Global Liquid Vitamins Market Size, Share Analysis Report By Soluble (Water, Fat), By Application (Food and Beverage, Pharmaceuticals, Cosmetic and Personal Care, Food Additive, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153579

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

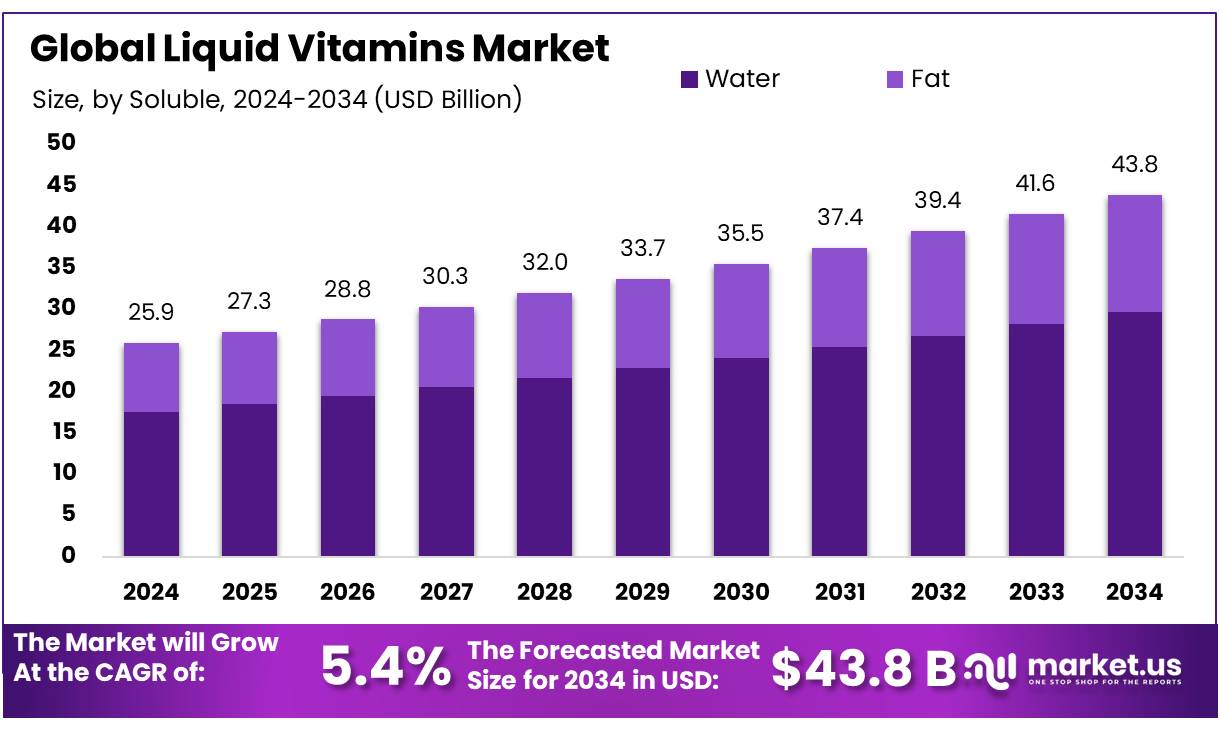

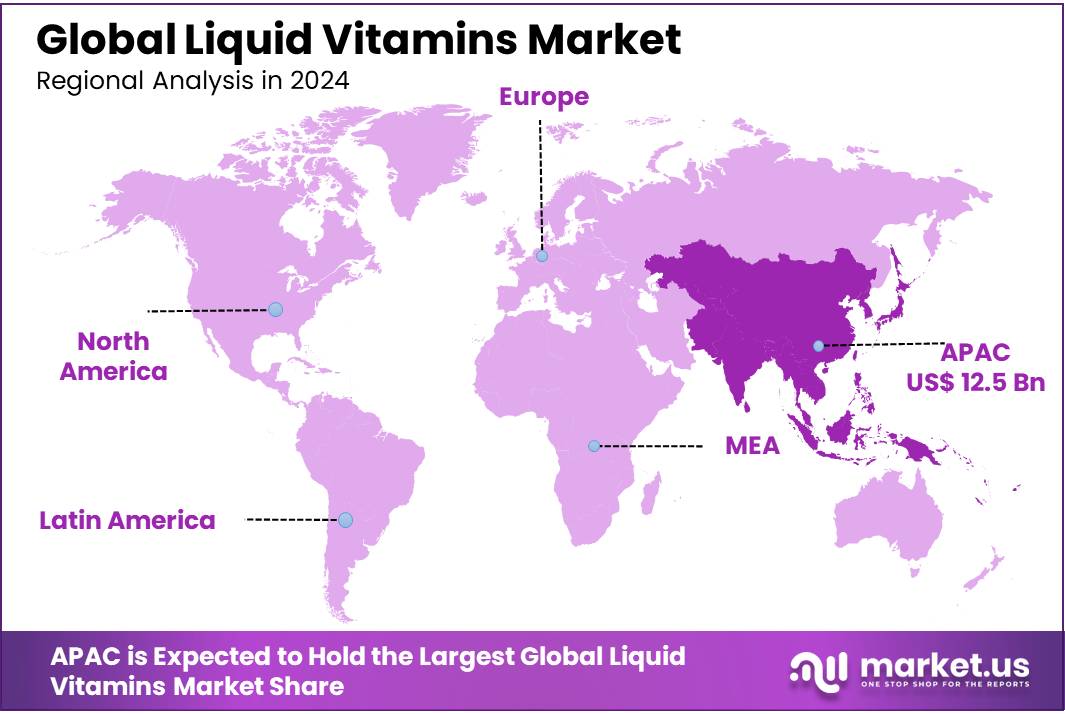

The Global Liquid Vitamins Market size is expected to be worth around USD 43.8 Billion by 2034, from USD 25.9 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 48.5% share, holding USD 12.5 Billion revenue.

The liquid vitamin concentrates reflects a specialized segment within the broader dietary and nutritional supplement industry. These concentrates, typically formulated in water‑ or oil based formats, serve both as direct consumer supplements and as additive ingredients in the food, beverage, and pharmaceutical sectors.

Role clarity is delineated by regulatory bodies such as the U.S. FDA, which situates liquid vitamin concentrates under dietary supplement guidelines, mandating Supplement Facts labeling and adherence to current good manufacturing practices. Applications span fortified beverages, health tonics, and emulsified delivery formats, often with solubility-based formulation strategies—water-soluble for B-complex and C, fat-soluble for vitamins A, D, E, and K.

Driving factors for this segment are both demand and supply-side. On the demand side, consumer health awareness is increasing: in the U.S., dietary supplement sales totaled USD 55.7 billion in 2020, with USD 21.2 billion attributed to vitamin-mineral products. The COVID-19 pandemic accelerated interest in nutrient supplementation, with global supplement sales rising by 50% between 2018 and 2020 to exceed USD 220 billion in 2020. Consumer preferences similarly favor convenience, rapid absorption, and palatable liquid formats, aligning with broader lifestyles and aging populations.

Regulatory and government initiatives have also catalyzed growth. In the EU, Directive 2002/46/EC continues to harmonize supplementation standards and authorize vitamin sources in concentrated formats, supported by EFSA guidelines. In the U.S., FDA clear distinctions between dietary supplements and conventional foods guide labeling and market entry, ensuring standardized oversight. Additional public health initiatives aimed at micronutrient fortification, such as childhood nutrition programs, increasingly include liquid forms due to improved bioavailability and ease of administration.

Key Takeaways

- Liquid Vitamins Market size is expected to be worth around USD 43.8 Billion by 2034, from USD 25.9 Billion in 2024, growing at a CAGR of 5.4%.

- Water held a dominant market position in the liquid vitamins market by solubility, capturing more than a 67.8% share.

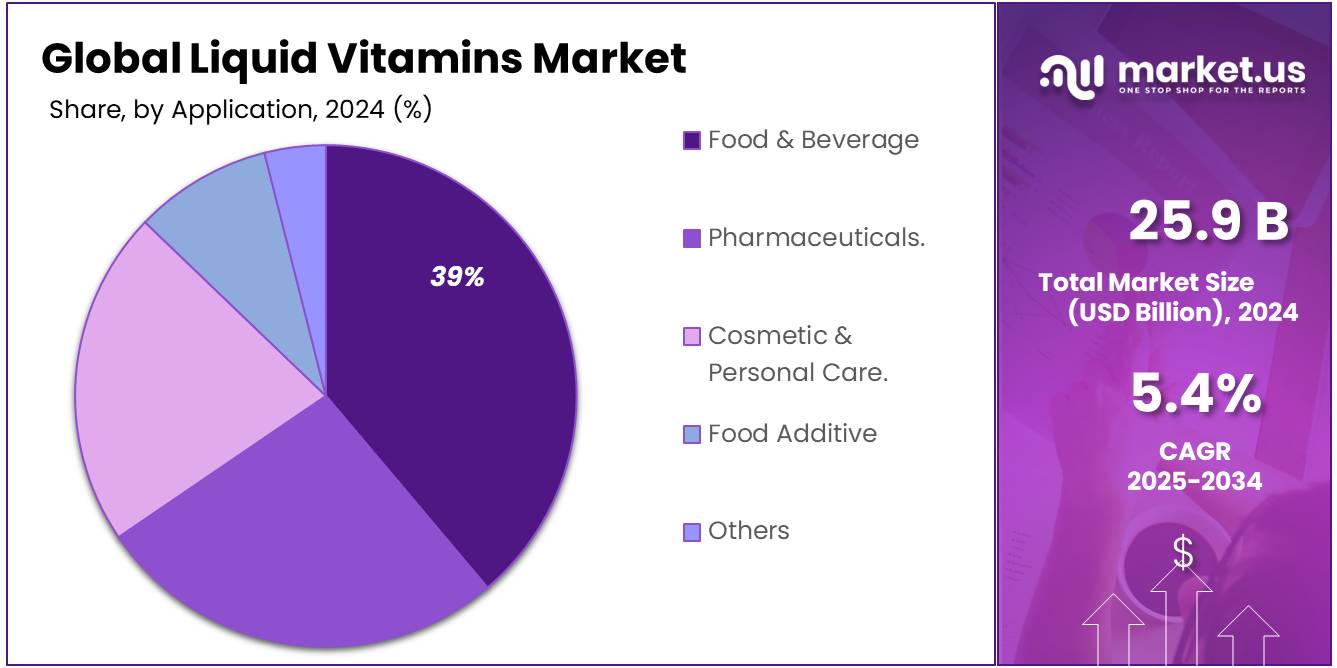

- Food & beverage held a dominant market position in the liquid vitamins market by application, capturing more than a 39.4% share.

- Asia-Pacific (APAC) region emerged as the dominant force in the global liquid vitamins market, accounting for approximately 48.5% of the total market share and generating revenues close to USD 12.5 billion.

By Soluble Analysis

Water-soluble vitamins lead with 67.8% in 2024 due to better absorption and broad usage.

In 2024, water held a dominant market position in the liquid vitamins market by solubility, capturing more than a 67.8% share. This strong lead is mainly driven by the ease with which water-soluble vitamins are absorbed into the bloodstream, making them highly effective and preferred by consumers. Vitamins such as B-complex and vitamin C, which fall under this category, are widely used in functional beverages, health tonics, and dietary supplements.

Their quick absorption and ability to support immune function, energy levels, and overall well-being have made them popular across all age groups. Additionally, the rising demand for clean-label and easy-to-digest products has further pushed the use of water-soluble formats in the nutraceutical and pharmaceutical sectors. As consumer focus shifts towards preventive health and natural supplementation, water-soluble liquid vitamins are expected to maintain their dominant role throughout 2024 and beyond.

By Application Analysis

Food & Beverage dominates with 39.4% in 2024 driven by rising demand for fortified consumables.

In 2024, food & beverage held a dominant market position in the liquid vitamins market by application, capturing more than a 39.4% share. This leadership is largely due to the increasing consumer preference for nutrient-enriched drinks, juices, and functional foods that support immunity, energy, and overall health. Manufacturers are incorporating liquid vitamins into ready-to-drink products, dairy alternatives, and health shots to meet the growing need for convenient nutrition.

The clean-label trend and growing interest in preventive wellness have encouraged the addition of vitamins like B12, D3, and C into daily consumables. In both developed and emerging regions, food and beverage companies are responding with fortified product launches that cater to health-conscious lifestyles. As a result, the integration of liquid vitamins into everyday food items has become a key strategy for meeting consumer demand, helping the segment maintain its top position through 2024.

Key Market Segments

By Soluble

- Water

- Fat

By Application

- Food & Beverage

- Pharmaceuticals.

- Cosmetic & Personal Care.

- Food Additive

- Others

Emerging Trends

Surge in Liquid Vitamin Consumption Among Young Adults

In recent times, there’s been a notable shift in how younger generations approach health and wellness, particularly in their preference for liquid vitamins. A significant 66% of Australians aged 22 to 37 now incorporate daily supplements into their routines, marking a substantial increase from 34% the previous year. This demographic is leading the charge, spending over $56 each month on supplements, influenced heavily by social media trends and online influencers .

Governments and health organizations are also acknowledging the importance of supplements in addressing nutritional gaps. For instance, the UK’s National Institute for Health and Care Excellence (NICE) recommends certain food supplements for specific groups, such as folic acid for pregnant women and vitamin D for children and older adults .

This trend towards liquid vitamins reflects a broader shift towards personalized, convenient, and effective health solutions. As younger generations continue to prioritize wellness and seek out products that fit seamlessly into their lifestyles, the demand for liquid vitamins is expected to keep rising, shaping the future of the supplement industry.

Government health initiatives are reinforcing this momentum. In the United States, the National Institutes of Health (NIH) actively supports campaigns promoting hydration and micronutrient adequacy, encouraging usage of liquid vitamins when oral intake is compromised (e.g., during illness or for elderly patients). Meanwhile, several EU member states are investing in public health programs that advocate liquid vitamin supplementation in elderly care facilities and early childhood nutrition schemes, given their superior absorption and ease of administration.

Drivers

Growing Health Consciousness and Aging Populations Fuel Liquid Vitamin Demand

A significant factor contributing to this growth is the rising health consciousness among consumers. As individuals become more proactive about their health, there is an increased preference for dietary supplements that offer convenience and ease of consumption. Liquid vitamins, in particular, are gaining popularity due to their quick absorption and suitability for individuals who have difficulty swallowing pills. This trend is evident in various regions, including North America, where the liquid dietary supplements market held over 36% of the global revenue in 2023.

- According to the World Social Report 2023, the number of people aged 65 years or older worldwide is projected to more than double, from 771 million in 2022 to 1.6 billion in 2050 . Older adults often require supplements to address nutritional deficiencies and support overall health, further driving the consumption of liquid vitamins.

Government initiatives also play a role in promoting the use of dietary supplements. For instance, in the United States, the National Institute for Health and Care Excellence (NICE) recommends certain food supplements for specific groups, such as folic acid supplements during pregnancy and vitamin D supplements for pregnant and breastfeeding women, children aged six months to five years, people aged 65 and over, and those with limited sun exposure. These recommendations underscore the importance of supplementation in maintaining health, particularly among vulnerable populations.

Restraints

Regulatory Challenges and Safety Concerns in the Liquid Vitamin Market

Despite the growing popularity of liquid vitamins, the market faces significant hurdles stemming from regulatory complexities and safety concerns. In the United States, the Food and Drug Administration (FDA) oversees dietary supplements under the Dietary Supplement Health and Education Act (DSHEA) of 1994. This legislation classifies supplements as foods, allowing them to be marketed without prior approval from the FDA. Manufacturers are responsible for ensuring their products are safe, but the FDA’s authority is largely reactive, intervening only after products are on the market and if adverse effects are reported.

This regulatory framework has led to challenges in ensuring the safety and efficacy of liquid vitamins. The FDA’s limited premarket oversight means that potentially harmful products can reach consumers without adequate scrutiny. For instance, some dietary supplements have been found to contain unlisted pharmaceutical drugs, posing serious health risks. Between 2007 and 2016, a study identified 776 supplements that contained unapproved pharmaceutical ingredients, many of which could interact with other medications and lead to hospitalization.

Moreover, the lack of standardized regulations across different regions complicates the global market for liquid vitamins. In Europe, for example, the Food Supplements Directive requires that supplements be demonstrated to be safe before they can be marketed. However, the process for adding new substances to the permitted list is often slow and cumbersome, leading to delays in product availability.

These regulatory challenges not only affect consumer safety but also hinder market growth. Consumers may be hesitant to purchase liquid vitamins without clear and consistent safety information, and manufacturers face increased costs and delays in bringing new products to market. Addressing these issues requires a more proactive and harmonized regulatory approach to ensure the safety and efficacy of liquid vitamins globally.

Opportunity

Government Support and Growing Health Awareness Drive Liquid Vitamin Market Growth

Government programs such as the Poshan Abhiyaan (National Nutrition Mission) have been instrumental in addressing malnutrition and promoting dietary supplements across the country. These initiatives focus on improving nutritional outcomes through awareness campaigns and the distribution of fortified foods and supplements, thereby creating a conducive environment for the growth of the liquid vitamin market.

Additionally, the rise in disposable incomes and urbanization has led to a shift towards preventive healthcare, with consumers increasingly opting for convenient and effective nutritional solutions like liquid vitamins. This trend is particularly evident among working professionals and health-conscious individuals seeking easy-to-consume supplements that fit into their busy lifestyles.

The integration of traditional Ayurvedic ingredients into modern liquid supplement formulations has further enhanced their appeal, offering consumers a blend of conventional wisdom and contemporary convenience. This fusion caters to the growing demand for natural and holistic health solutions, aligning with the broader wellness movement gaining momentum in India.

Regional Insights

In 2024, the Asia-Pacific (APAC) region emerged as the dominant force in the global liquid vitamins market, accounting for approximately 48.5% of the total market share and generating revenues close to USD 12.5 billion. This significant regional lead can be attributed to growing consumer awareness of preventive health, increasing demand for functional foods and beverages, and rising disposable incomes across major economies such as China, India, Japan, and South Korea.

Rapid urbanization and lifestyle changes have contributed to a surge in health concerns, including vitamin deficiencies, fatigue, and immunity-related disorders—driving consumers toward vitamin-enriched liquid supplements that offer easy absorption and fast results.

In China and India, expanding middle-class populations and an increase in e-commerce platforms have made liquid vitamins more accessible to urban and semi-urban populations. Government initiatives promoting public health and nutrition, such as India’s POSHAN Abhiyaan (National Nutrition Mission), have also contributed to increased demand for fortified food products and supplements. In Japan, an aging population and preference for easy-to-consume formulations have boosted the consumption of liquid vitamins, particularly in the elderly care and clinical nutrition segments.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Adisseo has built its reputation on liquid nutritional additives for the animal feed industry. In 2024, it continued investing heavily in R&D—enhancing its methionine and vitamin lines—backed by decades of innovation in liquid solutions for poultry, swine, aquaculture, and ruminants. Its flagship products include Rhodimet AT88 (88% liquid methionine) and Microvit E Promix 50 (500,000IU vitamin E), both delivering targeted animal health benefits. By focusing on user needs and sustainability, Adisseo continues shaping the future of fluid additive solutions with a human-centred approach.

Farbest Brands offers a comprehensive portfolio of clean-label nutrition ingredients, including water- and fat-soluble vitamins, carotenoids, proteins, and premixes for food, beverage, and supplement sectors. In 2024, the company supported product developers with custom blends such as Vitamin D3 in MCT oil, lycopene suspensions, and vitamin premixes for dairy and energy drinks. By combining formulation flexibility with transparent sourcing, Farbest appeals to manufacturers aiming to deliver effective and consumer-trusted nutritional products.

In 2024, Lonza recorded CHF 6.6 billion in sales with a CORE EBITDA margin of 29%, driven by strong CDMO demand despite softness in its Capsules & Health Ingredients (CHI) division. This segment—serving the nutraceutical capsule market—saw around USD 600 million in CHI sales during H1 2024. While it plans to divest CHI to focus on core biologics and drug delivery services, Lonza continues to support liquid-filled and functional capsule innovation through its Licaps® and Enprotect® technologies. Their human-centred approach balances operational strength with product-level excellence.

Top Key Players Outlook

- Adisseo

- Farbest Brands

- Stern Vitamin Gmbh & CO. KG

- Lonza Group

- ADM

- Glanbia Plc

- DSM

- Amway

- Atlantic Essentials Products Inc.

Recent Industry Developments

In 2024, Adisseo strengthened its position in the liquid vitamins segment of the animal nutrition industry with impressive financial and operational results. The company reported full-year revenue of CNY 15.53 billion—an 18% increase from the prior year—while achieving a robust gross margin of 30%, up 9 percentage points, and net profit reaching CNY 1.2 billion.

In 2024, Lonza Group delivered solid performance in its liquid vitamins and related health ingredient activities as part of its broader Capsules & Health Ingredients (CHI) division. The company reported total group sales of CHF 6.6 billion in 2024—on par with the previous year—with CHF 1.9 billion in CORE EBITDA at a 29.0% margin, supported by a CHF 1.4 billion CAPEX investment across its asset base.

Report Scope

Report Features Description Market Value (2024) USD 25.9 Bn Forecast Revenue (2034) USD 43.8 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Soluble (Water, Fat), By Application (Food and Beverage, Pharmaceuticals, Cosmetic and Personal Care, Food Additive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adisseo, Farbest Brands, Stern Vitamin Gmbh & CO. KG, Lonza Group, ADM, Glanbia Plc, DSM, Amway, Atlantic Essentials Products Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adisseo

- Farbest Brands

- Stern Vitamin Gmbh & CO. KG

- Lonza Group

- ADM

- Glanbia Plc

- DSM

- Amway

- Atlantic Essentials Products Inc.