Global Luxury Pet Accessories Insurance Market Size, Share Analysis By Type of Insurance Coverage (Health Insurance, Accident & Injury Insurance, Theft or Loss Insurance, Others), By Type of Pet (Dogs, Cats, Other Pets), By Consumer Demographics (Wealthy Pet Owners, Millennials and Gen Z, Baby Boomers, Others), Distribution Channels (Direct Sales, Online Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155366

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- US Market Size

- Growth Drivers

- Trends and Innovations

- By Type of Insurance Coverage

- By Type of Pet

- By Consumer Demographics

- By Distribution Channels

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

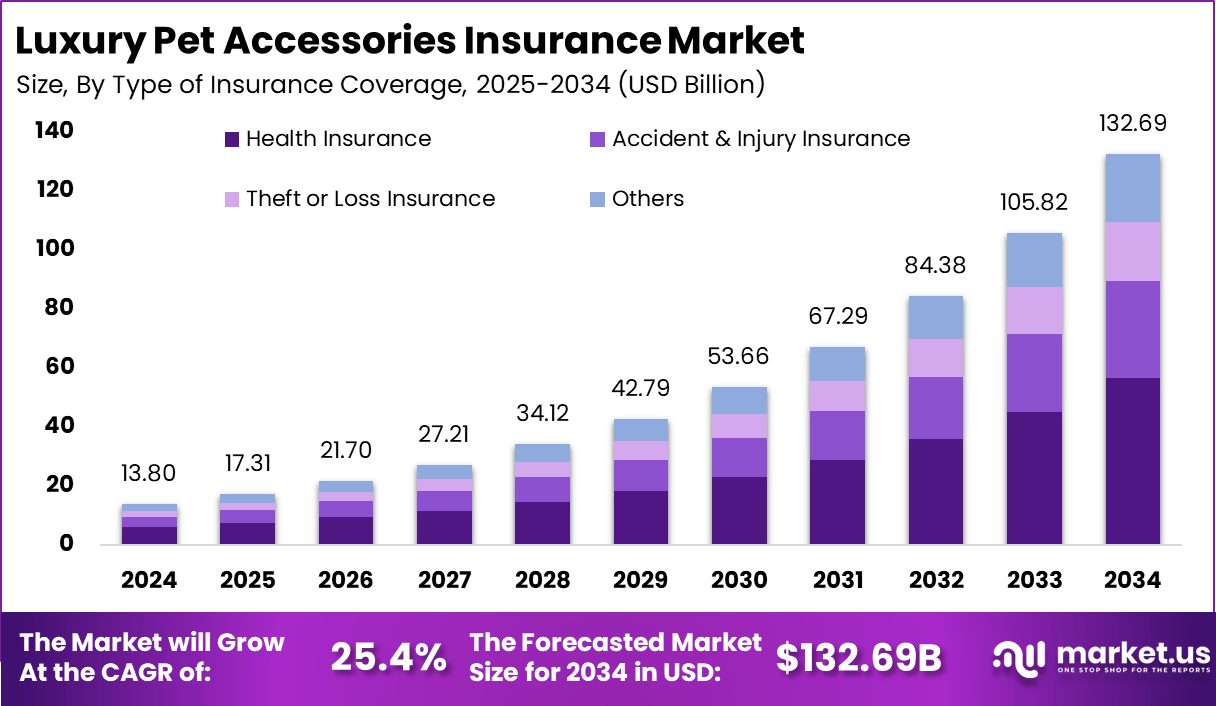

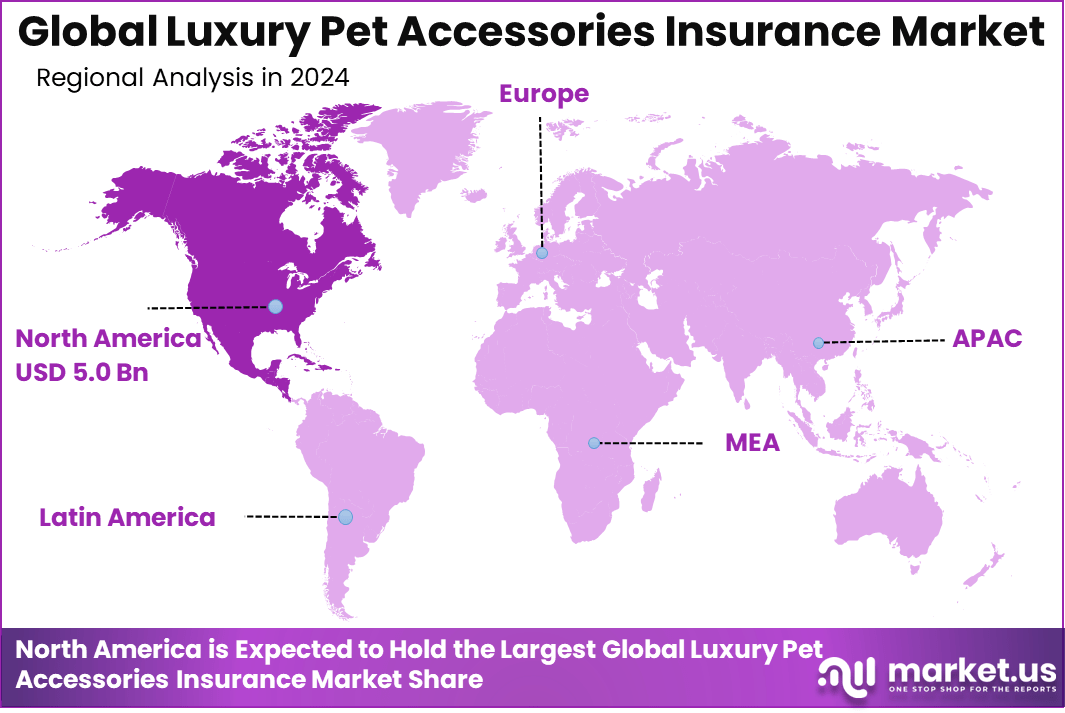

The Global Luxury Pet Accessories Insurance Market size is expected to be worth around USD 132.69 Billion By 2034, from USD 13.80 billion in 2024, growing at a CAGR of 25.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 36.7% share, holding USD 5.0 Billion revenue.

The Luxury Pet Accessories Insurance Market refers to specialized insurance products that cover premium accessories and high-end gear for companion animals, including designer collars, smart trackers, strollers, bespoke apparel, and travel carriers. Demand has been reinforced by pet humanization and the expansion of discretionary pet spending, with U.S. pet industry expenditures reaching $152 billion in 2024 across food, supplies, and veterinary service

Top driving factors for this market include the growing number of pet owners treating pets as family members, which fuels demand for premium products and associated insurance. The rise in disposable income and willingness to spend on high-quality, exclusive pet accessories also push demand for protection against loss, damage, or theft.

The growth of e-commerce and the luxury pet accessory market is creating opportunities for insurers to offer tailored policies for high-value items with costly replacements. The increasing adoption of digital platforms and mobile applications facilitates easy access to customized insurance products, enabling pet owners to add accessory coverage to their existing pet insurance policies or purchase standalone plans.

Key Insight Summary

- By coverage type, Health Insurance led with a 42.6% share, reflecting growing demand for premium medical protection for high-value pets, including advanced veterinary care and specialized treatments.

- By pet type, Dogs dominated at 40.4%, driven by their higher ownership rates among affluent households and greater spending on healthcare and accessories.

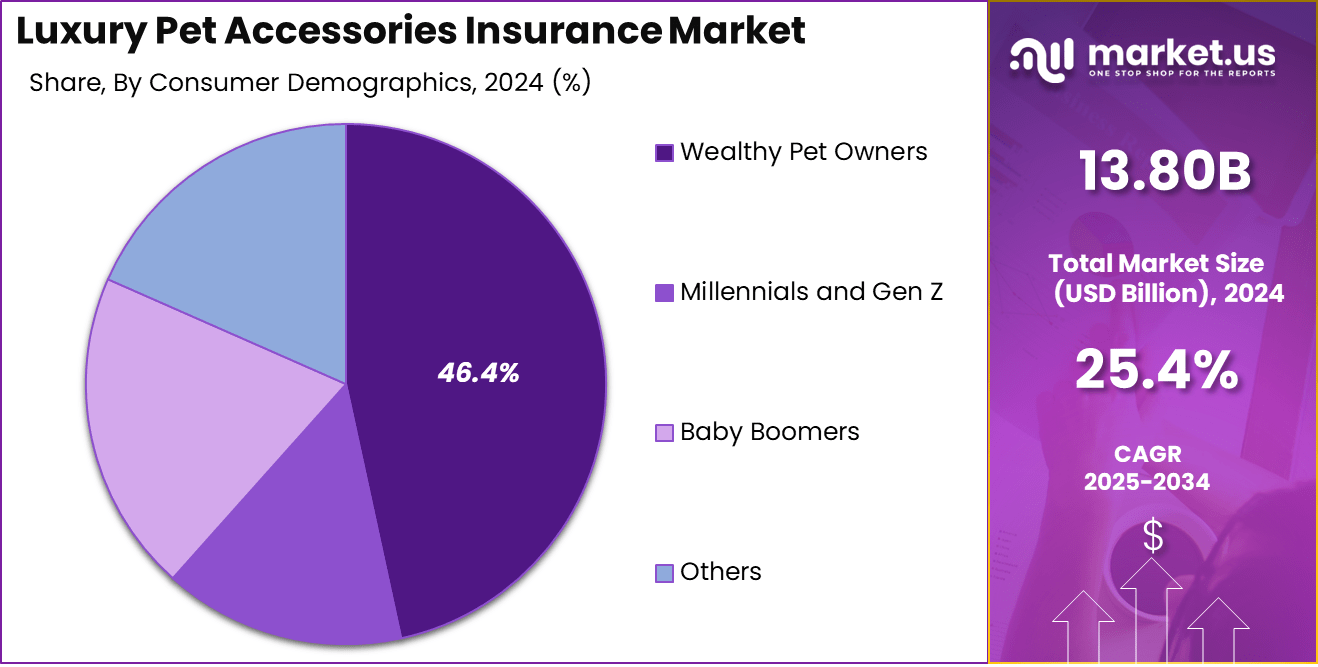

- By consumer demographics, Wealthy Pet Owners accounted for the largest share at 46.6%, highlighting the market’s focus on high-income individuals willing to invest in comprehensive coverage.

- Direct Sales was the leading distribution channel with 58.9%, enabled by personalized policy offerings and direct relationships with premium pet care providers.

- North America captured 36.7% of the global market, supported by high pet ownership rates, strong insurance infrastructure, and a culture of premium pet care spending.

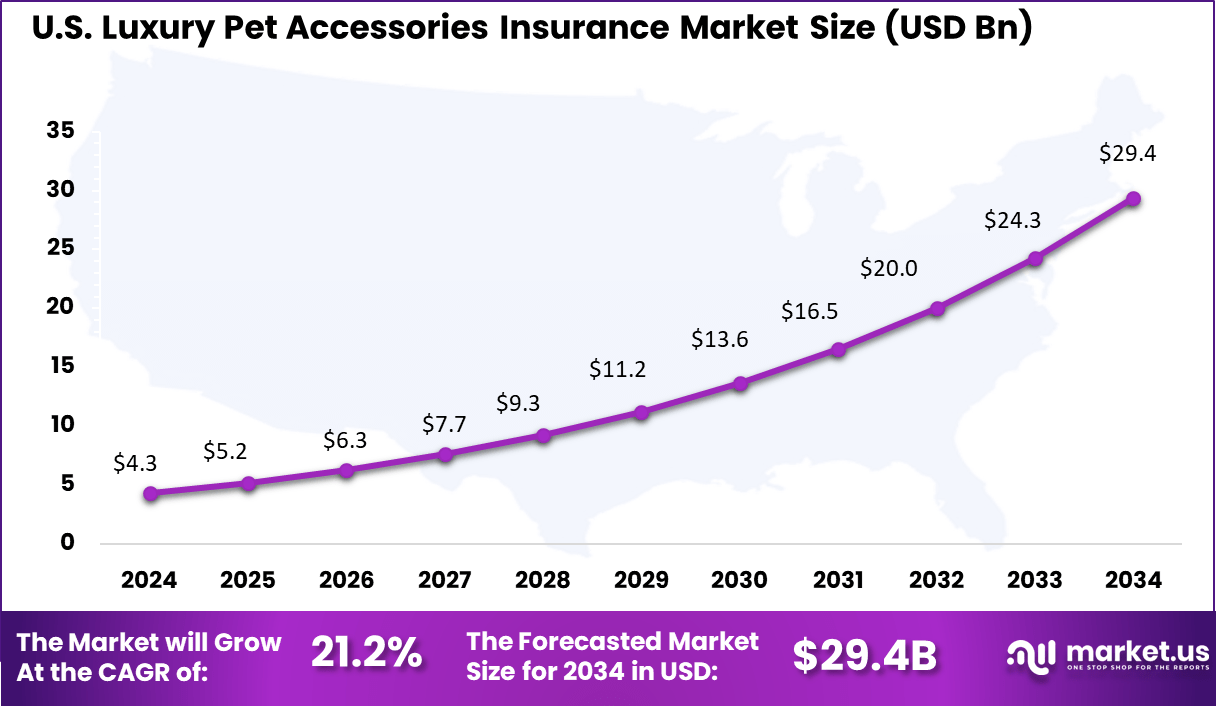

- The U.S. market was valued at USD 4.30 billion in 2024 and is forecasted to grow at a robust CAGR of 21.2%, driven by increasing demand for exclusive pet wellness services and luxury coverage options.

US Market Size

The U.S. Luxury Pet Accessories Insurance Market was valued at USD 4.3 Billion in 2024 and is anticipated to reach approximately USD 29.4 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 21.2% during the forecast period from 2025 to 2034.

The United States leads the Luxury Pet Accessories Insurance Market primarily due to its strong culture of pet humanization and high discretionary spending on pet care. American consumers increasingly view pets as integral family members, resulting in greater willingness to invest in premium accessories and safeguard them through specialized insurance coverage.

In 2024, North America held a dominant market position, capturing more than 36.7% of the Luxury Pet Accessories Insurance Market and generating approximately USD 5.0 billion in revenue. This leadership is driven by the region’s high pet ownership rates, particularly in the United States, where pets are increasingly treated as family members.

The growing trend of premiumization in pet care, combined with the rising popularity of luxury pet accessories such as designer collars, custom carriers, and high-end bedding, has created a strong demand for specialized insurance coverage. Consumers are more willing to invest in protecting these high-value items, especially as pet-related spending continues to climb.

Growth Drivers

- Pet Humanization: Luxury pet insurance and accessories are fueled by the trend where pets are integral family members, prompting owners to invest in high-quality, fashionable, and well-protected products.

- Rising Disposable Incomes: Especially in urban and affluent segments, increasing incomes allow for premium purchases and insurance coverage.

- Social Media Influence: Celebrity endorsements and influencer promotion of luxury pet products boost demand.

- Technology Enablement: AI-enabled claims processing, wearable health monitors, and telehealth vet services add value to insurance offerings linked with luxury pet care.

- E-Commerce Expansion: Online platforms make luxury accessories and related insurance more accessible globally.

- Customization & Sustainable Options: Demand for eco-friendly, ethically made luxury products alongside personalized insurance policies meets evolving consumer preferences.

Trends and Innovations

- Tech-Enabled Accessories: Smart collars with GPS, health monitoring, and luxury pet tech are trending, with insurance providers increasingly offering coverage inclusive of such devices.

- AI and Predictive Analytics: Insurers use AI to adjust premiums based on pet lifestyle, genetic risks, and behavior, enabling dynamic, personalized pricing.

- Blockchain for Policy Transparency: Adoption of blockchain technology enhances trust, claims transparency, and fraud prevention.

- Collaborations with Luxury Brands: Partnerships between pet accessory companies and high-end fashion houses create exclusive lines and elevate market appeal.

- Wellness and Holistic Care Coverage: Insurance plans now often include comprehensive wellness and alternative therapies aligned with luxury pet care trends.

By Type of Insurance Coverage

In 2024, Health insurance represents 42.6% of the luxury pet accessories insurance market, indicating a strong demand for coverage that protects pets against medical expenses. This type of insurance typically includes veterinary care, treatments, surgeries, and preventive health services tailored to the unique needs of pets outfitted with luxury accessories. Owners seek to safeguard their pets’ well-being while protecting the substantial investment made in premium accessories and related care.

The prominence of health insurance within this market reflects the growing trend among pet owners to provide comprehensive healthcare coverage alongside high-end pet products. As luxury pet accessories become more popular, the need for insurance products that mitigate the costs of healthcare emergencies and ongoing medical care continues to rise.

By Type of Pet

In 2024, Dogs constitute 40.4% of the insured pet types in the luxury pet accessories insurance segment, underscoring their status as the most common recipients of such coverage. Dogs are often the primary beneficiaries of luxury accessories such as designer collars, clothing, and tech-enhanced gear, which can be costly to replace or repair.

This makes insurance an attractive option for protective measures against loss, damage, or health issues correlated with these investments. The focus on dogs aligns with their central role in the pet market, where owners frequently prioritize both the pet’s comfort and style. Insurance products tailored for dogs reflect the growing affluence and willingness of pet owners to spend extensively on their companions, ensuring both protection and luxury.

By Consumer Demographics

In 2024, Wealthy pet owners account for 46.6% of the consumer base in this market, highlighting a key demographic that drives demand for luxury pet accessories insurance. High-net-worth individuals often treat pets as family members and seek to combine style, comfort, and security by purchasing premium accessories accompanied by insurance coverage.

This demographic values the protection of both their pets and their invested luxury goods, emphasizing peace of mind and comprehensive risk management. The significant presence of affluent consumers underscores the luxury segment’s niche appeal and the customization of insurance products to meet their unique expectations.

By Distribution Channels

In 2024, Direct sales account for 58.9% of distribution channels in the luxury pet accessories insurance market, reflecting a preference for direct engagement between insurers and affluent customers. This channel enables personalized communication, customized policy offerings, and enhanced service experiences that are valued in the luxury market.

Insurers using direct sales can build closer relationships with consumers, offering tailored advice and fast claim processing. The dominance of direct sales also supports effective brand positioning and customer loyalty by delivering exclusive benefits and premium service. This approach aligns well with the expectations of wealthy pet owners, who often prefer transparent, direct interactions over intermediary-based channels.

Key Market Segments

By Type of Insurance Coverage

- Health Insurance

- Accident & Injury Insurance

- Theft or Loss Insurance

- Others

By Type of Pet

- Dogs

- Cats

- Other Pets

By Consumer Demographics

- Wealthy Pet Owners

- Millennials and Gen Z

- Baby Boomers

- Others

Distribution Channels

- Direct Sales

- Online Platforms

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Growing Pet Humanization and E-Commerce Expansion

A primary growth driver in the luxury pet accessories market is the deepening trend of pet humanization, where pets are viewed as family members deserving of high-quality, personalized products. This emotional connection motivates owners to invest in luxury collars, designer apparel, and custom bedding, reflecting their commitment to pet comfort and style.

At the same time, rising disposable incomes globally enable consumers to allocate more expenditure to premium pet items. The burgeoning e-commerce landscape further accelerates market growth by broadening access to luxury brands and enabling convenient discovery and purchase of exclusive accessories worldwide.

E-commerce platforms not only enhance visibility for niche and luxury brands but also facilitate global expansion by overcoming traditional distribution barriers. This democratization of access allows more pet owners to experience premium products, fueling overall demand. Combined, these factors form a robust foundation for sustained market expansion, with innovation in product design and seamless online shopping experiences acting as key enablers.

Restraint Analysis

High Costs and Economic Sensitivities

Despite strong demand, the luxury pet accessories market faces notable restraints due to the high price points associated with premium materials and craftsmanship. These costs limit the market primarily to affluent consumers, restricting broader adoption among pet owners with tighter budgets, especially in economically volatile times.

Economic uncertainties or downturns often prompt consumers to prioritize essential pet care needs over discretionary luxury purchases, impacting sales of high-end accessories. Additionally, limited exposure and awareness in emerging markets pose challenges for wider penetration.

In regions where luxury pet products are relatively new or less culturally ingrained, consumer hesitation and lack of familiarity restrict growth potential. The ongoing need to justify premium pricing amid growing competition further pressures brands to continually innovate and demonstrate distinct value to their customers.

Opportunity Analysis

Personalized and Sustainable Products in Emerging Markets

The luxury pet accessories market holds promising opportunities, particularly in offering personalized, custom-designed products that cater to unique pet and owner preferences. Demand for bespoke collars, beds, and apparel continues to rise as consumers seek exclusive items that showcase individuality and affection for their pets.

Moreover, the push toward sustainability offers an attractive avenue for differentiation by developing eco-friendly accessories crafted from recycled or biodegradable materials, appealing to environmentally conscious buyers. Emerging markets, especially in Asia-Pacific and Latin America, present significant growth prospects due to increasing pet ownership and rising incomes.

Brands that can effectively educate and engage these new consumers while delivering products aligned with local tastes and values stand to capture new revenue streams. Expanding social media influence and celebrity endorsements further boost market visibility, accelerating acceptance and enthusiasm for luxury pet products.

Challenge Analysis

Intense Competition and Supply Chain Vulnerabilities

The luxury pet accessories market confronts considerable challenges from intensifying competition among numerous premium brands striving for market share. Maintaining product differentiation amid saturation requires ongoing innovation in design, materials, and technology, which can be costly and resource-intensive. Without distinct features or strong brand identity, companies risk commoditization and price erosion.

Supply chain disruptions represent another critical hurdle, affecting timely access to high-quality raw materials essential for luxury products. These disruptions can cause production delays, increased costs, and difficulty meeting consumer demand. Building consistent global brand recognition is also complex due to cultural diversity and varying consumer preferences, which can limit international expansion efforts.

Competitive Analysis

HDFC ERGO General Insurance Company Limited and Bajaj Allianz have established strong positions in the luxury pet accessories insurance market by offering comprehensive policies that cater to high-value pet items. Their products emphasize risk coverage for theft, loss, or damage, along with flexible premium structures suited for luxury product owners.

PawsIndia and Shodashi Sutras Private Limited contribute to market expansion through integrated offerings that combine premium pet accessories with insurance coverage, creating value-added propositions for affluent pet owners and enhancing market reach.

SMC Insurance and Embrace Pet Insurance Agency, LLC have focused on product differentiation and service innovation to meet evolving consumer expectations. Okbima and United States Fire Insurance Company leverage digital platforms to simplify policy management, streamline claims processing, and enhance customer engagement.

ManyPets, Inc., PetPartners, Inc., and Supertails are driving awareness through targeted marketing campaigns and partnerships with pet lifestyle brands. Their approach combines customer education with value-driven coverage options, ensuring policyholders understand the benefits of insuring luxury pet items.

Top Key Players in the Market

- HDFC ERGO General Insurance Company Limited

- Bajaj Allianz

- PawsIndia

- Shodashi Sutras Private Limited

- SMC INSURANCE

- Embrace Pet Insurance Agency, LLC

- Okbima

- United States Fire Insurance Company

- ManyPets, Inc.

- PetPartners, Inc.

- Supertails

- Others

Recent Developments

- Bajaj Allianz made a significant move in March 2025 by acquiring the remaining 26% stake from Allianz, ending a 24-year joint venture. This acquisition gives Bajaj Finserv full ownership of Bajaj Allianz General and Life Insurance Companies. This strategic consolidation is expected to fuel independent insurance initiatives and the adoption of next-gen insurance technologies, which could include niche products such as luxury pet accessories insurance

- HDFC ERGO General Insurance launched an innovative digital platform in late 2024, enabling faster, personalized insurance solutions across various segments including commercial and retail products. This technological upgrade positions them to better serve diverse customer needs with affordable and accessible insurance options, potentially extending to specialized categories like luxury pet accessories.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Insurance Coverage (Health Insurance, Accident & Injury Insurance, Theft or Loss Insurance, Others), By Type of Pet (Dogs, Cats, Other Pets), By Consumer Demographics (Wealthy Pet Owners, Millennials and Gen Z, Baby Boomers, Others), Distribution Channels (Direct Sales, Online Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape HDFC ERGO General Insurance Company Limited, Bajaj Allianz, PawsIndia, Shodashi Sutras Private Limited, SMC INSURANCE, Embrace Pet Insurance Agency, LLC, Okbima, United States Fire Insurance Company, ManyPets, Inc., PetPartners, Inc., Supertails, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Luxury Pet Accessories Insurance MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Luxury Pet Accessories Insurance MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- HDFC ERGO General Insurance Company Limited

- Bajaj Allianz

- PawsIndia

- Shodashi Sutras Private Limited

- SMC INSURANCE

- Embrace Pet Insurance Agency, LLC

- Okbima

- United States Fire Insurance Company

- ManyPets, Inc.

- PetPartners, Inc.

- Supertails

- Others