Global Lithium-Ion Battery Solvent Market Size, Share Analysis Report By Type (Ethylene Carbonate (EC), Propylene Carbonate (PC), Dimethyl Carbonate (DMC), Ethyl Methyl Carbonate (EMC), Others), By End Use (EV, Consumer Electronics, Energy Storage, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160858

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

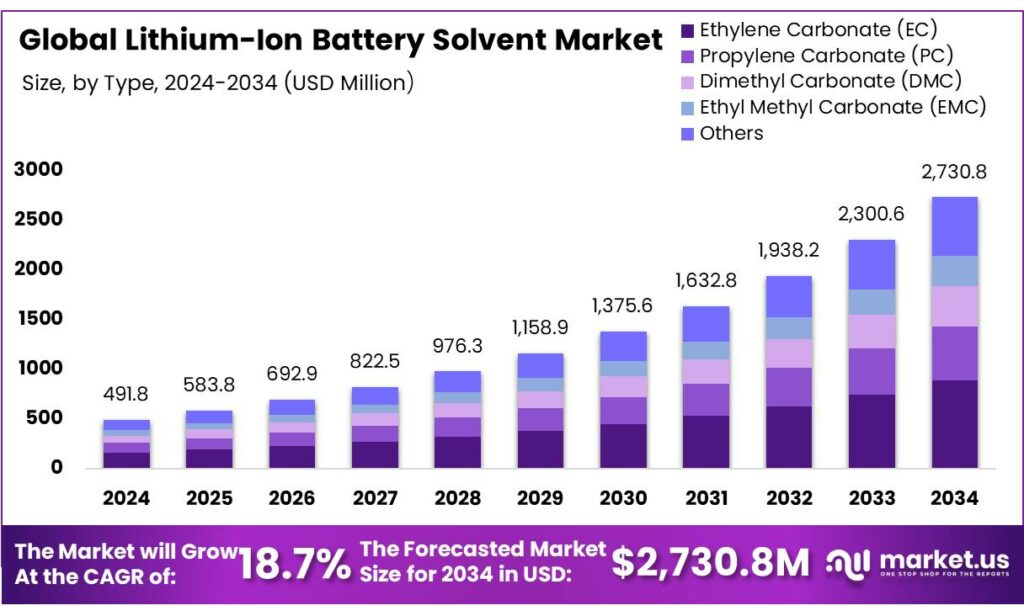

The Global Lithium-Ion Battery Solvent Market size is expected to be worth around USD 2730.8 Million by 2034, from USD 491.8 Million in 2024, growing at a CAGR of 18.7% during the forecast period from 2025 to 2034.

The lithium-ion (Li-ion) battery solvent industry is a pivotal component of the global energy storage and electric vehicle (EV) sectors. These solvents, primarily ethylene carbonate (EC), diethyl carbonate (DEC), dimethyl carbonate (DMC), and ethyl methyl carbonate (EMC), serve as essential mediums in battery electrolytes, facilitating the movement of lithium ions between the anode and cathode.

Several factors are driving the growth of the lithium-ion battery solvent market. The global shift towards electric mobility, supported by government incentives and environmental regulations, is increasing the demand for high-performance batteries. For instance, the International Energy Agency (IEA) projects that, under current policies, the number of electric vehicles on the road will surpass 200 million by 2030. Additionally, advancements in renewable energy storage systems are further propelling the need for efficient battery solutions.

This growth is primarily attributed to the rising adoption of EVs, which accounted for nearly 80% of all lithium-ion batteries produced globally from 2021 to 2030. The global production of lithium-ion batteries is expected to increase fivefold to 5,500 GWh by 2030, highlighting the substantial demand for electrolyte solvents.

Government initiatives also play a pivotal role in fostering market growth. In India, the lithium-ion battery market is projected to grow by 48% by 2030, driven by the increasing adoption of EVs and renewable energy storage solutions. Similarly, in the United States, the Department of Energy’s investments in battery manufacturing and recycling infrastructure are expected to bolster the domestic supply chain and reduce reliance on imports.

Key Takeaways

- Lithium-Ion Battery Solvent Market size is expected to be worth around USD 2730.8 Million by 2034, from USD 491.8 Million in 2024, growing at a CAGR of 18.7%.

- Ethylene Carbonate (EC) held a dominant market position, capturing more than a 32.4% share.

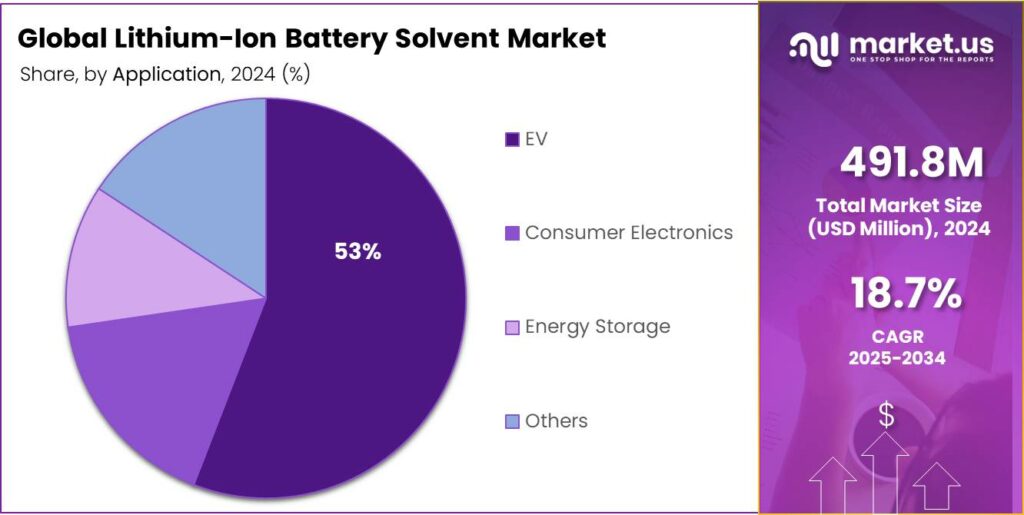

- EV held a dominant market position, capturing more than a 53.2% share of the global lithium-ion battery solvent market.

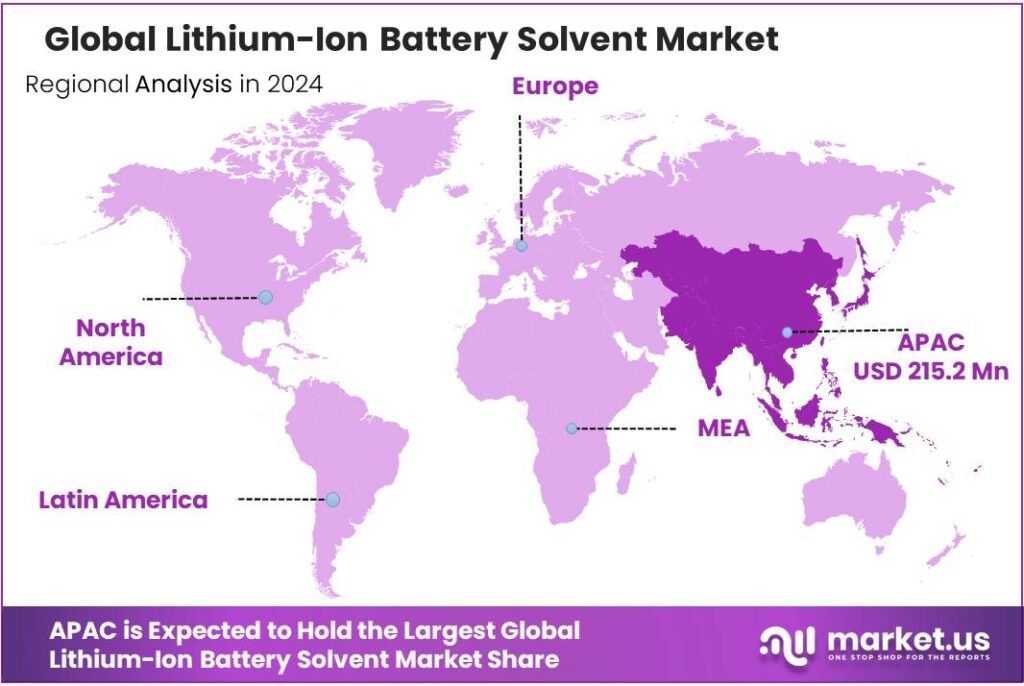

- Asia Pacific region dominated the global lithium-ion battery solvent market, capturing a 43.8% share, equivalent to USD 215.2 million.

By Type Analysis

Ethylene Carbonate (EC) dominates with 32.4% share in 2024 due to its high efficiency in lithium-ion batteries.

In 2024, Ethylene Carbonate (EC) held a dominant market position, capturing more than a 32.4% share of the global lithium-ion battery solvent market. This preference can be attributed to its superior chemical stability, high dielectric constant, and excellent ability to dissolve lithium salts, which enhances ionic conductivity in batteries. The widespread adoption of electric vehicles (EVs) and portable electronic devices has further driven the demand for EC, as manufacturers focus on solvents that improve battery performance and lifespan. EC’s compatibility with other carbonate solvents allows it to be used in blends, optimizing battery efficiency and safety.

The industrial scenario indicates that battery manufacturers are increasingly selecting EC to meet the performance requirements of high-capacity and fast-charging applications. In 2025, the share of EC is expected to maintain its lead due to continued growth in the EV sector and increased investments in renewable energy storage systems. Additionally, regulatory emphasis on battery safety and performance is encouraging the use of high-quality solvents like EC, reinforcing its dominant position in the market.

By End Use Analysis

Electric Vehicles (EV) dominate with 53.2% share in 2024 driven by rising adoption and energy storage needs.

In 2024, EV held a dominant market position, capturing more than a 53.2% share of the global lithium-ion battery solvent market. This strong market presence is largely due to the rapid growth of the electric vehicle industry and the increasing demand for high-performance batteries that offer longer range, faster charging, and improved safety. Lithium-ion battery solvents used in EVs are critical for enhancing ionic conductivity, thermal stability, and overall battery efficiency, making them indispensable in modern EV applications.

The industrial scenario indicates that EV manufacturers are investing heavily in battery technologies to meet consumer expectations and regulatory standards for emissions reduction. In 2025, the EV segment is expected to maintain its dominance as global EV sales continue to rise, supported by government incentives, subsidies, and stricter emission norms in key markets. The expanding charging infrastructure and growing consumer preference for sustainable transportation solutions further reinforce the reliance on advanced lithium-ion battery solvents in this segment.

Key Market Segments

By Type

- Ethylene Carbonate (EC)

- Propylene Carbonate (PC)

- Dimethyl Carbonate (DMC)

- Ethyl Methyl Carbonate (EMC)

- Others

By End Use

- EV

- Consumer Electronics

- Energy Storage

- Others

Emerging Trends

Lithium-Ion Battery Solvents: Growth in Non-Carbonate Electrolytes

A significant trend in the lithium-ion battery solvent market is the shift towards non-carbonate-based electrolytes, notably ionic liquids. These solvents are gaining traction due to their superior thermal stability, non-flammability, and enhanced safety profiles compared to traditional carbonates like ethylene carbonate (EC) and diethyl carbonate (DEC). This transition aligns with the increasing demand for high-performance batteries in electric vehicles (EVs), renewable energy storage systems, and consumer electronics.

The adoption of non-carbonate electrolytes is further supported by regulatory frameworks in regions like Europe, Japan, and South Korea, which are enforcing the use of safer, environmentally sourced solvents. These regulations are creating a favorable policy ecosystem for the development and commercialization of non-carbonate-based electrolytes.

The shift towards non-carbonate electrolytes, particularly ionic liquids, represents a significant trend in the lithium-ion battery solvent market. This transition is driven by the need for safer, more efficient battery solutions and is supported by technological advancements and favorable government policies. As the demand for high-performance batteries continues to rise, the adoption of non-carbonate electrolytes is expected to play a pivotal role in the evolution of energy storage technologies.

Drivers

Government Policies and Incentives Driving Lithium-Ion Battery Solvent Demand

A significant driving factor for the growth of the lithium-ion (Li-ion) battery solvent market is the robust support from government policies and incentives aimed at accelerating the adoption of electric vehicles (EVs). In India, the government’s commitment to promoting EVs is evident through initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme and the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage.

The FAME scheme, launched in 2015 and extended in phases, provides financial incentives for the purchase of electric vehicles and the establishment of charging infrastructure. Under this scheme, the government has allocated substantial funds to encourage the adoption of EVs across various segments, including two-wheelers, three-wheelers, and four-wheelers. For instance, in 2024, the government approved a $1.3 billion incentive scheme, known as PM E-DRIVE, to promote the adoption of electric vehicles and reduce pollution. This scheme includes subsidies for electric two-wheelers, three-wheelers, ambulances, and trucks, as well as funding for the purchase of electric buses by public transport agencies.

In addition to the FAME scheme, the PLI scheme for ACC battery storage, announced in 2024, aims to boost domestic manufacturing of lithium-ion batteries by providing financial incentives to manufacturers. This initiative is expected to reduce dependency on imports, lower battery costs, and enhance the overall EV ecosystem in India.

These government policies not only stimulate demand for electric vehicles but also indirectly drive the need for high-quality lithium-ion battery solvents. As the adoption of EVs increases, the demand for efficient and reliable battery components, including solvents, grows correspondingly. This creates a favorable market environment for manufacturers of lithium-ion battery solvents to expand their production capacities and innovate to meet the evolving needs of the EV industry.

Restraints

Supply Chain Disruptions Impacting Lithium-Ion Battery Solvent Availability

A significant challenge hindering the growth of the lithium-ion (Li-ion) battery solvent market is the vulnerability of the global supply chain for critical materials. Lithium-ion battery solvents, such as ethylene carbonate (EC), dimethyl carbonate (DMC), and diethyl carbonate (DEC), are essential for the performance and safety of Li-ion batteries. However, the production and availability of these solvents are closely tied to the supply of raw materials and the efficiency of manufacturing processes, both of which face several constraints.

One of the primary concerns is the limited domestic production of critical materials required for solvent manufacturing. In the United States, for instance, there is a heavy reliance on imports for materials like lithium, cobalt, and nickel, which are vital for producing battery solvents. This dependency exposes the supply chain to geopolitical risks and trade policy changes that can disrupt material availability and increase costs. The U.S. Department of Energy’s National Blueprint for Lithium Batteries highlights the need to reduce reliance on foreign sources and develop domestic capabilities to ensure a stable supply of critical materials

Additionally, the extraction and processing of these raw materials often involve complex and environmentally challenging procedures. For example, lithium extraction can lead to significant water consumption and environmental degradation, particularly in arid regions. Such environmental impacts can lead to stricter regulations and public opposition, further complicating the supply chain

These supply chain vulnerabilities not only affect the availability of battery solvents but also impact the broader electric vehicle (EV) and renewable energy sectors. Delays in solvent production can lead to slower battery manufacturing, affecting the rollout of EVs and energy storage systems. This, in turn, can hinder the transition to cleaner energy solutions and affect market dynamics.

Opportunity

Rapid Expansion in Electric Vehicles & Grid-Scale Storage

To put this into perspective in a national market: in India, the lithium-ion battery industry itself is predicted to leap from 2.9 GWh in 2018 to about 132 GWh by 2030, which represents a CAGR of ~35.5 %. As battery manufacturing scales up, solvent demand will grow in tandem (because solvents are a key component of electrolytes).

In parallel, the Indian government is backing “giga-scale battery manufacturing” to reduce import dependence and build domestic capacity. A policy document from NITI Aayog outlines plans for support mechanisms for cell manufacturers, and strategies to stimulate demand for energy storage and EV batteries. Meanwhile, India has also opened 100 % foreign direct investment (FDI) in battery assembly and related segments. These government moves can further accelerate local manufacturing of batteries—and thus the solvent market as well.

Governments are keen to push EV targets, energy transition, and local manufacturing. So solvent companies who partner with battery makers, invest in cleaner and safer chemistries, localize production to reduce shipping costs, and align with policy incentives—these are well positioned to ride the wave.

Regional Insights

Asia Pacific leads with 43.8% share in 2024, valued at USD 215.2 million, driven by robust EV and energy storage sectors.

In 2024, the Asia Pacific region dominated the global lithium-ion battery solvent market, capturing a 43.8% share, equivalent to USD 215.2 million. This leadership is primarily attributed to the region’s substantial investments in electric vehicle (EV) production and renewable energy storage solutions. Countries like China, Japan, South Korea, and India are at the forefront, implementing policies that promote EV adoption and the development of energy storage infrastructure. For instance, China’s aggressive EV manufacturing plans and India’s push for renewable energy integration have significantly boosted the demand for high-performance battery solvents.

The industrial scenario in Asia Pacific reflects a concerted effort to enhance battery technology and manufacturing capabilities. The region is home to leading battery manufacturers and chemical producers specializing in solvents such as ethylene carbonate (EC) and dimethyl carbonate (DMC), which are essential for high-capacity and fast-charging batteries. The growing consumer electronics market further contributes to the demand for efficient and safe battery solutions.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CAPCHEM is a global leader in the supply of electrolyte solvents for lithium-ion batteries, offering a comprehensive range of products, including carbonate-based solvents. The company’s extensive product portfolio and commitment to research and development enable it to meet the evolving needs of the battery industry. CAPCHEM’s strategic initiatives, such as the establishment of manufacturing facilities in key markets, strengthen its position in the global market.

BASF SE is a major player in the lithium-ion battery solvent market, known for its high-performance electrolyte solutions. In 2025, BASF entered a strategic partnership with LG Energy Solution to supply carbonate-based solvents for next-generation EV batteries, enhancing battery performance and safety. This collaboration underscores BASF’s commitment to advancing battery technology and its significant role in the global battery materials sector.

Mitsubishi Chemical Corporation specializes in the production of formulated electrolytes for lithium-ion batteries, utilizing organic solvents such as ethylene carbonate. Their Sol-Rite™ formulation is designed to optimize the solid electrolyte interface, enhancing battery efficiency and longevity. Mitsubishi Chemical’s expertise in electrolyte solutions positions it as a key contributor to the advancement of battery technologies.

Top Key Players Outlook

- UBE Corporation

- OUCC

- Dongwha Electrolyte

- CAPCHEM

- BASF SE

- Mitsubishi Chemical Corporation

- Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd.

- Huntsman International LLC

- Shandong Lixing Advanced Material Co., Ltd.

- Lotte Chemical

Recent Industry Developments

In May 2024, Capchem USA announced plans to build the largest lithium-ion battery materials plant in the United States, with an anticipated investment of $350 million. This state-of-the-art facility, located in Ascension Parish, Louisiana, is expected to have an annual production capacity of 200,000 tons of solvent and 100,000 tons of electrolyte, positioning Capchem as a significant player in the North American battery materials market

In 2025, BASF entered a strategic partnership with LG Energy Solution to supply high-purity carbonate-based solvents for next-generation EV batteries, aiming to enhance battery performance and safety.

Report Scope

Report Features Description Market Value (2024) USD 491.8 Mn Forecast Revenue (2034) USD 2730.8 Mn CAGR (2025-2034) 18.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ethylene Carbonate (EC), Propylene Carbonate (PC), Dimethyl Carbonate (DMC), Ethyl Methyl Carbonate (EMC), Others), By End Use (EV, Consumer Electronics, Energy Storage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape UBE Corporation, OUCC, Dongwha Electrolyte, CAPCHEM, BASF SE, Mitsubishi Chemical Corporation, Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd., Huntsman International LLC, Shandong Lixing Advanced Material Co., Ltd., Lotte Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lithium-Ion Battery Solvent MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Lithium-Ion Battery Solvent MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- UBE Corporation

- OUCC

- Dongwha Electrolyte

- CAPCHEM

- BASF SE

- Mitsubishi Chemical Corporation

- Zhangjiagang Guotai Huarong New Chemical Materials Co., Ltd.

- Huntsman International LLC

- Shandong Lixing Advanced Material Co., Ltd.

- Lotte Chemical