Global IT Spending In Oil and Gas Market Size, Share Analysis Report By Offering (Hardware, Software, Services), By Deployment Mode (On-Premises, Cloud-based), By Application (Exploration and Production (E&P), Supply Chain Management, Asset Management, Data Analytics and Business Intelligence, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152779

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- U.S. Market Size

- By Offering: Hardware (51.7%)

- By Deployment Mode: On-Premises (58.3%)

- By Application: Supply Chain Management (36.4%)

- Key Market Segments

- Emerging Trend

- Key Driver

- Main Restraint

- Promising Opportunity

- Persistent Challenge

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

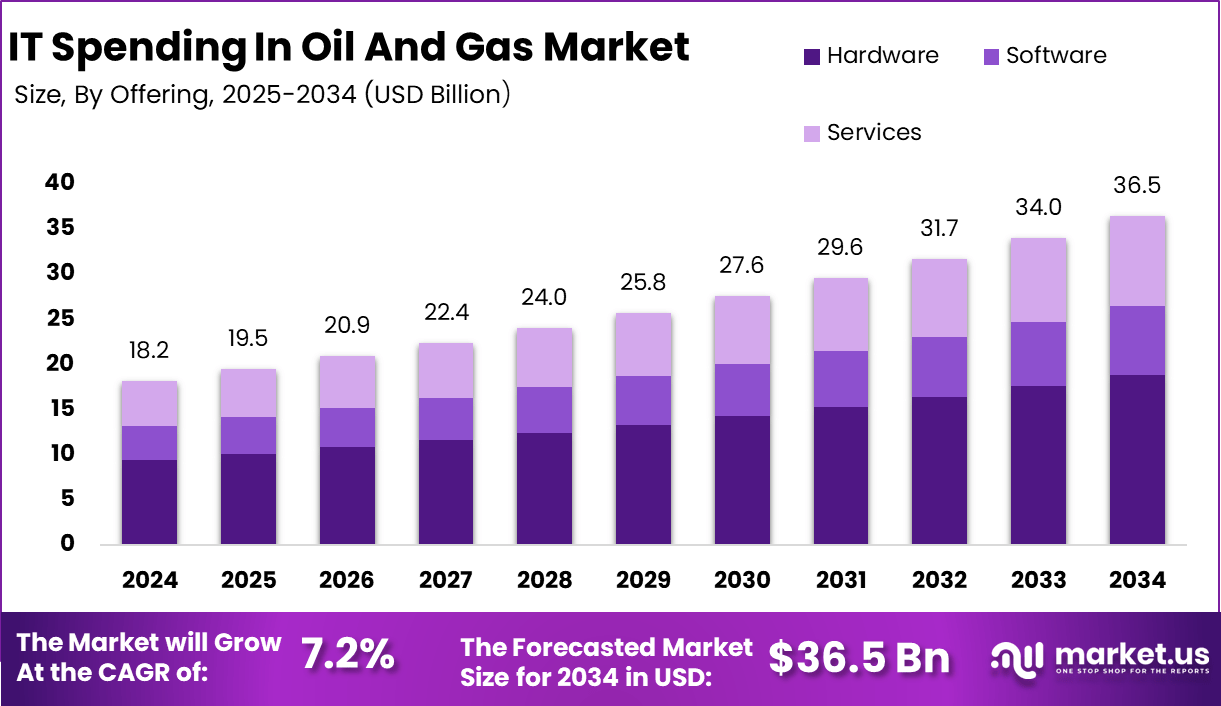

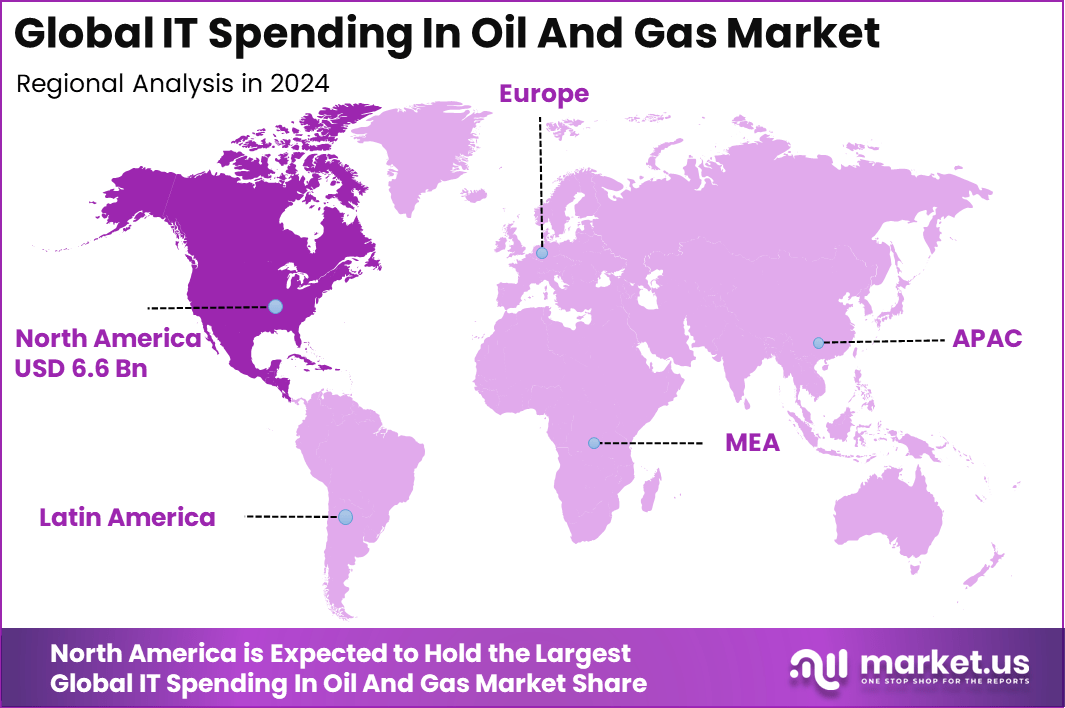

The Global IT Spending In Oil And Gas Market size is expected to be worth around USD 36.5 Billion by 2034, from USD 18.2 Billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.1% share, holding USD 6.6 Billion revenue.

The oil and gas industry is experiencing a significant transformation as companies increasingly invest in information technology to modernize their operations. IT spending in this sector covers a wide range of applications, from exploration and production to refining and distribution. The focus is on digitalizing processes, improving asset management, and ensuring efficient resource utilization.

A primary driver behind the surge in IT spending is the push for digital transformation. The industry is moving toward automation and data-driven decision-making to optimize performance and reduce costs. The need for real-time asset monitoring, predictive maintenance, and enhanced cybersecurity is also fueling investment in advanced IT solutions.

Demand for IT solutions in oil and gas is rising as companies seek to improve efficiency, minimize downtime, and manage risks. The shift toward remote operations, especially after global disruptions, has highlighted the importance of robust IT infrastructure. There is growing interest in cloud computing, big data analytics, and artificial intelligence to handle vast amounts of operational data.

Scope and Forecast

Report Features Description Market Value (2024) USD 18.2 Bn Forecast Revenue (2034) USD 36.5 Bn CAGR (2025-2034) 7.2% Largest market in 2024 North America [36.1% market share] Key Takeaway

- The global IT spending in oil and gas market is projected to grow from USD 18.2 billion in 2024 to approximately USD 36.5 billion by 2034, registering a steady CAGR of 7.2% over the forecast period.

- In 2024, North America led the market with over 36.1% share, generating around USD 6.6 billion in revenue, supported by digitalization initiatives and mature energy infrastructure.

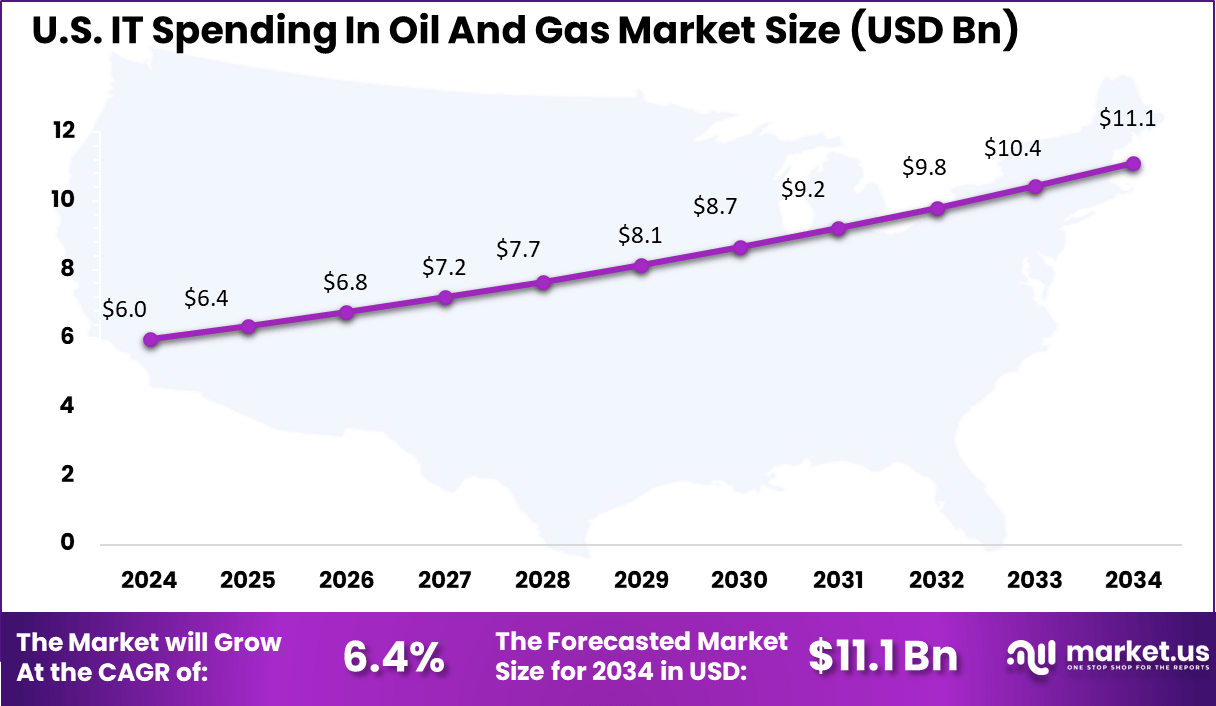

- The U.S. market alone contributed about USD 5.97 billion in 2024 and is expected to expand at a CAGR of 6.4%, reflecting continued investments in technology to optimize operations.

- By offering, hardware dominated with a 51.7% share, driven by the need for robust physical infrastructure in exploration and production activities.

- On-premises deployment led with 58.3% share, favored for data security and control in critical operations.

- In terms of application, supply chain management held the largest share at 36.4%, as companies focus on improving logistics, inventory, and procurement efficiency.

U.S. Market Size

The U.S. IT spending in oil and gas Market was valued at USD 6.0 Billion in 2024 and is anticipated to reach approximately USD 11.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 6.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position in the global IT Spending In Oil And Gas market, capturing more than a 36.1% share. There is a significant growth in IT spending in the oil and gas industry in North America, primarily through the strategic investments and technology. The U.S. Department of Energy’s USD 41 million allocations to Arbor, a bioenergy company, represent a government clean energy effort in terms of carbon capture and advanced technologies in resource production.

The funding is meant for the US state of Louisiana, and the capacity of the plant will be the first commercial one, and the focus will be on technology to absorb carbon and then to make the energy clean. In addition, a proposal for new regulations by the U.S. Interior Department is expected to reduce the bureaucracy in the oil and gas sector and lead to savings of up to USD 1.8 billion per year.

By Offering: Hardware (51.7%)

Hardware continues to dominate IT spending in the oil and gas sector, accounting for 51.7% of total investments. This strong emphasis on hardware is driven by the need for robust infrastructure to support the industry’s digital transformation.

Oil and gas companies are investing heavily in servers, storage systems, networking equipment, and advanced computing devices to handle the vast amounts of data generated daily. These investments are crucial for enabling real-time data processing, remote monitoring, and automation across exploration, production, and distribution activities.

The reliance on hardware is also a reflection of the sector’s commitment to operational resilience and security. Reliable hardware ensures that mission-critical operations can withstand harsh environments and unexpected disruptions. As digital technologies like IoT and advanced analytics become more integral, having a solid hardware foundation allows companies to scale their digital initiatives confidently and securely.

By Deployment Mode: On-Premises (58.3%)

On-premises deployment models make up 58.3% of IT spending in oil and gas. This preference is rooted in the industry’s need for control over sensitive data and compliance with strict regulatory requirements. By keeping IT infrastructure on-site, companies can better manage data security, maintain system integrity, and ensure uninterrupted access to critical applications. This is crucial for large enterprises in remote areas where connectivity is weak and data privacy is critical.

Despite the growing popularity of cloud solutions, many oil and gas firms remain cautious about fully migrating to the cloud. On-premises systems offer a sense of familiarity and reliability, allowing organizations to customize their IT environments to meet unique operational needs. This approach also helps mitigate concerns about data sovereignty and potential cyber threats, ensuring that companies can meet both internal and external compliance standards.

By Application: Supply Chain Management (36.4%)

Supply chain management represents 36.4% of IT spending within the oil and gas industry. The sector’s complex and global supply chains demand advanced digital solutions to optimize procurement, inventory control, and logistics. By investing in IT for supply chain management, companies can enhance visibility, reduce costs, and improve coordination across suppliers, manufacturers, and distributors.

This focus on digital supply chains is essential for maintaining efficiency and resilience in a market that faces frequent disruptions and fluctuating demand. Digital tools in supply chain management also empower oil and gas companies to respond quickly to market changes and regulatory shifts.

With real-time analytics, predictive modeling, and automated workflows, organizations can anticipate challenges, streamline operations, and make better-informed decisions. This proactive approach not only boosts profitability but also strengthens relationships with partners and customers throughout the value chain.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud-based

By Application

- Exploration and Production (E&P)

- Supply Chain Management

- Asset Management

- Data Analytics and Business Intelligence

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Rise of Artificial Intelligence and IoT

A major trend shaping IT spending in the oil and gas sector is the rapid adoption of artificial intelligence and the Internet of Things. Companies are increasingly using smart sensors and machine learning algorithms to monitor equipment, predict failures, and optimize resource allocation.

These technologies are transforming how operations are managed, enabling real-time data analysis and more informed decision-making. The integration of AI and IoT is helping to reduce downtime, improve safety, and boost overall efficiency across exploration, production, and distribution activities.

Key Driver

Demand for Operational Efficiency

The push for greater operational efficiency is a strong force driving IT investment in this industry. Oil and gas companies are looking for ways to automate processes, cut costs, and get the most out of their assets. Advanced IT solutions, such as predictive maintenance tools and real-time monitoring systems, are being adopted to streamline workflows and minimize unplanned interruptions. This focus on efficiency is especially important as companies face fluctuating market conditions and strive to maintain profitability.

Main Restraint

High Implementation Costs

One significant barrier to IT spending in oil and gas is the high cost of adopting new technologies. Implementing advanced solutions like AI, IoT, and cloud computing often requires substantial upfront investment, not only in technology but also in training staff to use these systems effectively. For many organizations, especially smaller players, these costs can delay or limit the adoption of innovative IT tools, slowing down digital transformation.

Promising Opportunity

Automation of Hazardous Tasks

There is a clear opportunity for growth in automating routine and hazardous tasks within oil and gas operations. By investing in robotics, digital twins, and remote monitoring solutions, companies can reduce risks to workers, improve safety, and enhance productivity. Automation also allows for better asset management and more reliable performance, opening the door to safer and more efficient operations in challenging environments.

Persistent Challenge

Legacy Systems and Integration Issues

A persistent challenge in the sector is dealing with outdated IT infrastructure and legacy systems. Many oil and gas companies still rely on older technologies that are not compatible with modern digital tools. This makes it difficult to integrate new solutions, increases maintenance costs, and can lead to inefficiencies or even security vulnerabilities. Overcoming these integration hurdles is essential for companies aiming to fully benefit from digital transformation and stay competitive in a rapidly evolving market.

Key Players Analysis

Microsoft, Amazon Web Services (AWS), and SAP are key players driving digital transformation in IT spending within the oil and gas sector. Their cloud platforms, AI capabilities, and enterprise resource planning tools enable real-time decision-making, predictive maintenance, and data-driven asset management. These companies support upstream and downstream operations with scalable infrastructure and secure data environments.

Siemens, Schlumberger, Baker Hughes, and Halliburton have built deep expertise in integrating IT with operational technology. These companies offer advanced automation, digital twin solutions, and analytics platforms tailored to reservoir modeling, drilling optimization, and equipment health monitoring. Their domain knowledge combined with IT innovation enables oil and gas operators to enhance exploration efficiency, minimize safety risks, and streamline field service operations.

Schneider Electric, Honeywell, Emerson, GE Oil & Gas, Orstec, Bentley Systems, and AVEVA contribute specialized software and hardware solutions. Their offerings focus on process automation, energy management, and visualization tools that support asset integrity and emissions monitoring. These vendors help operators comply with environmental standards while improving production reliability.

Top Key Players in the Market

- Microsoft

- Amazon Web Services (AWS)

- Siemens

- Schlumberger

- Baker Hughes Company

- Halliburton

- SAP

- Schneider Electric

- Honeywell

- Emerson

- GE Oil & Gas

- Orstec

- Bentley Systems

- AVEVA

- Others

Recent Developments

- Schneider Electric unveiled its EcoStruxure Power and Process (EP&P) platform for the oil, gas, and petrochemical sector in May 2025. Developed in partnership with Microsoft, this IoT-enabled solution leverages Microsoft Azure for advanced cloud and edge computing, driving efficiency and profitability for oil and gas operators in India and beyond.

- May 2024: ConocoPhillips announced the acquisition of Marathon Oil for $22.5 billion. The deal is expected to close by the end of 2024 and is set to strengthen ConocoPhillips’ position beyond the Permian Basin.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware, Software, Services), By Deployment Mode (On-Premises, Cloud-based), By Application (Exploration and Production (E&P), Supply Chain Management, Asset Management, Data Analytics and Business Intelligence, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft, Amazon Web Services (AWS), Siemens, Schlumberger, Baker Hughes Company, Halliburton, SAP, Schneider Electric, Honeywell, Emerson, GE Oil & Gas, Orstec, Bentley Systems, AVEVA, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IT Spending In Oil and Gas MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

IT Spending In Oil and Gas MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- Amazon Web Services (AWS)

- Siemens

- Schlumberger

- Baker Hughes Company

- Halliburton

- SAP

- Schneider Electric

- Honeywell

- Emerson

- GE Oil & Gas

- Orstec

- Bentley Systems

- AVEVA

- Others