Global Luxury Fabric Market By Fabric Type (Interior, Exterior), By Raw Material (Silk, Velvet, Linen, Jacquard, Cashmere, Cotton, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133185

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

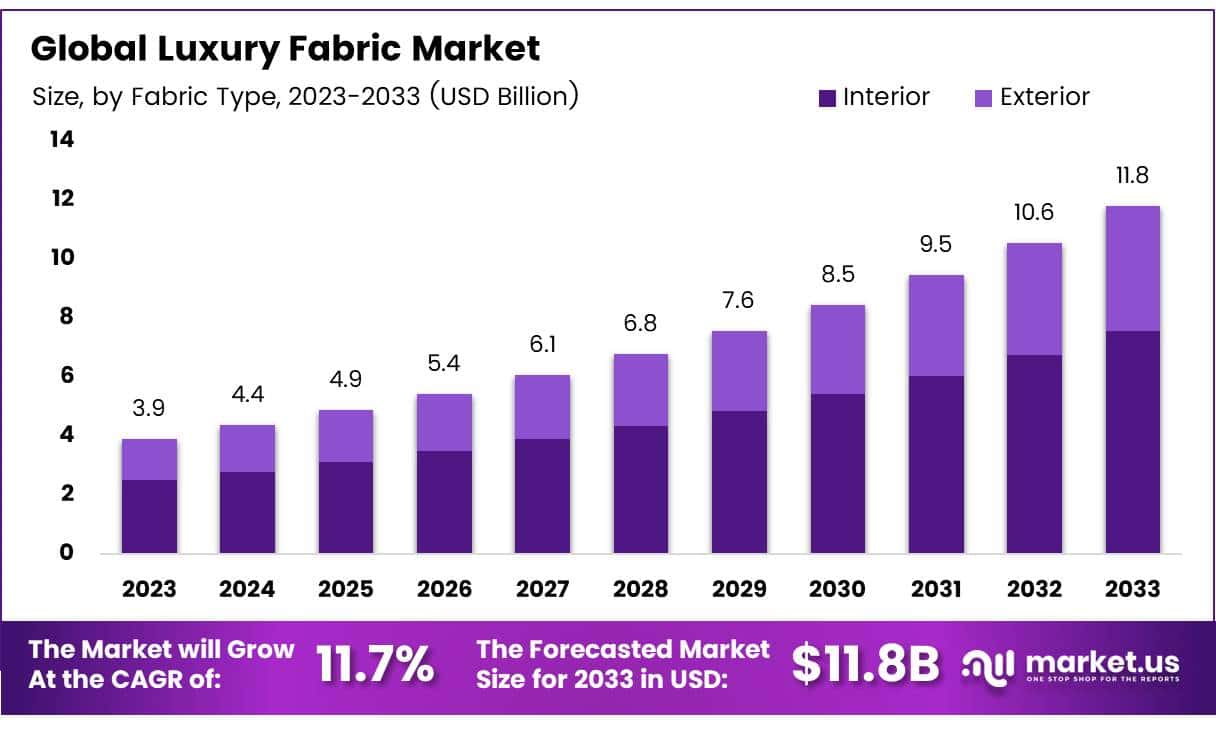

The Global Luxury Fabric Market size is expected to be worth around USD 11.8 Billion by 2033, from USD 3.9 Billion in 2023, growing at a CAGR of 11.7% during the forecast period from 2024 to 2033.

Luxury fabrics are renowned for their exceptional quality, craftsmanship, and unique features. These premium materials are made from natural fibers like silk, cashmere, and high-grade cotton, often enhanced with cutting-edge technologies to boost their aesthetic and functional qualities.

The market targets a specific segment of the fashion and interior design industries, supplying materials for upscale luxury apparel, accessories, and home décor.

The luxury fabric market is driven by exclusivity and high-quality standards, appealing to customers who prioritize superior products. This market is distinguished by rigorous quality controls, a tradition of craftsmanship, and partnerships with high-end fashion houses and interior designers.

Growth in the luxury fabric market is fueled by an increase in global wealth and a demand for premium, sustainable products. As incomes rise, especially in emerging markets, the demand for luxury items, including quality fabrics, grows. This trend is supported by the expanding middle and upper classes who value products that represent status and quality.

Technological advancements also offer growth opportunities in the luxury fabric market. Innovations like nanotechnology and biotechnology improve fabric qualities, making them more sustainable, functional, and exclusive. The trend towards personalized and custom luxury fashion services further boosts demand for these fabrics.

Government support and regulations also significantly affect the luxury fabric market. Initiatives in countries with a strong textile heritage, like Italy and India, help local industries compete globally through subsidies and grants. Environmental regulations requiring manufacturers to reduce their carbon footprint and trade policies also influence market dynamics.

Asia dominates the global luxury fabric production, particularly in silk. According to Inserco, Asia produces 90% of mulberry silk and nearly all non-mulberry silk across over 60 countries. This dominance affects global prices and availability.

In terms of pricing, fibre2fashion notes that Chinese high-grade raw silk traded at $64.42 per kg in early 2023, setting an industry benchmark. The International Cotton Advisory Committee (ICAC) reports that global cotton production for the 2023/24 season is estimated at 24.12 million tons, a slight decrease from the previous year. However, demand for luxury cotton fabrics remains strong in fashion and high-end textiles.

ICAC also notes Brazil’s rise as a leading cotton exporter, surpassing the United States with exports of 12.4 million bales in the 2023-24 season. This shift not only affects global cotton markets but also introduces new, high-quality cotton sources to the luxury fabric industry.

Key Takeaways

- The Global Luxury Fabric Market is projected to grow from USD 3.9 billion in 2023 to USD 11.8 billion by 2033, at a CAGR of 11.7%.

- Interior fabrics dominated the Fabric Type Analysis segment in 2023, holding a significant 64.3% market share.

- Silk was the leading raw material in the Luxury Fabric Market in 2023, capturing a 24.5% share.

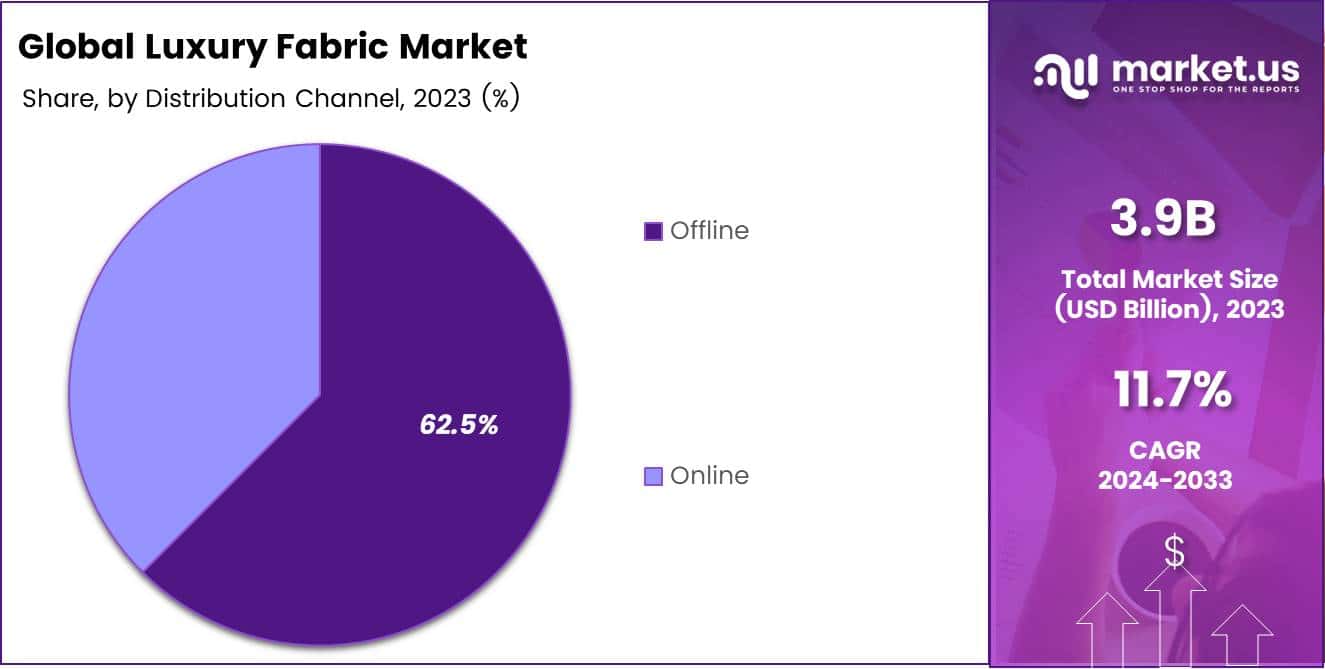

- Offline distribution channels were predominant in 2023, securing a 62.5% share of the market.

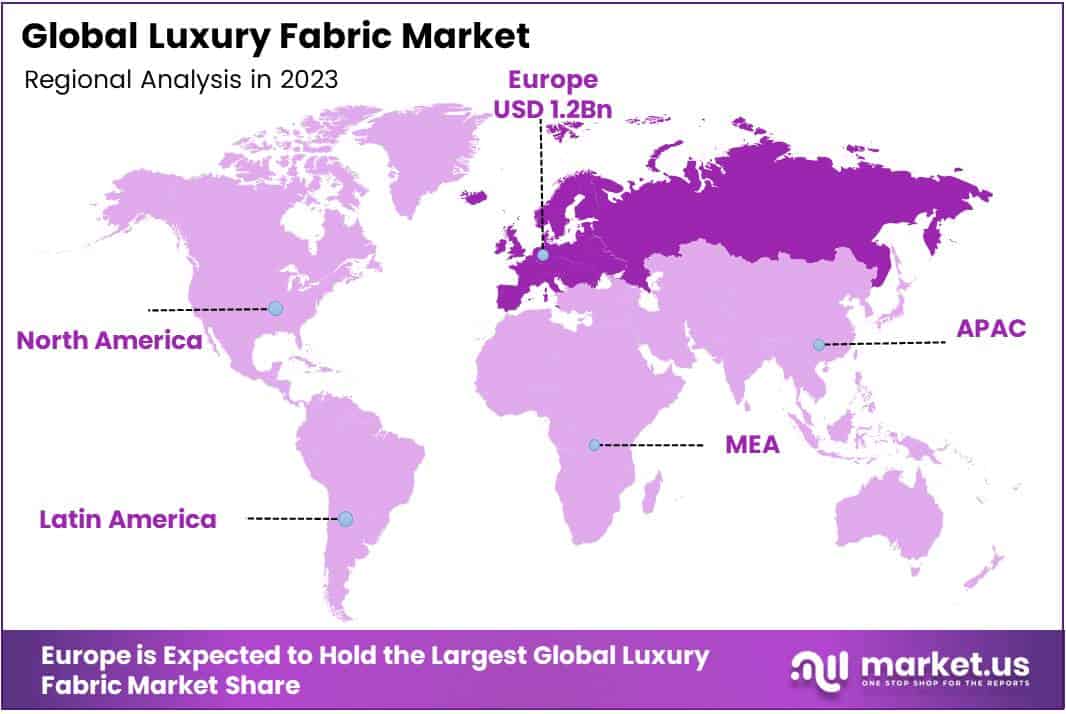

- Europe led the global luxury fabric market in 2023 with a 33% share, valued at USD 1.28 billion.

Fabric Type Analysis

Luxury Fabric Market Dominant by Interior Segment at 64.3%

In 2023, Interior held a dominant market position in the By Fabric Type Analysis segment of the Luxury Fabric Market, capturing a significant 64.3% share. This segment encompasses a range of products tailored for indoor use, including curtains, mattress coverings, bed linen, and upholstery.

These items collectively represent a cornerstone of the luxury fabric market, reflecting consumer preferences for high-end, quality materials in their living spaces. The demand within this sector is propelled by increasing consumer expenditure on home décor and the growing inclination towards luxurious and comfortable interior environments.

Conversely, the Exterior segment, which includes outdoor furniture upholstery, cabana and outdoor curtains, tablecloths and linens, poolside lounging items, outdoor pillows and cushions, gazebo drapes, and other related products, caters to a niche market focused on enhancing outdoor living spaces.

Despite a smaller market share, this segment benefits from the rising trend of creating aesthetically appealing and functional outdoor areas, especially in regions with favorable weather conditions year-round.

The stark contrast in market share between the Interior and Exterior segments underscores the prevailing consumer investment in indoor luxury fabric applications, driven by an enduring desire to enrich the comfort and elegance of personal living spaces.

Raw Material Analysis

Silk Leads the Luxury Fabric Market with a 24.5% Share in 2023

In 2023, Silk held a dominant market position in the By Raw Material Analysis segment of the Luxury Fabric Market, capturing a 24.5% share. Esteemed for its natural sheen and unmatched texture, silk’s prominence underscores its enduring appeal in high-end fashion and luxury goods. Velvet followed as a significant contender, prized for its rich texture and depth, often chosen for its opulent aesthetics in apparel and home décor.

Linen was also notable for its natural qualities and breathability, making it a preferred choice for sustainable luxury fashion. Jacquard, with its intricate patterns, catered to a niche yet affluent market segment looking for detailed and expressive fabric designs.

Cashmere maintained a luxurious status with its exceptional warmth and softness, appealing to consumers seeking comfort in their luxury purchases. Cotton, recognized for its versatility and comfort, continued to hold a substantial portion of the market, reflecting a growing inclination towards casual luxury.

The Others category, which includes innovative and blended materials, captured the attention of the market by offering unique properties and expanding the possibilities within the luxury fabric market. Collectively, these materials define the contours of competition and innovation in the luxury fabric sector, reflecting broader consumer trends towards quality, comfort, and sustainability.

Distribution Channel Analysis

Offline Dominates Luxury Fabric Distribution with 62.5% Market Share

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Luxury Fabric Market, boasting a 62.5% share. This significant dominance can be attributed to consumer preferences for tactile purchasing experiences, where the quality and texture of luxury fabrics can be directly assessed.

Physical stores not only provide immediate product access but also offer a level of customer service and a shopping experience that online channels struggle to match. This has helped maintain a strong foothold despite the growing trend of digitalization in retail.

Conversely, the Online segment, while smaller, has shown a steady increase in market penetration. The convenience of online shopping, coupled with improved e-commerce platforms and virtual reality tools that simulate the in-store experience, are slowly reshaping consumer habits.

Online platforms are enhancing their service offerings by integrating advanced technologies that allow for better visualization and customization of luxury fabrics, promising significant growth potential in the coming years. This segment’s expansion is driven by technological advancements and a shift in consumer behavior towards digital channels.

Key Market Segments

By Fabric Type

- Interior

- Curtains

- Mattress Coverings

- Bed Linen

- Upholstery

- Exterior

- Outdoor Furniture Upholstery

- Cabana and Outdoor Curtains

- Tablecloths and Linens

- Poolside Lounging

- Outdoor Pillows and Cushions

- Gazebo Drapes

- Others

By Raw Material

- Silk

- Velvet

- Linen

- Jacquard

- Cashmere

- Cotton

- Others

By Distribution Channel

- Online

- Offline

Drivers

Rising Incomes Boost High-End Fashion Demand

In the luxury fabric market, a significant driver is the increasing demand for high-end fashion, fueled by rising disposable incomes and a growing appreciation for premium aesthetics. As consumers become more affluent, their inclination towards luxurious and quality garments strengthens, driving up sales in the luxury fabric sector.

Additionally, established luxury brands are expanding their global presence and diversifying their product offerings, further stimulating market growth. These brands leverage their reputation and customer loyalty to penetrate new markets and introduce innovative products.

Technological advancements in textile manufacturing also play a crucial role, as they lead to improvements in fabric quality, functionality, and design. Innovations such as 3D printing, laser cutting, and eco-friendly production processes not only enhance the appeal of luxury fabrics but also meet the increasing consumer demand for sustainability. These factors collectively contribute to the robust growth of the luxury fabric market, making it a dynamic and evolving industry.

Restraints

High Costs Challenge Luxury Fabric Production

luxury fabric market faces significant restraints primarily due to the high cost of production. These costs stem from the sourcing and manufacturing of premium, often rare materials, which are essential for creating luxury textiles.

These materials not only command a higher price but also necessitate specialized, often labor-intensive, processing techniques to meet the quality standards expected in the luxury segment.

Additionally, maintaining a smooth and ethical supply chain adds another layer of complexity. The need for transparency and ethical sourcing practices often leads to longer lead times and higher operational costs. These factors collectively contribute to the overall challenges in scaling operations in the luxury fabric market while maintaining profitability and ethical standards.

Growth Factors

Enhanced Online Retail Channels Boost Luxury Fabric Sales

The luxury fabric market is poised for significant growth through strategic enhancements in online retail channels. By crafting immersive digital shopping experiences specifically designed for luxury buyers, companies can attract a more affluent customer base, who value the convenience and exclusivity offered online.

Additionally, tapping into new geographic markets, particularly in regions experiencing rapid growth in luxury consumer segments, presents a lucrative opportunity for expansion. Establishing strategic partnerships and collaborations with renowned fashion designers and luxury brands can also amplify market reach and influence.

These alliances not only enhance brand visibility but also integrate innovative designs with traditional luxury fabrics, creating unique offerings that appeal to diverse consumer tastes and preferences. This multi-faceted approach, combining digital innovation with geographic and collaborative expansion, sets the stage for sustained growth and profitability in the luxury fabric market.

Emerging Trends

Digitalization Shapes the Luxury Fabric Market

The luxury fabric market is being significantly influenced by the adoption of digital tools and virtual innovations. Designers and brands are increasingly leveraging digitalization to streamline the creation of bespoke fabrics, enabling enhanced precision and faster production timelines.

Virtual try-ons are becoming a standard, allowing customers to visualize products made with luxury fabrics before purchase, improving personalization.

Additionally, the rise of eco-luxury fabrics is reshaping consumer preferences, with a growing demand for materials crafted from organic or recycled resources, emphasizing sustainability.

Luxury sportswear and athleisure are also emerging as prominent trends, as high-end consumers seek premium-quality fabrics that blend elegance with functionality for active lifestyles.

Another transformative factor is the adoption of 3D printing technologies in textile production. These innovations are allowing manufacturers to experiment with unique textures, patterns, and intricate designs, further elevating the appeal of luxury fabrics. Together, these trends highlight the industry’s focus on technology, sustainability, and the evolving tastes of modern consumers.

Regional Analysis

European Dominants the Global Luxury Fabric Market Capturing 33% Market Share with USD 1.28 Billion

Europe, the luxury fabric market remains dominant, accounting for approximately 33% of the global share, valued at USD 1.28 billion. This region’s supremacy is anchored in its rich history of textile craftsmanship and the presence of iconic fashion capitals such as Paris, Milan, and London.

European manufacturers are renowned for their expertise in producing high-end fabrics, including silk, cashmere, and premium wool, which are integral to the luxury apparel and home décor sectors.

Regional Mentions:

The global luxury fabric market exhibits a diverse landscape across key regions, influenced by cultural, economic, and fashion trends.

North America, characterized by its robust fashion industry and high consumer spending power, plays a pivotal role in driving demand for luxury fabrics. The region’s market is bolstered by the presence of major fashion houses and designers, which consistently innovate and uphold high-quality standards in fabric production.

Asia Pacific is witnessing rapid growth in the luxury fabric market, driven by increasing economic prosperity and a growing middle class. The expansion of local luxury brands, coupled with rising interest in high-end fashion, propels demand for quality textiles. Countries like China and India are not only major consumers but also key producers of luxurious silk and embroidered fabrics.

The Middle East & Africa region, though smaller in comparison, is experiencing a surge in luxury fabric consumption due to the rising affluence in Gulf countries and a strong preference for lavish fashion and interior design. Latin America, on the other hand, is gradually carving a niche in the luxury fabric market, with Brazil and Argentina leading the way in adopting luxury fashion trends and fostering local craftsmanship.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Luxury Fabric Market of 2023, key players have strategically positioned themselves to capitalize on evolving consumer preferences and technological advancements.

Jim Thompson Fabrics continues to enchant the high-end market with its exquisite silk offerings, leveraging traditional craftsmanship combined with modern aesthetic trends.

Sattler Group, under its SUN-TEX brand, remains a leader in performance fabrics, focusing on innovations in sustainability and UV resistance, crucial for outdoor applications.

Sanderson Design Group stands out for its commitment to blending historic motifs with contemporary design, catering to a sophisticated clientele that values both tradition and trend.

Similarly, Perennials and Sutherland, L.L.C., dominate the segment for high-performance luxury textiles, prioritizing durability without compromising on style, making them favorites for both residential and commercial designers.

Pierre Frey captures a niche market with its eclectic and bold designs, emphasizing artisanal techniques and cultural storytelling in its fabrics.

LVMH’s Loro Piana segment epitomizes luxury through its ultra-fine cashmere and wool textiles, which are benchmarks of quality and elegance in high fashion and upscale interior design.

Ermenegildo Zegna N.V. extends its luxury tailoring expertise into textile production, offering bespoke fabric options that complement its high-end apparel lines. The Romo Group is noted for its extensive range of fabrics characterized by refined designs and a wide color palette, catering to diverse consumer tastes and interior decors.

Kravet Inc. continues to lead with a vast repository of fabric collections that include collaborations with top-tier designers, providing custom and ready-to-use solutions.

De Le Cuona cements its status with a focus on rich textures and organic materials, appealing to those seeking understated luxury and environmental consciousness in their fabric choices. These companies, by adapting to market demands and emphasizing sustainability and innovation, are set to maintain their prominence in the luxury fabric industry.

Top Key Players in the Market

- Jim Thompson Fabrics

- Sattler Group (SUN-TEX GmbH)

- Sanderson Design Group

- Perennials and Sutherland L.L.C.

- Pierre Frey

- LVMH Moët Hennessy Louis Vuitton (Loro Piana)

- Ermenegildo Zegna N.V.

- The Romo Group

- Kravet Inc.

- De Le Cuona

Recent Developments

- In October 2024, Zara’s parent company, Inditex, initiated a €50 million fund to foster innovation within the textile industry, aiming to invest in cutting-edge projects that drive sustainability and technological advancements.

- In November 2024, the prestigious luxury fabrics manufacturer Dormeuil announced the launch of three exclusive fabrics in collaboration with P N RAO, marking a significant enhancement in luxury textile offerings.

- In September 2024, Morocco’s Prime Minister Aziz Akhannouch met with Chairman Lei Xu of China’s Sunrise Group in Shanghai to express support for a substantial $421.3 million investment project focused on strategic developments within Morocco.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 11.8 Billion CAGR (2024-2033) 11.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fabric Type (Interior, Exterior), By Raw Material (Silk, Velvet, Linen, Jacquard, Cashmere, Cotton, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Jim Thompson Fabrics, Sattler Group (SUN-TEX GmbH), Sanderson Design Group, Perennials and Sutherland L.L.C., Pierre Frey, LVMH Moët Hennessy Louis Vuitton (Loro Piana), Ermenegildo Zegna N.V., The Romo Group, Kravet Inc., De Le Cuona Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Jim Thompson Fabrics

- Sattler Group (SUN-TEX GmbH)

- Sanderson Design Group

- Perennials and Sutherland L.L.C.

- Pierre Frey

- LVMH Moët Hennessy Louis Vuitton (Loro Piana)

- Ermenegildo Zegna N.V.

- The Romo Group

- Kravet Inc.

- De Le Cuona