Global LiDAR Market Size and Forecast Industry Analysis Report By Product Type (Airborne, Terrestrial, Mobile & UAV), By Component (GPS, Navigation (IMU), Laser Scanners), By Application (Corridor Mapping, Engineering, Environment, Exploration and Detection, Advanced Driver Assistance Systems (ADAS), Other Applications), By End-User (Automotive, Aerospace & Defense, Healthcare, IT & Telecom, Oil & Gas, Other End-users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sept. 2025

- Report ID: 50873

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- By Product Type Analysis

- By Component Analysis

- By Application Analysis

- By End-user Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors for LiDAR Market

- Emerging Trends in LiDAR Market

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

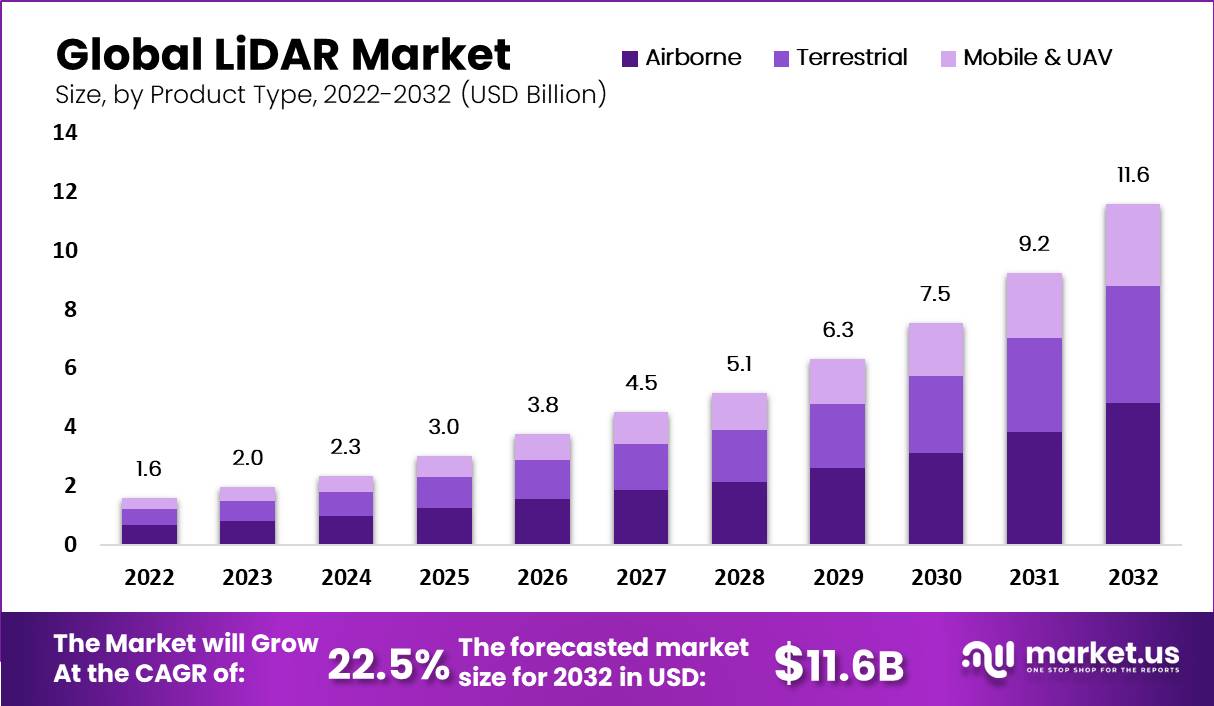

The global LiDAR Market size is expected to be worth around USD 11.6 Billion by 2032, from USD 2.0 Billion in 2023, growing at a CAGR of 22.5% during the forecast period from 2023 to 2032.

The LiDAR (Light Detection and Ranging) market is centered on the technology that uses laser pulses to generate precise 3D maps of physical environments. LiDAR is widely adopted in industries like automotive for autonomous driving, infrastructure development, agriculture, forestry, and smart city planning. It offers accurate spatial data that supports decision-making in diverse applications, including topographic mapping, environmental monitoring, and urban planning.

Top driving factors include the surge in demand for autonomous vehicles, which rely heavily on LiDAR for real-time object detection and accurate environmental mapping. Regulations encouraging the integration of advanced driver assistance systems (ADAS) and autonomous capabilities in vehicles have promoted LiDAR adoption significantly. Additionally, the growing focus on smart city infrastructure creates demand for detailed 3D mapping and sensor integration.

Key Takeaway

- The global LiDAR Market is projected to achieve a valuation of approximately USD 11.6 Billion by 2032, up from USD 2.0 Billion in 2023, representing a compound annual growth rate (CAGR) of 22.5% over the forecast period from 2023 to 2032.

- In the year 2022, the Airborne LiDAR segment secured a predominant position within the LiDAR market, capturing a substantial market share.

- During the same period, the Laser Scanners segment emerged as a prominent player within the LiDAR industry, accounting for a significant portion of the market share.

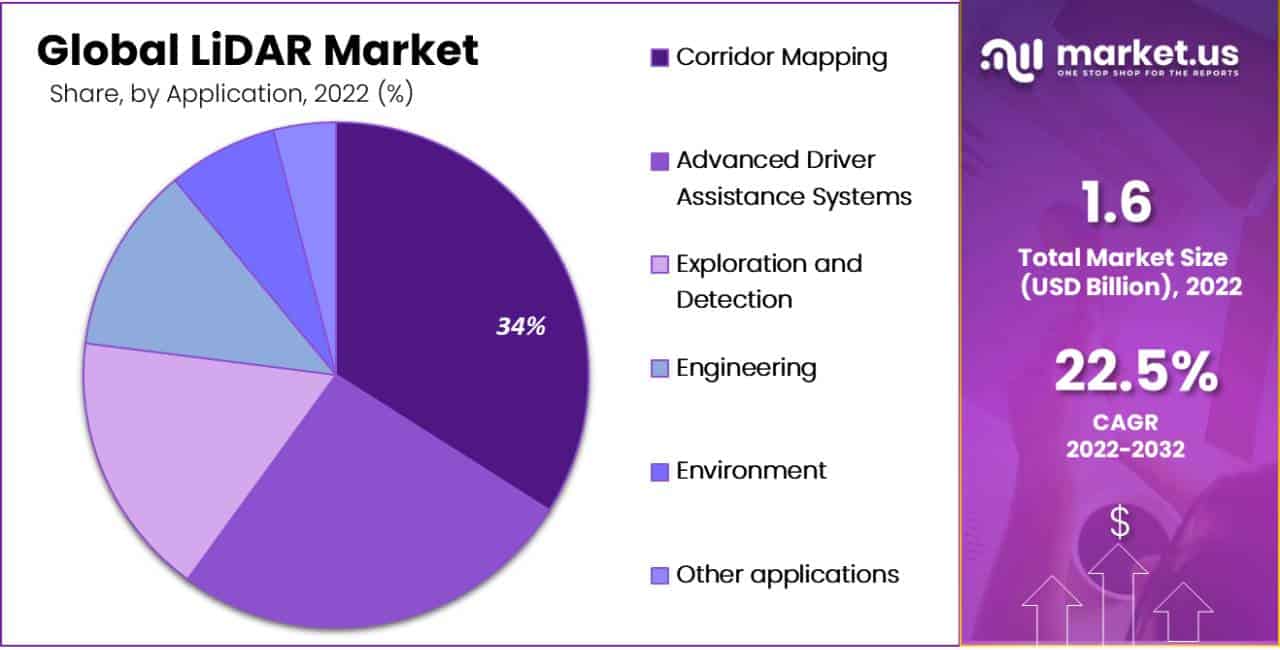

- Furthermore, the Corridor Mapping application within the LiDAR sector accounted for over 34% of the market share in 2022, demonstrating a strong demand in this application area.

- In the automotive sector, LiDAR technology played an essential role in the advancement of autonomous driving technologies, leading to the automotive segment capturing a significant market share in 2022.

- Regionally, North America dominated the LiDAR market in 2022, holding more than 40% of the market share and generating revenue of USD 0.6 billion.

Analysts’ Viewpoint

Demand analysis shows strong expansion in the automotive sector, where LiDAR enables the navigation of self-driving cars. Corridor mapping and surveying also dominate application areas due to the need for high-resolution spatial data. The U.S. leads market growth with a 21% CAGR, supported by investments in next-generation LiDAR systems. High adoption rates in electric and autonomous vehicle industries, combined with infrastructure modernization, fuel demand.

Technologies advancing LiDAR adoption include solid-state LiDAR for cost reduction and miniaturization; 4D LiDAR offering enhanced spatial detection; and integration with AI and machine learning to improve data processing and predictive analytics. The proliferation of unmanned aerial vehicles (UAVs) equipped with LiDAR sensors is expanding applications in agriculture, forestry, and environmental monitoring. LiDAR’s ability to combine with GPS, camera systems, and communication networks enhances its mapping power.

Key reasons for adopting LiDAR range from its precision in 3D spatial measurements, efficiency gains over traditional surveying, to improved safety in autonomous systems. It helps businesses and governments reduce errors and operational costs while delivering rich, accurate data. LiDAR also supports sustainability goals by enabling more effective environmental monitoring and resource management.

Investment opportunities are abundant due to LiDAR’s expanding use in automotive, smart cities, robotics, and defense sectors. Private equity and venture capital increasingly target companies with strong intellectual property and software capabilities for SaaS-based analytics. Mergers and acquisitions are consolidating the market, aiming to amplify R&D and scale production capacities.

Business benefits include enhanced spatial awareness, faster project completion, and improved risk management. LiDAR enables efficient infrastructure planning, disaster response, and precision agriculture. Its contribution to autonomous vehicle safety is a key advantage, offering accurate obstacle detection and navigation.

By Product Type Analysis

In 2022, the Airborne LiDAR segment held a dominant market position, capturing a significant share of the overall LiDAR market. This leadership stems from its extensive use in environmental monitoring, agriculture, forestry, and mineral exploration industries.

Airborne LiDAR systems are favored for their ability to cover large areas efficiently and provide precise, high-resolution images of the earth’s surface, even through dense vegetation or over rugged terrains. This capability is indispensable for generating accurate topographic maps and has been integral to advancing geospatial data collection.

Airborne LiDAR technology has been leading the segments due to several key advantages. Firstly, it offers unmatched speed and accuracy in data collection, which is crucial for timely and informed decision-making in disaster management and urban planning. Secondly, the integration of advanced sensors and imaging technologies has enhanced the ability of Airborne LiDAR to penetrate atmospheric obstructions like clouds and fog, which often limit other surveying methods.

Furthermore, as the technology continues to evolve, the cost of deploying Airborne LiDAR systems has gradually decreased, making it more accessible for various applications. The ongoing research and development aimed at improving the compactness and efficiency of these systems are likely to propel their adoption further. With the growth of industries like real estate and construction, which rely heavily on detailed geographical data, the demand for Airborne LiDAR is expected to increase, maintaining its leading position in the market.

By Component Analysis

In 2022, the Laser Scanners segment held a dominant market position within the LiDAR industry, capturing a significant share. This segment’s leadership is primarily attributed to the critical role that laser scanners play in the core functionality of LiDAR systems.

Laser scanners are fundamental for capturing the raw data that these systems use to create detailed 3D models and maps. Their precision and efficiency in measuring distances and mapping physical environments make them indispensable across various applications, including autonomous vehicles, geospatial analysis, and construction.

Laser scanners lead the market segments due to their advanced capabilities in delivering high-resolution images and accurate topographical outputs in real-time. The technology behind these scanners has evolved significantly, enabling them to operate over longer distances and at faster speeds, thus increasing their appeal across several industries. For example, in automotive applications, the accuracy and rapid response of laser scanners are essential for the safe navigation of autonomous vehicles.

Moreover, ongoing innovations in laser scanner technology have expanded their use beyond traditional applications. In sectors like agriculture and forestry, laser scanners are now used for crop monitoring and forest management, providing vital data that supports sustainable practices. As the technology becomes more refined and cost-effective, the adoption of laser scanners is expected to grow, further cementing their position as a leading component in the LiDAR market.

By Application Analysis

In 2022, the Corridor Mapping segment held a dominant market position within the LiDAR industry, capturing more than a 34% share. This segment’s prominence is largely due to its critical application in infrastructure and transportation planning.

Corridor mapping involves the precise surveying of narrow areas slated for the development of transport routes like highways, railways, and power line installations. The ability of LiDAR technology to deliver detailed and accurate 3D representations of long stretches of land makes it particularly suited for this task, ensuring that planners and engineers have the precise data needed for effective project execution.

The leadership of the Corridor Mapping segment can also be attributed to the growing global emphasis on infrastructure development and the need for sustainable urban planning. Governments and private sectors are increasingly investing in infrastructure projects that require extensive preliminary surveys to avoid costly errors. LiDAR’s efficiency in collecting high-resolution geographical data over large areas plays a pivotal role in the planning and monitoring of these projects, making it indispensable in corridor mapping.

Furthermore, advancements in LiDAR technology, such as increased data collection speeds and the integration of AI for faster data processing, have significantly reduced the time and labor costs associated with traditional survey methods. This has made LiDAR an even more attractive option for corridor mapping applications.

As urbanization continues and infrastructure projects expand, the demand for LiDAR in corridor mapping is expected to grow, maintaining its leadership in the market. The ongoing development and improvement of LiDAR systems will likely open new avenues for their application, ensuring the Corridor Mapping segment remains at the forefront of the LiDAR industry.

By End-user Analysis

In 2022, the automotive segment held a dominant position in the LiDAR market, capturing a significant share due to its critical role in advancing autonomous driving technologies. LiDAR sensors are pivotal in the development of self-driving cars, as they provide precise and real-time 3D mapping of the environment, enhancing vehicle safety and navigation capabilities. The push towards fully autonomous vehicles has led major automotive manufacturers and tech companies to invest heavily in LiDAR technology, propelling this segment’s growth.

The integration of LiDAR systems in automotive applications goes beyond just autonomous vehicles. Advanced Driver Assistance Systems (ADAS), which include features like adaptive cruise control, emergency braking, and lane-keeping assistance, also rely on the accuracy and reliability of LiDAR technology. As regulatory bodies increase safety requirements, the adoption of ADAS is expected to rise, further boosting the demand for LiDAR systems in this segment.

Additionally, the continuous advancements in LiDAR technology, such as solid-state LiDARs, offer smaller, more cost-effective solutions, making them more accessible for integration into consumer vehicles. This technological evolution is likely to drive down costs and spur wider adoption in the automotive industry, maintaining its lead in the LiDAR market. The ongoing partnerships between automotive giants and LiDAR manufacturers are testament to the sector’s commitment to innovating and scaling this technology, ensuring its dominant market position in the foreseeable future.

Key Market Segments

By Product Type

- Airborne

- Terrestrial

- Mobile & UAV

By Component

- GPS

- Navigation (IMU)

- Laser Scanners

- Other Components

By Application

- Corridor Mapping

- Engineering

- Environment

- Exploration and Detection

- Advanced Driver Assistance Systems (ADAS)

- Other Applications

By End-user

- Automotive

- Aerospace & Defense

- Healthcare

- IT & Telecom

- Oil & Gas

- Other End-users

Driver

Advancements in Autonomous Vehicles

The automotive industry’s shift towards autonomous vehicles is a significant driver for the LiDAR market. LiDAR technology is essential for developing advanced driver-assistance systems (ADAS) and fully autonomous driving solutions due to its ability to provide precise and reliable 3D mapping and imaging.

This technology helps in detecting and navigating obstacles, thereby enhancing vehicle safety and functionality. The push from automotive manufacturers to incorporate more automated features and the rise in consumer demand for safer, more efficient vehicles continue to propel the adoption of LiDAR systems, ensuring its growth within this sector.

Restraint

High Cost and Complexity

Despite the growing application of LiDAR technology, its adoption is restrained by high costs and complexity associated with its systems. The development and maintenance of LiDAR sensors involve significant financial investment, which can be a barrier for new entrants and small to medium enterprises.

Additionally, the integration of LiDAR systems into existing infrastructures or vehicles demands extensive customization, adding further to the costs. This economic challenge is compounded by the sophisticated nature of LiDAR technology, which requires specialized skills for operation and interpretation, limiting its accessibility and widespread deployment.

Opportunity

Expansion into New Geographic and Application Areas

LiDAR technology presents substantial opportunities for expansion into new geographic regions and applications beyond automotive, such as environmental monitoring, urban planning, and smart city initiatives. As urban areas continue to grow, there is an increasing need for advanced surveying tools to manage and plan urban spaces effectively.

LiDAR can play a crucial role in this regard by providing detailed topographical data that supports infrastructure development, disaster management, and environmental conservation. The technology’s versatility in application across different sectors and its ability to provide detailed, accurate geographical data opens up numerous possibilities for market expansion.

Challenge

Technological Complexity and Integration Issues

A primary challenge in the LiDAR market is the technological complexity associated with the integration of LiDAR systems into various platforms. Integrating these systems often requires extensive calibration, customization, and maintenance, which can hinder their practical application.

Additionally, as LiDAR competes with other technologies like radar and camera systems, which are often cheaper and easier to integrate, overcoming these integration challenges is crucial. Ensuring compatibility with various platforms and simplifying the integration process without compromising on data quality is essential for the broader adoption of LiDAR technology across different industries.

Growth Factors for LiDAR Market

- Autonomous Vehicles and ADAS Expansion: The increasing development and deployment of autonomous vehicles, along with the advancement of advanced driver-assistance systems (ADAS), are primary growth drivers. These automotive technologies rely heavily on LiDAR for navigation and safety features, pushing the demand for more sophisticated and reliable LiDAR systems.

- Government Initiatives for Infrastructure Development: Various government projects related to infrastructure development and urban planning increasingly utilize LiDAR technology for accurate and detailed geographical data collection. This governmental support boosts the adoption of LiDAR in public sector projects, further stimulating market growth.

- Technological Advancements in LiDAR Systems: Innovations such as solid-state LiDAR and improvements in 3D imaging capabilities enhance the functionality and reduce the cost of LiDAR systems. These advancements make LiDAR more accessible and practical for broader applications, contributing significantly to market expansion.

- Rising Demand in Aerospace and Defense: LiDAR’s ability to generate precise topographical data is invaluable in the aerospace and defense sectors for surveillance, reconnaissance, and mission planning. Increasing security concerns and military spending are thus expected to drive the LiDAR market forward.

- Integration with UAVs and Drones: The integration of LiDAR with unmanned aerial vehicles (UAVs) and drones for applications like terrain mapping, agriculture, and disaster management is rapidly growing. This integration allows for more efficient and cost-effective data collection, opening new avenues for LiDAR’s application and market growth.

Emerging Trends in LiDAR Market

- AI and Machine Learning Integration: Incorporating artificial intelligence (AI) and machine learning (ML) with LiDAR technology is a significant trend. This integration enhances the processing and analysis of the vast amounts of data LiDAR systems generate, leading to more accurate and actionable insights.

- Solid-State LiDAR Development: The shift towards solid-state LiDAR systems, which offer fewer moving parts, increased reliability, and lower costs, is reshaping the market. This trend is particularly important for automotive and consumer electronics applications, where durability and cost are critical considerations.

- Environmental Monitoring and Climate Change Applications: LiDAR is increasingly being used for environmental monitoring and managing the effects of climate change. Its ability to provide detailed 3D models of forests, coastlines, and urban areas makes it crucial for ecological studies and disaster management planning.

- Mobile and Stationary LiDAR Growth: There is a growing trend towards the use of mobile and stationary LiDAR systems for applications beyond traditional mapping, such as real-time crowd monitoring and security surveillance. This flexibility in deployment modes broadens the scope of potential applications.

- Increased Use in Cultural Heritage and Archaeology: LiDAR technology is finding new applications in the fields of archaeology and cultural heritage preservation. It allows researchers to discover and model archaeological sites and historical landscapes without disturbing the actual sites, preserving them for future generations.

Regional Analysis

In 2022, North America held a dominant market position in the LiDAR industry, capturing more than a 40% share and holding USD 0.6 billion in revenue. This leadership is primarily driven by the region’s advanced technological infrastructure and significant investments in research and development. The United States, in particular, has been a frontrunner in the adoption and innovation of LiDAR technology, leveraging it across various sectors such as autonomous vehicles, environmental monitoring, and smart city projects.

North America’s leadership in the LiDAR market can be attributed to several factors. Firstly, the presence of major LiDAR manufacturers and technology companies in the region fosters a robust ecosystem for continuous innovation and development. Companies like Velodyne LiDAR, Luminar Technologies, and Quanergy Systems are headquartered in the U.S., contributing significantly to market growth through constant technological advancements and strategic partnerships.

Additionally, the region benefits from strong government support and funding for infrastructure and defense projects, which heavily utilize LiDAR technology. For instance, initiatives like the U.S. Department of Transportation’s push for autonomous vehicle development and the Federal Emergency Management Agency’s (FEMA) use of LiDAR for disaster management and environmental monitoring underscore the importance of this technology in critical applications.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The LiDAR market is highly competitive, with several key players driving innovation and market growth. Among these, Leica Geosystems Holdings AG stands out for its advanced LiDAR solutions used in high-precision surveying and mapping applications. Faro Technologies Inc. is renowned for its portable measurement and imaging solutions, which have broad applications in industrial manufacturing and 3D documentation. Beijing SureStar Technology Co. Ltd has made significant strides in developing cost-effective and high-performance LiDAR systems, particularly for the automotive sector.

Velodyne LiDAR, Inc. remains a pivotal player, known for its versatile LiDAR sensors that cater to autonomous vehicles, mapping, and industrial automation. Trimble Navigation Limited offers integrated solutions that combine LiDAR technology with GPS and other sensors, enhancing precision and efficiency in construction and agriculture. Sick AG is another major player, providing innovative LiDAR sensors primarily for automation and safety applications in industrial settings.

GeoDigital is recognized for its geospatial solutions that integrate LiDAR data for enhanced decision-making in infrastructure management and environmental monitoring. RIEGL USA Inc. specializes in high-end LiDAR sensors and systems, known for their accuracy and reliability in various surveying applications. Quanergy Systems Inc. focuses on solid-state LiDAR sensors that offer durability and performance for automotive and smart city applications.

Top Key Players in the Market

- Leica Geosystems Holdings AG

- Faro Technologies Inc.

- Beijing SureStar Technology Co. Ltd

- Velodyne LiDAR, Inc.

- Trimble Navigation Limited

- Sick AG

- GeoDigital

- RIEGL USA Inc.

- Quanergy Systems Inc.

- Topcon Corp

- Other Key Players

Recent Developments

- In September 2024, Teledyne Geospatial introduced a range of new solutions at the INTERGEO 2024 event, including the Galaxy Edge airborne LiDAR system and the Network Surveyor. These offerings focus on delivering advanced real-time data processing for improved mapping and spatial analysis.

- In August 2024, YellowScan entered into a collaboration with Nokia to integrate the Surveyor Ultra LiDAR scanner into Nokia’s Drone Networks. The initiative aims to support industrial operations by enabling automated 5G-based LiDAR scanning for use cases such as utility inspections and telecommunications tower monitoring.

- In June 2024, Innoviz Technologies partnered with an automotive OEM to enhance Level 4 autonomous driving capabilities. The integration of Innoviz’s short-range LiDAR sensors, part of the InnovizTwo platform, is targeted at light commercial vehicles, reflecting the rising need for safer and more efficient autonomous systems.

- In April 2024, Hesai Group collaborated with Marelli Holdings Co., Ltd. to embed its ATX LiDAR technology into Marelli’s next-generation headlamp design. This innovation improves object detection and safety while ensuring aerodynamic and aesthetic efficiency. The collaboration highlights advancements in compact LiDAR integration, making the technology more accessible for both cost-sensitive and premium vehicle models.

Report Scope

Report Features Description Market Value (2023) USD 2.0 Bn Forecast Revenue (2032) USD 11.6 Bn CAGR (2023-2032) 22.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Airborne, Terrestrial, Mobile & UAV, By Component- GPS, Navigation (IMU), Laser Scanners, and Other Components, By Application – Corridor Mapping, Engineering, Environment, Exploration and Detection, Advanced Driver Assistance Systems (ADAS), and Other Applications, and by End-user- Automotive, Aerospace & Defense, Healthcare, IT & Telecom, Oil & Gas, and Other End-users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Leica Geosystems Holdings AG, Faro Technologies Inc., Beijing SureStar Technology Co. Ltd, Velodyne LiDAR, Inc., Trimble Navigation Limited, Sick AG, GeoDigital, RIEGL USA Inc., Quanergy Systems Inc., Topcon Corp, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Leica Geosystems Holdings AG

- Faro Technologies Inc.

- Beijing SureStar Technology Co. Ltd

- Velodyne LiDAR, Inc.

- Trimble Navigation Limited

- Sick AG

- GeoDigital

- RIEGL USA Inc.

- Quanergy Systems Inc.

- Topcon Corp