Global Luxury Candle Market By Product (Container, Pillar, Votive, Tapers, Others), By Wax Type (Paraffin, Soywax, Beeswax, Palm Wax, Others), By Distribution Channel (Departmental Stores, Stand-Alone Boutiques, Specialty Stores, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133025

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

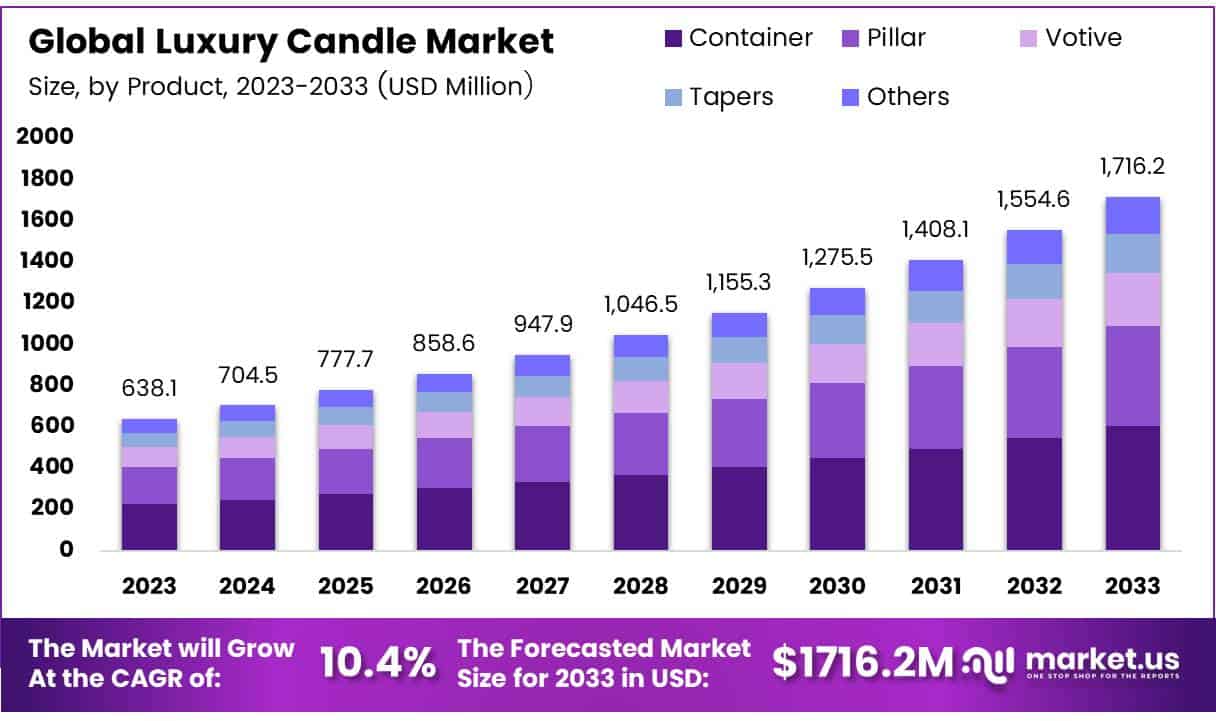

The Global Luxury Candle Market size is expected to be worth around USD 1716.2 Mn by 2033, from USD 638.1 Mn in 2023, growing at a CAGR of 10.4% during the forecast period from 2024 to 2033.

Luxury candles, known for their superior materials, expert craftsmanship, and distinctive fragrances, occupy a unique and growing niche in the broader candle market.

These high-end products often utilize premium waxes such as soy, beeswax, or exotic blends with essential oils and rare aromatics, focusing on providing a sensory experience beyond simple lighting, appealing to consumers interested in premium, eco-friendly, and health-conscious home decor choices.

The luxury candle market consists of manufacturers, boutique brands, and extensive distribution networks, including online platforms, high-end department stores, and specialty boutiques. This market targets affluent consumers who value quality, sustainability, exclusivity, and artisanal craftsmanship.

Market growth is driven by increased disposable incomes, a rising interest in upscale home decor, and a focus on mental wellness, which is supported by therapeutic fragrances. The expanding consumer base includes individuals who view home fragrances as a lifestyle luxury. The trend toward personalization, allowing consumers to customize their candle scents and designs, further enhances the appeal and perceived value of these products.

There are significant opportunities for growth, especially in adopting eco-friendly and sustainable practices. The demand for organic waxes and natural, non-toxic fragrances opens new avenues for innovation and differentiation. Additionally, luxury candles are well-suited to benefit from direct-to-consumer sales models, which use online marketing to effectively target specific customer demographics.

Support from government investments in small and medium enterprises is crucial, particularly for artisanal and boutique candle makers practicing sustainability. This support not only boosts local economies but also promotes craftsmanship within the luxury goods sector.

Regulations ensure product safety and quality control, crucial in maintaining consumer trust and manufacturer credibility. These rules include specifications like the allowable percentage of fragrance in waxes and accurate labeling, which is essential for consumer protection.

According to industry insights, most candle waxes can contain up to 12% fragrance oil, though 10% is recommended to maintain safety and quality. This detail highlights the expertise required to balance fragrance intensity with candle performance, a critical factor in the luxury segment where fragrance depth and longevity are key selling points.

European import statistics reveal market dynamics, with Germany leading candle imports at 22%, followed by the UK at 14% and the Netherlands at 10%. This data helps predict market trends and identify high-demand regions, guiding targeted marketing and distribution strategies for luxury candle brands aiming to expand or strengthen their presence in Europe.

Key Takeaways

- The global Luxury Candle Market is projected to grow from USD 638.1 million in 2023 to USD 1716.2 million by 2033, with a CAGR of 10.4%.

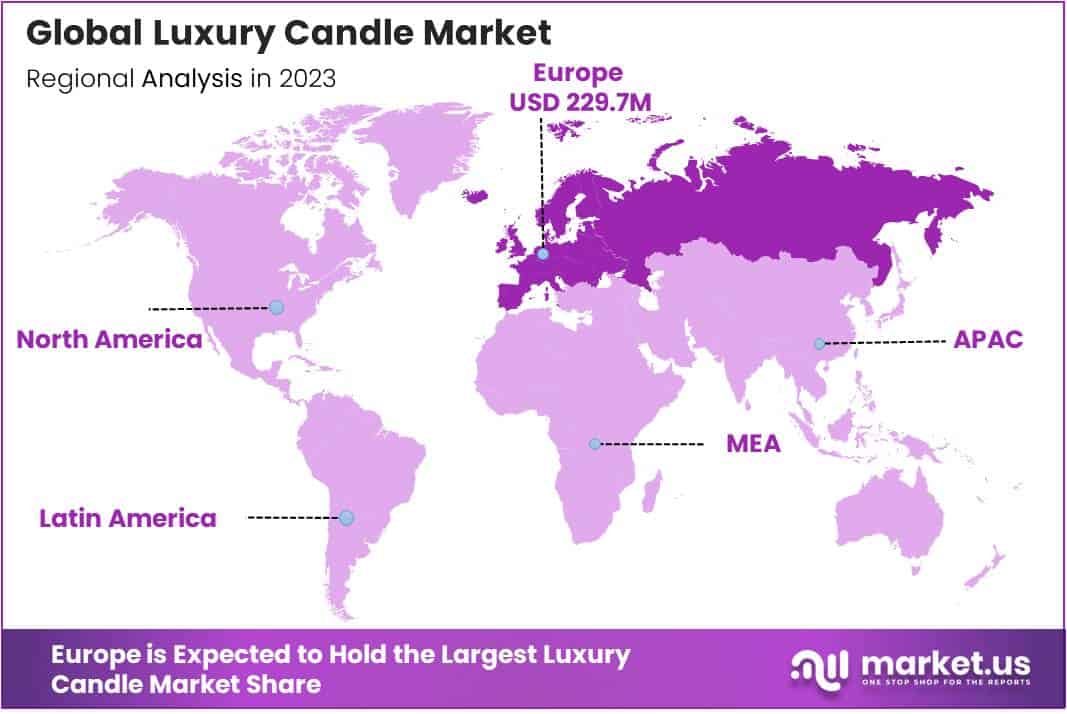

- Europe is the largest market for luxury candles, holding a 36% share, driven by its wealthy consumer base and preference for premium, artisanal products.

- Container candles dominate the product analysis segment with a 55.6% share in 2023, popular for their convenience, safety, and aesthetic appeal.

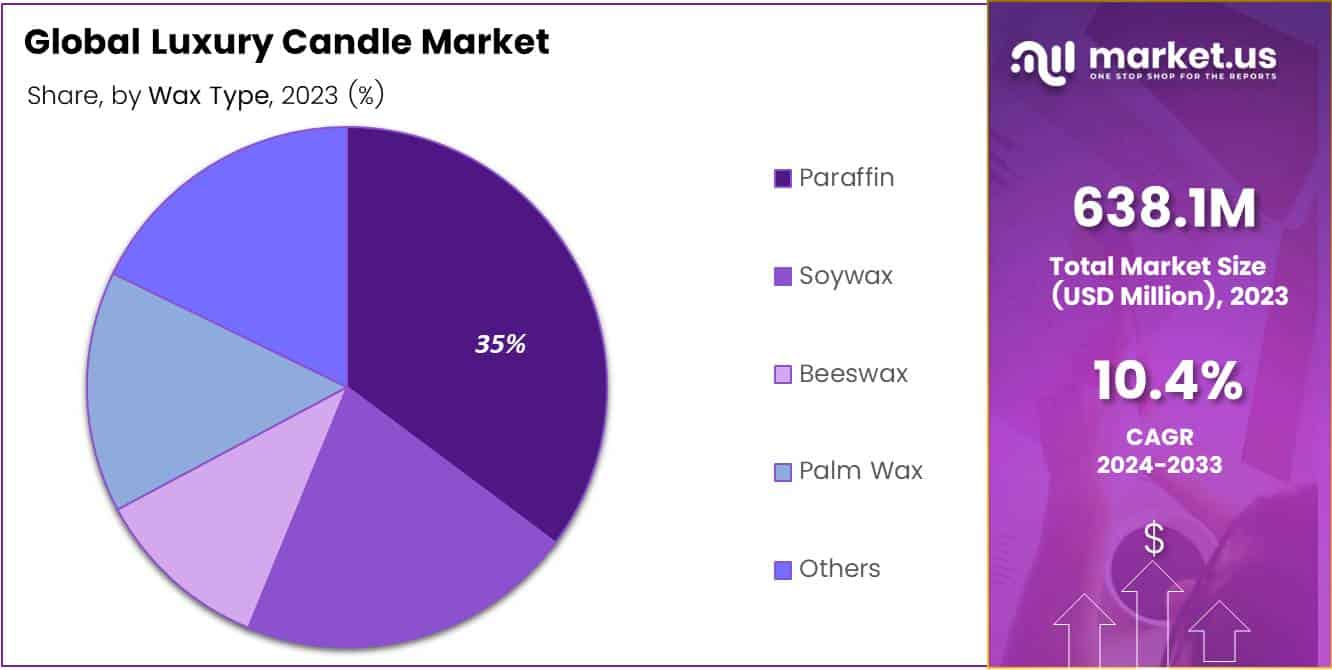

- In the wax type segment, paraffin leads with a 35.2% share in 2023, prized for its cost-effectiveness and superior fragrance and color retention.

- Departmental stores are the leading distribution channel for luxury candles, capturing a 49% market share, due to their wide selection and the convenience of immediate access.

Product Analysis

Container Candles Lead with 55.6% Share

In 2023, Container held a dominant market position in the By Product Analysis segment of the Luxury Candle Market, with a 55.6% share. Container candles have proven to be immensely popular, largely due to their convenience, safety, and versatility in design. These candles are typically poured into glass, metal, or ceramic vessels, which not only serve as a safety barrier but also enhance aesthetic appeal, making them a favorite in household and commercial settings alike.

Pillar candles followed as the second most favored type, appreciated for their long burning times and ability to stand independently without the need for a supporting container. This segment has carved out a substantial niche, contributing significantly to market dynamics.

Votive candles, often used in religious and spiritual ceremonies as well as in restaurants and spas for creating a tranquil ambiance, also captured a noticeable market share.

Tapers, known for their slender and elegant shape, remain a classic choice for formal events and dining settings, though they hold a smaller portion of the market compared to more practical candle types.

The Others category, which includes specialty and novelty candles, continues to attract interest for unique applications, highlighting the market’s diverse consumer preferences and the ongoing innovation within the luxury candle industry.

Wax Type Analysis

Paraffin Leads the Wax Type Analysis in the Luxury Candle Market with a 35.2% Share

In 2023, Paraffin held a dominant market position in the By Wax Type Analysis segment of the Luxury Candle Market, with a 35.2% share. This segment’s prominence is primarily attributed to paraffin’s cost-effectiveness and its ability to hold fragrance and color more effectively compared to other waxes.

Following paraffin, Soywax emerges as the second most prevalent wax type, favored for its natural and renewable qualities that align with increasing consumer preferences for sustainable products.

Beeswax, known for its non-toxic and long-burning characteristics, also maintains a significant portion of the market. However, its higher price point compared to paraffin and soywax limits its market penetration. Palm Wax, while eco-friendly, faces challenges due to concerns over deforestation and environmental sustainability, impacting its market acceptance.

The category labeled ‘Others’ includes a variety of lesser-used waxes such as coconut wax and rapeseed wax, which are gradually gaining attention due to their unique properties and the shifting focus towards more sustainable and environmentally friendly candle-making materials.

Collectively, these emerging wax types are set to reshape market dynamics by catering to niche but growing consumer segments seeking eco-conscious alternatives.

Distribution Channel Analysis

Varied Distribution Channels Shape Luxury Candle Market Landscape

In 2023, Departmental Stores held a dominant market position in the By Distribution Channel Analysis segment of the Luxury Candle Market, capturing a 49% share. Their comprehensive selection and the convenience of one-stop shopping greatly contributed to their leading status, as consumers favor the hands-on experience and immediate product availability that department stores provide.

Stand-alone boutiques captured a significant portion of the market as well, appealing to consumers with their exclusive, often artisan-crafted candles, representing a unique shopping experience focused on luxury and exclusivity.

Specialty stores, known for their expert knowledge and specialized selections, also carved out a substantial share. These stores attract discerning customers who appreciate guidance and the opportunity to explore products tailored to specific tastes or needs.

The online segment, while smaller, still played a crucial role, driven by the growing consumer preference for the convenience of shopping from home. This channel has been steadily gaining traction, offering access to a broader range of products and appealing to a technology-savvy customer base.

Each channel uniquely caters to the diverse preferences of luxury candle consumers, highlighting the multifaceted nature of the market.

Key Market Segments

By Product

- Container

- Pillar

- Votive

- Tapers

- Others

By Wax Type

- Paraffin

- Soywax

- Beeswax

- Palm Wax

- Others

By Distribution Channel

- Departmental Stores

- Stand-Alone Boutiques

- Specialty Stores

- Online

Drivers

Increasing Consumer Spending Power Boosts Luxury Candle Sales

The luxury candle market is experiencing growth primarily due to rising disposable incomes, which allow consumers to allocate more funds towards non-essential luxury goods.

As disposable income increases, individuals are more inclined to indulge in premium products such as high-end candles, which not only serve a functional purpose but also enhance the aesthetic appeal of their living spaces. The decorative qualities of luxury candles make them a popular choice for adding a touch of elegance and ambiance to home decor.

Furthermore, the proliferation of e-commerce has significantly broadened the accessibility of luxury candles, enabling consumers to easily purchase them from the comfort of their own homes. This convenience has facilitated the expansion of the market by reaching a wider demographic of customers, including those who prefer online shopping over traditional retail experiences.

The combined impact of increased consumer spending power, the appeal of candles as decorative elements, and the growth of e-commerce channels are key drivers propelling the luxury candle market forward.

Restraints

High Production Costs Limit Entry

As an analyst examining the luxury candle market, it is evident that several factors restrict its expansion. Firstly, the high cost of production stands as a significant barrier.

The crafting of luxury candles involves the use of premium materials alongside meticulous craftsmanship, which inherently elevates production expenses. This elevation in cost not only affects the pricing strategy but also limits entry into the market, as new entrants must be capable of sustaining higher initial investments to compete.

Furthermore, the reach of luxury candles remains constrained within emerging markets due to limited distribution channels. These markets often lack the robust infrastructure required to support widespread distribution of luxury items, thereby hindering potential market growth in regions that could contribute significantly to global sales volumes.

Consequently, while the allure of luxury candles continues to grow, these restraints play a crucial role in shaping the market dynamics.

Growth Factors

Emerging Markets Expand Customer Base

The luxury candle market presents several growth opportunities poised to enhance market penetration and profitability. Firstly, expanding into emerging markets with rising middle-class populations offers a significant opportunity to broaden the customer base. The increasing disposable income in these regions can lead to greater consumer spending on luxury items, including candles, thus boosting overall sales.

Additionally, partnerships with established luxury brands in sectors such as fashion and beauty can serve to elevate a candle brand’s status and extend its market reach. Such collaborations can leverage the brand equity of partner brands, attracting a more affluent clientele.

Lastly, capitalizing on seasonal and limited-edition releases can effectively generate consumer buzz and increase engagement. These strategies not only promote exclusivity and desirability but also encourage repeat purchases during peak seasons, thereby driving additional revenue streams.

Collectively, these strategic moves can robustly position companies within the competitive landscape of the luxury candle market, ensuring sustained growth and market share expansion.

Emerging Trends

Artisanal Appeal Elevates Luxury Candle Market

In the luxury candle market, a significant trend is the increasing preference for artisanal and handcrafted products. Consumers are gravitating towards candles that are not only aesthetically pleasing but also crafted with an emphasis on authenticity and individual artistry. This shift is driven by a desire for unique, bespoke items that stand apart from mass-produced goods.

Additionally, there is a growing demand for exotic and unique fragrances, with luxury brands sourcing rare scents from around the world to appeal to a sophisticated clientele. These scents often incorporate elements that evoke specific memories or feelings, enhancing the consumer’s experience. Furthermore, health and safety innovations are also shaping the market.

Today’s consumers are increasingly aware of the ingredients and production methods used in candles, opting for options that promise cleaner burning without harmful toxins, like smokeless and non-toxic varieties.

These trends collectively underscore a market that values uniqueness, sensory experience, and consumer well-being, positioning artisanal candles not just as products, but as holistic experiences that cater to the discerning tastes of luxury buyers.

Regional Analysis

Europe Dominates Luxury Candle Market with 36% Share, Valued at USD 229.7 Million

Europe emerges as the dominating region in the global Luxury Candle Market, holding a 36% share, valued at USD 229.7 million. This dominance is propelled by the region’s affluent consumer base and a deep-rooted cultural affinity for luxury home décor products.

European consumers display a preference for premium, artisanal candles that incorporate natural fragrances and bespoke designs, making it a pivotal market for luxury candle manufacturers.

Regional Mentions:

In North America, the market is characterized by a strong demand for eco-friendly and natural candles, reflecting the region’s growing consumer awareness about sustainability. Although exact figures for North America are not specified, it commands a substantial market share, driven by the U.S., which is a major hub for luxury goods.

The Asia Pacific market is rapidly expanding due to increasing disposable incomes and the influence of Western lifestyle trends. The luxury candle segment in this region benefits from the burgeoning middle-class population and their rising expenditure on luxury and wellness products. However, the market share specifics for Asia Pacific are not detailed here.

Middle East & Africa, and Latin America are witnessing gradual growth in luxury candle sales. These regions are experiencing an increase in consumer spending power and a growing interest in luxury home décor items.

The Middle East, in particular, shows potential for higher market penetration due to its luxury retail sectors and affluent consumer base. Latin America, though smaller in market size compared to other regions, is seeing an uptick in demand driven by urbanization and increased consumer spending on lifestyle products.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Luxury Candle Market continued to thrive, buoyed by consumers’ increasing affinity for high-end home fragrances that offer both aesthetic and olfactory indulgence. Prominent among the key players, Byredo and Diptyque Paris maintained their reputations for creating sophisticated scents that cater to a discerning clientele, often incorporating rare ingredients and elegant packaging that doubles as home décor.

Parfums de Marly and Tom Ford Beauty, traditionally known for their luxury perfumes, successfully extended their olfactory expertise into the candle market, offering products that complement their fragrance lines. This strategy has enhanced brand coherence and deepened customer loyalty by providing a comprehensive sensory experience.

Jo Malone London continues to excel in creating distinctive, customizable scents that appeal to consumers interested in personalized fragrances. Their approach to combining scents for a unique ambience has set them apart in a crowded market.

On the niche side, Fornasetti S.P.A. and Trudon stand out with their art-driven approach. Fornasetti’s candles merge visual art with fragrance, incorporating whimsical designs that make their candles collector’s items beyond their scent appeal. Similarly, Trudon’s rich heritage as a candle provider to the French court adds a historical richness to its brand narrative, attracting buyers interested in both legacy and luxury.

Emerging players like LUMIRA Co Pty Ltd and Ellis Brooklyn are carving out niches by focusing on specific themes and ethical sourcing, appealing to younger, environmentally conscious consumers who seek luxury with sustainability.

Top Key Players in the Market

- Byredo

- Parfums de Marly

- Tom Ford Beauty

- Diptyque Paris

- Jo Malone London

- Fornasetti S.P.A.

- Hermès

- Trudon

- Louis Vuitton

- Acqua Di Parma SRL

- Creed Fragrances

- Ellis Brooklyn

- c.f.e.b. SISELY

- Eight & Bob

- LUMIRA Co Pty Ltd

- Le Labo

Recent Developments

- In June 2023, luxury candle company Otherland was acquired by Curio Brands, a notable player in the fragrance industry. Although the financial details of the transaction were not revealed, the press release shared with Retail Dive emphasizes the strategic alignment aimed at expanding Curio Brands’ market presence in high-end home décor.

- In December 2023, STILL, a prominent home fragrance manufacturer, announced its acquisition of National Candles. This move is part of STILL’s strategy to enhance its product portfolio and market share in the decorative candle sector, strengthening its position in the industry.

- In January 2023, SSEK Legal Consultants provided advisory services to Blackstone-backed Moonbug Entertainment during its acquisition of a Singapore-based animation studio known for producing the popular children’s show ‘Oddbods’. This acquisition is part of Moonbug’s strategy to diversify its global entertainment offerings.

Report Scope

Report Features Description Market Value (2023) USD 638.1 Mn Forecast Revenue (2033) USD 1716.2 Mn CAGR (2024-2033) 10.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Container, Pillar, Votive, Tapers, Others), By Wax Type (Paraffin, Soywax, Beeswax, Palm Wax, Others), By Distribution Channel (Departmental Stores, Stand-Alone Boutiques, Specialty Stores, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Byredo, Parfums de Marly, Tom Ford Beauty, Diptyque Paris, Jo Malone London, Fornasetti S.P.A., Hermès, Trudon, Louis Vuitton, Acqua Di Parma SRL, Creed Fragrances, Ellis Brooklyn, c.f.e.b. SISELY, Eight & Bob, LUMIRA Co Pty Ltd, Le Labo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Byredo

- Parfums de Marly

- Tom Ford Beauty

- Diptyque Paris

- Jo Malone London

- Fornasetti S.P.A.

- Hermès

- Trudon

- Louis Vuitton

- Acqua Di Parma SRL

- Creed Fragrances

- Ellis Brooklyn

- c.f.e.b. SISELY

- Eight & Bob

- LUMIRA Co Pty Ltd

- Le Labo