Global Magazine and Literature Bag Market Size, Share, Growth Analysis By Material (Polyethylene, Polypropylene, Polyvinyl Chloride, Other), By Basis Weight (Up to 25 GSM, 25 to 30 GSM, 31 to 40 GSM, Above 40 GSM), By Sales Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169129

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

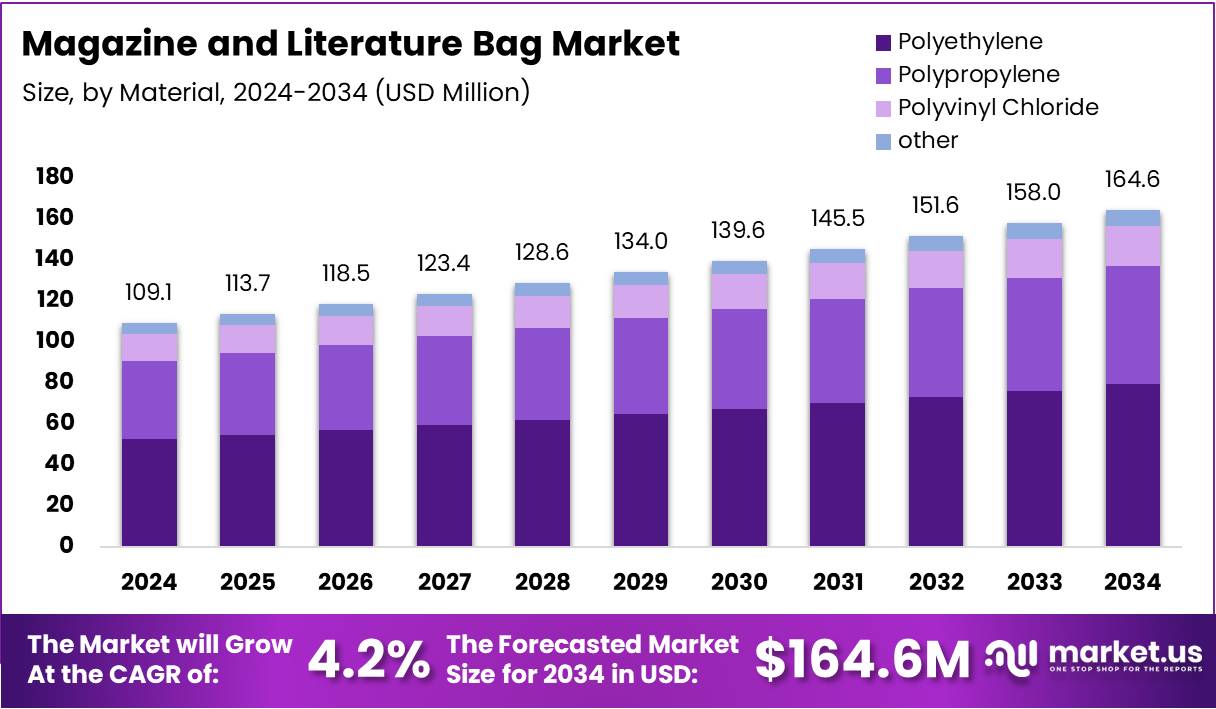

The Global Magazine and Literature Bag Market size is expected to be worth around USD 164.6 Million by 2034, from USD 109.1 Million in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

The Magazine and Literature Bag Market plays a vital role in the packaging and promotional products industry. These bags are designed to transport magazines, brochures, and literature efficiently while offering branding opportunities. Growing awareness around eco-friendly alternatives is shaping product demand and encouraging innovation in materials and design.

Consumer preference is increasingly shifting toward reusable and durable materials, driving demand for cotton and non-woven polypropylene tote bags. These bags provide longevity and convenience while supporting sustainability initiatives. Their functional design also enhances usability for retail, corporate, and educational purposes, promoting consistent adoption across various regions and industries.

Government regulations and environmental mandates are contributing to market growth. Policies encouraging reduced use of single-use plastics are prompting organizations to adopt eco-friendly literature bags. Incentives for sustainable packaging, coupled with rising environmental consciousness, are expected to accelerate the adoption of cotton and non-woven polypropylene bags in multiple sectors.

Innovation in materials and production techniques is creating significant opportunities. Lightweight, durable, and customizable bags are becoming popular among consumers seeking practical yet stylish solutions. Non-woven polypropylene tote bags, support heavy loads of up to 20 lbs, combining strength with eco-conscious design for everyday and promotional use.

Pricing flexibility is a key factor driving market penetration. Literature and tote bags range from US$0.15 for kraft paper bag to over US$8 for premium cotton, with non-woven polypropylene options typically between US$0.80–2.50. Affordable and reusable options encourage wide adoption while supporting promotional and marketing objectives.

Sustainability considerations remain central to market development. Cotton bags need to be used approximately 52 times to balance climate impacts and up to 7,100 times considering broader environmental indicators. This highlights the importance of material choice in meeting consumer expectations and supporting eco-friendly initiatives.

The Magazine and Literature Bag Market is expected to grow steadily, driven by promotional activities, government support, and consumer preference for sustainable solutions. Companies can leverage diverse materials, innovative designs, and cost-effective options to achieve market growth and long-term relevance.

Key Takeaways

- The Global Magazine and Literature Bag Market is expected to reach USD 164.6 Million by 2034, growing from USD 109.1 Million in 2024 at a CAGR of 4.2%.

- Polyethylene dominates the market by material with a 48.2% share in 2024.

- Up to 25 GSM leads the market by basis weight with a 34.8% share.

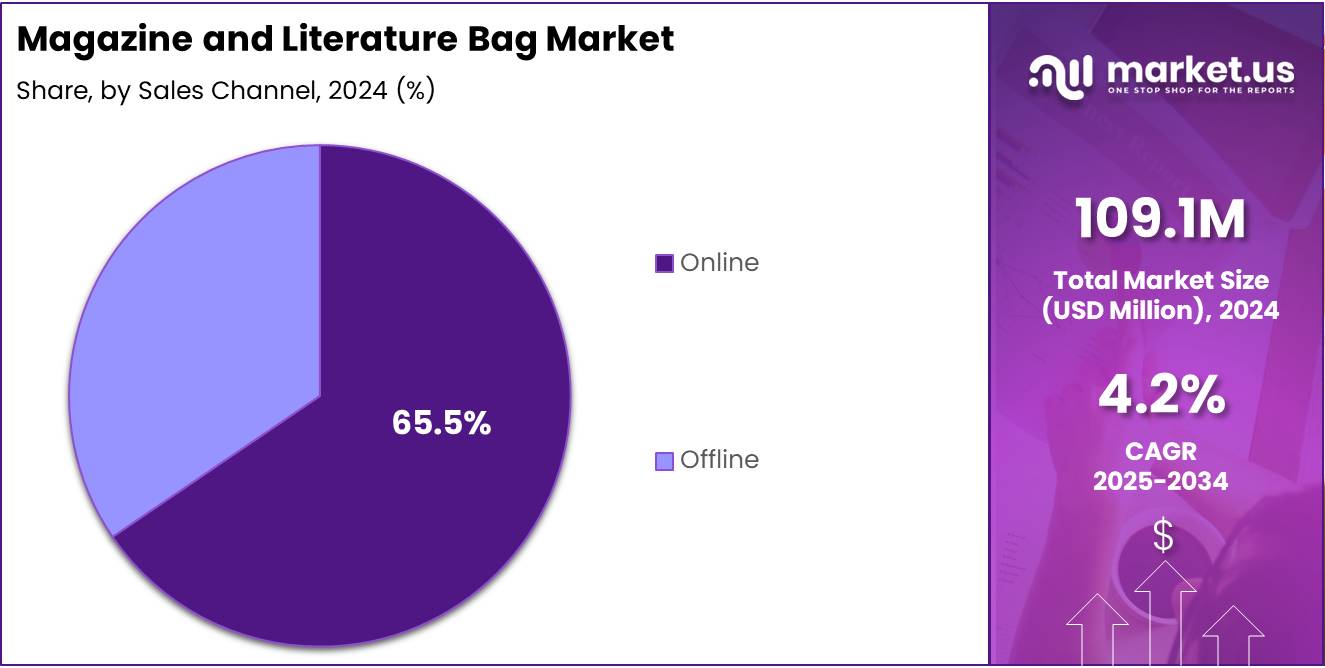

- Online sales dominate the market channel with a 65.5% share in 2024.

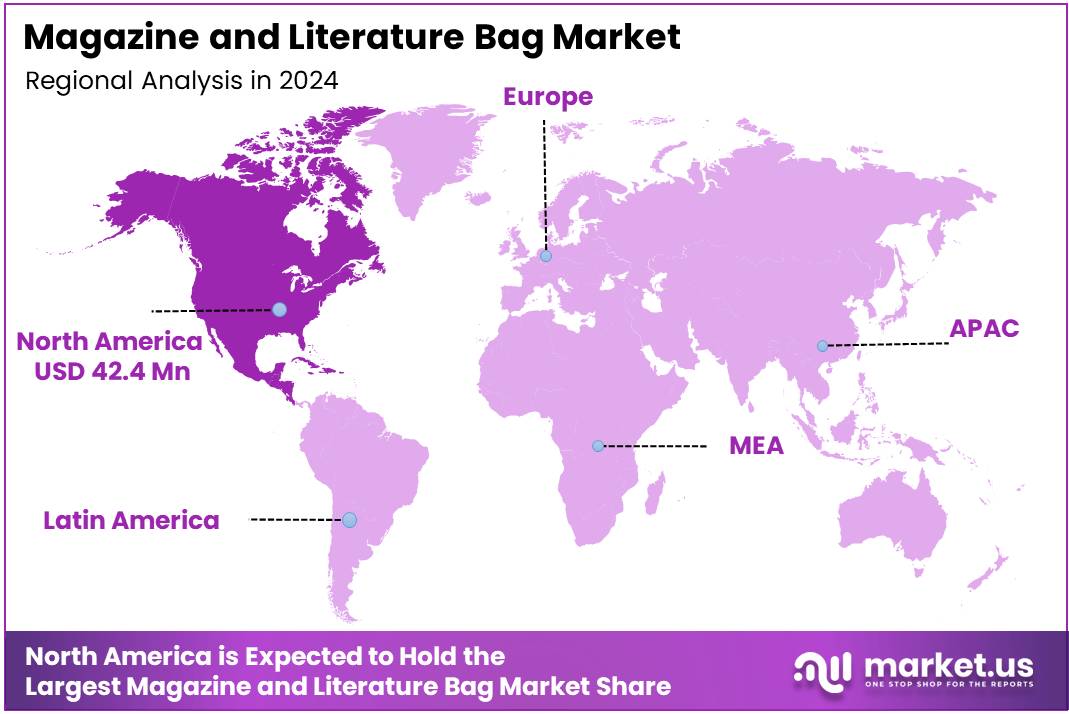

- North America is the leading region with a 38.9% market share, valued at USD 42.4 Million.

Material Analysis

Polyethylene dominates with 48.2% due to its lightweight nature and cost-efficiency.

In 2024, Polyethylene held a dominant market position in the By Material Analysis segment of Magazine and Literature Bag Market, with a 48.2% share. Its durability, affordability, and ease of production make it the preferred choice among manufacturers, boosting widespread adoption across various end-use sectors efficiently.

Polypropylene gained traction due to its strong chemical resistance and reusable nature. The segment is increasingly preferred by eco-conscious consumers and companies focusing on sustainable packaging. Manufacturers continue to innovate with polypropylene blends to improve strength while maintaining cost-effectiveness, gradually enhancing its market presence and customer acceptance.

Polyvinyl Chloride offers excellent rigidity and printability, making it ideal for premium and high-end magazine and literature bags. Despite being less flexible, its resistance to wear and tear drives niche demand. This segment benefits from customization trends, enabling brands to create attractive and long-lasting packaging solutions for specialty markets.

Other materials such as bioplastics and recycled fibers are gradually emerging in the market. These options appeal to environmentally conscious consumers and sustainable initiatives. Their adoption is slowly increasing due to growing awareness and regulatory support, providing new avenues for market expansion and product diversification opportunities.

By Basis Weight Analysis

Up to 25 GSM dominates with 34.8% due to affordability and lightweight convenience.

In 2024, Up to 25 GSM held a dominant market position in the By Basis Weight Analysis segment of Magazine and Literature Bag Market, with a 34.8% share. This lightweight category supports cost-effective production and easy handling, appealing to bulk buyers and retail distribution channels efficiently.

25 to 30 GSM provides a balance between strength and flexibility. This segment is often preferred for premium magazines and literature bags that require slightly more durability. Manufacturers focus on optimizing weight while maintaining affordability, gradually increasing the adoption of mid-range basis weight options in the market.

31 to 40 GSM offers higher durability, supporting repeated use and heavier content. This weight range appeals to niche segments seeking strong, long-lasting bags. Gradual innovations in material composition allow better performance without significantly increasing costs, attracting select commercial buyers.

Above 40 GSM represents a small but growing segment for highly durable and reusable magazine bags. This weight category is suitable for luxury or specialized retail products, addressing consumer needs for long-term usability and premium packaging solutions.

By Sales Channel Analysis

Online dominates with 65.5% due to convenience and broader reach.

In 2024, Online held a dominant market position in the By Sales Channel Analysis segment of Magazine and Literature Bag Market, with a 65.5% share. The segment benefits from easy accessibility, wide product variety, and growing e-commerce penetration, making it the preferred purchase channel for consumers globally.

Offline sales continue to hold relevance, especially in retail stores, supermarkets, and specialty outlets. Customers still value tactile inspection and immediate product availability. Although the share is lower, offline channels support brand visibility and cater to regions with limited online penetration, sustaining a steady market presence.

Key Market Segments

By Material

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Other

By Basis Weight

- Up to 25 GSM

- 25 to 30 GSM

- 31 to 40 GSM

- Above 40 GSM

By Sales Channel

- Online

- Offline

Drivers

Rising Circulation of Educational Content Supporting Literature Bag Demand

The growing circulation of educational materials is driving demand for literature bags. Schools, colleges, and training centers are increasingly providing books, magazines, and study kits in customized bags. This trend is boosting the need for durable and convenient packaging solutions that protect educational content during distribution.

Corporate gifting and promotional activities are creating further opportunities. Businesses are using literature bags to distribute printed kits, magazines, and marketing materials. High-quality, branded bags are preferred for creating a lasting impression among clients and employees, supporting overall market growth.

Magazine subscription services are expanding rapidly. Many publishers now deliver periodicals and print materials directly to subscribers. This has increased the need for sturdy and attractive literature bags to ensure safe delivery while maintaining the brand’s image.

Retail marketing activities are also contributing to market growth. Companies are offering branded literature bags as part of promotional campaigns. These bags are used to package magazines, catalogs, and gift items, which enhances brand visibility and customer engagement.

Restraints

Limited Material Options and Technology Adoption Challenges Restrict Market Growth

The Magazine and Literature Bag market faces challenges due to the limited availability of high-strength sustainable materials. Manufacturers often struggle to source eco-friendly materials that can withstand heavy loads, which restricts the production of durable and reusable bags. This limitation affects both cost efficiency and product quality.

Sustainable alternatives, such as bioplastics or recycled fabrics, are not widely available in large quantities. As a result, many producers rely on conventional materials that may not meet the growing consumer demand for eco-conscious products. This gap slows the market’s transition toward greener solutions.

Another restraint is the slower adoption of advanced printing technologies in traditional publishing markets. Customization and high-quality branding on literature bags are increasingly important, but many publishers and bag manufacturers are yet to integrate modern digital printing methods.

The lag in technology adoption limits innovation in design and personalization, reducing the appeal of bags in promotional or subscription contexts. As a result, the market growth is constrained, especially for premium and branded literature bag segments.

Growth Factors

Rising Demand for Premium Printed Bags Drives Market Growth

The demand for premium printed bags in luxury magazine distribution is creating significant growth opportunities. Publishers and brands are increasingly seeking high-quality, visually appealing bags to enhance customer experience. This trend allows bag manufacturers to offer customized designs and innovative printing techniques.

Expansion of retail bookstores is also fueling market growth. As more bookstores focus on providing a personalized shopping experience, they require literature bags with custom designs. These orders create a steady demand for small and large-scale production of stylish, functional bags.

Sustainability is becoming a major factor in the market. The growing adoption of biodegradable materials for bag manufacturing attracts environmentally conscious consumers. Brands are investing in eco-friendly options, creating opportunities for manufacturers to innovate with compostable and reusable materials.

Designer collaborations are further boosting growth in specialty literature packaging. Limited-edition bags created in partnership with artists or designers appeal to collectors and premium buyers. These collaborations not only enhance brand value but also drive higher profit margins for bag producers.

Emerging Trends

Shift Toward Minimalist and Artistic Bag Designs Drives Market Trends

The magazine and literature bag market is witnessing a clear shift toward minimalist and artistic designs. Brands are increasingly using simple yet creative designs to enhance visual appeal and connect with consumers. This trend helps in building brand recognition while keeping production costs manageable.

Another significant factor is the growing use of water-resistant laminated finishes. These coatings make magazine bags more durable and long-lasting, ensuring that publications remain protected during transit and storage. Durability is becoming a key selling point for both publishers and consumers.

Smart tracking labels are also gaining popularity. These labels allow publishers and retailers to monitor bag distribution and inventory efficiently. By integrating smart technology, literature bags are becoming more than just packaging—they are turning into tools for better supply chain management.

Additionally, reusable tote-style literature bags are increasingly favored by consumers. These bags not only promote sustainability but also offer practical everyday use. The rise in eco-conscious behavior is encouraging publishers and retailers to adopt designs that can be reused, creating a positive brand image and enhancing customer loyalty.

Regional Analysis

North America Dominates the Magazine and Literature Bag Market with a Market Share of 38.9%, Valued at USD 42.4 Million

In 2024, North America held a dominant position in the Magazine and Literature Bag Market, driven by strong corporate gifting activities and expanding magazine subscription services. The region accounted for a significant 38.9% share of the market, with a valuation of USD 42.4 Million. Rising retail marketing campaigns and promotional print media kits have further strengthened demand. Consumers increasingly prefer premium and reusable literature bags, supporting steady growth across major urban centers.

Europe Magazine and Literature Bag Market Trends

Europe demonstrates stable growth, supported by high adoption of designer collaboration bags and sustainable materials. The market is witnessing increasing demand for printed literature bags in bookstores and promotional campaigns. Rising focus on eco-friendly and reusable tote-style bags is boosting overall market penetration, while technological adoption in packaging solutions continues to enhance product appeal.

Asia Pacific Magazine and Literature Bag Market Trends

Asia Pacific is showing rapid growth due to expanding retail bookstores and rising literacy programs. Increasing urbanization and promotional activities in corporate and educational sectors are driving the market. Consumers are increasingly inclined toward smart tracking and durable laminated literature bags. The region presents substantial opportunities for sustainable and reusable bag offerings.

Middle East and Africa Magazine and Literature Bag Market Trends

The Middle East and Africa market is gradually growing with rising awareness about premium packaging for literature and magazines. Demand is supported by corporate gifting and niche promotional campaigns. Adoption of reusable and designer collaboration bags is improving, although slower penetration of advanced printing technologies limits market expansion.

Latin America Magazine and Literature Bag Market Trends

Latin America exhibits moderate growth in the literature bag segment, largely driven by retail bookstore expansion and magazine distribution. Consumers are increasingly adopting water-resistant and durable bag designs. However, slower infrastructure development and limited access to high-strength sustainable materials slightly restrain market growth compared to other regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Magazine and Literature Bag Company Insights

In 2024, the global magazine and literature bag market is shaped by evolving consumer demand for practical yet premium storage solutions. Rising demand in both corporate gifting and lifestyle retail channels has increased competition among suppliers.

BCW remains a dominant force thanks to its broad product portfolio tailored for corporate and promotional clients. Its advantage lies in reliable supply chains and consistent quality factors that help it maintain stable order volumes globally. BCW’s focus on customization for bulk clients continues to secure recurring contracts.

ULINE has carved out a niche through aggressive distribution networks, providing rapid turnaround and competitive pricing. Its strength is in catering to small and medium enterprise needs, offering magazine bags and literature sleeves in smaller batch sizes making it a go‑to for businesses seeking flexibility and speed. This agility helps it compete against larger manufacturers.

E. Gerber distinguishes itself via premium craftsmanship and materials, appealing to clients looking for higher‑end literature bags. Its reputation for durability and finish quality has earned trust among organizations demanding a polished look. E. Gerber’s premium positioning supports stable margins even when demand fluctuates.

Ultra Pro leverages brand recognition in niche specialty retail segments, particularly among hobbyists and fans needing magazine sleeves or literature bags for collectibles. This targeted focus allows it to command higher per‑unit pricing and maintain loyal customer segments. Ultra Pro’s ability to blend functional design with brand-driven demand helps it stand out.

Top Key Players in the Market

- BCW

- ULINE

- E. Gerber

- Ultra Pro

- Samsonite

- Tumi

- American Tourister

- Travelpro

- Briggs & Riley

Recent Developments

- In February 2025, EP Group launched the RePapaPac high-strength biodegradable paper bag. This bag was chosen as the official visitor bag for Packaging Innovations & Empack 2025, highlighting the shift toward sustainable packaging solutions.

- In June 2025, Mondi introduced the re/cycle PaperPlus Bag Advanced, a sustainable, high-barrier paper bag. It is designed to protect humidity-sensitive products while significantly reducing plastic usage across packaging processes.

- In October 2025, ProAmpac acquired International Paper’s Bag Converting Operations. This strategic move expands ProAmpac’s global footprint and strengthens its capabilities in high-quality bag production.

- In November 2024, Amcor agreed to acquire Berry Global, aiming to create one of the largest global packaging firms. The merger enhances product innovation, operational scale, and market reach worldwide.

Report Scope

Report Features Description Market Value (2024) USD 109.1 Million Forecast Revenue (2034) USD 164.6 Million CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polyethylene, Polypropylene, Polyvinyl Chloride, Other), By Basis Weight (Up to 25 GSM, 25 to 30 GSM, 31 to 40 GSM, Above 40 GSM), By Sales Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BCW, ULINE, E. Gerber, Ultra Pro, Samsonite, Tumi, American Tourister, Travelpro, Briggs & Riley Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Magazine and Literature Bag MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Magazine and Literature Bag MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BCW

- ULINE

- E. Gerber

- Ultra Pro

- Samsonite

- Tumi

- American Tourister

- Travelpro

- Briggs & Riley