Global Lifestyle Sneaker Market Report By Product Type (Low-Top Sneakers, Mid-Top Sneakers, High-Top Sneakers), By End-User (Men, Women, Children), By Price Range (USD 0-50, USD 50-100, USD 100-200, USD 200-300, USD 300 and above), By Distribution Channel (Online Stores, Department Stores, Specialty Stores, Brand Outlets, Discount Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 130818

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

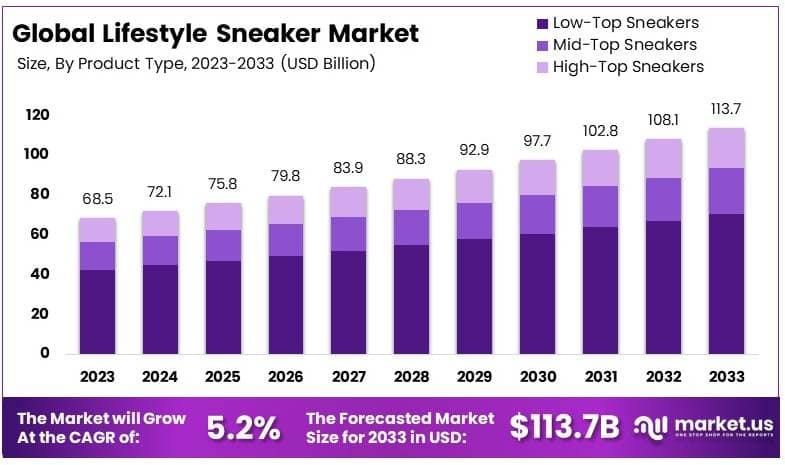

The Global Lifestyle Sneaker Market size is expected to be worth around USD 113.7 Billion by 2033, from USD 68.5 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

A lifestyle sneaker is a type of footwear designed for everyday wear, combining comfort, style, and casual appeal. Unlike performance sneakers used for sports, lifestyle sneakers focus on fashion and versatility. They are often worn for non-athletic purposes and have become a key part of modern streetwear culture.

The lifestyle sneaker market refers to the global industry of casual footwear designed for daily use. This market has seen significant growth as consumer preferences shift toward comfort-driven fashion. The rise of athleisure and streetwear trends has contributed to the increasing demand for lifestyle sneakers.

The shift towards casual, everyday wear, even in professional settings, has driven the demand for lifestyle sneakers. As a result, brands are introducing designs that combine athletic features with modern aesthetics.

This trend is particularly strong among younger consumers, who prioritize versatility in their wardrobe choices. The average American now owns 19 pairs of shoes, reflecting the trend towards expanding personal shoe collections, with lifestyle sneakers playing a key role in this shift.

The lifestyle sneaker market is experiencing healthy growth, supported by several key factors. Rising disposable income has fueled consumer spending on non-essential items, such as footwear. In the U.S., disposable personal income increased by 3% annually in 2024, with consistent growth month-over-month.

This rise in after-tax earnings allows consumers to maintain or improve their standard of living, even amid inflationary pressures, as reported by the U.S. Department of Commerce. This trend has had a positive impact on the footwear industry, driving demand for lifestyle sneakers.

Additionally, the growing popularity of online shopping presents a significant opportunity. In 2020, online sales accounted for 27% of total U.S. shoe sales, a figure that continues to grow as e-commerce and sneaker trading platforms becomes more prevalent. This shift has allowed brands to reach a wider audience and provide personalized experiences through digital platforms, further boosting market growth.

While the lifestyle sneaker market is growing, it is also becoming increasingly competitive. Major global brands, along with niche players, are battling for market share.

The market is approaching saturation in developed regions, particularly in the U.S. and Europe, where consumers have higher purchasing power and established preferences. However, emerging markets, especially in Asia, still offer significant room for growth due to rising incomes and a growing middle class.

Sneakerheads—consumers who view sneakers as part of their identity—represent a highly engaged market segment. While only 8% of consumers identify as sneakerheads, they are far more active in purchasing, with 33% of them shopping monthly, compared to the 66% of general consumers who purchase sneakers twice a year or less.

Brands catering to this group, through exclusive drops and limited-edition collections, can capitalize on their high spending and brand loyalty, further intensifying market competition.

Key Takeaways

- The Lifestyle Sneaker Market was valued at USD 68.5 billion in 2023 and is expected to reach USD 113.7 billion by 2033, with a CAGR of 5.2%.

- In 2023, Low-Top Sneakers dominated the product type segment with 62.1%, favored for their casual and versatile appeal.

- In 2023, the Under $50 price range led the market with 32.5%, driven by affordability and mass-market demand.

- In 2023, Men accounted for 56.3% of the end-user segment, reflecting a strong preference for lifestyle sneakers among males.

- In 2023, Offline channels held 69.2% of the distribution, highlighting the importance of physical retail in sneaker purchases.

- In 2023, North America led with 34.2% market share due to high consumer demand for athletic footwear.

Product Type Analysis

Low-Top Sneakers dominate the product type segment of the lifestyle sneaker market, accounting for 62.1% of the market. These sneakers are highly popular due to their versatility and comfort. They are lightweight, making them suitable for everyday wear, from casual outings to light physical activities.

This versatility has helped low-top sneakers capture a broad customer base, appealing to both young and older consumers who prioritize comfort and style.

The market for these sneakers is further driven by trends in athleisure, where casual yet sporty looks have become a standard in daily fashion. Additionally, low-top sneakers are available across a wide range of brands, from luxury shoes to budget-friendly options, making them accessible to diverse economic groups.

Mid-top sneakers, although less prevalent, offer a blend of support and style, appealing to those who want a little more ankle support without the bulk of high-tops. They often attract consumers who use them for both fashion and light sports.

High-top sneakers are more specialized, appealing to niche markets such as sneaker enthusiasts and those seeking a retro style. Their growth is slower due to their more specific design and higher price points, but they play a role in the lifestyle sneaker market by adding variety and catering to specific style preferences.

Price Range Analysis

In the price range segment, sneakers priced under $50 hold a 32.5% share. This segment is attractive due to its affordability, making lifestyle sneakers accessible to a broad demographic. The under $50 range is particularly popular in emerging markets, where cost-conscious consumers look for trendy footwear without high spending.

Brands that offer affordable yet stylish options in this category can attract young buyers and those seeking fashionable alternatives to high-priced brands. This segment’s strong market position is reinforced by the rise of fast fashion and the desire for budget-friendly, trendy sneakers.

Sneakers priced between $50-$100 appeal to a middle-income consumer base that seeks a balance between affordability and quality. This segment serves those willing to pay a bit more for well-known brands and durable materials.

The $100-$200 range focuses on premium materials and superior design, catering to consumers who value both brand prestige and long-term durability. The $200-$300 category offers more exclusive designs and limited-edition releases, attracting sneaker enthusiasts and collectors.

The $300 and above segment is largely driven by luxury footwear and designer brands, appealing to a niche market of buyers who prioritize status and exclusivity over price.

End-User Analysis

The men’s segment leads the end-user market, making up 56.3% of the lifestyle sneaker market. This segment’s dominance is due to the high demand among male consumers for versatile footwear that combines style and function. Men’s sneakers are often designed with both casual and semi-formal looks in mind, making them suitable for a wide range of settings.

The popularity of sports-inspired fashion among men also contributes to the high demand for lifestyle sneakers, blending the appeal of athletic aesthetics with daily wearability. Additionally, sneaker culture, particularly around limited releases and brand collaborations, has a strong following among male consumers, driving sales in this segment.

The women’s segment is growing steadily, driven by increasing interest in athleisure and the rising trend of comfortable fashion. Women are seeking sneakers that combine style with comfort, leading brands to expand their offerings in terms of colors, designs, and fits.

Children’s sneakers, although smaller in market share, provide growth opportunities due to the demand for stylish and durable footwear for kids. Parents often look for value-for-money options that offer both comfort and trendiness for their children’s everyday activities, supporting steady sales in this sub-segment.

Distribution Channel Analysis

The offline distribution channel remains dominant, accounting for 69.2% of the market. Physical stores like department stores, brand outlets, and specialty stores are preferred by many consumers who want to try on sneakers before purchasing. These stores offer a tactile shopping experience where customers can evaluate comfort and fit, which is especially important for footwear.

The presence of trained staff also helps guide customers toward the right choice, adding value to the in-store experience. Furthermore, many brands maintain exclusive releases and store-specific promotions that drive traffic to their physical locations, keeping the offline channel strong despite the rise of e-commerce.

Online stores are quickly gaining traction as more consumers become comfortable with digital shopping. They offer the convenience of home delivery, a wider range of products, and easy price comparisons. Department stores, while significant in offline sales, cater to consumers who value the availability of multiple brands under one roof.

Specialty stores focus on niche markets, offering exclusive or premium collections. Brand outlets provide a direct shopping experience, where consumers can access the latest releases and brand-specific promotions. Discount stores attract price-sensitive buyers looking for value deals on popular models.

Key Market Segments

By Product Type

- Low-Top Sneakers

- Mid-Top Sneakers

- High-Top Sneakers

By End-User

- Men

- Women

- Children

By Price Range

- $0-$50

- $50-$100

- $100-$200

- $200-$300

- $300 and above

By Distribution Channel

- Online Stores

- Department Stores

- Specialty Stores

- Brand Outlets

- Discount Stores

Drivers

Growing Athleisure and Social Media Influence Drive Market Growth

The Lifestyle Sneaker Market has seen substantial growth due to the rising popularity of athleisure trends. This trend merges fashion and comfort, making sneakers a preferred choice for everyday wear among consumers. The increased focus on comfort has led to a demand for sneakers that offer style without compromising on wearability.

Celebrity endorsements play a key role in influencing consumer choices, driving demand for specific brands and limited-edition releases. When well-known personalities promote sneaker brands, it boosts visibility and desirability among their followers. Social media marketing has also become a powerful tool, allowing brands to reach a broad audience.

Platforms like Instagram and TikTok showcase lifestyle sneakers as fashion statements, creating trends that encourage consumer purchases. These driving factors create a favorable environment for the lifestyle sneaker market, helping brands attract both new and existing customers.

Restraints

High Pricing and Counterfeiting Restrain Market Growth

Several factors restrain the growth of the Lifestyle Sneaker Market, with high product pricing being a significant barrier. Premium brands often price their products beyond the reach of average consumers, limiting their market penetration. Additionally, the market faces challenges from the proliferation of counterfeit products.

Counterfeit sneakers impact brand reputation and result in revenue losses, as consumers opt for cheaper alternatives. Fluctuating costs of raw materials like leather and rubber further affect pricing and profit margins for manufacturers.

Intense market competition adds another layer of difficulty, as numerous brands vie for market share. This competitive landscape often leads to price wars and reduces profitability, making it challenging for brands to maintain their premium status.

Opportunity

Expansion and Customization Provide Opportunities

Emerging economies, particularly in Asia-Pacific, present untapped potential with a growing middle-class population. As disposable incomes rise in these regions, consumers are willing to invest in branded and premium lifestyle sneakers.

The demand for customization and personalization is also rising, with consumers seeking unique designs that reflect their personal style. This trend enables brands to offer bespoke services, creating a niche market. The interest in sustainable products presents another growth avenue, as eco-conscious consumers seek alternatives that reduce environmental impact.

The growth of e-commerce platforms has further broadened the market reach of sneaker brands. Online platforms provide easy access to global markets, allowing brands to tap into diverse consumer bases.

Challenges

Rapid Trends and Supply Chain Issues Challenge Market Growth

The Lifestyle Sneaker Market faces challenges that require agile management. Rapidly changing fashion trends mean that brands must constantly innovate to stay relevant. What is popular today may quickly fall out of favor, necessitating quick product turnovers.

Supply chain disruptions pose another significant challenge, affecting the availability of materials and finished products. Delays in production can impact launch timelines, leading to missed sales opportunities. Additionally, building and maintaining brand loyalty is increasingly difficult with consumers having a wide array of options.

Environmental regulations also challenge manufacturers, particularly those using traditional production methods. Brands must adapt to stricter guidelines regarding emissions and material sourcing, which can increase production costs.

Growth Factors

Rising Income and Urbanization Are Growth Factors

Several growth factors contribute to the expansion of the Lifestyle Sneaker Market. Increasing disposable income allows consumers to spend more on premium and luxury sneakers, boosting market revenues. As incomes rise, consumers are more willing to invest in high-quality products that offer style and durability.

Higher demand for premium products is also driven by changing consumer preferences. As people seek brands that reflect their lifestyle and status, premium sneaker lines see increased demand. Additionally, the growing youth population plays a pivotal role in driving the market.

Young consumers are trend-conscious and actively seek out fashionable sneaker options that align with their identity. Urbanization further supports market growth, as urban dwellers favor trendy and comfortable footwear for their active lifestyles. These growth factors together create a positive outlook for the market, enabling brands to expand their reach and strengthen their market position.

Emerging Trends

Sustainable Sneakers and Tech Integration Are Latest Trending Factor

Several trending factors are shaping the Lifestyle Sneaker Market, with demand for vegan and eco-friendly sneakers leading the way. Consumers are increasingly looking for sustainable footwear options that minimize environmental impact, driving brands to innovate with materials like plant-based leather.

The focus on limited edition drops is another trend that is boosting market excitement. By creating exclusive releases, brands generate a sense of urgency and exclusivity among buyers. This strategy encourages immediate purchases, often leading to sold-out collections within minutes.

The integration of smart technology into sneakers is also gaining popularity. Features like fitness tracking and connectivity with mobile apps appeal to tech-savvy consumers, blending fashion with functionality. Retro style resurgence is another notable trend, as classic sneaker designs from past decades find renewed popularity among younger consumers.

Regional Analysis

North America Dominates with 34.2% Market Share

North America leads the Lifestyle Sneaker Market with a 34.2% share, valued at USD 23.43 billion. The region’s dominance is driven by a strong sneaker culture, particularly in the United States, where sneakers are seen as both fashion statements and everyday essentials. High disposable incomes and a preference for premium and limited-edition sneakers further support this market position.

The market benefits from the presence of global sneaker brands and a thriving retail ecosystem, including online platforms and specialty stores. North American consumers are highly brand-conscious and prioritize style, comfort, and performance in their footwear choices. Influencer marketing and collaborations with celebrities also play a major role in driving demand, keeping the sneaker culture vibrant and trendy.

North America is expected to maintain its market leadership as interest in athleisure and casual fashion remains strong. Emerging trends like sustainable materials and limited-edition releases could further fuel growth. The market is likely to see continued investment in innovation, maintaining the region’s appeal to both fashion-forward and performance-oriented consumers.

Regional Mentions:

- Europe: Europe is a significant market for lifestyle sneakers, driven by a mix of urban fashion trends and sports culture. Countries like Germany and France are key markets, with consumers favoring both heritage brands and contemporary designs.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the lifestyle sneaker market, led by China and Japan. Rising disposable incomes and a strong youth culture drive demand for premium and trendy sneakers.

- Middle East & Africa: The Middle East and Africa are emerging markets, with a growing appetite for luxury and limited-edition sneakers. Influences from Western culture and a young population fuel demand in cities like Dubai and Johannesburg.

- Latin America: Latin America shows moderate growth in the lifestyle sneaker market, with Brazil and Mexico leading the way. The region’s youth embrace urban streetwear trends, driving demand for both international brands and local designs.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Lifestyle Sneaker Market is dominated by established global brands. The top players include Nike, Inc., Adidas AG, Vans (VF Corporation), and New Balance Athletics, Inc.. These companies leverage strong brand identities, innovation, and extensive distribution networks to maintain their leadership in the market.

Nike, Inc. leads with a strong global presence and a focus on innovation and design. Its success is driven by popular lifestyle models like Air Force 1 and Air Max. Nike’s ability to tap into streetwear culture and collaborations with celebrities keeps its brand relevant and desirable among diverse consumer groups.

Adidas AG is known for blending sports performance with casual style, making it a major player in the lifestyle segment. The brand’s iconic Stan Smith and Superstar sneakers are popular choices worldwide. Adidas benefits from a focus on sustainability and partnerships with designers, attracting consumers who prioritize both style and eco-friendliness.

Vans (VF Corporation) has a niche in the skate and streetwear segments. Its classic designs, such as the Old Skool and Slip-On, have maintained popularity over decades. Vans’ emphasis on youth culture and customization options resonates well with younger consumers and maintains strong brand loyalty.

New Balance Athletics, Inc. differentiates itself with a focus on comfort and quality. It has gained popularity through retro-inspired designs that blend well with modern fashion. New Balance’s appeal to both fashion enthusiasts and sportswear consumers has strengthened its market position.

These companies collectively shape the Lifestyle Sneaker Market by offering a mix of heritage and contemporary styles. Their focus on innovation, brand storytelling, and strategic collaborations drives sustained interest and demand in this competitive industry.

Top Key Players in the Market

- Vans (VF Corporation)

- Reebok (Authentic Brands Group)

- Adidas AG

- Nike, Inc.

- New Balance Athletics, Inc.

- Skechers USA, Inc.

- Allbirds Inc.

- Converse (Nike, Inc.)

- Under Armour, Inc.

- Puma SE

- ASICS Corporation

Recent Developments

- Kith and ASICS: In October 2024, Kith announced a new collaboration with ASICS, unveiling two models: the GEL-Nimbus 10.1 and GEL-Kayano 12.1. These models blend retro and futuristic elements, continuing Kith’s tradition of high-end sneaker partnerships. The GEL-Nimbus 10.1, popularized by Stefon Diggs earlier in 2024, and the GEL-Kayano 12.1 feature technical innovations while maintaining a stylish and performance-ready design.

- HOKA: In October 2024, HOKA introduced the Elevon X, a sneaker blending performance and lifestyle aesthetics. Originally a discontinued 2018 running shoe, the redesigned model now features premium materials like Nubuck leather, a Pebax® plate, and TPU heel counters. Available in two unisex colorways, the shoe focuses more on style than performance.

- Nike: In July 2024, Nike released its Electric Pack, a 55-pair collection designed for the Paris Olympics. The collection includes models like the Pegasus 41, VaporMax Moc Roam, and AlphaFly 3, incorporating both Olympic-inspired themes and wild, animalistic patterns.

Report Scope

Report Features Description Market Value (2023) USD 68.5 Billion Forecast Revenue (2033) USD 113.7 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Low-Top Sneakers, Mid-Top Sneakers, High-Top Sneakers), By End-User (Men, Women, Children), By Price Range (USD 0-50, USD 50-100, USD 100-200, USD 200-300, USD 300 and above), By Distribution Channel (Online Stores, Department Stores, Specialty Stores, Brand Outlets, Discount Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vans (VF Corporation), Reebok (Authentic Brands Group), Adidas AG, Nike, Inc., New Balance Athletics, Inc., Skechers USA, Inc., Allbirds Inc., Converse (Nike, Inc.), Under Armour, Inc., Puma SE, ASICS Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lifestyle Sneaker MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Lifestyle Sneaker MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Vans (VF Corporation)

- Reebok (Authentic Brands Group)

- Adidas AG

- Nike, Inc.

- New Balance Athletics, Inc.

- Skechers USA, Inc.

- Allbirds Inc.

- Converse (Nike, Inc.)

- Under Armour, Inc.

- Puma SE

- ASICS Corporation