Global Lipid Injectable Market By Product Type (Smoflipid, Intralipid, Liposyn III and Clinolipid), By Application (Targeted Drug Delivery, Pain Reduction and Toxicity Reduction), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173904

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

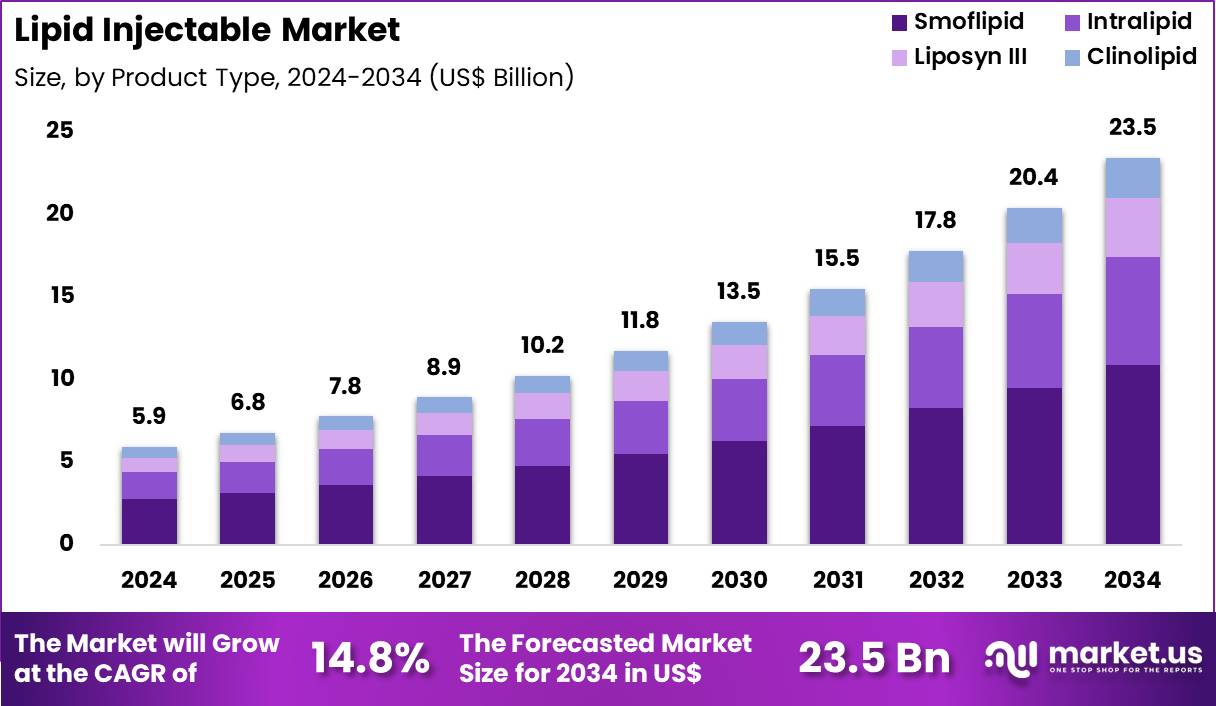

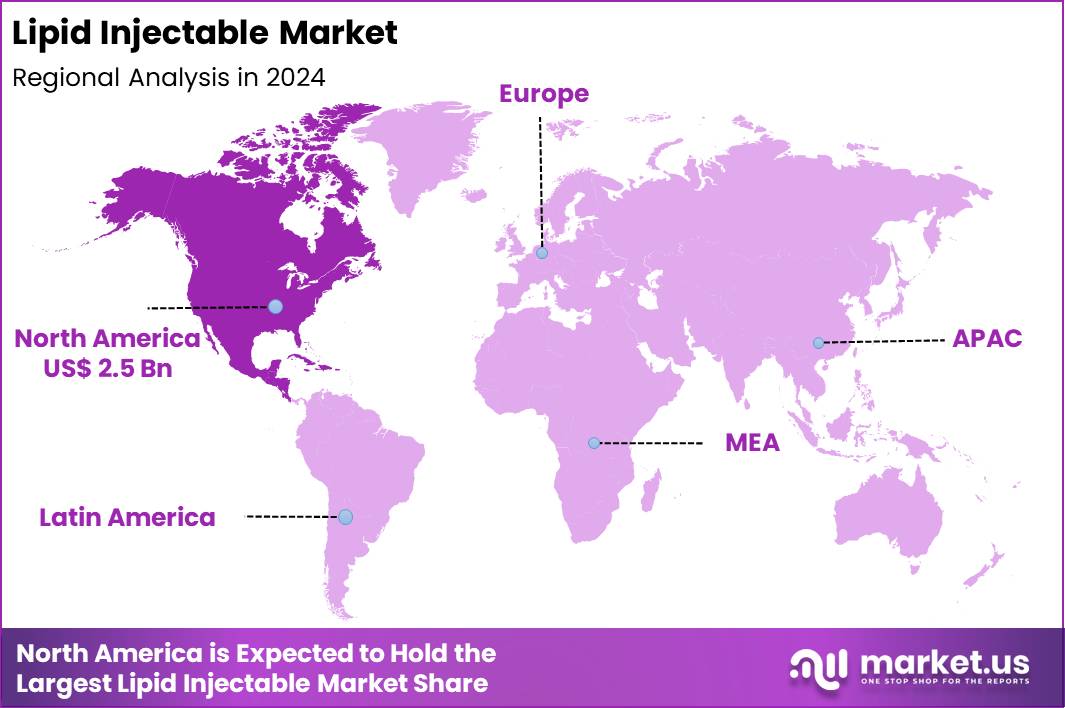

The Global Lipid Injectable Market size is expected to be worth around US$ 23.5 Billion by 2034 from US$ 5.9 Billion in 2024, growing at a CAGR of 14.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.7% share with a revenue of US$ 2.5 Billion.

Rising demand for intravenous nutritional support in critically ill patients drives the Lipid Injectable market as healthcare providers seek stable, high-energy emulsions that deliver essential fatty acids safely. Clinicians administer these lipid emulsions in total parenteral nutrition regimens to prevent essential fatty acid deficiency in patients with prolonged intestinal failure or severe malabsorption syndromes. These formulations supply concentrated calories for energy balance in surgical intensive care, supporting metabolic recovery following major abdominal operations.

Pharmacists incorporate lipid injectables into balanced parenteral nutrition for preterm neonates, providing long-chain polyunsaturated fatty acids critical for neurodevelopmental outcomes. These emulsions facilitate lipid replacement in patients with chylothorax or lymphatic leaks, minimizing further nutritional compromise during conservative management. For the 2024 fiscal year, B. Braun Melsungen achieved total sales of €9.137 billion, or around US$ 9.7 billion, reflecting a 4.4% annual increase.

Growth was largely supported by the Hospital Care division, which supplies ready-to-use medications and parenteral nutrition in multi-chamber bag formats. Financial performance strengthened further as profit before taxes rose to €270 million, supported by sustained investments totaling €1.3 billion in manufacturing capacity, automation, and advanced pharmaceutical technologies.

Manufacturers pursue opportunities to develop lipid emulsions enriched with omega-3 fatty acids, expanding applications in reducing inflammatory responses during prolonged mechanical ventilation and sepsis management. Developers engineer structured triglyceride formulations that improve clearance kinetics, broadening utility in patients with impaired lipoprotein lipase activity.

These advancements support pediatric applications by incorporating medium-chain triglycerides alongside long-chain fatty acids, optimizing energy delivery in neonates with immature metabolic pathways. Opportunities emerge in creating low-phospholipid emulsions that minimize liver dysfunction risks, facilitating extended use in home parenteral nutrition programs.

Companies advance lipid injectables with enhanced stability profiles, enabling safe storage and administration in resource-limited settings. Firms invest in combination multi-chamber systems that integrate lipids with amino acids and dextrose, streamlining preparation and reducing compounding errors.

Industry leaders refine particle size control to achieve uniform droplet distributions, ensuring consistent safety and efficacy across high-volume hospital nutrition protocols. Developers prioritize fish oil-based lipids that demonstrate anti-inflammatory benefits, enhancing outcomes in postoperative patients with systemic inflammatory response syndrome.

Market participants advance ready-to-use triple-chamber bags that incorporate lipid emulsions, accelerating initiation of therapy in emergency departments and intensive care units. Innovators explore plant-based lipid alternatives to address sustainability concerns while maintaining essential fatty acid profiles.

Companies emphasize pharmacovigilance programs that monitor long-term hepatic and metabolic effects, building evidence for broader chronic indications. Ongoing advancements focus on personalized lipid dosing guided by real-time lipid profiling, optimizing nutritional support in complex metabolic and critical care scenarios.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.9 Billion, with a CAGR of 14.8%, and is expected to reach US$ 23.5 Billion by the year 2034.

- The product type segment is divided into smoflipid, intralipid, liposyn III and clinolipid, with smoflipid taking the lead in 2023 with a market share of 46.5%.

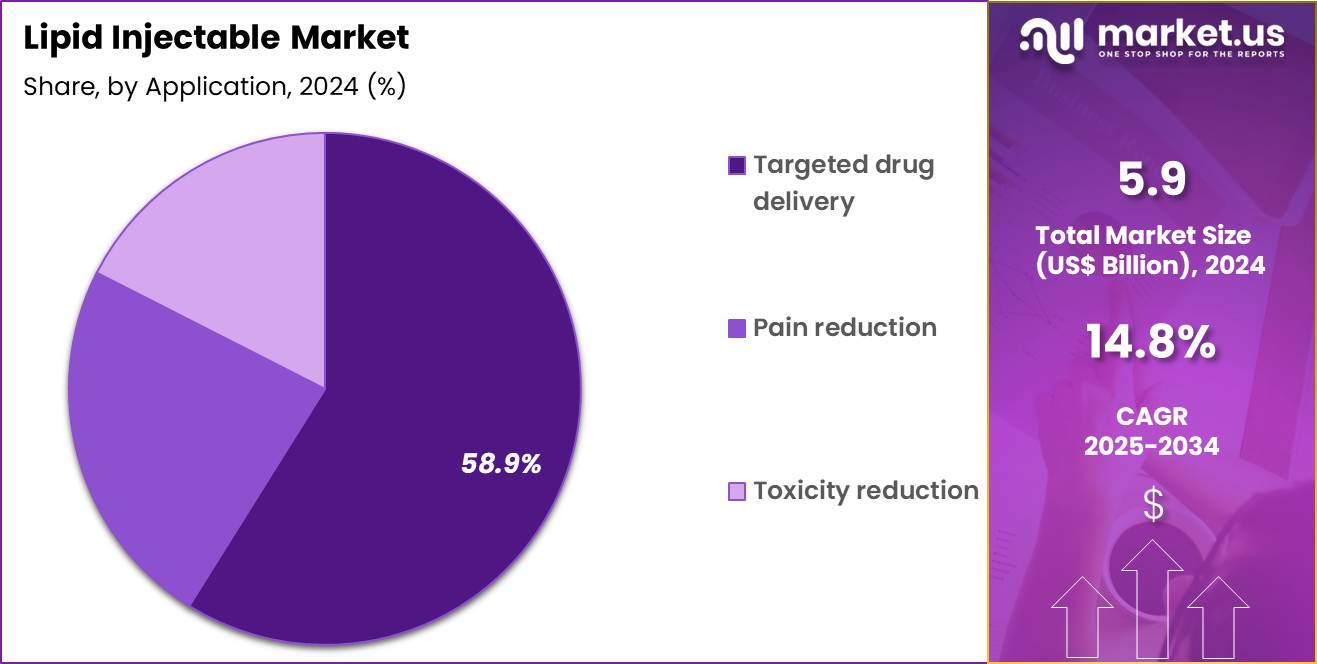

- Considering application, the market is divided into targeted drug delivery, pain reduction and toxicity reduction. Among these, targeted drug delivery held a significant share of 58.9%.

- North America led the market by securing a market share of 42.7% in 2024.

Product Type Analysis

Smoflipid accounted for 46.5% of growth within the product type category and represents the leading formulation in the Lipid Injectable market. Clinicians increasingly prefer Smoflipid due to its balanced lipid composition combining soybean oil, MCTs, olive oil, and fish oil. This composition supports improved fatty acid profiles and better metabolic tolerance. Hospitals emphasize reduced inflammatory response when selecting lipid emulsions for parenteral nutrition.

Smoflipid supports long-term intravenous nutrition in critically ill patients. Neonatal and ICU usage continues to expand demand. Improved liver safety outcomes strengthen clinician confidence. Reduced risk of parenteral nutrition–associated liver disease drives adoption. Smoflipid aligns with evolving clinical nutrition guidelines. Rising surgical and ICU admissions increase utilization.

Manufacturers promote Smoflipid for complex patient populations. Enhanced immune modulation supports recovery outcomes. Smoflipid demonstrates better triglyceride clearance compared to traditional emulsions. Formulation stability improves shelf life and handling. Clinicians value predictable infusion tolerance across age groups. Growing awareness of lipid quality influences procurement decisions.

Hospital formularies increasingly prioritize mixed-oil emulsions. Smoflipid adoption expands across developed and emerging healthcare systems. Clinical outcome data reinforces continued preference. The segment is projected to maintain dominance due to safety profile and clinical versatility.

Application Analysis

Targeted drug delivery captured 58.9% of growth within the application category and stands as the primary growth engine of the Lipid Injectable market. Lipid-based injectables enhance drug solubility for poorly water-soluble molecules. Pharmaceutical developers increasingly rely on lipid carriers to improve bioavailability. Targeted delivery reduces off-target exposure and systemic toxicity.

Oncology and specialty therapeutics drive strong demand for lipid-based delivery systems. Lipid injectables enable controlled release and tissue-specific accumulation. Advances in nanotechnology support precision delivery strategies. Reduced dosing frequency improves patient adherence. Lipid carriers protect active ingredients from rapid degradation.

Hospitals adopt targeted formulations to improve therapeutic outcomes. Regulatory approvals increasingly favor advanced delivery platforms. Injectable lipid systems support high-potency drug administration. Improved pharmacokinetic profiles strengthen clinical adoption. Targeted delivery aligns with precision medicine trends.

Pharmaceutical pipelines increasingly integrate lipid-based injectables. Reduced adverse effects enhance patient safety. Drug developers invest in lipid formulation expertise. Clinical trials demonstrate superior efficacy with targeted delivery. Demand rises with complex disease management needs. The segment is anticipated to remain dominant due to therapeutic efficiency and innovation momentum.

Key Market Segments

By Product Type

- Smoflipid

- Intralipid

- Liposyn III

- Clinolipid

By Application

- Targeted Drug Delivery

- Pain Reduction

- Toxicity Reduction

Drivers

Increasing demand for clinical nutrition is driving the market

The lipid injectable market is driven by the rising demand for clinical nutrition solutions, particularly in parenteral forms that include lipid emulsions for patients unable to consume food orally due to chronic conditions or post-surgical recovery. Healthcare providers increasingly rely on these products to prevent malnutrition, which can lead to prolonged hospital stays and higher medical costs. Regulatory bodies emphasize the importance of lipid emulsions in modulating immune responses and improving outcomes in critically ill patients.

Pharmaceutical companies are expanding production to meet the needs of an aging population and those with gastrointestinal disorders requiring intravenous nutrition. Clinical protocols integrate lipid injectables into standard care for immune support and energy provision. Global health trends in chronic disease management amplify the role of these emulsions in therapeutic nutrition.

Academic research supports the use of lipid-based formulations for their benefits in reducing inflammation and enhancing recovery. Patient care improves with tailored lipid emulsions that provide essential fatty acids without oral intake. Economic factors, such as the high cost of untreated malnutrition, further justify market expansion. According to Fresenius’ Annual Report 2024, the global clinical nutrition market, including parenteral nutrition with lipid emulsions, reached approximately €12 billion in 2024, with 7% growth versus the previous year.

Restraints

Pricing pressure and financial constraints are restraining the market

The lipid injectable market is restrained by pricing pressure in the public sector, where governments and payers seek to control healthcare costs, leading to reduced margins for lipid emulsion products. Manufacturers face challenges in maintaining profitability as pricing negotiations intensify for essential parenteral nutrition items. Regulatory requirements for quality assurance add to production costs, deterring innovation in lipid formulations.

Healthcare systems in industrialized countries, where healthcare constitutes a large budget portion, impose strict cost controls that limit market growth. Pharmaceutical distribution is impacted by these pressures, resulting in slower adoption of advanced lipid emulsions. Clinical budgeting prioritizes essential services, often sidelining premium lipid products. Global economic uncertainties exacerbate financial constraints for suppliers of injectable lipids.

Academic analyses highlight the impact on supply chain sustainability for nutrition therapies. Patient access is limited in regions with tight healthcare budgets, reducing overall utilization. According to Fresenius’ Annual Report 2024, financial constraints in the public sector led to pricing pressure and revenue slowdowns in the healthcare industry during 2024.

Opportunities

Underutilization of nutrition therapies is creating growth opportunities

The lipid injectable market offers growth opportunities through addressing the underutilization of nutrition therapies, where many hospitalized patients do not receive adequate parenteral nutrition despite medical benefits. Developers can expand awareness and access to lipid emulsions to prevent malnutrition consequences like extended hospital stays. Regulatory encouragement for early clinical nutrition screening supports the integration of lipid injectables in care protocols.

Healthcare initiatives can target this gap by promoting fish oil-based emulsions for immune modulation and cost savings. Pharmaceutical firms can partner with institutions to launch educational campaigns on the economic advantages of lipid therapies. Clinical research can demonstrate reduced morbidity and mortality with proper utilization, driving market adoption.

Global expansion into new countries provides avenues for lipid product distribution. Academic collaborations can standardize nutrition screening to increase therapy application. Patient outcomes improve with better utilization, reducing overall healthcare costs. According to Fresenius’ Annual Report 2024, malnutrition affects 1 in 4 hospitalized patients in Europe, presenting opportunities for greater use of parenteral nutrition including lipid emulsions.

Impact of Macroeconomic / Geopolitical Factors

Global economic upswings steer substantial capital toward nutritional support systems, catalyzing growth in the lipid injectable market via increased hospital procurements for critical care applications. Firms navigate favorable currency exchanges to penetrate untapped Latin American segments, where urbanization spurs demand for soy-based emulsions. Regrettably, worldwide inflationary spikes ratchet up solvent and sterilization expenditures, undermining cost efficiencies for operators in transitional economies.

Worsening superpower standoffs in maritime zones cripple fish oil derivations, exacerbating shortages for emulsion manufacturers reliant on Pacific routes. Entrepreneurs thwart these adversities by pivoting to synthetic lipid alternatives, which streamlines formulations and cultivates eco-conscious branding.

Contemporary US tariffs, pegged at 25% under Section 301 for Chinese-sourced medical preparations, inflate landing costs for imported lipid injectables. U.S. entities counter this by optimizing onshore blending facilities, which accelerates compliance and nurtures supply chain sovereignty. Evolving hybrid lipid technologies invariably energize market dynamics, heralding amplified resilience and lucrative expansions universally.

Latest Trends

Launch of new pediatric micro-nutrient products is a recent trend

In 2024, the lipid injectable market has demonstrated a prominent trend toward the launch of new pediatric micro-nutrient products integrated with parenteral nutrition, enhancing tailored formulations for young patients. Manufacturers are focusing on innovations like multi-chamber bags that include lipid emulsions for safe and convenient administration. Healthcare professionals are adopting these products to address specific nutritional needs in pediatric care, improving clinical outcomes.

Regulatory approvals highlight the trend’s emphasis on patient-specific solutions in nutrition therapy. Clinical protocols are incorporating these launches to reduce complications in critically ill children. Academic studies are evaluating the impact of new products on immune response and recovery times. Global distribution is expanding access to advanced lipid-inclusive nutrition in pediatric settings.

Patient therapies benefit from formulations that modulate inflammation and support growth. Ethical protocols ensure safety in vulnerable populations during product development. According to Fresenius’ Annual Report 2024, the launch of Peditrace Novum in Europe for pediatric micro-nutrient supply marks a key advancement in parenteral nutrition.

Regional Analysis

North America is leading the Lipid Injectable Market

In 2024, North America held a 42.7% share of the global lipid injectable market, driven by expanding indications for lipid emulsions in parenteral nutrition, particularly for critically ill patients and those with gastrointestinal disorders requiring calorie-dense intravenous support to prevent essential fatty acid deficiencies.

Clinicians increasingly prescribed soybean, olive, and fish oil-based formulations to optimize nutritional therapy in intensive care units, supported by guideline updates emphasizing balanced lipid profiles to reduce inflammation and liver complications. Innovations in multi-chamber bags and stable emulsions allowed for customized admixtures, aligning with regulatory focus on safety in home infusion programs.

Rising rates of prematurity and chronic conditions amplified usage for neonatal and adult populations, prompting integrated care models with monitoring for metabolic outcomes. Pharmaceutical firms refined purification processes to minimize contaminants, facilitating broader adoption in outpatient settings.

Collaborative studies validated long-term benefits for sepsis management, bridging gaps in underserved cohorts. Supply adaptations ensured sterile, ready-to-mix options compliant with biosafety protocols in high-volume hospitals. In May 2024, the FDA approved an expanded label for Clinolipid lipid injectable emulsion for use in pediatric patients, including preterm neonates.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry analysts anticipate vigorous progression in lipid injectable solutions across Asia Pacific over the forecast period, fueled by intensifying malnutrition interventions and healthcare infrastructure upgrades amid demographic pressures. Nutritionists integrate mixed lipid emulsions into enteral support protocols for undernourished children, adapting blends to address stunting in micronutrient-deficient regions.

Governments allocate resources to subsidize intravenous nutrition programs in public wards, equipping them to manage sepsis surges from environmental contaminants. Biotech developers customize fish oil-enriched variants with enhanced oxidation resistance, suiting tropical storage needs for hepatic care. Regional health bodies conduct efficacy assessments through population studies, fostering tailored applications for diabetic wound healing.

Pharmaceutical entities localize emulsion production through joint ventures, ensuring affordability for rural hospitals. Policy frameworks promote training on admixture safety, empowering frontline staff in peripheral facilities. In 2022, an estimated 25 million children under 5 in South Asia suffered from wasting, highlighting the critical role of nutritional support therapies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Lipid Injectable market drive growth by optimizing emulsion stability, particle size control, and safety profiles to support parenteral nutrition, anesthesia, and critical-care therapies. Companies expand demand by aligning products with hospital protocols and intensive-care standards that prioritize reliable energy delivery and reduced complication risk.

Commercial strategies focus on long-term supply agreements with health systems and group purchasing organizations to secure predictable volumes and formulary inclusion. Innovation priorities include advanced lipid sources, improved tolerance, and compatibility with multi-chamber bags that streamline pharmacy workflows.

Market expansion targets regions scaling critical-care capacity and neonatal nutrition programs amid rising acuity and aging populations. Fresenius Kabi operates as a leading participant with a global injectable and clinical nutrition portfolio, extensive sterile manufacturing capacity, and strong hospital relationships that support consistent adoption and supply reliability.

Top Key Players

- Baxter International Inc.

- Fresenius Kabi

- B. Braun Melsungen AG

- Grifols, S.A.

- Luitpold Pharmaceuticals, Inc.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Aspen Pharmacare Holdings Ltd.

- Mylan N.V.

- Sandoz International GmbH

Recent Developments

- In the third quarter of 2025, Fresenius Kabi reported that its Nutrition business, which covers lipid emulsion products used in clinical and parenteral nutrition, delivered revenue of about €601 million, equivalent to roughly US$ 635 million. Growth was supported by solid demand in the US market, where hospitals continued to increase the use of lipid-based nutritional therapies. For the full year 2024, the company generated total revenue of €8.414 billion and an EBIT of €1.319 billion, underscoring its strong positioning in intravenous nutrition and hospital-based therapies.

- In the third quarter of 2025, Baxter International recorded revenue of US$ 632 million from its Pharmaceuticals segment, which includes sterile injectables and compounding-related services. This represented a 7% increase year on year despite ongoing cost pressures and fluid management initiatives in the US healthcare system. Over the first nine months of 2025, Baxter’s international pharmaceutical and nutrition operations generated approximately US$ 1.14 billion in revenue, highlighting continued resilience and geographic diversification beyond the domestic market.

Report Scope

Report Features Description Market Value (2024) US$ 5.9 Billion Forecast Revenue (2034) US$ 23.5 Billion CAGR (2025-2034) 14.8 Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Smoflipid, Intralipid, Liposyn III and Clinolipid), By Application (Targeted Drug Delivery, Pain Reduction and Toxicity Reduction) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Baxter International Inc., Fresenius Kabi, B. Braun Melsungen AG, Grifols, S.A., Luitpold Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Pfizer Inc., Aspen Pharmacare Holdings Ltd., Mylan N.V., Sandoz International GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Baxter International Inc.

- Fresenius Kabi

- B. Braun Melsungen AG

- Grifols, S.A.

- Luitpold Pharmaceuticals, Inc.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Aspen Pharmacare Holdings Ltd.

- Mylan N.V.

- Sandoz International GmbH