Global Marine Prebiotics Market Size, Share Analysis Report By Product Type (Marine Polysaccharides, Marine Oligosaccharides, Marine Fibers, Others), By Application (Dietary Supplements, Functional Foods And Beverages, Infant And Clinical Nutrition, Animal Nutrition, Pharmaceuticals And Therapeutics, Cosmetics And Personal Care, Others), By End User (Human Nutrition And Health, Animal And Aquaculture Feed, Industrial Users), By Distribution Channel (Direct, Retail Sales, Online Sales, Specialty And Health Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170862

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

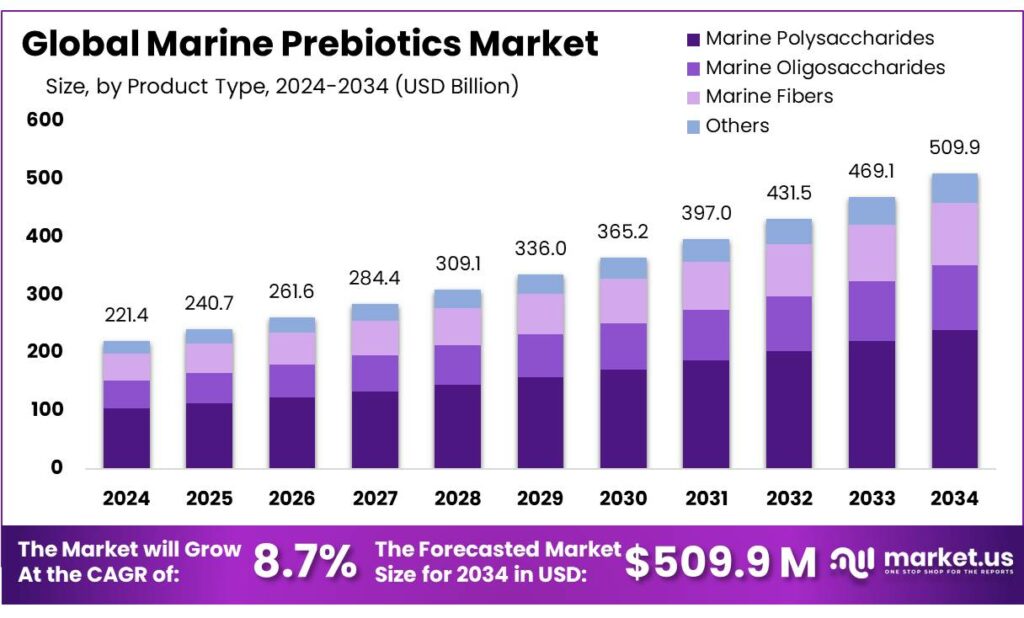

The Global Marine Prebiotics Market size is expected to be worth around USD 509.9 Million by 2034, from USD 221.4 Million in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 45.30 share, holding USD 9.4 Billion revenue.

Marine prebiotics are non-digestible marine carbohydrate that selectively feed beneficial gut microbes. In practice, the industrial focus is on brown and red seaweed extracts and newer enzymatically “cut” oligosaccharides designed for better solubility, taste, and targeted microbiome response. This category sits at the intersection of functional foods, dietary supplements, and “blue bioeconomy” ingredients, where buyers increasingly ask for clean-label positioning, traceable biomass, and safety dossiers that work across major markets.

- The supply base is expanding because algae production is already large at the primary level. FAO reports that total global fisheries and aquaculture output reached 223.2 million tonnes in 2022, including 37.8 million tonnes of algae. Seaweed is also becoming a more visible traded commodity: FAO’s seaweed trade analysis shows ~819,100 tonnes of seaweed products exported in 2023, valued at ~USD 3.21 billion—a useful signal that downstream processing and international specifications are maturing beyond niche volumes.

Key driving factors are coming from both nutrition targets and consumer pull. WHO recommends adults consume at least 25 g/day of naturally occurring dietary fibre and 400 g/day of fruits and vegetables, reinforcing a global “fibre gap” narrative that functional fibres (including marine-derived) can help address. On the demand side, large consumer surveys continue to show digestive health as a mainstream purchase motivator; for example, IFIC’s 2024 survey sampled 3,000 U.S. adults, reflecting how gut-health interest is no longer confined to early adopters and has become a scalable marketing platform for prebiotic claims.

- Government and trusted institutional initiatives are also shaping the competitive landscape by reducing technical and regulatory friction. In the EU, the Commission has stated that demand for algae products is expected to reach €9 billion by 2030, and EU project support has been substantial—CINEA summarizes €559+ million invested in algae-related projects across 2014–2023. Regulatory normalization is moving too: the EU has highlighted that 20+ algae species can now be marketed as food or supplements in the bloc, which matters for ingredient developers building multi-country launch plans.

Key Takeaways

- Marine Prebiotics Market size is expected to be worth around USD 509.9 Million by 2034, from USD 221.4 Million in 2024, growing at a CAGR of 8.7%.

- Marine Polysaccharides held a dominant market position, capturing more than a 46.9% share.

- Dietary Supplements held a dominant market position, capturing more than a 31.6% share.

- Human Nutrition & Health held a dominant market position, capturing more than a 65.2% share.

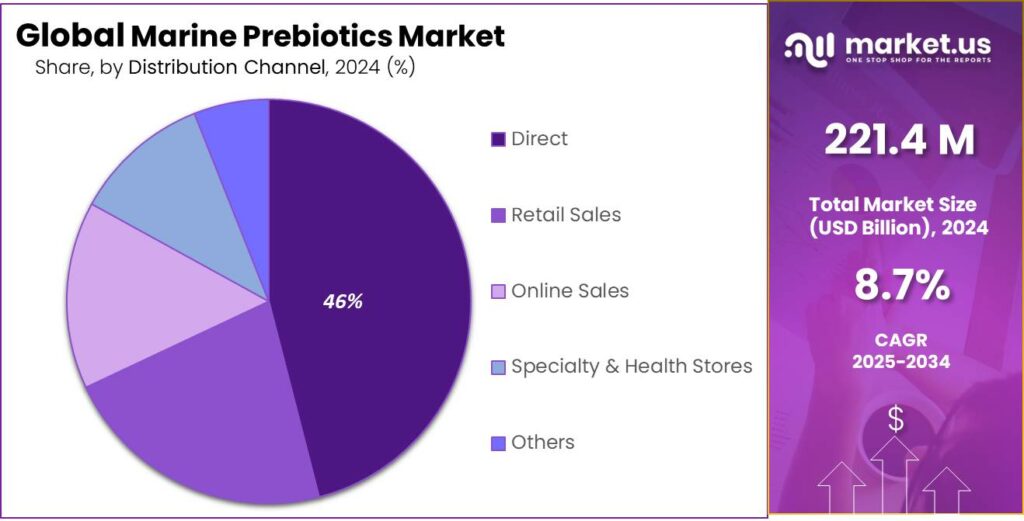

- Direct held a dominant market position, capturing more than a 46.7% share.

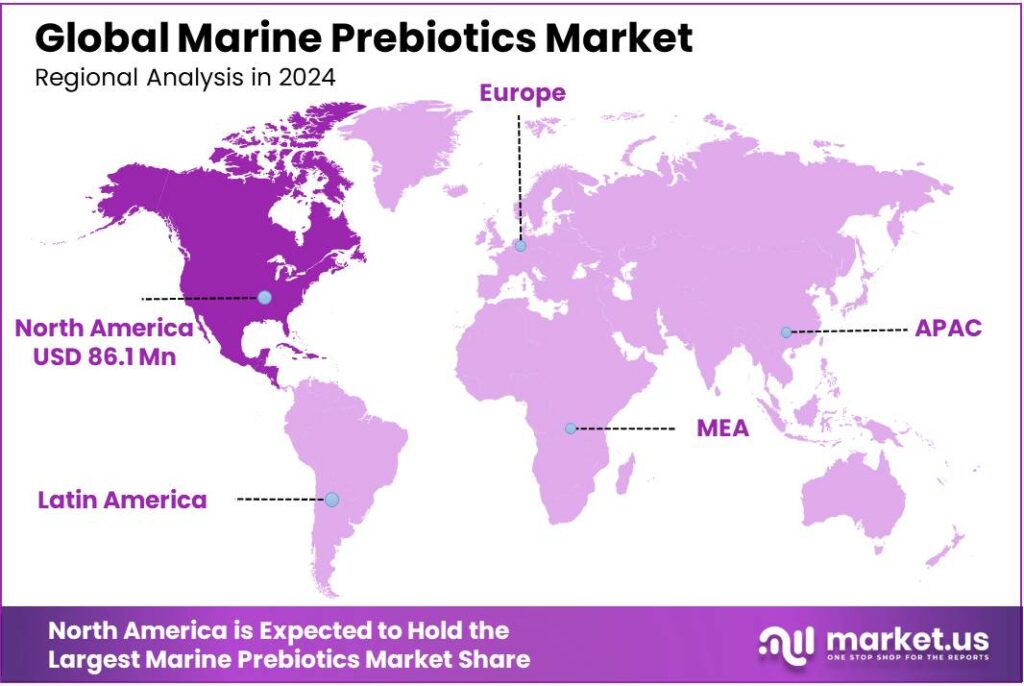

- North America accounted for 38.9% of the marine prebiotics market, representing approximately USD 86.1 million.

By Product Type Analysis

Marine polysaccharides lead with 46.9% as natural gut-health ingredients gain trust

In 2024, Marine Polysaccharides held a dominant market position, capturing more than a 46.9% share, supported by rising demand for natural and science-backed prebiotic ingredients sourced from marine biomass. These compounds, commonly extracted from seaweed and algae, were widely used in functional foods, dietary supplements, and animal nutrition due to their ability to support gut health and microbiome balance.

In 2024, manufacturers favored marine polysaccharides because of their clean-label appeal, high fiber content, and compatibility with plant-based and vegan formulations. Their stability in food processing and proven fermentability further strengthened adoption across multiple applications. In 2025, demand remained strong as consumers increasingly preferred sustainable, ocean-derived prebiotics that align with wellness trends and environmentally responsible sourcing practices.

By Application Analysis

Dietary supplements lead with 31.6% as gut-health awareness continues to rise

In 2024, Dietary Supplements held a dominant market position, capturing more than a 31.6% share, driven by increasing consumer focus on digestive health, immunity, and overall wellness. Marine prebiotics were widely incorporated into capsules, powders, and functional blends because of their natural origin and proven role in supporting healthy gut bacteria.

In 2024, demand was supported by growing acceptance of marine-based ingredients in premium supplement formulations, particularly among health-conscious and aging populations. These products were favored for their clean-label positioning and compatibility with daily nutrition routines. In 2025, the segment continued to grow steadily as preventive healthcare trends and personalized nutrition increased the use of marine prebiotics in dietary supplement products.

By End User Analysis

Human nutrition and health leads with 65.2% as wellness-focused consumption expands

In 2024, Human Nutrition & Health held a dominant market position, capturing more than a 65.2% share, supported by strong consumer demand for natural ingredients that promote digestive balance and overall well-being. Marine prebiotics were increasingly used in functional foods, beverages, and supplements due to their ability to support gut microbiota and nutrient absorption.

In 2024, the segment benefited from rising awareness of preventive healthcare and the role of prebiotics in immunity and metabolic health. Their marine origin also aligned with clean-label and sustainability preferences. In 2025, demand remained high as consumers continued to prioritize daily nutrition solutions that support long-term health through scientifically supported marine-derived ingredients.

By Distribution Channel Analysis

Direct B2B supply leads with 46.7% as manufacturers prefer reliable ingredient sourcing

In 2024, Direct held a dominant market position, capturing more than a 46.7% share, driven by strong demand from food, supplement, and nutrition manufacturers seeking consistent quality and traceable marine prebiotic ingredients. This channel allowed buyers to work closely with suppliers on formulation needs, volume contracts, and regulatory compliance.

In 2024, direct sourcing supported cost control and ensured stable supply for large-scale production. In 2025, the segment continued to lead as long-term supply agreements and demand for customized marine prebiotic solutions strengthened direct relationships between ingredient producers and end-use manufacturers.

Key Market Segments

By Product Type

- Marine Polysaccharides

- Marine Oligosaccharides

- Marine Fibers

- Others

By Application

- Dietary Supplements

- Functional Foods & Beverages

- Infant & Clinical Nutrition

- Animal Nutrition

- Pharmaceuticals & Therapeutics

- Cosmetics & Personal Care

- Others

By End User

- Human Nutrition & Health

- Animal & Aquaculture Feed

- Industrial Users

By Distribution Channel

- Direct

- Retail Sales

- Online Sales

- Specialty & Health Stores

- Others

Emerging Trends

Algae-derived gut-health ingredients are going mainstream

A clear latest trend in marine prebiotics is the shift from “specialty seaweed supplements” to mainstream gut-health ingredients that can sit inside everyday foods and beverages. Brands are increasingly formulating with prebiotic fibers and prebiotic-like ingredients because digestive comfort has become a normal, day-to-day consumer goal—not a niche wellness claim. In the 2024 IFIC Food & Health Survey, 36% of respondents said they seek digestive health/gut health benefits from foods, beverages, or nutrients.

The second part of this trend is industrialization and standardization. Marine prebiotics used to be viewed as “variable” because seaweed composition changes by species, season, and location. Now, more suppliers are building processes that help food companies trust the ingredient: tighter sourcing specs, more frequent lab testing, and controlled extraction or enzymatic “cutting” to make smaller carbohydrate fractions that behave more consistently in recipes. This push toward repeatable quality is happening because the upstream algae base is already large enough to support industrial supply planning. FAO reports global fisheries and aquaculture production reached 223.2 million tonnes in 2022, including 37.8 million tonnes of algae—meaning seaweed is no longer a tiny raw material stream.

Policy is also accelerating this “mainstreaming” trend, especially in Europe. The European Commission’s algae initiative points out that EU demand for algae products is expected to reach €9 billion by 2030, with food as a key outlet. That message matters because it tells ingredient developers and food brands that algae is being treated as a strategic, long-term supply chain—not a short-lived novelty. Alongside that, the European Climate, Infrastructure and Environment Executive Agency (CINEA) summarized that the EU invested over €559 million in algae-related projects during 2014–2023, supporting 219 projects and 1,470 organisations.

Drivers

Digestive health demand is pushing prebiotic ingredient adoption

One major driver for Marine Prebiotics is the clear “fiber and gut-health” need in everyday diets. Consumers are actively looking for ingredients that support digestion, and prebiotics fit that promise in a simple way: they are fibers that feed good gut bacteria. WHO’s updated nutrition guidance reinforces why this matters—WHO recommends adults eat at least 25 g of naturally occurring dietary fibre per day and at least 400 g of fruits and vegetables. When diets fall short, brands look for practical ways to add fiber-like functionality into foods, drinks, and supplements without making products hard to consume.

This is where marine prebiotics become commercially attractive. Seaweed and algae contain polysaccharides that behave like fermentable fibers, and suppliers can turn them into “clean label” prebiotic ingredients for gummies, powders, sachets, nutrition bars, dairy alternatives, and even hydration mixes. In the International Food Information Council’s (IFIC) 2024 Food & Health Survey, “digestive health/gut health” is listed among the benefits people seek from foods, beverages, and nutrients, with the survey run on 3,000 U.S. adults. In the same report, the chart of “Health Benefits Sought from Food/Beverages/Nutrients” shows digestive health/gut health at 36%.

- On the supply side, this demand has something important going for it: marine biomass is not a tiny raw-material base anymore. FAO reports global fisheries and aquaculture production reached 223.2 million tonnes in 2022, including 37.8 million tonnes of algae.

- Governments and trusted agencies are also actively building the enabling environment, which strengthens this driver over time. In Europe, the EU has invested over €559 million in algae-related projects between 2014 and 2023, supporting 219 projects involving 1,470 organisations, via programs such as EMFF, EMFAF, LIFE, Horizon 2020 and Horizon Europe. While this funding is broader than “prebiotics” alone, it directly improves the building blocks marine prebiotics depend on—cultivation methods, processing know-how, safety testing, and scalable biorefinery approaches.

Restraints

Food safety limits and variability slow down scaling

A major restraint for Marine Prebiotics is that seaweed-based ingredients can carry high and highly variable levels of iodine and certain metals, so manufacturers must spend more on testing, processing, and documentation before they can scale into mainstream foods. This is not a theoretical concern. ANSES notes that edible seaweed cadmium levels often exceed earlier French guidance, and it has pushed regulators toward tighter controls and closer monitoring.

Cadmium is a good example of how compliance risk becomes a commercial barrier. In 2020, ANSES proposed a maximum cadmium level of 0.35 mg/kg in edible seaweed, aiming to keep the tolerable intake from being exceeded in 95% of cases. ANSES also quantified the real-world impact: lowering cadmium to that level would reduce seaweed’s contribution to cadmium intake to about 11.5%, versus 19% currently observed. For ingredient buyers, these numbers translate into stricter supplier qualification, more batch rejections, and extra cost per kilogram—especially when prebiotics are intended for frequent, daily use.

The operational challenge gets tougher because seaweed contamination is not consistent across species or harvesting zones. A Nordic risk-management review highlights that cadmium levels can range from about 0.3 mg/kg dry matter to around 6 mg/kg dry matter even within the same broad species group, showing why “one certificate once a year” does not work for industrial buyers. The same Nordic document notes there is a maximum level of 3.0 mg cadmium/kg for food supplements consisting exclusively or mainly of dried seaweed, but “as yet no” maximum levels for seaweed consumed as food—meaning companies can face uncertainty and country-by-country interpretations when formulating everyday foods.

Iodine adds another layer of complexity because marine prebiotics are often positioned for gut health, yet excessive iodine intake is a recognized safety concern—particularly with brown seaweeds. ANSES reports brown seaweeds can exceed 10,000 µg/g iodine, and France revised the maximum iodine level to 2000 mg/kg dry weight due to changing consumption habits. The same ANSES opinion notes earlier authorization limits of 6000 mg/kg dry weight for laminaria and 5000 mg/kg dry weight for other species.

Opportunity

Standardized seaweed oligosaccharides for everyday foods

A big growth opportunity for marine prebiotics is to move from “seaweed as a niche health ingredient” into standardized, food-friendly oligosaccharides that can be used every day in common products like yogurt drinks, fiber waters, gummies, kids’ nutrition, and meal replacements. The reason is simple: food brands want gut-health ingredients that are consistent, easy to dose, and mild in taste. Marine polysaccharides can do the job, but the next step is industrial refinement—turning them into smaller, cleaner fractions with predictable performance.

The supply-side foundation is already strong, which makes this opportunity realistic, not wishful. FAO reports global fisheries and aquaculture output reached 223.2 million tonnes in 2022, including 37.8 million tonnes of algae. This scale matters because prebiotics need dependable raw material availability. When algae production is measured in tens of millions of tonnes, processors can justify investments in extraction lines, enzymatic conversion, filtration, and quality control systems that bring marine prebiotics closer to the reliability of established plant-based fibers.

Europe is an especially clear “scale-up runway” for marine prebiotics because the policy direction is openly supportive of algae-based value chains. The European Commission stated the EU’s demand for algae products is expected to reach €9 billion in 2030. That demand outlook encourages ingredient suppliers to build capacity, and it gives food brands confidence that algae ingredients are becoming part of the mainstream food system, not a short-term trend. The same policy push is backed by meaningful public funding: CINEA’s portfolio summary shows the EU invested over €559 million in algae-related projects during 2014–2023, supporting 219 projects involving 1,470 organisations.

Regulatory clarity is another part of the opportunity, because it reduces the “will this be allowed” friction for product teams. In 2024, EU oceans-and-fisheries updates noted that more than 20 algae species can now be sold as food or food supplements in the EU. For marine prebiotics, broader acceptance of algae as food helps ingredient companies build compliant source lists, document traceability, and develop standardized specs that can be reused across multiple customer projects.

Regional Insights

North America leads with 38.9% share and US$86.1 Mn in 2024, supported by strong supplement and functional-food demand

In 2024, North America accounted for 38.9% of the marine prebiotics market, representing approximately USD 86.1 million, a position supported by high consumer awareness of gut health and rapid adoption of marine-derived ingredients in dietary supplements and functional foods. The regional market was driven by steady investment in ingredient R&D, increasing launches of premium supplement formulations, and strong retail and e-commerce channels that enabled rapid product roll-out and consumer trial.

Supply-side developments included expanded processing capacity for alginate and other seaweed extracts, and several suppliers moved to formalize traceability and sustainability assurances to meet buyer expectations. Regulatory clarity for novel marine ingredients and growing scientific validation of microbiome benefits supported formulators in incorporating marine prebiotics into capsules, powders and functional bars, lifting average selling prices for specialty ingredients versus commodity prebiotics.

In 2024, institutional buyers such as nutraceutical manufacturers and specialty ingredient distributors accounted for the bulk of B2B contracts, while direct-to-consumer supplement brands drove awareness at retail. Short-term outlook into 2025 suggested continued mid-single-digit to high-single-digit growth as clinical evidence accumulates and product form innovation broadens application. The North American market structure in 2024 was therefore characterized by strong demand pull, targeted investment in sustainable sourcing, and a premiumization trend that preserved the region’s leading share.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, International Flavors & Fragrances Inc. diversified its portfolio to include marine prebiotic ingredients, targeting functional foods and beverages. The company reported total revenue of approximately US$12.3 billion, with marine prebiotics contributing around US$68 million. Its solutions supported product innovation and clean-label trends in North America, Europe, and Asia-Pacific, emphasizing customized formulations for gut health.

In 2024, Acadian Seaplants Limited strengthened its marine prebiotics presence through seaweed-derived oligosaccharides and polysaccharides for human and animal nutrition. The company achieved revenue of about US$41 million, with 90+ product offerings for dietary supplements and functional foods. Its focus on sustainable harvesting, traceability, and scientific-backed efficacy reinforced B2B partnerships across multiple regions.

In 2024, Beneo GmbH continued to lead in the prebiotic ingredient sector by offering marine-based inulin and polysaccharide solutions for human nutrition. The company achieved US$98 million in revenue and distributed over 200 product lines globally. Its emphasis on clinical validation, clean-label ingredients, and supply chain transparency supported adoption across dietary supplements, functional foods, and beverages.

Top Key Players Outlook

- AIDP, Inc.

- Marine Bio Co., Ltd.

- Beneo GmbH

- International Flavors & Fragrances Inc.

- Acadian Seaplants Limited

- Algaia S.A.S.

- Ocean Harvest Technology Group

Recent Industry Developments

In 2024, Acadian Seaplants Limited continued to establish itself as a key contributor to the marine prebiotics and seaweed‑derived functional ingredient space by advancing sustainable cultivation and application of red seaweed and other marine biomass with demonstrated prebiotic benefits. The company operates one of the world’s largest land‑based seaweed cultivation systems, which supports traceable and consistent production of fiber‑rich marine ingredients with ~27 % dietary fiber and >15 % xylan content, helping stimulate beneficial gut bacteria and short‑chain fatty acid production for digestive wellness.

In October 2024, Acadian announced a newly cultivated strain of red seaweed (Palmaria palmata, also called dulse) designed for health and wellness products, noting that this seaweed delivers about 27 % total dietary fiber by dry weight, with xylan over 15 %, which helps resist digestion and act as food for beneficial gut microbes—a core characteristic of prebiotic fibres.

Report Scope

Report Features Description Market Value (2024) USD 221.4 Bn Forecast Revenue (2034) USD 509.9 Bn CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Marine Polysaccharides, Marine Oligosaccharides, Marine Fibers, Others), By Application (Dietary Supplements, Functional Foods And Beverages, Infant And Clinical Nutrition, Animal Nutrition, Pharmaceuticals And Therapeutics, Cosmetics And Personal Care, Others), By End User (Human Nutrition And Health, Animal And Aquaculture Feed, Industrial Users), By Distribution Channel (Direct, Retail Sales, Online Sales, Specialty And Health Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AIDP, Inc., Marine Bio Co., Ltd., Beneo GmbH, International Flavors & Fragrances Inc., Acadian Seaplants Limited, Algaia S.A.S., Ocean Harvest Technology Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AIDP, Inc.

- Marine Bio Co., Ltd.

- Beneo GmbH

- International Flavors & Fragrances Inc.

- Acadian Seaplants Limited

- Algaia S.A.S.

- Ocean Harvest Technology Group