Global Managed Services Market Size, Share, Trends Analysis Report By Solution (Managed Data Center, Managed Network, Managed Mobility, Managed Infrastructure, Managed Backup and Recovery, Managed Communication, Managed Information, and Managed Security), By Enterprise Size (Small & Medium Enterprises and Large Enterprises), By Managed Information Service (Business Process Outsourcing, Business Support Systems, Project & Portfolio Management, and Other Services), By Deployment, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 100937

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

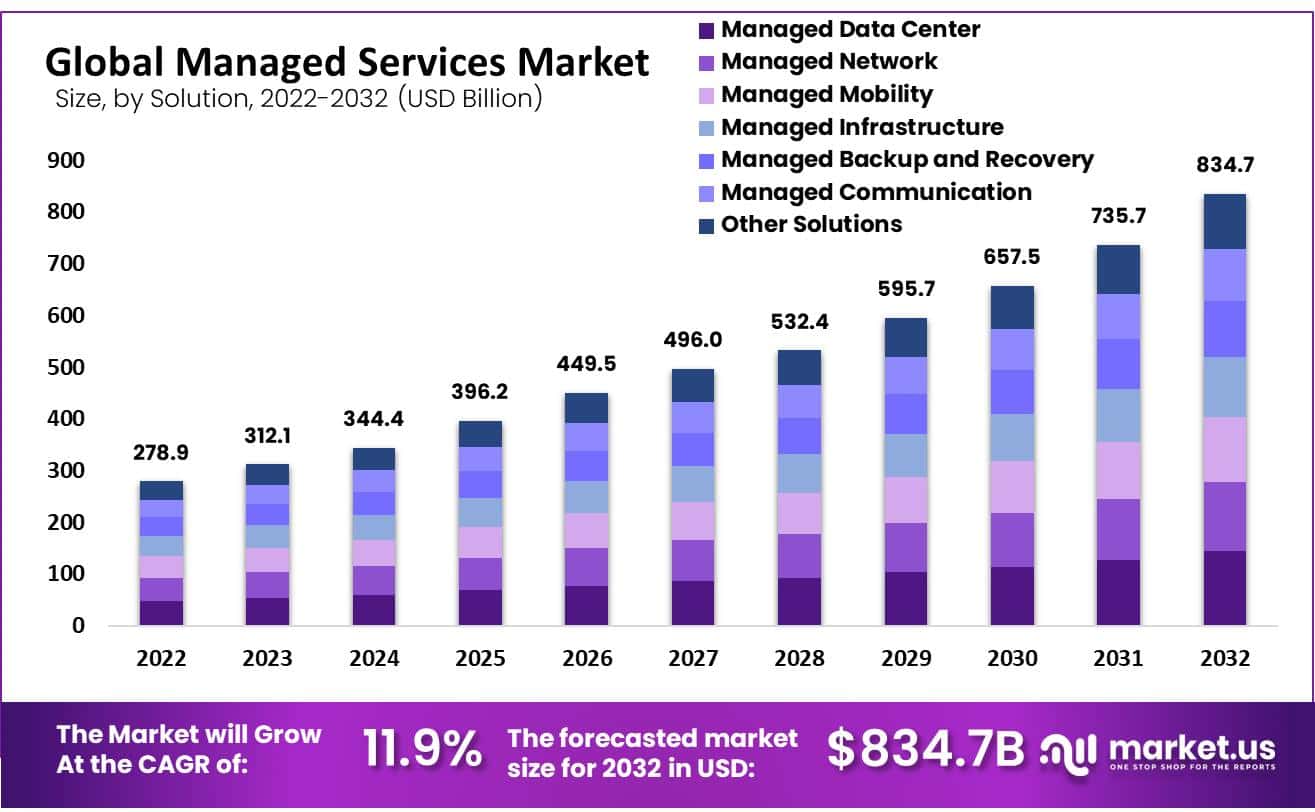

The Global Managed Services Market size is expected to be worth around USD 834.7 Billion By 2032, from USD 312.1 billion in 2023, growing at a CAGR of 11.9% during the forecast period from 2023 to 2032.

Managed services involve the outsourcing of various business functions and processes to a third-party provider. This practice enables organizations to reduce operating costs, enhance efficiency, and allow internal teams to focus on core business strategies. Managed services cover a wide range of areas, including IT services, payroll, human resources, customer service, and more. The service provider takes responsibility for the administration, management, and operational oversight of the designated functions.

The managed services market is witnessing significant growth, driven by the increasing complexity of business technologies and the need for specialized skills to manage advanced systems. Businesses of all sizes are leveraging these services to gain access to expertise and technology without the need to invest heavily in internal resources. The market is also supported by the growing trend towards digital transformation, as companies seek to enhance their operational agility and customer service capabilities.

The demand for managed services is on the rise as organizations strive to stay competitive in a technology-driven landscape. Businesses are increasingly turning to MSPs to handle routine IT operations, allowing internal teams to focus on strategic initiatives. This shift is particularly evident among small and medium-sized enterprises (SMEs) that may lack the resources to maintain comprehensive in-house IT departments.

The managed services market presents numerous opportunities for growth and innovation. As emerging technologies like artificial intelligence (AI), the Internet of Things (IoT), and big data analytics become more prevalent, MSPs can expand their service offerings to include advanced analytics, predictive maintenance, and IoT device management. Furthermore, the increasing emphasis on data privacy and regulatory compliance opens avenues for MSPs to provide specialized services in these areas.

For instance, In April 2024, SAS, a leader in data and AI solutions, expanded its managed services to include Amazon Web Services (AWS). This move gives customers more flexibility in how they deploy and manage SAS technology, allowing them to leverage AWS for enhanced scalability and efficiency. It’s a strategic step that aligns with the growing demand for cloud-based solutions and offers businesses more choices to optimize their analytics investments.

Technological advancements are reshaping the managed services landscape. The integration of AI and machine learning enables MSPs to offer proactive monitoring and automated issue resolution, enhancing service efficiency. Cloud-based managed services provide scalable solutions that can adapt to the evolving needs of businesses. Additionally, advancements in cybersecurity technologies allow MSPs to offer robust protection against sophisticated threats, ensuring the integrity and security of client data.

Key Takeaways

- The Managed Services Market was valued at USD 278.9 billion in 2022 and projected to reach an expected total market size of USD 834.7 billion by 2032 – at a compound annual growth rate of 11.9% between 2023-2033.

- In 2022, the Managed Data Center segment held the highest revenue share within the Managed Services Market with 17.3% and projected compound annual growth rates of 10.6% during its forecast period.

- The Managed Security Solution segment is projected to experience the fastest compound annual compound annual growth between 2023-2033. It is projected to experience compound annual compounding rates of 11.2% annually.

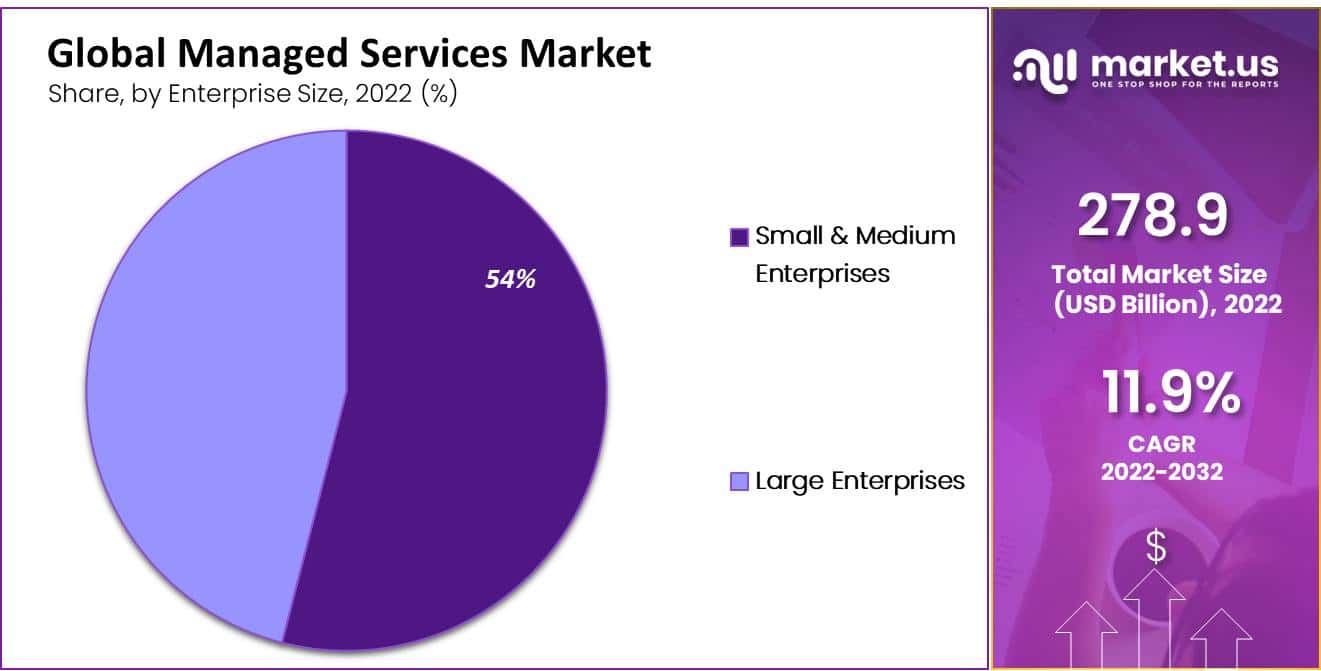

- Large Enterprises dominate the market in terms of enterprise size, commanding 54.6% in 2022 with an anticipated compound annual growth rate of 10.4% over their forecasted period.

- Business Process Outsourcing (BPO) dominates the Managed Information Service segment with 37.4% market share as of 2022 and an expected compound annual growth rate of 10% during its forecast period.

- On-premise deployment represent the highest revenue share of the Managed Services Market at 67.2% in 2022 and an anticipated compound annual growth rate of 10.9% during its projected forecast period.

- BFSI (Banking, Financial Services and Insurance) holds the largest revenue share among End-Use segments for Managed Services Market, at 18% in 2022 with an expected compound annual compound growth rate of 11.6% over its forecast period.

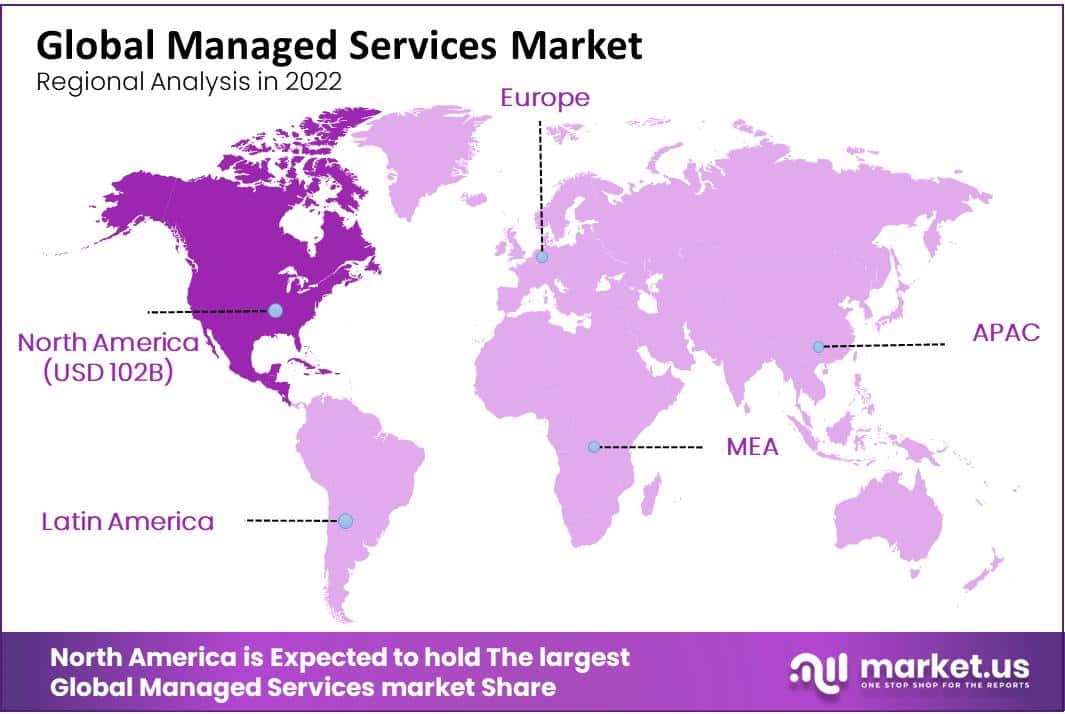

- North America is estimated to be the most lucrative market in the global Managed Services Market, with the largest market share of 36.6% in 2022 and a projected CAGR of 10.6% during the forecast period.

- Asia-Pacific is expected to be the fastest-growing region in the Managed Services Market, with a projected CAGR of 11.2% during the forecasted period.

- Some of the key players in the market include International Business Machines Corporation, Accenture PLC, Alcatel-Lucent Enterprise, AT&T Inc., Avaya Inc., Ericsson, Fujitsu Limited, Lenovo Group Limited, BMC Software, Inc., CA Technologies, and Cisco Systems, Inc.

Impact of Generative AI on Market

Generative AI (GenAI) is reshaping the managed services market by enhancing service offerings and operational efficiency, while also introducing new challenges and opportunities for growth and innovation.

- Enhancing Service Delivery and Efficiency: GenAI is significantly enhancing the operational efficiency of managed services through automation and advanced data processing capabilities. This includes autonomous management of IT incidents, proactive problem management, and the generation of knowledge articles. These advancements are enabling managed services providers (MSPs) to offer more sophisticated, efficient, and cost-effective solutions to their clients, driving value far beyond traditional IT support functions.

- Driving Business Innovation: Beyond improving existing services, GenAI is creating opportunities for MSPs to innovate and deliver new types of services that were previously not possible. For instance, GenAI enables the development of new business processes and customer interaction models, which can significantly enhance the user experience and operational productivity. This shift is leading to the transformation of managed services from basic support functions to strategic business enablers that can drive significant competitive advantages..

- Challenges and Strategic Adjustments: Despite its benefits, the integration of GenAI into managed services is not without challenges. These include the high costs associated with deploying advanced AI technologies, the need for significant adjustments in IT infrastructure, and potential regulatory and security concerns. As a result, MSPs are exploring various strategies to leverage GenAI effectively, including using open-source models and forming partnerships with AI development firms to reduce costs and mitigate risks.

Solution Analysis

The Managed Data Center Segment Accounted for the Largest Revenue Share in Managed Services Market in 2022.

Based on the solution, the market is segmented into managed data centers, managed networks, managed mobility, managed infrastructure, managed backup and recovery, managed communication, managed information, and managed security. Among these types, the managed data center is expected to be the most lucrative in the global managed services market, with the largest revenue share of 17.3% in 2022 and a projected CAGR of 10.6% during the forecast period.

Managed data centers, provide businesses with a number of advantages such as lower costs, increased dependability, scalability, flexibility, security, compliance, and 24/7 support. Organizations can concentrate on their core business while leaving the management and maintenance of their IT systems to professionals by outsourcing their IT infrastructure and equipment to a third-party company that operates and maintains the data center facilities.

The Managed Security Segment is Fastest Growing Solution Segment in Managed Services Market.

The managed security segment is projected as the fastest-growing solution segment in managed services market from 2023 to 2033 forecasted to increase at a CAGR of 11.2%. Cyber risks are avoided, found, and remedied through managed security services, which actively monitor and manage an organization’s security posture.

Security solutions including threat detection and response, vulnerability management, compliance monitoring, and security consultancy are all provided by managed security services providers (MSSPs). MSSPs leverage cutting-edge technology like automation, machine learning, and artificial intelligence (AI) to detect risks promptly and take appropriate action.

Enterprise Size Analysis

The Large Enterprises Hold the Significant Share of the Enterprise Size Segment in Managed Services Market.

Based on enterprise size, the market is divided into small & medium enterprises and large enterprises. Among these, the large enterprise segment is dominant in the enterprise size segment in the managed services market, with a market share of 54.6% in 2022 and a CAGR of 10.4% during the forecasted period.

Large businesses can benefit from managed services in a variety of ways, including cost savings, increased agility, and improved operational effectiveness. Large businesses frequently have complicated IT setups and wide-ranging data networks, which are difficult to properly manage without specialized knowledge and funding.

Network monitoring, help desk support, data backup and recovery, and cybersecurity are just a few of the services that managed services providers (MSPs) provide. These services can help major businesses optimize their IT operations and lighten the load on their internal IT teams.

Small & Medium Enterprises are Fastest Growing Enterprise Size Segment in Projected Period.

Small & medium enterprises are also important enterprise size segments in managed services market and it is expected to grow faster with a CAGR of 10.5% in 2022. SMEs often have constrained internal IT budgets and resources; therefore, managed services are a desirable choice for satisfying their technological requirements.

Managed services providers (MSPs) provide a variety of services, including network monitoring, data backup and recovery, help desk support, and cybersecurity, that can assist SMEs in managing their IT operations. SMEs can free up internal resources and concentrate on their main company operations by outsourcing these tasks to an MSP. The scalability and flexibility of managed services are also advantageous to SMEs. MSPs can quickly adjust to shifting business requirements, adding or eliminating services as needed to satisfy the needs of SMEs.

Managed Information Service Analysis

The Business Process Outsourcing Holds the Largest Market Share in Managed Information Service Segment in Managed Services Market.

Based on managed information services, the market is divided into business process outsourcing, business support systems, project & portfolio management, and other services. Among this, the business process outsourcing segment is dominant in managed information service segment in the managed services market, with a market share of 37.4% and a CAGR of 10% in 2022.

BPO may include a number of procedures, including supply chain management, accounting, and customer service. BPO managed services providers (MSPs) can provide their clients with a variety of solutions to improve business processes and aid in the accomplishment of their strategic objectives. BPO MSPs frequently have specialized knowledge in particular industries or procedures. They can offer their clients specialized solutions that are tailored to their particular business demands thanks to their knowledge.

Project & Portfolio Management are Fastest Growing Managed Information Service Segment in Projected Period.

Project & portfolio management is expected to fastest growing segment in the managed services market with a CAGR of 10.2% in 2022. PPM services are often provided by managed services providers who specialize in project management approaches including Agile, Waterfall, and Scrum as well as project management tools and software. From the beginning to the end of a project, MSPs may support Organizations by assisting with planning, scheduling, budgeting, resource allocation, risk management, and quality assurance.

Deployment Analysis

The On-premise Segment Accounted for the Largest Revenue Share in Managed Services Market in 2022.

Based on deployment, the market is segmented into on-premise and hosted. Among these types, the on-premise is expected to be the most lucrative in the global managed services market, with the largest revenue share of 67.2% and a projected CAGR of 10.9% during the forecast period.

A strategy for deployment known as “on-premise deployment” in the managed services sector comprises setting up and maintaining IT infrastructure and applications on a company’s actual premises. In this approach, the managed services provider (MSP) deploys and administers the hardware and software inside the business’s own data center or server room as opposed to using a cloud-based solution.

On-premise deployment may be a desirable solution for businesses with stringent security and regulatory requirements, significant levels of customization and control needed over their IT infrastructure, or both. With the help of an MSP’s knowledge and assistance, this deployment strategy enables Organizations to maintain total control over their data and IT infrastructure.

The Hosted Segment is Fastest Growing Deployment Segment in Managed Services Market.

The hosted segment is projected as the fastest-growing deployment segment in managed services market from 2022 to 2031 forecasted to increase at a CAGR of 11.5%. In the managed services sector, the term “hosted deployment” refers to hosting and managing IT tools and applications on a server or in the cloud.

Clients can access resources remotely because of the managed services provider (MSP), who manages and deploys hardware and software in their data center or cloud. Businesses that wish to keep control of their data and IT systems while avoiding the upfront expenditures and continuing maintenance requirements associated with on-premise implementation may consider hosted deployment. Businesses can take advantage of the scalability and dependability of cloud-based systems by using this deployment technique in conjunction with the knowledge and assistance of an MSP.

End-Use Analysis

The BFSI Segment Accounted for the Largest Revenue Share in Managed Services Market in 2022.

Based on end-use, the market is segmented into BFSI, government, healthcare, IT & telecom, manufacturing, media & entertainment, retail, and other end-use industries. Among these types, the BFSI is expected to be the most lucrative in the global managed services market, with the largest revenue share of 18% and a projected CAGR of 11.6% during the forecast period.

The BFSI sector (Banking, Financial Services, and Insurance), is one of the largest end-users in the IT industry. BFSI is always implementing new technologies to stay ahead of the competition, given the growing need for reliable and secured financial services. Managed services are a great solution for the BFSI sector. They offer solutions such as infrastructure and network management, security management, and application management.

These services help the BFSI industry operate more efficiently, spend less money and provide better customer service. Managed services also provide 24/7 supervision and assistance which is vital for the BFSI sector to ensure uninterrupted customer service.

The Retail Segment is Fastest Growing End-Use Segment in Managed Services Market.

The retail segment is projected as the fastest-growing end-use segment in managed services market from 2022 to 2031 forecasted to increase at a CAGR of 10.3%. Another big end-user of managed services in the IT sector is the retail sector.

Retailers are looking for ways to enhance their business operations and customer experience while cutting costs as a result of the growth of e-commerce and rising competition. Supply chain management, inventory management, customer relationship management, and point-of-sale management are just a few of the issues that managed services may help the retail sector with.

These services support merchants in streamlining their operations and enhancing their general effectiveness. Managed services also offer data analytics and insights that support retailers in making defensible choices regarding their business plans.

Key Market Segments

Based on Solution

- Managed Data Center

- Managed Network

- Managed Mobility

- Managed Infrastructure

- Managed Backup and Recovery

- Managed Communication

- Managed Information

- Managed Security

Based on Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

Based on Managed Information Service

- Business Process Outsourcing

- Business Support Systems

- Project & Portfolio Management

- Other Services

Based on Deployment

- On-premise

- Hosted

Based on End-Use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Media & Entertainment

- Retail

- Other End-Use Industries

Driver

Rising Adoption of Cloud-Based Solutions

The Managed Services market is experiencing significant growth, largely driven by the increasing adoption of cloud-based solutions. Organizations are shifting towards cloud environments to capitalize on their cost-efficiency, scalability, and flexibility. This trend is supported by the need for businesses to enhance their operational efficiency and streamline IT management, which cloud-based managed services can provide.

The rise of remote work models has further fueled this trend, as companies seek robust, scalable IT support that can be managed remotely. The comprehensive management of network, security, and data systems that managed services offer ensures that businesses can effectively respond to the dynamic IT landscape and maintain their competitiveness.

Restraint

Integration and Regulatory Challenges

However, the market faces notable constraints, particularly integration and regulatory challenges. As organizations increasingly depend on diverse IT systems and software, integrating these complex systems while ensuring they comply with stringent regulations becomes a hurdle. These challenges are accentuated by the varying compliance requirements across different regions, adding layers of complexity to the management of IT services.

The reliability concerns associated with ensuring consistent service delivery across geographically dispersed assets also pose a significant restraint, potentially impacting the overall efficiency of managed services. These factors can deter organizations from fully committing to outsourced managed services, impacting market growth.

Opportunity

Expansion into Emerging Markets

There is a significant opportunity for the Managed Services market within emerging economies across the Asia Pacific and other developing regions. These areas are witnessing rapid technological advancements and digitalization of businesses. The increasing investments in data security, coupled with a surge in the adoption of cloud services among SMEs and large enterprises, create a fertile ground for managed services providers.

Governments in these regions are actively investing in infrastructures like smart cities, which further opens avenues for managed services in data storage, security, and network management. This alignment with national development projects and the subsequent need for managed IT services is expected to drive considerable market expansion.

Challenge

Cybersecurity Threats

A paramount challenge in the Managed Services market is managing the growing cybersecurity threats. As the dependency on digital platforms increases, so does the vulnerability to cyber-attacks. Managed service providers must constantly update their cybersecurity measures to protect their clients’ critical data against evolving threats.

This requires significant investment in advanced security technologies and skilled personnel to manage these systems. The challenge is not only technical but also involves educating clients about potential risks and the importance of cybersecurity measures. The ongoing need to balance cost with advanced security measures continues to be a critical challenge for the market.

Regional Analysis

North America Accounted for the Largest Revenue Share in Managed Services Market in 2022.

North America is estimated to be the most lucrative market in the global managed services market, with the largest market share of 36.6%, and is expected to register a CAGR of 10.6% during the forecast period. Due to the widespread use of cloud-based services and the demand for cybersecurity solutions, North America is the region with the greatest market for managed services. Major players’ presence in the area also aids in its development.

Asia-Pacific is Expected as Fastest Growing Region in Projected Period in Managed Services Market.

Asia-pacific is expected as the fastest growing region in the forecasted period for the managed services market with a CAGR of 11.2%. The usage of digital technologies is expanding, there is a growing requirement for cybersecurity solutions, and there is an expanding need for IT optimization.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

Latin America

- Brazil

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Key Players Analysis

With several big and small suppliers offering a wide range of services, the managed services market is extremely competitive. Some of the key players in the market, in addition to several smaller vendors and startups, include IBM, Accenture, Hewlett Packard Enterprise, Cisco Systems, and Microsoft. To diversify their service portfolios and geographic reach, bigger providers frequently acquire smaller businesses in the market.

Market Key Players

- International Business Machines Corporation

- Accenture PLC

- Alcatel-Lucent Enterprise

- AT&T Inc.

- Avaya Inc.

- Ericsson

- Fujitsu Limited

- Lenovo Group Limited

- BMC Software, Inc.

- CA Technologies

- Cisco Systems, Inc.

- Other Key Players

Recent Developments

- In January 2024, Accenture made a strategic move to bolster its managed services by acquiring NaviSite. This acquisition is significant as it enhances Accenture’s capabilities in application and infrastructure management, crucial areas for businesses looking to modernize their operations. The primary focus for Accenture, through this acquisition, is to provide advanced support to its clients in the US and Canada, aiding them in navigating their digital transformation journeys.

- In September 2024, Tata Consultancy Services (TCS) introduced two AI-driven cybersecurity solutions, Managed Detection and Response (MDR) and Secure Cloud Foundation, in partnership with Google Cloud. The MDR service focuses on providing round-the-clock threat detection and response, helping businesses stay ahead of evolving cyber risks. Secure Cloud Foundation, on the other hand, is designed to strengthen cloud security and governance across hybrid environments.

Report Scope

Report Features Description Market Value (2023) USD 312.1 Bn Forecast Revenue (2032) USD 834.7 Bn CAGR (2023-2032) 11.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Managed Data Center, Managed Network, Managed Mobility, Managed Infrastructure, Managed Backup and Recovery, Managed Communication, Managed Information, Managed Security), By Enterprise Size (Small & Medium Enterprises, Large Enterprises), By Managed Information Service (Business Process Outsourcing, Business Support Systems, Project & Portfolio Management, Other Services), By Deployment (On-premise, Hosted), By End-Use (BFSI, Government, Healthcare, IT & Telecom, Manufacturing, Media & Entertainment, Retail, Other End-Use Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape International Business Machines Corporation, Accenture PLC, Alcatel-Lucent Enterprise, AT&T Inc., Avaya Inc., Ericsson, Fujitsu Limited, Lenovo Group Limited, BMC Software, Inc., CA Technologies, Cisco Systems, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Managed Services?Managed services refer to the practice of outsourcing the responsibility for maintaining, and anticipating the need for, a range of processes and functions to improve operations and cut expenses. These services can include the management of IT infrastructure, security, cloud services, and more.

What is the size of the Managed Services Market?The global managed services market is valued at USD 278.9 Bn In 2022 and is expected to reach USD 834.7 Bn in 2032, with a CAGR of 11.9% from 2023 to 2033.

What are the key driving factors for the growth of the Managed Services Market?The growth of the Managed Services Market is largely driven by factors such as the increasing complexity of IT infrastructure, a rise in cybersecurity threats, the need for cost-effective business solutions, and the focus on core business functions.

What are the benefits of adopting Managed Services?Adopting Managed Services can lead to various benefits for businesses, including improved operational efficiency, enhanced security, reduced operational costs, access to specialized expertise, increased scalability, and the ability to focus on core business functions.

What industries are driving the demand for Managed Services?Various industries, including IT & Telecom, BFSI (Banking, Financial Services, and Insurance), healthcare, retail, manufacturing, and government sectors, are driving the demand for Managed Services due to the need for enhanced security, improved operational efficiency, and effective management of IT infrastructure.

-

-

- International Business Machines Corporation

- Accenture PLC

- Alcatel-Lucent Enterprise

- AT&T Inc.

- Avaya Inc.

- Ericsson

- Fujitsu Limited

- Lenovo Group Limited

- BMC Software, Inc.

- CA Technologies

- Cisco Systems, Inc.

- Other Key Players