Global Malaria Ag Rapid Testing Market By Detection Type (Single Species and Multiple Species), By Target Antigen (HRP2, HRP3-based, pLDH and Others), By End User (Hospitals and Clinics, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167985

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

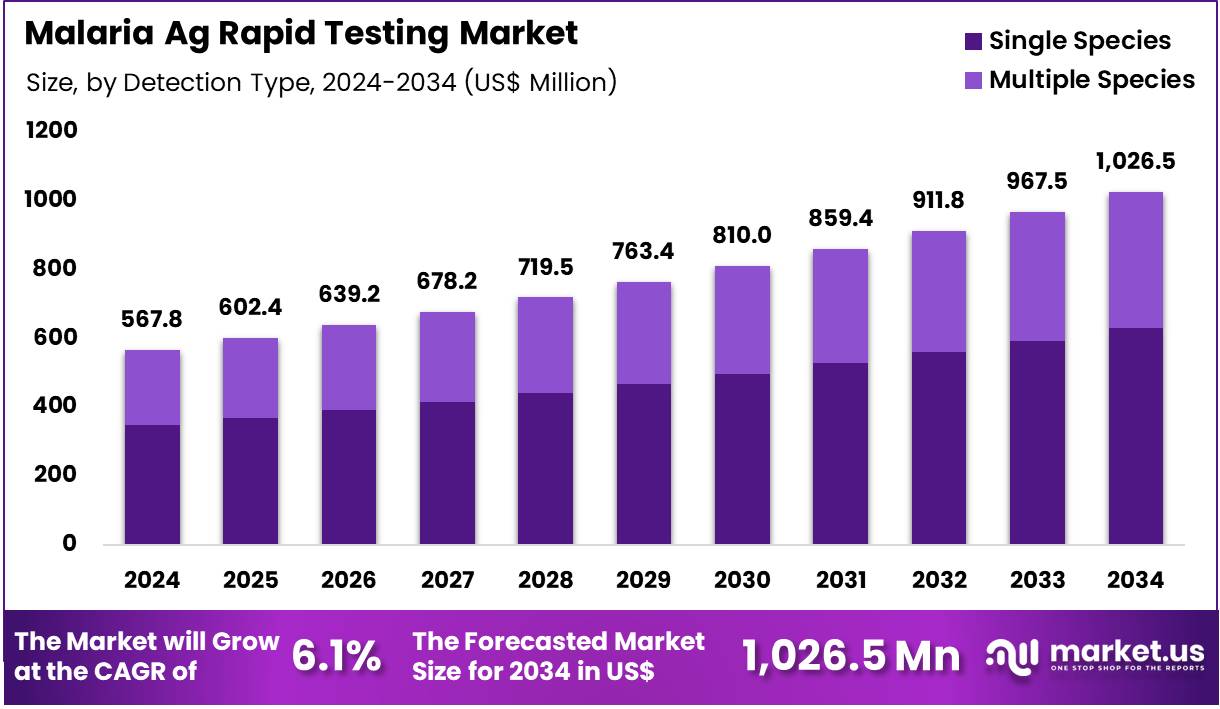

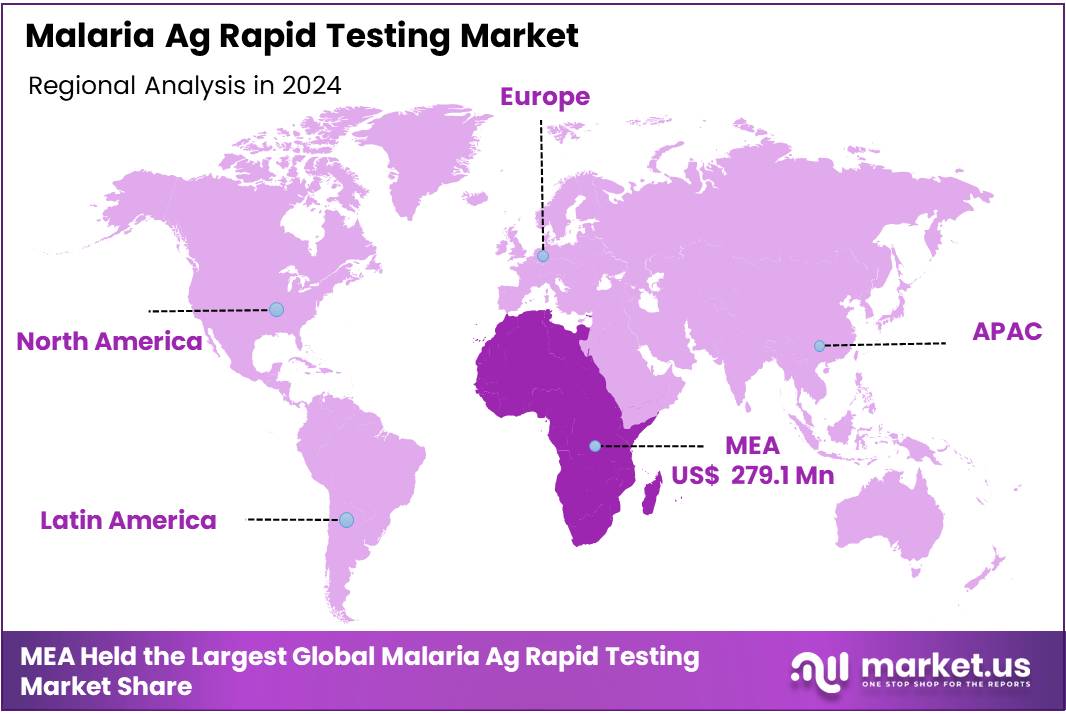

The Global Malaria Ag Rapid Testing Market size is expected to be worth around US$ 1,026.5 Million by 2034 from US$ 567.8 Million in 2024, growing at a CAGR of 6.1% during the forecast period 2025 to 2034. In 2024, Middle east & Africa led the market, achieving over 49.2% share with a revenue of US$ 279.1 Million.

The Malaria Ag Rapid Testing Market has grown into an essential diagnostic pillar, particularly in malaria-endemic countries, due to its critical role in early identification of Plasmodium antigen presence at the point-of-care. Rapid antigen tests provide a fast, accessible alternative to microscopy enabling health workers to quickly detect active infection, triage treatment, and prevent severe complications, especially in regions with limited laboratory access.

These tests use lateral-flow immune-chromatography technology to detect malaria-specific antigens from a finger-prick blood sample, providing results within 10–20 minutes. The technology has become widely adopted across rural clinics, national malaria control campaigns, emergency response programs, and community surveillance initiatives. Governments and NGOs increasingly expand deployment of such kits to accelerate early diagnosis and reduce mortality, particularly among children.

The market continues to expand due to the critical need for prompt, low-resource diagnostic tools that support surveillance, outbreak response, and universal health coverage goals. Rapid testing technologies have also advanced, offering improved sensitivity for mixed infections, enhanced antigen detection panels, and superior field stability in tropical conditions.

At the community level, antigen rapid test availability has become central in reducing diagnostic delays, improving treatment initiation timelines, and lowering overall transmission risks, especially in high-burden zones across Africa and Southeast Asia.

Key Takeaways

- In 2024, the market generated a revenue of US$ 567.8 million, with a CAGR of 6.1%, and is expected to reach US$ 1,026.5 million by the year 2034.

- The Detection Type segment is divided into Single Species, and Multiple Species, with Single Species taking the lead in 2024 with a market share of 61.4%

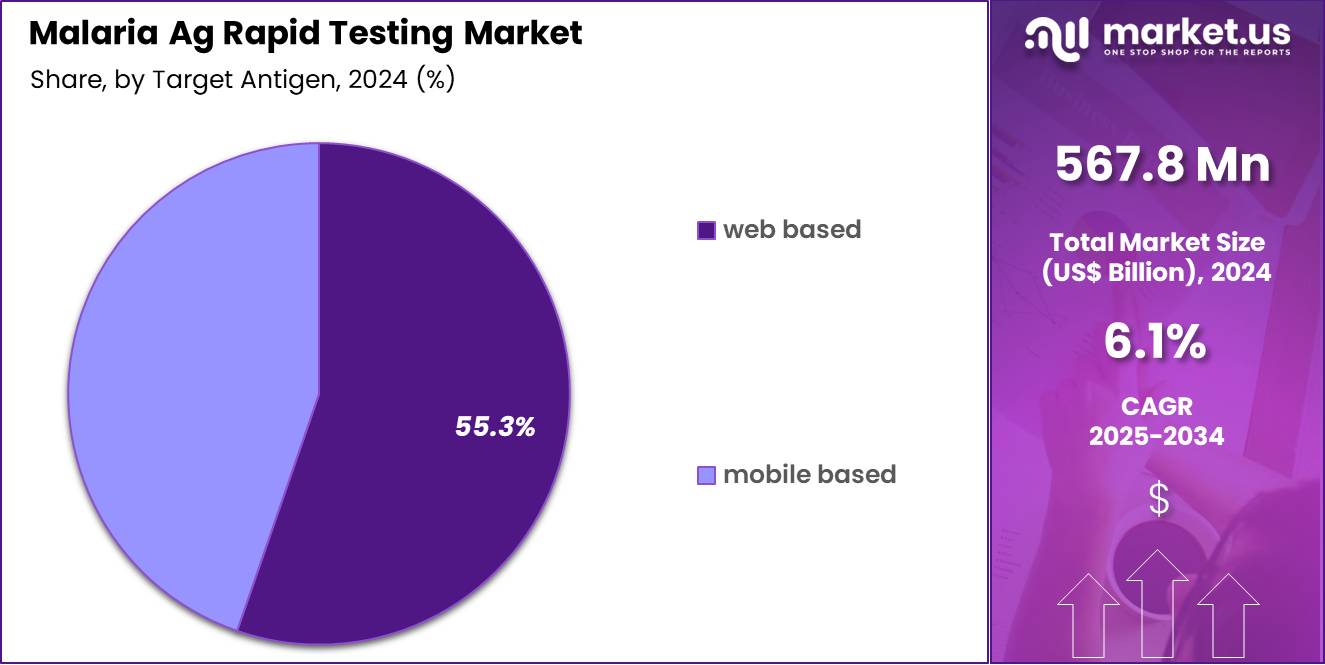

- The Target Antigen segment is divided into HRP2, HRP3-based, pLDH, and Others, with HRP2 taking the lead in 2024 with a market share of 70.4%

- The End-User segment is divided into Hospitals and Clinics, Diagnostic Centers, and Others, with Hospitals and Clinics taking the lead in 2024 with a market share of 63.8%

- Middle east & Africa led the market by securing a market share of 49.2% in 2024.

Detection Type Analysis

Single species antigen detection tests hold the largest share of 61.4% due to their role in identifying Plasmodium falciparum the most lethal malaria strain—widely prioritized across public health systems. These tests enable fast diagnosis, especially in regions where P. falciparum burden is highest, and where high-sensitivity detection is critical for care pathways. Ministries of Health frequently procure P. falciparum-only kits for nationwide distribution as part of fever-screening protocols. Single species tests are also more affordable, allowing volume-deployment in peripheral clinics.

Multiple species antigen tests have grown steadily as healthcare systems focus on capturing P. vivax, P. malariae, and P. ovale alongside P. falciparum. Multi-species detection improves diagnostic certainty in co-endemic regions and supports better management of recurrence-prone infections.

Target Antigen Analysis

HRP2 antigen detection remains the most widely used segment accounting for 70.4% market share due to its strong sensitivity for P. falciparum, affordability, and proven field performance over decades of national malaria control use. HRP2-based tests dominate government tenders due to their validated reliability in endemic zones. However, concerns over HRP2 gene deletions in certain geographies have increased interest in alternative antigen markers.

pLDH antigen detection kits expand their adoption due to their ability to test both species-specific and pan-malarial markers, supporting broader screening utility. pLDH levels decline faster following treatment, making these kits useful as supportive tools in monitoring therapeutic response.

HRP3-based tests and other antigen marker platforms continue to advance gradually with the goal to overcome genetic deletion concerns and improve field robustness.

End-User Analysis

Hospitals and clinics account for the majority share of test utilization with 63.8% in 2024 because rapid antigen testing is integrated into standardized clinical diagnostic algorithms for fever presentation, urgent triage, and treatment initiation. These sites maintain high testing demand due to constant patient inflow.

Diagnostic centers exhibit consistent adoption where confirmatory testing, differential diagnosis, and higher-volume screening occur, especially in urban zones with mixed infection incidence.

Other end-users, including community health workers and field surveillance teams, remain essential adopters in remote low-resource settings where laboratory infrastructure is limited.

Key Market Segments

By Detection Type

- Single Species

- Multiple Species

By Target Antigen

- HRP2

- HRP3-based

- pLDH

- Others

By End User

- Hospitals and Clinics

- Diagnostic Centers

- Others

Drivers

Increasing deployment of malaria antigen testing for community-based surveillance and early case detection

The market for antigen-based rapid diagnostic tests (RDTs) for malaria is expected to gain momentum as community-based surveillance expands. The testing rate in the public sector in Africa increased from 36% in 2010 to 82% by 2017, reflecting enhanced access to diagnostics.

Globally, manufacturers reported delivery of 3.9 million malaria RDTs between 2010-2022, with over 82% distributed to sub-Saharan African countries. These figures underscore the scale and rising utilisation of rapid antigen tests in endemic regions.

Community-based programmes often in remote or resource-limited settings benefit from antigen tests because they are quick, require minimal infrastructure, and enable early case detection which supports treatment and transmission interruption. Field deployment through outreach, active case finding and integrated health campaigns is anticipated to drive increased uptake of these antigen RDTs, bolstering the market for malaria antigen rapid testing.

Restraints

Emerging HRP2 gene deletions impacting test sensitivity reliability in certain regions

Emerging deletions of the pfhrp2 / pfhrp3 genes in the parasite Plasmodium falciparum represent a significant restraint on the reliability of HRP2-based antigen tests. A 2024 report from World Health Organization (WHO) indicated that pfhrp2/3 deletions have been documented in over 40 countries, and modelling projects that 28 of 49 African countries may have ≥5% prevalence of deletions in one or more first-level administrative units within 20 years.

An analytical study found that RDT positivity for pfhrp2-deleted parasites was only 40.1% overall (versus wild-type), and HRP2-only RDTs detected just 43.4% in such cases. The reduced sensitivity and reliability of antigen tests in areas with HRP2 deletion undermines confidence, restricts procurement and deployment of standard HRP2‐based tests, and thus constrains market growth for RDT formats reliant solely on HRP2 detection.

Opportunities

Growing demand for pan-species and multi-antigen RDT innovation supporting broader malaria elimination objectives

The push towards malaria elimination is expected to create significant opportunities for RDTs that cover multiple species of malaria parasites and detect multiple antigens simultaneously (for example HRP2 plus pLDH). Multi-species antigen tests help detect non-falciparum infections (e.g., Plasmodium vivax, Plasmodium malariae) which are increasingly relevant in elimination settings and in mixed-infection contexts. A study of a combined HRP2/pLDH RDT found sensitivity up to 99.4% in peripheral settings.

As malaria programmes increasingly focus on residual transmission, active surveillance and out-of-facility screening, the need for versatile RDTs that perform across species and geographies is projected to grow, offering test manufacturers a compelling innovation pathway and expanding market potential for novel antigen panels.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the Malaria Ag Rapid Testing Market by shaping consumer spending, supply chain stability, and access to diagnostic materials. Periods of economic slowdown typically shift household spending toward essential healthcare, which benefits at-home testing because it offers a lower-cost alternative to clinical diagnostics.

However, inflation-driven increases in raw material and logistics costs can raise kit prices, affecting affordability in price-sensitive markets. Geopolitical tensions also impact the sourcing of assay components, microfluidic cartridges, reagents, and lateral-flow materials, which are often manufactured across multiple countries. Disruptions in global trade routes or restrictions on chemical exports may slow production timelines and limit inventory availability for online and retail channels.

Public health policy changes in response to geopolitical events further influence demand. For example, global energy and food supply uncertainties increase consumer awareness of immunity, fatigue, and nutritional well-being, contributing to higher self-monitoring behavior.

Shifts in labor markets, such as the rise of remote work, encourage more people to adopt home diagnostics rather than visiting clinics. At the same time, increased government scrutiny over cross-border data transfers and digital health privacy may affect how testing companies store and process user data.

Latest Trends

Growing transition toward combo HRP2 + pLDH antigen panels to improve accuracy and sensitivity across geographic variants

In response to the gene deletion threat and species diversity, there is a clear market trend toward RDTs combining HRP2 and pLDH antigen detection. As noted above, the CareStart HRP2/pLDH combo test achieved high sensitivity and specificity in a field evaluation. In another performance evaluation in a region where ~80 % of P. falciparum infections had hrp2 or hrp3 deletions, a novel RDT (not HRP2 only) had sensitivity of 77.4 % and specificity of 96.0 %, compared to HRP2-only comparators at lower sensitivity (55.9 % and 56.8 %) in that setting.

These findings illustrate the shift toward dual-antigen panels to mitigate risks of false negatives due to gene deletions and improve accuracy across different geographic parasite variants. For buyers and manufacturers this means increased uptake of combo antigen tests, and for product developers an incentive to design next-generation RDTs that target multiple antigens and species in one package.

Regional Analysis

Africa is leading the Malaria Ag Rapid Testing Market

In the Africa region the market size for malaria antigen rapid testing is dominant, with the region accounting for about 49.15% of the malaria diagnostics market revenue in 2024. The vast majority of malaria burden lies in sub-Saharan Africa, driving high demand for rapid antigen tests for malaria diagnosis.

For example, between 2010 and 2022 manufacturers delivered approximately 3.9 million malaria rapid diagnostic tests (RDTs), with 82% of those sales occurring in sub-Saharan African countries. In this region national malaria programmes are prioritising early case detection via antigen testing, and many remote or resource-limited settings rely on RDTs rather than microscopy, further cementing Africa as the largest region for this market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia-Pacific region is projected to be the fastest-growing region for the malaria antigen rapid testing market. According to a recent market forecast, Asia-Pacific is expected to experience the highest growth rate from 2025 to 2035, driven by countries such as India, Indonesia and Myanmar, where mass deployment of rapid antigen tests is being facilitated by elimination programmes.

Growth in this region is supported by increasing healthcare infrastructure improvements, rising awareness of point-of-care diagnostics, and expanding public-health initiatives in previously underserved rural areas. Thus Asia-Pacific represents the fastest-growth opportunity in the market for malaria antigen rapid testing.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Abbott Laboratories, Access Bio, Inc., SD Biosensor, Inc., Bio-Rad Laboratories, Inc., Premier Medical Corporation Pvt. Ltd., Rapigen Inc., Advy Chemical Pvt. Ltd., Meril Life Sciences Pvt. Ltd., AdvaCare Pharma, INTEC., Beckman Coulter, Inc., bioMérieux SA, Olympus Corporation, Siemens Healthineers AG, and Others.

Abbott’s Bioline™ Malaria Ag series offers HRP2-based and HRP2/pLDH combo rapid diagnostic tests (RDTs) for Plasmodium falciparum and other species. However, recent field evaluations in Southeast Asia raised concerns about sensitivity and reliability of the Bioline PF/PV test in that region. Access Bio’s “CareStart™ Malaria RDT” product line offers HRP2 and HRP2/pLDH combo rapid antigen tests for malaria, and is WHO pre-qualified. The tests are designed for use in low-resource settings and support community and point-of-care deployment.

SD Biosensor produces the STANDARD Q Malaria P.f/Pan Ag Test, a dual-antigen RDT detecting HRP2 and pLDH, with WHO pre-qualification and strong reported sensitivity/specificity. The company is also collaborating to develop broader multiplex diagnostics combining malaria antigen detection with other biomarkers.

Top Key Players

- Abbott Laboratories

- Access Bio, Inc.

- SD Biosensor, Inc.

- Bio-Rad Laboratories, Inc.

- Premier Medical Corporation Pvt. Ltd.

- Rapigen Inc.

- Advy Chemical Pvt. Ltd.

- Meril Life Sciences Pvt. Ltd.

- AdvaCare Pharma

- INTEC.

- Beckman Coulter, Inc.

- bioMérieux SA

- Olympus Corporation

- Siemens Healthineers AG

- Others

Recent Developments

- In May 2025 the WHO and MPP announced a sublicensing agreement that enables Codix Bio (Nigeria) to manufacture rapid diagnostic test (RDT) technology transferred from SD Biosensor. The agreement facilitates local production in Africa of tests that can be adapted for malaria (in addition to HIV and syphilis) and aims to strengthen diagnostic access in low- and middle-income countries (LMICs).

- In August 2025, Rapigen announced that it had completed delivery of 18 million malaria rapid diagnostic tests (RDTs) to the Ethiopian Ministry of Health. This demonstrates a large-scale procurement and deployment of malaria antigen RDTs in a high-burden country, highlighting the scale of market demand and the importance of fulfilment capacity.

- In August 2024, the Africa Centres for Disease Control and Prevention (Africa CDC) designated the ongoing mpox outbreak as a Public Health Emergency of Continental Security (PHECS). A day later, the World Health Organization (WHO) elevated the situation to a Public Health Emergency of International Concern (PHEIC). Following these announcements, several countries intensified their efforts to allocate resources for scaling up laboratory testing, strengthening surveillance systems, and enhancing outbreak response activities. To support this rapid mobilization, Africa CDC released updated guidance, including a list of recommended RT-PCR (PCR) diagnostic tests for mpox.

Report Scope

Report Features Description Market Value (2024) US$ 567.8 Million Forecast Revenue (2034) US$ 1,026.5 Million CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Detection Type (Single Species and Multiple Species), By Target Antigen (HRP2, HRP3-based, pLDH and Others), By End User (Hospitals and Clinics, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Access Bio, Inc., SD Biosensor, Inc., Bio-Rad Laboratories, Inc., Premier Medical Corporation Pvt. Ltd., Rapigen Inc., Advy Chemical Pvt. Ltd., Meril Life Sciences Pvt. Ltd., AdvaCare Pharma, INTEC., Beckman Coulter, Inc., bioMérieux SA, Olympus Corporation, Siemens Healthineers AG, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Malaria Ag Rapid Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Malaria Ag Rapid Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Access Bio, Inc.

- SD Biosensor, Inc.

- Bio-Rad Laboratories, Inc.

- Premier Medical Corporation Pvt. Ltd.

- Rapigen Inc.

- Advy Chemical Pvt. Ltd.

- Meril Life Sciences Pvt. Ltd.

- AdvaCare Pharma

- INTEC.

- Beckman Coulter, Inc.

- bioMérieux SA

- Olympus Corporation

- Siemens Healthineers AG

- Others