Global Led Farming Market Size, Share Analysis Report By Wavelength (Blue Wavelength, Red Wavelength, Far Red Wavelength, Others), By Application (Vertical Farming, Indoor Farming, Commercial Greenhouse, Turf and Landscaping, Others), By Crop Type (Fruits And Vegetables, Herbs And Microgreens, Flowers And Ornamentals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159300

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

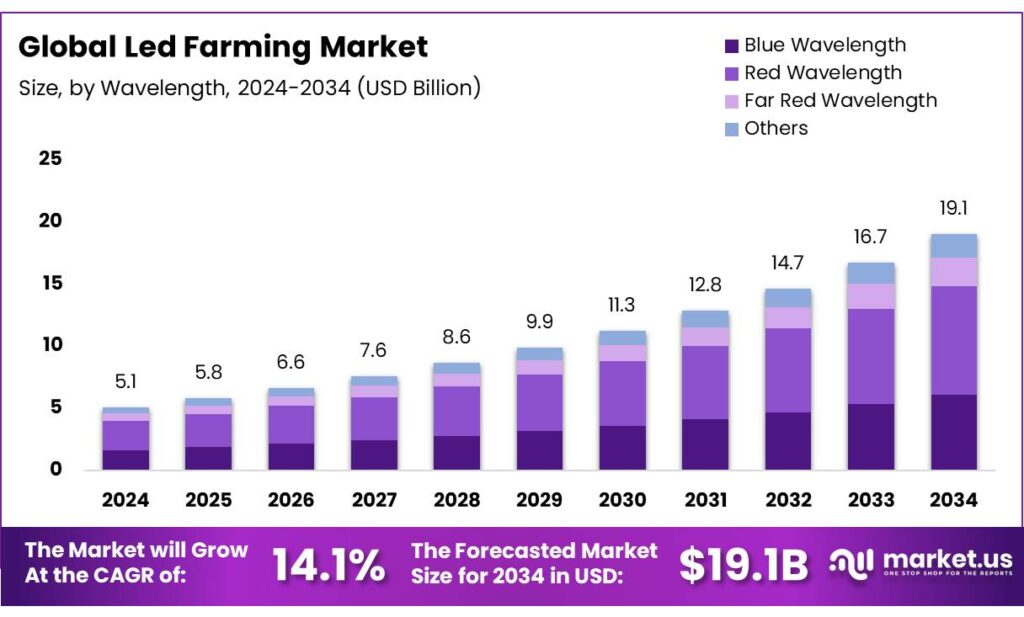

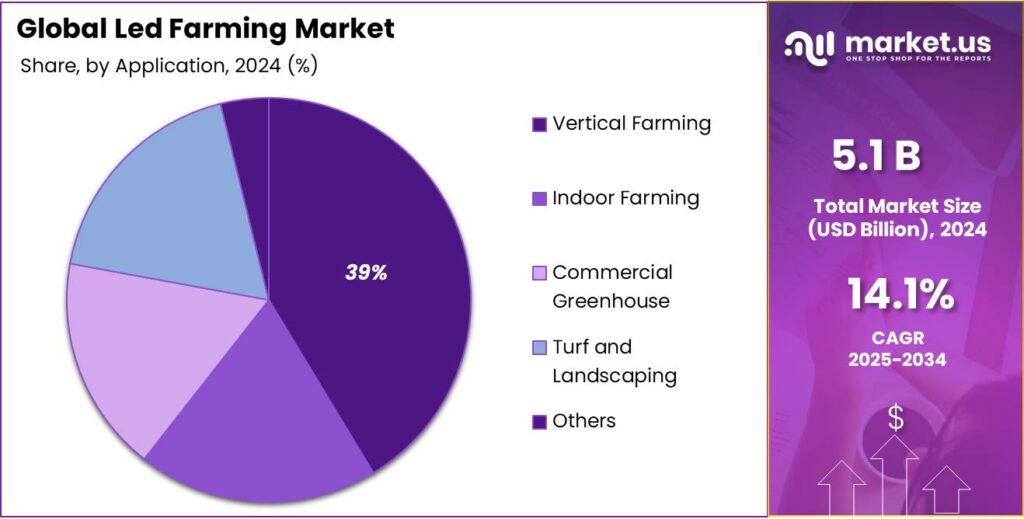

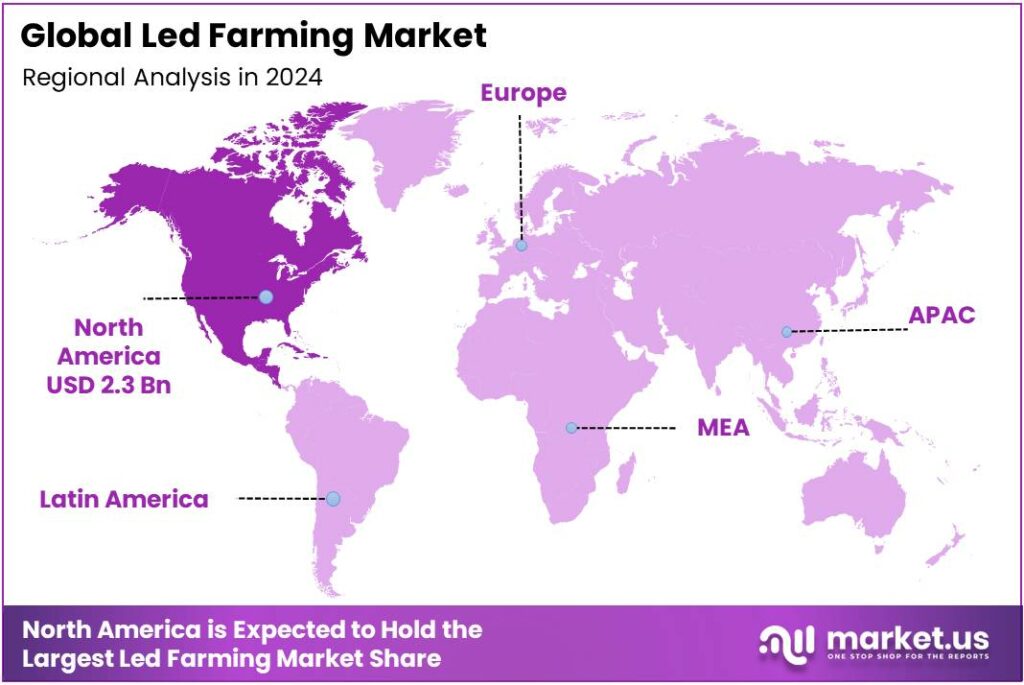

The Global Led Farming Market size is expected to be worth around USD 19.1 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 14.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 45.9% share, holding USD 2.3 Billion in revenue.

LED farming, encompassing indoor and vertical agriculture, is revolutionizing India’s agricultural landscape by integrating energy-efficient lighting solutions to enhance crop yields and sustainability. The adoption of LED grow lights has surged due to their energy efficiency, customizable light spectra, and ability to support year-round cultivation in controlled environments. This shift aligns with the Indian government’s commitment to modernizing agriculture through technology and sustainability initiatives.

The Indian government has introduced several initiatives to support farmers and promote sustainable farming practices. The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) has facilitated the expansion of micro-irrigation to over 61.72 lakh hectares, improving water efficiency and supporting farmers in arid regions. Additionally, the Paramparagat Krishi Vikas Yojana (PKVY) has helped convert 14.99 lakh hectares into organic farmland since 2015-16, benefiting over 25.20 lakh farmers and promoting eco-friendly agricultural practices.

Government initiatives play a pivotal role in promoting LED-based farming technologies. The Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme provides direct income support to small and marginal farmers, enhancing their purchasing power for modern farming equipment. Additionally, the Rashtriya Krishi Vikas Yojana (RKVY-RAFTAAR) offers grants of up to Rs. 25 lakh for AgriTech startups, fostering innovation in agricultural technologies.

- For example, Maharashtra’s ‘MahaAgri-AI Policy 2025-2029’ allocates ₹500 crore over five years to integrate artificial intelligence and modern technologies into agriculture, including the use of smart sensors and data analytics to optimize farming practices

Key Takeaways

- Led Farming Market size is expected to be worth around USD 19.1 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 14.1%.

- Red Wavelength held a dominant market position, capturing more than a 45.9% share of the global LED farming market.

- Vertical Farming held a dominant market position, capturing more than a 39.4% share of the global LED farming market.

- Fruits & Vegetables held a dominant market position, capturing more than a 56.8% share of the LED farming market.

- North America held a dominant market position in the LED farming sector, capturing more than a 45.90% share, valued at approximately USD 2.3 billion.

By Wavelength Analysis

Red Wavelength Dominates LED Farming Market with 45.9% Share in 2024

In 2024, Red Wavelength held a dominant market position, capturing more than a 45.9% share of the global LED farming market. This segment’s strong performance can be attributed to the significant role red light plays in the photosynthesis process. Red light is particularly effective in promoting plant growth, stimulating the flowering and fruiting stages, and enhancing overall plant health. As such, it has become a preferred choice for many indoor farming applications, including vertical farming and greenhouse operations.

The red wavelength typically falls within the range of 620 to 750 nanometers and is particularly effective in improving plant yields, making it highly sought after by farmers looking to optimize crop production. Over the past few years, there has been a steady increase in the adoption of red LED lights, driven by their energy efficiency and cost-effectiveness. Red wavelengths are known for their ability to increase plant growth rates, especially in crops like lettuce, tomatoes, and herbs, which has further solidified their position in the market.

By Application Analysis

Vertical Farming Dominates LED Farming Market with 39.4% Share in 2024

In 2024, Vertical Farming held a dominant market position, capturing more than a 39.4% share of the global LED farming market. This segment’s strong performance is driven by the increasing need for efficient land use and the growing demand for locally produced food in urban areas. Vertical farming, which involves growing crops in stacked layers or vertically inclined surfaces, has become a preferred solution for urban farming due to its space efficiency and reduced reliance on traditional agricultural land.

The use of LEDs in vertical farming is particularly beneficial as they provide controlled lighting that promotes optimal plant growth in indoor environments. Vertical farming systems make it possible to grow a wide variety of crops, such as leafy greens, herbs, and even strawberries, year-round, regardless of external weather conditions. This adaptability has contributed to the steady rise in vertical farming applications, especially in densely populated regions where space is limited.

By Crop Type Analysis

Fruits & Vegetables Lead LED Farming Market with 56.8% Share in 2024

In 2024, Fruits & Vegetables held a dominant market position, capturing more than a 56.8% share of the LED farming market. This segment’s leading position is driven by the increasing demand for fresh, locally grown produce and the ability to grow fruits and vegetables year-round, independent of seasonal or environmental conditions. LED technology, with its ability to provide precise light wavelengths, significantly enhances the growth cycles of fruits and vegetables, making it a preferred choice in both commercial and urban farming.

The controlled environment offered by LED farming allows for higher yields and faster crop rotations, which is especially beneficial for crops like leafy greens, tomatoes, cucumbers, and strawberries. These advantages are particularly important as urbanization increases, and space for traditional farming becomes more limited. Additionally, the demand for organic, pesticide-free fruits and vegetables has grown, further pushing the adoption of LED farming methods.

Key Market Segments

By Wavelength

- Blue Wavelength

- Red Wavelength

- Far Red Wavelength

- Others

By Application

- Vertical Farming

- Indoor Farming

- Commercial Greenhouse

- Turf and Landscaping

- Others

By Crop Type

- Fruits & Vegetables

- Herbs & Microgreens

- Flowers & Ornamentals

- Others

Emerging Trends

Integration of AI and IoT in LED and Hydroponic Farming

A transformative trend in LED and hydroponic farming in India is the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) to enhance productivity, sustainability, and resource efficiency. This technological convergence is reshaping the agricultural landscape, making it more data-driven and responsive to environmental variables.

In 2025, Maharashtra launched the ‘MahaAgri-AI Policy 2025-2029,’ a ₹500 crore initiative aimed at embedding AI into agriculture. The policy focuses on utilizing AI for crop monitoring, weather forecasting, pest control, and market analytics. It incorporates tools like drones, smart sensors, and mobile applications to provide real-time data to farmers, thereby enabling precision farming practices. This initiative is supported by the establishment of a Centre for AgriTech and AI Innovation, training centers, and the integration of existing digital platforms into a unified Agricultural Data Exchange (A-DeX)

Similarly, the Government Holkar Science College in Indore has implemented an innovative hydroponics project that employs AI-enabled systems to grow vegetables and medicinal plants indoors without soil or sunlight. This project utilizes nutrient-rich water or mist and artificial lighting to simulate sunlight, achieving significant reductions in water usage—only 10-20% of what traditional farming requires. The success of this project has garnered recognition, including the Second Prize at SRIJAN 2025 and the Young Scientist Award at the 40th MPCST Conference

The integration of AI and IoT in LED and hydroponic farming offers several advantages. It allows for real-time monitoring of environmental parameters such as temperature, humidity, and light intensity, enabling farmers to make data-driven decisions. This leads to optimized resource utilization, increased crop yields, and reduced environmental impact. Moreover, AI algorithms can predict potential issues like pest infestations or nutrient deficiencies, allowing for proactive interventions.

Drivers

Government Support and Financial Incentives for LED and Hydroponic Farming

One of the most compelling drivers of LED and hydroponic farming in India is the robust support provided by both central and state governments through financial incentives, subsidies, and policy initiatives. These measures aim to make advanced farming technologies more accessible and economically viable for farmers, especially those in resource-constrained regions.

- The Indian government has introduced several schemes to promote sustainable and technology-driven farming practices. Under the Agriculture Infrastructure Fund (AIF), loans up to ₹2 crore are available with a 3% interest subsidy for projects involving vertical farming, hydroponics, and polyhouses. This initiative is designed to encourage the adoption of modern farming techniques by reducing the financial burden on farmers and agripreneurs

Additionally, the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) has facilitated the expansion of micro-irrigation systems to over 61.72 lakh hectares, improving water use efficiency and supporting farmers in arid regions. Such initiatives not only enhance productivity but also promote sustainable water management practices.

State-level programs further bolster these efforts. For instance, the Maharashtra government offers a 50% subsidy for adopting hydroponics for animal feed production. Similarly, Gujarat provides up to a 50% subsidy for hydroponic projects, with specific schemes tailored to different states through the National Horticulture Board.

These financial incentives are complemented by skill development initiatives aimed at empowering farmers with the necessary knowledge and tools to implement advanced farming practices. Programs under the Rashtriya Krishi Vikas Yojana (RKVY-RAFTAAR) provide grants up to ₹25 lakh for agri-tech startups, fostering innovation and entrepreneurship in the agricultural sector

Restraints

High Initial Investment and Limited Access to Financing

One of the most significant challenges hindering the widespread adoption of LED and hydroponic farming in India is the substantial initial investment required for setting up such systems. These advanced farming technologies necessitate specialized infrastructure, including climate-controlled greenhouses, LED lighting systems, hydroponic setups, and automated nutrient delivery systems. The cost of establishing a medium-scale hydroponic farm can range from ₹10 lakh to ₹20 lakh, depending on the scale and sophistication of the system. For many small and marginal farmers, this upfront expenditure is prohibitively high.

While the Indian government has introduced various schemes to support farmers, such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and the Agriculture Infrastructure Fund (AIF), these initiatives primarily focus on traditional farming methods and infrastructure. The for instance, offers loans up to ₹2 crore with a 3% interest subsidy for projects involving vertical farming, hydroponics, and polyhouses. However, the application process can be cumbersome, and many farmers lack the necessary knowledge and resources to navigate it effectively.

Moreover, the lack of awareness and technical expertise among farmers poses a significant barrier. Many farmers are unfamiliar with the benefits and operational aspects of LED and hydroponic systems. This knowledge gap leads to apprehension and reluctance to invest in such technologies. While some state governments have initiated training programs and workshops to educate farmers about these advanced farming methods, the reach and effectiveness of these programs remain limited.

Opportunity

Government Support and Policy Initiatives

The growth of LED farming is significantly influenced by government support and policy initiatives aimed at promoting sustainable agriculture and food security. In the United States, the Department of Agriculture (USDA) has made substantial investments in conservation and climate-smart agriculture.

From 2019 through 2024, over $21 billion was committed to conservation contracts and projects benefiting farmers, ranchers, and forest landowners across the country. These federal investments generate approximately $3.45 billion in added economic value each year, supporting over 46,000 jobs annually through 2029

Additionally, the USDA’s 2024 Regional Conservation Partnership Program (RCPP) funding priorities include urban agriculture and climate-smart practices, which encompass the adoption of Controlled Environment Agriculture (CEA) technologies like LED farming. This focus aligns with the Biden-Harris Administration’s efforts to support farmers and ranchers in diversifying income and enhancing the resilience and profitability of their operations

Regional Insights

North America Leads LED Farming Market with 45.90% Share in 2024

In 2024, North America held a dominant market position in the LED farming sector, capturing more than a 45.90% share, valued at approximately USD 2.3 billion. This dominance can be attributed to the region’s advanced technological infrastructure, strong investment in agriculture innovation, and increasing demand for sustainable food production solutions. The region is witnessing significant growth in controlled environment agriculture (CEA), with vertical farming and indoor farming rapidly gaining popularity, particularly in urban areas where space is limited.

The U.S. and Canada are at the forefront of this growth, with major cities like New York, San Francisco, and Toronto embracing LED-based farming methods to address food security and reduce the carbon footprint of traditional agriculture. In the U.S., initiatives such as the USDA’s support for indoor agriculture and state-level incentives for sustainable farming practices have further fueled the adoption of LED farming technologies. In addition, the growing consumer demand for organic, locally grown, and pesticide-free produce is pushing North American farmers to adopt more advanced and efficient farming methods, such as LED-based cultivation.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Heliospectra is a Swedish specialist in intelligent LED farming systems, offering wireless dimming, multi‑channel spectrum control, and their helioCORE software platform. The company claims up to ~ 35 % additional energy savings via dynamic dimming (30 % + zone/price strategies) over static operation. Heliospectra emphasizes “lighting recipes” and automation for precise spectral control tailored to varying crop stages.

GE’s Lighting division markets LED grow light bulbs and fixtures with “balanced” and full‑spectrum outputs for indoor gardening. Its offerings aim to combine pleasing visual light quality with horticultural utility (e.g. red/blue spectrum) while leveraging GE’s scale in lighting. GE Lighting, now under Savant, continues leveraging legacy lighting expertise into the grow‑light niche.

ams OSRAM is actively promoting horticulture LED and sensor solutions, focusing on illumination uniformity, energy efficiency, and integrated system cost optimization. In 2023, the company launched its OSLON® Square Hyper Red LED tailored for greenhouse top lighting, interlighting, and vertical farming applications. Their strength lies in LED component design, sensor integration, and supply chain depth in the lighting space.

Top Key Players Outlook

- General Electric Company

- AMS Osram Group

- Heliospectra AB

- Hortilux Schreder B.V.

- Hubbell

- California Lightworks

- Gavita International B.V.

- Savant Systems, Inc.

- ams-OSRAM AG.

Recent Industry Developments

In 2024 Heliospectra AB, it posted revenue of SEK 32.41 million (down from SEK 35.31 million in 2023) and incurred a net loss of SEK 23.54 million, with gross profit of SEK 7.50 million.

In 2024, ams OSRAM introduced its OSCONIQ™ P 3737 high‑power LED for greenhouse use, boasting a wall plug efficiency (WPE) of 83.2 % and a Q90 lifetime of 102,000 hours, enabling growers to save energy while delivering stable photon output

Report Scope

Report Features Description Market Value (2024) USD 5.1 Bn Forecast Revenue (2034) USD 19.1 Bn CAGR (2025-2034) 14.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Wavelength (Blue Wavelength, Red Wavelength, Far Red Wavelength, Others), By Application (Vertical Farming, Indoor Farming, Commercial Greenhouse, Turf and Landscaping, Others), By Crop Type (Fruits And Vegetables, Herbs And Microgreens, Flowers And Ornamentals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape General Electric Company, AMS Osram Group, Heliospectra AB, Hortilux Schreder B.V., Hubbell, California Lightworks, Gavita International B.V., Savant Systems, Inc., ams-OSRAM AG. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- General Electric Company

- AMS Osram Group

- Heliospectra AB

- Hortilux Schreder B.V.

- Hubbell

- California Lightworks

- Gavita International B.V.

- Savant Systems, Inc.

- ams-OSRAM AG.