Global Manufacturing Outsourcing Market Size, Share Analysis Report By Service (3D Printing, CNC Machining, Sheet Metal Fabrication, Injection Molding, Others), By Equipment (Medical Devices, Industrial Machinery, Heavy Equipment (Construction, Mining, Agriculture), Oil and Gas Equipment, Renewable Energy Equipment, Machine Tools Manufacturing, Rail Transportation Equipment, Marine Equipment and Shipbuilding, Power Generation Equipment, HVAC Systems, Automotive Suppliers and Accessory Makers, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151791

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

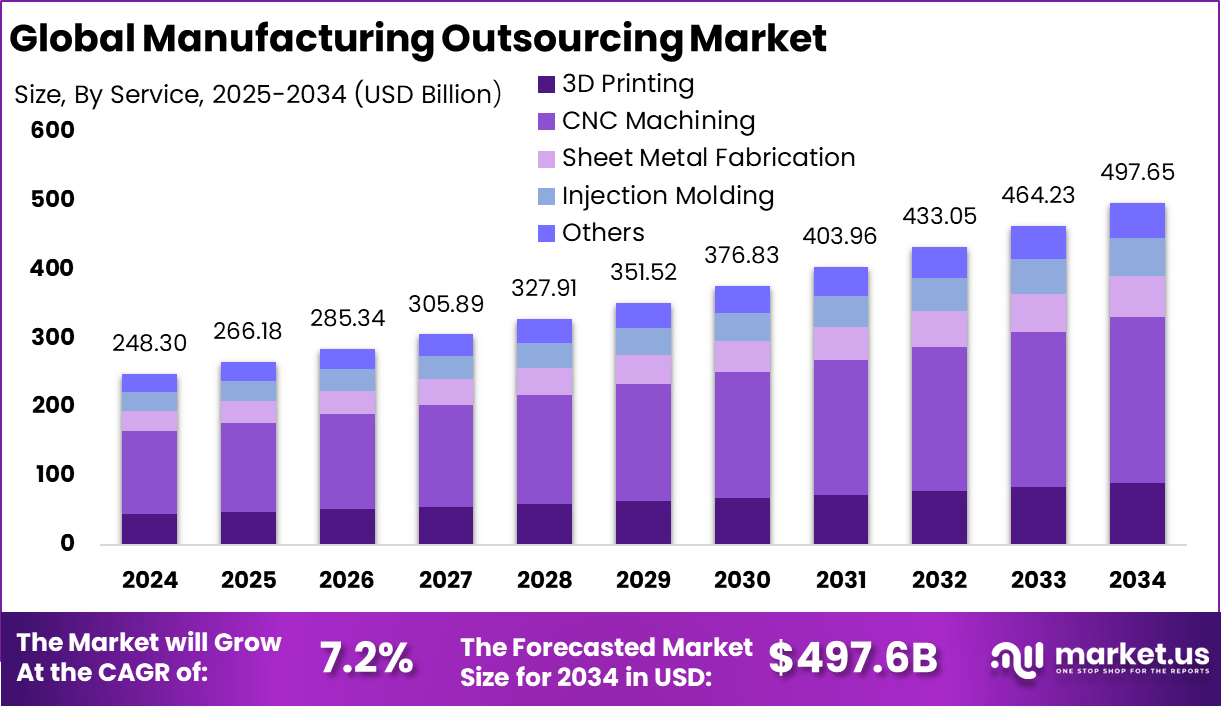

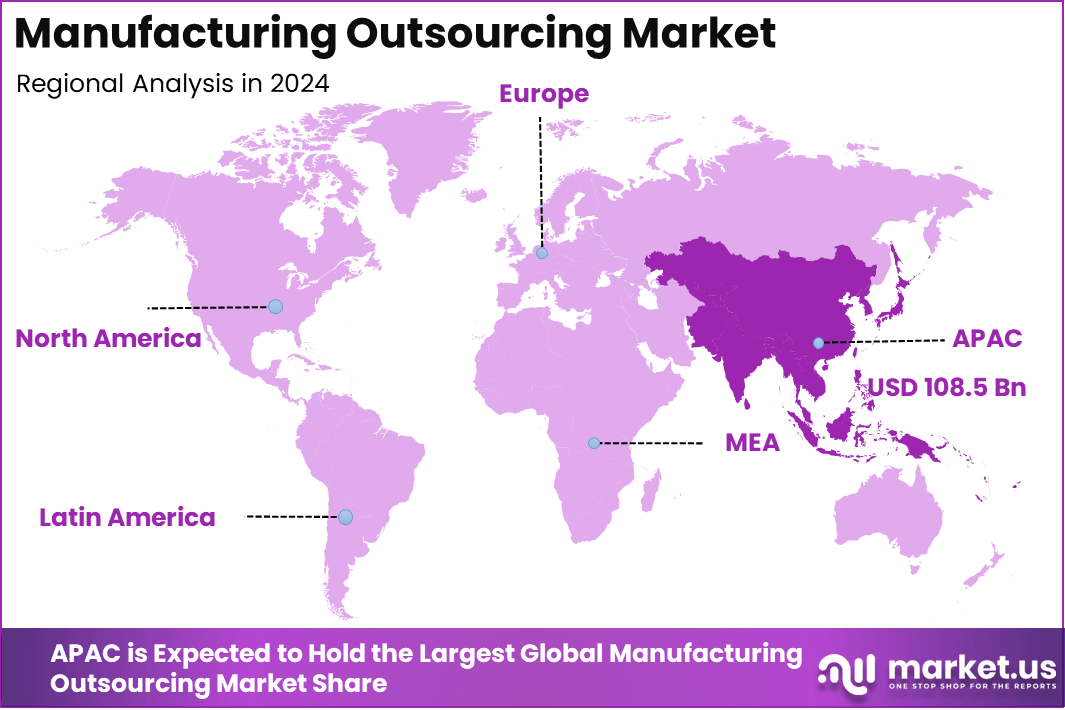

The Global Manufacturing Outsourcing Market size is expected to be worth around USD 497.65 Billion By 2034, from USD 248.30 billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 43.8% share, holding USD 108.5 Billion revenue.

The manufacturing outsourcing market encompasses the strategic engagement of external partners – such as contract manufacturers and specialized service providers – to handle all or part of production processes. This model is utilized across industries including electronics, pharmaceuticals, medical devices, and general manufacturing. Demand for outsourcing arises from a range of operational, technological, and market drivers.

According to findings from Infosys BPM, approximately 68% of companies in the United States outsource their business processes to countries in Asia and Eastern Europe, underscoring a strategic shift toward global efficiency and cost optimization. Manufacturing represents a significant portion of these outsourced activities, with China serving as the primary destination due to its established industrial base and supply chain infrastructure.

Following closely are India and various Southeast Asian nations, which continue to attract outsourcing demand for their skilled labor, competitive costs, and expanding digital capabilities. Cost efficiency remains a core rationale for outsourcing, as manufacturers can reduce capital expenses and overhead by leveraging external facilities.

Demand for manufacturing outsourcing is being driven by the increasing complexity of products, evolving global supply chains, and the need for operational agility. Within the medical device space, demand is particularly strong for outsourcing production of advanced equipment, driven by shifting demographics and rising chronic disease prevalence.

The adoption of smart manufacturing technologies is becoming widespread in outsourced production. Investments are being directed toward industrial IoT, sensors, automation hardware, and vision systems – foundational technologies enabling factory performance monitoring and enhanced efficiency. AI and machine learning are increasingly piloted for use cases such as predictive maintenance, defect detection, and quality control.

Key Insight Summary

- The global manufacturing outsourcing market is projected to grow from USD 248.30 billion in 2024 to USD 497.65 billion by 2034, reflecting a CAGR of 7.2%. This growth is driven by the need for cost-efficiency, scalability, and access to specialized production.

- In 2024, the Asia-Pacific region dominated the market, accounting for over 43.8% share, generating around USD 108.5 billion in revenue.

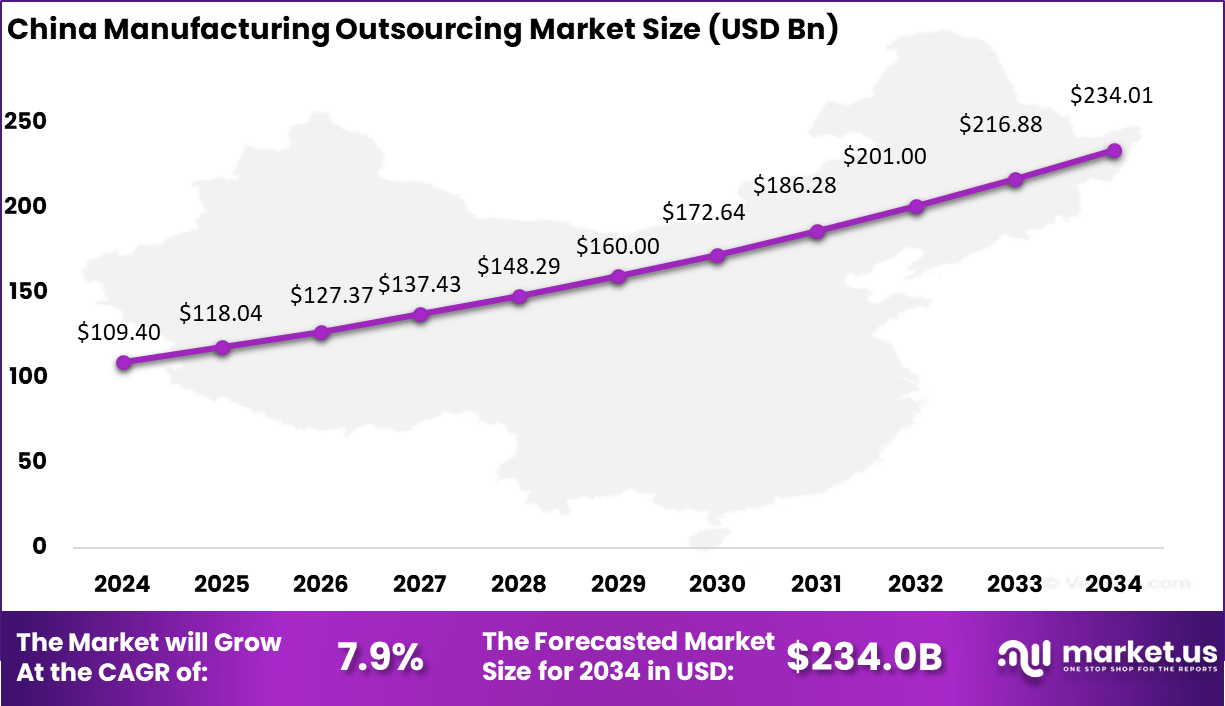

- China alone contributed USD 109.4 billion to the market in 2024, with an expected CAGR of 7.9%.

- By service type, CNC Machining led with 48.6% share, showing its central role in precision part production across multiple industries, including electronics and aerospace.

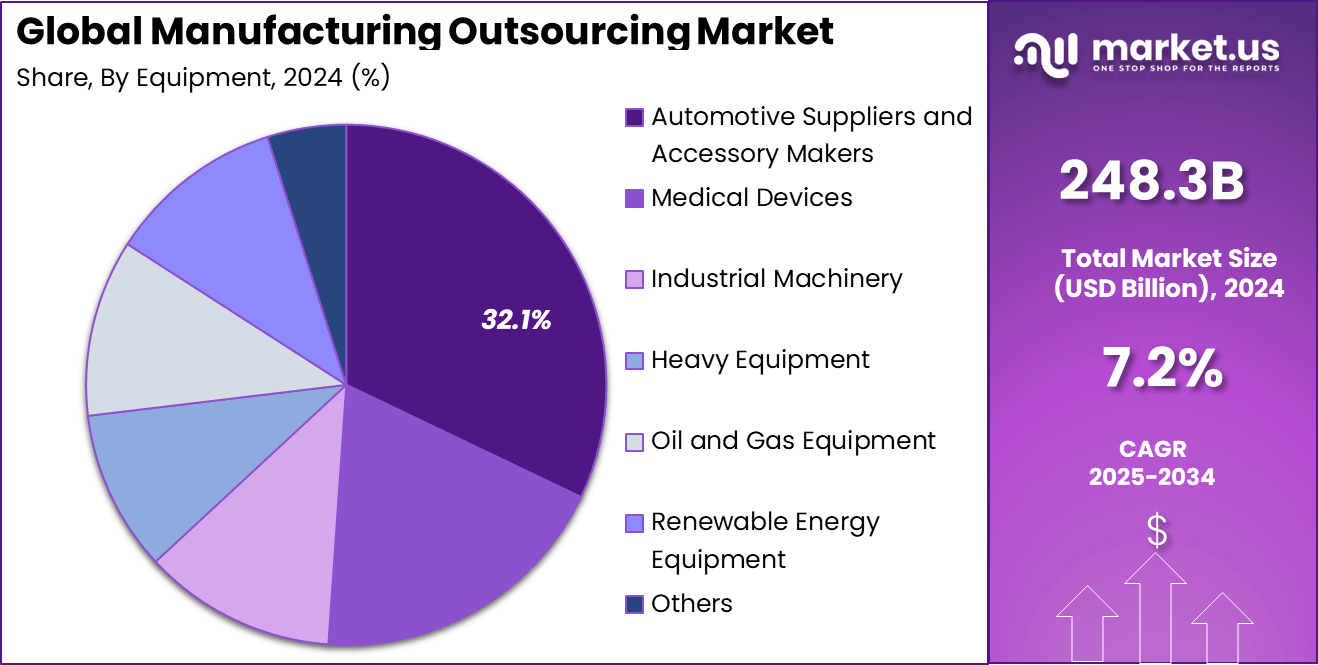

- Under equipment category, Automotive Suppliers and Accessory Makers held 32.1% share.

China Market Size

The China Manufacturing Outsourcing Market was valued at USD 109.4 Billion in 2024 and is anticipated to reach approximately USD 234.01 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.9% during the forecast period from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than a 43.8 % share and generating approximately USD 108.5 billion in revenue. This commanding lead can be attributed to its vast and cost-competitive manufacturing base, particularly in countries such as India, China, and South Korea.

A large and skilled engineering workforce supports high-value production across industries – from electronics and automotive to pharmaceuticals – while robust infrastructure, government incentives, and supportive trade policies further strengthen APAC’s appeal as a global outsourcing hub. The region’s ongoing digital transformation also contributes significantly.

APAC firms are rapidly adopting automation, industrial IoT, AI-led quality assurance, and additive manufacturing technologies to enhance efficiency and competitiveness. This focus on Industry 4.0 supports high-mix, low-volume production needs and meets global standards without incurring excessive capital outlays, reinforcing the region’s outsourcing leadership.

By Service Analysis

In 2024, CNC Machining segment held a dominant market position, capturing more than a 48.6 % share. This leadership is founded on its unparalleled precision, flexibility, and suitability for complex components across industries such as aerospace, automotive, and electronics.

CNC machining excels in delivering tight tolerances and intricate geometries, enabling manufacturers to meet demanding specifications without incurring the capital intensity and rigidity of other processes. This capability positions CNC as the go-to outsourcing service for high-value, highly regulated components.

The enduring prominence of CNC machining in outsourcing is supported by its capacity for rapid prototyping, small-batch production, and adaptive iterations. Contracts are often awarded based on CNC partners’ ability to deliver quality, speed, and cost-efficiency – factors that resonate strongly in product development cycles.

Recent industry focus on integration with automation, industrial IoT, and AI-enabled toolpaths further strengthens CNC’s appeal, reducing manual programming and shortening lead times . The emergence of cloud-based CAM tools has eased entry barriers by simplifying complex programming workflows, allowing smaller manufacturers and SMEs to benefit from CNC capabilities without heavy upfront investments.

By Equipment Analysis

In 2024, Automotive Suppliers and Accessory Makers segment held a dominant market position, capturing more than a 32.1% share. This leadership is driven by the rising complexity in vehicle systems and the fast transition toward electric and smart mobility solutions.

Automotive manufacturers are increasingly outsourcing the production of components such as electronic control units, infotainment modules, and lightweight parts to trusted partners who offer advanced capabilities without the need for internal investment.

The need for compliance with stringent safety and environmental standards has further pushed OEMs to rely on outsourcing specialists who already operate with certified, quality-controlled processes. This segment’s dominance is also supported by its flexibility in managing high-volume production with just-in-time delivery.

Outsourcing providers help automotive companies remain agile in response to changing consumer demand, regulatory shifts, and technological innovations. Many of these partners have adopted Industry 4.0 tools including robotics, predictive maintenance, and digital twins, allowing seamless integration into client supply chains while offering precision and scalability.

Key Market Segments

By Service

- 3D Printing

- CNC Machining

- Sheet Metal Fabrication

- Injection Molding

- Others

By Equipment

- Automotive Suppliers and Accessory Makers

- Medical Devices

- Industrial Machinery

- Heavy Equipment (Construction, Mining, Agriculture)

- Oil and Gas Equipment

- Renewable Energy Equipment

- Machine Tools Manufacturing

- Rail Transportation Equipment

- Marine Equipment and Shipbuilding

- Power Generation Equipment

- HVAC Systems

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Rise of Smart, Decentralized Outsourced Manufacturing

Outsourcing models are evolving toward smart, decentralized manufacturing supported by Industry 4.0 technologies. Increasing numbers of outsourcing partners are integrating IoT sensors, digital twins, AI-powered robotics and cloud infrastructure into their facilities.

This enables localized, responsive production nodes that communicate in real time with OEMs’ systems – reducing lead times and improving quality control. Such “smart factories” in outsourced networks are becoming more prevalent as cost-effective sensors and automation tools make advanced manufacturing capabilities accessible outside traditional captive plants

Driver Analysis

Demand for Proximity and Strategic Collaboration

A significant driver of manufacturing outsourcing has shifted from low-cost labor toward strategic collaboration and geographic proximity. Companies are selecting outsourcing partners not only for cost benefits but also for shared innovation, agility, and supply‑chain resilience. Nearshoring and regional partnerships are rising in importance, enabling faster iterations and risk sharing, and moving outsourcing toward business development strategies.

Restraint Analysis

Cyber‑Physical System Security and System Interoperability

As outsourced facilities become more connected and technology-dependent, their vulnerability to cybersecurity threats grows. Integrating legacy OEM systems with partner platforms introduces complexity. Ensuring secure data transfer, system interoperability, and protection of IP across outsourced networks presents a growing limitation – requiring significant investment in IT infrastructure and controls.

Opportunity Analysis

Localized Resilient Supply Chains via Decentralization

The trend toward decentralized outsourced manufacturing opens opportunities for building resilient, localized supply chains. By distributing production across multiple smart-enabled sites near key markets, OEMs can reduce logistical vulnerability, buffer geopolitical risk, and respond swiftly to regional demand fluctuations. This distributed model enhances continuity and agility without central fixed assets.

Challenge Analysis

Workforce Skill Gaps and Transformation

Transitioning outsourced partners to smart manufacturing requires a workforce proficient in digital tools, robotics, data analytics, and systems integration. Many regional manufacturing providers face shortages in skilled labor, particularly in IT and automation. Upskilling such workforces involves time, structured training programs, and financial commitments. Without addressing this gap, adoption of smart outsourcing infrastructure may stall.

Strategic Insight Summary

Aspect Insight Emerging Trend Smart, decentralized outsourced manufacturing enabled by Industry 4.0 technologies like IoT, AI, and digital twins. Driver Shift toward strategic, regional outsourcing partnerships for agility, innovation, and supply chain resilience. Restraint Cybersecurity risks and system interoperability issues due to integration of legacy and advanced technologies. Opportunity Building resilient, localized supply chains through distributed outsourced production hubs near demand centers. Challenge Shortage of skilled labor for advanced manufacturing processes; need for structured workforce upskilling. Key Player Analysis

In the evolving manufacturing outsourcing market, digital-first companies like Proto Labs, Xometry, Fictive, Fathom, and Fast Radius are setting benchmarks for speed and customization. These firms leverage cloud-based platforms to offer rapid prototyping and small-batch production using technologies such as 3D printing, CNC machining, and injection molding.

Established domestic manufacturers including Machining USA, LLC., American Micro Industries, Astro Machine Works, COX Manufacturing, and METRO STEEL USA continue to serve as essential partners for precision machining and custom metal fabrication. Their capabilities in high-tolerance manufacturing make them critical for sectors like defense, automotive, and heavy industrial equipment.

Global manufacturing giants such as Celestica Inc., Benchmark Electronics, SMTC Corporation, Flextronics International, Jabil Inc., Viant, and Technimark LLC dominate through large-scale, end-to-end production solutions. These players are known for managing complex supply chains and delivering full product lifecycle support.

Top Key Players Covered

- Proto Labs

- Xometry

- Fictive

- Fathom

- Fast Radius

- Machining USA, LLC.

- American Micro Industries

- Celestica Inc.

- Benchmark Electronics, Inc.

- SMTC Corporation

- Penton (Informa PLC)

- Methode Electronics, Inc.

- Astro Machine Works

- COX Manufacturing.

- METRO STEEL USA

- Flextronics International, Ltd

- Jabil Inc.

- Viant

- Technimark LLC

- Roberson Machine

- Others

Recent Developments

- May 2025 – Launched Fathom Edgeworks, a managed sourcing and global manufacturing service designed to counter supply-chain volatility

- January 2024 – Rebranded its international Hubs network as Protolabs Network, integrating over 250 vetted manufacturers for services like CNC machining, 3D printing, injection molding, and sheet metal. Q3 2023 revenue via this network rose +80 % year-over‑year.

Report Scope

Report Features Description Market Value (2024) USD 248.3 Bn Forecast Revenue (2034) USD 497.65 Bn CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service (3D Printing, CNC Machining, Sheet Metal Fabrication, Injection Molding, Others), By Equipment (Medical Devices, Industrial Machinery, Heavy Equipment (Construction, Mining, Agriculture), Oil and Gas Equipment, Renewable Energy Equipment, Machine Tools Manufacturing, Rail Transportation Equipment, Marine Equipment and Shipbuilding, Power Generation Equipment, HVAC Systems, Automotive Suppliers and Accessory Makers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Proto Labs, Xometry, Fictive, Fathom, Fast Radius, Machining USA, LLC., American Micro Industries, Celestica Inc., Benchmark Electronics, Inc., SMTC Corporation, Penton (Informa PLC), Methode Electronics, Inc., Astro Machine Works, COX Manufacturing, METRO STEEL USA, Flextronics International, Ltd, Jabil Inc., Viant, Technimark LLC, Roberson Machine, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Manufacturing Outsourcing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Manufacturing Outsourcing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Proto Labs

- Xometry

- Fictive

- Fathom

- Fast Radius

- Machining USA, LLC.

- American Micro Industries

- Celestica Inc.

- Benchmark Electronics, Inc.

- SMTC Corporation

- Penton (Informa PLC)

- Methode Electronics, Inc.

- Astro Machine Works

- COX Manufacturing.

- METRO STEEL USA

- Flextronics International, Ltd

- Jabil Inc.

- Viant

- Technimark LLC

- Roberson Machine

- Others