Global Lyophilized Injectable Drugs Market By Drug Class (Anti-Infective, Antineoplastic, Diuretics, Proton Pump Inhibitor, and Others) By Indication (Oncology, Autoimmune Diseases, Hormonal Disorders, Respiratory Diseases, Gastrointestinal Disorders, and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 42355

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

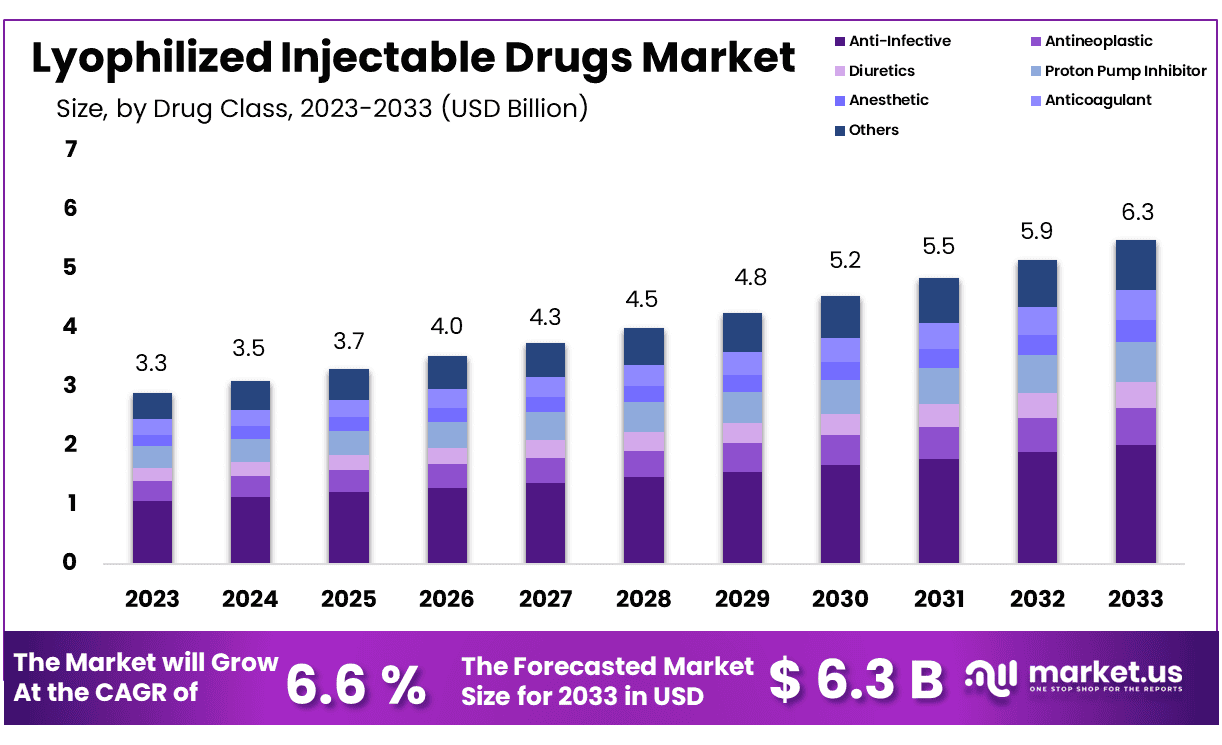

The Global Lyophilized Injectable Drugs Market size is expected to be worth around USD 6.3 Billion by 2033 from USD 3.3 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

Lyophilization is also known as the freeze-drying process in which the product is frozen and placed in a vacuum to remove water from the product. Lyophilization involves adjusting the solution’s temperature and pressure so that the solution phase can move directly from the frozen state to the gaseous state without moving through the liquid/state. Some typical drugs that undergo the lyophilization process include many active pharmaceutical ingredients (API), vaccines and antibodies, penicillin, blood plasma, proteins, enzymes, hormones, viruses, and bacteria.

Lyophilization can extend the shelf life, usually as long as two to five years, and reduces weight, making it easier to transport the product. The freeze-dried drug product is a lyophilized powder that can be reconstituted in a vial or prefilled syringe for self-administration by patients. Examples of freeze-dried biological products include many vaccines, such as typhoid vaccine, measles virus vaccine, cellular-derived vaccines, recombinant vaccines, and immunoglobulins. It consists of three interrelated stages, i.e., freezing, primary drying, and secondary drying.

Freezing is the first step in which water or solvent in the product gradually freezes through the cooling shelf. This creates ice crystals that separate from the drug product and are easier to remove by sublimation. In the second stage of freeze-drying, the sublimation process directly transforms solid ice into vapor without passing through the liquid phase. The vapor produced is collected by a condenser, and its temperature and pressure are lower than the product. The steam is thus converted back to ice on the surface of the condenser. The final stage of lyophilization is secondary drying (adsorption), during which ion-bound water molecules are removed by increasing the temperature above the temperature of the initial drying stage.

Key Takeaways

- Market Size: Lyophilized Injectable Drugs Market size is expected to be worth around USD 6.3 Billion by 2033 from USD 3.3 Billion in 2023.

- Market Growth: The market growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

- Drug Class Analysis: Anti-infectives stand out, taking up 32.3% of the market share.

- Indication Analysis: Oncology holds a substantial 29.2% market share within the Lyophilized Injectable Drugs Market.

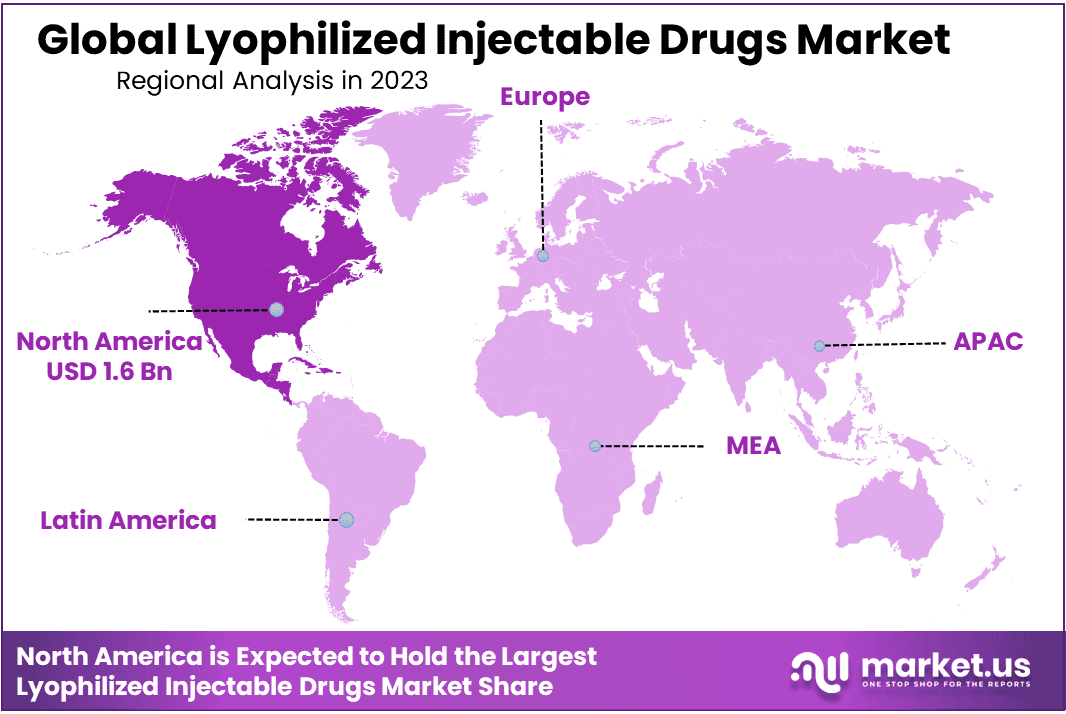

- Regional Analysis: North America holds the largest geographic market share with 48.1% and has generated USD 1.6 Billion in market revenue.

- Reaching Out Across Multiple Therapies: The market’s impact covers an array of therapeutic indications, from autoimmune diseases and hormonal issues to respiratory diseases, respiratory conditions, digestive disorders, dermatological conditions, and eye disorders.

- Medical Innovation Catalyst: The market serves as an incubator of medical innovation, specifically regarding pharmaceutical solutions that meet the evolving healthcare needs of multiple domains.

- Prevalence of Chronic Conditions: The market’s emphasis on therapeutic areas such as autoimmune and hormonal diseases as a response to rising prevalence rates worldwide for chronic health conditions can be seen as a response to their increasing presence.

Drug Class Analysis

The Lyophilized Injectable Drugs Market exhibits an exciting landscape, with various drug classes contributing to its expansion. Anti-infectives stand out, taking up 32.3% of the market share – an indication of global interest in effective treatments against infections – as their versatility and efficacy make them cornerstones of lyophilized injectable drugs market growth.

Antineoplastics for cancer treatment make up a large market segment, underlining their essential role in oncology therapies. Diuretics, Proton Pump Inhibitors, Anesthetics, Anticoagulants, NSAIDs, and Corticosteroids all play key roles in providing comprehensive offerings tailored to varied therapeutic needs and continue their expansion in healthcare today. The sustained demand for these drug classes highlights their critical nature within modern healthcare delivery.

Indication Analysis

Oncology holds a substantial 29.2% market share within the Lyophilized Injectable Drugs Market, making its prominence obvious. Furthermore, this dynamic industry encompasses various therapeutic indications, intending to meet healthcare challenges across multiple domains. Notable segments within this market include autoimmune diseases, hormonal disorders, respiratory illnesses, gastrointestinal conditions, dermatological problems, and ophthalmic conditions.

These indications together contribute to shaping the market’s trajectory, meeting critical medical needs, and driving advancements in lyophilized injectable drugs. With so many people suffering from conditions like autoimmune and hormonal diseases, innovative pharmaceutical solutions become even more essential. As the market changes, innovative research initiatives and strategic developments focused on providing more treatment options for these indications are projected to further bolster the lyophilized injectable drug sector, driving growth and innovation within therapeutic interventions.

Market Segments

Drug Class

- Anti-Infective

- Antineoplastic

- Diuretics

- Proton Pump Inhibitor

- Anesthetic

- Anticoagulant

- NSAID’s

- Corticosteroids

- Others

Indication

- Oncology

- Autoimmune Diseases

- Hormonal Disorders

- Respiratory Diseases

- Gastrointestinal Disorders

- Dermatological Disorders

- Ophthalmic Diseases

- Others

Drivers

Biologics in the Pharmaceutical Market

The recent surge in demand for lyophilized injectable drugs can be directly attributed to their increasing utilization in the pharmaceutical industry. Biologics require specific formulation techniques like lyophilization to enhance stability and increase shelf life, creating a significant market driver. This surge is contributing to its rise and driving forward its market.

Technological Advancements in Lyophilization

Continuous advances in lyophilization technologies play a pivotal role in market expansion. Innovations such as novel excipient development, optimized lyophilization cycles, and improvements to freeze-drying equipment improve manufacturing of injectable drugs with this process, thus serving as catalysts for market expansion.

Trends

Shift towards Personalized Medicine

One notable trend in the Lyophilized Injectable Drugs Market is its move toward personalized medicine. As the healthcare industry embraces individualized approaches for treatment, lyophilized formulations play a critical role in assuring stability and efficacy for personalized drug therapies; this trend is changing the landscape of pharmaceuticals as it influences the adoption of these injectable products.

Rising Adoption of Orphan Drugs

The market has witnessed an upward trend characterized by the increasing adoption of orphan drugs for rare diseases, often necessitating special formulations for stability and delivery. Lyophilization offers an effective solution by maintaining the integrity of such medications; making this trend key in shaping market dynamics.

Restrictions

High Costs of Lyophilization

A major impediment to growth in the Lyophilized Injectable Drugs Market is its high production costs associated with lyophilization technology, its complex nature and the need for specialized equipment and skilled personnel resulting in elevated production expenses that impede widespread adoption, particularly in cost-sensitive markets.

Stringent Regulatory Requirements

Lyophilized injectable drugs face stringent regulatory requirements that add layer of complexity to their market. Meeting such stringent standards often necessitates substantial investments in quality control and assurance measures, potentially slowing development and commercialization processes.

Opportunities

Expanding Applications in Emerging Markets

The Lyophilized Injectable Drugs Market presents promising opportunities in emerging markets, as healthcare infrastructure improves and awareness increases regarding advanced drug formulations. A strategic entry into untapped markets may prove profitable to industry players.

R&D Investments for Innovative Formulations

The innovation lies within increased research and development investments focused on creating unique lyophilized formulations. Focusing R&D resources on creating differentiated products gives companies an advantage in seizing emerging opportunities within the competitive landscape.

Regional Analysis

North America holds the largest geographic market share with 48.1% and has generated USD 1.6 Billion in market revenue. North America stands out for its advanced healthcare infrastructure, robust research and development activities, and widespread prevalence of chronic diseases. This region’s leading market share can be attributed to its strong healthcare infrastructure, high disease burden, technological advances, and established regulatory framework.

Research and development initiatives combined with key pharmaceutical players playing an instrumental role in driving growth and innovation within the lyophilized injectable drug market are factors of growth and innovation that contribute to its leadership position.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

A comprehensive outline of the competitive landscape within the Lyophilized Injectable Drug Market has been presented, outlining key details about each competitor. This information includes company overviews, financial standings, revenue generation and market potential; investments made into R&D initiatives within new markets; production sites and facilities strengths/weaknesses assessments for production sites/facilities strengths and weaknesses assessments for product launches product trials ongoing product approval patents approval dominance applications life cycles curve. All data points related specifically to each competitor within Lyophilized Injectable Drug Market. some of the top player are

Market Key Players

- Schott AG

- CIRON Drugs & Pharmaceuticals Pvt. Ltd

- Mylan N.V.

- Baxter

- Vetter Pharma

- BD

- SHL Group

- Novartis AG

- B. Braun Melsungen AG

- Jubilant HollisterStier

Recent Developments

- Schott AG (March 2024): Schott AG introduced EVERIC freeze pharmaceutical glass vials, specifically designed for deep-cold applications. These vials enhance the stability and integrity of lyophilized drugs during storage and transport, addressing critical needs in the biopharmaceutical industry.

- CIRON Drugs & Pharmaceuticals Pvt. Ltd (April 2024): CIRON Drugs & Pharmaceuticals Pvt. Ltd opened a new state-of-the-art lyophilization facility in Mumbai, India. This facility aims to increase production capacity for lyophilized injectables, catering to the growing demand for stable and long-shelf-life injectable drugs in both domestic and international markets.

- Mylan N.V. Baxter (June 2024): Baxter acquired a leading lyophilization technology company to strengthen its capabilities in developing stable and efficient injectable drugs. This strategic acquisition is expected to bolster Baxter’s position in the global lyophilized injectables market and expand its product offerings.

- Vetter Pharma (February 2024): Vetter Pharma announced a strategic partnership with a leading biopharmaceutical company to develop and manufacture lyophilized biologics. This collaboration aims to leverage Vetter’s expertise in fill-and-finish processes to bring innovative biologic treatments to market efficiently.

- BD (Becton, Dickinson and Company) (January 2024): BD launched a new advanced lyophilization platform that integrates with their existing syringe technology. This innovation is designed to enhance the lyophilization process, ensuring better drug stability and efficacy for injectable medications.

- SHL Group (March 2024): SHL Group expanded its manufacturing capabilities with a new production line dedicated to lyophilized injectables. This expansion aims to meet the increasing demand for high-quality lyophilized drugs and support the development of new drug formulations.

Report Scope

Report Features Description Market Value (2023) USD 3.3 Billion Forecast Revenue (2033) USD 6.3 Billion CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Class-(Anti-Infective, Antineoplastic, Diuretics, Proton Pump Inhibitor, Anesthetic, Anticoagulant, NSAID’s, Corticosteroids, Others);By Indication-(Oncology, Autoimmune Diseases, Hormonal Disorders, Respiratory Diseases, Gastrointestinal Disorders, Dermatological Disorders, Ophthalmic Diseases, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Schott AG, CIRON Drugs & Pharmaceuticals Pvt. Ltd, Mylan N.V., Baxter, Vetter Pharma, BD, SHL Group, Novartis AG, B. Braun Melsungen AG, Jubilant HollisterStier Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Which therapeutic areas does the market cover?The market spans diverse therapeutic indications, including autoimmune diseases, hormonal disorders, respiratory diseases, gastrointestinal disorders, dermatological disorders, and ophthalmic diseases.

How big is the Lyophilized Injectable Drugs Market?The global Lyophilized Injectable Drugs Market size was estimated at USD 3.3 Billion in 2023 and is expected to reach USD 6.3 Billion in 2033.

What is the Lyophilized Injectable Drugs Market growth?The global Lyophilized Injectable Drugs Market is expected to grow at a compound annual growth rate of 6.6%. From 2024 To 2033

Who are the key companies/players in the Lyophilized Injectable Drugs Market?Some of the key players in the Lyophilized Injectable Drugs Markets are Schott AG, CIRON Drugs & Pharmaceuticals Pvt. Ltd, Mylan N.V., Baxter, Vetter Pharma, BD, SHL Group, Novartis AG, B. Braun Melsungen AG, Jubilant HollisterStier.

What role does the market play in medical innovation?The market serves as a crucial catalyst for medical innovation, actively advancing pharmaceutical solutions to address evolving healthcare challenges.

How does the market respond to the prevalence of chronic conditions?The market strategically focuses on therapeutic areas like autoimmune diseases and hormonal disorders, responding to the growing prevalence of chronic health conditions globally.

What factors contribute to sustained market growth and innovation?A combination of diverse therapeutic indications, ongoing research initiatives, and a commitment to development fuels sustained market growth and fosters continuous innovation in lyophilized injectable drugs.

Lyophilized Injectable Drugs MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Lyophilized Injectable Drugs MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Schott AG

- CIRON Drugs & Pharmaceuticals Pvt. Ltd

- Mylan N.V.

- Baxter

- Vetter Pharma

- BD

- SHL Group

- Novartis AG

- B. Braun Melsungen AG

- Jubilant HollisterStier