Global IT Devices Market Size, US Tariff Impact Analysis Report By Product (Mobile Devices, Peripheral Devices, Computers and Laptops, Networking Equipment), By Operating System (Windows, macOS, Linux, iOS, Android, Others), By Distribution Channel (Online, Offline), By Application (Enterprise, Consumer), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145857

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Asia Pacific Market Size

- Product Analysis

- Operating System Analysis

- Distribution Channel Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

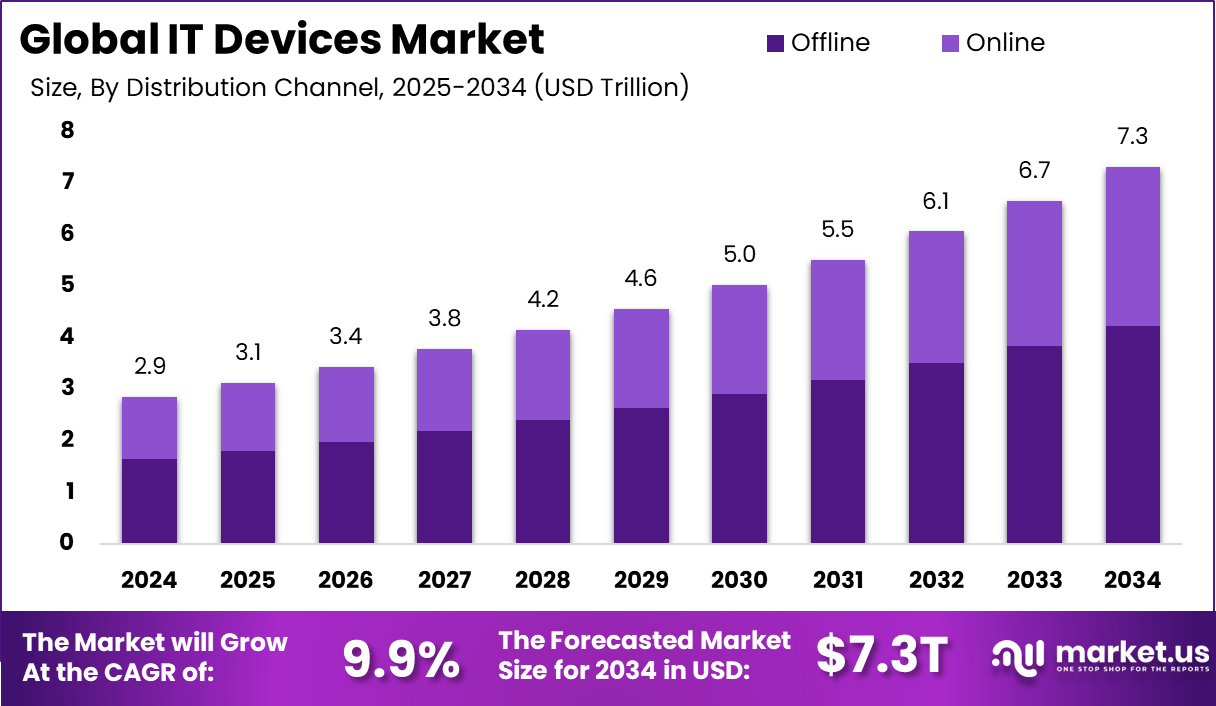

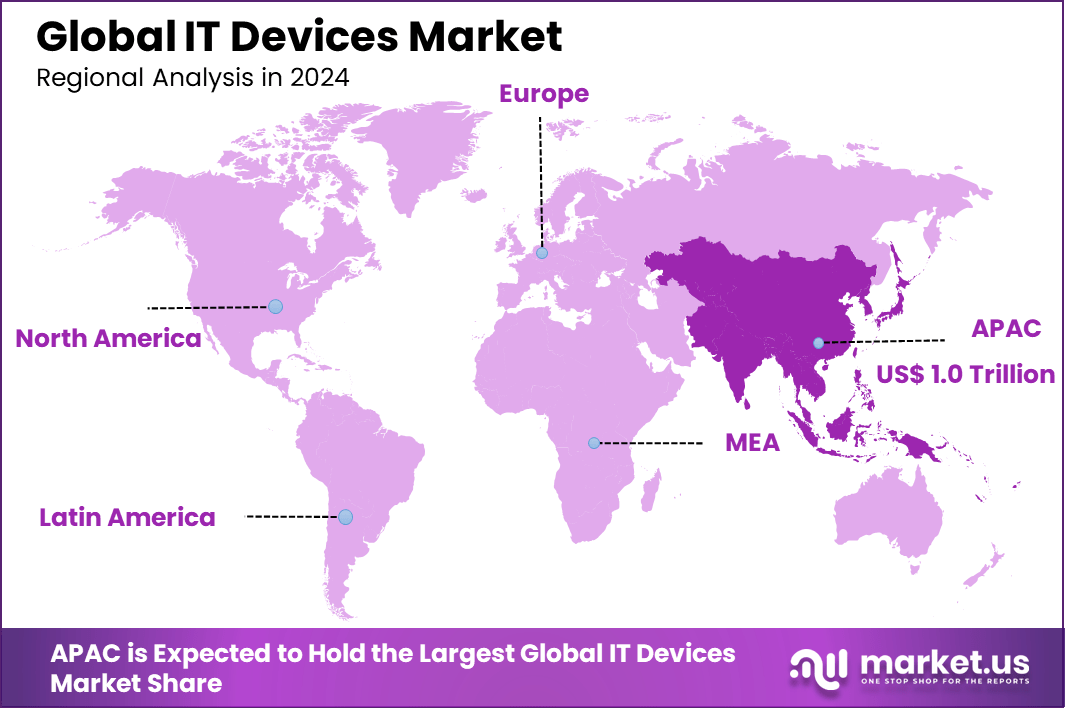

The Global IT Devices Market size is expected to be worth around USD 7.3 Trillion By 2034, from USD 2.9 Trillion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 36.2% share, holding USD 1.0 Trillion revenue.

IT devices encompass a broad category of hardware used to manage, process, store, and transmit information. These include personal computers, mobile devices, servers, and network devices which are pivotal in both consumer and enterprise environments. The market for IT devices is substantial, driven by continuous advancements in technology and growing digital transformation across industries.

The IT devices market is primarily propelled by the integration of advanced technologies such as IoT, AI, and 5G across various sectors. The rise in the global population and the expansion of corporate sectors also significantly boost demand for IT devices. For instance, the rollout of 5G networks enhances the capabilities of IT devices, thereby expanding their market reach.

There is an increasing demand for smart devices both in personal and commercial spaces. This is amplified by the global shift towards digitalization, where more devices are needed to handle various computational and communicative functions.

As per the latest insights from InvGate, global IT spending is forecasted to rise between 5.7% and 8% in 2024, driven by rapid digital transformation and increasing enterprise demand for scalable technologies. A major portion of this growth is attributed to artificial intelligence, with AI-related investments projected to touch $200 billion globally by 2025, primarily led by the United States.

This strategic shift is further evident as over 50% of Fortune 500 companies mentioned AI in their 2023 earnings calls, reflecting its rising influence in shaping core business decisions. However, security challenges persist – 90% of cloud data breaches were linked to misconfigured APIs, and 55% of IT workloads are now managed off-premises, indicating a clear migration toward hybrid cloud environments.

Regulatory and technological landscapes are evolving in parallel. The number of AI-related laws in the U.S. surged by 56.3% in 2023, reaching 25 distinct regulations, compared to just one in 2016. Meanwhile, quantum computing drew $3 billion in investments last year, signaling growing industry confidence in its transformative potential.

Despite this progress, AI-related incidents rose by 32.3% in 2023, bringing AI safety and ethical reliability into sharper focus. In the outsourcing space, the Global IT Outsourcing Market is expected to reach USD 1,094.9 billion by 2033, up from USD 471.1 billion in 2023, growing at a CAGR of 8.8%. Notably, North America led the market in 2023, capturing over 35.4% share and generating approximately USD 166.8 billion in revenue.

Additionally, the IT Services Outsourcing Market is projected to hit USD 1,461.2 million by 2034, growing steadily from USD 689.5 million in 2024 at a CAGR of 7.8%, underscoring consistent enterprise reliance on external tech expertise. Moreover, regions like Asia-Pacific are witnessing a surge in demand due to rising internet usage, higher disposable incomes, and urbanization.

Key Takeaways

- The Global IT Devices Market is witnessing robust expansion, projected to grow from USD 2.9 Trillion in 2024 to approximately USD 7.3 Trillion by 2034, advancing at a CAGR of 9.9% during the forecast period (2025-2034).

- In 2024, the Mobile Devices segment emerged as the most dominant category, capturing more than 46.3% of the total IT devices market.

- Asia-Pacific (APAC) held a dominant position in the IT devices market in 2024, accounting for over 36.2% share with an estimated revenue of USD 1.0 Trillion.

- The Android segment secured a commanding lead in 2024, holding a market share of more than 40.2% in the IT devices space.

- Despite global e-commerce expansion, offline channels captured a dominant 57.8% share of IT device distribution in 2024.

Analysts’ Viewpoint

Rapid advancements in hardware capabilities such as enhanced processors, better storage options, and superior networking technology are crucial. These improvements not only cater to the rising demand for faster and more efficient devices but also support the deployment of next-gen technologies like edge computing and quantum computing.

The continuous growth in the IT devices market provides substantial investment opportunities, especially in developing regions where technological adoption is accelerating. Companies are investing heavily in innovative product development to meet the evolving consumer and business needs.

For businesses, investing in modern IT devices means improved operational efficiency, enhanced security, and better customer engagement. With robust IT infrastructure, companies can leverage data-driven insights and automation to streamline operations and reduce costs.

The market is also influenced by regulatory standards which aim to ensure device security and data privacy. Regulations impact the manufacturing and deployment of IT devices, guiding companies to adhere to stringent security measures.

The growth of the IT devices market can be attributed to several factors including technological innovations, economic conditions, consumer trends, and governmental policies. Each of these elements plays a critical role in shaping the market dynamics.

Asia Pacific Market Size

In 2024, the Asia-Pacific (APAC) region secured a dominant position in the global IT devices market, capturing over 36.2% of the market share and generating approximately USD 1.0 trillion in revenue.

This leadership is attributed to the region’s robust manufacturing infrastructure, particularly in countries such as China, South Korea, and India, which serve as pivotal hubs for the production of consumer electronics and IT hardware.

The widespread adoption of smartphones, tablets, and wearable devices, coupled with increasing internet penetration and the proliferation of 5G networks, has significantly driven consumer demand. Moreover, governmental initiatives promoting digital transformation and smart city developments have further accelerated the uptake of IT devices across the region.

Product Analysis

In 2024, the Mobile Devices segment held a dominant market position in the IT devices sector, capturing more than a 46.3% share. This leadership can be attributed to several pivotal factors driving demand and adoption across consumer and enterprise segments. Firstly, the widespread deployment and advancement of 5G technology have significantly contributed to the expansion of the mobile devices market.

With 5G networks enhancing mobile connectivity and data transfer speeds, there has been a surge in consumer demand for 5G-enabled smartphones and tablets. These devices offer faster access to digital services, improved streaming of high-definition content, and more reliable online connections, which are essential for today’s mobile-first world.

Additionally, the mobile devices segment benefits from continuous innovations and product enhancements. Major manufacturers are consistently investing in research and development to introduce new functionalities and improve existing ones, such as enhanced camera capabilities, longer battery life, and superior display technologies.

Moreover, the mobile-first approach in various software and service sectors has supported the dominance of mobile devices. As businesses and services optimize their applications for mobile use, consumers are increasingly reliant on smartphones and tablets for a variety of daily activities including banking, shopping, and social networking.

Operating System Analysis

In 2024, the Android segment maintained a dominant position in the IT devices market, securing a significant market share of more than 40.2%. This leadership can be largely attributed to the operating system’s open-source framework, which permits extensive customization and adaptability across a diverse range of devices.

The prevalence of Android across multiple device categories can be credited to its accessibility and adaptability, which appeal to a broad spectrum of manufacturers and consumers alike. Manufacturers benefit from the lower costs associated with the open-source nature of Android, avoiding licensing fees while gaining the flexibility to modify the system to suit their devices’ specific needs.

This adaptability has enabled Android to become the platform of choice not only for smartphones and tablets but also for a growing array of connected devices. Moreover, Android’s extensive app ecosystem, supported by Google Play and other platforms, continues to drive consumer preference for Android devices.

The availability of millions of apps across various categories, including entertainment, productivity, and social media, enhances user engagement and loyalty. The continued advancement of Android is further supported by significant investments in mobile technologies, such as the expansion of 5G networks.

Distribution Channel Analysis

In 2024, the offline segment of the IT devices market held a dominant position, capturing more than a 57.8% share. This strong market presence can be attributed to several key factors that underline the ongoing value of physical retail environments in the distribution of IT devices.

Primarily, the offline channel benefits from the direct interaction it offers consumers. Physical stores provide a tactile experience, allowing customers to handle and test products before purchasing. This hands-on interaction is particularly valued in the IT sector, where the look and feel of a device, as well as its operational capacity, play significant roles in the consumer’s purchasing decision.

Retail locations, including electronics stores, department stores, and authorized resellers, offer personalized customer service that helps in addressing specific queries and easing the purchasing process, which can be pivotal in complex product categories such as IT devices.

Moreover, the offline channel’s dominance is reinforced during high retail traffic periods such as Black Friday and other holiday seasons, where in-store promotions and the immediate product availability drive significant sales volumes. Such events capitalize on the impulse buying behavior of consumers who prefer to walk out with a product in hand rather than waiting for online delivery.

Application Analysis

In 2024, the Enterprise segment of the IT devices market held a commanding position, capturing more than a 58.3% share. This dominance can be attributed to several key factors that highlight the integral role of IT devices within corporate and organizational environments.

Firstly, enterprises are increasingly investing in digital transformation, integrating advanced IT devices into their core operations to enhance productivity, streamline processes, and facilitate remote work. This includes the deployment of sophisticated network infrastructure, data management systems, and cybersecurity solutions, which are essential for maintaining operational continuity and safeguarding sensitive information.

Secondly, the growing reliance on cloud computing and the expansion of 5G technology have further bolstered the demand for enterprise IT devices. These technologies require robust hardware that can handle increased data volumes and provide faster, more reliable connectivity to support cloud-based applications and services.

Moreover, the enterprise segment’s expansion is supported by the widespread adoption of the Internet of Things (IoT) and smart technologies, which are being increasingly utilized to optimize operations, reduce costs, and improve service delivery in industries ranging from manufacturing to healthcare.

Key Market Segments

By Product

- Mobile Devices

- Peripheral Devices

- Computers and Laptops

- Networking Equipment

By Operating system

- Windows

- macOS

- Linux

- iOS

- Android

- Others

By Distribution Channel

- Online

- Offline

By Application

- Enterprise

- Consume

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Adoption of IoT and Smart Devices

The IT devices market is significantly driven by the burgeoning adoption of the Internet of Things (IoT) and smart devices across various sectors. As industries continue to embrace digital transformation, there is a heightened demand for interconnected devices that can communicate and operate intelligently within an IoT ecosystem.

This trend is particularly pronounced in sectors such as healthcare, manufacturing, and consumer electronics, where the integration of smart technologies facilitates enhanced operational efficiency, improved health monitoring, and better consumer convenience.

The proliferation of smart home devices, such as smart thermostats, home security systems, and smart appliances, further underscores the growing consumer appetite for connected technology, thereby fueling the expansion of the IT devices market.

Restraint

Security Concerns

Despite the rapid growth of IT devices, security remains a significant restraint. The increasing complexity and connectivity of IT devices have escalated the vulnerability to cyber-attacks, data breaches, and privacy issues. As more devices connect to the internet and each other, the potential entry points for hackers multiply, thereby heightening the risk of unauthorized access and data theft.

This challenge is compounded in industries handling sensitive information, such as finance and healthcare, where the implications of security breaches can be particularly severe. Consequently, the persistent concerns regarding data security and privacy are compelling organizations and consumers to be cautious, potentially slowing down the market’s growth.

Opportunity

Advancements in Artificial Intelligence (AI)

The IT devices market stands to benefit enormously from advancements in artificial intelligence (AI). AI integration into IT devices not only enhances the functionality and efficiency of these devices but also opens up new avenues for automation and personalized user experiences.

For instance, AI can enable more sophisticated data analysis tools, improve the responsiveness of voice-activated assistants, and allow for more accurate health monitoring systems in wearable technologies. As AI continues to evolve, its integration into IT devices is expected to drive innovation, create new product categories, and provide substantial growth opportunities for the market.

Challenge

Technological Obsolescence

One of the primary challenges facing the IT devices market is the rapid pace of technological change, leading to obsolescence. The constant evolution of technology means that devices can become outdated quickly, compelling both consumers and enterprises to upgrade frequently to keep pace with new standards and capabilities.

This rapid turnover can lead to increased costs and waste, posing significant challenges for both market growth and environmental sustainability. Furthermore, the need for continuous investment in R&D to stay competitive can strain resources, particularly for smaller players in the market.

Growth Factors

The IT devices market is poised for significant growth, driven by several key factors. Firstly, the rollout of 5G technology is a major catalyst. As 5G networks become more widespread, demand for 5G-enabled devices is surging, creating new opportunities for IT device manufacturers to expand their product offerings and market reach.

Additionally, the increasing integration of Artificial Intelligence (AI) across various tech sectors is pushing IT spending upwards. Businesses are investing heavily in generative AI technologies, recognizing their potential to transform operations and drive efficiencies.

Moreover, the demand for cloud computing continues to soar, significantly influencing the IT market. Many businesses are transitioning to cloud-hosted applications for their daily operations, driven by the enhanced scalability and flexibility that cloud services offer.

Emerging Trends

Several trends are shaping the future of the IT devices market. The evolution of smart cities is one such trend, where the development and deployment of interconnected devices are enhancing urban management and efficiency.

Furthermore, the market is witnessing a shift towards hybrid work environments, which is accelerating the adoption of cloud computing and sustainable IT practices. The focus on cybersecurity is also more pronounced than ever, with businesses increasing their investment in security solutions to protect against escalating cyber threats.

Business Benefits

Advancements in IT devices are yielding substantial business benefits. The proliferation of IoT devices, for example, is enhancing operational efficiencies and data analytics capabilities. Businesses are leveraging these devices to gain real-time insights and improve decision-making processes.

Additionally, the shift towards AI and machine learning is enabling businesses to streamline operations and offer more personalized services to customers. These technologies are being integrated into various products, from smartphones to enterprise software, enhancing productivity and user experiences.

Key Player Analysis

In the rapidly evolving IT devices market, leading companies have strategically pursued acquisitions, introduced innovative products, and explored mergers to strengthen their market positions and drive technological advancement.

Apple Inc. has actively expanded its capabilities in artificial intelligence (AI) through targeted acquisitions. In November 2024, Apple acquired Pixelmator, a renowned image editing application, aiming to enhance its suite of creative tools and integrate advanced AI-driven image processing features.

Samsung Electronics has focused on diversifying its product offerings and investing in emerging technologies. In January 2024, Samsung’s CEO indicated plans for a significant merger and acquisition deal within the year, targeting areas such as AI, digital health, fintech, robotics, and vehicle components.

Dell Technologies has prioritized advancements in AI and infrastructure solutions. In May 2024, Dell expanded its AI portfolio by introducing the Dell AI Factory in collaboration with NVIDIA, aiming to accelerate AI adoption across enterprises.

Top Key Players in the Market

- Microsoft Corporation

- Open Systems International Inc.

- Rockwell Automation Inc.

- S & C Electric Company

- Samsung Electronics Co Ltd

- Schneider Electric S.E.

- Siemens AG

- ABB Ltd.

- Apple Inc.

- Cisco Systems

- Dell Technologies Inc.

- Eaton Corporation

- Honeywell International Inc.

- Landis Gyr Inc.

- Lenovo Group Limited

Recent Developments

- In February 2024, Xiaomi revealed plans to introduce a new wearable device aimed at enhancing personal security and privacy. This upcoming innovation is designed to detect hidden cameras in the surrounding environment and alert users if they are being secretly photographed.

- In February 2024, Honar prepared to launch its second smartphone in the Indian market, the Honar X9b 5G. The brand actively promoted the product on social media, placing strong emphasis on its ‘ultra-bounce’ display technology.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Trillion Forecast Revenue (2034) USD 7.3 Trillion CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product (Mobile Devices, Peripheral Devices, Computers and Laptops, Networking Equipment), By Operating System (Windows, macOS, Linux, iOS, Android, Others), By Distribution Channel(Online, Offline), By Application (Enterprise, Consumer) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Open Systems International Inc., Rockwell Automation Inc., S & C Electric Company, Samsung Electronics Co Ltd, Schneider Electric S.E., Siemens AG, ABB Ltd., Apple Inc., Cisco Systems, Dell Technologies Inc., Eaton Corporation, Honeywell International Inc., Landis Gyr Inc., Lenovo Group Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Microsoft Corporation

- Open Systems International Inc.

- Rockwell Automation Inc.

- S & C Electric Company

- Samsung Electronics Co Ltd

- Schneider Electric S.E.

- Siemens AG

- ABB Ltd.

- Apple Inc.

- Cisco Systems

- Dell Technologies Inc.

- Eaton Corporation

- Honeywell International Inc.

- Landis Gyr Inc.

- Lenovo Group Limited