Global Maritime Insurance Market Size, Share, Statistics Analysis Report By Coverage (Transport/cargo, Hull, Offshore/energy, Marine liability), By Distribution Channel (Direct sale (Transport/cargo, Hull, Offshore/energy, Marine liability), Wholesale (Transport/cargo, Hull, Offshore/energy, Marine liability), By Policy (Floating policy, Voyage policy, Time policy, Fleet policy, Blanket policy, Others), By End User (Shipping companies, Ports and terminals, Cargo owners, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145309

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Government Led Investments

- Analyst’s Viewpoint

- China Maritime Insurance Market

- Coverage Analysis

- Distribution Channel Analysis

- Policy Analysis

- End User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

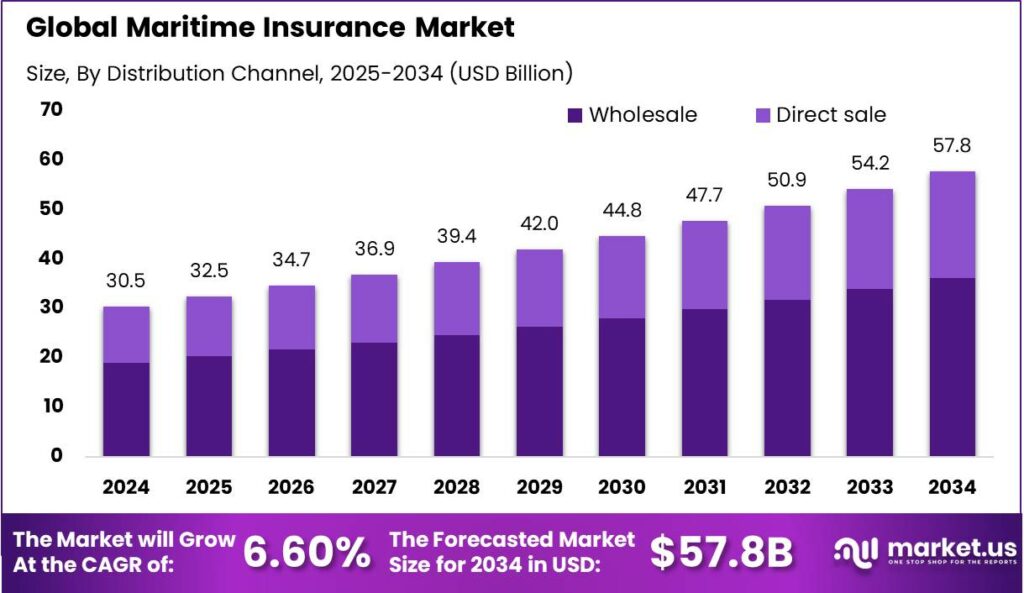

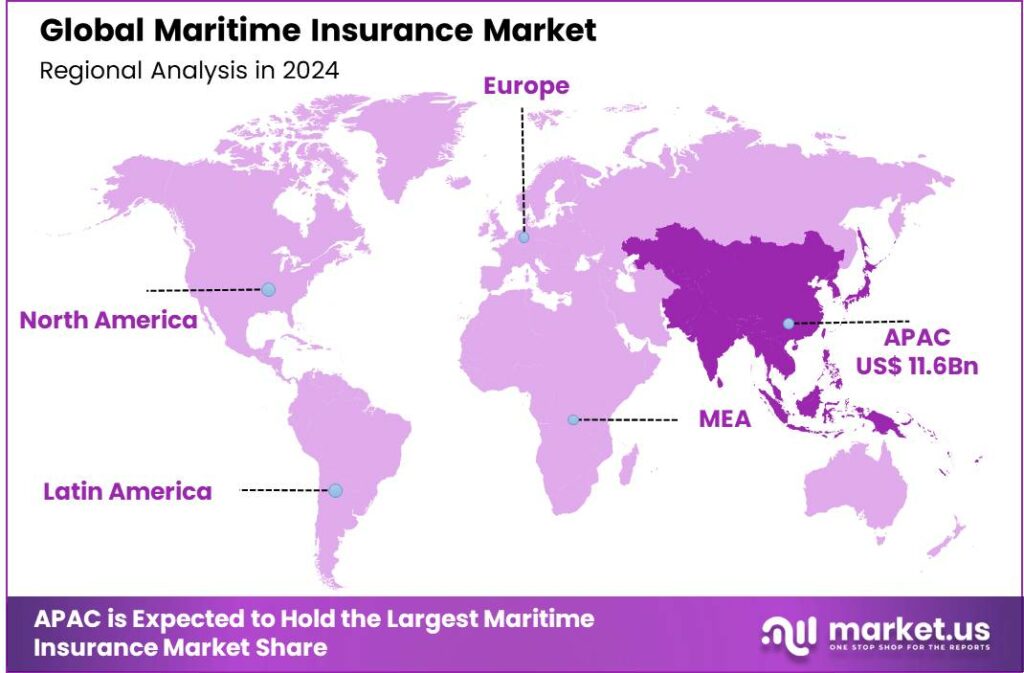

The Global Maritime Insurance Market size is expected to be worth around USD 57.8 Billion By 2034, from USD 30.5 Billion in 2024, growing at a CAGR of 6.60% during the forecast period from 2025 to 2034. The Asia-Pacific region held a dominant position in the global maritime insurance market in 2024, capturing more than 38.2% of the market share, with revenues amounting to USD 11.6 billion.

Maritime insurance, or marine insurance, offers coverage for the loss or damage of ships, cargo, terminals, and transport during transit between the origin and destination. It’s vital for businesses in both international and domestic shipping, providing financial protection against risks at sea.

The market includes various policies such as hull and machinery insurance, marine cargo insurance, and marine liability insurance, each tailored to address specific maritime risks. An increase in incidents like collisions, groundings, and piracy heightens the perceived risks of maritime operations, driving businesses to seek better insurance coverage.

The rising frequency and severity of extreme weather events due to climate change push shipping companies to adopt robust policies to mitigate losses from disruptions and natural disasters. The growth of the maritime insurance market is driven by increasing global trade, which raises demand for coverage against higher cargo volumes and more frequent shipping.

Adopting robust maritime insurance offers businesses key benefits, such as risk mitigation and financial stability. It protects companies from costly losses due to unforeseen maritime events, ensuring they are not overly burdened. Additionally, effective maritime insurance helps maintain operational continuity and shields against disruptions, crucial for business resilience and long-term success.

The maritime insurance market is swiftly integrating technologies like AI, data analytics, and blockchain, revolutionizing risk assessment and efficiency. These innovations enhance risk assessment, streamline claims processing, and boost transaction transparency. By leveraging these technologies, insurers can provide more tailored products and services to meet the evolving needs of modern shipping operations.

Growth opportunities in the market arise through expansion into emerging markets and product innovation. As regions with growing maritime activities seek secure trading conditions, there is increasing demand for tailored insurance solutions. Additionally, the integration of sustainability in shipping creates new opportunities for specialized insurance products supporting environmentally friendly practices.

For instance, In April 2024, the Indian government launched a subsidy program designed to promote marine cargo insurance among exporters, particularly targeting small and medium enterprises (SMEs). This initiative is intended to reduce the costs associated with insurance, thereby mitigating export risks and fostering international trade.

The maritime insurance market is expanding both geographically and in scope. As global trade becomes more complex, insurers must adapt to cover emerging risks like cyber threats and geopolitical uncertainties. This expansion into new areas of coverage will help insurers stay competitive in a rapidly evolving market.

Key Takeaways

- The Global Maritime Insurance Market is expected to reach USD 57.8 billion by 2034, growing from USD 30.5 billion in 2024, with a CAGR of 6.60% during the forecast period from 2025 to 2034.

- In 2024, the Transport/cargo segment held a dominant position in the maritime insurance market, capturing more than 35.8% of the market share.

- The Wholesale segment also held a dominant position in 2024, capturing more than 62.6% of the market share.

- The Floating policy segment led the market in 2024, securing more than 32.5% of the market share.

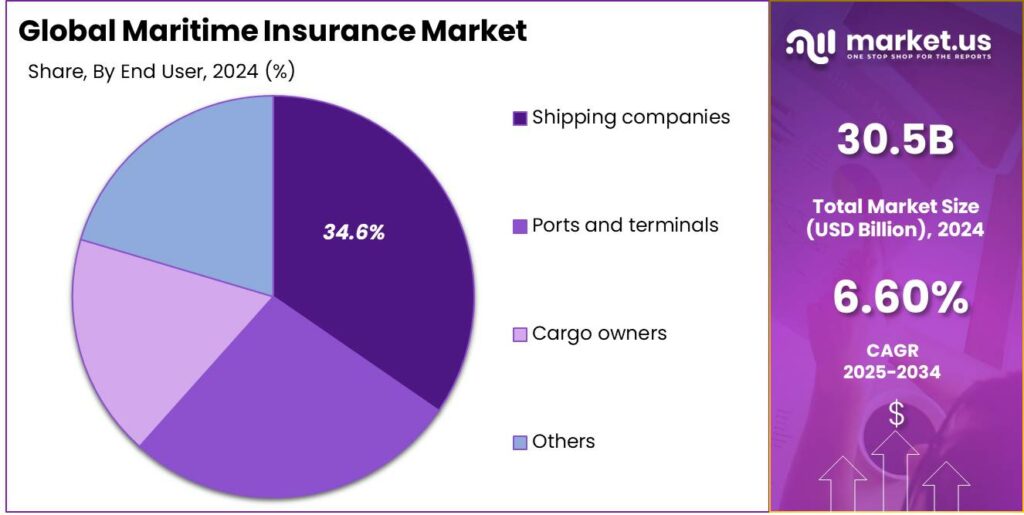

- In 2024, the Shipping Companies segment dominated the maritime insurance market, holding more than 34.6% of the market share.

- The Asia-Pacific region held a dominant position in the global maritime insurance market in 2024, capturing more than 38.2% of the market share, with revenues amounting to USD 11.6 billion.

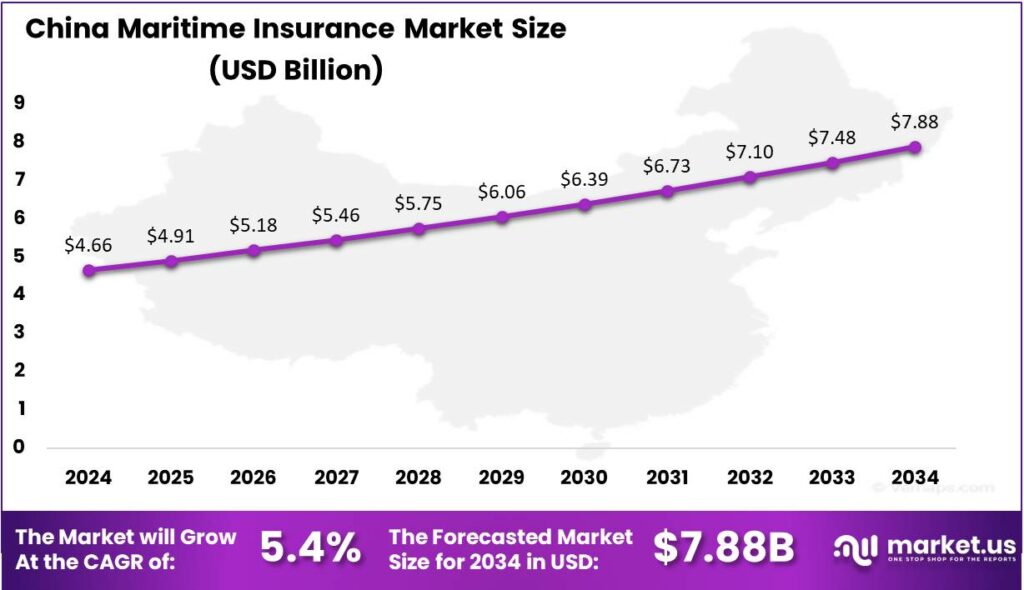

- The maritime insurance market in China was estimated to be valued at USD 4.66 billion in 2024 and is projected to grow at a CAGR of 5.4%.

Government Led Investments

The Poseidon Principles for Marine Insurance: Global sustainability initiatives, such as the Poseidon Principles for Marine Insurance, are playing a key role in advancing climate reporting frameworks. These initiatives help align the maritime industry with the International Maritime Organization’s (IMO) 2050 net-zero target, driving progress toward a more sustainable and climate-conscious future for global shipping.

Nine signatories, representing 25% of the global fleet’s deadweight, disclosed climate alignment scores, highlighting data-driven decarbonization strategies. Technological adoption of blockchain, AI, and IoT has accelerated risk assessment and fraud prevention, helping to tackle emerging challenges like cyber threats and climate-related disruptions.

Analyst’s Viewpoint

The marine insurance landscape is being shaped by environmental concerns, particularly climate change, leading to stricter regulations on shipping emissions. Insurers are responding by offering policies that help meet these standards. Geopolitical tensions and economic shifts are also affecting trade routes, prompting insurers to reassess risks and adjust coverage.

The growing complexity of maritime operations, driven by digital technologies, offers significant investment opportunities. The use of automation and AI boosts efficiency but introduces new risks. Investing in insurance products to address these risks is essential. Additionally, the expansion of global trade routes, like the Northern Sea Route, requires tailored insurance solutions to mitigate new risks.

Marine insurance industry is evolving with AI, blockchain, and IoT enhancing underwriting, risk assessment, and claims management. AI improves risk evaluation, blockchain ensures secure transactions, and new regulations, like IMO emission rules, are shaping the industry. Legal frameworks are also adapting, including a U.S. Supreme Court ruling on choice-of-law clauses.

China Maritime Insurance Market

In 2024, the market for maritime insurance in China was estimated to be valued at USD 4.66 billion. It is projected to grow at a compound annual growth rate (CAGR) of 5.4%. The market’s growth is mainly driven by China’s expanding maritime activities, including shipping and trade, which require strong insurance policies to mitigate associated risks.

Additionally, the Chinese government’s supportive policies toward maritime infrastructure development and its initiatives to boost the maritime economy have positively impacted the growth of the maritime insurance sector. These governmental efforts are designed to enhance safety measures and protect marine assets, further fueling the need for comprehensive insurance coverage.

The integration of technology in maritime operations, such as digital tools for navigation and risk management, has brought both opportunities and complexities to maritime insurance. Insurance providers are adopting advanced analytics and big data to assess risks more accurately and create tailored products, driving the sector’s growth.

In 2024, the Asia-Pacific region held a dominant position in the global maritime insurance market, capturing more than a 38.2% share with revenues amounting to USD 11.6 billion. This region’s leadership in the maritime insurance sector can be attributed to several factors.

The Asia-Pacific region, home to major ports like Shanghai, Singapore, and Hong Kong, is a key hub for international trade. The region’s high volume of shipping activities drives the demand for extensive maritime insurance to manage transport risks. Its strategic role in global supply chains significantly boosts its share in the maritime insurance market.

The increase in maritime insurance uptake in Asia-Pacific is driven by the region’s economic growth and the corresponding expansion of its shipping industry. As economies like China, India, and ASEAN countries continue to develop, their demand for maritime insurance products has surged to protect against operational risks and maritime accidents.

Technological advancements in ship and cargo tracking have also supported the growth of the maritime insurance market in Asia-Pacific. Insurance companies are using IoT sensors, satellite communications, and big data analytics to enhance risk assessment and claims management. This digital transformation allows insurers to provide more customized and efficient services, attracting more clients in the region.

Coverage Analysis

In 2024, the Transport/cargo segment held a dominant market position within the maritime insurance landscape, capturing more than a 35.8% share. This segment’s leadership can be attributed to its critical role in safeguarding against the risks associated with the movement of goods across international waters.

Transport/cargo insurance is essential for companies involved in global trade, as it covers the loss or damage of cargo, vessels, and terminals due to events like collisions, theft, and natural disasters. The robust demand for this insurance stems from the increasing volume of goods being shipped worldwide, which escalates the potential financial risks businesses face without adequate coverage.

Hull insurance, another vital component of maritime insurance, protects the vessel itself against damages and losses during maritime operations. While it does not command as large a market share as the Transport/cargo segment, its importance cannot be understated, especially for operators of large fleets and high-value ships.

The Offshore/energy segment of maritime insurance offers specialized coverage for operations and equipment used in offshore oil rigs, wind farms, and other maritime energy activities. This niche segment addresses the unique risks associated with energy exploration and production, including accidents, environmental disasters, and equipment malfunctions.

Distribution Channel Analysis

In 2024, the Wholesale segment held a dominant position in the maritime insurance market, capturing more than a 62.6% share. This segment’s prominence is explained by several key factors, each contributing to its substantial market uptake.

The Wholesale distribution channel thrives by enabling bulk transactions and offering specialized insurance tailored to large maritime operations. It serves clients with extensive fleets or high-value assets, providing comprehensive coverage options such as transport/cargo, hull, offshore/energy, and marine liability insurances.

Furthermore, Wholesale brokers play a crucial role in connecting insurers with a global network of clients, thereby broadening the insurers’ market reach. These brokers possess deep knowledge and understanding of different maritime markets, regulatory environments, and specific client needs, which enables them to effectively tailor insurance products.

Moreover, the wholesale segment benefits from a strong reputation for providing reliable and effective risk management services. In the maritime industry, where the potential for large-scale losses is high, the expertise offered by wholesale brokers in risk assessment and crisis management is highly valued. Their services ensure that clients not only receive insurance coverage but also strategic advice on minimizing risks.

Policy Analysis

In 2024, the Floating policy segment held a dominant position in the maritime insurance market, capturing more than a 32.5% share. This segment leads due to its flexibility and comprehensive coverage, particularly appealing to businesses with frequent and varied shipping activities. Floating policies, which cover unspecified cargo amounts over time, are essential for companies with high shipping volumes and unpredictable schedules.

The preference for Floating policies stems from their ability to consolidate numerous shipments under a single contract, which simplifies the administrative process and reduces the need for multiple individual policies. This feature is highly advantageous for companies engaging in international trade, where frequent adjustments to shipping volumes and destinations are common.

The growth of e-commerce and increased international trade have boosted the Floating policy segment’s dominance. As businesses expand globally, the demand for versatile maritime insurance rises, with floating policies offering adjustable coverage to manage risks for businesses involved in large-scale import-export activities.

Increased awareness of maritime risks has led to a rise in Floating policy uptake, as companies take a more proactive approach to managing logistics and supply chain disruptions. Ongoing advancements in tailored insurance solutions further improve coverage, strengthening the Floating policy segment’s dominant position in the maritime insurance market.

End User Analysis

In 2024, the Shipping Companies segment held a dominant position in the Maritime Insurance Market, capturing more than a 34.6% share. Leadership in maritime logistics is driven by the substantial financial value and assets managed by shipping companies, including vessels, cargo, and infrastructure. Facing risks like piracy, cargo theft, and environmental hazards, these companies rely on comprehensive insurance to mitigate operational risks and ensure business continuity.

Ports and terminals are crucial to global trade, handling large volumes of cargo daily. Their complex operations and exposure to natural and man-made risks require strong insurance coverage, including protection against infrastructure damage, machinery breakdown, and business interruption. While smaller than the shipping sector, their strategic importance drives consistent demand for maritime insurance.

Cargo owners are key players in the maritime insurance market, with coverage protecting against loss or damage to goods in transit due to accidents, natural disasters, or piracy. As global trade grows and goods travel longer distances across multiple transport modes, the demand for this insurance increases, driving the segment’s growth despite its smaller market share compared to shipping companies.

Key Market Segments

By Coverage

- Transport/cargo

- Hull

- Offshore/energy

- Marine liability

By Distribution Channel

- Direct sale

- Transport/cargo

- Hull

- Offshore/energy

- Marine liability

- Wholesale

- Transport/cargo

- Hull

- Offshore/energy

- Marine liability

By Policy

- Floating policy

- Voyage policy

- Time policy

- Fleet policy

- Blanket policy

- Others

By End User

- Shipping companies

- Ports and terminals

- Cargo owners

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Expansion of Global Trade

The expansion of global trade has significantly increased the demand for maritime insurance. As international commerce grows, a higher volume of goods is transported across oceans, necessitating robust insurance coverage to mitigate risks associated with marine transportation.

The rise of e-commerce and the globalization of supply chains have further amplified this trend, leading to a surge in shipping activities. Consequently, businesses seek comprehensive marine insurance policies to protect against potential losses from cargo damage, piracy, and other maritime perils. This heightened reliance on maritime transport underscores the critical role of marine insurance in facilitating secure and efficient global trade operations.

Restraint

Geopolitical Tensions and Trade Conflicts

Geopolitical tensions and trade conflicts present substantial challenges to the maritime insurance market. Disputes between major trading nations can lead to the imposition of tariffs, sanctions, and other trade barriers, disrupting established shipping routes and reducing trade volumes.

In addition to tariffs, sanctions, and disruptions to shipping routes, geopolitical tensions and trade conflicts can also lead to increased risks for shipping companies. For instance, the threat of military confrontations, piracy, or attacks on shipping vessels in politically unstable regions becomes more prominent. This raises the cost of insurance premiums for maritime operators, as insurers may assess higher risks associated with navigating these volatile zones.

Opportunity

Integration of Advanced Technologies

The integration of advanced technologies presents a significant opportunity for the maritime insurance sector. Utilizing data analytics, artificial intelligence (AI), and the Internet of Things (IoT) enables insurers to enhance risk assessment, streamline claims processing, and offer more tailored insurance solutions.

For example, real-time tracking of vessels and cargo through IoT devices allows for proactive risk management and quicker response to incidents. AI-driven analytics can identify patterns and predict potential risks, facilitating more accurate underwriting decisions.

Furthermore, blockchain technology can improve transparency and efficiency in policy administration and claims settlement. By adopting these technological advancements, marine insurers can improve operational efficiency, reduce costs, and provide greater value to their clients.

Challenge

Regulatory Compliance and Evolving Legal Frameworks

Navigating international regulations is a major challenge for the maritime insurance industry. Insurers must stay compliant with diverse laws, including environmental standards, safety protocols, and trade sanctions. New regulations, like stricter emissions controls or updated safety conventions, require constant adaptation of policies and coverage terms.

Non-compliance can result in legal liabilities, financial penalties, and reputational damage. The rising focus on environmental, social, and governance (ESG) factors further complicates matters for insurers, who must ensure their practices align with sustainable and ethical standards. Staying updated on these regulatory changes and maintaining compliance demands considerable resources, creating an ongoing challenge for the industry.

Emerging Trends

A key trend is the growing use of digital technologies, such as automation, AI, and blockchain, in shipping operations. While these innovations boost efficiency, they also bring new cyber risks, like GPS spoofing and ransomware, which can disrupt supply chains and jeopardize vessel security. As a result, insurers are broadening their policies to include cyber liability coverage to tackle these evolving threats.

Climate change is significantly impacting maritime insurance. The increase in extreme weather events like hurricanes and typhoons raises the risk of vessel damage and cargo loss. Additionally, shifting environmental conditions are changing global trade routes. While new routes, such as those between Europe and Asia, offer shorter transit times, they also present unique risks that insurers must factor into coverage development.

Geopolitical tensions and regulatory changes are increasingly shaping the maritime insurance landscape. One key initiative is targeting of aging vessels attempting to bypass sanctions. This effort seeks to enhance the safety and transparency of maritime operations, ensuring that vessels comply with international regulations and minimizing risks for insurers.

Business Benefits

Maritime insurance plays a vital role in ensuring the stability and growth of businesses in shipping and trade. It offers financial protection against unexpected events like vessel damage, cargo loss, and environmental liabilities, allowing companies to recover quickly without shouldering the entire financial burden.

Additionally, having comprehensive maritime insurance enhances a company’s reputation and credibility. Clients and partners are more likely to engage with businesses that demonstrate a commitment to risk management and the safeguarding of assets. This assurance can lead to stronger business relationships and a competitive edge in the market.

Furthermore, maritime insurance plays a vital role in ensuring legal compliance. Many jurisdictions and international regulations mandate specific insurance coverage for vessels and cargo. Adhering to these requirements not only avoids legal penalties but also facilitates smoother operations across international waters.

Key Player Analysis

The key players in the maritime insurance sector offer a range of policies that cover the complexities of international trade, shipping routes, and other maritime activities.

Allianz SE is one of the global leaders in maritime insurance. The company’s comprehensive insurance offerings for the maritime sector include hull and cargo insurance, protection, and indemnity (P&I) insurance. Allianz stands out for its wide-reaching international presence, with tailored solutions designed for various sectors within the maritime industry.

American International Group, Inc. (AIG) is another dominant player in the maritime insurance market. The company has earned a strong reputation for providing innovative marine insurance products, including comprehensive coverage for vessels, cargo, and marine liabilities. AIG’s risk management expertise and ability to offer customized solutions have made them a top choice for large shipping companies, freight forwarders, and logistics providers.

AXA XL, part of the AXA Group, is a key competitor in the maritime insurance space, offering a broad portfolio of marine insurance products. They provide coverage for hull, cargo, and liability risks, along with specialized solutions for offshore and energy-related maritime activities. AXA XL is recognized for its strong financial backing and ability to adapt to the evolving risks of global shipping.

Top Key Players in the Market

- Allianz SE

- American International Group, Inc. (AIG)

- AXA XL

- Chubb Limited

- Lloyd’s of London

- Munich Re

- Swiss Re

- The Travelers Companies, Inc.

- Tokio Marine Holdings, Inc.

- Zurich Insurance Group

- Others

Top Opportunities for Players

The maritime insurance market is poised for significant growth and transformation, offering multiple opportunities for industry players.

- Premium Adjustments and Specialized Coverage: As global risks, including cybersecurity threats and environmental liabilities, evolve, maritime insurance providers are adjusting premiums and offering specialized coverage, such as cyber insurance for digital infrastructure and environmental liability insurance, to manage higher risks and meet the sector’s specific needs and regulatory requirements.

- Technological Innovations: The integration of technology in maritime operations, like digitalized supply chains and autonomous vessels, presents a dual opportunity for insurers to cover new kinds of risks. Cyber policies that cater specifically to the digital vulnerabilities of maritime operations and insurance for autonomous vessels are becoming essential.

- Geopolitical and Trade Route Changes: Ongoing geopolitical tensions and shifting trade routes require maritime insurers to provide policies that address new risks, such as extended shipping routes and port disruptions. Business interruption coverage is becoming increasingly vital in the volatile global trade environment.

- Regulatory Compliance: With governments worldwide imposing stricter environmental and safety regulations, compliance has become a major concern for shipowners. Marine insurers that can provide broad coverage that helps clients navigate these regulations effectively will find growth in demand.

- Emerging Market Demand: The Asia-Pacific region is projected to be the fastest-growing market for marine insurance, driven by increasing maritime activities and the expansion of trade. Insurers focusing on this region with tailored products and services can capture significant market share.

Recent Developments

- In August 2024, AXA XL partnered with U.S. Marine Insurance Group (US MIG) to expand its inland marine insurance offerings. This collaboration aimed to provide coverage for various risks faced by transportation and logistics businesses, including storage and transit.

- In September 2024, Tokio Marine Kiln, in collaboration with broker Marsh, launched a port disruption insurance product. This offering provides coverage for business interruption risks faced by ports due to various disruptions, including geopolitical events.

Report Scope

Report Features Description Market Value (2024) USD 30.5 Bn Forecast Revenue (2034) USD 57.8 Bn CAGR (2025-2034) 6.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage (Transport/cargo, Hull, Offshore/energy, Marine liability), By Distribution Channel (Direct sale (Transport/cargo, Hull, Offshore/energy, Marine liability), Wholesale (Transport/cargo, Hull, Offshore/energy, Marine liability), By Policy (Floating policy, Voyage policy, Time policy, Fleet policy, Blanket policy, Others), By End User (Shipping companies, Ports and terminals, Cargo owners, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, American International Group, Inc. (AIG), AXA XL, Chubb Limited, Lloyd’s of London, Munich Re, Swiss Re, The Travelers Companies, Inc., Tokio Marine Holdings, Inc., Zurich Insurance Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Maritime Insurance MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Maritime Insurance MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz SE

- American International Group, Inc. (AIG)

- AXA XL

- Chubb Limited

- Lloyd's of London

- Munich Re

- Swiss Re

- The Travelers Companies, Inc.

- Tokio Marine Holdings, Inc.

- Zurich Insurance Group

- Others