Global Lithium Ion Battery for Energy Storage Systems Market By Battery Type (Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Lithium Titanate Oxide (LTO), Lithium Manganese Iron Phosphate - LMFP, and Lithium Manganese Nickel Oxide - LMNO), By Capacity (Below 100 MWh, 100 to 500 MWh, and Above 500 MWh), By Connection Type (On-grid, and Off-grid) By End-use (Utility, Commercial & Industrial, and Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 117159

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

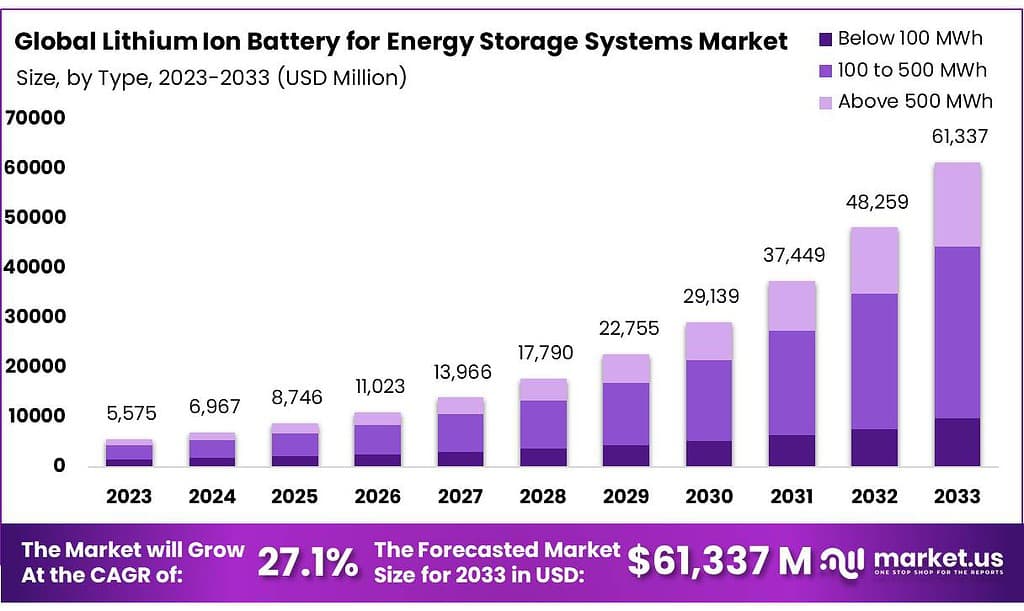

The Global Lithium Ion Battery for Energy Storage Systems Market size is expected to be worth around USD 61337 Million by 2033, from USD 5,575.3 Million in 2023, growing at a CAGR of 27.1% during the forecast period from 2023 to 2033.

The advent of lithium-ion battery technology has significantly catalyzed the evolution of energy storage systems, positioning it as a pivotal component in the global shift towards renewable energy solutions. Characterized by high energy density, longer life cycles, and efficiency in charging and discharging processes, lithium-ion batteries have emerged as the preferred choice for energy storage, underpinning a wide array of applications from residential and commercial to utility-scale projects.

The market’s growth is fundamentally driven by the escalating demand for clean and sustainable energy sources, alongside the global push for electrification and energy security. As governments and corporations intensify their commitment to decarburization and green energy initiatives, the deployment of lithium-ion battery-based storage systems is witnessing exponential growth, further bolstered by technological advancements, cost reductions, and supportive regulatory frameworks.

Key Takeaways

- The global lithium-ion battery market for energy storage systems market was valued at USD 5,575.3 million in 2023.

- The global lithium-ion battery market for energy storage systems market is projected to reach USD 61,337 million by 2033 with an estimated CAGR of 27.1%.

- Among battery Types, Lithium Iron Phosphate (LFP) accounted for the largest market share of 51.4%.

- Among capacity, the 100 to 500 MWh accounted for the majority of the market share with 51.5%.

- Based on connection Battery Type, on-grid accounted for the largest market share in 2023 with 73.3%.

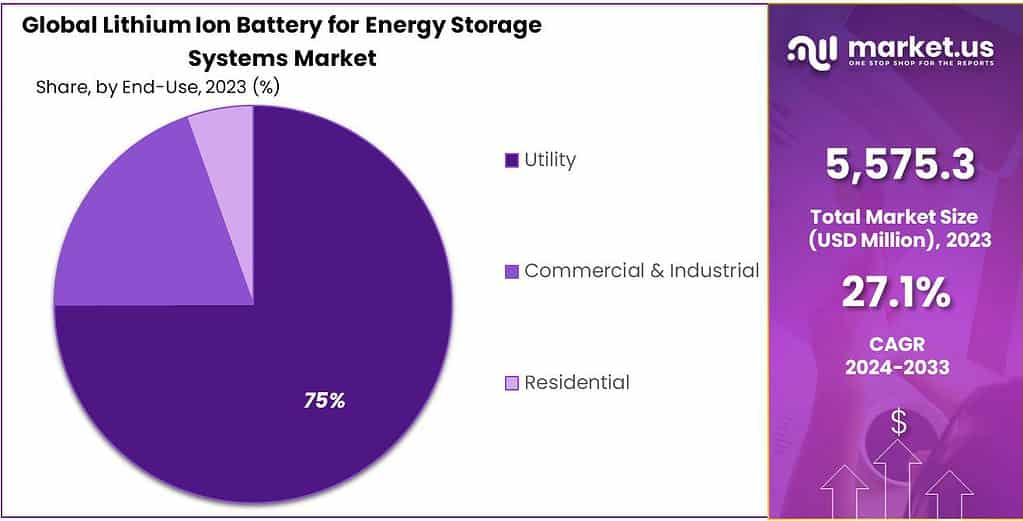

- By end-use, the Utility is anticipated to dominate the market in the coming years. In 2023, it accounted for the majority of the share of 75.0%.

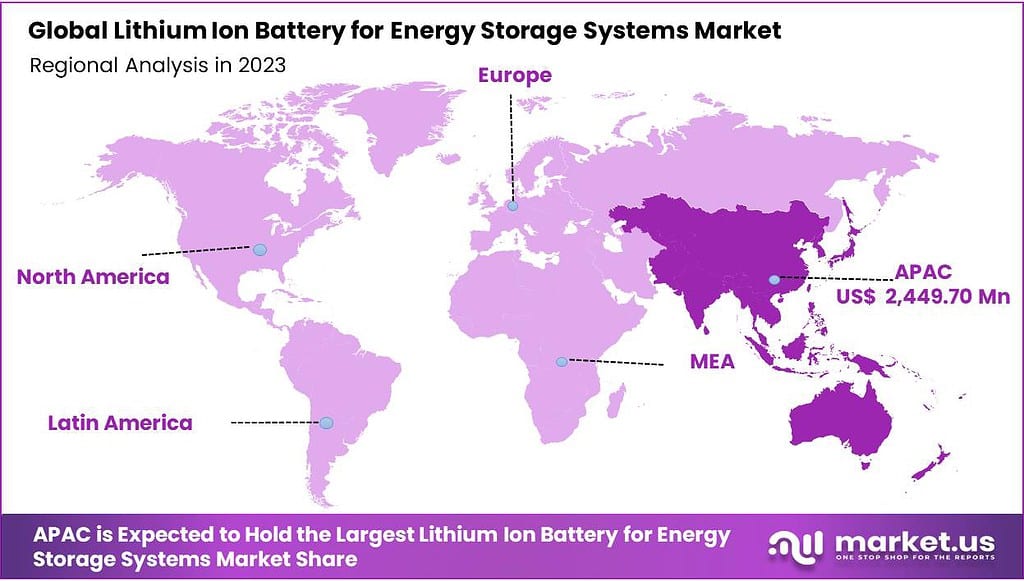

- Asia Pacific is expected to hold the largest global lithium-ion battery market for energy storage systems market share with 43.9% of the market share.

Battery Type Analysis

With a Lower Risk of Thermal Runaway, Lithium Iron Phosphate Is Dominant Among Others

The lithium-ion battery market for energy storage systems market is segmented based on battery type into Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Lithium Titanate Oxide (LTO), Lithium Manganese Iron Phosphate – LMFP, and Lithium Manganese Nickel Oxide – LMNO.

Among these, Lithium Iron Phosphate (LFP) held the majority of the revenue share of 51.4% in 2023. LFP batteries offer superior safety, with a lower risk of thermal runaway compared to other chemistries, making them highly desirable for energy storage applications.

Furthermore, their long cycle life and stability under various thermal conditions enhance durability and reduce lifecycle costs. LFP’s lower cost, attributed to the absence of cobalt, a costly and geopolitically sensitive material, also contributes to its preferential market position. These factors collectively ensure LFP’s majority stake in the market, addressing the safety, economic, and operational priorities of energy storage systems.

Capacity Analysis

Owing to Their Cost-Efficiency, 100 to 500 MWh Dominate the Market Among Capacity

Based on capacity, the market is segmented into below 100 MWh, 100 to 500 MWh, and above 500 MWh. Among these, the 100 to 500 MWh accounted for the majority of the market share with 51.5% due to its optimal balance between scalability, cost-efficiency, and application versatility.

This capacity range effectively meets the requirements of a broad spectrum of applications, from grid support and renewable energy integration to commercial and industrial energy storage solutions. Its prominence reflects the segment’s capacity to provide sufficient energy storage for peak shaving, load leveling, and emergency backup, while also being economically viable for a wide range of customers, thereby driving its significant market share.

Connection Type Analysis

Based on connection types, the market is further divided into on-grid and off-grid. Among these connection types, on-grid accounted for the largest market share in 2023 with 73.3% owing to the increasing adoption of renewable energy sources, such as solar and wind, which are integrated into the main electricity grid to ensure a stable and reliable power supply.

On-grid systems, by enabling energy storage and supply during peak demand periods, enhance grid stability and energy efficiency. Moreover, supportive government policies, incentives for renewable energy integration, and the growing need for grid modernization and resilience against power outages further propelled the dominance of on-grid connections in the energy storage market.

End-Use Analysis

Based on end-uses, the market is further divided into utility, commercial & industrial, and residential. Among these end-uses, utility accounted for the largest market share in 2023 with 75.0%. Owing to the escalating demand for large-scale energy storage solutions that support the integration of renewable energy sources into the grid.

Utilities are increasingly investing in lithium-ion batteries to enhance grid stability, manage peak load demands, and provide emergency backup power, reflecting a global shift towards sustainable energy practices. This substantial market share underscores the critical role of energy storage in achieving energy transition goals, with utilities at the forefront of adopting advanced storage technologies to meet evolving energy demands efficiently.

Key Market Segments

By Battery Type

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Iron Phosphate (LFP)

- Lithium Titanate Oxide (LTO)

- Lithium Manganese Iron Phosphate – LMFP

- Lithium Manganese Nickel Oxide – LMNO

By Capacity

- Below 100 MWh

- 100 to 500 MWh

- Above 500 MWh

By Connection Type

- On-grid

- Off-grid

By End-Use

- Utility

- Commercial & Industrial

- Transportation

- Critical Infrastructure

- Infrastructure & Commercial Buildings

- Hybrid Systems

- Residential

Drivers

Rapid Growth Growing Electric Vehicle Market is Anticipated to Bolster the Demand

As the EV market expands, driven by global efforts to reduce carbon emissions and transition towards more sustainable transportation solutions, the demand for lithium-ion batteries surges. This demand not only boosts production volumes but also fosters technological innovations aimed at enhancing battery efficiency, capacity, and safety.

One noticeable example of this dynamic is seen in the expansion plans of major automotive manufacturers and battery producers. Companies such as Tesla, BYD, and Volkswagen have committed to significant investments in battery production facilities, often referred to as giga factories, which are dedicated to manufacturing lithium-ion batteries at scale. These facilities not only aim to meet the growing demand for electric vehicles but also contribute to reducing the cost per kilowatt-hour (kWh) of battery packs through economies of scale. As battery costs decline, EVs become more accessible to a broader range of consumers, further stimulating market growth.

Moreover, the integration of EVs with energy storage systems presents innovative opportunities for grid management and renewable energy utilization. For instance, vehicle-to-grid (V2G) technology allows EV batteries to store excess renewable energy during periods of low demand and feed it back into the grid when demand is high.

This not only enhances grid stability but also turns EVs into mobile energy storage solutions, amplifying the utility and value of lithium-ion batteries beyond transportation. The advancement in battery technology driven by the EV market also has direct implications for the broader ESS market.

Innovations such as improved cathode materials, solid-state electrolytes, and enhanced battery management systems (BMS) developed for EVs are transferable to stationary energy storage applications. These advancements can lead to longer battery life spans, higher energy densities, and better safety profiles for ESS, making them more attractive for residential, commercial, and utility-scale energy storage solutions.

Restraints

Concerns Over Safety and Environmental Impact of Lithium Ion Battery May Hinder the Growth of the Market

Battery safety concerns primarily revolve around the risk of thermal runaway, a condition where an increase in temperature can lead to a self-sustaining reaction within the battery, potentially causing fires or explosions. Moreover, the environmental impact of lithium-ion batteries presents another significant challenge.

The production of these batteries requires the extraction of lithium, cobalt, and nickel, processes that are energy-intensive and can lead to significant environmental degradation. For example, lithium mining in regions such as Latin America’s Lithium Triangle has raised concerns about water usage and pollution, impacting local ecosystems and communities.

Moreover, the end-of-life disposal and recycling of lithium-ion batteries pose considerable environmental challenges. Currently, only a small percentage of lithium-ion batteries are recycled, leading to waste and the loss of valuable materials. The lack of efficient recycling processes and infrastructure exacerbates these issues, contributing to resource depletion and environmental pollution.

Furthermore, the increasing demand for lithium-ion batteries exacerbates these concerns. As the market for ESS and EVs grows, so does the demand for critical raw materials, potentially leading to more intensive mining activities and associated environmental impacts. This situation is compounded by geopolitical risks and supply chain vulnerabilities, as the majority of these critical materials are concentrated in a few countries, raising concerns about sustainable and ethical sourcing.

Opportunity

Expansion in Developing Markets

The expansion in developing markets is poised to create significant opportunities for the growth of the global lithium-ion battery for energy storage systems market. This can be attributed to several key factors, including the escalating demand for renewable energy sources, government initiatives to promote energy storage solutions, and the increasing adoption of electric vehicles (EVs).

Developing economies are witnessing a substantial surge in energy consumption due to rapid industrialization, urbanization, and economic growth. As these economies strive for sustainable development, there is a growing emphasis on integrating renewable energy sources into their power grids.

Lithium-ion batteries, known for their high energy density, long life span, and efficiency, are becoming the cornerstone technology for storing renewable energy. This storage capability is crucial for addressing the intermittent nature of renewable sources such as solar and wind, thereby ensuring a stable and reliable energy supply.

Governments in developing countries are implementing policies and incentives to support energy storage solutions. For example, India’s National Energy Storage Mission aims to foster the adoption of energy storage technologies, including lithium-ion batteries, to enhance the country’s energy security and grid stability.

Similarly, China’s 13th Five-Year Plan prioritizes energy storage as part of its broader energy strategy, facilitating substantial investments in lithium-ion battery production and deployment. These initiatives not only boost the local energy storage market but also open avenues for international manufacturers and investors to participate in these burgeoning markets.

Trends

Rise of Energy Storage as a Service (ESaaS)

The emergence of Energy Storage as a Service (ESaaS) has significantly influenced the trajectory of the global lithium-ion battery for energy storage systems market, marking a pivotal shift in how energy storage solutions are deployed and managed across various sectors. This innovative service model facilitates the adoption of energy storage technologies by mitigating upfront capital expenditure, thereby accelerating the integration of lithium-ion batteries into the broader energy ecosystem.

The ESaaS model leverages operational and financial flexibility to cater to a wide range of clients, from utility providers to commercial entities, encouraging the proliferation of lithium-ion batteries as a preferred choice for energy storage solutions. One of the core factors driving the growth of the lithium-ion battery for energy storage systems market within the ESaaS framework is the increasing demand for renewable energy integration. As the global economy seeks to transition towards cleaner energy sources, the intermittent nature of renewable energy sources such as solar and wind necessitates robust energy storage solutions.

Lithium-ion batteries, known for their high energy density, efficiency, and longer life cycles, emerge as the ideal technology to bridge the gap between energy generation and consumption. The ESaaS model, by offering energy storage as a manageable service, lower barriers to entry for utilizing advanced lithium-ion battery technology, thereby enhancing grid stability and supporting the expansion of renewable energy infrastructure.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impact the Growth of the Lithium Ion Battery Market for Energy Storage Systems Market Due to The Halt in Production and Supply Chain Activities

The current geopolitical landscape significantly influences the Lithium-Ion Battery for Energy Storage Systems (ESS) market, reflecting complex interactions between international trade policies, regional conflicts, and strategic alliances. Presently, several key geopolitical dynamics are shaping market trajectories, investment flows, and supply chain configurations in this sector.

Primarily, the intensification of trade tensions between major economies, notably the United States and China, impacts the Lithium-Ion Battery market. These tensions manifest in tariffs, trade barriers, and restrictions on technology transfers, affecting the cost structures and supply chain reliability for lithium-ion batteries. China’s dominant position in the lithium-ion battery supply chain, coupled with its significant reserves of critical raw materials such as lithium, cobalt, and nickel, places it at the center of geopolitical maneuvers affecting the market.

Furthermore, the growing emphasis on energy security and sustainability across nations accelerates the shift towards renewable energy sources, subsequently driving demand for energy storage solutions. Countries are increasingly recognizing the strategic importance of controlling or having access to essential battery materials and technology, leading to national strategies aimed at securing supply chains and reducing dependency on geopolitically sensitive regions.

Moreover, recent geopolitical events, such as regional conflicts and sanctions, have underscored the vulnerability of global supply chains. For instance, the situation in the Democratic Republic of Congo (DRC), a major source of cobalt, illustrates how political instability can disrupt the availability of critical minerals for battery production. Similarly, Russia’s role as a key supplier of nickel raises concerns about supply security amidst international sanctions and geopolitical tensions.

Regional Analysis

APAC is estimated to be the Most Lucrative Market in the Global Lithium Ion Battery for Energy Storage Systems Market

Asia Pacific held the largest market share, with 43.9% of the lithium-ion battery market for energy storage systems market in 2023. Asia Pacific dominates the Lithium-Ion Battery for Energy Storage Systems market due to several factors. Rapid urbanization, industrialization, and the adoption of electric vehicles in countries such as China, Japan, and South Korea drive substantial demand. Moreover, supportive government policies, incentives for renewable energy integration, and investments in infrastructure further bolster the market.

Additionally, Asia Pacific hosts major manufacturers and suppliers of lithium-ion batteries, benefiting from established supply chains and economies of scale. These dynamics, coupled with growing environmental concerns and the push for clean energy solutions, consolidate Asia Pacific’s position as the leading market contributor, capturing 43.9% in 2023.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Strong Focus On Product Portfolio Expansion Through Various Strategies Maintain the Dominance of Industry Leaders

Major players are heavily investing in R&D to develop advanced battery chemistries, improve energy density, enhance safety features, and reduce costs. These innovations enable them to stay ahead in a highly competitive market and meet evolving customer demands. There is a growing emphasis on sustainability across the industry, with major players investing in recycling technologies, renewable energy integration, and eco-friendly manufacturing processes.

This focus on sustainability not only aligns with consumer preferences but also helps in complying with regulatory requirements and reducing environmental impact. To meet the growing demand for lithium-ion batteries, key players are expanding their manufacturing facilities globally. This expansion allows them to serve diverse markets efficiently while reducing lead times and transportation costs.

Collaborations with technology companies, energy firms, and government agencies enable key players to access new markets, share expertise, and accelerate innovation. These partnerships facilitate the development of integrated energy storage solutions and promote sustainable growth.

Market Key Players

Key players are diversifying their product offerings to cater to a wide range of applications beyond electric vehicles and stationary energy storage. This includes batteries for consumer electronics, grid stabilization, renewable energy integration, and backup power systems, ensuring revenue stability and market resilience. The evolution of major key players in the lithium-ion battery for energy storage systems market is characterized by a focus on innovation, sustainability, and strategic partnerships to capitalize on growth opportunities and address emerging challenges in the dynamic energy storage landscape.

The following are some of the major players in the industry

- BYD Co. Ltd.

- Panasonic Corporation

- Toshiba Corporation

- Samsung SDI Co., Ltd.

- Tesla Inc.

- LG Energy Solution Ltd

- Hitachi Energy Ltd.

- GS Yuasa International Ltd.

- Saft

- Narada Power Source Co., Ltd.

- Contemporary Amperex Technology Co., Limited.

- BAK Power

- Morrow

- Other Key Players

Recent Development

- On Dec. 19, 2023, Panasonic entered into a partnership with Sila Nanotechnologies, a battery materials firm, to collaborate on the development of electric vehicle batteries featuring silicon-based anodes.

- On Dec 20, 2023, LG Energy Solution and Vertech Selected signed a contract to provide 10 GWh of grid-scale battery energy storage (ESS) projects in the US.

Report Scope

Report Features Description Market Value (2023) USD 5,575.3 Mn Forecast Revenue (2033) USD 61,337 Mn CAGR (2024-2033) 27.1% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Lithium Titanate Oxide (LTO), Lithium Manganese Iron Phosphate – LMFP, and Lithium Manganese Nickel Oxide – LMNO), By Capacity (Below 100 MWh, 100 to 500 MWh, and Above 500 MWh), By Connection Type (On-grid, and Off-grid) By End-use (Utility, Commercial & Industrial, and Residential) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BYD Co. Ltd., Panasonic Corporation, Toshiba Corporation, Samsung SDI Co., Ltd., Tesla Inc., LG Energy Solution Ltd, Hitachi Energy Ltd., GS Yuasa International Ltd., Saft, Narada Power Source Co., Ltd., Contemporary Amperex Technology Co., Limited., BAK Power, others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Lithium Ion Battery for Energy Storage Systems Market?Global Lithium Ion Battery for Energy Storage Systems Market size is expected to be worth around USD 61337 billion by 2033, from USD 5,575.3 Million in 2023

What CAGR is projected for the Lithium Ion Battery for Energy Storage Systems Market?The Lithium Ion Battery for Energy Storage Systems Market is expected to grow at 27.1% CAGR (2024-2033).Name the major industry players in the Lithium Ion Battery for Energy Storage Systems Market?BYD Co. Ltd., Panasonic Corporation, Toshiba Corporation, Samsung SDI Co., Ltd., Tesla Inc., LG Energy Solution Ltd, Hitachi Energy Ltd., GS Yuasa International Ltd., Saft, Narada Power Source Co., Ltd., Contemporary Amperex Technology Co., Limited., BAK Power, others

Lithium Ion Battery for Energy Storage Systems MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Lithium Ion Battery for Energy Storage Systems MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BYD Co. Ltd.

- Panasonic Corporation

- Toshiba Corporation

- Samsung SDI Co., Ltd.

- Tesla Inc.

- LG Energy Solution Ltd

- Hitachi Energy Ltd.

- GS Yuasa International Ltd.

- Saft

- Narada Power Source Co., Ltd.

- Contemporary Amperex Technology Co., Limited.

- BAK Power

- Morrow

- Other Key Players