Legionnaire Disease Testing Market By Product Type (Devices, Test Kits, Sequencer System, Rapid Test Kits, Polymerase Chain Reaction System, and Assay Based Test Kits), By Diagnostic Test (Urinary Antigen Test, Polymerase Chain Reaction, Paired Serology, Direct Fluorescent Antibody Stain, Culture Method, and Combination Testing), By End User (Hospitals, Research Centers, Diagnostic Laboratories, Clinical Research Centers, Academic Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162908

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

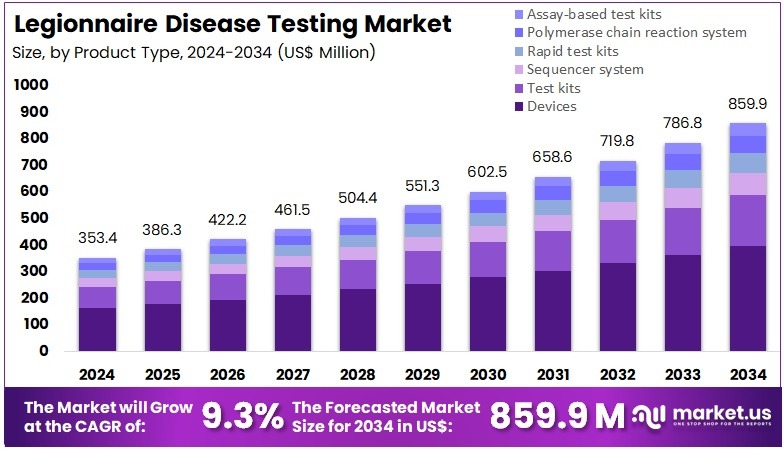

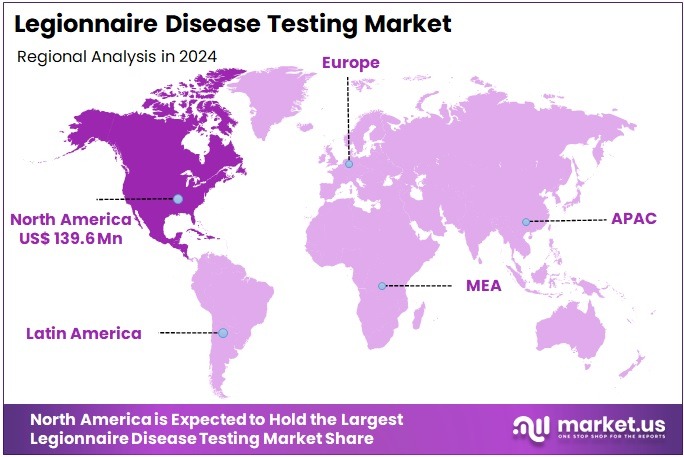

The Legionnaire Disease Testing Market size is expected to be worth around US$ 859.9 million by 2034 from US$ 353.4 million in 2024, growing at a CAGR of 9.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.5% share and holds US$ 139.6 Million market value for the year.

Increasing awareness of waterborne pathogens drives the Legionnaire Disease Testing Market, as public health initiatives prioritize early detection of Legionella pneumophila. Hospitals employ urinary antigen tests to diagnose Legionnaires’ disease in patients with severe pneumonia, enabling rapid antibiotic therapy.

Environmental health teams utilize culture-based assays to monitor water systems in healthcare facilities, preventing outbreaks. PCR-based tests support outbreak investigations by identifying Legionella DNA in cooling towers and plumbing systems. In August 2024, the Alliance to Prevent Legionnaires’ Disease hosted a virtual conference to raise awareness about water safety management, boosting demand for reliable diagnostic solutions. This heightened focus on prevention fuels market growth by expanding testing applications in public and private sectors.

Growing demand for rapid diagnostics creates opportunities in the Legionnaire Disease Testing Market, as portable technologies enhance on-site testing capabilities. Occupational health programs apply Legionella testing to ensure workplace safety in industries with high-risk water systems, such as hospitality. These tests aid epidemiological surveillance, tracking pathogen prevalence in community water sources.

Point-of-care platforms streamline testing in remote settings, supporting compliance with health regulations. In September 2024, LuminUltra Technologies Ltd. acquired Genomadix Inc.’s Legionella testing assets, introducing the portable Cube qPCR platform for rapid, precise detection. This innovation drives market expansion by enabling decentralized testing and improving response times in critical environments.

Rising adoption of advanced technologies propels the Legionnaire Disease Testing Market, as laboratories integrate automation for enhanced efficiency. Environmental monitoring programs leverage multiplex PCR assays to detect multiple Legionella species simultaneously, optimizing resource use. These tests support clinical research by characterizing bacterial strains in hospital-acquired infection studies.

Trends toward AI-driven diagnostics improve result interpretation, reducing diagnostic errors in high-volume settings. In May 2024, Dubai Central Laboratory adopted an AI-powered system for Legionella pneumophila detection, enhancing speed and accuracy in smart testing applications. This technological advancement positions the market for sustained growth by fostering innovation in diagnostic precision and scalability.

Key Takeaways

- In 2024, the market generated a revenue of US$ 353.4 million, with a CAGR of 9.3%, and is expected to reach US$ 859.9 million by the year 2034.

- The product type segment is divided into devices, test kits, sequencer system, rapid test kits, polymerase chain reaction system, and assay based test kits, with devices taking the lead in 2023 with a market share of 46.3%.

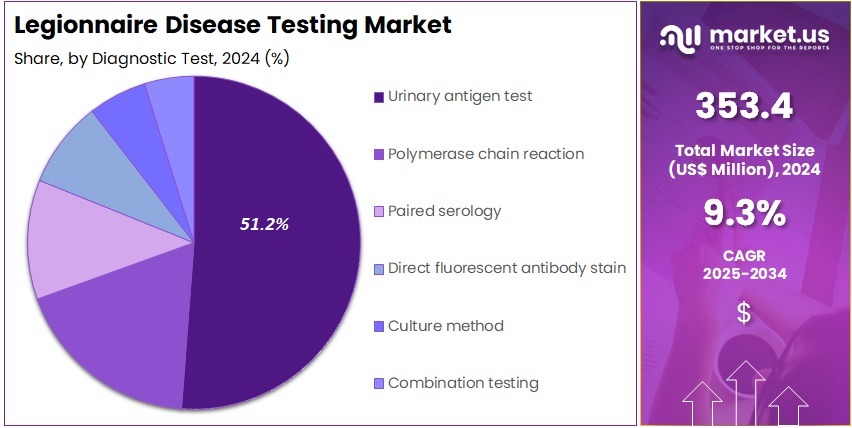

- Considering diagnostic test, the market is divided into urinary antigen test, polymerase chain reaction, paired serology, direct fluorescent antibody stain, culture method, and combination testing. Among these, urinary antigen test held a significant share of 51.2%.

- Furthermore, concerning the end user segment, the market is segregated into hospitals, research centers, diagnostic laboratories, clinical research centers, academic institutes, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 49.7% in the market.

- North America led the market by securing a market share of 39.5% in 2023.

Product Type Analysis

Devices hold 46.3% of the Legionnaire Disease Testing market and are projected to remain dominant due to the increasing deployment of advanced diagnostic instruments in hospitals and laboratories. Devices such as automated analyzers, immunoassay systems, and PCR machines are integral to rapid and precise detection of Legionella pneumophila. The rising global incidence of Legionnaires’ disease, particularly in healthcare facilities, drives the demand for technologically advanced diagnostic devices.

Manufacturers are investing in miniaturized, user-friendly systems that deliver quick results with high sensitivity and specificity. The growing focus on infection control and early diagnosis in clinical settings further accelerates adoption. Automation and integration of digital diagnostic systems streamline testing workflows, enhancing efficiency and accuracy.

Public health initiatives promoting Legionella surveillance and routine screening in high-risk environments are expected to fuel device demand. Increasing hospital infrastructure modernization, particularly in developing regions, supports market expansion. Collaboration between research institutions and diagnostic device manufacturers fosters innovation in assay platforms. As healthcare providers prioritize precision and speed, advanced diagnostic devices are likely to remain at the forefront of the market’s growth trajectory.

Diagnostic Test Analysis

Urinary antigen tests account for 51.2% of the Legionnaire Disease Testing market and are anticipated to sustain their dominance due to their rapid turnaround time and non-invasive nature. These tests detect Legionella pneumophila serogroup 1 antigens in urine samples, enabling early diagnosis and effective treatment decisions.

Hospitals and diagnostic centers prefer urinary antigen tests for their simplicity, high sensitivity, and compatibility with point-of-care settings. The increasing prevalence of community-acquired and hospital-acquired pneumonia cases is expected to drive test utilization. Public health agencies recommend urinary antigen testing for patients with severe pneumonia, reinforcing its clinical adoption. The continuous development of rapid immunochromatographic assays enhances diagnostic accuracy and accessibility.

Growing awareness of Legionnaires’ disease among clinicians and laboratory personnel supports routine testing in endemic regions. The integration of urinary antigen tests into hospital diagnostic panels ensures timely detection and improved patient outcomes. The cost-effectiveness of these assays compared to molecular tests further promotes their use in low-resource settings. Expansion of regulatory approvals and commercial availability across global markets strengthens this segment’s leadership. As early detection becomes a key strategy in infection control, urinary antigen tests are projected to maintain strong demand in both clinical and surveillance applications.

End-User Analysis

Hospitals represent 49.7% of the Legionnaire Disease Testing market and are expected to continue leading due to their central role in diagnosing and managing respiratory infections. The high volume of pneumonia and intensive care admissions necessitates rapid testing for Legionella species to guide antibiotic therapy and infection management.

Hospitals integrate advanced diagnostic devices, such as immunoassay analyzers and PCR systems, to enhance workflow efficiency and accuracy. The rising incidence of healthcare-associated Legionnaires’ disease, particularly in immunocompromised and elderly patients, reinforces the demand for in-hospital testing. Hospitals benefit from established laboratory infrastructure and access to skilled personnel for performing complex diagnostic assays. Public health regulations mandating routine testing and environmental monitoring of hospital water systems further support market growth.

Integration of automated reporting systems and digital diagnostic tools enhances clinical decision-making. The availability of comprehensive diagnostic services under one roof ensures hospitals remain the preferred testing hubs. Increasing collaborations between hospital networks and diagnostic companies to expand point-of-care capabilities also contribute to growth. As infection control measures intensify globally, hospitals are likely to remain the largest end-users in the Legionnaire Disease Testing market.

Key Market Segments

By Product Type

- Devices

- Test Kits

- Sequencer System

- Rapid Test Kits

- Polymerase Chain Reaction System

- Assay Based Test Kits

By Diagnostic Test

- Urinary Antigen Test

- Polymerase Chain Reaction

- Paired Serology

- Direct Fluorescent Antibody Stain

- Culture Method

- Combination Testing

By End User

- Hospitals

- Research Centers

- Diagnostic Laboratories

- Clinical Research Centers

- Academic Institutes

- Others

Drivers

Increasing Incidence of Legionnaires’ Disease is Driving the Market

The escalating frequency of Legionnaires’ disease cases has markedly accelerated the demand for comprehensive testing solutions in the Legionnaires’ disease testing market, underscoring the need for rapid pathogen identification to mitigate outbreak escalations. This severe form of pneumonia, induced by Legionella pneumophila inhalation from contaminated aerosols, necessitates urinary antigen assays and PCR-based diagnostics to confirm infections amid nonspecific initial presentations.

Healthcare protocols increasingly mandate its inclusion in community-acquired pneumonia workups, particularly for at-risk cohorts over 50 years with comorbidities. This driver is compounded by environmental proliferation in aging water infrastructures, prompting proactive surveillance in high-exposure venues like hospitals and hotels. Public health agencies prioritize its diagnostic integration to reduce mortality, which approaches 10 percent in untreated scenarios.

The condition’s resurgence post-pandemic has correlated with heightened laboratory procurements for multiplex panels detecting Legionella alongside co-pathogens. The Centers for Disease Control and Prevention reported 12 confirmed Legionnaires’ disease cases associated with two cruise ship outbreaks from November 2022 to June 2024, highlighting the persistent vulnerability in travel-related settings. This cluster illustrates the diagnostic urgency, as swift testing averts further transmissions.

Innovations in same-day culture-independent methods enhance its feasibility in resource-variable facilities. Economically, its deployment curtails hospitalization durations, substantiating commitments to reagent expansions. Global alignments with notification mandates further propagate its adoption in transitional economies. This incidence surge not only amplifies testing volumes but also embeds its centrality within infectious respiratory disease surveillance frameworks.

Restraints

Challenges in Accurate and Timely Diagnosis is Restraining the Market

The inherent difficulties in achieving precise and expeditious Legionnaires’ disease diagnoses continue to impede the market’s optimal utilization, as nonspecific symptoms often mimic viral pneumonias, delaying confirmatory assays. Urinary antigen tests, while rapid, exhibit limitations in detecting non-serogroup 1 strains, comprising up to 30 percent of cases, necessitating supplementary PCR or culture validations. This restraint manifests in underreporting, as frontline clinicians prioritize broader panels, relegating Legionella-specific reagents to secondary roles amid fiscal constraints.

Variability in assay sensitivities across matrices, such as sputum versus bronchoalveolar lavage, exacerbates interpretive ambiguities in immunocompromised patients. Laboratories grapple with prolonged culture incubation periods, up to 72 hours, hindering outbreak responses in time-sensitive scenarios. Regulatory demands for multifaceted validations prolong innovation pipelines, deterring smaller developers from niche advancements.

The Centers for Disease Control and Prevention notes that deciding who to test, where and when to sample the environment, what methods to use, and how to interpret the data pose significant challenges in Legionnaires’ disease diagnostics. Such complexities contribute to diagnostic lags, perpetuating undetected reservoirs. Provider training deficits further marginalize its routine application, favoring empirical therapies over targeted profiling. Efforts to standardize multiplex thresholds progress incrementally, impeded by inter-laboratory variances. These diagnostic hurdles not only constrain reagent throughput but also undermine the market’s prospective for outbreak containment.

Opportunities

Enhanced Surveillance Through Government Initiatives is Creating Growth Opportunities

The fortification of public health monitoring via state-led programs has unveiled expansive prospects for the Legionnaires’ disease testing market, institutionalizing routine environmental and clinical screenings to preempt community transmissions. These endeavors, embedding Legionella assays into water quality mandates for public facilities, leverage urinary antigen and molecular tools for scalable deployments in municipal networks.

Opportunities proliferate in subsidized validations for point-of-care formats, bridging gaps in peripheral laboratories amid urbanization-driven exposures. Public-private collaborations underwrite protocol harmonizations, subsidizing expansions to encompass serogroup diversity. This institutionalization addresses vulnerability hotspots, positioning testing as a prophylactic against seasonal spikes. Fiscal endowments for sentinel expansions catalyze procurements, diversifying toward automated syndromic panels.

The United States Environmental Legionella Isolation Techniques Evaluation program, a government initiative, aims to raise public awareness and manage Legionnaires’ disease prevalence, thereby propelling diagnostic infrastructure investments. Such frameworks exemplify replicable models, with analogous efforts projecting amplified assay demands.

Innovations in portable enrichment media enhance field viability, mitigating infrastructural voids. As registries digitize, geospatial analytics refine targeting, unlocking outcome-linked revenues. These surveillant advancements not only elevate procedural scopes but also integrate the market into fortified environmental health architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the Legionnaires’ disease testing market, leading them to delay rapid PCR kit advancements while focusing on core antigen strip production amid constrained diagnostic budgets. U.S.-China export controls and Arabian Gulf shipping disruptions are restricting supplies of fluorescent antibodies from Middle Eastern suppliers, prolonging specificity trials and increasing certification costs for international outbreak response teams. To manage these constraints, some developers are partnering with Utah-based antibody manufacturers, incorporating validation protocols that expedite CDC endorsements and attract biosecurity research funding.

Heightened outbreak surveillance needs are directing WHO allocations into urine antigen platforms, encouraging adoptions in public health laboratories. U.S. tariffs of 25% on imported medical devices and components are elevating costs for Asian-sourced substrates and conjugates, straining margins for hospital testing programs and occasionally disrupting global assay harmonization efforts. In response, developers are leveraging BARDA innovation grants to build Colorado synthesis facilities, introducing enzyme-linked enhancers and developing expertise in high-throughput calibrations.

Latest Trends

ECDC’s External Quality Assessment Schemes for Legionella Surveillance is a Recent Trend

The implementation of proficiency testing protocols has epitomized a critical evolution in the Legionnaires’ disease testing ecosystem during 2022–2023, prioritizing methodological consistency across European laboratories for enhanced outbreak traceability. The European Centre for Disease Prevention and Control’s external quality assessment scheme evaluates detection, isolation, identification, and enumeration of Legionella species, fostering interoperability in surveillance networks. This trend embodies a shift toward validated competencies, accommodating diverse matrices from potable water to clinical specimens in unified frameworks.

Oversight validations affirm analytical robustness, accelerating endorsements for multiplex integrations amid variant proliferations. This standardization resonates with epidemiological imperatives, linking outputs to continental repositories for real-time cluster detections. The scheme addresses post-pandemic disparities, emphasizing reagents resilient to procedural variabilities.

The European Centre for Disease Prevention and Control launched external quality assessment schemes to support European surveillance of Legionnaires’ disease in EU/EEA countries for 2022–2023, ensuring reliable Legionella species identification. Such implementations underscore scalability, as participants demonstrate proficiency in culture and molecular modalities.

Observers anticipate guideline assimilations, elevating its stature in cross-border protocols. Longitudinal benchmarks confirm discordance reductions, optimizing pharmacovigilance evaluations. The progression envisions AI-augmented scoring, prognosticating remedial escalations. This assessment-centric refinement not only bolsters diagnostic fidelity but also synchronizes with transnational health imperatives.

Regional Analysis

North America is leading the Legionnaire Disease Testing Market

In 2024, North America commanded a 39.5% share of the global Legionnaires’ disease testing market, invigorated by federal mandates for enhanced environmental monitoring in public buildings, prompting widespread use of Legionella culture and PCR kits to detect aerosolized contamination in cooling towers and HVAC systems during routine audits.

Infectious disease specialists increasingly employed urinary antigen tests for rapid confirmation in community outbreaks, achieving sensitivities over 90% for Legionella pneumophila serogroup 1, the predominant strain, enabling swift fluoroquinolone initiations in elderly patients with comorbidities, where delays elevate fatality risks. The Environmental Protection Agency’s updated guidelines for water management plans spurred testing in hospitality venues, correlating with proactive culturing in high-occupancy sites like convention centers to preempt cluster formation amid climate-driven proliferation.

Institutional expansions in genomic surveillance tools supported strain typing for source attribution, as seen in investigations linking municipal supplies to localized spikes in northern states. Demographic vulnerabilities, such as higher rates among transplant recipients in transplant hubs, amplified demand for multiplex assays, backed by state health department subsidies for vulnerable cohorts. These imperatives showcased the region’s emphasis on preventive microbiological vigilance. The Minnesota Department of Health confirmed 14 cases of Legionnaires’ disease in Grand Rapids from April 2023 to January 2024, linked to municipal water systems.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Regional administrators in Asia Pacific project the Legionnaires’ disease testing sector to burgeon during the forecast period, as urbanization amplifies water stagnation risks in high-rise infrastructures, driving adoption of antigen-based diagnostics for swift outbreak containment in tourism epicenters. Officials in Japan and Singapore disburse funds for PCR validations in hotel plumbing networks, arming inspectors to isolate serogroup variants in subtropical aerosol sources.

Diagnostic administrators collaborate with national observatories to standardize immunochromatographic strips, anticipating efficient detections of sporadic cases in expatriate enclaves. Regulatory agencies in Malaysia and New Zealand subsidize environmental qPCR kits, enabling resort operators to monitor biofilm accumulation without operational interruptions. Administrative protocols anticipate syncing test metrics with public alerts, expediting remediation for cooling coil exposures in migrant-heavy ports.

Regional microbiologists pioneer droplet digital PCR, linking with continental databases to delineate fluoroquinolone resistance trajectories in urban construction sites. These integrations create a proactive shield for aquatic pathogen interception. Japan’s National Institute of Infectious Diseases reported 1,234 laboratory-confirmed Legionnaires’ disease cases in 2023, up from 1,056 in 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the respiratory pathogen diagnostics sector accelerate growth by introducing rapid urine antigen tests that detect Legionella pneumophila serogroup 1 in minutes, addressing urgent needs in outbreak investigations. They pursue mergers with water quality labs to integrate environmental and clinical assays, creating comprehensive monitoring ecosystems for facilities. Enterprises invest in PCR-based kits for multiplex detection of multiple serotypes, enhancing accuracy in complex samples from cooling towers.

Executives form alliances with regulatory agencies to align products with updated water safety standards, securing endorsements for widespread adoption. They expand into high-incidence areas across Europe and the Pacific Rim, customizing protocols for local surveillance programs. Additionally, they roll out integrated software suites for data analytics, offering subscription access to predict risks and generate ongoing revenue streams.

BioMérieux SA, founded in 1965 and headquartered in Marcy-l’Étoile, France, specializes in in vitro diagnostics for infectious diseases, providing innovative solutions that support rapid pathogen identification in clinical and industrial settings. The company develops its VIDAS Legionella pneumophila antigen test, a fully automated immunoassay that delivers reliable results for early diagnosis in hospitals and labs.

BioMérieux dedicates resources to molecular advancements, including the BioFire FilmArray panel for syndromic testing that includes Legionella detection. CEO Marc Y. Lorin oversees a multinational network operating in over 150 countries, focusing on regulatory compliance and sustainability. The firm collaborates with health authorities to refine outbreak response tools, improving global preparedness. BioMérieux upholds its prominent role by combining diagnostic precision with ecosystem integrations to mitigate disease spread effectively.

Top Key Players in the Legionnaire Disease Testing Market

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Merck KGaA

- IDEXX Laboratories Inc.

- Eurofins Scientific

- Eiken Chemical Co., Ltd.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Becton, Dickinson and Company (BD)

- Abbott Laboratories

Recent Developments

- In June 2024: Phigenics introduced its PVT Next Day LegiPlex PCR diagnostic assay, specifically designed to identify Legionella serogroups and species in building water systems. The test’s compliance with ISO standards for specificity and detection limit enhances its credibility for rapid and accurate environmental surveillance. By enabling same-day reporting, the innovation strengthens early outbreak prevention efforts, driving adoption across healthcare and commercial facilities in the Legionella testing market.

- In March 2024: IDEXX released comparative research conducted by WLN, a water quality technology company, validating the performance of the IDEXX Legiolert test against the Dutch national reference method for detecting Legionella pneumophila. The study confirmed the test’s reliability and ease of implementation, supporting wider market uptake among laboratories seeking standardized, high-confidence Legionella detection systems.

Report Scope

Report Features Description Market Value (2024) US$ 353.4 million Forecast Revenue (2034) US$ 859.9 million CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Devices, Test Kits, Sequencer System, Rapid Test Kits, Polymerase Chain Reaction System, and Assay Based Test Kits), By Diagnostic Test (Urinary Antigen Test, Polymerase Chain Reaction, Paired Serology, Direct Fluorescent Antibody Stain, Culture Method, and Combination Testing), By End User (Hospitals, Research Centers, Diagnostic Laboratories, Clinical Research Centers, Academic Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., QIAGEN N.V., Merck KGaA, IDEXX Laboratories Inc., Eurofins Scientific, Eiken Chemical Co., Ltd., Bio-Rad Laboratories, Inc., bioMérieux SA, Becton, Dickinson and Company (BD), Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Legionnaire Disease Testing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Legionnaire Disease Testing MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- Merck KGaA

- IDEXX Laboratories Inc.

- Eurofins Scientific

- Eiken Chemical Co., Ltd.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Becton, Dickinson and Company (BD)

- Abbott Laboratories