Global Mannequin Market Size, Share, Growth Analysis By Material-Based (Plastic Mannequins, Fiberglass Mannequins, Wooden Mannequins, Metal Mannequins, Others), By Product Type (Women, Men, Children, Others), By End-User (Retail Stores, Exhibition and Trade Shows, Theater and Film Productions, Fashion Designers and Studios, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172514

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

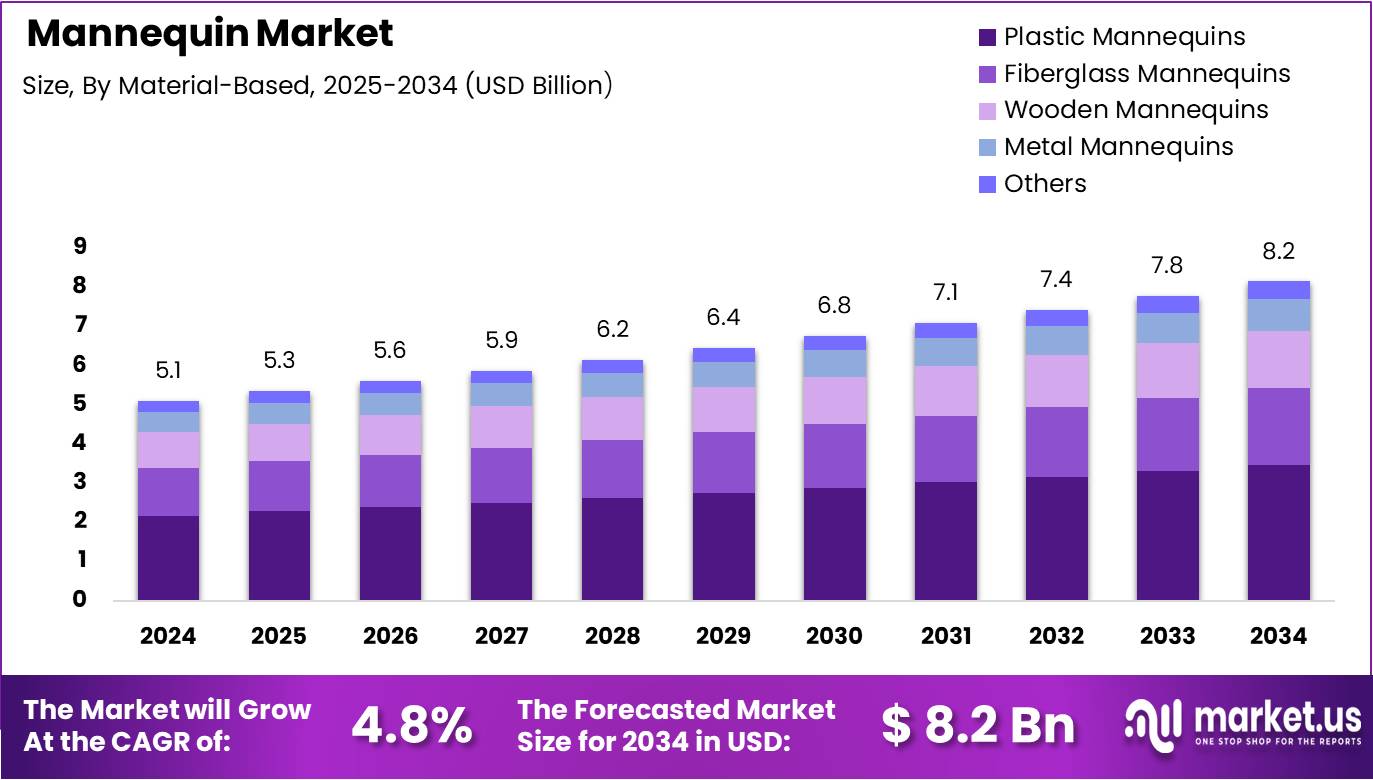

The Global Mannequin Market size is expected to be worth around USD 8.2 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The mannequin market represents a specialized segment within the retail display industry, encompassing life-sized human forms used to showcase apparel and accessories. These fixtures serve as silent salespeople in stores worldwide. Mannequins bridge the gap between products and consumer imagination, transforming static merchandise into aspirational lifestyle statements that drive purchasing behavior.

The market continues experiencing steady growth driven by expanding retail infrastructure globally. Physical stores increasingly recognize the competitive advantage of compelling visual merchandising. This growth trajectory reflects retailers’ ongoing investment in customer experience enhancement. Furthermore, e-commerce brands are establishing brick-and-mortar presences, subsequently boosting demand for quality display solutions across multiple retail formats.

Significant opportunities emerge from technological integration within traditional mannequin design frameworks. Smart mannequins equipped with digital capabilities are revolutionizing in-store analytics and customer engagement strategies. Additionally, sustainable materials and customizable designs are opening new market segments. Retailers seeking differentiation through unique brand experiences are particularly driving innovation in this space, creating substantial expansion potential.

Government initiatives supporting retail sector development indirectly benefit the mannequin market through infrastructure investments. Various regions offer incentives for retail modernization, encouraging store renovations and visual merchandising upgrades. However, regulations regarding manufacturing materials and workplace safety standards influence production costs. Environmental compliance requirements are pushing manufacturers toward eco-friendly materials, reshaping supply chain dynamics across the industry.

Market data reveals compelling insights into mannequin effectiveness in retail environments. Research indicates 85% of retailers strategically incorporate mannequins in their window displays to attract foot traffic. Consumer behavior analysis shows 73% of shoppers acknowledge that mannequins significantly influence their purchasing decisions through effective product visualization.

Research demonstrate 23.7% of respondents specifically believe mannequins help visualize garment appearance, enabling better understanding of fit and style while stimulating purchase intent. Moreover, 54% of consumers believe mannequins positively improve their lifestyle choices by presenting cohesive fashion narratives.

Key Takeaways

- Global Mannequin Market size is expected to reach USD 8.2 Billion by 2034 from USD 5.1 Billion in 2024, growing at a CAGR of 4.8%.

- Plastic Mannequins dominate the material-based segment with 42.6% market share in 2024.

- Women mannequins lead the product type segment with 52.8% share in 2024.

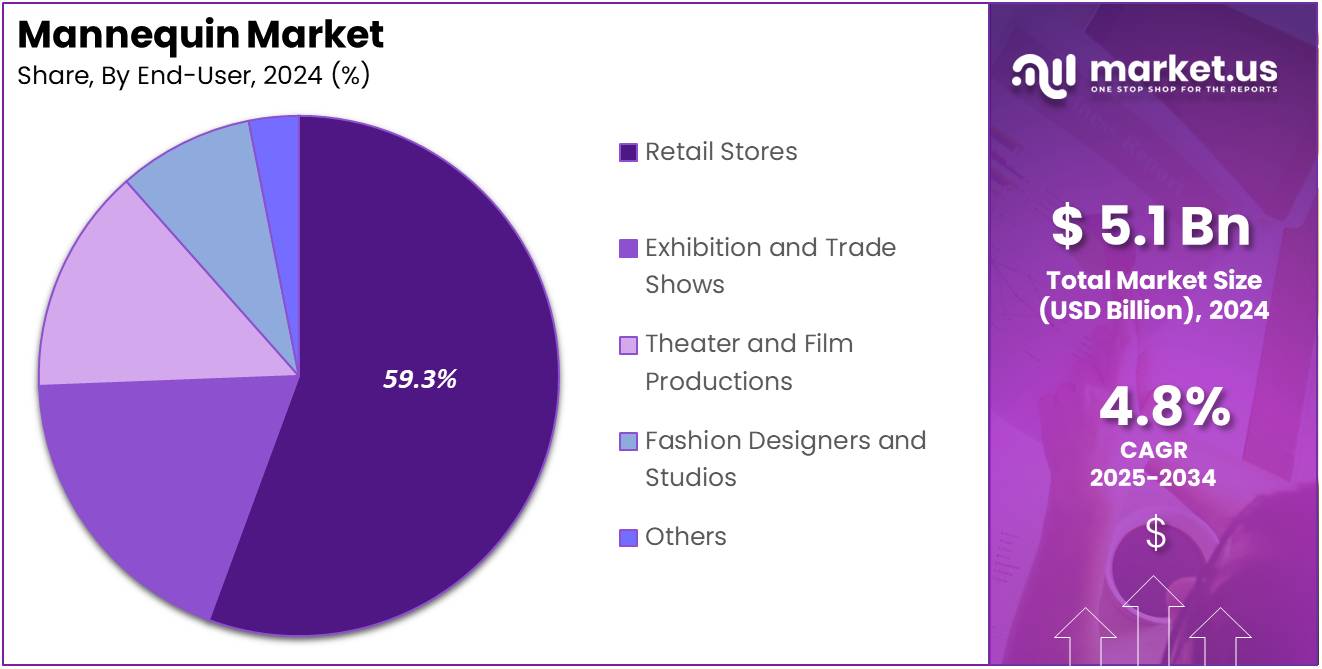

- Retail Stores represent the largest end-user segment at 59.3% in 2024.

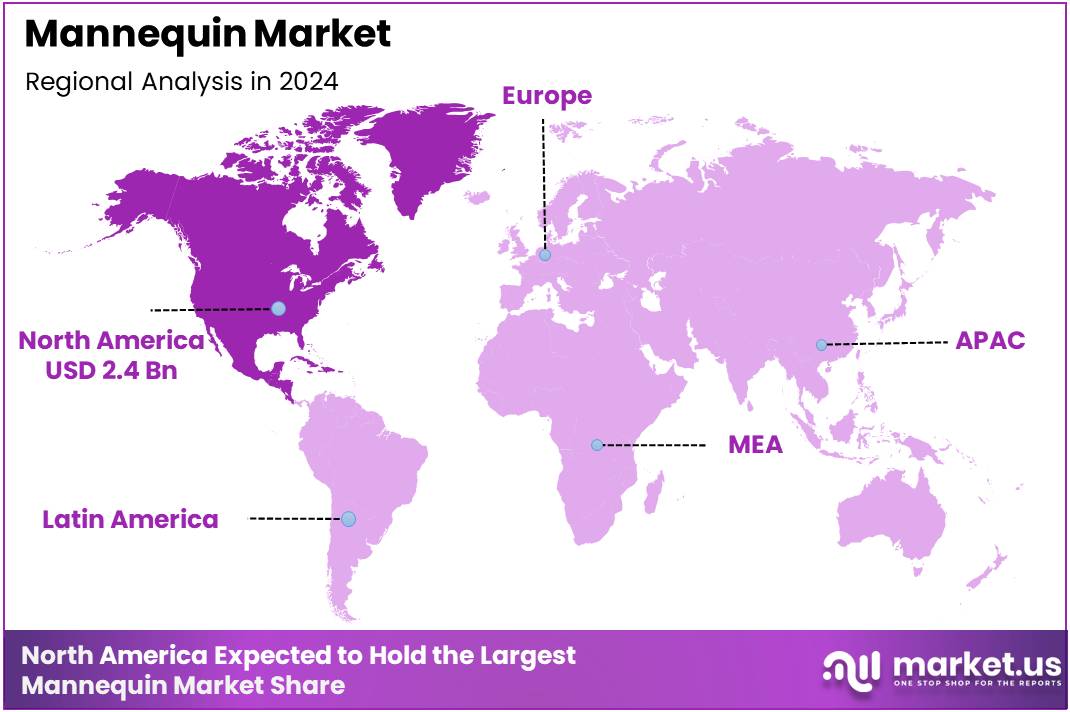

- North America holds 47.3% market share, valued at USD 2.4 Billion, leading the global mannequin market.

By Material-Based Analysis

Plastic Mannequins dominate with 42.6% due to their lightweight design and affordability.

Plastic Mannequins held a dominant market position in 2024, capturing 42.6% of the material-based segment. Their popularity stems from exceptional cost-effectiveness and versatility across retail environments. Retailers prefer plastic variants for their durability, ease of transportation, and flexible design options. Advancements in manufacturing technology have enhanced their aesthetic appeal, making them suitable for various display requirements. The ability to produce these mannequins in diverse colors and finishes further strengthens their market appeal.

Fiberglass Mannequins represent a premium segment valued for superior strength and longevity. These mannequins provide exceptional surface finishes that closely mimic human skin textures. Retailers increasingly adopt fiberglass options for high-end fashion displays where presentation quality matters significantly. Their resistance to breakage and weathering makes them ideal for both indoor and outdoor display applications.

Wooden Mannequins appeal to eco-conscious retailers and boutique stores emphasizing sustainability. They deliver unique artistic characteristics that complement vintage and artisanal brand aesthetics. The natural material resonates with environmentally aware consumers, though higher costs limit widespread adoption. Wooden mannequins also offer customization potential through hand-crafted detailing and unique finishing techniques.

Metal Mannequins serve specialized applications requiring durable and modern display solutions. Metal variants offer industrial aesthetics for contemporary fashion presentations and avant-garde retail concepts. Their robust construction withstands high-traffic environments while delivering sleek, minimalist appeal. These mannequins provide distinctive visual statements that differentiate brands in competitive marketplaces.

Others encompass alternative materials such as paper-mâché, recycled composites, and innovative sustainable materials. These variants cater to specific creative requirements in unique retail environments and art installations. Experimental materials allow brands to showcase environmental commitment and creative innovation simultaneously.

By Product Type Analysis

Women mannequins dominate with 52.8% due to the larger women’s fashion market and diverse styling requirements.

Women Mannequins commanded 52.8% market share in 2024, reflecting the substantial size of the women’s apparel industry. The fashion sector produces extensive collections targeting female consumers, necessitating diverse mannequin options. Women’s fashion encompasses multiple categories including casual wear, formal attire, and activewear, driving consistent demand. The availability of various body types and poses allows retailers to create inclusive and relatable displays.

Men Mannequins constitute a significant portion supporting the growing menswear sector. Increased fashion consciousness among male consumers has expanded this segment considerably. Retailers invest in sophisticated male mannequins featuring athletic builds and contemporary styling to attract discerning shoppers. Modern menswear displays now emphasize lifestyle presentations that resonate with evolving masculine fashion trends.

Children Mannequins address specialized needs of kids fashion retailers and department stores. These mannequins feature age-appropriate proportions representing various developmental stages from infants to teenagers. Parents increasing spending on children’s fashion drives demand for appealing displays. Playful poses and expressions help create engaging environments that attract family shoppers effectively.

Others includes specialized mannequins for maternity wear, plus-size fashion, and abstract forms.These variants serve evolving market demands for inclusive representation and creative merchandising approaches in contemporary retail spaces. Abstract and headless designs offer minimalist aesthetics preferred by modern fashion brands.

By End-User Analysis

Retail Stores dominate with 59.3% due to extensive physical store networks and continuous merchandising needs.

Retail Stores represented 59.3% of the end-user segment in 2024, establishing dominance through vast networks of physical outlets worldwide. Department stores, specialty boutiques, and fashion chains require substantial mannequin inventories for displays. Regular seasonal changes and promotional campaigns necessitate continuous investment in display equipment. Window displays utilizing mannequins remain powerful tools for attracting foot traffic and communicating brand identity.

Exhibition and Trade Shows utilize mannequins extensively for temporary displays and brand presentations. These events demand portable, durable mannequins that withstand frequent assembly and transportation. Fashion brands showcase new collections through strategically positioned mannequins that capture attendee attention effectively. Lightweight and modular designs facilitate quick setup and breakdown during time-sensitive exhibition schedules.

Theater and Film Productions employ mannequins for costume design, set decoration, and special effects requirements. Production teams value realistic mannequins for authenticity in period pieces and contemporary settings. These specialized applications require customizable features matching script requirements. Mannequins also serve as stand-ins during lighting setup and camera blocking processes.

Fashion Designers and Studios use mannequins for garment development, fitting sessions, and creative conceptualization. Design studios require adjustable forms facilitating pattern making and construction processes throughout collection development cycles. Professional dress forms with adjustable measurements enable designers to perfect fit and proportions efficiently.

Others encompasses educational institutions, museums, and visual merchandising training centers. These entities utilize mannequins for teaching purposes, historical costume displays, and professional skill development. Museums preserve cultural heritage through period-appropriate mannequin presentations that educate visitors effectively.

Key Market Segments

By Material-Based

- Plastic Mannequins

- Fiberglass Mannequins

- Wooden Mannequins

- Metal Mannequins

- Others

By Product Type

- Women

- Men

- Children

- Others

By End-User

- Retail Stores

- Exhibition and Trade Shows

- Theater and Film Productions

- Fashion Designers and Studios

- Others

Drivers

Expansion of Organized Retail and Shopping Mall Infrastructure Drives Market Growth

The mannequin market is experiencing significant growth due to the rapid expansion of organized retail chains and modern shopping malls across developed and emerging economies. As retailers open new stores, the demand for quality mannequins to showcase merchandise increases substantially. Large retail formats require multiple display units to effectively present their product collections.

Brand storytelling has become a critical component of retail strategy, with businesses investing heavily in creating immersive in-store experiences. Mannequins serve as essential tools for conveying brand narratives through carefully curated visual displays that connect emotionally with shoppers. Retailers use these displays to communicate lifestyle aspirations and product benefits effectively.

The frequent introduction of new product lines in fashion sectors necessitates dynamic visual presentation strategies. Brands launching seasonal collections require thematic mannequin displays that capture consumer attention and highlight product features, maintaining steady demand for versatile display solutions.

Restraints

Fragility and Limited Durability of Mannequins in High-Traffic Retail Environments Restrains Market Growth

The mannequin market faces durability challenges, particularly in busy retail environments with high customer footfall. Traditional mannequins made from fiberglass or plastic are prone to damage from accidental bumps and frequent handling during merchandise changes. This fragility leads to increased replacement costs and maintenance expenses for retailers.

Repair costs and downtime associated with damaged mannequins impact the overall cost-effectiveness of visual merchandising programs. Retailers operating multiple locations find it challenging to maintain consistent display standards when mannequins require frequent repairs or replacements. The limited lifespan of these display tools affects return on investment calculations.

Space constraints present another significant barrier for small and medium-sized retail stores in compact urban locations. Full-size mannequins require considerable floor space that many retailers cannot dedicate solely to displays. Limited storage areas make seasonal rotation difficult, forcing some retailers to reduce mannequin usage and restricting market expansion potential.

Growth Factors

Increasing Use of Mannequins in Experiential Retail and Pop-Up Store Concepts Creates Growth Opportunities

The mannequin market is expanding through the growing experiential retail trend, where brands create immersive shopping experiences beyond traditional transactions. Pop-up stores and temporary installations increasingly rely on striking mannequin displays to generate social media buzz and attract foot traffic while testing new markets.

Sportswear and athleisure segments represent substantial growth opportunities as these categories continue gaining market share globally. Brands in this sector require specialized mannequins featuring dynamic athletic poses that showcase garments during movement and activity. These action-oriented displays help customers visualize product performance and fit during various physical activities.

The luxury and premium retail sectors are investing heavily in sophisticated visual merchandising to differentiate their brands and justify premium pricing. High-end retailers demand custom-designed mannequins with refined aesthetics that complement their brand identity. This approach drives demand for premium solutions with superior finishes and customization options aligned with exclusive brand positioning.

Emerging Trends

Rising Preference for Realistic Facial Features and Anatomically Accurate Mannequins Shapes Market Trends

The mannequin industry is shifting toward hyper-realistic designs featuring detailed facial features, natural skin tones, and anatomically accurate body proportions. Retailers recognize that realistic mannequins help customers better envision themselves wearing displayed merchandise, leading to improved conversion rates and authentic shopping experiences.

Modular and adjustable mannequin systems are gaining popularity as retailers seek flexible display solutions that adapt to diverse merchandising needs. These innovative designs allow retailers to modify poses, interchange body parts, and adjust heights without purchasing entirely new units. The versatility reduces long-term costs and enables creative freedom in visual presentation.

Smart technology integration represents the cutting edge of mannequin innovation, with digital-integrated models featuring embedded screens, interactive sensors, and connectivity capabilities. These tech-enabled mannequins display product information, pricing, and promotional content while collecting customer engagement data, providing retailers valuable insights into shopper behavior and transforming traditional displays into intelligent merchandising tools.

Regional Analysis

North America Dominates the Mannequin Market with a Market Share of 47.3%, Valued at USD 2.4 Billion

North America leads the global mannequin market, accounting for 47.3% of the market share with a valuation of USD 2.4 billion. The region benefits from well-established retail chains and major department stores. A thriving fashion industry in urban centers drives continuous demand for mannequins. The United States stands out for adopting technologically advanced mannequins early. Retailers focus on creating immersive in-store shopping experiences that attract consumers.

Europe Mannequin Market Trends

Europe holds a significant share in the mannequin market, supported by its rich fashion heritage. Countries like France, Italy, the UK, and Germany host numerous luxury brands. Sophisticated retail environments and high consumer spending enhance market growth. European retailers increasingly prefer eco-friendly and sustainable mannequin materials. There is strong demand for customized designs reflecting diverse body types and cultural aesthetics.

Asia Pacific Mannequin Market Trends

The Asia Pacific mannequin market is expanding rapidly due to rising retail infrastructure and disposable incomes. Key countries include China, India, Japan, and South Korea, with a growing fashion industry. Proliferation of shopping malls and retail chains drives consistent demand for display solutions. The region combines strong manufacturing capabilities with high consumption rates. Urbanization continues to boost retail activity, fueling mannequin adoption.

Middle East and Africa Mannequin Market Trends

The Middle East and Africa mannequin market is growing steadily, supported by luxury retail in the GCC countries. Investment in large shopping complexes and tourism-driven retail sectors increases demand. Retailers consider cultural preferences, emphasizing modest display solutions. Africa’s urbanization creates emerging opportunities despite the market being relatively nascent. Growth is gradual but presents potential for new suppliers and premium offerings.

Latin America Mannequin Market Trends

Latin America shows moderate growth potential driven by modernization of the retail sector. Countries like Brazil, Mexico, and Argentina exhibit rising consumer spending on fashion. A vibrant fashion culture and growing middle class support demand for mannequins. Retailers invest in store aesthetics to improve customer experiences. There is growing interest in solutions balancing quality and affordability for visual merchandising.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Mannequin Company Insights

In 2024, the global mannequin market continues to evolve with key players innovating to meet dynamic retail and display needs. From advanced material use to customizable design solutions, leading companies are leveraging strengths to capture market share and drive customer value.

Able Art Limited stands out for its emphasis on craftsmanship and versatile product lines that address both fashion and commercial display segments. The company’s investments in sustainable materials and modular designs have strengthened its appeal with environmentally conscious brands.

Genesis Display GmbH is recognized for its precision-engineered mannequins that marry aesthetic appeal with functional durability. Its strong design focus, particularly in high‑end retail environments, has helped it maintain relevance among premium global retailers seeking bespoke display solutions.

Best Mannequin BV leverages its European market expertise to offer a wide array of mannequin styles, from classic forms to avant‑garde figures. The company’s capacity to tailor products to regional fashion trends and retailer specifications has enhanced its competitive position in key geographies.

35 Mannequin Inc. has built a reputation on rapid turnaround and scalable production capabilities, meeting the needs of fast‑moving retail sectors. By streamlining its manufacturing processes and fostering agile customization options, it has successfully supported both large chains and emerging brands with cost‑efficient display solutions.

Collectively, these players demonstrate differentiated strategies — from sustainability and design excellence to manufacturing agility — shaping the trajectory of the global mannequin market. Their focus on meeting diverse customer requirements and adapting to shifting retail landscapes underscores the competitive dynamism within the industry.

Top Key Players in the Market

- Able Art Limited

- Genesis Display GmbH

- Best Mannequin BV

- 35 Mannequin Inc.

- IDW Display

- EUVEKA

- Abstract Mannequin

- Hans Boodt Mannequin

- Global Mannequin

- BONAVERI

- Las Vegas Mannequin

Recent Developments

- In November 2024, Kesslers London acquired the globally recognised German brand, Genesis Mannequins, strengthening its presence in the European mannequin market. This strategic move aims to enhance Kesslers’ portfolio with premium display solutions and innovative designs.

- In December 2024, Hans Boodt Mannequins showcased its latest innovations in 3D-printed custom mannequins, highlighting advanced customization and sustainable production methods. The launch reflects the growing trend of tailored retail displays and cutting-edge manufacturing technologies.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Billion Forecast Revenue (2034) USD 8.2 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material-Based (Plastic Mannequins, Fiberglass Mannequins, Wooden Mannequins, Metal Mannequins, Others), By Product Type (Women, Men, Children, Others), By End-User (Retail Stores, Exhibition and Trade Shows, Theater and Film Productions, Fashion Designers and Studios, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Able Art Limited, Genesis Display GmbH, Best Mannequin BV, 35 Mannequin Inc., IDW Display, EUVEKA, Abstract Mannequin, Hans Boodt Mannequin, Global Mannequin, BONAVERI, Las Vegas Mannequin Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Able Art Limited

- Genesis Display GmbH

- Best Mannequin BV

- 35 Mannequin Inc.

- IDW Display

- EUVEKA

- Abstract Mannequin

- Hans Boodt Mannequin

- Global Mannequin

- BONAVERI

- Las Vegas Mannequin