Global Manufactured Homes Market Size, Share, Growth Analysis Structure Type (Single-Section Homes, Multi-Section Homes, Others), Size (Under 1,000 sq. ft., 1,000-1,500 sq. ft., Above 1,500 sq. ft.), Material (Timber, Metal, Concrete, Others), Application (Residential, Commercial, Recreational), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177345

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

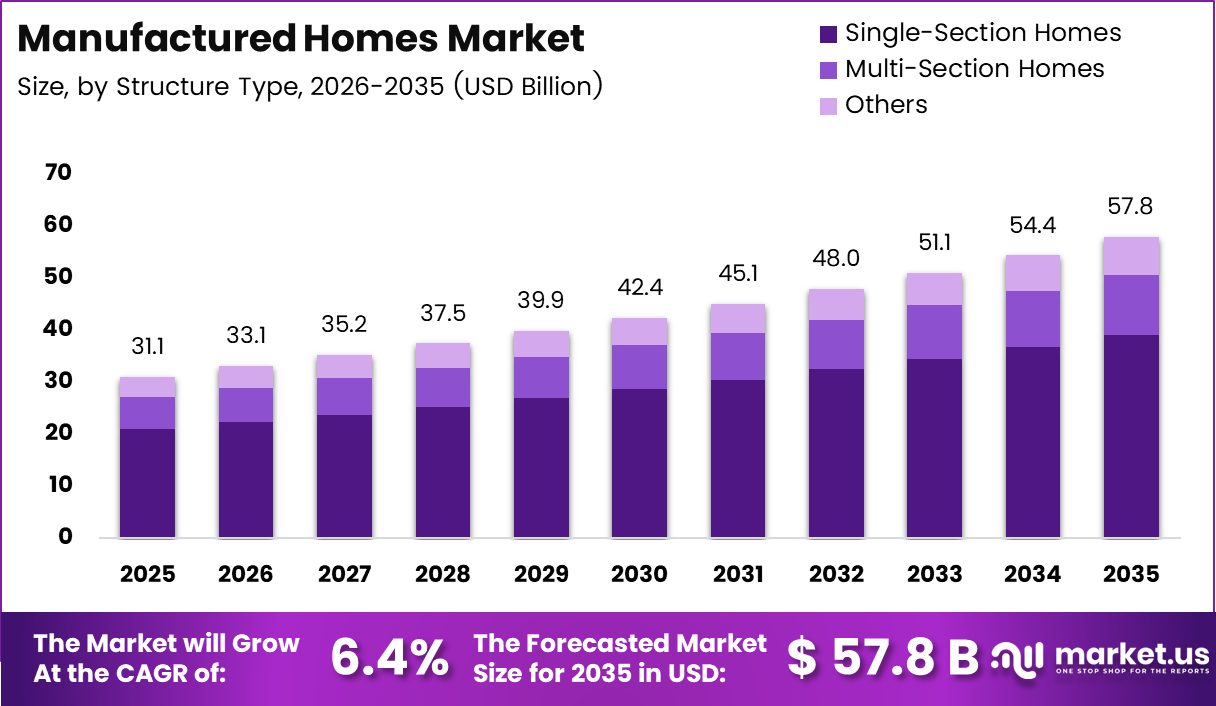

Global Manufactured Homes Market size is expected to be worth around USD 57.8 Billion by 2035 from USD 31.1 Billion in 2025, growing at a CAGR of 6.4% during the forecast period 2026 to 2035.

Manufactured homes are factory-built dwellings constructed on permanent chassis, designed to meet federal building codes. These homes offer affordable housing alternatives to traditional site-built construction. They are built entirely in controlled factory environments before transportation to their final locations.

The market encompasses single-section and multi-section units, ranging from compact designs to luxury configurations. Modern manufactured homes feature advanced materials, energy-efficient systems, and customizable floor plans. They serve residential, commercial, and recreational applications across diverse geographic markets.

Market growth is driven by escalating urban housing shortages and rising construction labor costs. Factory-built homes deliver faster project completion timelines compared to conventional construction methods. Moreover, improved quality standards enhance consumer confidence and market acceptance among first-time homebuyers.

The residential segment dominates market applications, addressing critical affordable housing needs. Government incentives for low-income housing programs further accelerate adoption rates. Additionally, manufactured home communities expand rapidly in suburban and semi-rural areas, creating new growth opportunities.

Technological advancements enable greater customization and integration of smart home features. Eco-friendly materials and sustainable manufacturing processes gain traction among environmentally conscious consumers. However, zoning restrictions and persistent social stigma present ongoing challenges to market expansion.

According to Eye on Housing, the West South Central region maintains the highest concentration of manufactured homes, representing 9.3% of total occupied housing. The Mountain region follows with 8.5%, while the South Atlantic region holds 7.7%. These regional patterns reflect varying housing affordability dynamics and land availability.

According to the American Housing Survey, 57% of occupied manufactured homes are single-section units, while 43% are multi-sections. Single-section homes typically measure under 1,000 square feet with five total rooms. Conversely, multi-section homes range from 1,000 to 2,000 square feet with six rooms, offering expanded living space.

Key Takeaways

- Global Manufactured Homes Market projected to reach USD 57.8 Billion by 2035, growing at 6.4% CAGR from 2026 to 2035

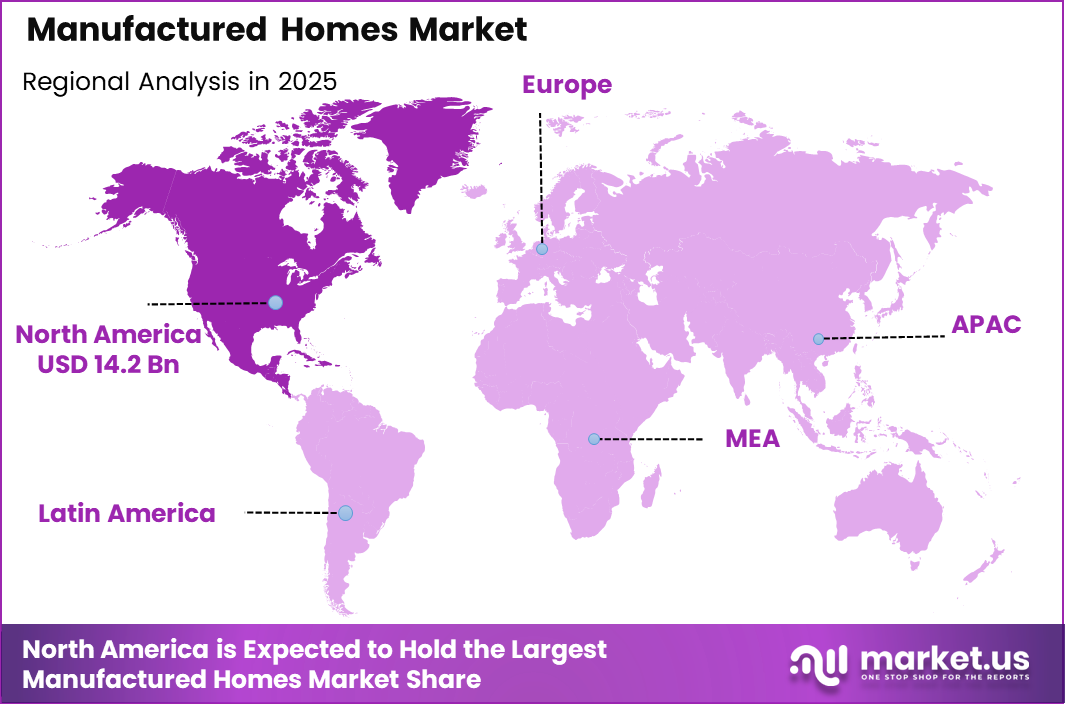

- North America dominates with 45.90% market share, valued at USD 14.2 Billion

- Single-Section Homes segment leads Structure Type category with 67.6% market share

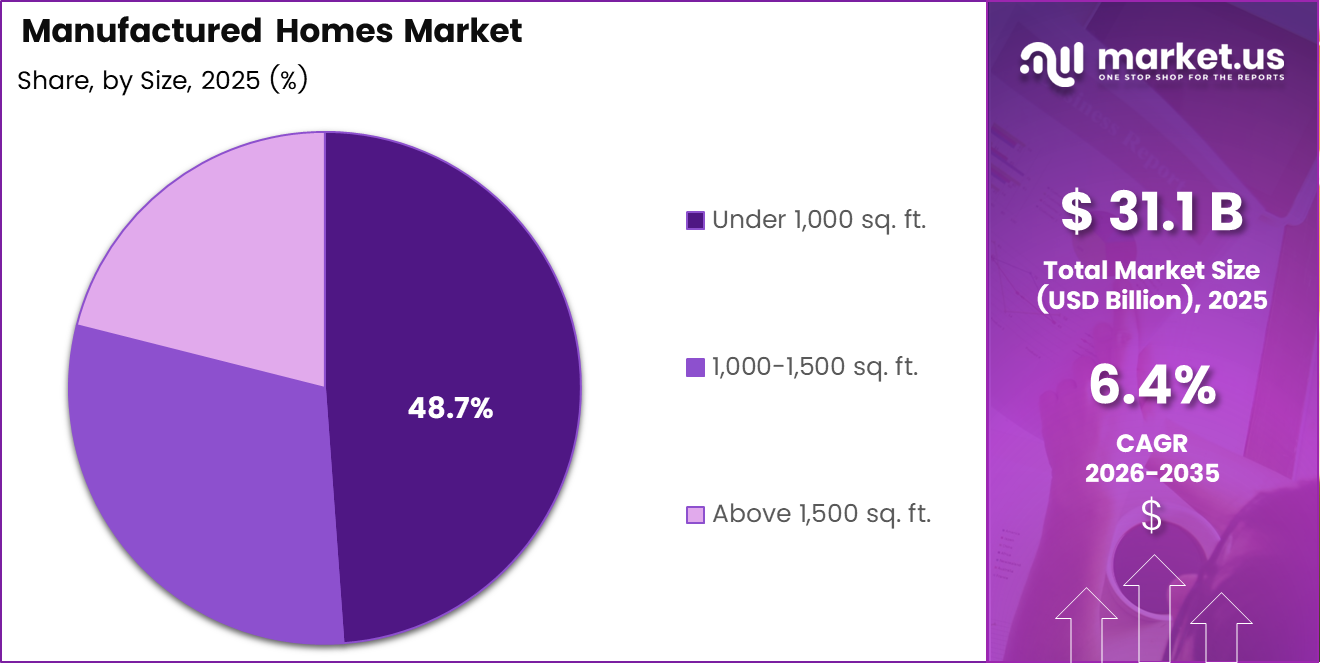

- Under 1,000 sq. ft. size segment holds 48.7% dominance in Size category

- Timber Material segment commands 54.2% market share

- Residential Application segment accounts for 78.4% of total market demand

- Market valued at USD 31.1 Billion in 2025 with strong growth trajectory

Structure Type Analysis

Single-Section Homes dominates with 67.6% due to affordability and faster installation timelines.

In 2025, Single-Section Homes held a dominant market position in the Structure Type segment of Manufactured Homes Market, with a 67.6% share. These compact units appeal to first-time buyers and cost-conscious consumers seeking immediate housing solutions. They require minimal site preparation and deliver faster occupancy compared to multi-section alternatives.

Multi-Section Homes serve families requiring expanded living space and enhanced amenities. These structures combine two or more sections to create larger floor plans with improved functionality. They offer better resale value and align with evolving consumer preferences for spacious manufactured housing options.

Others include specialized configurations and custom-designed manufactured structures for unique applications. This category addresses niche market segments requiring tailored solutions beyond standard single or multi-section formats. Innovation drives gradual growth within this emerging subsegment.

Size Analysis

Under 1,000 sq. ft. dominates with 48.7% due to affordability and entry-level buyer demand.

In 2025, Under 1,000 sq. ft. held a dominant market position in the Size segment of Manufactured Homes Market, with a 48.7% share. These compact homes provide cost-effective housing for singles, couples, and small families. They require smaller lots and lower utility expenses, enhancing overall affordability.

1,000-1,500 sq. ft. homes attract growing families seeking balanced space and value. This mid-range category offers additional bedrooms and functional living areas without significant cost escalation. Moreover, these homes address suburban market demands effectively.

Above 1,500 sq. ft. represents the luxury manufactured housing segment with premium features and finishes. These spacious units compete directly with traditional site-built homes through enhanced customization options. Consequently, they appeal to affluent buyers prioritizing quality and design flexibility.

Material Analysis

Timber dominates with 54.2% due to traditional construction methods and cost advantages.

In 2025, Timber held a dominant market position in the Material segment of Manufactured Homes Market, with a 54.2% share. Wood-based construction remains the industry standard, offering structural integrity and design versatility. Additionally, timber provides excellent insulation properties and renewable material benefits for sustainable building practices.

Metal components gain adoption for structural frames and exterior cladding applications. Stainless Steel and aluminum offer superior durability, fire resistance, and reduced maintenance requirements over time. However, higher material costs limit widespread adoption compared to timber alternatives.

Concrete serves foundation and flooring applications, enhancing structural stability and longevity. This material provides excellent moisture resistance and thermal mass benefits. Meanwhile, Others include composite materials and innovative building technologies emerging within the manufactured housing sector.

Application Analysis

Residential dominates with 78.4% due to primary housing demand and affordability factors.

In 2025, Residential held a dominant market position in the Application segment of Manufactured Homes Market, with a 78.4% share. Manufactured homes address critical affordable housing shortages across urban and rural markets. They provide permanent housing solutions for diverse demographic groups, including first-time buyers and retirees.

Commercial applications include temporary office spaces, construction site facilities, and retail kiosks. Businesses leverage manufactured structures for cost-effective expansion and rapid deployment capabilities. These units offer flexibility for evolving operational requirements and seasonal business activities.

Recreational uses encompass vacation properties, campground facilities, and seasonal retreats. Manufactured homes provide affordable recreational housing alternatives in tourist destinations and remote locations. Therefore, this segment benefits from growing outdoor recreation trends and second-home ownership patterns.

Drivers

Escalating Urban Housing Shortages Driving Demand for Cost-Efficient Factory-Built Homes

Urban population growth intensifies housing demand across metropolitan areas, creating supply shortages and affordability challenges. Manufactured homes deliver cost-efficient solutions through streamlined factory production processes and economies of scale. These homes address critical gaps in affordable housing supply for middle-income and entry-level buyers.

Rising Construction Labor Costs accelerate market adoption as traditional building methods face skilled worker shortages. Factory-based manufacturing reduces dependency on on-site labor while maintaining consistent quality standards. Consequently, developers achieve predictable project timelines and reduced construction expenses through manufactured housing approaches.

Faster project completion timelines support adoption in residential developments requiring rapid occupancy schedules. Manufactured homes reduce construction duration by 50% or more compared to site-built alternatives. Additionally, improved quality standards and building codes enhance consumer confidence, eliminating historical perceptions regarding manufactured housing durability and safety.

Restraints

Zoning Restrictions and Land-Use Regulations Limiting Manufactured Home Placements

Municipal zoning ordinances frequently prohibit or restrict manufactured home installations in established residential neighborhoods. These regulatory barriers limit available land parcels and increase development costs for manufactured housing communities. Moreover, inconsistent local regulations create complex compliance challenges across different jurisdictions and markets.

Persistent social stigma associates manufactured homes with lower quality compared to site-built construction despite modern advancements. Consumer perceptions influence financing availability and resale values, creating market acceptance barriers. Traditional homebuyers often overlook manufactured housing options due to outdated assumptions regarding durability and aesthetics.

Financing challenges emerge as conventional mortgage lenders apply stricter underwriting standards to manufactured homes. Limited appreciation potential and classification as personal property rather than real estate complicate lending decisions. Therefore, buyers face higher interest rates and reduced loan-to-value ratios compared to traditional housing alternatives.

Growth Factors

Increasing Government Incentives for Affordable and Low-Income Housing Programs

Federal and state housing programs expand support for manufactured homes through subsidies and financing assistance. These initiatives address affordable housing crises by promoting factory-built solutions as viable alternatives. Consequently, government backing enhances market legitimacy and consumer access to manufactured housing options.

Expansion of manufactured home communities in suburban and semi-rural areas creates dedicated residential developments. These communities offer amenities, professional management, and social environments that enhance resident satisfaction. Additionally, growing demand for disaster-relief and temporary housing solutions accelerates emergency response capabilities through manufactured homes.

Technological advancements enable customization options and energy-efficient designs that attract environmentally conscious buyers. Smart home integration, Bifacial solar panels, and advanced insulation systems improve operational efficiency and reduce utility costs. Moreover, digital sales platforms streamline purchasing processes through virtual tours and online configuration tools.

Emerging Trends

Rising Integration of Smart Home Features in Manufactured Housing Units

Manufacturers increasingly incorporate smart thermostats, security systems, and automated lighting into standard home packages. These technologies enhance convenience, safety, and energy management for modern homeowners. Connected home features position manufactured housing as technologically competitive with traditional site-built alternatives.

Growing preference for eco-friendly materials and sustainable manufacturing processes reshapes production standards across the industry. Recycled materials, low-VOC finishes, and energy-efficient appliances reduce environmental footprints while appealing to green-conscious consumers. Additionally, manufacturers pursue certifications like ENERGY STAR to differentiate products in competitive markets.

Increasing popularity of multi-section and luxury manufactured homes expands market reach beyond traditional entry-level segments. Premium finishes, custom floor plans, and upscale amenities attract affluent buyers seeking value without compromising quality. Furthermore, digital sales platforms and virtual tours streamline home buying processes, enabling remote selection and customization.

Regional Analysis

North America Dominates the Manufactured Homes Market with a Market Share of 45.90%, Valued at USD 14.2 Billion

North America leads global manufactured housing markets due to established regulatory frameworks and strong consumer acceptance. The region benefits from mature distribution networks, experienced manufacturers, and comprehensive financing options. Moreover, housing affordability challenges drive sustained demand across 45.90% market share, valued at USD 14.2 Billion.

Europe Manufactured Homes Market Trends

Europe experiences gradual growth as modular construction gains recognition for addressing urban housing shortages. Strict building regulations and cultural preferences for traditional construction methods moderate adoption rates. However, sustainability initiatives and affordable housing programs support manufactured housing expansion across Western European markets.

Asia Pacific Manufactured Homes Market Trends

Asia Pacific demonstrates strong growth potential driven by rapid urbanization and middle-class expansion. Countries like Japan and Australia lead regional adoption through innovative manufacturing technologies. Therefore, government infrastructure investments and housing affordability challenges accelerate market development across emerging economies.

Latin America Manufactured Homes Market Trends

Latin America presents emerging opportunities as economic development increases housing demand across urban centers. Affordable housing initiatives and informal settlement challenges create market potential for manufactured solutions. Nevertheless, regulatory frameworks and financing infrastructure require further development to support sustained growth.

Middle East & Africa Manufactured Homes Market Trends

Middle East and Africa markets focus on temporary housing for workforce accommodation and refugee settlements. Oil-producing nations leverage manufactured homes for remote worker housing in industrial zones. Additionally, disaster relief applications and population growth drive gradual market expansion across diverse regional contexts.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Clayton Homes operates as the largest manufactured housing producer in North America, delivering comprehensive home solutions through extensive retail networks. The company emphasizes quality construction, innovative designs, and customer-centric service models. Their vertically integrated operations control manufacturing, financing, and retail distribution, ensuring consistent product delivery and customer satisfaction across diverse market segments.

Skyline Champion Corporation maintains strong market presence through diverse product portfolios spanning entry-level to luxury manufactured homes. The company focuses on operational efficiency, strategic acquisitions, and geographic expansion to strengthen competitive positioning. Their commitment to innovation drives continuous product improvements and market share growth across North American manufactured housing sectors.

Cavco Industries Inc. delivers high-quality manufactured homes through established brands and efficient production facilities across multiple states. The company leverages advanced manufacturing technologies and sustainable building practices to differentiate product offerings. Moreover, their financial services division provides integrated lending solutions, enhancing customer access to affordable homeownership opportunities.

Fleetwood Homes combines decades of manufacturing expertise with contemporary design trends to serve evolving consumer preferences. The company emphasizes energy efficiency, customization options, and quality craftsmanship throughout production processes. Their dealer network ensures broad market reach while maintaining consistent brand standards and customer service excellence across regional markets.

Key Players

- Clayton Homes

- Skyline Champion Corporation

- Cavco Industries Inc.

- Fleetwood Homes

- Palm Harbor Homes

- Champion Home Builders

- Deer Valley Homebuilders

- Nobility Homes

- Kit Custom Homebuilders

- Sunshine Homes

Recent Developments

- December 2025 – REALM accelerated growth with strategic acquisition of three manufactured housing communities in Eastern North Carolina. The expansion strengthens their portfolio presence across key regional markets, enhancing operational scale and revenue diversification opportunities.

- March 2024 – Crow Holdings announced manufactured housing portfolio acquisition comprising 46 properties with nearly 10,000 homesites across six U.S. states. The transaction builds on an established platform emphasizing community resident benefits and operational excellence standards.

Report Scope

Report Features Description Market Value (2025) USD 31.1 Billion Forecast Revenue (2035) USD 57.8 Billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Structure Type (Single-Section Homes, Multi-Section Homes, Others), Size (Under 1,000 sq. ft., 1,000-1,500 sq. ft., Above 1,500 sq. ft.), Material (Timber, Metal, Concrete, Others), Application (Residential, Commercial, Recreational) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Clayton Homes, Skyline Champion Corporation, Cavco Industries Inc., Fleetwood Homes, Palm Harbor Homes, Champion Home Builders, Deer Valley Homebuilders, Nobility Homes, Kit Custom Homebuilders, Sunshine Homes Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Clayton Homes

- Skyline Champion Corporation

- Cavco Industries Inc.

- Fleetwood Homes

- Palm Harbor Homes

- Champion Home Builders

- Deer Valley Homebuilders

- Nobility Homes

- Kit Custom Homebuilders

- Sunshine Homes