Global Manga and Anime Licensing Market Size, Share Analysis Report By Type (Manga Licensing, Anime Licensing), By Application (TV & Film, Digital Platforms, Merchandise, Video Games), By End-User (Individual, Commercial), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146303

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- US Tariff Impact Analysis

- Analysts’ Viewpoint

- APAC Market Growth

- Type Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

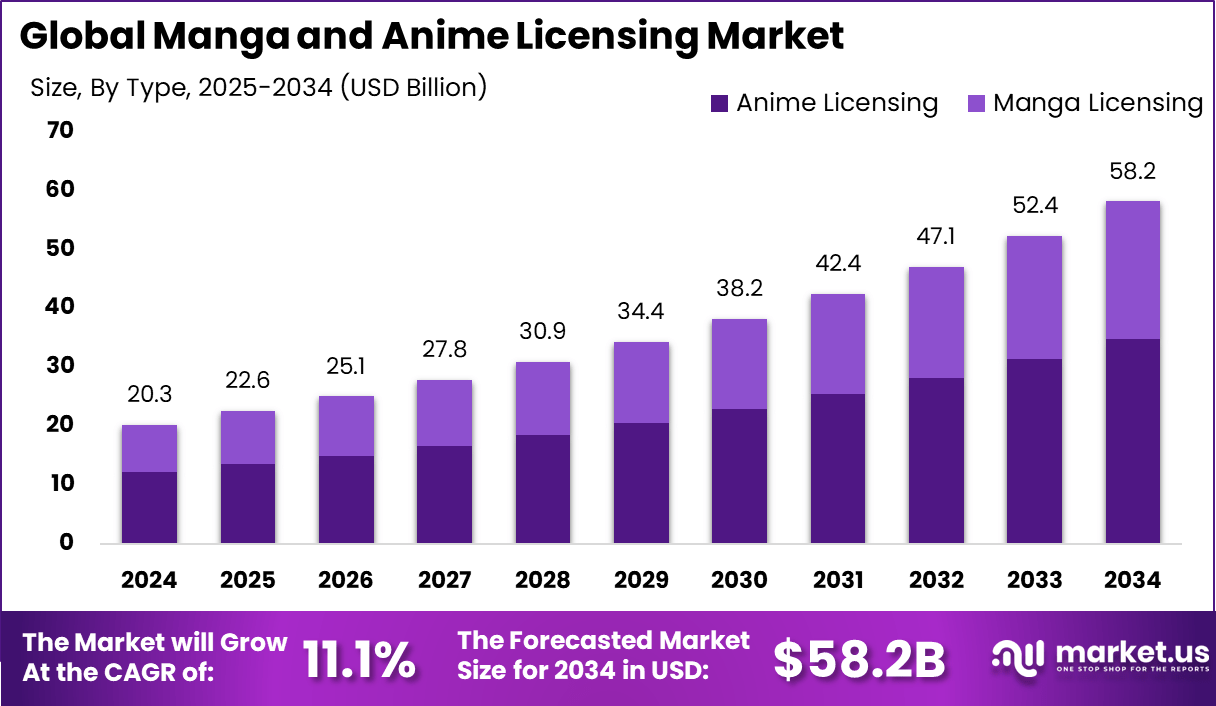

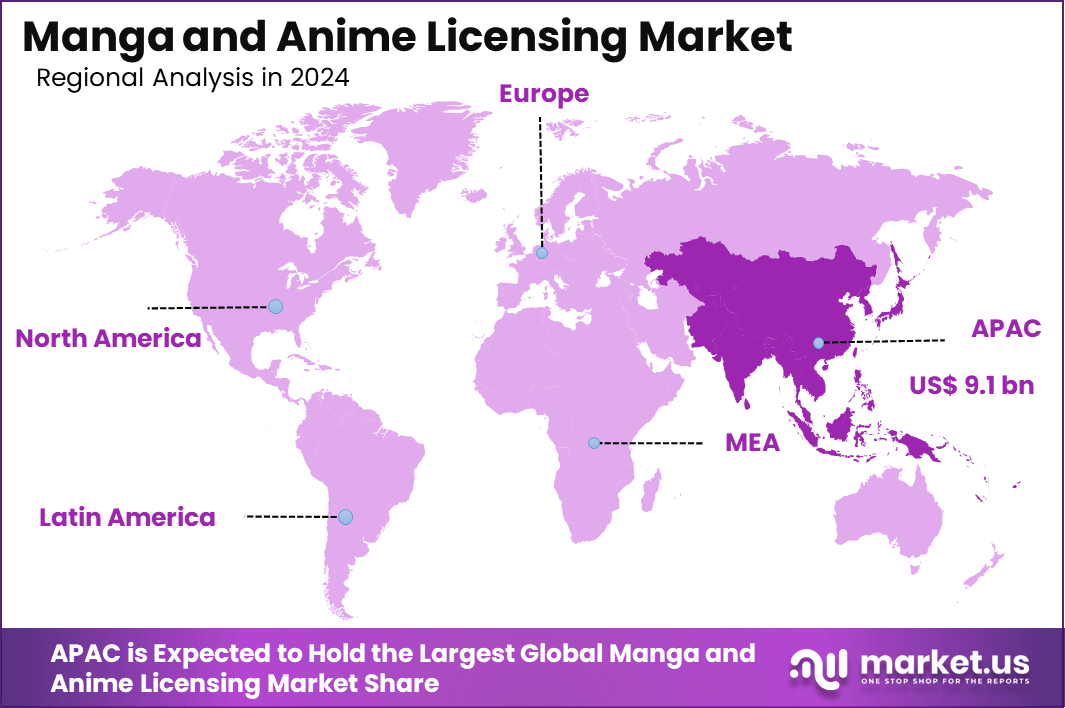

The Global Manga and Anime Licensing Market size is expected to be worth around USD 58.2 Billion By 2034, from USD 20.3 billion in 2024, growing at a CAGR of 11.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 45% share, holding USD 9.1 Billion revenue.

Manga and Anime Licensing refers to the legal permissions and contracts that allow companies to reproduce, distribute, and market manga and anime content in various forms across different media platforms. This licensing process is pivotal for the expansion of manga and anime beyond Japanese borders, enabling their integration into global entertainment markets. It involves various types of media including print manga, digital manga, anime series, and anime films.

The manga and anime licensing market is a dynamic segment of the entertainment industry, characterized by its robust expansion as global demand for Japanese culture continues to grow. This market facilitates the distribution and commercialization of manga and anime content outside of Japan, encompassing a variety of licensed products including video games, novels, action figures, and clothing.

The primary driving factor of the Manga and Anime Licensing Market is the increasing global consumption of Japanese content facilitated by digital distribution channels. Streaming services like Crunchyroll, Netflix, and Hulu play a critical role by providing accessibility to anime series and films, thus expanding the audience base internationally.

As reported by Market.us, The global manga market is anticipated to grow significantly, reaching a value of approximately USD 84 billion by 2034, up from USD 15.4 billion in 2024, expanding at a robust CAGR of 18.5% between 2025 and 2034. This surge can be attributed to the increasing global consumption of Japanese pop culture, digital manga subscriptions, and expanding distribution via streaming and e-commerce platforms.

Meanwhile, the global anime market is expected to attain a valuation of approximately USD 74.8 billion by 2033, rising from USD 30.2 billion in 2023, with a forecasted CAGR of 9.5% from 2024 to 2033. The market is benefiting from global demand for anime content, increased licensing deals, streaming growth, and merchandising expansion

The market is witnessing a shift towards digital consumption. Digital manga platforms and anime streaming services have seen increased user adoption, reflecting a broader trend towards digital media across entertainment industries. This shift is facilitated by technological advancements that allow for high-quality streaming and enhanced user experiences.

There is a notable trend towards the digitalization of manga and the increasing use of anime in various formats such as movies, TV shows, and online series. Technological advancements in animation and the adoption of CGI and AI-enhanced production techniques are reshaping how content is created and consumed, making it more accessible and appealing to a global audience.

The adoption of advanced technologies in the anime industry is driven by the need to meet the high-quality expectations of a global audience and to streamline production processes. Technologies like AI and CGI help studios achieve these goals efficiently, ensuring the scalability of operations to meet international demand.

Key Takeaways

- The market is expected to grow significantly from USD 20.3 Billion in 2024 to USD 58.2 Billion by 2034, progressing at a strong CAGR of 11.1%.

- In 2024, the Asia-Pacific (APAC) region accounted for over 45% of the global market, generating approximately USD 9.1 Billion in revenue.

- Anime Licensing held the dominant market share at 60%, outpacing manga licensing due to the format’s stronger commercial adaptability.

- Digital Platforms emerged as the leading application, capturing 40% of the market share. Platforms such as Netflix, Crunchyroll, and Amazon Prime Video are playing a vital role in global content dissemination.

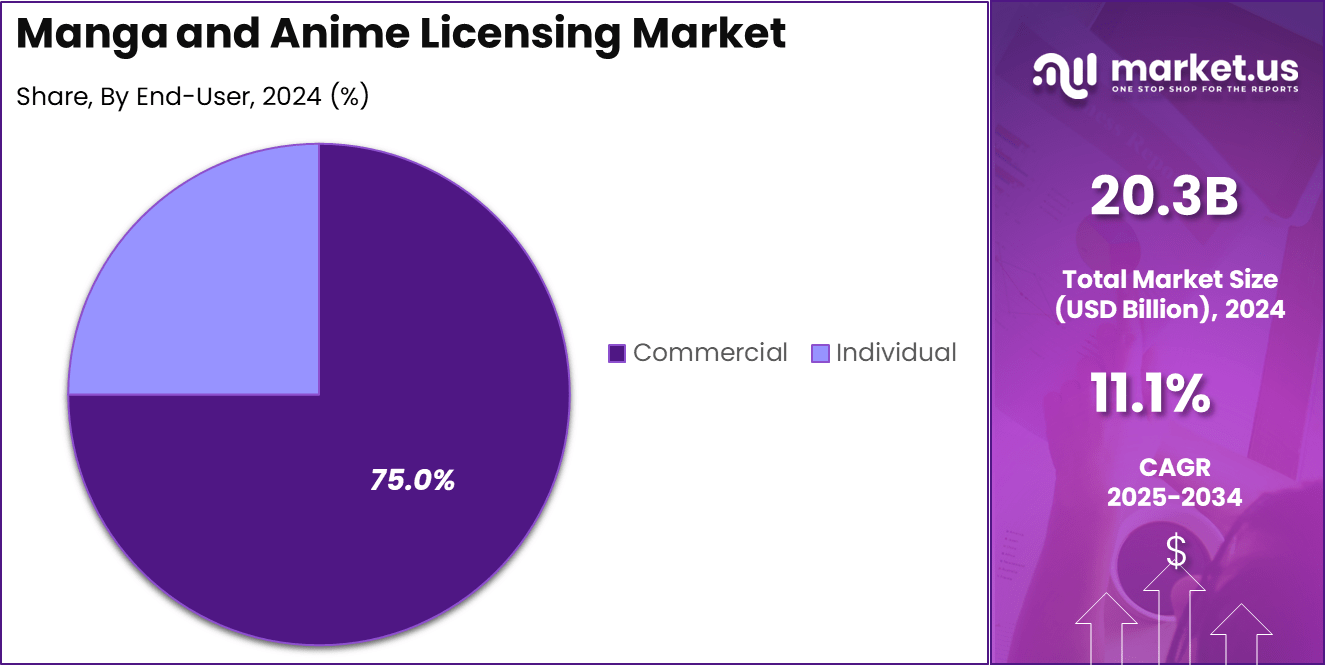

- The Commercial end-user segment held a commanding 75% share in 2024, driven by extensive licensing agreements across broadcast networks, e-commerce, retail, and gaming sectors.

US Tariff Impact Analysis

The recent U.S. tariffs are poised to significantly impact the anime and manga industries in several key areas:

- Cost Increases and Supply Chain Disruptions: The implementation of tariffs has led to increased costs for importing goods from Japan and China, where a substantial portion of manga and anime merchandise is produced. This includes not just physical goods like manga books and anime DVDs but also related merchandise such as toys and apparel.

- Shift in Market Dynamics: In response to these increased costs, there is a noticeable shift towards other markets. Japanese companies are now looking more towards emerging markets like Latin America and Southeast Asia, where anime and manga consumption is growing and not currently subjected to similar tariffs.

- Impact on Small Businesses: Smaller retailers and comic book stores in the U.S., many of whom rely heavily on the import of manga and anime-related products, are particularly vulnerable. The tariffs have increased their operational costs, making it challenging for them to sustain business.

- Digital Adaptation: On a somewhat positive note, the rise in tariffs coincides with a strengthening of digital platforms for manga and anime. Digital distribution and streaming are less affected by physical import tariffs, allowing platforms like Netflix and Crunchyroll to continue offering anime without additional costs.

- Long-term Industry Outlook: The ongoing trade tensions and tariffs are fostering a climate of uncertainty in the anime and manga industries. Long-term planning and investment may be hindered, affecting everything from the production of new anime series to the licensing agreements that allow for global distribution.

Analysts’ Viewpoint

The expanding global market for manga and anime presents significant investment opportunities, especially in digital platforms and emerging markets like India and China, where the youth demographic is rapidly embracing this genre. Businesses benefit from the broad appeal and versatility of anime, which can be adapted across various merchandise, gaming, and even virtual reality experiences.

Technological innovations in the sector include the development of anime creation software and platforms that support sophisticated animation techniques. These advancements not only enhance the visual experience but also reduce production times and costs, making high-quality anime more accessible.

The regulatory environment for manga and anime licensing varies by region but generally includes copyright laws and distribution regulations. These ensure the protection of intellectual property rights and govern the commercial use of the content. The top impacting factors in the market include cultural trends, technological advancements, and changes in consumer media consumption habits.

APAC Market Growth

In 2024, APAC held a dominant market position, capturing more than a 45% share with USD 9.1 million in revenue. The region’s leadership can be attributed to several key factors.

First, Japan, as the origin of both manga and anime, has a well-established ecosystem supporting both creation and distribution, making it a central hub for the industry. This geographic advantage is bolstered by strong local demand and a culturally ingrained fanbase that consistently consumes and supports manga and anime products.

Additionally, APAC benefits from the rapid digitalization across its other major markets, such as China, South Korea, and India, where young populations are increasingly turning to digital platforms for entertainment.

These platforms are expanding access to manga and anime, further driving regional market growth. The proliferation of mobile internet access in these areas also plays a crucial role, allowing a broader audience to engage with this content more frequently and intensively than ever before

Type Analysis

In 2024, the Anime Licensing segment held a dominant market position, capturing more than a 60% share. This leadership can be attributed to several key factors. Firstly, the global popularity of anime has surged, with an expansive fan base that spans various demographics and geographic regions.

The visual appeal, diverse genres, and rich storytelling associated with anime have captivated a broad audience, significantly outpacing the growth seen in manga consumption. Moreover, technological advancements in animation production and distribution have facilitated the broader reach and accessibility of anime.

Streaming platforms such as Netflix, Crunchyroll, and Hulu have played pivotal roles by featuring extensive libraries of anime content that are easily accessible worldwide. This has not only expanded the viewership but also bolstered licensing opportunities across different media channels.

Lastly, the anime industry has seen a substantial increase in merchandising opportunities, from collectibles and apparel to video games and live events. This aspect of commercialization has proved lucrative, enhancing the revenue streams for licensors and reinforcing the market strength of the Anime Licensing segment.

Application Analysis

In 2024, the Digital Platforms segment held a dominant market position in the Manga and Anime Licensing Market, capturing more than a 40% share. This leadership is largely driven by the digital transformation of the media landscape, where streaming services and online platforms have become central to content distribution and consumption.

Digital platforms such as Netflix, Amazon Prime Video, and Crunchyroll have significantly invested in the licensing of anime and manga to cater to a global audience that increasingly prefers on-demand entertainment. These platforms offer immediate access to a vast array of titles, including exclusive releases and original productions, which have attracted millions of subscribers worldwide.

Furthermore, the ease of accessibility, coupled with the ability to target niche markets with specific content, allows digital platforms to effectively engage with diverse audiences. This adaptability is crucial in capturing the nuanced tastes of manga and anime enthusiasts, who often seek content that is not readily available through traditional media channels.

End-User Analysis

In 2024, the Commercial segment held a dominant market position in the Manga and Anime Licensing Market, capturing more than a 75% share. This dominance is primarily attributed to the extensive use of anime and manga content within various commercial applications, ranging from television broadcasts and online streaming services to merchandise and video games.

Commercial entities, including major entertainment and media companies, have leveraged the strong brand recognition and fan base of popular anime and manga to generate substantial revenue through these channels. Additionally, the commercial segment benefits from the broad scalability of licensing opportunities.

Enterprises in this sector are keen to exploit cross-platform synergies, where popular manga and anime titles are adapted into films, series, and digital games, enhancing audience engagement and opening up multiple streams of revenue. This strategy not only solidifies the commercial viability of the content but also extends its lifecycle across different media formats.

Moreover, the global expansion of the anime and manga market has been significantly driven by commercial stakeholders who invest in localization and marketing strategies to make the content accessible and appealing in diverse regions.

This includes dubbed and subtitled versions tailored to specific international markets, thereby broadening the global reach and reinforcing the leading position of the Commercial segment in the manga and anime licensing landscape.

Key Market Segments

By Type

- Manga Licensing

- Anime Licensing

By Application

- TV & Film

- Digital Platforms

- Merchandise

- Video Games

By End-User

- Individual

- Commercial

Driver

Global Popularity and Expanding Fanbase

The Manga and Anime Licensing market is experiencing significant growth, primarily driven by the expanding global fanbase and the digital transformation of content distribution. The rising global popularity of manga and anime, facilitated by streaming platforms like Crunchyroll, Funimation, and Netflix, significantly boosts demand for licensing.

These platforms not only expand access to anime and manga but also invest heavily in this content, enhancing availability and fan engagement worldwide. Social media platforms contribute to this trend by enabling fans to share and promote their favorite series, further amplifying interest and participation in anime and manga cultures.

Restraint

Complex Licensing Agreements and High Competition

One major restraint in the Manga and Anime Licensing market is the complexity of licensing agreements. These agreements often involve intricate negotiations over intellectual property rights, exclusivity clauses, and revenue-sharing arrangements, which can be both time-consuming and challenging.

Moreover, the market faces intense competition among numerous companies and platforms seeking lucrative licensing deals. This competitive environment not only elevates the cost of licenses but also makes it difficult for smaller entities to secure profitable agreements.

Opportunity

Merchandising and International Expansion

There exists a substantial opportunity in the merchandising of manga and anime-related products. The strong and active fanbase is continually seeking official merchandise, which includes apparel, toys, and other branded products. Licensing facilitates the creation and distribution of these items, tapping into the dedicated and growing fan community.

Additionally, the increasing focus of Japanese creators and studios on international markets presents further opportunities for licensing, aiming at global distribution and the creation of localized content, which helps in capturing diverse audience segments across different regions.

Challenge

Piracy and Cultural Adaptation

Piracy remains a significant challenge, as unauthorized distribution of manga and anime content can substantially undermine the potential revenue from licensing. Pirated websites and services often provide free access to content, diminishing the demand for officially licensed products.

Additionally, adapting content to suit different cultural and regional preferences poses its own set of challenges. Localization, including translation and cultural adaptation, is crucial but can be complex and risky, potentially affecting the appeal and success of licensed products in international markets.

Growth Factors

The Manga and Anime Licensing market is poised for significant growth, driven by several key factors. One of the primary growth drivers is the burgeoning global popularity of manga and anime, which has been amplified by the expansion of streaming platforms such as Crunchyroll, Funimation, and Netflix.

These platforms have not only increased access to anime and manga but have also actively invested in the development and distribution of this content. This expansion is supported by a robust increase in international fan communities and extensive cultural exchange, making manga and anime mainstream phenomena outside Japan.

Emerging Trends

Emerging trends in the market include the diversification of revenue streams through various licensing models such as exclusive licensing, sublicensing, and merchandising rights. There is also a notable shift towards digital distribution licenses, reflecting the digital transformation of content consumption.

The market is seeing innovations in cross-media promotions and collaborations, where manga and anime properties are being adapted into video games, movies, and even live-action series, further broadening the scope and reach of Japanese content globally.

Business Benefits

The licensing of manga and anime offers substantial business benefits, including access to a growing and dedicated fan base eager for authentic and high-quality merchandise. Licensing agreements allow creators and rights holders to monetize their properties across different formats and platforms, from physical goods to digital experiences, enhancing brand visibility and profitability.

The international expansion of Japanese content through licensing has opened up new markets, particularly in regions like North America, Europe, and Southeast Asia, where there is a high demand for culturally rich and diverse programming. This not only aids in revenue generation but also establishes a global footprint for Japanese studios and creators.

Furthermore, the active and engaged fan communities contribute significantly to the dynamics of the market. Their enthusiasm and support fuel continuous demand for new and innovative content, which can be strategically leveraged through various licensing agreements to sustain engagement and drive sales.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The Manga and Anime Licensing market features several key players who are pivotal in shaping its landscape. Notably, Bandai Namco stands out for its extensive portfolio of anime titles and related merchandise, which have a global fanbase. They not only license from creators but also develop and distribute video games, thereby enriching their licensing strategy.

Another prominent player, Funimation, specializes in the distribution of anime content and related merchandise in the Western market. Their expertise in dubbing and distributing for English-speaking audiences makes them a central figure in expanding anime’s reach outside Japan.

Kodansha, one of the largest publishing companies in Japan, plays a critical role through its vast array of manga titles. As a key licenser, Kodansha deals with international markets, providing content that fuels the global manga and anime scenes.

These companies, among others, are instrumental in driving the growth and global expansion of manga and anime, adapting to diverse markets and evolving consumer preferences. Their strategic approaches to licensing, coupled with robust distribution networks, underscore their significant influence in the industry.

Top Key Players in the Market

- Bandai Namco

- Good Smile Company

- Kotobukiya

- Taito Corporation

- Tokyo Otaku Mode

- Aoshima

- SuperGroupies

- Penguin Parade

- Alter

- Megahouse

- Banpresto

- Funko

- Figuarts (S.H. Figuarts)

- Other Key Players

Recent Developments

- In January 2025, Bandai Spirits announced the launch of Gundam Assemble, a tabletop miniatures game featuring 5 cm Gunpla figures. This initiative is part of Bandai Namco’s strategy to expand the global presence of the Gundam franchise.

- Taito launched “DRESSTA,” a new figure brand, at Anime Expo Chibi 2024 in California. The initial lineup included four items, with two brand-new releases, targeting the U.S. market and beyond.

Report Scope

Report Features Description Market Value (2024) USD 20.3 Bn Forecast Revenue (2034) USD 58.2 Bn CAGR (2025-2034) 11.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Manga Licensing, Anime Licensing), By Application (TV & Film, Digital Platforms, Merchandise, Video Games), By End-User (Individual, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bandai Namco, Good Smile Company, Kotobukiya, Taito Corporation, Tokyo Otaku Mode, Aoshima, SuperGroupies, Penguin Parade, Alter, Megahouse, Banpresto, Funko, Figuarts (S.H. Figuarts), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Manga and Anime Licensing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Manga and Anime Licensing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bandai Namco

- Good Smile Company

- Kotobukiya

- Taito Corporation

- Tokyo Otaku Mode

- Aoshima

- SuperGroupies

- Penguin Parade

- Alter

- Megahouse

- Banpresto

- Funko

- Figuarts (S.H. Figuarts)

- Other Key Players