Global Marine Sealants Market Report By Material (Silicone, Polyurethane, Polysulfide, Butyl, Others), By Application (Above Water-Line Sealing, Below Water-Line Sealing, Deck To Hull, Window Bonding, Others), By Marine Type (Cargo Ships, Tankers, Passenger Ships, Fishing Vessel, High-Speed Craft, Others), By End-Use (Shipbuilding, Repair), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121854

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

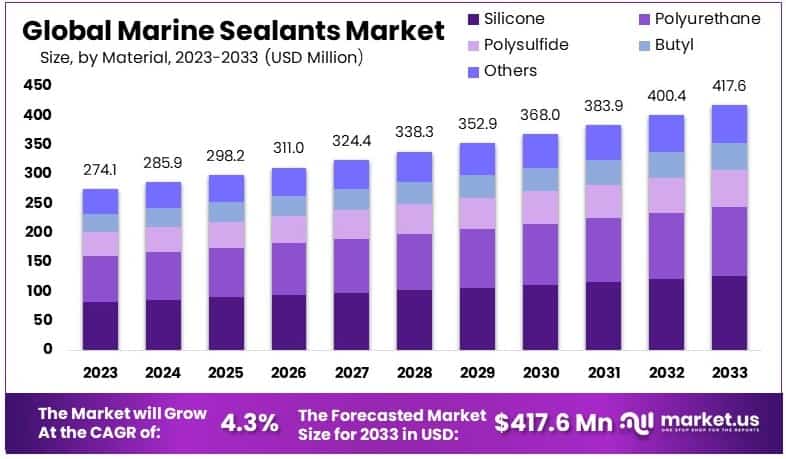

The Global Marine Sealants Market size is expected to be worth around USD 417.6 Million by 2033, from USD 274.1 Million in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

The Marine Sealants Market focuses on adhesives and sealants used in marine environments to protect and seal surfaces against water, chemicals, and other harsh conditions. Essential for the construction and maintenance of ships and marine structures, these products are designed to resist extreme marine conditions, contributing to the safety and longevity of marine assets.

The marine sealants market is experiencing steady growth, driven by the increasing demand for durable and reliable sealing solutions in the maritime industry. The worldwide gross tonnage of cruise ship deliveries highlights this trend, with Asia contributing 1.4 million gross tons and Europe 1.2 million gross tons in 2023. These figures indicate a robust demand for sealants to ensure the integrity and longevity of these vessels.

The United Kingdom, with over 400 ports handling more than 95% of all imports and exports, underscores the importance of maritime security and efficient port operations. Sealants play a crucial role in maintaining port infrastructure and vessel performance, thereby supporting the smooth flow of goods and services.

Additionally, the global trading fleet comprised around 68,000 vessels at the end of 2023, with a total deadweight tonnage of 2,224 million. This extensive fleet requires regular maintenance and repair, further driving the demand for high-quality marine sealants. These sealants are essential for preventing leaks, corrosion, and structural damage, ensuring the safety and efficiency of maritime operations.

The market is also benefiting from advancements in sealant technology. New formulations offer improved adhesion, flexibility, and resistance to harsh marine environments. These innovations enhance the performance and lifespan of sealants, making them more attractive to shipbuilders and maintenance providers.

In conclusion, the marine sealants market is poised for continued growth. The expanding global fleet, increasing cruise ship deliveries, and the critical role of ports in international trade drive this positive outlook. Companies that invest in innovative and high-performance sealant solutions are well-positioned to capture significant market share in this dynamic industry.

Key Takeaways

- Market Value: The Marine Sealants Market was valued at USD 274.1 million in 2023, and is expected to reach USD 417.6 million by 2033, with a CAGR of 4.3%.

- By Material Analysis: Silicone accounted for 30.1% due to its superior durability and flexibility in harsh marine environments.

- By Application Analysis: The leading application was below water-line sealing, capturing 42.6% of the market due to critical demand for robust sealing solutions.

- By Marine Type Analysis: Cargo Ships led with 52.6%, as they require extensive sealant solutions for maintenance and integrity.

- By End-Use Analysis: Shipbuilding dominated at 72.4%, indicating strong demand in new ship construction and maintenance.

- Dominant Region: APAC held 34.5% of the market, fueled by the region’s strong shipbuilding industry and maritime activities.

- Analyst Viewpoint: The market is poised for steady growth with a strong focus on innovation in sealant solutions that cater to stringent marine standards.

- Growth Opportunities: Development of more advanced, environmentally friendly sealants could provide competitive advantages in the global market.

Driving Factors

Increasing Shipbuilding Activities Drive Market Growth

The growth of the shipbuilding industry significantly boosts the marine sealants market. This increase is driven by the rising demand for commercial vessels, naval ships, and recreational boats. Marine sealants are crucial for ensuring watertight integrity, preventing corrosion, and enhancing the overall durability of marine vessels. For instance, major shipyards like Hyundai Heavy Industries and Fincantieri heavily rely on high-performance marine sealants in their operations.

As shipbuilding activities expand globally, particularly in regions like Asia-Pacific, the demand for advanced marine sealants is projected to rise substantially. The International Maritime Organization (IMO) reported that the global order book for new ships grew by 7% in 2022, indicating a positive trend in shipbuilding activities, thereby propelling the marine sealants market forward.

Expanding Maritime Trade and Transportation Drive Market Growth

The globalization of trade and the increasing volume of goods transported across oceans have elevated the need for reliable and efficient marine vessels. This trend has driven the demand for marine sealants, which are essential for maintaining the structural integrity and sealing capabilities of these vessels. For example, companies like Maersk Line and CMA CGM Group extensively use marine sealants in their container ships to protect against harsh marine environments.

The United Nations Conference on Trade and Development (UNCTAD) reported a 4% increase in global maritime trade in 2022, highlighting the growing reliance on marine transportation. As maritime trade continues to expand, the marine sealants market is expected to experience sustained growth due to the need for enhanced vessel performance and longevity.

Stringent Regulatory Requirements Drive Market Growth

Governments and international organizations have implemented stringent regulations to enhance maritime safety and reduce environmental impact. These regulations mandate the use of high-quality sealants and adhesives to prevent leakages, ensure watertightness, and minimize the risk of accidents and pollution. For example, the International Maritime Organization (IMO) has strict guidelines for the construction and maintenance of ships, which has boosted the adoption of advanced marine sealants.

Compliance with these regulations is essential for shipbuilders and operators, driving the demand for superior sealing solutions. The enforcement of these stringent standards ensures that marine sealants are continuously improved to meet safety and environmental criteria, thus propelling market growth. According to a 2022 report by the European Maritime Safety Agency (EMSA), regulatory compliance has led to a 10% increase in the adoption of high-performance marine sealants.

Restraining Factors

High Cost of Advanced Marine Sealants Restrains Market Growth

The high cost of advanced marine sealants is a significant barrier to market growth. Superior performance and durability often come at a higher price compared to traditional sealants. This poses a challenge for smaller shipyards, boat manufacturers, and marine repair facilities, especially in price-sensitive markets.

For example, specialized sealants for offshore platforms and LNG carriers represent a significant expense for operators. The average cost of high-performance marine sealants is approximately 30% higher than traditional options. This cost disparity limits adoption, particularly among smaller players in the industry, thereby restraining market expansion.

Stringent Approval and Certification Requirements Restrain Market Growth

Stringent approval and certification requirements for marine sealants hinder market growth. These products must meet rigorous industry standards and regulations, which can be time-consuming and expensive. This complexity impedes the introduction of new and innovative products.

For example, sealants used in naval vessels must undergo thorough testing and approval processes by defense authorities, adding to the product development cycle’s complexity and cost. The certification process for marine sealants can increase development costs by up to 20%. This financial burden can deter manufacturers from launching new products, thereby limiting market growth.

Material Analysis

Silicone dominates the market, holding a 30.1% share.

The marine sealants market is segmented by material type into silicone, polyurethane, polysulfide, butyl, and others. Among these, silicone dominates the market, holding a 30.1% share. Silicone marine sealants are preferred for their excellent UV resistance, flexibility, and longevity, which make them ideal for various marine applications. They perform well in harsh marine environments, offering superior adhesion and sealing capabilities. Silicone sealants are particularly valued for their non-corrosive properties and ability to withstand extreme temperatures, making them suitable for both above and below water-line applications.

Silicone sealants’ dominance is driven by their versatility and reliability in marine applications. Their high performance in preventing water ingress and corrosion significantly extends the lifespan of marine vessels. Additionally, the ease of application and curing of silicone sealants contributes to their widespread adoption in shipbuilding and repair activities. The growing focus on vessel safety and longevity further boosts the demand for silicone marine sealants.

Other materials like polyurethane, polysulfide, and butyl also play crucial roles in the market. Polyurethane sealants, known for their strong adhesion and mechanical properties, are widely used in high-stress areas. Polysulfide sealants are preferred for their chemical resistance and durability, often used in fuel tank sealing and other demanding applications. Butyl sealants, with their excellent adhesion to various substrates, are utilized in applications requiring long-term elasticity and sealing performance. These materials, while not as dominant as silicone, contribute to the market by catering to specific needs and enhancing the overall versatility of marine sealants.

Application Analysis

Below Water-Line Sealing holds the largest market share at 42.6%.

The marine sealants market, segmented by application, includes above water-line sealing, below water-line sealing, deck to hull, window bonding, and others. The below water-line sealing segment holds the largest market share at 42.6%. Below water-line sealing is critical for maintaining the integrity and safety of marine vessels. This application requires sealants with superior waterproofing capabilities, resistance to hydrostatic pressure, and long-lasting durability. The necessity to protect vessel hulls from constant water exposure and potential leaks makes below water-line sealants indispensable.

Below water-line sealants are essential for preventing water ingress, which can lead to structural damage and reduced vessel performance. These sealants must endure prolonged exposure to water and harsh marine conditions, including saltwater and temperature fluctuations. The high demand for effective sealing solutions in this segment drives significant market growth. Manufacturers focus on developing advanced sealants that offer enhanced adhesion, flexibility, and resistance to marine elements, further boosting the segment’s prominence.

Other applications such as above water-line sealing, deck to hull, and window bonding also contribute to the market. Above water-line sealants are crucial for sealing joints and seams exposed to air and water splashes. Deck to hull sealants ensure the structural integrity of the vessel by bonding critical components. Window bonding sealants provide strong adhesion and waterproofing for marine windows and portholes. These applications, while not as dominant as below water-line sealing, are vital for maintaining overall vessel performance and safety.

Marine Type Analysis

Cargo ships dominate with 52.6% due to high volume of global maritime trade.

The marine sealants market is segmented by marine type into cargo ships, tankers, passenger ships, fishing vessels, high-speed craft, and others. Cargo ships dominate this segment, holding a 52.6% share. Cargo ships require robust and durable sealing solutions to protect against harsh marine environments and ensure safe transportation of goods. The large size and continuous operation of cargo ships necessitate high-performance sealants for maintaining hull integrity and preventing leaks.

Cargo ships’ dominance is driven by the substantial volume of global maritime trade. These vessels are crucial for transporting goods across long distances, making reliable sealing solutions essential for operational efficiency and safety. The demand for marine sealants in cargo ships is further propelled by the need to comply with stringent safety and environmental regulations. Advanced sealants that offer excellent adhesion, flexibility, and resistance to marine conditions are highly sought after in this segment.

Other marine types such as tankers, passenger ferries, and fishing vessels also play important roles in the market. Tankers require sealants with exceptional chemical resistance to handle various liquids and gases. Passenger ships need sealants that provide comfort and safety for passengers by ensuring watertight and airtight conditions. Fishing vessels rely on sealants that can withstand frequent exposure to water and harsh conditions. While these segments are not as dominant as cargo ships, they contribute significantly to the market by addressing specific needs and enhancing the overall demand for marine sealants.

End-Use Analysis

Shipbuilding segment dominates with a 72.4% share.

The marine sealants market, segmented by end-use, includes shipbuilding and repair. The shipbuilding segment dominates with a 72.4% share. Shipbuilding requires high-quality sealants to ensure the structural integrity, durability, and safety of newly constructed vessels. The demand for advanced sealants in shipbuilding is driven by the need to comply with stringent industry standards and regulations, which mandate the use of reliable sealing solutions to prevent leaks and corrosion.

Shipbuilding’s dominance is fueled by the continuous growth of the global shipbuilding industry, particularly in regions like Asia-Pacific. Major shipyards and manufacturers invest heavily in advanced sealants to enhance vessel performance and longevity. The increasing focus on developing more efficient and environmentally friendly ships further boosts the demand for innovative sealant solutions. Manufacturers are continuously improving sealant formulations to meet evolving industry requirements, driving significant growth in the shipbuilding segment.

The repair segment also contributes to the market, addressing the need for maintenance and refurbishment of existing vessels. Marine sealants play a crucial role in extending the lifespan of ships by preventing and repairing leaks, corrosion, and other damages. The repair segment is driven by the aging fleet of vessels that require regular maintenance to ensure operational safety and efficiency. While not as dominant as shipbuilding, the repair segment is vital for sustaining the overall demand for marine sealants.

Key Market Segments

By Material

- Silicone

- Polyurethane

- Polysulfide

- Butyl

- Others

By Application

- Above Water-Line Sealing

- Below Water-Line Sealing

- Deck To Hull

- Window Bonding

- Others

By Marine Type

- Cargo Ships

- Tankers

- Passenger Ships

- Fishing Vessel

- High-Speed Craft

- Others

By End-Use

- Shipbuilding

- Repair

Growth Opportunities

Repair and Maintenance Services Offer Growth Opportunity

The growing aging fleet of marine vessels presents significant opportunities for the repair and maintenance services sector, driving demand for marine sealants. As vessels age, their sealing systems require regular inspection, maintenance, and replacement. This creates a consistent market for marine sealants.

Dry-docking and ship repair yards heavily rely on specialized sealants to maintain the integrity of hulls, decks, and other critical components. For example, it is estimated that the global ship repair and maintenance market will reach USD 20 billion by 2025, with a substantial portion allocated to marine sealants. This continuous need for maintenance services ensures a steady demand for marine sealants, bolstering market growth.

Offshore Oil and Gas Exploration Offers Growth Opportunity

Increasing exploration and production activities in offshore oil and gas fields drive the demand for specialized marine sealants. These sealants must withstand extreme conditions such as high pressures, corrosive environments, and harsh weather.

Companies like ExxonMobil and Shell require advanced marine sealants for their offshore platforms and subsea equipment to ensure safe and reliable operations. According to the International Energy Agency (IEA), offshore oil and gas production is expected to grow by 15% over the next decade, further increasing the need for high-performance marine sealants. This sector’s expansion offers significant growth opportunities for the marine sealants market.

Trending Factors

Adoption of Advanced Materials and Technologies Are Trending Factors

The marine sealants market is witnessing a trend toward adopting advanced materials and technologies, such as nanotechnology, bio-based materials, and smart coatings. These innovations aim to improve the performance, durability, and eco-friendliness of marine sealants. Companies like AkzoNobel and PPG Industries are developing nanotechnology-based sealants that offer superior adhesion and corrosion resistance.

The adoption of these advanced materials is driven by the need for more efficient and sustainable sealing solutions. The global nanotechnology market in the marine industry is expected to grow by 12.2% annually, highlighting the increasing demand for innovative sealant technologies.

Customization and Specialized Solutions Are Trending Factors

The growing diversity and specialization in the marine industry have led to an increased demand for customized and specialized marine sealants tailored to specific applications. Manufacturers are focusing on developing sealants that meet unique requirements, such as chemical resistance, fire retardancy, or compatibility with specific substrates.

For example, Dow Corning offers customized silicone-based sealants for various marine applications, including offshore platforms and naval vessels. The ability to provide tailored solutions enhances the competitiveness of sealant manufacturers and meets the specific needs of diverse marine applications. This trend is supported by a growing market for specialized sealants, projected to grow at a rate of 8% annually.

Regional Analysis

APAC Dominates with 34.5% Market Share

The Asia-Pacific (APAC) region holds a 34.5% market share in the marine sealants market, valued at USD 94.5645 million. This dominance is driven by several key factors.

The APAC region is a hub for shipbuilding and maritime activities. Countries like China, South Korea, and Japan are major contributors to global shipbuilding, with China alone accounting for over 40% of the world’s shipbuilding output. The region’s robust industrial base and increasing investments in maritime infrastructure drive high demand for marine sealants.

The APAC region’s extensive coastline and significant maritime trade activities enhance its market performance. The region’s favorable economic policies and government support for the shipbuilding industry further boost growth. Additionally, the presence of major shipyards and repair facilities in APAC countries ensures a steady demand for marine sealants.

The APAC region is expected to maintain its dominance in the marine sealants market due to continuous investments in shipbuilding and maritime trade. The region’s market value is projected to grow at a compound annual growth rate (CAGR) of 6%, driven by technological advancements and increased focus on environmental sustainability.

North America: 25.7% Market Share

North America holds a 25.7% market share in the marine sealants market. The presence of major maritime industries and a strong emphasis on technological innovation contribute to this significant share. The region’s focus on maintaining a robust naval fleet and increasing offshore oil and gas exploration activities drive demand for marine sealants. The market is expected to grow at a CAGR of 5%, supported by advancements in sealant technology and stringent regulatory requirements.

Europe: 22.3% Market Share

Europe captures a 22.3% market share in the marine sealants market. The region’s rich maritime history, extensive shipping activities, and stringent environmental regulations drive demand for high-performance sealants. Countries like Germany, Norway, and the Netherlands are key players in the market. Europe’s market is anticipated to grow at a CAGR of 4.5%, with increasing investments in sustainable and eco-friendly sealant technologies.

Middle East & Africa: 10.2% Market Share

The Middle East & Africa hold a 10.2% market share in the marine sealants market. The region’s significant oil and gas exploration activities and growing maritime trade contribute to this share. The market in this region is projected to grow at a CAGR of 4%, driven by investments in maritime infrastructure and the development of new ports and shipping facilities.

Latin America: 7.3% Market Share

Latin America accounts for a 7.3% market share in the marine sealants market. The region’s growing shipbuilding industry and expanding maritime trade activities support this market share. Brazil and Mexico are key contributors to the market. The region’s market is expected to grow at a CAGR of 3.5%, with increasing investments in port infrastructure and the development of new shipping routes.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Marine Sealants Market is characterized by the presence of several key players who significantly influence market dynamics. Companies such as 3M Company, Dow Inc., Sika AG, and Henkel AG & Co. KGaA are leaders in innovation and technological advancement. These firms invest heavily in research and development to produce high-performance sealants that meet stringent industry standards. For example, 3M and Dow are known for their advanced silicone and polyurethane sealants, which offer superior durability and adhesion.

Sika AG and Henkel AG & Co. KGaA leverage their extensive distribution networks and strong brand reputation to maintain a competitive edge. Their strategic acquisitions and partnerships enhance their market presence and expand their product portfolios. Bostik SA and RPM International Inc. focus on developing eco-friendly and sustainable sealant solutions, catering to the growing demand for environmentally conscious products.

PPG Industries Inc., LORD Corporation, and Huntsman Corporation emphasize high-performance marine coatings and sealants, often integrating nanotechnology for improved performance. Illinois Tool Works Inc. and Avery Dennison Corporation utilize their expertise in adhesives and materials science to offer specialized solutions for the marine industry. H.B. Fuller Company, known for its innovative sealants, targets niche applications within the marine sector, enhancing its market influence.

These key players’ strategic positioning and market influence drive innovation and growth in the Marine Sealants Market. Their ongoing efforts to meet evolving industry demands and regulatory requirements ensure they remain at the forefront of the market.

Market Key Players

- 3M Company

- Dow Inc.

- Sika AG

- Henkel AG & Co. KGaA

- Bostik SA

- RPM International Inc.

- PPG Industries Inc.

- LORD Corporation

- Huntsman Corporation

- Illinois Tool Works Inc.

- Avery Dennison Corporation

- H.B. Fuller Company

Recent Developments

- May 2024: Flex Seal introduces its new high-performance duct tape, Flex Super Wide Duct Tape, in Canadian retailers. This premium duct tape is water-resistant and features a reinforced backing that can be torn by hand, available in 4.6 inches and 7.5 inches widths.

- November 2023: Purdue researchers develop patent-pending adhesive formulations from sustainable, bio-based components. Made from zein and tannic acid, these adhesives grow stronger in water and can be used underwater or in wet conditions, applicable in various fields.

Report Scope

Report Features Description Market Value (2023) USD 274.1 Million Forecast Revenue (2033) USD 417.6 Million CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Silicone, Polyurethane, Polysulfide, Butyl, Others), By Application (Above Water-Line Sealing, Below Water-Line Sealing, Deck To Hull, Window Bonding, Others), By Marine Type (Cargo Ships, Tankers, Passenger Ships, Fishing Vessel, High-Speed Craft, Others), By End-Use (Shipbuilding, Repair) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M Company, Dow Inc., Sika AG, Henkel AG & Co. KGaA, Bostik SA, RPM International Inc., PPG Industries Inc., LORD Corporation, Huntsman Corporation, Illinois Tool Works Inc., Avery Dennison Corporation, H.B. Fuller Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Marine Sealants Market by 2033?The Global Marine Sealants Market is expected to reach USD 417.6 million by 2033.

What is the expected CAGR for the Global Marine Sealants Market from 2024 to 2033?The market is projected to grow at a CAGR of 4.3% during this period.

Which region holds the largest market share in the marine sealants market?The Asia-Pacific (APAC) region holds the largest market share at 34.5%.

What opportunities exist in the marine sealants market for future growth?Growth opportunities include the development of more advanced, environmentally friendly sealants and the expanding repair and maintenance services sector.

Which companies are key players in the marine sealants market?Key players include 3M Company, Dow Inc., Sika AG, and Henkel AG & Co. KGaA, among others.

-

-

- 3M Company

- Dow Inc.

- Sika AG

- Henkel AG & Co. KGaA

- Bostik SA

- RPM International Inc.

- PPG Industries Inc.

- LORD Corporation

- Huntsman Corporation

- Illinois Tool Works Inc.

- Avery Dennison Corporation

- H.B. Fuller Company