Global Luxury Furniture Market By Raw Material(Wood, Plastic, Metal, Others), By End-user(Residential, Commercial), By Distribution Channel(Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133237

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

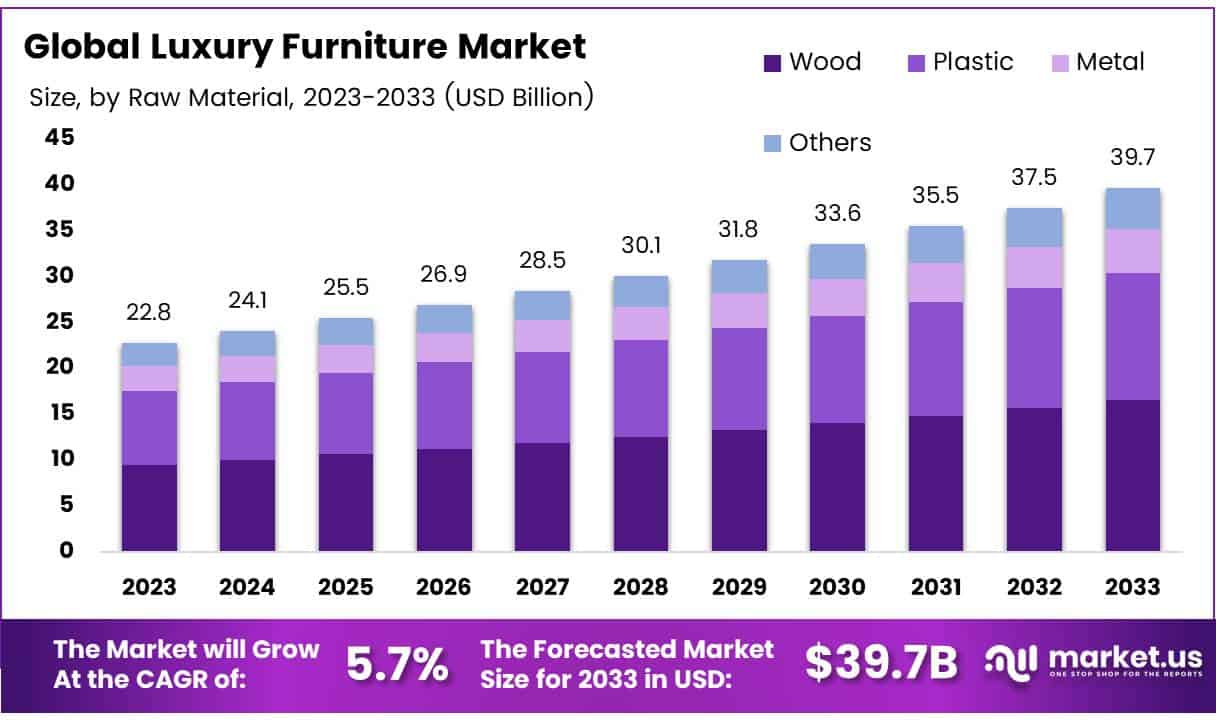

The Global Luxury Furniture Market size is expected to be worth around USD 39.7 Billion by 2033, from USD 22.8 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

Luxury furniture is characterized by its superior craftsmanship, high-quality materials, and distinctive designs that offer both aesthetic appeal and lasting value. These pieces often incorporate exotic woods, precious metals, and artisan techniques that set them apart from standard furniture offerings.

The luxury furniture market refers to the commercial arena where these high-end furniture products are traded. This market caters to a niche clientele that prioritizes exclusivity, design, and quality over cost. It serves various segments, including residential, commercial, and hospitality industries, each demanding unique styles and functionalities that reflect opulence and comfort.

The luxury furniture market is experiencing significant growth, driven by increasing disposable incomes and a growing emphasis on living standards and home décor among the affluent classes.

As global wealth distribution expands, more consumers are willing to invest in luxury items that signify status and offer enhanced quality. Additionally, the rise in luxury real estate developments and premium hospitality sectors worldwide fuels demand for high-end furniture that complements the sophisticated environments of these spaces.

Government policies and investments play a pivotal role in shaping the luxury furniture market. Several governments are promoting local furniture industries through subsidies and tax benefits, which encourage domestic production and enhance competitiveness in international markets.

Additionally, regulations concerning sustainable practices and material sourcing are becoming stricter, compelling manufacturers to innovate with eco-friendly materials and processes.

This regulatory environment not only ensures product safety and sustainability but also influences design and production standards across the market, ensuring that luxury furniture not only meets aesthetic and functional criteria but also adheres to environmental and ethical standards.

Recent trends in adjacent luxury markets, such as luxury watches, provide insightful parallels for understanding consumer behavior in the luxury furniture segment.

For instance, a noticeable shift towards pre-owned luxury items, highlighted by the Financial Times, reveals that nearly 20% of Generation Z consumers are considering purchasing luxury watches in the upcoming year. This trend towards high-end, pre-owned goods could mirror similar patterns in the luxury furniture market, where vintage pieces and antique furniture are gaining popularity among younger consumers who value both luxury and sustainability.

Furthermore, data from WatchCharts indicates that certified pre-owned luxury items, such as Rolex watches, command a premium of about 27% over non-certified items in North America, with prices averaging around $23,510. This premium underscores the significant value placed on authenticity and certification, which could translate into the luxury furniture market as consumers increasingly seek assurance of quality and authenticity in their high-end furniture purchases.

Additionally, insights from a Boston Consulting Group study, as reported by WatchPro, reveal that 77% of luxury watch enthusiasts, predominantly male, are significant contributors to the robust growth of the pre-owned luxury watch market. This demographic insight could inform targeted marketing strategies in the luxury furniture sector, where understanding the preferences and purchasing power of key consumer segments can optimize product offerings and marketing campaigns.

Key Takeaways

- Global Luxury Furniture Market projected to grow from USD 22.8 Billion in 2023 to USD 39.7 Billion by 2033, at a CAGR of 5.7%.

- Wood dominates the Luxury Furniture Market by raw material with a 65.7% share in 2023, favored for its durability and natural aesthetics.

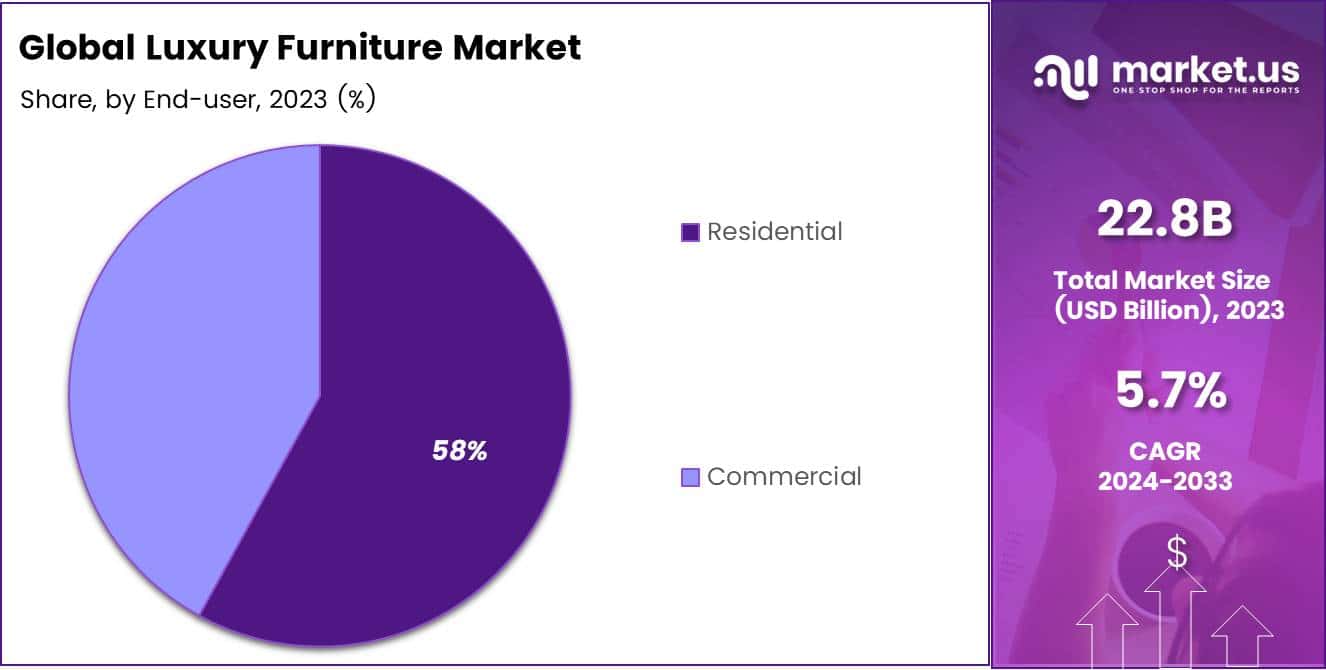

- Residential sector leads the Luxury Furniture Market by end-user, holding a 58% share in 2023, highlighting demand in private home settings.

- Offline distribution channels prevail in the Luxury Furniture Market with a 55% share in 2023, preferred for tactile shopping experiences.

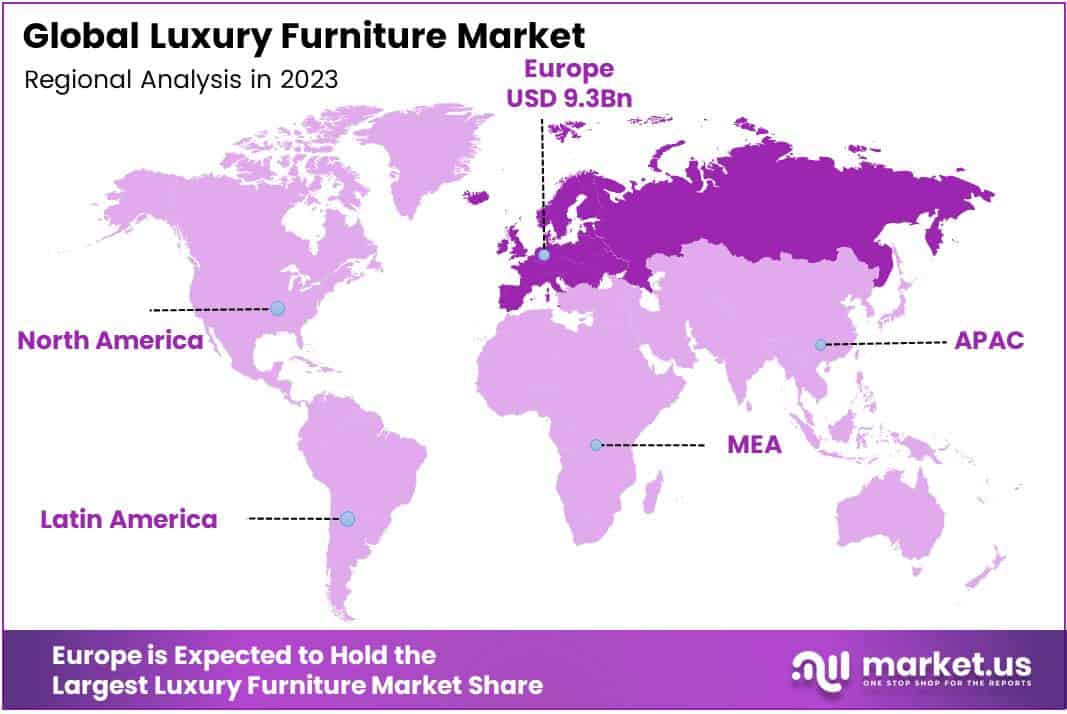

- Europe leads in the luxury furniture market with a 41.3% share, valued at approximately USD 9.3 billion, supported by a strong heritage in furniture design.

Raw Material Analysis

Wood Dominates Luxury Furniture Market with 65.7% Share in 2023

In 2023, Wood held a dominant market position in the By Raw Material Analysis segment of the Luxury Furniture Market, with a 65.7% share. This substantial market presence can be attributed to wood’s enduring appeal, natural aesthetics, and robustness, which align closely with consumer preferences for sustainable and quality furnishings in the luxury sector.

Metal followed, offering sleek, modern designs favored in contemporary luxury interiors, contributing significantly to the market’s diversity in style and function.

Plastic, though less prevalent in luxury segments due to its perception as less durable, has seen innovative uses, particularly in high-end outdoor furniture settings, due to its versatility and weather resistance.

The Others category, which includes materials like glass and fabrics, also plays a crucial role, especially in accent pieces and décor-focused furniture, enhancing the overall aesthetic and functional value of luxury spaces.

Together, these materials underscore the dynamic composition of the Luxury Furniture Market, responding adeptly to evolving design trends and consumer expectations.

End-user Analysis

Residential Dominates Luxury Furniture Market with 58% Share

In 2023, Residential held a dominant market position in the By End-user Analysis segment of the Luxury Furniture Market, capturing a 58% share.

This substantial market share underscores the robust demand within private home settings for high-end furniture, driven by increased consumer interest in bespoke and premium design aesthetics.

Factors contributing to this dominance include rising disposable incomes, the proliferation of luxury residential projects, and a growing consumer penchant for customizing living spaces to reflect personal style and comfort.

On the commercial front, while holding a smaller segment of the market, there is notable growth driven by luxury establishments such as boutique hotels, upscale offices, and high-end retail spaces. These sectors increasingly invest in luxury furniture to enhance aesthetic appeal and comfort, aiming to attract a discerning clientele.

The commercial segment’s growth is fueled by the hospitality industry’s recovery post-pandemic and the ongoing trend of corporate environments emphasizing brand image through high-quality interiors.

This segment’s expansion, however, contrasts with the more substantial investments seen in residential luxury furniture, reflecting a more cautious yet steady approach to capital expenditure in commercial interiors.

Distribution Channel Analysis

Offline Dominates Luxury Furniture Sales with 55% Market Share

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Luxury Furniture Market, with a 55% share. This traditional retail format continues to appeal to luxury buyers who prefer a tactile shopping experience, allowing for physical interaction with high-quality materials and craftsmanship before purchase.

Offline channels offer personalized customer service, which is highly valued in the luxury sector, and contributes to building customer loyalty and trust.

Conversely, the Online segment is progressively capturing market interest, driven by the digitization of retail and the increasing convenience of e-commerce platforms.

Online sales are bolstered by detailed product visuals, augmented reality applications that allow consumers to visualize products in their own space, and the growing consumer confidence in online transactions.

While still trailing behind offline sales, online channels are expected to grow as they offer broader access to various brands and styles, especially in geographically dispersed markets.

As the market landscape evolves, the interaction between these distribution channels will be crucial in shaping future strategies for engaging luxury furniture buyers.

Key Market Segments

By Raw Material

- Wood

- Plastic

- Metal

- Others

By End-user

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

Drivers

Urbanization Fuels Luxury Furniture Demand

The luxury furniture market is experiencing robust growth, primarily driven by rapid urbanization and the expansion of real estate. As cities expand, there is a noticeable increase in the construction of luxury apartments and upscale residential spaces, which in turn fuels the demand for high-end furniture that enhances living environments.

This market is also responding to significant changes in lifestyle preferences, where consumers increasingly value personalized and aesthetically pleasing home décor. This shift encourages the integration of unique and custom furniture pieces into living spaces.

Moreover, the incorporation of technology into furniture design is gaining traction. Modern consumers, particularly those who are tech-savvy, are attracted to furniture that offers more than just aesthetics—such as pieces with built-in smart features that enhance convenience and functionality. This blend of luxury, customization, and technology is reshaping the furniture market, catering to evolving consumer expectations and lifestyle enhancements.

Restraints

Challenges in the Luxury Furniture Sector

The luxury furniture market faces significant constraints due to its limited consumer base, as it primarily caters to high-income segments, reducing its overall market reach. This exclusivity narrows the scope for widespread adoption, confining sales to a smaller group of affluent buyers.

Additionally, the market is hampered by intricate supply chains. Sourcing high-quality materials necessary for luxury furniture often involves complex logistics, making the supply chain vulnerable to disruptions.

Delays in material procurement or shipping can lead to increased production costs and extended delivery times, further limiting market flexibility and responsiveness. These factors combined pose substantial challenges, impacting the market’s ability to expand and meet changing consumer demands efficiently.

Growth Factors

Explore New Horizons with Emerging Markets

The luxury furniture market is poised for significant growth, driven by expanding opportunities in emerging regions such as Asia-Pacific, Latin America, and the Middle East, where increasing affluence is boosting demand for high-end furnishings.

Additionally, the integration of augmented reality (AR) and virtual reality (VR) technologies is transforming how customers interact with furniture before purchase, allowing them to visualize how these luxury items will look in their own spaces. This not only enhances the customer experience but also reduces the uncertainty associated with expensive purchases, potentially increasing sales.

Furthermore, there is a growing trend towards luxurious outdoor living spaces, prompting luxury furniture brands to extend their product lines to include high-end outdoor furniture. This expansion caters to the rising consumer interest in sophisticated outdoor living solutions, further broadening the market’s scope and potential for growth.

Emerging Trends

Minimalism Leads Luxury Furniture Trends

In the luxury furniture market, minimalism stands out as a leading trend, as consumers increasingly prefer sleek, functional, and simplistic designs that not only enhance aesthetic appeal but also cater to modern living standards. This shift towards minimalism aligns with a growing demand for modular furniture, which offers versatile and space-saving solutions, ideal for urban environments where space is at a premium.

Additionally, the market is witnessing a significant rise in the adoption of smart furniture, which integrates advanced technologies to offer enhanced functionality and convenience. These smart pieces often include features like built-in charging stations, app-controlled settings, and customizable configurations, making them highly attractive to tech-savvy consumers seeking comfort and innovation in their luxury furnishings.

This trend reflects a broader move towards more personalized and technologically integrated living spaces, marking a transformative phase in the luxury furniture sector.

Regional Analysis

Europe Leads with 41.3% Market Share in the Luxury Furniture Sector, Valued at USD 9.3 Billion

The global luxury furniture market exhibits notable distinctions across various geographic regions, reflecting diverse consumer preferences and economic dynamics.

In Europe, the luxury furniture market is particularly robust, commanding a dominant 41.3% market share, which translates to a market valuation of approximately USD 9.3 billion. This region’s market strength is driven by a rich heritage in furniture design and manufacturing, coupled with high consumer purchasing power and a strong preference for luxury goods.

Regional Mentions:

North America also presents a significant segment of the luxury furniture market, characterized by a preference for custom and eco-friendly pieces. This market leverages the region’s advanced manufacturing technologies and substantial consumer spending power.

The Asia Pacific region is rapidly growing in this market due to increasing urbanization, rising disposable incomes, and growing brand awareness among the middle and upper-middle classes. This region is anticipated to exhibit the fastest growth rates in the coming years due to these factors.

Middle East & Africa region shows a growing affinity for luxury furniture, supported by the expansion of luxury hotels and residential developments, particularly in the Gulf Cooperation Council (GCC) countries. Latin America, though smaller in comparison, is slowly expanding its market presence, driven by economic improvements and a rising number of affluent consumers seeking luxury lifestyle products.

Each region’s unique economic landscape, consumer trends, and local cultures significantly shape the demand patterns and growth prospects in the luxury furniture market. Europe’s dominance is supported by its renowned craftsmanship and design innovation, setting a high benchmark for quality and style globally.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global luxury furniture market has seen varied contributions from its key players, with each brand offering distinct elements that underscore their market positions.

Muebles Pico is renowned for its artisanal excellence and custom, handcrafted pieces that appeal to the luxury segment looking for unique designs. Giovanni Visentin stands out with its Italian craftsmanship, offering classic furniture that combines traditional aesthetics with modern demands.

Duresta Upholstery Ltd. has maintained a strong presence in the market through its commitment to comfort and luxury, making it a preferred choice for upscale home furnishings. Nella Vetrina showcases a fusion of contemporary and traditional styles, providing exclusive designs crafted by leading Italian designers.

Turri S.r.l. leverages its heritage to offer luxury furniture that embodies Italian elegance, catering to a sophisticated clientele. Laura Ashley Holding Plc, although traditionally known for its soft furnishings, has successfully expanded into the luxury furniture market, emphasizing refined and graceful designs that appeal to contemporary tastes.

Henredon Furniture Industries Inc. has continued to impress with its wide range of high-end furniture, characterized by superior craftsmanship and timeless designs. Scavolini focuses on integrating luxury into functional spaces like kitchens and bathrooms, setting trends in these niche markets.

Iola Furniture Ltd. specializes in outdoor luxury furniture, distinguishing itself with durable yet stylish products that offer comfort and aesthetic appeal outdoors. Lastly, Valderamobili stands firm in the high-end market with its luxurious finishes and meticulous attention to detail, embodying the opulence desired in classical furniture styles.

Top Key Players in the Market

- Muebles Pico

- Giovanni Visentin

- Duresta Upholstery Ltd.

- Nella Vetrina

- Turri S.r.l.

- Laura Ashley Holding Plc

- Henredon Furniture Industries Inc.

- Scavolini

- Iola Furniture Ltd.

- Valderamobili

Recent Developments

- In December 2023, Regency Front committed to investing 6 million euros in establishing a new furniture production line, enhancing its manufacturing capabilities and capacity.

- In September 2024, Ashley Furniture disclosed plans to invest $80 million to augment its manufacturing operations across two cities in Mississippi, bolstering its production footprint.

- In September 2023, Helsinki-based furniture re-commerce company Mjuk secured €2.5 million in funding to support its mission of minimizing waste for brands, promoting sustainable practices in the furniture industry.

- In December 2023, Wooden Street announced a significant investment of Rs 200 crore aimed at expanding its store count to 300, signaling a robust growth strategy in the retail furniture sector.

- In December 2023, Regency Front committed to investing 6 million euros in establishing a new furniture production line, enhancing its manufacturing capabilities and capacity.

- In September 2024, Ashley Furniture disclosed plans to invest $80 million to augment its manufacturing operations across two cities in Mississippi, bolstering its production footprint.

- In September 2023, Helsinki-based furniture re-commerce company Mjuk secured €2.5 million in funding to support its mission of minimizing waste for brands, promoting sustainable practices in the furniture industry.

- In December 2023, Wooden Street announced a significant investment of Rs 200 crore aimed at expanding its store count to 300, signaling a robust growth strategy in the retail furniture sector.

Report Scope

Report Features Description Market Value (2023) USD 22.8 Billion Forecast Revenue (2033) USD 39.7 Billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material(Wood, Plastic, Metal, Others), By End-user(Residential, Commercial), By Distribution Channel(Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Muebles Pico, Giovanni Visentin, Duresta Upholstery Ltd., Nella Vetrina, Turri S.r.l., Laura Ashley Holding Plc, Henredon Furniture Industries Inc., Scavolini, Iola Furniture Ltd., Valderamobili Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Muebles Pico

- Giovanni Visentin

- Duresta Upholstery Ltd.

- Nella Vetrina

- Turri S.r.l.

- Laura Ashley Holding Plc

- Henredon Furniture Industries Inc.

- Scavolini

- Iola Furniture Ltd.

- Valderamobili