Global Lubricants Market Size, Share, And Industry Analysis Report By Group (Group I, Group II, Group III, Group IV, Group V), By Base Stock (Mineral Oil Lubricants, Synthetic Lubricants, Semi-Synthetic Lubricants, Bio-Based Lubricants), By Product Type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, Metalworking Fluids, Greases), By End-User (Automotive, Power Generation, Heavy Equipment, Metallurgy and Metalworking), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171763

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

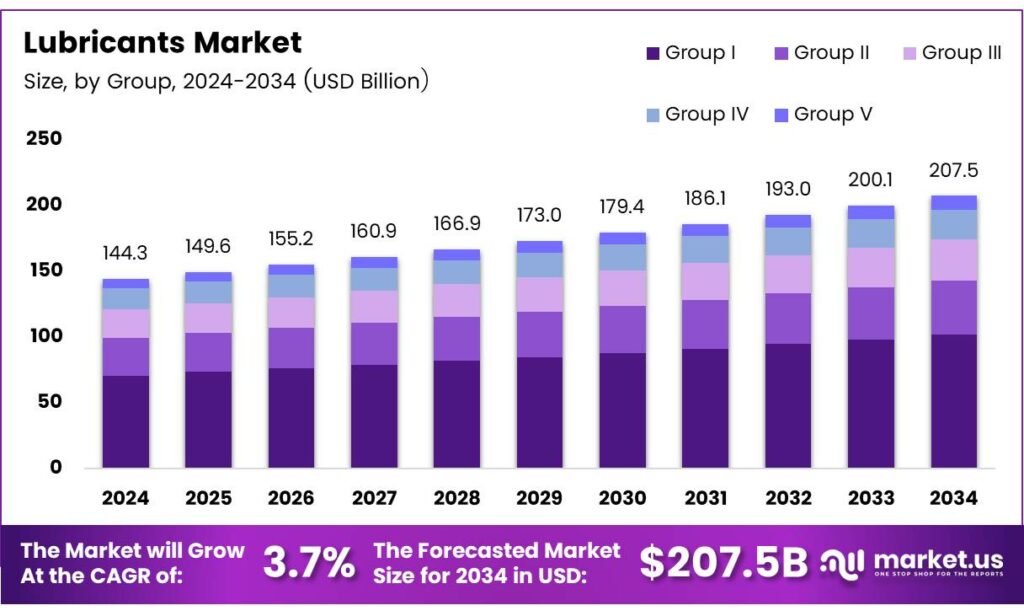

The Global Lubricants Market size is expected to be worth around USD 207.5 billion by 2034, from USD 144.3 billion in 2024, growing at a CAGR of 3.7% during the forecast period from 2025 to 2034.

The lubricants market represents a critical pillar of industrial reliability, enabling friction control, equipment protection, and energy efficiency across automotive, manufacturing, construction, and power sectors. It continues expanding as industries automate and demand higher-performance fluids. Growing investments in clean mobility and precision engineering further strengthen long-term opportunities for advanced lubrication solutions.

The market is benefiting from steady automotive demand, rising machinery uptime priorities, and new synthetic formulations. Additionally, industry players are exploring lower-emission lubricants aligned with sustainability goals. Governments promoting energy-efficient manufacturing create opportunities for high-performance industrial oils. As equipment complexity rises, premium lubricants with higher stability continue gaining strategic importance worldwide.

- Base oil usage shifted dramatically over the past decade. Modern plants use 47% Group II oils, rising from 21% earlier, while Group I declined from 56% to 28%. Group III currently represents less than 1% capacity, reflecting cleaner refining methods and evolving performance expectations in global plants.

Automotive lubricants form 65% of finished lube demand, where commercial vehicles contribute half, passenger cars 7%, and two-wheelers 25%, with agriculture and other uses at 18%. Additionally, base oil specifications show Group I contains less than 90% saturates, while Group II exceeds 90%, underpinning evolving preferences.

The industry is witnessing a shift toward technologically optimized oils that offer longer drain intervals. Manufacturers increasingly emphasize thermal stability and compatibility with advanced engines. As electrification grows, diversification into EV-compatible fluids enhances future relevance. This transition encourages R&D initiatives focusing on viscosity control, oxidation resistance, and material-safe lubrication chemistry.

Key Takeaways

- The Global Lubricants Market is projected to reach USD 207.5 billion by 2034, up from USD 144.3 billion in 2024, at a 3.7% CAGR from 2025–2034.

- Group II led the base oil group segment with a dominant 38.8% share in 2024.

- Mineral Oil Lubricants remained the top base stock, capturing 59.6% of the market in 2024.

- Engine Oils dominated the product type segment with a strong 45.7% share in 2024.

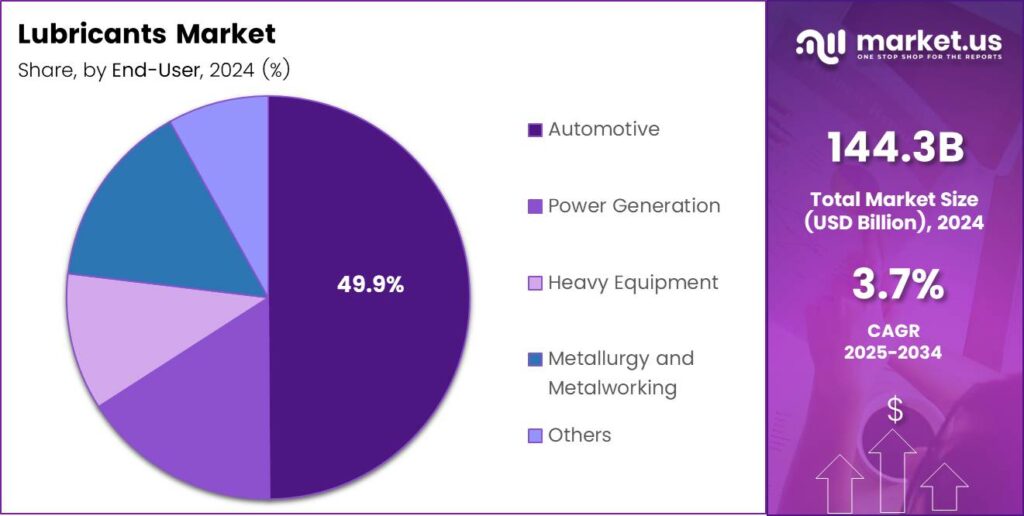

- The Automotive end-user segment accounted for the largest contribution, holding 49.9% of total demand in 2024.

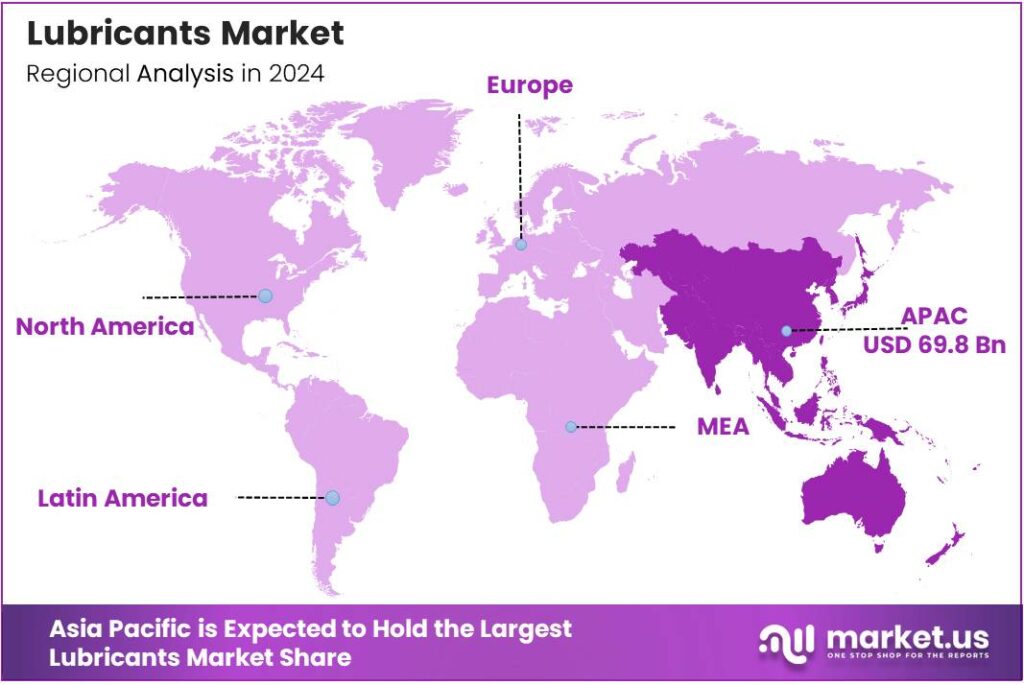

- Asia Pacific emerged as the leading regional market with a 48.4% share valued at USD 69.8 billion in 2024.

By Group Analysis

Group II dominates with 38.8% due to its balanced performance and affordability.

In 2024, Group II held a dominant market position in the By Group segment of the Lubricants Market, with a 38.8% share. It advanced steadily as industries preferred cleaner and cost-effective base oils. Its high saturation levels and lower sulfur content improved efficiency, encouraging manufacturers to expand production capacity worldwide.

Group I remained relevant due to its affordability and compatibility with older machinery. Although demand gradually shifted toward higher-performance grades, Group I continued serving industrial equipment in developing markets. Companies relied on it for applications where extreme purity was not mandatory, sustaining its long-standing presence across traditional lubrication settings.

Group III experienced rising adoption as industries moved toward premium-quality lubricants. With strong viscosity performance and suitability for synthetic formulations, Group III attracted automotive and industrial buyers seeking higher durability. Its ability to support modern engines and energy-efficient systems positioned it as a preferred option in technologically advancing sectors.

Group IV and Group V gained traction across specialized applications that demanded high stability and extreme-temperature performance. These segments supported synthetic and custom formulations. Even though their share remained smaller, they built opportunities in aerospace, high-end automotive, and advanced manufacturing, reflecting a gradual but meaningful shift toward premium lubricant technologies.

By Base Stock Analysis

Mineral Oil Lubricants dominate with 59.6% due to wide accessibility and cost advantage.

In 2024, Mineral Oil Lubricants held a dominant market position in the By Base Stock segment of the Lubricants Market, with a strong 59.6% share. They remained essential because of their economical production and broad industrial acceptance. Their reliability supported transportation, machinery, and equipment operations across global markets, particularly in cost-sensitive regions.

Synthetic Lubricants continued expanding as users demanded longer drain intervals and better high-temperature stability. These formulations offered enhanced performance, making them suitable for modern engines and heavy-duty systems. Despite higher prices, their lifespan and efficiency benefits encouraged increased adoption in automotive, aviation, and advanced industrial operations.

Bio-based Lubricants gained attention as sustainability regulations strengthened. Their biodegradable nature attracted environmentally conscious industries, prompting interest from government-backed infrastructure and green-energy projects. Although adoption remained limited due to higher production costs, demand steadily increased as companies explored cleaner, renewable lubrication alternatives to reduce long-term environmental impacts.

By Product Type Analysis

Engine Oils dominate with 45.7% owing to heavy automotive and machinery consumption.

In 2024, Engine Oils held a dominant market position in the By Product Type segment of the Lubricants Market, with a 45.7% share. Their extensive use in passenger vehicles, commercial fleets, and industrial engines maintained steady demand. Engines required regular lubrication, ensuring engine oils remained central to global consumption.

Transmission and Gear Oils advanced gradually due to rising vehicle production and increased focus on drivetrain efficiency. These lubricants improved shifting performance and minimized wear, making them vital for both manual and automatic transmissions. Industrial gear systems also contributed significantly to demand as automation expanded.

Hydraulic Fluids served essential roles across construction equipment, factory machinery, and material-handling systems. Their ability to transmit power efficiently supported growing industrial activity. Companies relied on these fluids to maintain operational precision and system responsiveness, especially across high-pressure hydraulic applications in manufacturing environments.

By End-User Analysis

Automotive dominates with 49.9% driven by global vehicle use and maintenance cycles.

In 2024, the Automotive segment held a dominant market position in the By End-User category of the Lubricants Market, securing a 49.9% share. Routine servicing, engine maintenance, and expanding vehicle fleets sustained strong demand. Automakers and service centers played key roles in supporting consistent lubricant consumption around the world.

Power Generation continued relying on lubricants to maintain turbines, generators, and heavy-duty mechanical systems. As energy infrastructure modernized, demand grew steadily. Reliable lubrication helped minimize downtime and preserve long-term asset performance, especially in thermal plants, hydro facilities, and renewable-energy machinery requiring stable operation.

Heavy Equipment usage supported construction, mining, and agriculture sectors. These machines worked under harsh conditions, increasing their lubrication needs. High-load-bearing lubricants ensured durability and reduced wear, making them essential for equipment longevity. Demand rose as countries expanded infrastructure spending and mechanization in labor-intensive industries.

Key Market Segments

By Group

- Group I

- Group II

- Group III

- Group IV

- Group V

By Base Stock

- Mineral Oil Lubricants

- Synthetic Lubricants

- Semi-Synthetic Lubricants

- Bio-Based Lubricants

By Product Type

- Engine Oils

- Transmission and Gear Oils

- Hydraulic Fluids

- Metalworking Fluids

- Greases

- Others

By End-User

- Automotive

- Power Generation

- Heavy Equipment

- Metallurgy and Metalworking

- Others

Emerging Trends

Shift Toward Eco-Friendly Lubricants Shapes Market Trends

A major trend in the lubricants market is the rapid growth of eco-friendly and low-emission formulations. Industries want solutions that align with sustainability goals, prompting a move away from conventional mineral oils toward synthetic and bio-based alternatives. This change is reshaping product development strategies worldwide.

- Lubricants used in oil-to-sea interfaces on vessels operating in U.S. waters must meet strict biodegradability criteria. Those criteria often require lubricants to degrade by at least 60% within 28 days under standardized test methods — a benchmark of environmentally acceptable performance, not just efficiency.

Digital monitoring solutions are also gaining popularity. Smart lubrication systems equipped with sensors help track temperature, viscosity, and performance in real time. This allows industries to adopt predictive maintenance, reducing downtime and extending equipment life.

Drivers

Rising Industrial Automation Boosts Lubricants Consumption

The lubricants market is growing steadily as factories across automotive, metals, chemicals, and manufacturing adopt more automated machinery. These advanced systems run for longer hours, which increases the need for high-performance engine oils, hydraulic fluids, and gear oils. As a result, industries rely on stable lubrication cycles to prevent downtime.

- At the same time, heavy-duty equipment used in mining, construction, and energy operations requires consistent lubricant usage to maintain performance in demanding environments. The EU Ecolabel for Lubricants sets clear criteria for reducing hazardous substances, limiting environmental impact, and maintaining performance, while also promoting a minimum 25% recycled content in packaging for labeled products.

Growing vehicle usage also contributes to market expansion. Commercial vehicles, passenger cars, and two-wheelers require regular oil changes and maintenance, keeping lubricant demand stable even during economic fluctuations. As mobility increases in developing regions, consumption continues to rise.

Restraints

Stringent Environmental Rules Limit Conventional Lubricants’ Growth

Environmental restrictions are creating challenges for the lubricants market, especially for mineral-oil-based products. Governments are tightening rules on emissions, waste oil disposal, and chemical compositions, making it harder for companies to rely on traditional formulations. This increases compliance costs for producers and distributors.

- Disposal and recycling of used lubricants also remain major concerns. Many industries still struggle to manage waste oil responsibly, which leads to higher operational expenses and stricter enforcement requirements. Global oil consumption rose by only 0.8%, a much smaller increase than seen in previous years, illustrating the changing dynamics in transport energy use.

Volatile crude oil prices also act as a restraint on the market. Since base oils are derived from petroleum, sudden changes in global oil prices disrupt supply chains and increase production costs. This uncertainty affects both manufacturers and end users. EVs require fewer lubricants compared to traditional internal combustion engines, gradually reducing demand for engine oils.

Growth Factors

Expansion of Synthetic Lubricants Creates New Market Potential

The shift toward synthetic and high-performance lubricants is creating strong opportunities for market growth. Industries are increasingly opting for synthetic oils because they offer better thermal stability, longer service life, and enhanced protection for machinery. This helps reduce maintenance costs and enhances operational efficiency.

Developing countries offer another major opportunity. Rapid industrialization, expanding transportation networks, and increasing vehicle ownership are driving up lubricant consumption across Asia, Africa, and Latin America. These regions are becoming key markets for both automotive and industrial lubricants.

The rise of energy-efficient machinery is further expanding demand. New equipment requires lubricants designed for high-load conditions and extended drain intervals, encouraging manufacturers to develop advanced formulations. This trend promotes innovation and boosts profitability.

Regional Analysis

Asia Pacific Dominates the Lubricants Market with a Market Share of 48.4%, Valued at USD 69.8 Billion

Asia Pacific stands as the leading region in the global lubricants market, driven by rapid industrialization, strong automotive production, and expanding manufacturing bases across China, India, and Southeast Asia. In 2024, the region captured a dominant 48.4% share, valued at USD 69.8 billion, supported by rising demand from transportation, heavy machinery, and power generation sectors.

North America shows steady growth supported by advanced automotive industries, strong OEM standards, and robust industrial maintenance practices. The U.S. leads regional consumption due to its high vehicle ownership and widespread use of synthetic and high-performance lubricants. Increasing adoption of energy-efficient industrial systems and demand for cleaner formulations also reinforce long-term market stability across the region.

Europe remains a mature but technologically advanced lubricants market, shaped by strict regulatory norms and a strong shift toward low-emission, synthetic, and bio-based products. Industrial automation and the presence of well-established automotive hubs, especially in Germany and Eastern Europe, continue to support demand. Sustainability-driven reforms and circular-economy strategies are encouraging higher adoption of long-drain and environmentally safe lubricants.

The U.S. remains one of the most advanced and high-value markets globally, backed by strong demand for premium synthetic lubricants and strict equipment-efficiency standards. Industrial machinery, aviation, and high-mileage vehicles play a major role in consumption. Continuous technological upgrades and adherence to emission norms encourage wider adoption of fuel-efficient and long-drain lubricant formulations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global lubricants market in 2024 reflects steady momentum driven by industrial recovery, rising mobility demand, and increasing adoption of high-performance synthetic formulations. Major players continue to expand product portfolios, invest in cleaner technologies, and strengthen supply networks to capture emerging opportunities across Asia-Pacific, the Middle East, and Latin America.

Shell maintained a strong market presence in 2024 by focusing on premium synthetic lubricants and advanced engine oil technologies. Its consistent push toward carbon-neutral products and digital service platforms strengthened its competitive position among automotive and industrial clients seeking reliable, efficient lubrication solutions.

ExxonMobil leveraged its formulation expertise and large-scale refining capabilities to enhance market penetration, especially in high-performance industrial lubricants. The company’s strategic emphasis on energy-efficient fluids and reliability-driven maintenance solutions supported strong adoption across manufacturing, heavy-equipment, and power sectors.

BP/Castrol continued to build on its brand strength by expanding EV-compatible fluids, thermal-management solutions, and next-generation engine oils. Castrol’s focus on collaborative R&D and partnerships with OEMs helped reinforce its relevance in both traditional and electrified vehicle ecosystems.

Total Energies advanced its presence in the global lubricants market by prioritizing cleaner formulations, broader distribution in emerging markets, and localized blending capacity. Its commitment to sustainability and diversified product offerings supported strong market engagement across transportation, mining, and industrial applications.

Top Key Players in the Market

- Shell

- ExxonMobil

- BP/Castrol

- Total Energies

- Chevron

- PetroChina

- Sinopec

- Idemitsu

- Fuchs

Recent Developments

- In 2025, Shell has been focusing on sustainability and infrastructure-related applications in its lubricants business. The company highlighted how high-performance lubricants for engines and hydraulics can optimize equipment life amid increased global infrastructure investments, emphasizing cost savings through better lubrication strategies.

- In 2024, ExxonMobil is expanding its lubricants production capacity with a new greenfield plant in Raigad, India. The company continues to innovate in base stocks and lubricants, leading with over 135 years of experience in developing solutions like Group II/III base oils that outperform competitors in tests for applications such as 5W-30 lubricants.

Report Scope

Report Features Description Market Value (2024) USD 144.3 Billion Forecast Revenue (2034) USD 207.5 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Group (Group I, Group II, Group III, Group IV, Group V), By Base Stock (Mineral Oil Lubricants, Synthetic Lubricants, Semi-Synthetic Lubricants, Bio-Based Lubricants), By Product Type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, Metalworking Fluids, Greases, Others), By End-User (Automotive, Power Generation, Heavy Equipment, Metallurgy and Metalworking, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Shell, ExxonMobil, BP/Castrol, Total Energies, Chevron, PetroChina, Sinopec, Idemitsu, Fuchs Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Shell

- ExxonMobil

- BP/Castrol

- Total Energies

- Chevron

- PetroChina

- Sinopec

- Idemitsu

- Fuchs