Global Kids scooter Market Size, Share, Growth Analysis By Type (Kick Scooters & Electric Scooters), By Wheel Type (2-Wheel, 3-Wheel, 4-Wheel), By Material (Aluminum, Steel, & Plastic/Composite), By Age Group (Below 5 Years, 5–8 Years, 9–12 Years, Above 12 Years), By Price Range (Economy, Mid-Range, & Premium), By Distribution Channel (Offline & Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 144503

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Wheel Type Analysis

- Material Analysis

- Age Group Analysis

- Price Range Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Geopolitical Impact Analysis

- Regional Analysis

- Key Kids scooter Company Insights

- Recent Developments

- Report Scope

Report Overview

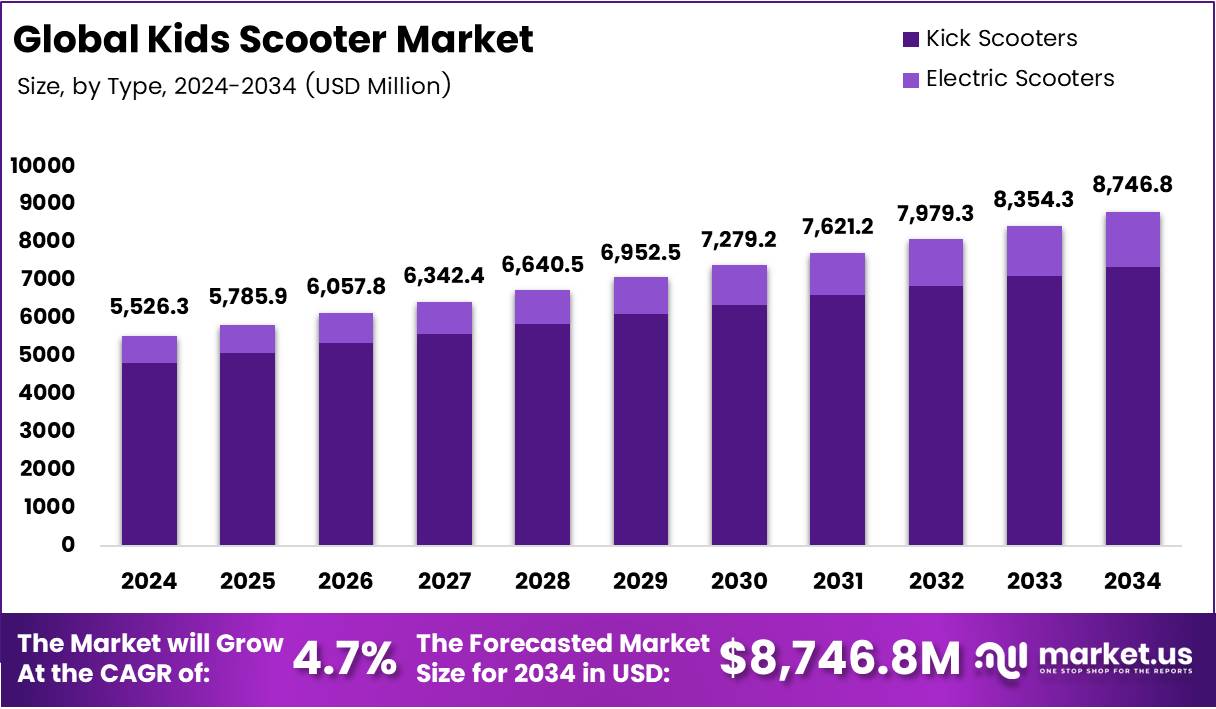

The Global Kids scooter Market size is expected to be worth around USD 8,802.67 Million by 2034, from USD 5,526.25 Million in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The global kids’ scooter market is expanding rapidly as parents increasingly prioritize physical activity, reduced screen time, and safe outdoor play for children. With more than 2.2 billion children worldwide and growing concerns that over 80% fail to meet recommended daily activity levels, scooters have become popular tools for encouraging movement and improving balance and coordination. Urbanization—now encompassing over 56% of the global population—further boosts demand for compact, easy-to-use mobility toys suited for sidewalks, parks, and school zones.

Innovation is accelerating market growth, with manufacturers introducing lightweight frames, LED wheels, ergonomic handlebars, and modular designs tailored to different age groups. Three-wheel scooters dominate the preschool segment, while two-wheel and stunt scooters gain traction among older children seeking more advanced riding experiences.

Evolving smart mobility trends are influencing premium offerings, including app-connected and GPS-enabled scooters. Although brick-and-mortar stores remain important for safety evaluation, online retail is rapidly capturing market share. Asia-Pacific leads in production and consumption, supported by strong manufacturing capabilities and rising middle-class spending.

Key Takeaways

- The global kids scooter market was valued at US$ 5,526.25 million in 2024.

- The global kids scooter market is projected to grow at a CAGR of 4.7% and is estimated to reach US$ 8,802.67 million by 2034.

- Between types, kick scooters accounted for the largest market share of 87.4%.

- Among wheel type, 3-wheel accounted for the majority of the market share at 65.4%.

- Among materials, aluminum accounted for 46.4% of the kids scooter market share.

- Based on age group, 5–8 years accounted for 39.0% of the market share.

- Between price range, mid-range accounted for the largest market share of 47.7%.

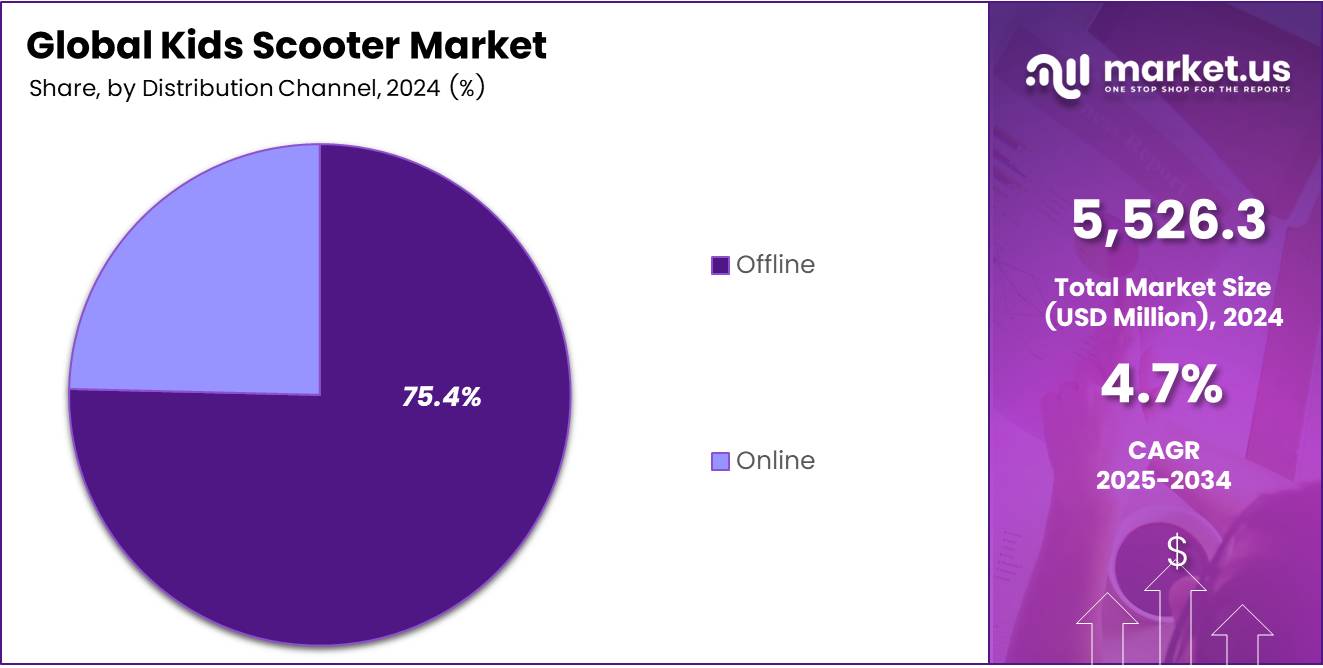

- Among distribution channel, offline accounted for 75.4% of the kids scooter market share.

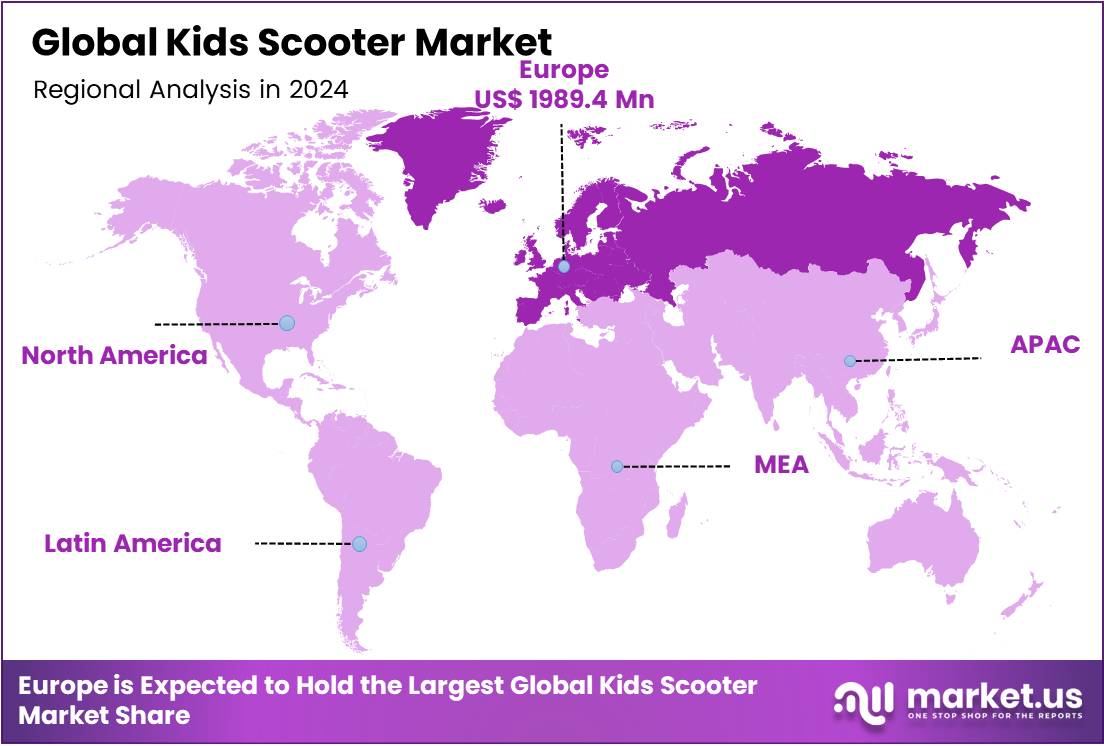

- Europe is estimated as the largest market for kids scooter with a share of 35.9% of the market share.

Type Analysis

Based on type, the market is further divided into kick scooters & electric scooters. As of 2024, the kick scooters dominated the kids scooter market with a 87.4% share primarily due to their affordability, simplicity, and suitability for younger age groups. Parents often prefer kick scooters because they are safe, lightweight, and easy for children to control, reducing the risk of accidents compared to faster electric models. Their lower price point makes them accessible to a broader consumer base, especially in cost-sensitive markets.

Kick scooters also require no charging or maintenance, offering convenience and durability for everyday outdoor play. Additionally, various schools, parks, and residential communities encourage non-motorized toys for safety reasons, further boosting demand. Growing awareness of the importance of physical activity among children has also contributed to the popularity of kick scooters, as they help improve balance, coordination, and fitness.

Wheel Type Analysis

The kids scooter market was segmented into 2-wheel, 3-wheel & 4-wheel. Among them, 3-wheel kids scooter accounted for 65.4% of the total market share because they offer the ideal balance of stability, safety, and ease of use for younger children, making them the preferred choice for parents.

Their two-front-wheel or wide-triangular-base design provides enhanced balance, allowing toddlers and early learners to ride confidently without advanced coordination or strong motor skills. This makes three-wheel scooters a popular first-step mobility toy, particularly for children aged 2–6.

Additionally, features like lean-to-steer mechanisms, wider decks, adjustable handlebars, and safer speed control make them more suitable for developmental learning and outdoor play. The segment also benefits from strong adoption in preschools, daycare centers, and households focused on early childhood development. Manufacturers increasingly introduce colorful, themed, and LED-equipped three-wheel models that appeal to both children and parents, further driving demand.

Material Analysis

The kids’ scooter market is segmented by material into aluminum, steel, and plastic/composites. In 2024, aluminum accounted for 46.4% of the total market share, primarily due to its ideal balance of strength, lightweight performance, and durability—key factors for children’s mobility products. Aluminum scooters are easier for kids to maneuver, carry, and control, while still offering strong structural stability and long product life.

Unlike steel, aluminum is resistant to rust and corrosion, making it better suited for outdoor use and reducing long-term maintenance for parents. It also outperforms plastic/composite options in terms of safety and durability. As a result, aluminum has become the preferred material for both entry-level and premium kids’ scooters, driving its dominant market share.

Age Group Analysis

Based on age segmentation, the market is categorized into below 5 years, 5–8 years, 9–12 years, and above 12 years. Among these groups, the 5–8 years segment accounted for the largest share at 39.0% reflecting its strong demand potential. Children in this age range are highly active, curious, and increasingly engaged in structured learning and recreational activities, driving higher consumption of related products.

Parents also tend to invest more in educational toys, creative tools, furniture, and developmental products for this age group, boosting market growth. Additionally, this segment benefits from rising awareness of early learning development, expanding product availability, and increased spending on child enrichment, making it the most influential demographic within the overall market.

Price Range Analysis

The mid-range segment holds the largest market contribution at 47.7% because it offers the best balance between affordability, quality, and performance, making it the most attractive option for the majority of buyers. Consumers increasingly seek durable and reliable products without the high cost of premium offerings, while also avoiding the compromises often associated with economy options.

Mid-range products typically provide solid material quality, better aesthetics, and enhanced features at accessible price points, appealing to both cost-conscious and value-driven customers. Additionally, retailers and manufacturers prioritize this segment due to higher sales volume and broader market demand, further strengthening its dominance in overall market share.

Distribution Channel Analysis

Based on distribution channels, the market is classified into offline and online segments, with offline channels accounting for the dominant 75.4% share. Traditional retail formats—including toy stores, specialty sports shops, supermarkets, hypermarkets, and local distributors—continue to attract the majority of consumers due to the ability to physically inspect products, assess build quality, and compare options before purchase.

Parents often prefer in-store purchases for safety-related products such as scooters, valuing expert guidance and immediate product availability. Additionally, strong brand presence in retail outlets, seasonal promotions, and the influence of impulse buying further reinforce offline sales. Despite rapid growth in e-commerce, offline channels remain the primary purchasing avenue due to trust, convenience, and established retail networks.

Key Market Segments

By Type

- Kick Scooters

- Electric Scooters

By Wheel Type

- 2-Wheel

- 3-Wheel

- 4-Wheel

By Material

- Aluminum

- Steel

- Plastic/Composite

By Age Group

- Below 5 Years

- 5–8 Years

- 9–12 Years

- Above 12 Years

By Price Range

- Economy

- Mid-Range

- Premium

By Distribution Channel

- Offline

- Toy Stores

- Specialty Sports Stores

- Departmental Stores

- Supermarkets/Hypermarkets

- Online

- E-commerce Platforms

- Brand-Owned Websites

Drivers

Rising Focus on Physical Activity & Reducing Screen Time Is Driving The Global Kids Scooter Market Growth

The growing global emphasis on children’s physical activity and the urgent need to counter rising screen-time habits have become one of the most influential drivers accelerating the growth of the global kids’ scooter market. As concerns mount over the negative effects of sedentary lifestyles—including obesity, reduced motor skills, behavioral issues, and developmental delays—parents, educators, and healthcare organizations worldwide are encouraging outdoor play as a daily routine.

This shift in consumer mindset is directly increasing the adoption of kids’ scooters as an accessible, low-cost, and highly engaging physical activity tool. Kids’ scooters are emerging not merely as toys but as essential mobility and wellness products that support gross motor development, balance, coordination, cardiovascular activity, and social engagement.

As a result, parents increasingly view scooters as a practical alternative to digital entertainment, aiding in reducing children’s dependence on smartphones, tablets, and gaming consoles. From a market perspective, this behavioral shift aligns with broader societal and policy-level trends advocating reduced screen exposure for young children.

Educational institutions, pediatric associations, and government health agencies in various countries are promoting initiatives that encourage at least 60 minutes of moderate physical activity per day. This creates a strong pull for outdoor ride-on toys—particularly scooters, which are easier to learn, safer than bicycles for younger children, and adaptable across age groups.

Manufacturers are responding by developing ergonomic, lightweight, and safer scooter models with improved stability, wider decks, adjustable handlebars, and age-specific designs. These innovations make scooters more appealing to parents seeking structured ways to integrate physical play into children’s routines.

Restraints

Safety Concerns & Rising Injury Rates May Hamper The Global Kids Scooter Market

Growing safety concerns and the rising incidence of injuries associated with kids’ scooters are increasingly emerging as significant restraints for the global market. As scooters become a mainstream mobility and recreational product for children, the visibility of accident risks—particularly head injuries, fractures, and traffic-related incidents—has intensified scrutiny from parents, schools, regulators, and community organizations. This heightened risk perception directly impacts purchase decisions, slows adoption in certain regions, and increases the regulatory burden on manufacturers.

In various countries, injuries linked to scooters, skateboards, and other wheeled recreational devices have shown an upward trend due to higher usage, greater urban congestion, and insufficient protective measures. Parents are now more cautious about permitting children to use scooters unsupervised, which reduces everyday usage frequency and limits broader consumer confidence in the category.

A key barrier stems from inadequate use of protective equipment. Although helmets, elbow pads, knee guards, and wrist guards significantly reduce injury severity, compliance rates remain low in several markets. For instance, industry studies show that a large proportion of children ride scooters without helmets, and injuries to the head and upper limbs continue to dominate emergency-room cases. These behavioral gaps amplify parental anxiety and can discourage new purchases, particularly for younger children.

Growth Factors

Increasing Product Innovation Smart & Connected Scooters Create New Opportunities in Kids Scooter Market

The rising wave of product innovation—particularly the introduction of smart and connected kids’ scooters—is creating one of the most transformative opportunities in the global kids’ scooter market. As parents become more safety-conscious and digitally engaged, demand is shifting from traditional mechanical scooters toward tech-enhanced models that combine mobility, entertainment, and parental oversight.

Smart scooters equipped with GPS tracking, geo-fencing alerts, speed monitoring, and ride-history analytics offer a new value proposition that aligns with modern parenting expectations: freedom for children, control and peace of mind for adults. This convergence of safety technology and outdoor recreation is driving the emergence of a premium mobility segment, especially across North America, Western Europe, Japan, South Korea, and rapidly urbanizing Asia-Pacific markets.

Manufacturers who integrate Bluetooth connectivity, app-based parental dashboards, and customizable digital features—for instance, speed-limit settings or location notifications—can differentiate themselves in a crowded market and command premium pricing. In parallel, the increasing popularity of electric kids’ scooters is reshaping consumer preferences in metros and suburban communities.

In regions such as India, Southeast Asia, and Latin America, mini electric scooters have become a common household product, supported by rising disposable income and expanding nuclear family structures. Parents view these scooters not only as a source of entertainment but also as a controlled mobility solution for gated communities and housing societies.

As this category evolves, smart features become essential to addressing safety concerns associated with cheaper, unregulated imports—such as inconsistent brake performance, poor battery protection, or excessive speed. Brands that integrate smart safety protocols, such as automatic shutdown, battery-overheat protection, speed capping, and stability sensors, gain a significant competitive edge by reducing parental anxiety and improving trust.

Emerging Trends

Integration of Digital & Educational Elements

The integration of digital and educational elements into kids’ scooters is emerging as a significant new trend in the global market, driven by the convergence of smart mobility, experiential learning, and the evolving expectations of modern parents.

As families increasingly seek toys that combine entertainment with cognitive development, manufacturers are embedding digital features that transform scooters from simple ride-on products into interactive learning platforms. This trend is gaining traction across developed and emerging markets alike, supported by rising digital literacy among children, growing parental emphasis on skill-building play, and the expanding availability of child-safe digital technologies.

Smart scooters equipped with Bluetooth connectivity, app-based dashboards, and motion sensors allow parents to track riding activity, monitor route safety, encourage physical movement, and set ride-time limits—bridging outdoor play with responsible technology use.

At the same time, the educational layer is creating differentiated value propositions: scooters now incorporate learning games, progress-tracking modules, augmented reality (AR) overlays for road-safety education, and voice-guided riding tutorials that teach balance, direction control, and safe commuting habits.

Geopolitical Impact Analysis

Geopolitical Scenerios Of The Kids scooter Market.

The evolving U.S.–China tariff landscape is exerting a significant and multi-layered influence on the global kids’ scooter market, reshaping sourcing strategies, pricing structures, and competitive dynamics for American importers and brands. Since most kids’ scooters—especially kick scooters, 3-wheel scooters, and entry-level electric scooters—are manufactured in China, tariff adjustments directly impact cost structures across the U.S. value chain.

Historically, Section 301 tariffs added an extra 25% duty on many children’s mobility products, inflating wholesale prices and forcing retailers to absorb losses or pass higher costs on to consumers. However, the USTR’s decision to grant tariff exclusions on several children’s wheeled products—similar to past exemptions granted for kids’ bicycles—has created short-term relief for importers.

If similar exemptions extend to scooters or their components (frames, wheels, saddles, or aluminum assemblies), U.S. companies could recover substantial amounts in overpaid duties, just as the bicycle industry previously reclaimed more than US$60 million in additional tariffs.

Yet the broader tariff environment in 2025–2026 remains highly volatile. Overlapping duty categories—including Section 301, reciprocal tariffs, and “fentanyl-related” tariffs, each ranging from 7.5% to 20%—continue to apply to several consumer goods originating from China, creating unpredictable import costs.

Even though reciprocal tariffs have been reduced to 10%, and fentanyl tariffs are temporarily lowered from 20% to 10%, the “stacking effect” still leaves several kids’ scooter imports facing total effective tariffs of 30% or more, significantly increasing landed costs for U.S. distributors. This directly affects retail pricing, limiting margin flexibility for mass-market brands that compete in price-sensitive categories.

For budget scooters—typically selling between US$25 and US$60—an effective tariff burden above 25% can erase profitability entirely, prompting importers to reconsider their reliance on Chinese manufacturing. As a result, several U.S. scooter brands are now accelerating diversification strategies, exploring alternative sourcing locations such as Vietnam, Taiwan, India, and Mexico.

Regional Analysis

Europe Held the Largest Share of the Global Kids Scooter Market

Europe holds the largest share of the global kids’ scooter market due to its strong policy focus on active mobility, well-developed urban infrastructure, and high parental awareness regarding children’s physical activity. European governments and municipalities actively promote walking, cycling, and micro-mobility as part of sustainability and public-health strategies, creating safe, scooter-friendly environments across parks, pedestrian zones, and school areas.

Rising concerns about sedentary behavior among children, reinforced by WHO and EU health guidelines, further encourage families to adopt scooters as accessible tools for outdoor exercise and motor-skill development. Europe’s mature retail ecosystem—spanning toy stores, sports retailers, and robust e-commerce channels—ensures widespread product availability, while strict safety standards increase consumer confidence.

Additionally, cultural emphasis on outdoor play and short-distance mobility supports strong adoption across age groups. Collectively, these factors position Europe as a leading market where public policy, urban planning, and lifestyle preferences align to drive sustained demand for kids’ scooters.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kids scooter Company Insights

Product Innovation and Robust Research & Development Are The Key Strategies Of Major Players Of Kids Scooter Market.

Major players in the kids’ scooter market focus on strategies such as continuous product innovation, emphasizing lightweight materials, enhanced safety features, and age-specific ergonomic designs. They invest in branding and licensing partnerships with popular characters to attract younger users, while expanding omni-channel distribution across retail and e-commerce platforms.

Companies also adopt competitive pricing, customization options, and eco-friendly materials to differentiate their offerings. Additionally, targeted marketing, community engagement, and safety education programs help strengthen brand loyalty and capture a broader consumer base.

Top Key Players in the Market

- Segway-Ninebot

- Simba Dickie Group

- Radio Flyer

- HTI Group

- Pacific Cycle, Inc.

- Micro Mobility Systems AG

- Hydo Sports

- Razor USA LLC

- Zinc Sports

- Jetson Electric Bike

- R for Rabbit Baby Products Pvt Ltd

- Globber

- Hoverpro

- iScooter

- GOTRAX

- Other Key Players

Recent Developments

- September 2025: Micro Mobility Systems and Porsche unveiled a collaborative GT3 RS Edition micromobility collection, introducing three premium models designed for children and teenagers. Showcased at the LA Fall Preview, the lineup includes a Smart Balance Bike, Mini Micro Deluxe LED, and Micro Kickboard Deluxe LED—each reflecting Porsche’s iconic GT3 RS aesthetics and Micro’s engineering precision. The products feature illuminated branding, advanced safety integrations, durable materials, and adjustable components tailored to young riders. Brokered by CAA Brand Management on behalf of Porsche, the partnership brings Porsche-inspired performance and design into everyday family mobility.

Report Scope

Report Features Description Market Value (2024) USD 5,526.25 Million Forecast Revenue (2034) USD 8,802.67 Million CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Kick Scooters & Electric Scooters), By Wheel Type (2-Wheel, 3-Wheel, 4-Wheel), By Material (Aluminum, Steel, & Plastic/Composite), By Age Group (Below 5 Years, 5–8 Years, 9–12 Years, Above 12 Years), By Price Range (Economy, Mid-Range, & Premium), By Distribution Channel (Offline & Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Segway-Ninebot, Simba Dickie Group , Radio Flyer , HTI Group , Pacific Cycle, Inc. , Micro Mobility Systems AG , Hydo Sports , Razor USA LLC , Zinc Sports, Jetson Electric Bike , R for Rabbit Baby Products Pvt Ltd , Globber, Hoverpro, iScooter, GOTRAX, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Segway-Ninebot

- Simba Dickie Group

- Radio Flyer

- HTI Group

- Pacific Cycle, Inc.

- Micro Mobility Systems AG

- Hydo Sports

- Razor USA LLC

- Zinc Sports

- Jetson Electric Bike

- R for Rabbit Baby Products Pvt Ltd

- Globber

- Hoverpro

- iScooter

- GOTRAX

- Other Key Players