Global IV Disposables Market By Product Type (Infusion Pumps, Intravenous Administration Set, IV Fluid Solution Bags and Others), By End-user (Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Home Care Settings), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171660

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

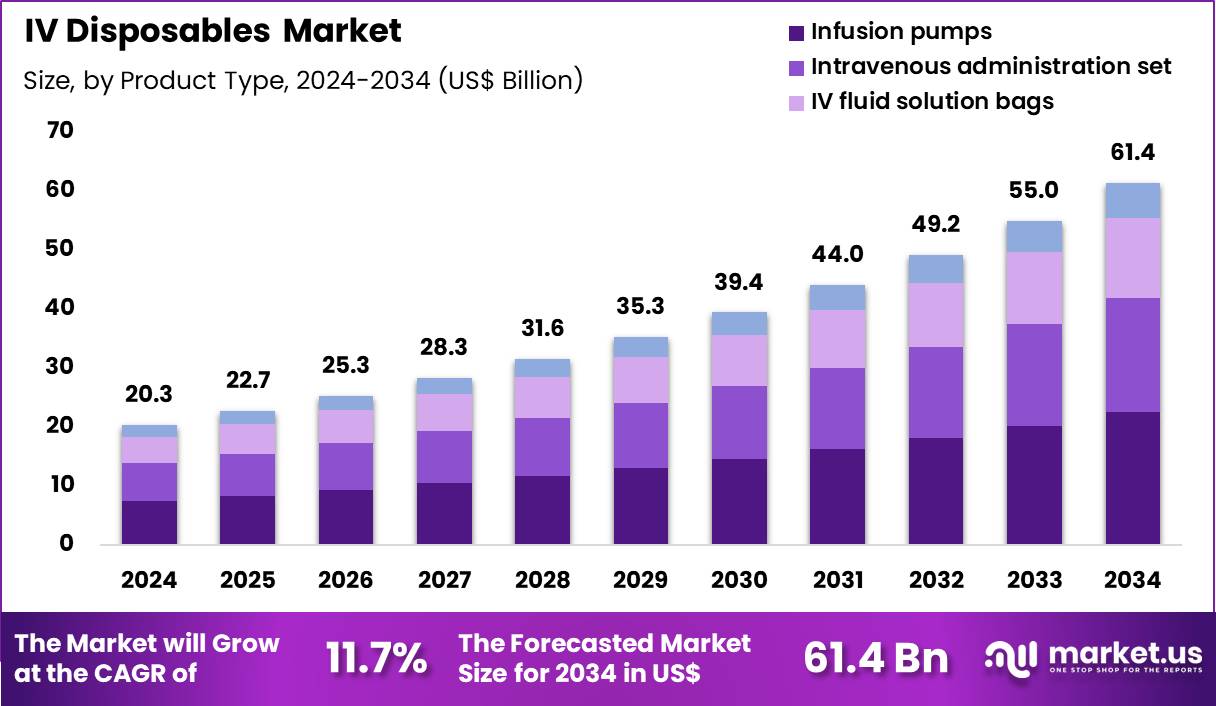

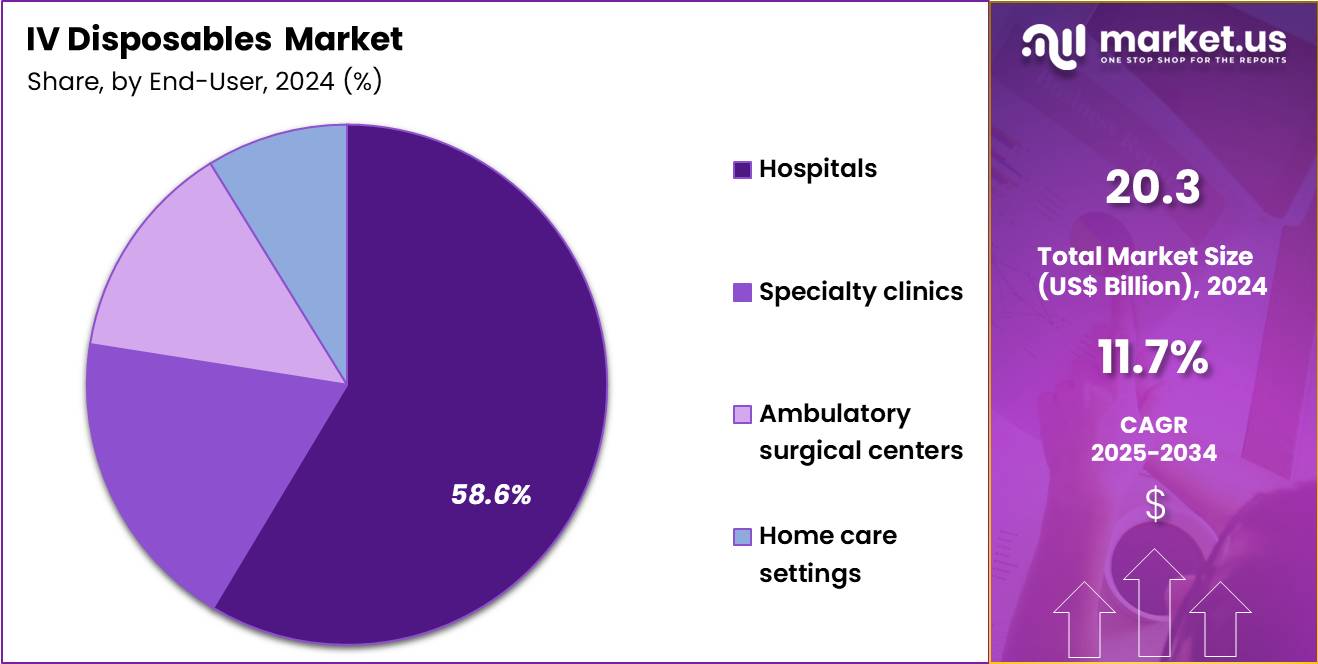

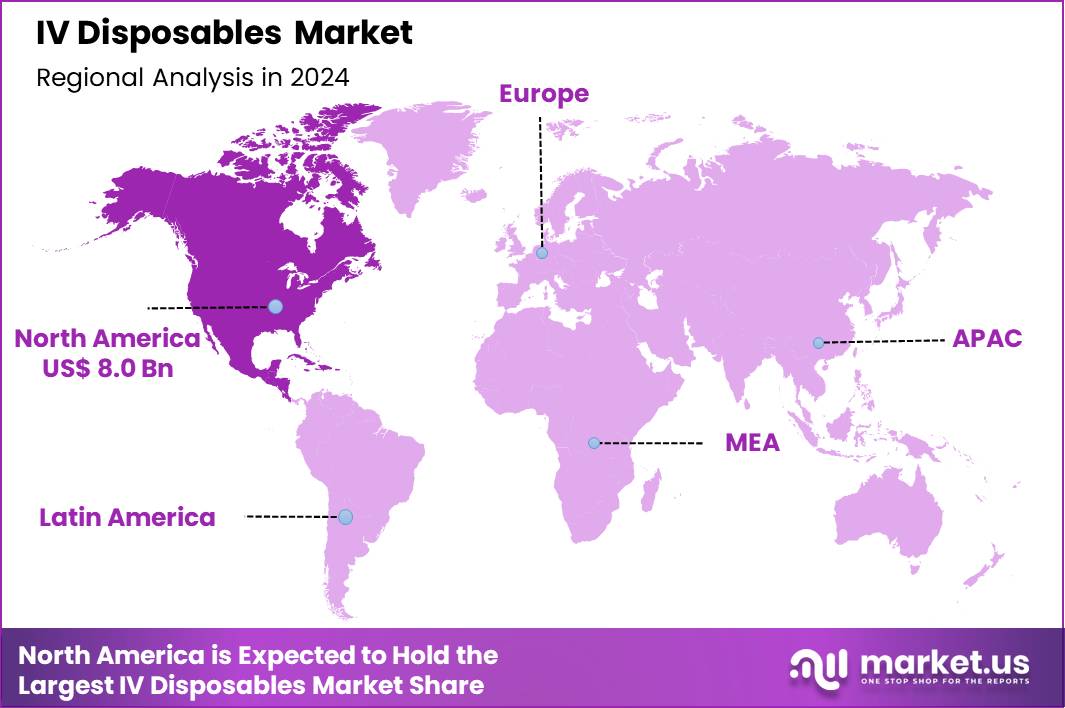

The Global IV Disposables Market size is expected to be worth around US$ 61.4 Billion by 2034 from US$ 20.3 Billion in 2024, growing at a CAGR of 11.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 0.8 Billion.

Increasing demand for safe intravenous administration propels the IV Disposables market, as healthcare providers prioritize single-use components to prevent cross-contamination and bloodstream infections during fluid and medication delivery. Manufacturers produce sterile catheters, infusion sets, and extension tubing that ensure reliable vascular access with minimal tissue trauma.

These disposables support chemotherapy infusion for oncology patients requiring cytotoxic drug delivery, antibiotic therapy in sepsis management for broad-spectrum coverage, parenteral nutrition in gastrointestinal failure cases for essential nutrient provision, and hydration therapy in postoperative recovery for electrolyte balance restoration. Clinical trial outcomes reinforce the continued reliance on IV routes despite alternative administration methods.

Merck reported positive Phase 3 trial results in March 2025 showing subcutaneous pembrolizumab achieved non-inferior efficacy compared to intravenous dosing; while subcutaneous options may shorten administration time, they sustain demand for IV disposables through combination regimens, line maintenance, and hospital-based biologic workflows. This development highlights opportunities for hybrid delivery systems that complement evolving therapeutic landscapes.

Growing emphasis on home-based infusion therapy accelerates the IV Disposables market, as patients manage chronic conditions outside hospital settings with portable pumps and prefilled administration sets. Suppliers engineer closed-system transfer devices and needle-free connectors that enhance safety during self-administration or caregiver-assisted procedures.

Applications include immunoglobulin replacement in primary immunodeficiency disorders for immune function support, iron supplementation in anemia of chronic disease for hemoglobin optimization, bisphosphonate delivery in osteoporosis management for bone density preservation, and enzyme replacement in rare metabolic disorders for substrate clearance.

Home-care expansions create opportunities for user-friendly kits with integrated filters and anti-reflux valves that reduce complication risks. Pharmaceutical partnerships increasingly bundle disposables with long-acting injectables to facilitate outpatient transitions. This patient-empowering trend drives market innovation in lightweight, ergonomic designs tailored for non-clinical environments.

Rising integration of smart infusion technologies invigorates the IV Disposables market, as facilities adopt compatible tubing and connectors that interface with dose-error reduction software for precise delivery monitoring. Developers incorporate RFID tags and flow sensors into disposable sets that provide real-time feedback on occlusion or air-in-line events.

These advanced components facilitate high-risk medication administration in critical care for vasopressor titration, continuous renal replacement therapy in acute kidney injury for solute removal, total parenteral nutrition in short bowel syndrome for caloric sustenance, and palliative hydration in end-of-life care for comfort maintenance.

Connectivity features open avenues for data analytics that predict adverse events and optimize inventory management. Healthcare systems actively invest in these interoperable disposables to comply with safety standards and improve clinical outcomes. This intelligent evolution establishes IV disposables as vital enablers of error-free, evidence-based infusion practices.

Key Takeaways

- In 2024, the market generated a revenue of US$ 20.3 Billion, with a CAGR of 11.7%, and is expected to reach US$ 61.4 Billion by the year 2034.

- The product type segment is divided into infusion pumps, intravenous administration set, IV fluid solution bags and others, with infusion pumps taking the lead in 2023 with a market share of 36.8%.

- Considering end-user, the market is divided into hospitals, specialty clinics, ambulatory surgical centers and home care settings. Among these, hospitals held a significant share of 58.6%.

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

Infusion pumps, holding 36.8%, are expected to dominate because precise and controlled drug delivery remains essential across acute and chronic care settings. Increasing complexity of infusion therapies, including chemotherapy, antibiotics, and critical care medications, strengthens reliance on programmable pumping systems. Hospitals and clinics prioritize infusion accuracy to reduce medication errors and improve patient safety outcomes.

Advancements in smart pump technologies enhance dose-error reduction and interoperability with electronic health records. Rising surgical volumes and intensive care admissions increase demand for continuous and intermittent infusion support. Expansion of outpatient infusion services further boosts utilization across care pathways. Regulatory focus on infusion safety standards accelerates replacement of manual delivery methods. These factors keep infusion pumps anticipated to remain the leading product type in the IV disposables market.

End-User Analysis

Hospitals, holding 58.6%, are projected to dominate because they manage the highest volume of intravenous therapies across emergency, surgical, oncology, and critical care departments. High patient throughput and complex treatment protocols require consistent availability of IV disposables to maintain care continuity. Hospitals invest heavily in standardized IV systems to support infection control and medication safety initiatives.

Growth in inpatient admissions related to chronic diseases and acute conditions strengthens ongoing consumption of IV products. Integration of infusion technologies into hospital workflows improves efficiency and clinical oversight. Teaching hospitals and tertiary care centers also adopt advanced infusion infrastructure for specialized treatments. These drivers keep hospitals expected to remain the dominant end-user segment in this market.

Key Market Segments

By Product Type

- Infusion Pumps

- Intravenous Administration Set

- IV Fluid Solution Bags

- Others

By End-user

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Home Care Settings

Drivers

Increasing prevalence of chronic conditions is driving the market

The rising incidence of chronic conditions among adults has substantially elevated the requirement for intravenous disposables in ongoing therapeutic administrations, such as hydration and medication delivery. This demographic shift underscores the essential role of IV sets, catheters, and bags in managing conditions like diabetes and cardiovascular disease within clinical and ambulatory environments.

Healthcare providers increasingly depend on these disposables to support long-term patient care, ensuring consistent fluid and nutrient supply without recurrent invasive procedures. National health surveillance efforts highlight the scale of this burden, prompting expanded procurement to accommodate heightened utilization rates. The integration of IV disposables into standardized treatment protocols for chronic management enhances procedural safety and efficacy across diverse care settings.

Economic pressures from prolonged hospitalizations further incentivize the adoption of reliable, single-use components to optimize resource allocation. Notably, in April 2025, Teleflex secured U.S. Food and Drug Administration 510(k) clearance for the AC3 Range™ Balloon Pump (Intra-Aortic), facilitating expanded use of mechanical circulatory support in cardiovascular cases and thereby increasing the need for dedicated single-use IV tubing, catheters, and related balloon pump accessories in associated procedures.

Collaborative initiatives among health agencies promote awareness of these tools in preventive care strategies, fostering market resilience. Advancements in disposable design, including antimicrobial coatings, align with infection control imperatives in chronic therapy. As populations age, the demand for versatile IV solutions intensifies, supporting scalable supply chains. Overall, this driver solidifies the foundational importance of IV disposables in addressing the multifaceted challenges of chronic health maintenance.

Restraints

Escalation in medical device shortages is restraining the market

Persistent supply chain vulnerabilities have led to a marked uptick in shortages of critical medical devices, including IV disposables, thereby disrupting availability and escalating procurement challenges for healthcare facilities. These interruptions stem from manufacturing constraints and global logistical hurdles, compelling institutions to ration essential components like infusion sets and tubing.

The resultant delays in patient care heighten operational risks, particularly in high-acuity environments where timely IV access is paramount. Regulatory monitoring of shortage impacts reveals a pronounced increase in affected product categories, straining inventory management practices. Cost fluctuations associated with scarcity further burden budgets, diverting funds from innovation to contingency planning.

Variability in regional access exacerbates inequities, with rural providers facing prolonged backorders compared to urban centers. Mitigation strategies, such as alternative sourcing, introduce compatibility concerns that compromise procedural standards. The psychological toll on clinical staff from resource limitations contributes to burnout and reduced efficiency.

These dynamics collectively temper investment in advanced disposable variants, prioritizing basic stock replenishment. In essence, this restraint necessitates fortified supply resilience to sustain uninterrupted therapeutic delivery.

Opportunities

Expansion of home-based chronic disease management is creating growth opportunities

The burgeoning shift toward home-based care for chronic conditions presents expansive prospects for IV disposables tailored to ambulatory infusion therapies, enabling patient-centered delivery outside traditional hospital confines. This transition empowers individuals with self-administration capabilities, reducing institutional dependencies while maintaining therapeutic continuity.

Innovations in user-friendly disposables, such as pre-filled syringes and compact pumps, facilitate seamless integration into daily routines for conditions requiring regular IV support. Public health frameworks endorse this model to alleviate system-wide congestion, unlocking demand in residential settings. Cost-effectiveness analyses demonstrate substantial savings through decreased readmissions, incentivizing payer support for home-compatible products.

Educational programs equipping caregivers with proficiency in disposable handling broaden adoption across socioeconomic strata. Technological synergies, like smart monitoring attachments, enhance adherence and outcomes, appealing to tech-savvy demographics. Global equity initiatives extend these opportunities to low-resource households via affordable, durable designs.

Validation of home efficacy through longitudinal studies bolsters reimbursement landscapes for specialized disposables. Collectively, this paradigm fosters a decentralized ecosystem, propelling innovation and accessibility in chronic IV management.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends energize the IV disposables market as rising healthcare expenditures and expanding hospital infrastructures worldwide drive hospitals and clinics to stock advanced catheters, tubing sets, and infusion bags for critical patient care. Manufacturers rapidly innovate with safer, anti-microbial coated products, capturing robust demand from aging populations and the growth in chronic treatments requiring reliable intravenous delivery.

Persistent inflation and uneven global recoveries, however, push up costs for plastics and sterile packaging materials, prompting healthcare providers to ration supplies and delay bulk procurements in tighter budgets. Geopolitical tensions, particularly U.S.-China trade disputes and ongoing regional conflicts, frequently interrupt flows of essential raw components and finished disposables, sparking shortages and forcing suppliers to seek costlier alternatives.

Current U.S. tariffs impose a universal baseline duty on imported medical devices alongside higher rates on Chinese-origin supplies, significantly raising landed costs for American distributors and challenging affordability for domestic healthcare systems. These duties also provoke retaliatory barriers overseas that hinder U.S. exports of specialized IV products and strain international supply partnerships.

Nevertheless, the policies spur aggressive investments in North American production facilities and regional sourcing networks, forging a more resilient and independent supply base that will support innovation and sustained market strength ahead.

Latest Trends

Resolution of national IV saline solution shortage is a recent trend

In August 2025, the U.S. Food and Drug Administration announced the resolution of the nationwide shortage of sodium chloride 0.9% injection products, critical components integral to IV disposable assemblies. This development followed intensive coordination with manufacturers to ramp up production capacities amid prior disruptions from raw material constraints.

The announcement alleviates pressures on healthcare supply chains, ensuring restored availability for routine hydration and dilution applications in clinical workflows. Regulatory updates confirm that affected products are being delisted from the FDA’s current shortage roster, signaling normalized distribution. This trend reflects broader stabilization efforts in essential medical fluids, benefiting downstream integration with IV sets and catheters.

Facilities report improved inventory predictability, enabling proactive planning for elective procedures. The resolution underscores the efficacy of federal mitigation protocols in addressing acute supply vulnerabilities. Industry stakeholders anticipate sustained monitoring to prevent recurrences, incorporating diversified sourcing strategies. Early post-resolution data indicate reduced workaround expenditures for alternative formulations. This 2025 milestone exemplifies regulatory agility in safeguarding IV therapy continuity.

Regional Analysis

North America is leading the IV Disposables Market

In 2024, North America captured a 39.6% share of the global IV disposables market, sustained by expanding ambulatory care networks and heightened emphasis on infection prevention protocols. Healthcare providers accelerate adoption of safety-engineered catheters and infusion sets to align with Occupational Safety and Health Administration directives, curbing needlestick incidents in high-throughput infusion centers.

Chronic illness prevalence, particularly diabetes and oncology, necessitates frequent vascular access for chemotherapy and hydration therapies, spurring demand for antimicrobial-locking devices in home-based settings. Payer incentives under the Affordable Care Act reimburse advanced fluid administration systems, facilitating seamless integration into value-based care models. Biomedical engineers refine multi-lumen extensions for critical care, supporting hemodynamic monitoring in intensive units amid staffing optimizations.

Regional manufacturing hubs enhance supply reliability, mitigating disruptions through just-in-time inventories of sterile tubing assemblies. Guideline updates from the Infusion Nurses Society endorse needleless connectors, promoting compliance in pediatric and geriatric cohorts. These elements converge to underpin therapeutic efficacy, fortifying intravenous pathways against evolving clinical exigencies. The American Hospital Association reported 32,345,846 admissions to U.S. community hospitals in 2023, highlighting the substantial reliance on disposables for patient fluid management.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Healthcare executives envision steady proliferation of intravenous supply solutions in Asia Pacific through the forecast period, as infrastructure modernizations address escalating care volumes. Authorities in the Philippines and Vietnam earmark funds for centralized procurement, stocking district facilities with ergonomic drip chambers to streamline antibiotic deliveries in outbreak scenarios.

Innovation hubs in Taiwan pioneer eco-compatible bags resistant to leaching, enabling sustainable hydration support for disaster relief operations across island chains. Trade blocs like the Regional Comprehensive Economic Partnership streamline certifications, allowing exporters in South Korea to supply precision valves for neonatal parenteral nutrition.

Rising medical tourism in Thailand attracts international patients, compelling resorts to equip suites with user-centric Y-site adapters for cosmetic recovery infusions. Philanthropic ventures train nurses in Myanmar on secure port access, expanding reach to remote enclaves grappling with vector-borne dehydration risks.

Digital platforms in Indonesia facilitate predictive ordering of electrolyte sets, curbing stockouts during monsoon-induced surges. These developments empower frontline teams, cultivating adaptive networks that sustain vital fluid restorations. A study published in BMC Health Services Research documented 250 million discharged patients in China during 2022, signaling profound opportunities for disposables in regional throughput.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key manufacturers in IV disposables accelerate growth by focusing on safety-engineered designs that reduce needlestick injuries, improve flow control accuracy, and support infection-prevention protocols across hospitals and outpatient settings. They expand demand by aligning product portfolios with high-volume therapies such as oncology infusions, critical-care delivery, and home-based intravenous treatments.

Commercial leaders strengthen market penetration through long-term supply agreements with hospital systems and group purchasing organizations, ensuring predictable volume and recurring revenue. Operations teams invest in large-scale, cost-efficient manufacturing and regional distribution hubs to maintain supply continuity amid fluctuating clinical demand.

Product strategists differentiate through material innovation, closed-system compatibility, and ease-of-use features that improve clinician efficiency and patient comfort. Becton, Dickinson and Company anchors its position through a broad infusion-therapy and vascular-access portfolio, global manufacturing scale, and deep relationships with healthcare providers, enabling the company to deliver reliable, standardized IV consumables across diverse care environments worldwide.

Top Key Players

- B. Braun Melsungen AG

- Baxter International Inc.

- Fresenius Kabi

- Smiths Medical

- ICU Medical, Inc.

- Terumo Corporation

- Nipro Corporation

- Cardinal Health

Recent Developments

- In July 2024, Becton Dickinson & Company completed the acquisition of Tepha, Inc., strengthening its capabilities in resorbable polymer technologies. This move supports the development of advanced, biocompatible IV disposables such as catheters and access devices, accelerating innovation in single-use infusion components and reinforcing demand for next-generation IV consumables.

- In May 2025, Fresenius Kabi finalized its acquisition of Ivenix, expanding its infusion therapy portfolio and smart infusion infrastructure. The integration enhances the deployment of infusion systems that rely heavily on compatible disposable tubing sets, cartridges, and connectors, directly increasing recurring demand for IV disposables across hospital and acute care settings.

- In April 2025, BD introduced the HemoSphere Alta platform featuring AI-enabled clinical decision support for hemodynamic monitoring in critical care. Adoption of advanced monitoring platforms drives higher utilization of disposable pressure transducers, sensor sets, and fluid management accessories, reinforcing steady growth in high-value IV disposables used in ICUs.

Report Scope

Report Features Description Market Value (2024) US$ 20.3 Billion Forecast Revenue (2034) US$ 61.4 Billion CAGR (2025-2034) 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Infusion Pumps, Intravenous Administration Set, IV Fluid Solution Bags and Others), By End-user (Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Home Care Settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape B. Braun Melsungen AG, Baxter International Inc., Fresenius Kabi, Smiths Medical, ICU Medical Inc., Terumo Corporation, Nipro Corporation, Cardinal Health Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- B. Braun Melsungen AG

- Baxter International Inc.

- Fresenius Kabi

- Smiths Medical

- ICU Medical, Inc.

- Terumo Corporation

- Nipro Corporation

- Cardinal Health