Global Luxury Smart Jewelry Market Size, Share, Growth Analysis By Age Group (Adult, Geriatric, Pediatric), By Product (Fitness Tracking, Stress and Mood Tracking, Heart Rate Monitoring, Sleep Tracking, Others), By Application (Smart Rings, Smart Bracelets, Smart Necklaces, Others), By Distribution Channels (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152127

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

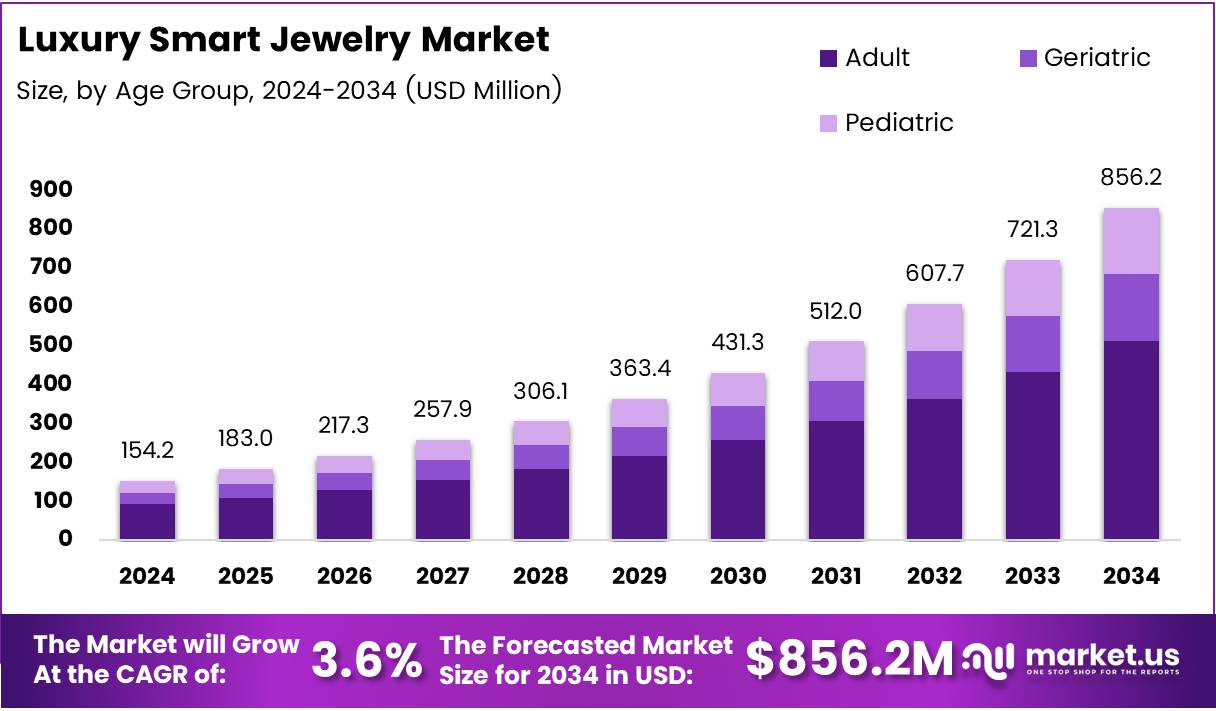

The Global Luxury Smart Jewelry Market size is expected to be worth around USD 856.2 Million by 2034, from USD 154.2 Million in 2024, growing at a CAGR of 18.7% during the forecast period from 2025 to 2034.

The Luxury Smart Jewelry market blends high-end fashion with advanced technology, offering innovative products that enhance both lifestyle and connectivity. This sector includes wearable devices such as smart rings, bracelets, and necklaces, which not only provide a luxurious appearance but also offer practical functionalities like fitness tracking, notifications, and health monitoring.

As wearable technology continues to gain popularity, luxury jewelry brands are leveraging this trend by incorporating these advanced features into their designs. The increasing demand for stylish yet functional wearable tech is driving the growth of this market, with consumers seeking more than just aesthetic appeal from their jewelry.

Growth in the Luxury Smart Jewelry market is significantly driven by shifting consumer preferences toward wearable technology. According to NationalJeweler, a survey revealed that 44% of consumers are open to purchasing wearable technology jewelry, with 13% of them being very likely and 31% somewhat likely to buy. This presents a promising opportunity for brands that can seamlessly blend aesthetics with functionality.

Consumers are increasingly seeking products that offer value beyond just looks, driving innovation in the sector. Furthermore, the strong economic resilience of the luxury jewelry market, particularly in regions like China, supports this growth. As reported by VogueBusiness, despite economic challenges, China’s luxury jewelry market saw a 22.1% year-on-year increase in sales of gold, silver, and jewelry, making it the fastest-growing product category in the consumer goods sector.

One of the major opportunities in this market lies in the rising purchasing power of Gen Z, who are anticipated to represent 30% of luxury purchases by 2030. This demographic is particularly drawn to bold and unconventional jewelry designs, as indicated by NuOrder.

The demand from younger consumers for innovative, personalized, and tech-integrated jewelry is expected to spur further development in the Luxury Smart Jewelry sector. Brands that cater to these preferences, integrating fashion-forward designs with smart features, will likely capture a significant share of this market.

Government investments and regulations are also playing a crucial role in shaping the future of this market. Regulatory frameworks ensuring product safety, data protection, and ethical sourcing are becoming increasingly stringent. Governments across regions are setting standards for wearables, which are positively influencing market growth by ensuring consumer confidence.

Additionally, government-backed initiatives for technological innovation and digital health are fostering an environment conducive to the integration of smart features into luxury jewelry.

Key Takeaways

- Global Luxury Smart Jewelry Market is expected to reach USD 856.2 Million by 2034, growing at a CAGR of 18.7% from 2025 to 2034.

- Adult segment leads in the By Age Group Analysis with 48.1% share, driven by interest in wearable tech and luxury preferences.

- Fitness Tracking dominates the By Product Analysis with 31.8% share, reflecting the demand for stylish, health-tracking jewelry.

- Smart Rings hold the largest share in By Application Analysis with 43.1%, favored for their compact design and versatility.

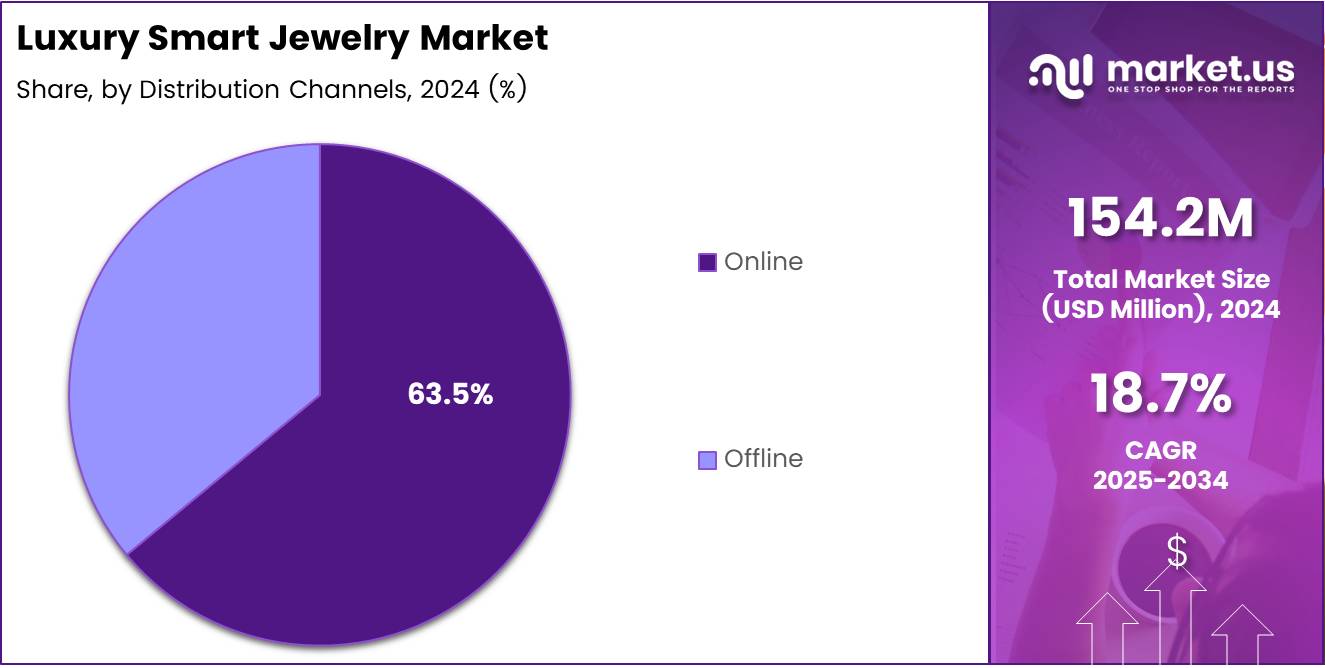

- Online channels lead the By Distribution Channels Analysis with 63.5% share, benefiting from ease of comparison and global accessibility.

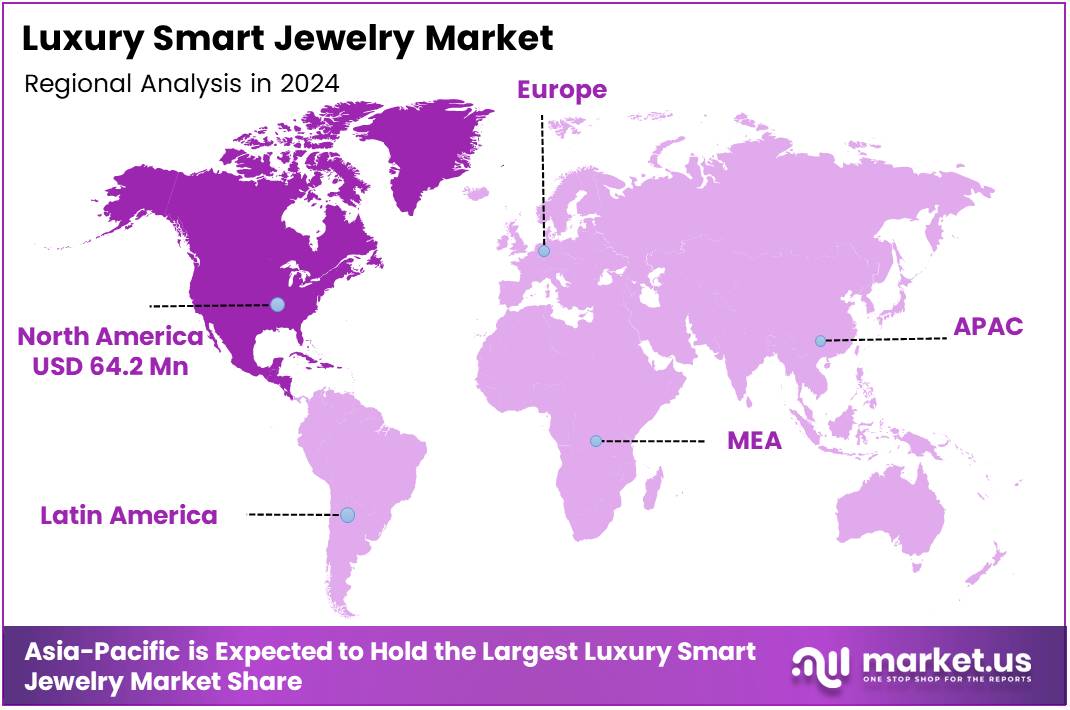

- North America dominates the market with 41.6% share and a valuation of USD 64.2 Million, supported by high consumer spending and digital infrastructure.

Age Group Analysis

Adult dominates with 48.1% due to higher purchasing power and lifestyle alignment.

In 2024, Adult held a dominant market position in By Age Group Analysis segment of Luxury Smart Jewelry Market, with a 48.1% share. This dominance is largely attributed to this group’s increased interest in premium wearable tech that aligns with both their health tracking needs and luxury preferences.

The Geriatric segment is steadily gaining traction, driven by rising health awareness and the integration of heart rate and stress monitoring features in luxury smart jewelry. However, its adoption remains lower than that of the adult group.

Pediatric users represent a niche segment. While safety and health monitoring features appeal to parents, the overall demand remains modest due to lower discretionary spending and limited product offerings tailored for children.

Product Analysis

Fitness Tracking leads with 31.8% as users prioritize health-centric features in luxury wearables.

In 2024, Fitness Tracking held a dominant market position in By Product Analysis segment of Luxury Smart Jewelry Market, with a 31.8% share. Consumers are increasingly choosing products that combine elegant design with robust activity-tracking capabilities, making fitness-centric smart jewelry the preferred option.

Stress and Mood Tracking is emerging as a significant category, especially among urban professionals seeking holistic wellness. However, it trails Fitness Tracking due to relatively limited user awareness.

Heart Rate Monitoring maintains a consistent demand, particularly among health-conscious adults and older users. Sleep Tracking also shows promise as more users recognize the role of rest in overall wellness. The Others category, while minor, includes niche functionalities that could gain future relevance.

Application Analysis

Smart Rings dominate with 43.1% for blending functionality with fashion-forward design.

In 2024, Smart Rings held a dominant market position in By Application Analysis segment of Luxury Smart Jewelry Market, with a 43.1% share. The compact form factor, aesthetic versatility, and multi-functionality have driven their appeal across diverse age groups.

Smart Bracelets follow closely, often favored by fitness enthusiasts who seek more screen space and additional functionalities. However, they slightly lag behind rings in terms of style integration and discrete wearability.

Smart Necklaces cater to niche luxury buyers and those preferring a pendant-style wearable. While stylish, their functionality often falls short compared to rings and bracelets. The Others category includes emerging formats, yet adoption remains limited.

Distribution Channels Analysis

Online leads with 63.5% due to convenience and broader product accessibility.

In 2024, Online held a dominant market position in By Distribution Channels Analysis segment of Luxury Smart Jewelry Market, with a 63.5% share. The dominance is fueled by the ease of comparing brands, access to global marketplaces, and exclusive online launches.

Consumers increasingly prefer digital channels for purchasing wearable luxury items, driven by personalized recommendations, virtual try-on features, and direct-to-consumer models.

The Offline segment still plays a vital role, particularly in delivering a tactile shopping experience and brand trust through physical stores. However, it continues to lag due to limited reach and the growing preference for seamless digital shopping journeys.

Key Market Segments

By Age Group

- Adult

- Geriatric

- Pediatric

By Product

- Fitness Tracking

- Stress and Mood Tracking

- Heart Rate Monitoring

- Sleep Tracking

- Others

By Application

- Smart Rings

- Smart Bracelets

- Smart Necklaces

- Others

By Distribution Channels

- Online

- Offline

Drivers

Increasing Demand for High-Tech Wearable Devices Drives Market Growth

The demand for luxury smart jewelry is rising as more consumers seek wearable technology that combines style and functionality. Today’s buyers are interested in smart rings, necklaces, and bracelets that can track health metrics, manage notifications, or even make contactless payments—all without compromising on design.

Luxury and fashion brands are also playing a key role in this growth. Well-known labels are teaming up with tech firms to create stylish smart jewelry that blends innovation with prestige. This growing influence is making tech products more appealing to fashion-conscious consumers who previously may not have been interested in wearables.

Meanwhile, improvements in battery life and sensor accuracy are making luxury smart jewelry more reliable and user-friendly. New devices are slimmer, more comfortable, and can last longer on a single charge. These advancements are helping brands overcome some of the earlier limitations in design and functionality.

Restraints

Privacy Concerns Related to Data Collection and Security Limit Market Growth

One major challenge for the luxury smart jewelry market is data privacy. Many of these devices collect sensitive personal information, like health data or location details. Consumers are becoming more aware and cautious about how their data is used and stored, which may discourage purchases.

Another issue is the lack of standardization across smart jewelry devices. Different brands use different software systems and connectivity methods. This can create compatibility problems for users who want seamless syncing with other devices, such as smartphones or fitness apps.

Additionally, awareness of smart jewelry among traditional jewelry buyers remains limited. Many consumers still associate luxury jewelry with classic styles and are not fully aware of the added benefits that smart features can bring. This gap in awareness could slow market adoption, especially among older or less tech-savvy audiences.

Growth Factors

Expansion of Luxury Brand Partnerships with Tech Companies Creates New Market Opportunities

The luxury smart jewelry market is seeing promising growth opportunities through collaborations between high-end fashion brands and tech firms. These partnerships allow companies to design smart wearables that are not only functional but also stylish and premium in appearance—attracting both tech lovers and fashion-conscious consumers.

Another exciting area is health-tracking integration. Luxury smart jewelry is evolving beyond just notifications to include features like heart rate monitoring, sleep tracking, and stress management. This opens up the market to health-aware users who value both wellness and aesthetics.

Emerging markets also offer huge potential. As wealth increases and smartphone use expands in countries like India, China, and Brazil, there is a growing demand for premium wearable products. These regions are ripe for luxury brands looking to tap into new consumer bases.

Sustainability is also becoming a key trend. Consumers are more eco-conscious, and companies that develop smart jewelry with sustainable or recycled materials can differentiate themselves. This not only helps the planet but also adds a strong selling point for socially responsible buyers.

Emerging Trends

Increased Focus on Personalization and Customization Shapes Market Trends

Personalization is becoming a major trend in the luxury smart jewelry market. Consumers want products that reflect their individual tastes and lifestyles. From custom engravings to interchangeable bands and personalized tech settings, this demand is pushing brands to offer more unique and flexible options.

Smart jewelry is also gaining traction in the fitness and wellness space. Items like smart rings and bracelets are now used to track steps, monitor sleep, and even detect stress levels. This fusion of wellness and luxury design is making these products more attractive to health-focused consumers.

Another trend is the push for smart jewelry that connects seamlessly with smart home devices. People want their jewelry to do more than just look good—they want it to control lights, music, or security systems with just a tap or gesture. This type of integration is expected to drive future innovation in the space.

Finally, the blending of modern design with high-end technology is becoming a key factor. Brands are releasing elegant, minimalist pieces that hide advanced tech features inside, allowing users to stay stylish without sacrificing functionality.

Regional Analysis

North America Dominates the Luxury Smart Jewelry Market with a Market Share of 41.6%, Valued at USD 64.2 Million

North America holds the leading position in the luxury smart jewelry market, driven by high consumer spending power, strong demand for wearable technology, and an established digital infrastructure. The region’s dominance is further supported by early adoption trends and a growing inclination toward wellness-focused luxury products. With a market share of 41.6% and valuation of USD 64.2 Million, North America sets the benchmark in this rapidly evolving segment.

Europe Luxury Smart Jewelry Market Outlook

Europe represents a mature and steadily growing market, supported by a strong base of fashion-forward consumers and increasing awareness of wearable wellness technologies. The region is characterized by a blend of traditional jewelry preferences and openness to innovation, fueling interest in luxury smart jewelry. Growth is further propelled by sustainable product preferences and rising demand for personalized tech-driven accessories.

Asia Pacific Luxury Smart Jewelry Market Trends

The Asia Pacific region is emerging as a high-growth market due to a large, tech-savvy population and rising disposable incomes. Increasing urbanization and a strong affinity for smart devices are contributing to the market’s expansion. The region’s growth is further catalyzed by evolving fashion trends and the popularity of connected lifestyle products among younger consumers.

Middle East and Africa Luxury Smart Jewelry Market Insights

The Middle East and Africa region is witnessing gradual growth in the luxury smart jewelry market, influenced by rising digital awareness and increasing demand for high-end, multifunctional accessories. Affluent populations in major urban centers and a growing interest in wellness-driven luxury are contributing to regional adoption. However, the market remains nascent with ample room for expansion.

Latin America Luxury Smart Jewelry Market Overview

Latin America is developing as an emerging market for luxury smart jewelry, fueled by expanding e-commerce penetration and increasing consumer exposure to global fashion and technology trends. While adoption remains in early stages, countries in the region are showing growing interest in tech-infused personal accessories, creating opportunities for market expansion in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Luxury Smart Jewelry Company Insights

In 2024, the global Luxury Smart Jewelry Market continues to evolve, with several key players contributing to its dynamic growth. Motiv, Inc. has maintained a strong position with its discreet, ring-based fitness and security tracking products. Its sleek design and minimalist approach appeal to high-end consumers seeking function without compromising fashion.

Zepp Health Corporation, Ltd., known for integrating advanced biometric sensors into wearable technology, is focusing on premium smart accessories with enhanced health-monitoring capabilities. Their strategic move into luxury designs is gaining traction among affluent, health-conscious users.

Samsung, a global tech leader, remains a dominant force by integrating smart functionalities into traditional luxury wearables. Their continued innovation in health tracking and seamless connectivity within the Galaxy ecosystem keeps them relevant in the premium smart jewelry space.

Boat, while initially recognized for affordable electronics, is making a calculated entry into the luxury segment. By blending youthful design with smart technology, Boat is attempting to capture the aspirational urban market seeking stylish yet tech-driven wearables.

Overall, these key players are shaping a competitive and fast-growing segment, with each brand leveraging its unique strengths in technology, design, or branding to appeal to luxury consumers.

Top Key Players in the Market

- Motiv, Inc.

- Zepp Health Corporation, Ltd.

- Samsung

- Boat

- RINGLY

- Oura Health Oy

Recent Developments

- In Feb 2025, Limelight Diamonds secured $11 million in funding to expand its retail presence across India and globally. The investment is aimed at boosting its lab-grown diamond offerings and in-store experiences.

- In Dec 2024, pearls have acquired a new luster among young designers, becoming a contemporary favorite in luxury jewelry collections. This resurgence is driven by innovative designs and sustainable sourcing trends.

- In Jan 2024, three years into LVMH’s acquisition of Tiffany & Co., the brand has undergone a stylish transformation under new leadership. The merger has revitalized Tiffany’s image, aligning it closer with modern luxury aesthetics.

Report Scope

Report Features Description Market Value (2024) USD 154.2 Million Forecast Revenue (2034) USD 856.2 Million CAGR (2025-2034) 18.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Age Group (Adult, Geriatric, Pediatric), By Product (Fitness Tracking, Stress and Mood Tracking, Heart Rate Monitoring, Sleep Tracking, Others), By Application (Smart Rings, Smart Bracelets, Smart Necklaces, Others), By Distribution Channels (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Motiv, Inc., Zepp Health Corporation, Ltd., Samsung, Boat, RINGLY, Oura Health Oy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Luxury Smart Jewelry MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Luxury Smart Jewelry MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Motiv, Inc.

- Zepp Health Corporation, Ltd.

- Samsung

- Boat

- RINGLY

- Oura Health Oy