Global Lawn Mowers Market Size, Share, And Business Benefits By Offering (Hardware (Ultrasonic Sensors, Lift Sensors, Tilt Sensors, Motors, Microcontrollers, Batteries), Software), By Propulsion Type (Electric, ICE), By Type (Riding Lawn Movers, Walk-behind Lawn Movers, Robotic Lawn Movers), By Lawn Size (Small, Medium, Large), By End Use (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157812

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

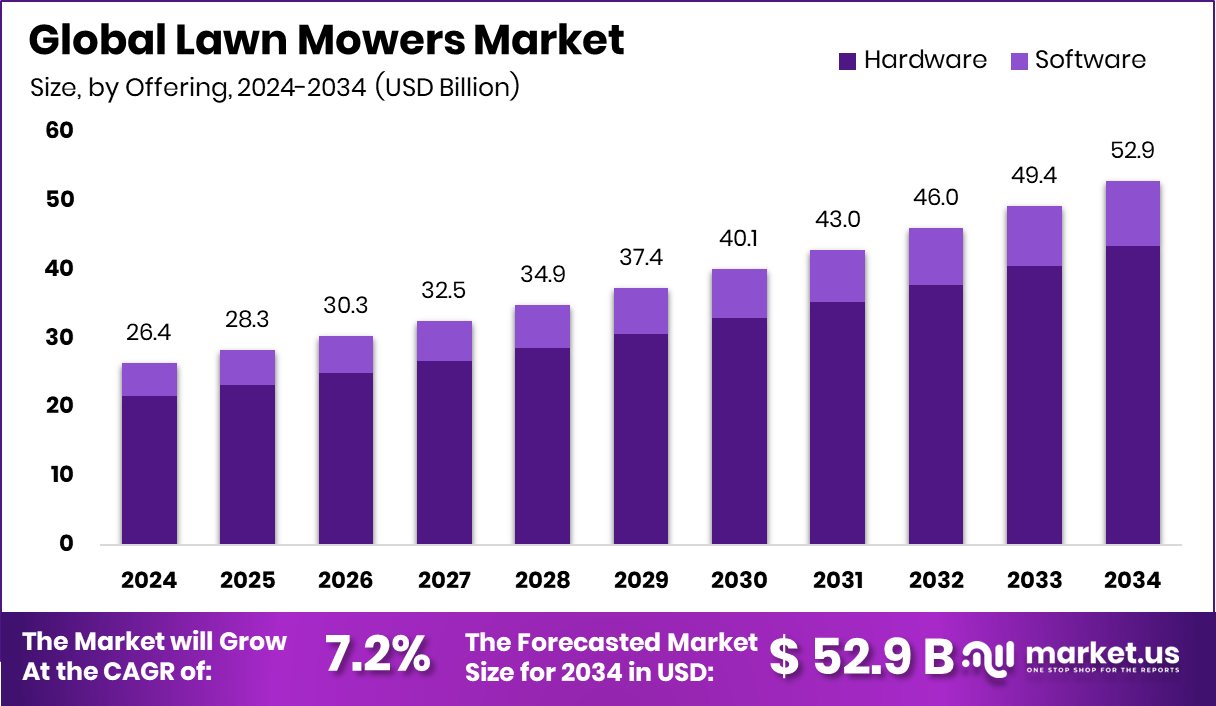

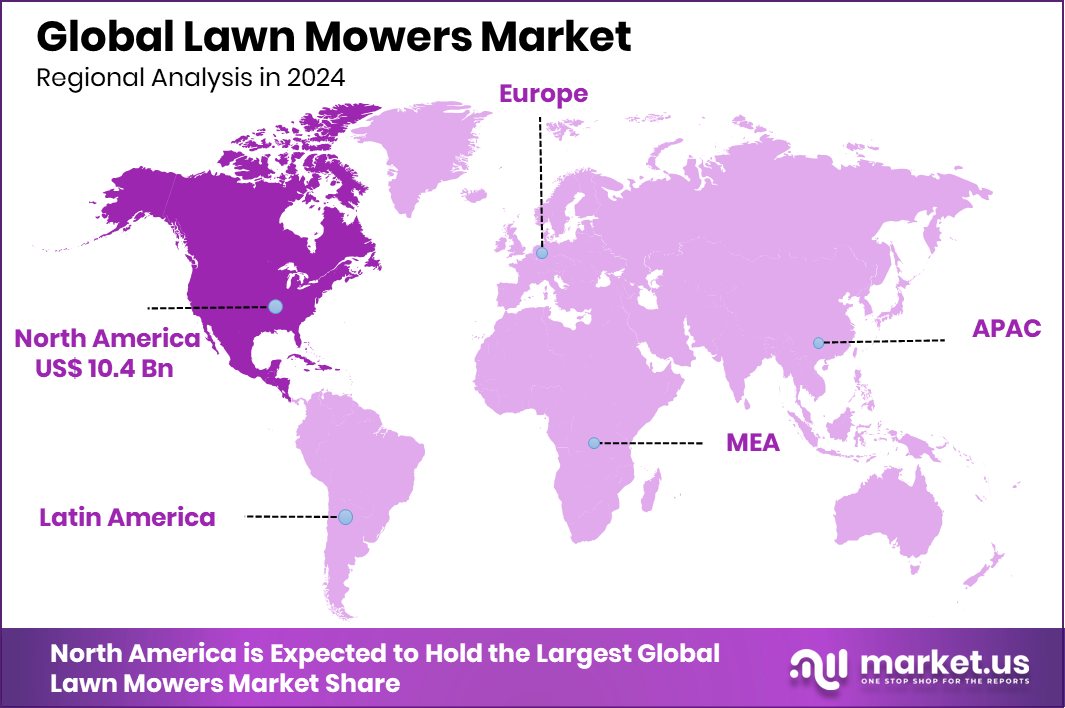

The Global Lawn Mowers Market is expected to be worth around USD 52.9 billion by 2034, up from USD 26.4 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034. With a USD 10.4 Bn size, North America captured a 39.70% share in the Lawn Mowers Market.

Lawn mowers are mechanical or powered machines used to trim and maintain grass at an even height in gardens, lawns, parks, and sports grounds. They come in various types, such as manual push mowers, electric models, and fuel-powered versions, each designed to suit different yard sizes and usage needs. A lawn mower helps in keeping outdoor spaces neat, enhances curb appeal, and plays a role in landscape care. According to an industry report, Greenzie successfully secured $8 million in funding to advance its autonomous mowing solutions.

The lawn mowers market refers to the industry that designs, manufactures, and sells these machines across residential, commercial, and industrial sectors. It is influenced by trends in urbanization, gardening activities, landscaping services, and growing awareness around outdoor aesthetics. The market covers both traditional mower types and advanced models with automation and eco-friendly technologies. According to an industry report, Chinese robotic lawn mower manufacturer Oasa has shut down operations despite previously raising $2.3 million.

Rising urban housing projects with gardens, along with an increasing trend of home gardening, are fueling the steady growth of lawn mowers. Additionally, awareness of landscaping for both aesthetics and property value contributes to higher demand. According to an industry report, Positec Group has raised $250 million to accelerate the development of its autonomous mower technology.

Demand is being driven by the need for convenient, time-saving equipment for lawn care. People are shifting towards efficient models that reduce manual effort and support modern lifestyles with outdoor leisure spaces. According to an industry report, A robotic lawn mower startup, founded by a former Yunjing executive, has secured another financing round, bringing its cumulative funding close to $100 million within just three months.

Key Takeaways

- The Global Lawn Mowers Market is expected to be worth around USD 52.9 billion by 2034, up from USD 26.4 billion in 2024, and is projected to grow at a CAGR of 7.2% from 2025 to 2034.

- In 2024, hardware accounted for an 82.2% share, highlighting strong equipment-driven Lawn mower market growth.

- ICE propulsion type dominated the lawn mower market with 68.5%, reflecting consumer reliance on fuel-based models.

- Walk-behind lawn mowers secured a 47.9% share, proving their popularity among medium-sized lawn mower market users.

- The medium lawn size category contributed 56.1%, showing lawn mower market demand from average residential yard owners.

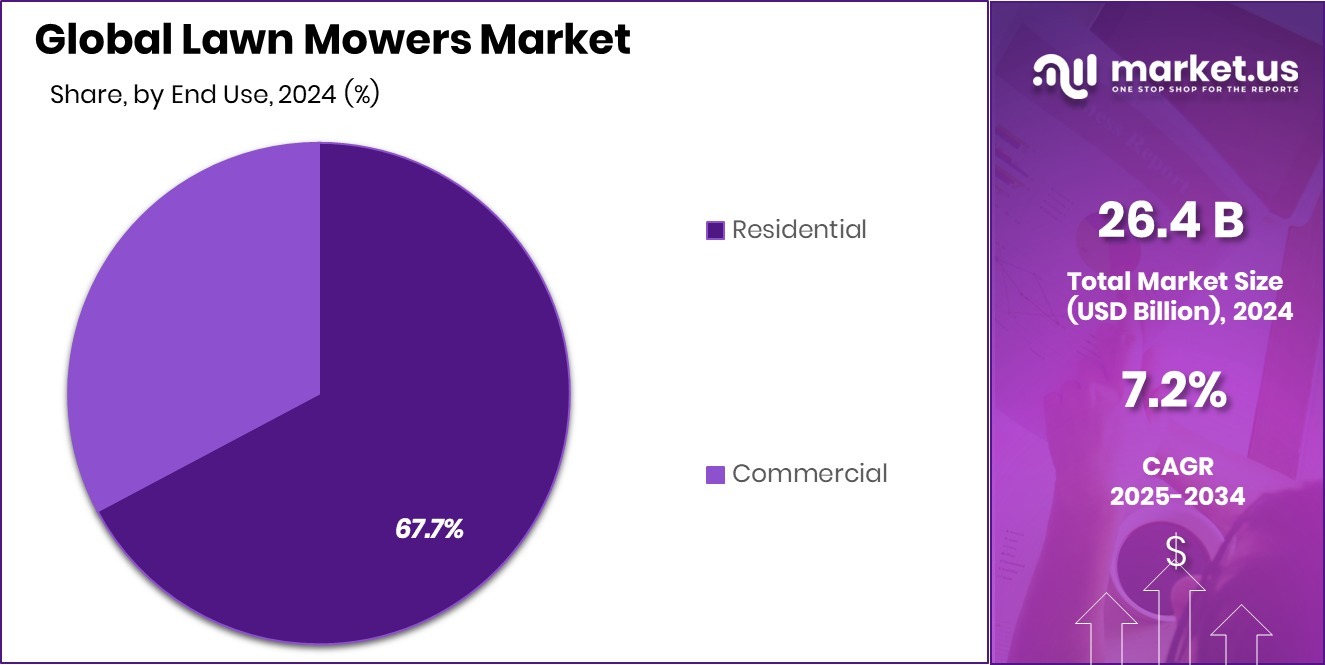

- Residential end use led with 67.7%, emphasizing household dominance in the global lawn mower market.

- North America’s 39.70% market dominance reflects rising residential lawn care demand, valued at USD 10.4 Bn.

By Offering Analysis

Lawn mowers market held by hardware has an 82.2% strong global share.

In 2024, Hardware held a dominant market position in the offering segment of the Lawn Mowers Market, with a commanding 82.2% share. This highlights the strong reliance of end-users on tangible equipment and machinery for effective lawn care across both residential and commercial applications. The hardware segment includes core components such as blades, cutting decks, motors, and drive systems, which are essential for the performance and efficiency of lawn mowers.

The 82.2% share also reflects the high preference for advanced mower designs that integrate robust hardware with features like height adjustment, improved ergonomics, and energy-efficient engines. Consumers are increasingly willing to invest in reliable hardware, as it directly impacts the quality of mowing, durability, and ease of operation. Moreover, the replacement cycle for parts such as blades and drive systems further supports recurring demand, strengthening this segment’s dominance.

Looking forward, the hardware segment is expected to maintain its lead, as innovation in lightweight materials, battery integration, and precision cutting technologies creates further value for end-users, ensuring its critical role in shaping the lawn mowers market.

By Propulsion Type Analysis

ICE propulsion lawn mowers dominate with 68.5% steady market control.

In 2024, Hardware held a dominant market position in the By Propulsion Type segment of the Lawn Mowers Market, with a 68.5% share. This strong positioning reflects the widespread preference for hardware-driven propulsion systems, which remain the backbone of mower performance and efficiency. Propulsion hardware encompasses critical elements such as engines, transmissions, wheels, and drive assemblies that directly determine how effectively a mower can maneuver across different terrains.

The 68.5% share also signals the continued demand for reliable and high-performing propulsion systems, especially as users seek convenience in mowing larger areas with minimal manual effort. Advances in propulsion hardware, including smoother drive systems, enhanced torque distribution, and energy-efficient engines, have further boosted adoption. Additionally, the need for periodic replacement and upgrades of propulsion parts supports consistent revenue flow, strengthening the segment’s leadership.

With ongoing innovation in lightweight materials, noise reduction, and fuel or battery efficiency, the hardware for propulsion type is expected to retain its dominance. Its role remains central to improving mower usability, performance, and durability, ensuring it stays a key driver of market growth.

By Type Analysis

Walk-behind lawn mowers account for 47.9% of total demand.

In 2024, Walk-behind Lawn Mowers held a dominant market position in By Type segment of the Lawn Mowers Market, with a 47.9% share. This dominance reflects the strong adoption of walk-behind models, which are widely favored for their ease of use, affordability, and suitability for small to medium-sized lawns. These mowers remain a preferred choice for residential users who value direct control, precision cutting, and maneuverability in tight spaces such as gardens, yards, and landscaped areas.

The 47.9% share also points to a steady demand for push and self-propelled variants within the walk-behind category, as consumers seek flexible options to match their yard size and physical effort preferences. Improved hardware features like adjustable cutting heights, ergonomic handles, and lightweight frames further contribute to their popularity. Regular maintenance and replacement needs, such as blades and wheels, also ensure consistent demand, reinforcing the strength of this segment.

As landscaping and home gardening trends expand globally, walk-behind lawn mowers are expected to maintain their lead. Their practicality, reliability, and alignment with consumer expectations for manageable outdoor care keep them central to the growth trajectory of the lawn mowers market.

By Lawn Size Analysis

The medium lawn size segment leads, capturing 56.1% of the global share.

In 2024, Medium held a dominant market position in the By Lawn Size segment of the Lawn Mowers Market, with a 56.1% share. This dominance highlights the strong presence of medium-sized lawns as the most common category among residential and commercial users. Medium lawns typically require reliable mowing solutions that balance efficiency, cost, and ease of operation, driving consistent demand for machines tailored to this size.

The segment’s leadership is supported by the practicality and versatility of lawn mowers designed for medium spaces. These machines often integrate features such as adjustable cutting widths, ergonomic handling, and propulsion systems that reduce physical strain, enhancing user experience. Additionally, medium lawns typically require regular upkeep to maintain aesthetics and functionality, which ensures steady equipment usage and replacement cycles.

With urban housing developments, community parks, and landscaped commercial properties falling largely into this category, medium lawn size demand is expected to remain strong. This ensures that the segment continues to play a pivotal role in shaping the future growth of the lawn mowers market.

By End Use Analysis

Residential end use dominates the lawn mowers market with a 67.7% share.

In 2024, Residential held a dominant market position in the By End Use segment of the Lawn Mowers Market, with a 67.7% share. This significant lead reflects the growing preference among households for maintaining personal green spaces, gardens, and yards. Homeowners increasingly view lawn care not only as a necessity but also as part of enhancing property aesthetics and value. The 67.7% share indicates that the majority of lawn mower demand is generated from residential users who seek reliable, efficient, and easy-to-operate equipment suited to their property size and lifestyle needs.

The segment’s dominance is further supported by rising urban housing projects, suburban expansions, and the cultural emphasis on outdoor leisure spaces. Residential users often prioritize features like compact designs, adjustable cutting heights, low maintenance, and eco-friendly options that simplify routine yard work. The recurring need for upkeep throughout the year ensures consistent product usage, while replacement cycles and upgrades add to sustained demand.

As residential landscapes continue to expand globally, this segment is expected to retain its stronghold. The preference for tidy, well-kept lawns and gardens ensures that residential use remains the primary driver of market growth, reinforcing its central role in shaping the lawn mowers industry.

Key Market Segments

By Offering

- Hardware

- Ultrasonic Sensors

- Lift Sensors

- Tilt Sensors

- Motors

- Microcontrollers

- Batteries

- Software

By Propulsion Type

- Electric

- ICE

By Type

- Riding Lawn Movers

- Walk-behind Lawn Movers

- Robotic Lawn Movers

By Lawn Size

- Small

- Medium

- Large

By End Use

- Residential

- Commercial

Driving Factors

Rising Urbanization and Growing Home Gardening Trends

One of the biggest driving factors for the lawn mowers market is the rise of urbanization, combined with the growing interest in home gardening. As more people move into urban and suburban areas, houses with lawns, gardens, and outdoor spaces are becoming more common.

Homeowners increasingly see lawn care as an essential part of maintaining property value and creating appealing outdoor environments. The trend of spending more time at home has also encouraged people to invest in gardening and lawn upkeep, boosting demand for reliable mowing equipment.

This factor is not only fueling the adoption of modern and easy-to-use mowers but is also pushing innovation in designs that suit smaller, more manageable residential lawns.

Restraining Factors

High Maintenance Costs and Operational Expense Burden

A key restraining factor for the lawn mowers market is the high cost of maintenance and operational expenses. While lawn mowers are essential for keeping outdoor spaces neat, they often require regular servicing, replacement of blades, engine upkeep, and other mechanical repairs that can be costly over time.

Fuel-powered models add to the burden with recurring fuel expenses, while even electric or battery-powered versions involve costs related to charging and battery replacement. For many households, especially those with smaller lawns, these expenses can discourage frequent use or delay purchases of new equipment.

This financial strain limits adoption, as buyers carefully weigh long-term costs against the convenience offered, slowing down market expansion in some regions. According to an industry report, Electric Sheep raised $21.5 million, intending to turn standard lawnmowers into autonomous machines.

Growth Opportunity

Rising Demand for Eco-Friendly and Smart Mowers

A major growth opportunity in the lawn mowers market comes from the rising demand for eco-friendly and smart mowing solutions. With increasing awareness about sustainability and the push to reduce carbon emissions, consumers are showing strong interest in battery-powered and electric lawn mowers that offer clean and quiet operations.

At the same time, technological advancements are opening doors for smart and robotic mowers, which allow homeowners to automate lawn care with minimal effort. Features like app-based controls, sensors for navigation, and energy efficiency make these products attractive for modern lifestyles.

As governments also encourage greener technologies, this shift toward sustainable and intelligent lawn mowers is expected to create significant opportunities for future market expansion. According to an industry report, Kingdom Technologies obtained £1.4 million in investment to further enhance its robotic lawn mower technology.

Latest Trends

Integration of Robotics and Smart Connectivity Features

One of the latest trends shaping the lawn mowers market is the integration of robotics and smart connectivity features. Consumers are increasingly adopting robotic lawn mowers that operate autonomously, saving both time and effort.

These machines use sensors, GPS, and smart navigation systems to cut grass efficiently while avoiding obstacles. Many advanced models now come with smartphone connectivity, allowing users to monitor and control their mowers remotely.

This trend reflects the broader move toward smart home ecosystems, where outdoor maintenance becomes as automated as indoor devices. The growing appeal of convenience, precision, and reduced manual labor ensures that robotic and connected lawn mowers are not just a novelty but a rising standard in modern lawn care.

Regional Analysis

In 2024, North America held a 39.70% share of the Lawn Mowers Market, reaching USD 10.4 Bn.

In 2024, North America emerged as the dominating region, accounting for a significant 39.70% share of the global market, valued at USD 10.4 billion. This leadership is strongly supported by high residential ownership of lawns and gardens, coupled with the cultural emphasis on well-maintained outdoor spaces.

The region’s established landscaping industry, combined with rising demand for both residential and commercial property maintenance, further strengthens its position. Favorable economic conditions and consumer willingness to invest in advanced lawn care equipment also fuel steady growth.

Meanwhile, Europe continues to see steady adoption, driven by lifestyle gardening trends and environmental regulations favoring electric mowers. Asia Pacific, though developing, shows strong potential with rapid urbanization, increasing disposable incomes, and rising interest in home gardening.

The Middle East & Africa and Latin America are also gradually expanding, with demand supported by landscaping projects in the residential and hospitality sectors. While all regions contribute to market expansion, North America’s dominant share highlights its mature lawn culture and robust consumer base, ensuring its continued leadership in the years ahead.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

American Honda Motor Co., Inc. continues to build on its reputation for reliability and energy efficiency. With a strong product line of gas-powered and battery-operated mowers, Honda remains a preferred choice among residential users who value durable hardware and consistent performance. Their emphasis on environmentally friendly engines and ergonomic designs supports the growing demand for user-friendly and sustainable lawn care solutions.

Ariens Company stands out for its specialization in outdoor power equipment, particularly walk-behind and riding mowers. Known for its durability and heavy-duty models, Ariens addresses the needs of both homeowners and professionals in landscaping. In 2024, its focus on innovation in propulsion systems and comfortable designs positions it as a strong contributor to the segment of medium to large lawn sizes.

Briggs & Stratton continues to be a vital force in the market, primarily through its expertise in manufacturing powerful engines that are widely integrated into various mower brands. Its engineering capabilities ensure efficiency, longevity, and adaptability, making it a backbone supplier in the industry.

Top Key Players in the Market

- American Honda Motor Co., Inc.

- Ariens Company

- Briggs Stratton

- Deere & Company

- Falcon Garden Tools

- Fiskars

- Husqvarna Group

- MTD Products

- Robert Bosch GmbH

- Robomow Friendly House

- The Toro Company

Recent Developments

- In October 2024, Ariens introduced the RIDGELINE™, a new stand-on mower aimed at homeowners seeking commercial-grade performance in a more compact format. This mower features a 2-in-1 design, letting users switch between stand-on and walk-behind modes, plus ENVY® fabricated decks (7- or 10-gauge steel) in 32″, 48″, and 52″ sizes. It’s powered by Kawasaki® FS600V or FS651V engines and offers speeds up to 7 mph.

- In September 2024, Briggs & Stratton partnered with Sol-Ark to introduce plug-and-play battery backup packages. These include SimpliPHI® 6.6 batteries, Sol-Ark inverters, and a monitoring system, simplifying the selection and installation process for residential backup power. While this development is primarily in energy solutions, it highlights the company’s broader move into battery technologies relevant to electrification trends in outdoor equipment, including lawn mowers.

Report Scope

Report Features Description Market Value (2024) USD 26.4 Billion Forecast Revenue (2034) USD 52.9 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware (Ultrasonic Sensors, Lift Sensors, Tilt Sensors, Motors, Microcontrollers, Batteries), Software), By Propulsion Type (Electric, ICE), By Type (Riding Lawn Movers, Walk-behind Lawn Movers, Robotic Lawn Movers), By Lawn Size (Small, Medium, Large), By End Use (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American Honda Motor Co., Inc., Ariens Company, Briggs Stratton, Deere & Company, Falcon Garden Tools, Fiskars, Husqvarna Group, MTD Products, Robert Bosch GmbH, Robomow Friendly House, The Toro Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Honda Motor Co., Inc.

- Ariens Company

- Briggs Stratton

- Deere & Company

- Falcon Garden Tools

- Fiskars

- Husqvarna Group

- MTD Products

- Robert Bosch GmbH

- Robomow Friendly House

- The Toro Company