Global IV Infusion Gravity Bags Market By Product Type (Single-chamber, Multi-chamber), By Material (PVC, Non-PVC, Polyolefins (PP/PE), Ethyl Vinyl Acetate (EVA), Others), By End User (Hospitals, Clinics, Ambulatory Surgical Centers, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168723

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

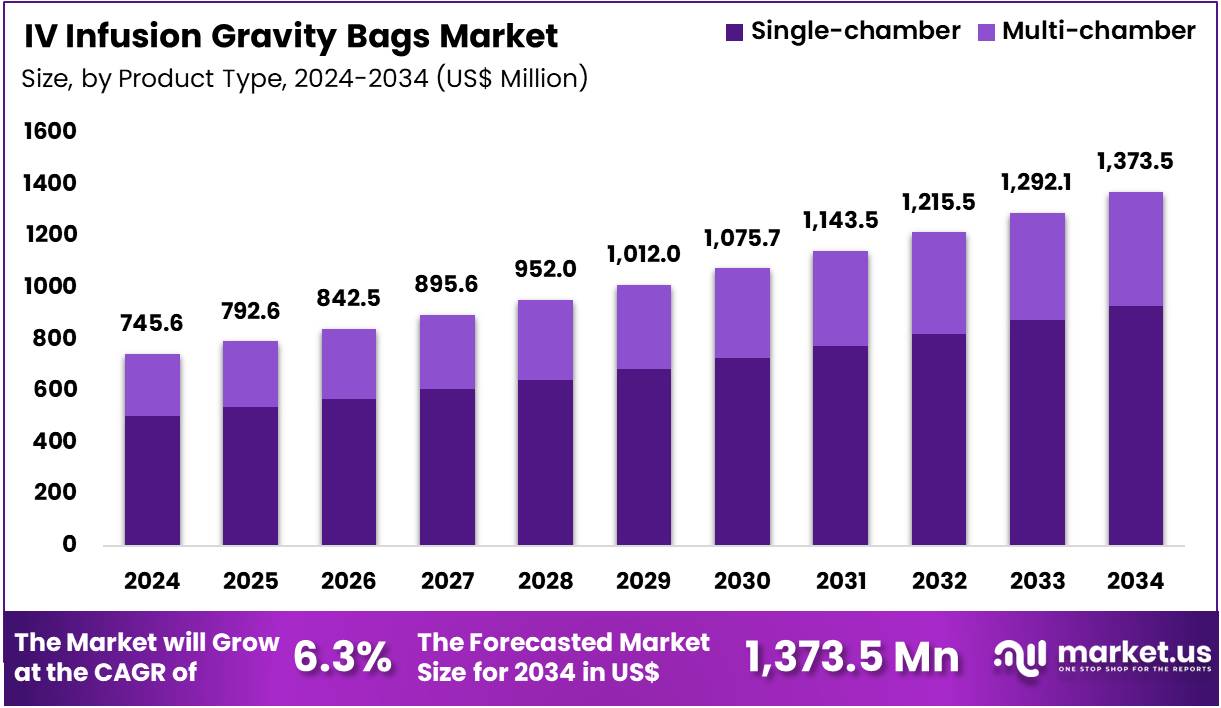

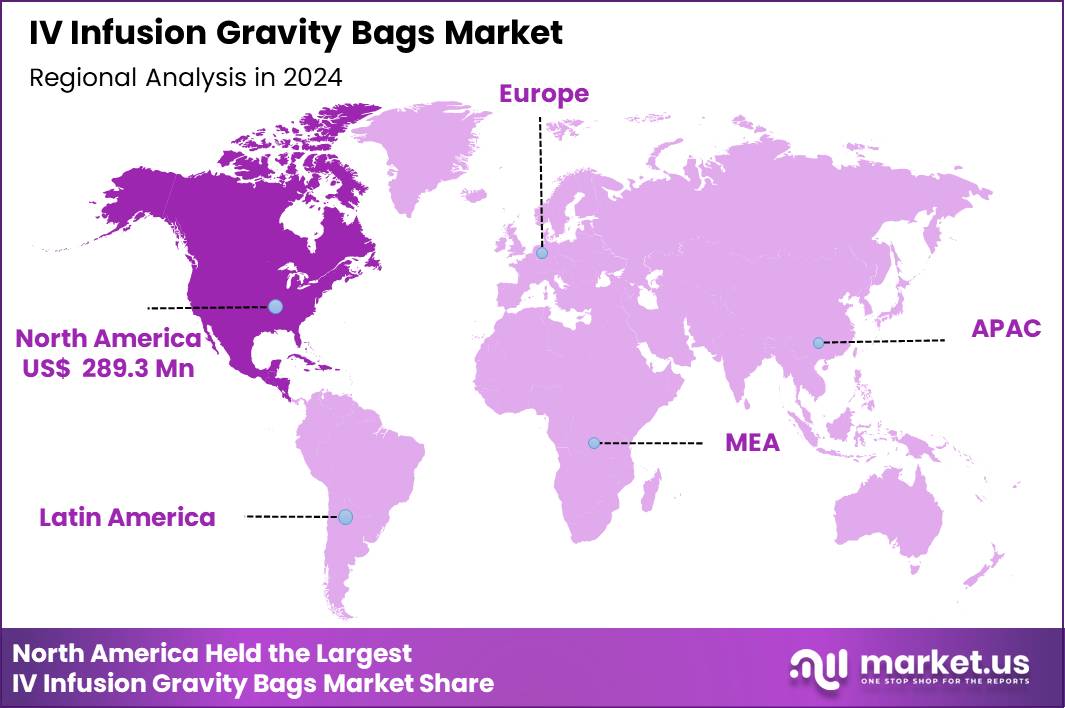

The Global IV Infusion Gravity Bags Market size is expected to be worth around US$ 1,373.5 Million by 2034 from US$ 745.6 Million in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.8% share with a revenue of US$ 289.3 Million.

The IV Infusion Gravity Bags Market is experiencing steady growth as healthcare systems increasingly rely on gravity-based IV delivery for fluid therapy, drug administration, parenteral nutrition, and emergency resuscitation. Gravity infusion remains widely used due to its simplicity, low cost, and suitability in both advanced and resource-limited healthcare settings. The market benefits from rising hospitalization rates, increased surgical volumes, and expanding demand for sterile, contamination-free fluid-delivery systems.

Manufacturers are introducing non-PVC, DEHP-free, and multi-layer film IV bags to meet safety standards and regulatory shifts away from PVC-based medical plastics. Adoption is also rising in home-care settings, field hospitals, and ambulatory centers where lightweight gravity bags provide flexibility without requiring infusion pumps. Increased production of parenteral nutrition fluids, hydration solutions, and specialized drug-compatible bags continues to reinforce market expansion.

Key Takeaways

- In 2024, the market generated a revenue of US$ 745.6 Million, with a CAGR of 6.3%, and is expected to reach US$ 1,373.5 Million by the year 2034.

- The Product Type segment is divided into Single-chamber, and Multi-chamber, with Single-chamber taking the lead in 2024 with a market share of 67.7%

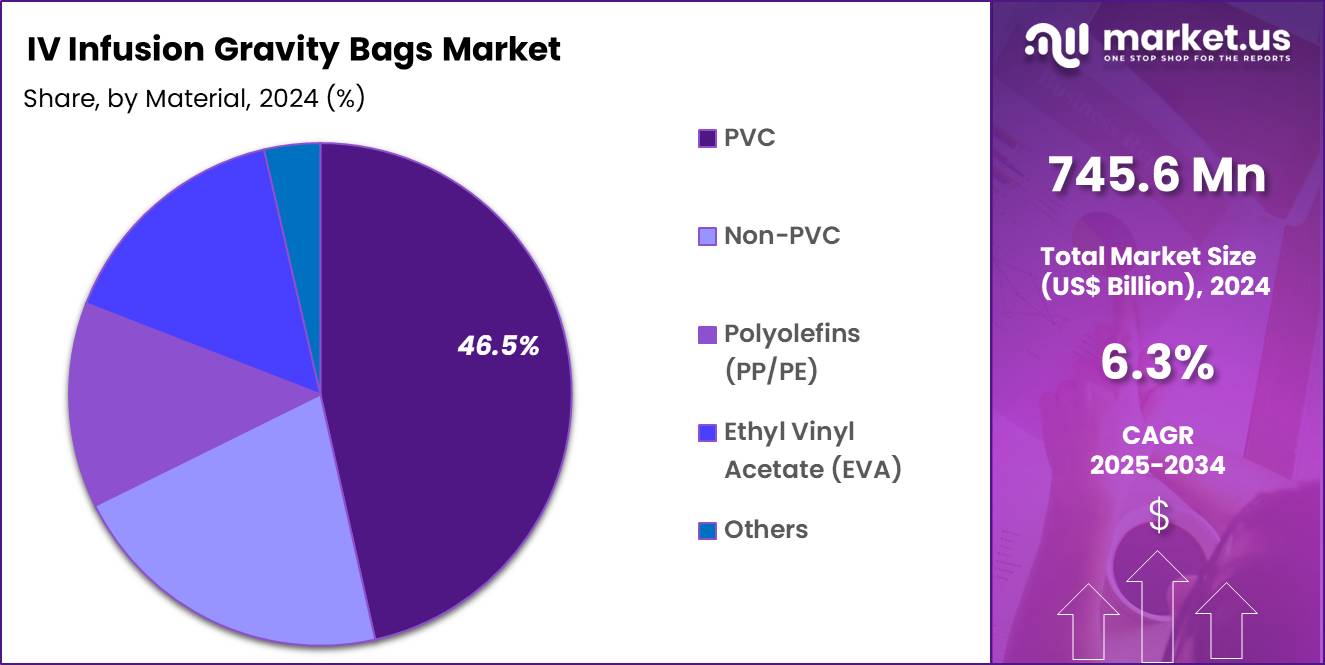

- The Material segment is divided into PVC, Non-PVC, Polyolefins (PP/PE), Ethyl Vinyl Acetate (EVA), and Others, with PVC taking the lead in 2024 with a market share of 46.5%

- The End-User segment is divided into Hospitals, Clinics, Ambulatory surgical Centers, and Others, with Hospitals taking the lead in 2024 with a market share of 57.1%

- North America led the market by securing a market share of 38.8% in 2024.

Kit Type Analysis

Single-chamber IV Gravity Bags dominated the market with 67.7% market share in 2024 as they provide the simplest and most cost-effective solution for hydration therapy, electrolyte replacement, and routine drug infusion. Hospitals rely heavily on these bags for high-volume daily fluid administration across ICUs, general wards, emergency medicine, and perioperative care. Their wide compatibility with standard IV tubing systems and broad availability across pharmacies and procurement networks support sustained usage.

Multi-chamber IV Gravity Bags serve more specialized applications such as parenteral nutrition, customized drug formulations, and time-sensitive admixture therapies. These bags separate components such as lipids, electrolytes, amino acids, or medications until the moment of administration, improving stability and reducing contamination risk. Growth is driven by rising demand for nutritional therapy and expanded use in critical care units.

Material Analysis

PVC IV Gravity Bags continue to account for a significant share of 46.5% in 2024 due to low cost, high durability, and long-standing use in hospital systems worldwide. However, concerns about DEHP leaching and global regulatory pressure are gradually shifting procurement toward safer alternatives.

Non-PVC IV Gravity Bags are rapidly gaining adoption, especially in North America, Europe, and Japan. Their biocompatibility, chemical-resistance profile, and suitability for a broader range of drugs including chemotherapy and lipid-based formulations make them preferred in advanced healthcare systems.

Polyolefins (PP/PE) hold a growing share of the non-PVC category. They offer strong chemical stability and low extractables, making them ideal for sensitive formulations. Ethyl Vinyl Acetate (EVA) bags remain widely used for parenteral nutrition and photosensitive compounds. Their flexibility, clarity, and compatibility with frozen storage support higher adoption in nutrition therapy.

End User Analysis

Hospitals represent the largest end-user segment due to continuous, large-scale utilization of IV fluids across emergency care, surgery, critical care, oncology, and general medicine which accounted for over 57.1% market share in 2024. High patient inflow and dependence on hydration therapy reinforce strong demand.

Clinics use gravity bags primarily for outpatient hydration, minor procedures, and chronic-care treatments, especially in infusion therapy centers.

Ambulatory Surgical Centers increasingly rely on gravity bags for perioperative fluid delivery due to efficiency, portability, and lower equipment requirements. Others include home-care setups, long-term care facilities, and EMS units where lightweight and portable infusion systems are essential.

Key Market Segments

By Product Type

- Single-chamber

- Multi-chamber

By Material

- PVC

- Non-PVC

- Polyolefins (PP/PE)

- Ethyl Vinyl Acetate (EVA)

- Others

By End User

- Hospitals

- Clinics

- Ambulatory surgical Centers

- Others

Drivers

Rising Global Surgical & Hospitalization Volumes Driving IV Fluid Demand

A major driver for the IV Infusion Gravity Bags Market is the continuous rise in global hospitalization rates and surgical procedures, which directly increases the consumption of IV fluids and the need for gravity-based infusion bags. According to the WHO, more than 330 million surgeries are performed worldwide each year, and this figure grows steadily due to expanding access to healthcare in developing regions.

Every surgical case requires perioperative fluid management, typically through IV gravity bags for hydration, electrolyte replacement, antibiotics, and anesthesia support. Additionally, hospitalization for chronic diseases such as kidney failure, gastrointestinal disorders, and cancer has increased substantially. The International Agency for Research on Cancer (IARC) reported 19.3 million new cancer cases in 2022, many of whom require frequent parenteral nutrition and fluid therapy, driving higher IV bag utilization.

Emergency departments rely heavily on gravity bags for trauma resuscitation, burn management, and infectious disease treatment. In lower-income countries and remote settings, gravity infusion is preferred over pump-based systems due to reliability and cost efficiency. The rapid growth of geriatric populations expected to reach 1.5 million by 2050 further increases fluid therapy needs. Together, these factors create a strong, sustained demand for IV infusion gravity bags across global healthcare systems.

Restraints

Regulatory Pressure on PVC & Supply Chain Instability

A major restraint in the IV Infusion Gravity Bags Market is the increasing regulatory pressure on PVC and DEHP plasticizers, which have historically dominated IV fluid bag manufacturing. PVC-based bags face scrutiny because DEHP may leach into certain drugs or lipid formulations, especially during long infusions.

Agencies such as the European Chemicals Agency (ECHA) and US FDA have issued advisories recommending reduced DEHP exposure, particularly in pediatric, neonatal, and oncology care. As a result, hospitals in the EU have reduced PVC procurement, forcing manufacturers to adopt costlier non-PVC materials such as EVA or multilayer polyolefins.

This shift increases production costs by an estimated 15–30%, impacting margins and pricing. Another strong restraint is global supply chain instability. Medical-grade polymers, sterilization materials, and elastomers were affected during the 2020–2023 supply disruptions, resulting in 6–12-month delays in raw material availability for many IV bag producers. Freight shortages and high logistics costs also impacted distribution, particularly across Asia, Africa, and Latin America.

Opportunities

Rapid Expansion of Non-PVC IV Bag Manufacturing

A strong opportunity in the IV Infusion Gravity Bags Market is the global shift toward non-PVC, DEHP-free, and drug-compatible infusion bags. Healthcare systems are increasingly adopting safer materials due to regulatory pressure, rising concerns about chemical extractables, and the growing use of sensitive formulations such as oncology drugs, lipid emulsions, and parenteral nutrition.

Non-PVC IV bags (EVA, PP/PE, and multilayer films) are projected to grow significantly faster than traditional PVC bags. Industry assessments show that the non-PVC IV bag segment may exceed USD 3–4 million by 2030, reflecting a global transition across hospitals. EVA bags are particularly favored for parenteral nutrition because they maintain stability for lipids and amino acid mixtures.

Polyolefin bags offer strong chemical resistance and reduced drug adsorption, improving compatibility for antibiotics and chemotherapy. Emerging economies are investing heavily in sterile fluid-production infrastructure India, for example, has expanded its IV fluid manufacturing capacity by 40% since 2020 due to increased domestic demand.

ICU Medical, Inc. announced in November 2024 a partnership with a manufacturing facility, creating one of the largest global IV solutions manufacturing networks expanding annual production capacity significantly, which supports greater availability of IV bags and infusion sets.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the IV Infusion Gravity Bags Market by influencing raw material availability, manufacturing costs, supply chain reliability, and global demand patterns. The majority of IV bag production depends on medical-grade polymers such as PVC, EVA, and polyolefins materials that experienced sharp price fluctuations during global inflationary cycles.

Between 2021 and 2023, polymer prices increased by 20–40% in several regions, raising manufacturing costs and forcing suppliers to adjust procurement strategies. Geopolitical tensions, including trade restrictions, container shortages, and port disruptions, further strained supply chains, particularly for sterilized medical films and pharmaceutical-grade plasticizers. This led to extended lead times for IV bags in North America, Europe, and parts of Asia.

Healthcare systems in low-income countries were particularly affected, as rising import costs reduced their access to essential IV fluids and infusion bags. During global emergencies such as pandemics or regional conflicts, hospitals experience surging demand for hydration solutions and parenteral nutrition, intensifying pressure on production capacity.

Regulatory changes including restrictions on DEHP-containing PVC also require costly material transitions that impact manufacturers financially. Despite these challenges, increased government investment in domestic IV fluid production in regions like India and Southeast Asia has helped offset supply constraints, improving long-term market stability.

Latest Trends

Shift Toward DEHP-Free and Drug-Compatible Materials

A key trend reshaping the IV Infusion Gravity Bags Market is the movement toward sustainable, lightweight, multilayer, and high-performance medical films that support safety, drug stability, and environmental goals. Hospitals and regulatory bodies are pushing manufacturers to reduce reliance on single-use PVC and adopt recyclable or lower-toxicity materials. This transition mirrors broader European healthcare sustainability initiatives, where medical plastic waste reduction targets are accelerating non-PVC adoption.

EVA and polyolefin-based films are gaining traction due to clarity, flexibility, and resistance to lipid degradation. In fact, EVA-based IV bags already account for over 25% of non-PVC bag usage in the nutrition segment. Another emerging trend is the integration of light-protective UV-blocking layers, essential for photosensitive drugs such as certain antibiotics and parenteral nutrition lipids.

Manufacturers are also developing thinner but stronger films to reduce material consumption while maintaining durability some multilayer bags achieve 20–30% weight reduction, decreasing shipping and storage costs.

Regional Analysis

North America is leading the IV Infusion Gravity Bags Market

North America remains the largest region for IV infusion gravity bags. The region accounted for approximately 38.8% of the global IV Infusion Gravity Bags Market in 2024. Strong demand stems from a mature and extensive healthcare infrastructure, high rates of hospital admissions, advanced critical-care facilities, and widespread use of infusion therapy for chronic diseases, surgeries, and emergency care.

The presence of major global suppliers and robust procurement channels, along with regulatory standards that support sterile fluid-delivery systems, reinforce dominance. High per-capita healthcare spending, a large geriatric population requiring frequent fluid therapy, and the prevalence of chronic pathologies such as cancer, kidney disease, and cardiovascular conditions maintain stable, high-volume usage of IV gravity bags.

Fresenius Kabi in 2024 opened a new IV bag manufacturing facility (free flex® IV bag line) in Wilson, North Carolina, expanding capacity for IV solutions including gravity bags, improving supply reliability and lead times for U.S. customers.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific represents the fastest-growing region for IV infusion gravity bags. Growth in this region is driven by expanding healthcare infrastructure, rising hospital and clinic capacity, growing prevalence of chronic diseases, and rising demand from emerging economies. Governments and private sectors are scaling up medical services, increasing surgical volumes and critical-care capacity.

Market studies consistently identify Asia Pacific as the region with the highest projected growth rate in coming years. In addition, increasing access to infusion therapy in rural and urban areas, rising awareness of intravenous treatment benefits, and expanding demand in parenteral nutrition and emergency care support accelerated uptake of IV bags. The shift toward non-PVC materials and modern manufacturing in the region further boosts adoption of safer and higher-quality gravity bags.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include GVS, Sippex IV Bag, Kraton Corporation, ICU Medical, Inc., Baxter International Inc., Terumo BCT Ltd., The Metrix Company, Renolit, Technoflex, Bioteque Corporation, B. Braun Melsungen AG, Fresenius Kabi AG, Polycine GmbH, Grifols, and Other key players.

GVS plays an important role in the IV infusion gravity bags ecosystem through its advanced filtration technologies integrated into IV sets, vents, and sterile fluid pathways. Its medical-grade filters enhance safety by preventing particulate contamination and maintaining sterility during gravity-based infusion, making GVS a key supplier of critical components used alongside IV bags.

Sippex IV Bag is a prominent manufacturer specializing in non-PVC and multi-layer film infusion bags used for parenteral solutions, hydration therapies, and nutrition formulations. The company’s multilayer EVA and polyolefin bags offer strong drug compatibility and DEHP-free performance, meeting the rising demand for safer infusion solutions.

Kraton Corporation contributes through its high-performance polymers and elastomers used in medical films and infusion-bag components. Its specialty polymers improve flexibility, chemical resistance, and sealing performance in non-PVC IV bags, supporting the industry’s transition toward next-generation, biocompatible medical packaging materials.

Top Key Players

- GVS

- Sippex IV Bag

- Kraton Corporation

- ICU Medical, Inc.

- Baxter International Inc.

- Terumo BCT Ltd.

- The Metrix Company

- Renolit

- Technoflex

- Bioteque Corporation

- Braun Melsungen AG

- Fresenius Kabi AG

- Polycine GmbH

- Grifols

- Other key players

Recent Developments

- In December 2023, Baxter International Inc. announced the launch of a pilot recycling program for its IV bags enabling hospitals to recycle used PVC IV bags as part of sustainability efforts.

- In October 2024, B. Braun Medical issued a press release describing ramp-up of production of IV fluids, tubing, valves and infusion devices to secure supply after weather-related manufacturing disruptions.

- In October 2024, B. Braun announced a 20% increase in production at its U.S. facilities, aiming to boost annual IV set output by tens of millions and mitigate supply shortages — a move directly affecting IV gravity-bag availability.

Report Scope

Report Features Description Market Value (2024) US$ 745.6 Million Forecast Revenue (2034) US$ 1,373.5 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single-chamber & Multi-chamber), By Material (PVC, Non-PVC, Polyolefins (PP/PE), Ethyl Vinyl Acetate (EVA) and Others), By End User (Hospitals, Clinics, Ambulatory surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape GVS, Sippex IV Bag, Kraton Corporation, ICU Medical, Inc., Baxter International Inc., Terumo BCT Ltd., The Metrix Company, Renolit, Technoflex, Bioteque Corporation, B. Braun Melsungen AG, Fresenius Kabi AG, Polycine GmbH, Grifols, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IV Infusion Gravity Bags MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

IV Infusion Gravity Bags MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GVS

- Sippex IV Bag

- Kraton Corporation

- ICU Medical, Inc.

- Baxter International Inc.

- Terumo BCT Ltd.

- The Metrix Company

- Renolit

- Technoflex

- Bioteque Corporation

- Braun Melsungen AG

- Fresenius Kabi AG

- Polycine GmbH

- Grifols

- Other key players