Laboratory Equipment and Disposables Market By Product Type (Laboratory Equipment (Spectrophotometers, Centrifuges, Chromatography Systems, Microscopes, Incubators, Autoclaves and Sterilizers, Balances and Scales and Others), Laboratory Disposables (Gloves, Syringes and Needles, Tubes and Vials, Petri Dishes, Filter Papers, Culture Media and Other Disposable)), By Application (Clinical Diagnostics, Biotechnology, Pharmaceutical Research, Environmental Testing, Food & Beverage Testing and Others), By End-User (Hospitals and Diagnostic Laboratories, Research Laboratories, Pharmaceutical and Biotech Companies, Environmental Testing Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153787

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

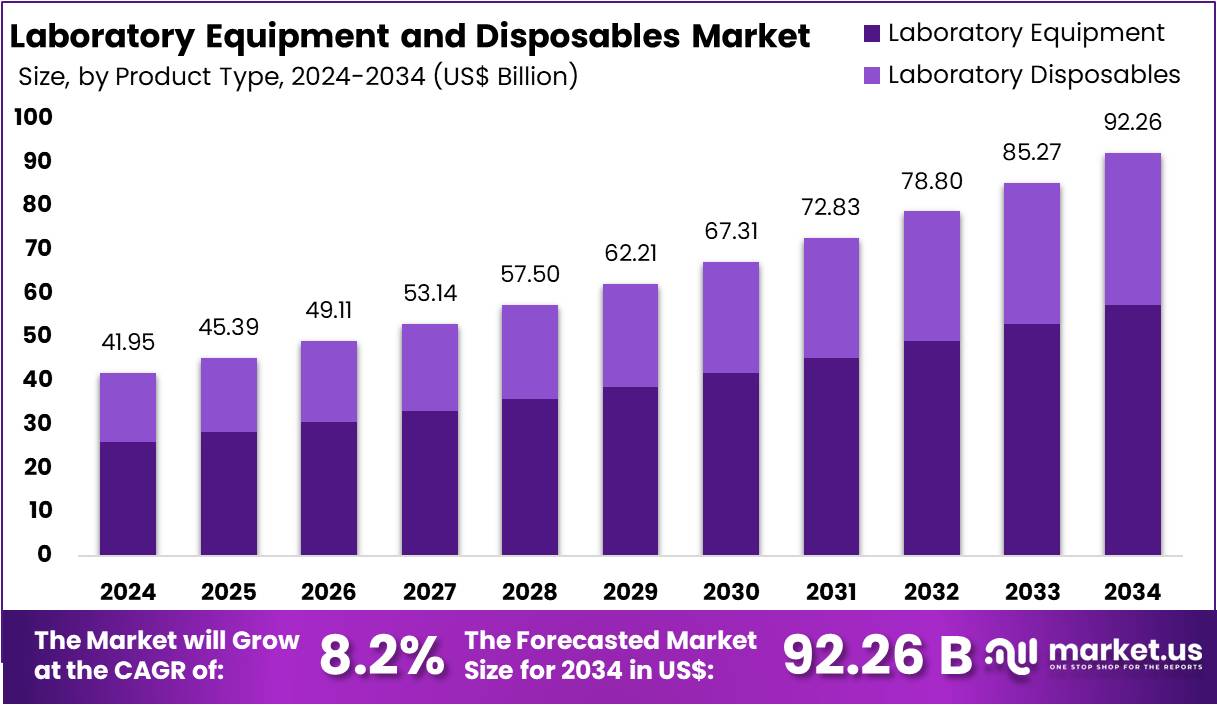

The Laboratory Equipment and Disposables Market size is expected to be worth around US$ 92.26 billion by 2034 from US$ 41.95 billion in 2024, growing at a CAGR of 8.2% during the forecast period 2025 to 2034.

The Laboratory Equipment and Disposables Market is projected to expand, driven by the growing demand from the biotechnology, pharmaceutical, and medical device sectors. Additionally, heightened public health concerns are leading to increased investments from both the government and private sectors, further supporting market growth.

For instance, in February 2025, KNAUER, a Berlin-based manufacturer of high-tech laboratory instruments, invested millions in expanding and converting its production facility located on Hegauer Weg in Berlin-Zehlendorf. The company is constructing a new logistics center on the first floor to accommodate rising production volumes and enhance speed and automation. This development will streamline processes by shortening routes, implementing a new airlock for handling incoming and outgoing goods, and optimizing storage locations.

Technological advancements have also enabled lab equipment manufacturers to introduce innovative products, contributing to the overall growth of the market. The laboratory equipment and disposables market is poised for robust growth, driven by technological innovations and increasing demand across various sectors. Stakeholders are advised to focus on emerging markets and invest in research and development to capitalize on the evolving opportunities within this dynamic industry.

Leading companies in the laboratory equipment and disposables market include Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories, PerkinElmer, and Sartorius AG. These companies are focusing on innovation, strategic partnerships, and expanding their product portfolios to maintain a competitive edge.

In March 2025, it was reported that Thermo Fisher Scientific Inc. launched the Thermo Scientific Vulcan Automated Lab—an advanced system developed to enhance process development and control within semiconductor manufacturing. This integrated solution is expected to significantly increase productivity, optimize yield, and reduce operating costs for manufacturers. Industry observers note that as semiconductor technologies continue to advance and shrink in scale, the need for precise atomic-level metrology—particularly through transmission electron microscopy (TEM)—has grown rapidly, prompting the development of such innovative tools.

Key Takeaways

- In 2024, the market for Laboratory Equipment and Disposables generated a revenue of US$ 95 billion, with a CAGR of 8.2%, and is expected to reach US$ 92.26 billion by the year 2034.

- The product type segment is divided into Laboratory Equipment, and Laboratory Disposables with Laboratory Equipment taking the lead in 2023 with a market share of 62.3%.

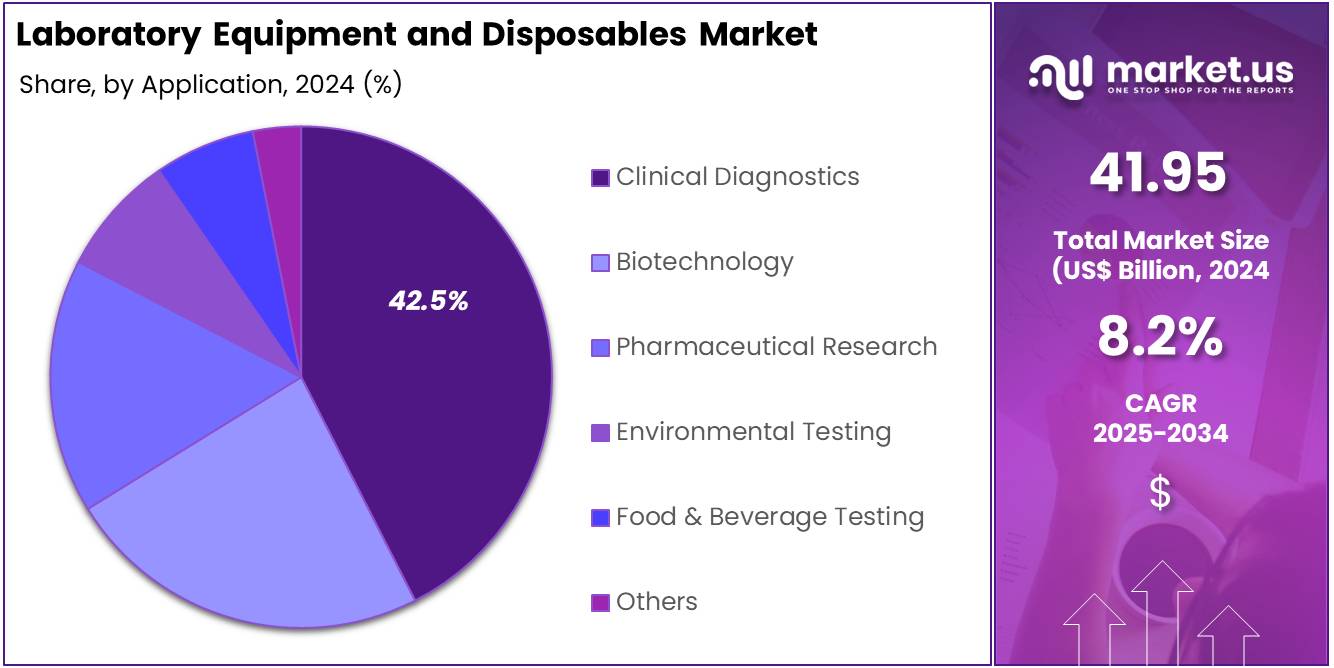

- By Application, the market is bifurcated into Clinical Diagnostics, Biotechnology, Pharmaceutical Research, Environmental Testing, Food & Beverage Testing, and Others with Clinical Diagnostics leading the market with 42.5% of market share.

- Furthermore, concerning the End-User segment, the market is segregated into Hospitals and Diagnostic Laboratories, Research Laboratories, Pharmaceutical and Biotech Companies, Environmental Testing Laboratories, and Others. The Hospitals and Diagnostic Laboratories stands out as the dominant segment, holding the largest revenue share of 48.3% in the Laboratory Equipment and Disposables market.

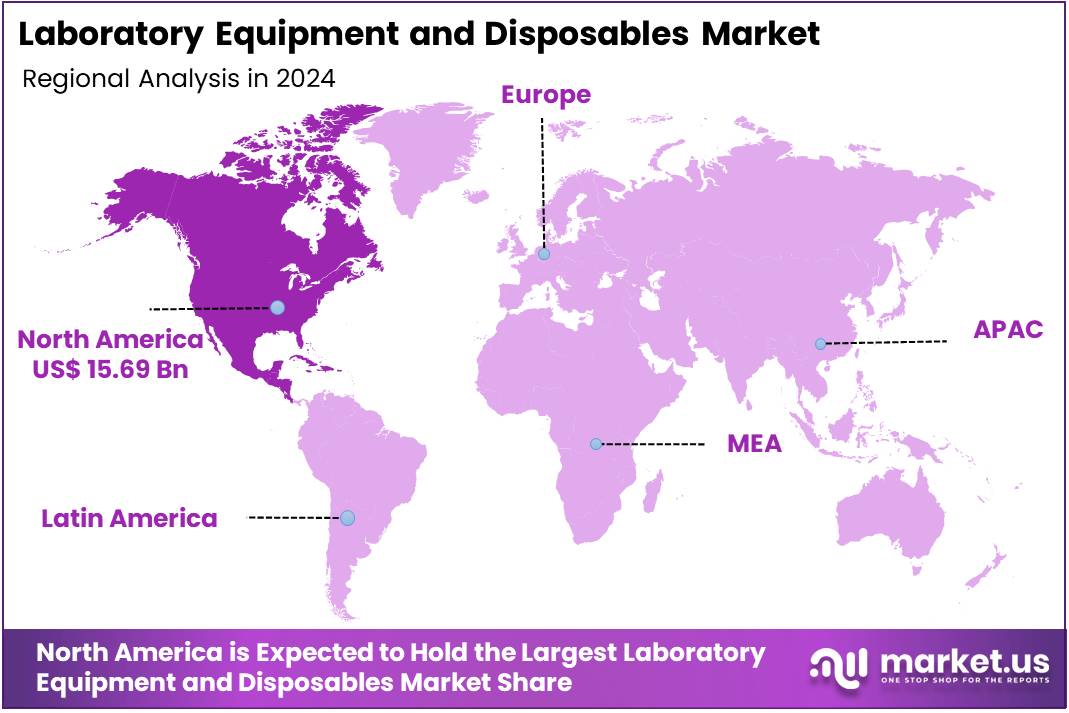

- North America led the market by securing a market share of 37.4% in 2023.

Product Type Analysis

In the laboratory equipment and disposables market, the laboratory disposables segment dominated the overall market which accounted for over 62.3% market share. This segment is expected to continue leading due to its widespread use across various laboratory functions, particularly in diagnostics, research, and healthcare. Laboratory disposables include products such as gloves, pipettes, petri dishes, syringes, and test tubes, which are essential for ensuring hygiene, preventing contamination, and supporting accurate results.

The growing demand for disposable products is driven by their single-use nature, which is critical for maintaining cleanliness and avoiding cross-contamination, especially in clinical and research settings. Additionally, the rising focus on healthcare and safety protocols across industries has increased the use of laboratory disposables. This trend is particularly prominent in the pharmaceutical and biotechnology sectors, where compliance with strict regulatory standards is paramount.

For instance, in May 2024, Sherlock Biosciences announced the enrollment of the first participant in the PROMISE Study, a multicenter clinical trial designed to assess the performance of the Sherlock STI over-the-counter (OTC) disposable molecular test against the gold standard of central lab PCR testing. The Sherlock test is among the first molecular disposable tests for Chlamydia Trachomatis (CT) and Neisseria Gonorrhoeae (NG). Results are delivered in under 30 minutes by analyzing DNA and RNA self-collected through penile meatal or vaginal swabs.

Application Analysis

The clinical diagnostics segment dominated the laboratory equipment and disposables market which accounted for over 42.5% market share due to the growing demand for accurate and timely medical diagnoses. This application area benefits from advancements in diagnostic technologies, which are essential in detecting a wide range of diseases, including infectious diseases, cancer, and chronic conditions.

The increasing prevalence of diseases, the aging population, and the rise in healthcare spending globally have driven demand for clinical diagnostics tools and consumables. The clinical diagnostics segment encompasses various laboratory tests, including blood tests, urinalysis, and molecular diagnostics, which require specialized laboratory equipment and disposables such as test tubes, reagents, and diagnostic kits.

In addition, the rapid adoption of point-of-care testing and home-based diagnostics, particularly during the COVID-19 pandemic, has further fueled the growth of this segment. The demand for disposable products in clinical diagnostics is particularly high due to the need for ensuring contamination-free, accurate results while maintaining stringent safety standards.

End-User Analysis

The hospitals and diagnostic laboratories segment held the dominant position in the laboratory equipment and disposables market which covered 48.3% market share. This dominance is driven by the increasing demand for diagnostic tests, imaging, and laboratory procedures in hospitals and diagnostic centers, especially in light of the rising prevalence of chronic diseases, infectious diseases, and the aging population.

In March 2023, IceCure Medical Ltd. announced that it had received approval from the National Medical Products Administration (NMPA) of China for the commercial use of its IceSense3 disposable cryoprobes. These cryoprobes are designed to be used with the IceSense3 console, which had already been approved by the NMPA. This regulatory achievement marked a significant milestone for IceCure Medical Ltd. in advancing the commercialization of its cryoablation technology within the Chinese market.

Hospitals and diagnostic laboratories require a wide range of laboratory equipment and consumables for routine diagnostic tests, such as blood tests, biopsies, and imaging studies. These institutions are equipped with advanced diagnostic tools to provide accurate and timely results to patients, driving the demand for both laboratory equipment and disposables. The disposable products in this segment are crucial for maintaining hygiene standards, preventing cross-contamination, and ensuring patient safety.

Additionally, as healthcare systems become more focused on early disease detection and personalized medicine, hospitals and diagnostic laboratories continue to expand their capabilities, further enhancing the demand for laboratory equipment and disposables. The ongoing advancements in diagnostic technologies, coupled with an increased focus on infection control, will likely keep this segment at the forefront of market growth.

Key Market Segments

By Product Type

- Laboratory Equipment

- Spectrophotometers

- Centrifuges

- Chromatography Systems

- Microscopes

- Incubators

- Autoclaves and Sterilizers

- Balances and Scales

- Others

- Laboratory Disposables

- Gloves

- Syringes and Needles

- Tubes and Vials

- Petri Dishes

- Filter Papers

- Culture Media

- Other Disposable

- Others

By Application

- Clinical Diagnostics

- Biotechnology

- Pharmaceutical Research

- Environmental Testing

- Food & Beverage Testing

- Others

By End-User

- Hospitals and Diagnostic Laboratories

- Research Laboratories

- Pharmaceutical and Biotech Companies

- Environmental Testing Laboratories

- Others

Drivers

Growing Demand for Research and Development (R&D)

The growing demand for research and development (R&D) in the pharmaceutical and biotechnology industries is a key driver for the Laboratory Equipment and Disposables Market. As the healthcare sector faces increasing challenges related to the development of new drugs and therapies, there is an escalating need for advanced laboratory equipment and consumables.

In July 2023, GE HealthCare topped the U.S. Food and Drug Administration (FDA) list of AI-enabled medical device authorizations for the fourth consecutive year, with a total of 100 authorizations granted in the U.S. This achievement highlights GE HealthCare’s ongoing investment in research and development (R&D) and its commitment to advancing precision care through AI solutions that enhance medical devices throughout the care journey.

This need is further amplified by the rise of personalized medicine, which requires highly specialized equipment and disposables for drug testing and diagnostics. Additionally, pharmaceutical companies are increasingly focusing on biotechnology-based treatments, such as biologics and gene therapies, which demand cutting-edge laboratory tools and consumables for research, testing, and development.

According to recent reports, the global pharmaceutical industry is projected to continue expanding, thus driving the demand for high-performance laboratory instruments and disposable items. As pharmaceutical companies invest heavily in R&D, laboratory equipment and disposables remain essential for maintaining effective and accurate laboratory testing, fueling market growth.

Restraints

Stringent Regulatory Guidelines

Stringent regulatory guidelines are a significant restraint for the Laboratory Equipment and Disposables Market. Laboratories, particularly those in the pharmaceutical and healthcare sectors, must comply with numerous regulations set by health authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These regulations are essential for ensuring that laboratory products meet required safety, quality, and performance standards.

For instance, in May 2025, The Federal Communications Commission (FCC) implemented new rules to prevent Chinese government and other unreliable actors from gaining control over the U.S. wireless equipment authorization process. These regulations will ensure that the hundreds of equipment test labs and telecommunications certification bodies—organizations responsible for testing, reviewing, and certifying wireless electronic devices for importation, marketing, and sale in the U.S.—do not have ownership interests that pose national security risks, including the potential for foreign adversaries to exert influence.

However, the complex and often time-consuming process of obtaining approvals can delay the introduction of new laboratory products into the market. Additionally, compliance with these stringent regulations requires significant investments in quality control, documentation, and testing, which can increase operational costs for manufacturers. Moreover, regulations vary by region, adding complexity for companies operating in multiple markets. This restraint may slow down the pace at which new innovations in laboratory equipment and disposables are adopted globally, limiting overall market growth.

Opportunities

Expansion of Home Healthcare Testing

One of the key opportunities in the Laboratory Equipment and Disposables Market lies in the expansion of home healthcare testing. For example, in June 2025, Amazon India launched Amazon Diagnostics, a new at-home diagnostics service that allows customers to book lab tests, schedule and track appointments, and access digital reports instantly through the Amazon app. Available in 6 cities across over 450 pin codes, Amazon Diagnostics offers easy access to more than 800 diagnostic tests. Customers can enjoy doorstep sample collection within 60 minutes and receive digital reports in as little as 6 hours for routine tests.

With the rising trend of remote patient monitoring and self-diagnosis, more individuals are utilizing at-home diagnostic tools. These include devices for blood glucose monitoring, cholesterol testing, and pregnancy tests, among others. The convenience and accessibility of home healthcare products are becoming increasingly popular due to the growing prevalence of chronic diseases, the aging population, and the global trend of personal health management.

As patients seek more control over their health, manufacturers in the laboratory equipment and disposables sector have an opportunity to innovate and develop compact, affordable, and accurate diagnostic tools tailored for home use. This expansion is expected to drive the demand for disposable items such as test strips, swabs, and diagnostic kits, providing a significant opportunity for market players to capitalize on this growing trend.

Impact of Macroeconomic / Geopolitical Factors

Economic stability plays a crucial role in determining healthcare spending, research funding, and investment in laboratory technologies. During periods of economic growth, healthcare budgets and research investments tend to rise, boosting the demand for advanced laboratory equipment and disposables.

Conversely, during economic downturns, tight budgets may lead to delayed or reduced purchases, especially for non-essential items, affecting market growth. Inflation and fluctuating currency exchange rates can also impact the cost of raw materials used in manufacturing laboratory disposables, increasing production costs.

Geopolitical instability, such as trade wars, sanctions, and international conflicts, can disrupt the global supply chain for laboratory equipment and consumables. Countries imposing tariffs or restricting trade can cause delays in the import and export of essential materials.

Additionally, political decisions on healthcare policies, research funding, and public health initiatives can influence the demand for laboratory technologies. For example, government investments in healthcare infrastructure in emerging markets can drive demand, while political uncertainties in developed regions can result in stalled market growth.

Latest Trends

Technological Advancements in Lab Equipment

Technological advancements in laboratory equipment are one of the major trends shaping the Laboratory Equipment and Disposables Market. The development of automated systems, AI-powered diagnostics, and miniaturized devices has significantly enhanced the efficiency and precision of laboratory testing. Automation in laboratories, such as the use of robotic systems for sample analysis and handling, is reducing human error, speeding up testing processes, and increasing productivity.

Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in diagnostic devices is transforming laboratory procedures, allowing for faster and more accurate analysis. In May 2025, VitalEdge Technologies, a global leader in ERP and dealer management systems (DMS) for heavy equipment dealerships, introduced VitalEdge AI Labs, a new initiative focused on accelerating innovation through advanced artificial intelligence (AI). This strategic move further strengthens VitalEdge’s position as an industry leader, enhancing its e-Emphasys and IntelliDealer platforms with AI-driven insights.

These advancements are also driving the demand for more sophisticated disposables, such as high-precision test tubes, vials, and culture media. Moreover, innovations in materials used for disposables, such as biodegradable plastics and more efficient filtration systems, are being integrated into laboratory equipment, improving sustainability. As laboratories continue to adopt cutting-edge technologies, the market for both equipment and disposables is expected to grow.

Regional Analysis

North America is leading the Laboratory Equipment and Disposables Market

North America is projected to hold a significant market share of 37.4% during the forecasted period. The region’s dominance is driven by the presence of leading pharmaceutical and biotech companies, along with a rise in research activities. These factors are expected to increase the demand for laboratory equipment and disposables, thereby fueling market growth in North America. Additionally, the market is anticipated to experience growth due to the presence of key market players, coupled with frequent product developments and new launches.

In January 2023, SCHOTT MINIFAB officially inaugurated its new facility at 4217 E Cotton Center Blvd, Phoenix, AZ 85040. The event was attended by SCHOTT executives, Phoenix Mayor Kate Gallego (D), and representatives from both The Office of U.S. Senator Mark Kelly (D-AZ) and The Office of Congressman Reuben Gallego (D-AZ). This new site in Phoenix marks SCHOTT’s third diagnostics location, joining existing centers of excellence in Jena, Germany, and Melbourne, Australia.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Laboratory Equipment and Disposables market includes Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Sartorius AG, PerkinElmer, Inc., Danaher Corporation, Merck KGaA, Darmstadt, Germany, Abbott Laboratories, Siemens Healthineers, Bio-Rad Laboratories, Inc., Beckman Coulter, Inc. (A Danaher Company), Eppendorf AG, Becton, Dickinson and Company (BD), VWR International, LLC, Waters Corporation, Roche Diagnostics, Mettler-Toledo International Inc., LabCorp, and Other key players.

Thermo Fisher Scientific is a global leader in laboratory equipment and disposables, offering a comprehensive range of products for life sciences, diagnostics, and research. The company provides laboratory instruments, reagents, consumables, and software solutions, enabling advancements in healthcare, biotechnology, and pharmaceutical research. Agilent Technologies provides high-quality laboratory instruments, consumables, and services, primarily focusing on analytical testing, diagnostics, and life sciences.

Agilent’s solutions support industries like pharmaceuticals, environmental testing, and clinical diagnostics, helping researchers achieve precision in data collection and analysis, driving innovation in scientific workflows. Sartorius is a leading provider of laboratory equipment and disposables, specializing in solutions for the biopharmaceutical and life sciences sectors. The company’s products include filtration, purification, and analytics equipment, widely used in research, pharmaceutical manufacturing, and quality control, helping to streamline laboratory processes and improve efficiencies.

Top Key Players in the Laboratory Equipment and Disposables Market

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Sartorius AG

- PerkinElmer, Inc.

- Danaher Corporation

- Merck KGaA, Darmstadt, Germany

- Abbott Laboratories

- Siemens Healthineers

- Bio-Rad Laboratories, Inc.

- Beckman Coulter, Inc. (A Danaher Company)

- Eppendorf AG

- Becton, Dickinson and Company (BD)

- VWR International, LLC

- Waters Corporation

- Roche Diagnostics

- Mettler-Toledo International Inc.

- LabCorp

- Other key players

Recent Developments

- May 2025: Leica Microsystems, recognized globally for its expertise in microscopy and scientific instrumentation, launched the Visoria series of upright microscopes. According to third-party observers, the new Visoria line is engineered to streamline routine microscopy workflows, improving both operational efficiency and user comfort for professionals such as pathologists, quality assurance personnel, and academic researchers.

- April 2025: Marama Labs, an emerging instrumentation firm with operations in both Wellington, New Zealand, and Dublin, Ireland, introduced an upgraded version of its CloudSpec device. Independent analysis highlights that this advanced UV-vis spectrophotometer is specifically tailored to expedite the development of nanoparticle-based drug formulations. These include critical applications in vaccine production, oncology therapeutics, and gene therapy, where time-to-market and formulation precision are essential.

- September 2024: The MDI Biological Laboratory announced a significant enhancement of its Center for Advanced Microscopy. External commentators note that the facility’s expansion includes the introduction of a cutting-edge, laser-enabled 3D microscope equipped with virtual reality capabilities. This open-access instrument allows researchers to explore and quantify internal molecular structures of entire organisms in unprecedented detail, potentially accelerating biological discovery and collaboration within the scientific community.

- March 2024: Hindustan Syringes and Medical Devices (HMD) unveiled its Dispojekt line of single-use syringes with integrated safety needles in Hyderabad. Industry experts suggest that this innovation is poised to reduce the incidence of Needle Stick Injuries (NSIs) among healthcare providers. Additionally, the Dispojekt syringes are expected to help healthcare facilities reduce long-term expenditures associated with infection control, waste disposal, and staff training.

Report Scope

Report Features Description Market Value (2024) US$ 41.95 billion Forecast Revenue (2034) US$ 92.26 billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Laboratory Equipment (Spectrophotometers, Centrifuges, Chromatography Systems, Microscopes, Incubators, Autoclaves and Sterilizers, Balances and Scales and Others), Laboratory Disposables (Gloves, Syringes and Needles, Tubes and Vials, Petri Dishes, Filter Papers, Culture Media and Other Disposable)), By Application (Clinical Diagnostics, Biotechnology, Pharmaceutical Research, Environmental Testing, Food & Beverage Testing and Others), By End-User (Hospitals and Diagnostic Laboratories, Research Laboratories, Pharmaceutical and Biotech Companies, Environmental Testing Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Sartorius AG, PerkinElmer, Inc., Danaher Corporation, Merck KGaA, Darmstadt, Germany, Abbott Laboratories, Siemens Healthineers, Bio-Rad Laboratories, Inc., Beckman Coulter, Inc. (A Danaher Company), Eppendorf AG, Becton, Dickinson and Company (BD), VWR International, LLC, Waters Corporation, Roche Diagnostics, Mettler-Toledo International Inc., LabCorp, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Laboratory Equipment and Disposables MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Laboratory Equipment and Disposables MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Sartorius AG

- PerkinElmer, Inc.

- Danaher Corporation

- Merck KGaA, Darmstadt, Germany

- Abbott Laboratories

- Siemens Healthineers

- Bio-Rad Laboratories, Inc.

- Beckman Coulter, Inc. (A Danaher Company)

- Eppendorf AG

- Becton, Dickinson and Company (BD)

- VWR International, LLC

- Waters Corporation

- Roche Diagnostics

- Mettler-Toledo International Inc.

- LabCorp

- Other key players