies in these regions.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Medical 3D Printing Market, companies such as Formlabs Inc. and General Electric are making significant strides. Formlabs Inc. is renowned for its advanced, high-resolution 3D printers, which have become indispensable in creating precise medical models and surgical guides. Their affordable and reliable solutions have democratized access to sophisticated medical applications. Meanwhile, General Electric, through its healthcare division, has been instrumental in integrating 3D printing technologies into healthcare. Their focus on producing patient-specific models and instruments highlights a strategic push towards personalized medicine, leveraging additive manufacturing to streamline healthcare delivery and enhance operational efficiency.

On the other hand, 3D Systems Corporation and Exone Company are also key contributors to the market’s growth. 3D Systems offers a wide array of 3D printing technologies and services, catering to various medical applications from dental to complex surgical planning. Their commitment to innovation is evident in their continuous development of new materials and printing techniques. Exone Company, with its specialization in industrial 3D printing solutions, brings metal medical implants and devices with complex geometries to life, challenging traditional manufacturing methods. Together with other notable market players, these companies drive innovation, fostering a competitive environment that benefits the healthcare sector by expanding the applications and capabilities of medical 3D printing.

Market Key Players

- Formlabs Inc.

- General Electric

- 3D Systems Corporation

- Exone Company

- Materialise NV

- Oxferd Performance Materials Inc.

- SLM Solutions Group AG

- Organovo Holdings, Inc.

- Proto Labs

- Stratasys Ltd

Recent Developments

- In September of 2023, Formlabs Inc. introduced the Fuse 1+ 3D Printer, tailored specifically for the efficient production of medical and dental models as well as surgical guides. This updated model promises enhanced speed, precision, and dependability compared to its predecessor.

- In February 2023, ExOne Company made a significant move by acquiring Desktop Metal Inc., a prominent player in binder jet additive manufacturing. This strategic acquisition aims to bolster ExOne’s presence in the medical device manufacturing sector by merging their expertise in both metal and polymer 3D printing technologies.

- In October 2023, Materialise NV unveiled a strategic partnership with Siemens Healthineers, aimed at developing and bringing to market personalized 3D printed implants for intricate surgeries. This collaboration harnesses Materialise’s proficiency in 3D printing alongside Siemens Healthineers’ expertise in medical imaging and clinical data, resulting in tailored solutions for patients.

- In December 2023, Organovo Holdings Inc. entered into a collaboration agreement with the National Institutes of Health (NIH) to develop bioprinted human liver tissue for drug discovery and toxicity testing. This partnership seeks to advance the utilization of 3D-printed tissues in preclinical research, potentially streamlining drug development processes.

Report Scope

Report Features Description Market Value (2023) USD 1994.6 Mn Forecast Revenue (2033) USD 4593.7 Mn CAGR (2024-2033) 19.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (System, Materials, Services), By Technology (Droplet Deposition, Photopolymerization, Laser Beam Melting, Electronic Beam Melting, Laminated Object Manufacturing, Others), By Application (External Wearable Devices, Clinical Study Devices, Implants, Tissue Engineering), By End-Users (Hospitals, Ambulatory Surgical Centres, Academic Institutions, CROs, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Formlabs Inc., General Electric, 3D Systems Corporation, Exone Company, Materialise NV, Oxferd Performance Materials Inc., SLM Solutions Group AG, Organovo Holdings, Inc., Proto Labs, Stratasys Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Medical 3D Printing market in 2023?The Medical 3D Printing market size is USD 1994.6 million in 2023.

What is the projected CAGR at which the Medical 3D Printing market is expected to grow at?The Medical 3D Printing market is expected to grow at a CAGR of 19.5% (2024-2033).

List the segments encompassed in this report on the Medical 3D Printing market?Market.US has segmented the Medical 3D Printing market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Component the market has been segmented into System, Materials, Services. By Technology the market has been segmented into Droplet Deposition, Photopolymerization, Laser Beam Melting, Electronic Beam Melting, Laminated Object Manufacturing, Others. By Application the market has been segmented into External Wearable Devices, Clinical Study Devices, Implants, Tissue Engineering. By End-Users the market has been segmented into Hospitals, Ambulatory Surgical Centres, Academic Institutions, CROs, Others.

List the key industry players of the Medical 3D Printing market?Formlabs Inc., General Electric, 3D Systems Corporation, Exone Company, Materialise NV, Oxferd Performance Materials Inc., SLM Solutions Group AG, Organovo Holdings, Inc., Proto Labs, Stratasys LtdInc. (Abbott), Other Key Player

Which region is more appealing for vendors employed in the Medical 3D Printing market?North America is expected to account for the highest revenue share of 44.1% and boasting an impressive market value of USD 749 million. Therefore, the Medical 3D Printing industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Medical 3D Printing?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Medical 3D Printing Market.

Medical 3D Printing MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Medical 3D Printing MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Formlabs Inc.

- General Electric

- 3D Systems Corporation

- Exone Company

- Materialise NV

- Oxferd Performance Materials Inc.

- SLM Solutions Group AG

- Organovo Holdings, Inc.

- Proto Labs

- Stratasys Ltd