Global KNX Products Market Size, Share and Report Analysis By Type (Sensors, Actuators, System Devices, Others), By Application (Lighting Control, HVAC Control, Shutter And Blind Control, Energy Management, Access And Security Control, Others), By End-use (Commercial, Residential, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec. 2025

- Report ID: 137913

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type – Sensors (65.1%)

- By Application – Lighting Control (43.2%)

- By End Use – Commercial (52.2%)

- Investment and Business Benefits

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- By Region – Europe (45.4%)

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

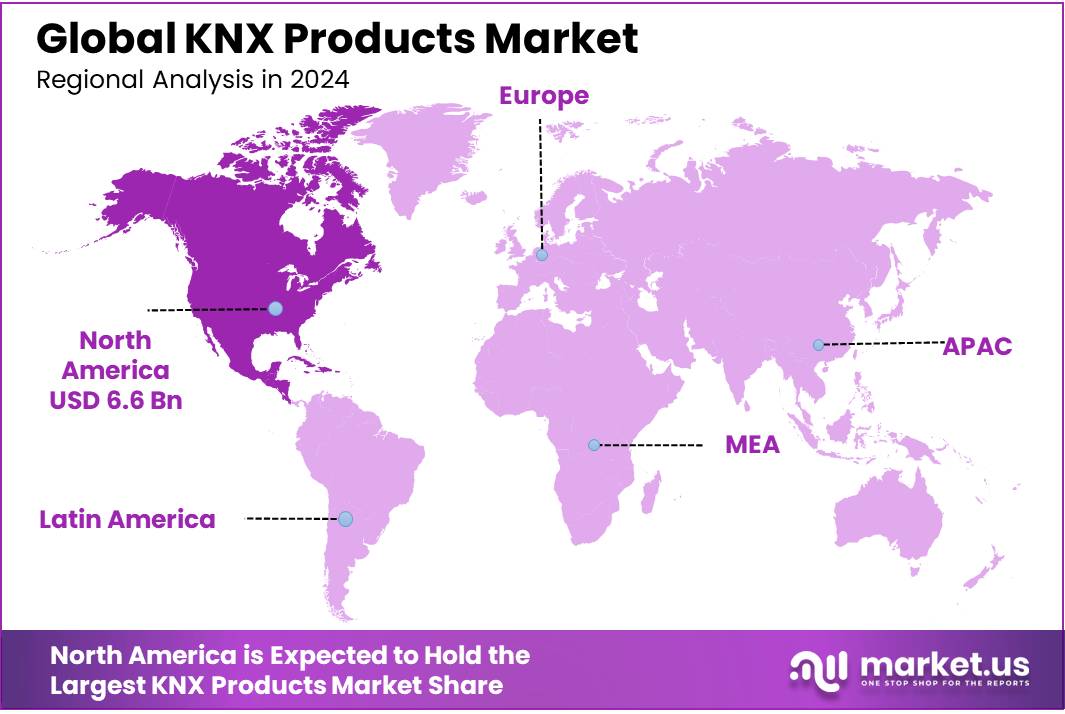

The Global KNX Products Market size is expected to be worth around USD 24.3 Billion By 2034, from USD 14.8 billion in 2024, growing at a CAGR of 11% during the forecast period from 2025 to 2034. In 2024, Europe held a dominan Market position, capturing more than a 45.4% share, holding USD 6.6 Billion revenue.

The KNX products market refers to a broad range of devices and components built on the KNX open standard for building automation. KNX products enable communication and coordinated control of lighting, heating, ventilation, air conditioning, blinds, security systems, energy monitoring devices, sensors, actuators, and user interfaces within residential and commercial buildings. Because KNX is an internationally recognised and vendor-neutral protocol, products from different manufacturers can interoperate seamlessly.

The KNX products market plays a key role in delivering integrated and interoperable automation across smart homes, offices, hotels, and institutional buildings. KNX solutions enable centralized control of lighting, climate, and other building functions, allowing systems to respond to occupancy, daylight, and energy demand. This unified approach improves user comfort, reduces operational complexity, and supports efficient building management.

Market growth is driven by rising demand for energy efficient buildings, wider adoption of smart technologies, and the need for flexible and reliable automation infrastructure. Increasing focus on sustainability and real time monitoring is encouraging adoption, while KNX’s open and standardized architecture continues to appeal to system integrators seeking scalable solutions without vendor lock in.

Key Takeaways

- KNX Products Market size is expected to be worth around USD 24.3 Bn by 2034, from USD 14.8 Bn in 2024, growing at a CAGR of 11.0%.

- Sensors held a dominant market position, capturing more than a 65.1% share of the KNX products market.

- Lighting Control held a dominant market position, capturing more than a 43.2% share of the KNX products market.

- Commercial held a dominant market position, capturing more than a 52.2% share of the KNX products market.

- Europe dominated the global KNX products market, capturing a significant share of 45.4%, valued at approximately USD 6.6 billion.

By Type – Sensors (65.1%)

In 2024, sensors held a dominant share of 65.1%, showing their critical role in KNX-based automation systems. Sensors are used to detect motion, temperature, light levels, and environmental conditions within buildings. These inputs enable automated responses across connected systems.

Strong adoption of sensors is driven by demand for responsive and energy-efficient buildings. Sensors help reduce manual control and improve system accuracy. Their ability to provide real-time data supports reliable automation outcomes.

By Application – Lighting Control (43.2%)

Lighting control accounted for 43.2% in 2024, making it the leading application within KNX products. Automated lighting systems allow centralized control, scheduling, and adaptive brightness based on occupancy and daylight. This improves comfort and reduces unnecessary energy usage.

Growth in lighting control is supported by rising focus on efficiency and smart infrastructure. Buildings increasingly adopt lighting automation as a core automation function. KNX lighting solutions offer flexibility across residential and commercial environments.

By End Use – Commercial (52.2%)

The commercial segment held 52.2% in 2024, reflecting strong adoption across offices, hotels, retail spaces, and public buildings. Commercial facilities require reliable automation to manage large and complex systems. KNX products support consistent control across multiple zones.

Demand in this segment is driven by operational efficiency and regulatory compliance. Automation helps commercial users lower energy costs and improve building management. Long-term system reliability supports continued adoption.

Investment and Business Benefits

Investment opportunities exist in developing new KNX-compatible devices that support emerging building functions, energy monitoring features, and advanced user interfaces. Growth is also strong in software tools that simplify configuration, diagnostics, and remote management of KNX networks. Service providers that offer system design, installation, and training for KNX technologies have potential to expand as adoption grows.

Wireless KNX product lines and hybrid systems that blend wired and wireless solutions present further opportunities for innovation and market entry. KNX products deliver meaningful business benefits by increasing operational efficiency, improving occupant comfort, and reducing energy costs.

Standardised interoperability minimises integration challenges and supports modular expansion as needs evolve. For installers and system integrators, KNX’s certification and global ecosystem reduce risk and improve project predictability. Users benefit from reliable and coordinated automation that enhances daily convenience and supports sustainability goals through intelligent energy management.

Emerging Trends

A notable trend in the KNX products market is the expansion of interoperable devices that support a wide range of building functions including lighting control, HVAC regulation, security systems, energy management, sensors, and actuators. KNX products are designed to communicate using a common open standard protocol, which means devices from different manufacturers can work together in unified automation networks.

Another emerging trend is the growing availability of modular and hybrid KNX devices that can be integrated into both wired and wireless systems. Manufacturers are increasingly releasing products that can function in traditional bus architectures or communicate over IP interfaces, which simplifies installation and supports retrofit projects. This flexibility enhances adoption in a variety of building types where infrastructure constraints or user preferences require adaptable solutions.

Growth Factors

A primary growth factor for the KNX products market is the rising demand for energy efficient and integrated building control solutions. KNX enabled devices support coordinated control of lighting, heating, cooling, and other systems, which helps to optimize energy use and improve operational efficiency. This capability aligns with sustainability objectives and energy management priorities in both residential and commercial developments.

Another important growth factor is the sustained adoption of the KNX standard as a globally recognized protocol for building automation. With a large base of certified manufacturers and a wide range of compatible products, KNX provides long term reliability and scalability for complex automation projects. This established ecosystem encourages new installations and upgrades of automation systems, supporting continued market traction.

Key Market Segments

By Type

- Sensors

- Actuators

- System Devices

- Others

By Application

- Lighting Control

- HVAC Control

- Shutter & Blind Control

- Energy Management

- Access & Security Control

- Others

By End-use

- Commercial

- Residential

- Others

Driver

A key driver of the KNX products market is the need for centralized and seamless control of diverse building systems. KNX products enable users to manage lighting, climate, security, energy, and other functions from common interfaces or integrated control platforms. This centralized control improves operational convenience and supports enhanced occupant comfort.

Another driver is the increasing integration of automation solutions into smart home and smart building initiatives. As buildings adopt digital technologies and connected ecosystems, KNX products offer a standardised foundation for scalable automation. The open nature of the protocol encourages broad adoption across different sectors and geographies.

Restraint

A notable restraint in the KNX products market is the initial complexity associated with configuring and commissioning KNX systems. Professional expertise is often required to design, program, and deploy KNX networks effectively, which can increase project time and cost for end users or system integrators.

Another restraint relates to competition from simpler, consumer focused smart home technologies that use proprietary protocols. In some segments, these alternatives are perceived as easier to install and manage, which can limit the appeal of KNX products among non-technical users or in small-scale applications.

Opportunity

An opportunity in the KNX products market exists in the development of enhanced software and commissioning tools that simplify configuration and ongoing system management. Improvements in user interfaces and automated setup routines can reduce dependency on specialised technicians and broaden accessibility for installers and end users.

Another opportunity is the increasing integration of KNX products with cloud platforms, mobile applications, and voice control systems. This enhanced connectivity can improve user engagement and support remote system monitoring and control, aligning with broader trends in connected building technologies.

Challenge

A central challenge in this market is maintaining interoperability as new device types and communication technologies emerge. Ensuring that KNX products remain compatible with evolving standards and interfaces requires ongoing coordination between manufacturers and the KNX Association.

Another challenge is balancing performance with simplicity for end users. As KNX networks grow in complexity with more devices and functions, ensuring that system behaviour remains predictable and manageable without extensive technical skills is essential for sustained adoption.

By Region – Europe (45.4%)

In 2024, Europe dominated the global KNX products market with a 45.4% share, valued at approximately USD 6.6 billion. The region shows strong adoption of standardized building automation systems across residential and commercial properties. Early acceptance of KNX standards has supported widespread system deployment.

Growth in Europe is driven by strict energy efficiency regulations and strong focus on sustainable buildings. Countries across the region continue to invest in smart infrastructure and renovation of existing buildings. This steady demand supports Europe’s leading position in the KNX products market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The KNX products market is highly competitive, with several key players dominating the industry. Siemens, Schneider Electric, and ABB are the primary leaders in this sector, each contributing significantly to the development and adoption of smart building technologies. Siemens, known for its advanced automation solutions, has a strong presence in the KNX market, offering a wide range of products for energy management, lighting control, and HVAC systems.

Schneider Electric’s focus on sustainability and energy efficiency has made it a prominent player, providing KNX-compatible products that enable seamless integration of building systems for optimized energy use. ABB, with its extensive experience in industrial automation, also offers KNX products designed to enhance energy efficiency and system control in both residential and commercial settings.

Albrecht Jung GmbH & Co. KG (JUNG), G. Brück Electronic GmbH, GVS, and STEINEL, which offer specialized products for lighting control, security, and building automation. Companies like Urmet, Lime International, and Hager are also expanding their footprint by providing innovative solutions tailored to smart homes and commercial buildings. Smaller players such as Berker, Gira, and HDL Automation focus on premium KNX solutions with a strong emphasis on design and functionality.

Ekinex, MDT Technologies GmbH, Zennio Avance y Tecnología S.L., and IPAS GmbH are increasingly gaining traction in the market with their advanced and cost-effective KNX-compatible products, catering to the growing demand for smart home solutions. The collaboration among these companies and their continuous investment in R&D ensure the sustained evolution of KNX technology, addressing the increasing need for energy-efficient, automated building systems.

Top Key Players

- Siemens

- Schneider Electric

- ABB

- Albrecht Jung GmbH & Co. KG (JUNG)

- G. Brück Electronic GmbH

- GVS

- STEINEL

- Urmet

- Lime International

- Hager

- Berker

- Gira

- HDL Automation

- Ekinex

- MDT Technologies GmBH

- Zennio Avance y Tecnología S.L.

- IPAS GmbH

Recent Developments

- March, 2025 – Siemens highlighted its KNX all-in-one solutions and sustainable hybrid heating controls at ISH 2025, drawing attention from system integrators for easier installs and energy savings.

- October, 2025 – MDT Technologies bought majority stakes in Tapko Technologies and Apricum, boosting its sensor tech and long-term KNX partnerships.

Report Scope

Report Features Description Market Value (2024) USD 14.8 Bn Forecast Revenue (2034) USD 24.3 Bn CAGR (2025-2034) 11.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sensors, Actuators, System Devices, Others), By Application (Lighting Control, HVAC Control, Shutter And Blind Control, Energy Management, Access And Security Control, Others), By End-use (Commercial, Residential, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens, Schneider Electric, ABB, Albrecht Jung GmbH & Co. KG (JUNG), G. Brück Electronic GmbH, GVS, STEINEL, Urmet, Lime International, Hager, Berker, Gira, HDL Automation, Ekinex, MDT Technologies GmBH, Zennio Avance y Tecnología S.L., IPAS GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens

- Schneider Electric

- ABB

- Albrecht Jung GmbH & Co. KG (JUNG)

- G. Brück Electronic GmbH

- GVS

- STEINEL

- Urmet

- Lime International

- Hager

- Berker

- Gira

- HDL Automation

- Ekinex

- MDT Technologies GmBH

- Zennio Avance y Tecnología S.L.

- IPAS GmbH