Global Invoice Factoring Market Size, Share Analysis Report By Type (Recourse Factoring, Non-Recourse Factoring), By Factoring Category (Domestic Factoring, International Factoring), By Provider (Banks, Non-banking Financial Companies), By Industry Vertical (Manufacturing, Construction, IT and Telecommunications, Healthcare, Energy and Utilities, Transportation and Logistics, Other Industry Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 138463

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- France Invoice Factoring Market Size

- Type Analysis

- Factoring Category Analysis

- Provider Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

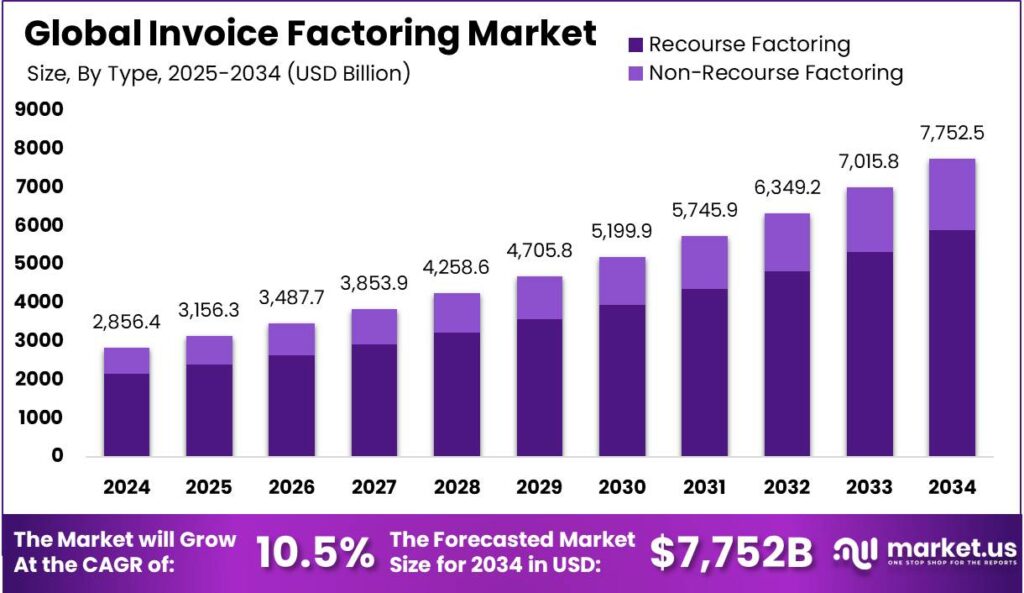

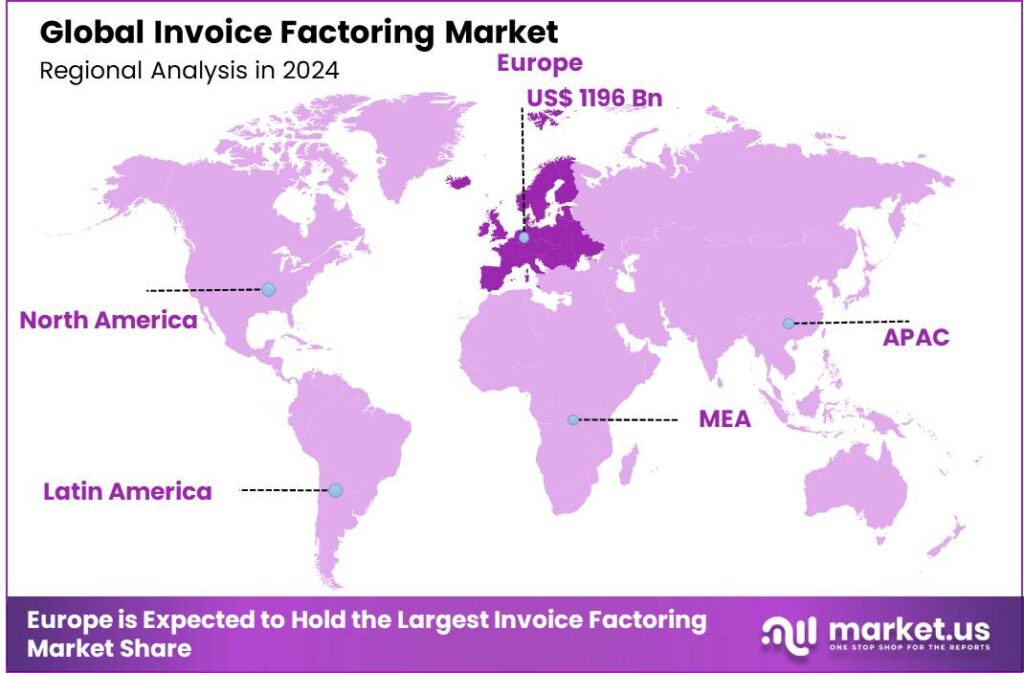

The Global Invoice Factoring Market size is expected to be worth around USD 7,752 Billion By 2034, from USD 2,856.4 Billion in 2024, growing at a CAGR of 10.50% during the forecast period from 2025 to 2034. In 2024, Europe led the global invoice factoring market, holding a dominant share of over 41.9%, with revenues reaching USD 1196 billion.

Invoice factoring, also known as accounts receivable factoring or debt factoring, is a financial transaction where businesses sell their outstanding invoices to a third-party company, known as a factor, at a discount. This allows businesses to receive immediate cash advances, typically ranging from 80% to 90% of the invoice value, which can improve their cash flow and immediate financial needs.

The invoice factoring market provides a critical service by offering liquidity to businesses that need immediate funding without waiting for their customers to pay their invoices. This market is particularly beneficial for small to medium-sized enterprises (SMEs) that operate on thinner cash reserves and may not have access to traditional financing options. The accessibility of this financial service has grown, with many providers offering varied terms that can cater to a diverse range of business needs and sectors.

The primary driving force behind the growth of the invoice factoring market is the need for businesses to manage their cash flow efficiently. Many companies face delays in payments which can hamper their operational capabilities. Factoring provides a solution by converting sales on credit terms into immediate cash flow.

Additionally, the ease of qualification and flexibility offered by invoice factoring makes it an appealing option compared to traditional financing methods, which often have more stringent credit requirements. Recently, there has been a significant shift towards digital and automated factoring solutions, which reduce the time and complexity involved in the factoring process.

According to data from ecapital, factoring rates in 2024 vary widely across industries, reflecting different levels of risk and funding needs. Transportation businesses enjoy some of the best terms, with factoring rates between 1.95%-4.0% and high advance rates of 97%-100%+, making it a cost-effective financing option. Healthcare companies face slightly higher costs, with rates ranging from 2.5%-4.5% and advance rates between 85%-95%, likely due to complex billing cycles.

Staffing agencies and general small businesses see similar rates of 1.95%-4.5%, with advance rates of 85%-97%, making factoring a flexible funding option. However, construction firms experience the highest costs, with factoring rates between 3.0%-6.0% and lower advance rates of 70%-80%, reflecting the industry’s higher financial risk.

Technological advancements have facilitated a more streamlined approach, allowing for faster approval processes and quicker fund disbursement. Moreover, there is an increasing trend of integrating invoice factoring services with other financial products, providing a comprehensive suite of solutions for business clients.

The demand for invoice factoring services is largely driven by SMEs that require swift access to working capital to maintain operations, manage inventory, or expand their business activities. The flexibility of factoring services, allowing businesses to factor all or select invoices, also caters to varying cash flow needs, thus broadening the market demand across different industries and sectors.

For the businesses engaging in invoice factoring, the key benefits include improved liquidity, better cash flow management, and the ability to handle larger orders or contracts without being constrained by cash flow limitations. Factoring companies benefit from steady returns through fees associated with the services provided, while also mitigating risk through various forms of credit analysis and insurance on the receivables they purchase.

Key Takeaways

- The Global Invoice Factoring Market size is projected to reach USD 7,752 Billion by 2034, up from USD 2,856.4 Billion in 2024, growing at a CAGR of 10.50% during the forecast period from 2025 to 2034.

- In 2024, the Recourse Factoring segment held a dominant position, capturing more than 76.1% of the global invoice factoring market.

- The Domestic Factoring segment also dominated in 2024, accounting for over 70.5% of the global invoice factoring market share.

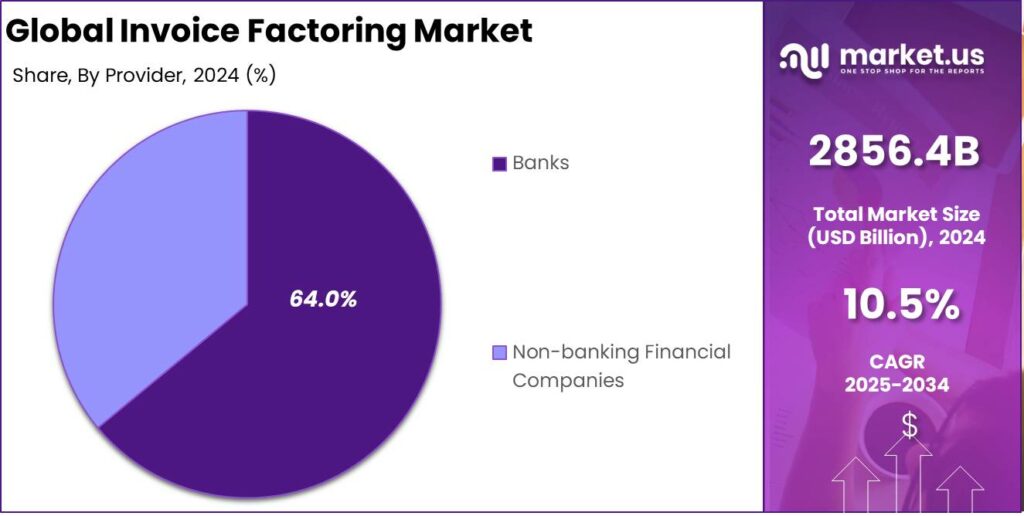

- The Banks segment held a leading market share in 2024, with more than 64.0% of the invoice factoring market.

- The Manufacturing segment accounted for over 22.4% of the invoice factoring market in 2024.

- Europe led the global invoice factoring market in 2024, capturing more than 41.9% of the market share, with total revenues amounting to USD 1,196 billion.

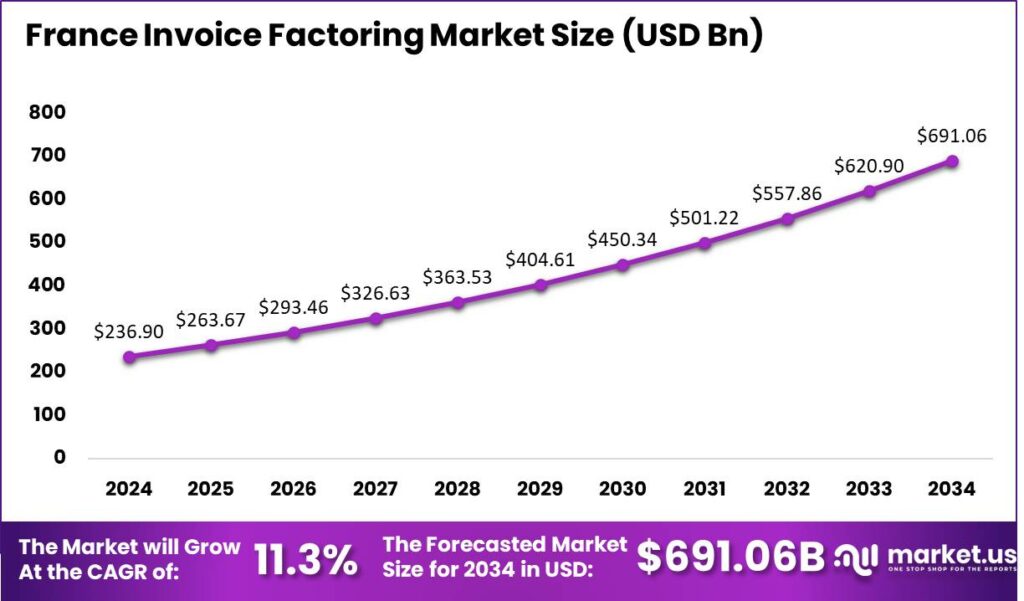

- In 2024, France’s invoice factoring market was valued at USD 236.9 billion, and it is projected to grow at a CAGR of 11.3% over the forecast period.

France Invoice Factoring Market Size

In 2024, the invoice factoring market in France was valued at USD 236.9 billion. It is projected to expand at a compound annual growth rate (CAGR) of 11.3% over the forecast period. This growth signifies a robust increase in the adoption of invoice factoring solutions among French businesses, driven by the evolving financial needs of companies across various sectors.

The growth of the French invoice factoring market can be attributed to the rising demand for quick liquidity, especially among SMEs. This alternative financing solution helps businesses manage cash flow and support expansion without relying on traditional bank loans.

The growth in international trade among French companies has increased the demand for invoice factoring services. As businesses expand globally, factoring helps manage cash flow, mitigate currency risks, and handle credit management. This trend suggests continued growth and opportunities in the French invoice factoring market.

In 2024, Europe held a dominant market position in the global invoice factoring market, capturing more than a 41.9% share, with revenues amounting to USD 1196 billion.

Europe’s mature financial markets and strong economic frameworks have fostered a tradition of using non-traditional financial instruments like invoice factoring. This has contributed to significant growth in the sector, supporting businesses in managing cash flow and funding expansion.

Europe’s dominance in the invoice factoring market is driven by the high number of SMEs that rely on factoring to manage cash flow, as they often struggle with securing traditional loans. The region’s strong regulatory environment ensures transparency and reliability, making it an appealing market for both factoring companies and clients.

The growth of international trade within the EU and expanding export markets in Eastern Europe are driving the demand for invoice factoring. European factoring companies are helping businesses manage both domestic and complex international receivables, strengthening their role in global trade finance.

Type Analysis

In 2024, the Recourse Factoring segment held a dominant market position, capturing more than a 76.1% share of the global invoice factoring market. This segment’s prominence is primarily due to its lower risk and cost for factors.

Recourse factoring allows the factor to have a safety net where the original seller is liable if the debtor fails to settle the invoice. This reduces the financial risk for factors, making it a more appealing option for them and leading to more competitive and attractive pricing for businesses seeking immediate cash flow solutions.

Recourse Factoring holds a significant market share due to its popularity among SMEs, who favor it for quicker cash access and lower fees compared to non-recourse factoring. The ability to manage non-payment risk through their own credit practices makes it a practical and attractive option for these businesses.

The dominance of Recourse Factoring in the market is due to its familiarity and simplicity for both factors and businesses. With established procedures and legal frameworks, it offers a reliable, trusted financing option, enabling quicker decisions and smoother transactions.

Factoring Category Analysis

In 2024, the Domestic Factoring segment held a dominant market position, capturing more than a 70.5% share of the global invoice factoring market. This substantial market share is primarily attributed to the segment’s strong alignment with the cash flow needs of domestic businesses, which often face delays in payment due to extended credit terms offered to their customers.

Domestic Factoring dominates due to its lower risk profile compared to international factoring. By staying within the same country, businesses avoid complexities like currency fluctuations and legal differences. This simplicity makes domestic factoring more accessible and appealing, especially to smaller businesses and those new to factoring.

Small and medium-sized enterprises (SMEs), particularly those operating on thin margins and limited cash reserves, heavily rely on domestic factoring. This segment’s attractiveness lies in its ability to offer quick cash flow solutions without the need for traditional credit, which can be hard to obtain for smaller companies.

The Domestic Factoring segment is set for continued growth, fueled by the rising number of startups and growing SMEs needing quick funding solutions. As the demand for flexible financing increases, domestic factoring will play a crucial role in supporting small and medium-sized businesses.

Provider Analysis

In 2024, the Banks segment held a dominant market position in the invoice factoring market, capturing more than a 64.0% share. Banks have traditionally been the preferred choice for businesses seeking invoice factoring services due to their established reputations and comprehensive financial services.

The trust and reliability associated with banks enable them to attract a larger client base, particularly among small and medium enterprises (SMEs) that rely on the credibility of their financial partners to support their operations and growth ambitions. Moreover, banks offer more competitive rates and terms due to their access to cheaper funding sources and their ability to manage risk effectively.

The Banks segment maintains a leading position due to their extensive network and customer base. By leveraging existing infrastructure, banks seamlessly offer factoring services alongside other financial products. Their ability to cross-sell factoring to current clients further strengthens their market position.

Furthermore, banks have the advantage of regulatory support which often favors established financial institutions over newer market entrants. Regulatory frameworks in many regions are more adapted to banking institutions, which simplifies compliance for these entities compared to non-banking financial companies (NBFCs).

Industry Vertical Analysis

In 2024, the Manufacturing segment held a dominant market position in the invoice factoring market, capturing more than a 22.4% share. This dominance can be attributed to the inherent nature of the manufacturing industry, which involves extensive supply chains, significant inventory needs, and prolonged invoice payment cycles.

Manufacturers often require immediate cash flow to maintain their operations and manage raw material procurement without disruptions. Invoice factoring provides a vital financial lifeline by enabling manufacturers to convert their accounts receivable into immediate working capital, thus supporting continuous production cycles and timely fulfillment of new orders.

Manufacturers typically deal with large invoices and high transaction volumes, which make them ideal candidates for factoring services. The size and frequency of transactions in the manufacturing sector provide a steady stream of factoring opportunities, contributing to the substantial share of this segment.

Global supply chain complexities and the need for quick adaptation to market changes make flexible financial solutions essential for manufacturers. Factoring services help manage financial pressures by providing cash flow to respond to market demands, invest in new technologies, and scale operations, all without waiting for lengthy payment terms.

Key Market Segments

By Type

- Recourse Factoring

- Non-Recourse Factoring

By Factoring Category

- Domestic Factoring

- International Factoring

By Provider

- Banks

- Non-banking Financial Companies

By Industry Vertical

- Manufacturing

- Construction

- IT and Telecommunications

- Healthcare

- Energy and Utilities

- Transportation and Logistics

- Other Industry Verticals

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Immediate Cash Flow Improvement

One of the primary reasons businesses turn to invoice factoring is the immediate boost it provides to cash flow. Instead of waiting for clients to pay their invoices, companies can access funds promptly by selling these receivables to a factor. This immediate access to cash enables businesses to meet operational expenses, invest in growth opportunities, and maintain smooth operations without the strain of delayed payments.

For instance, in industries like manufacturing and staffing, where upfront costs are significant, having immediate cash can be crucial for sustaining daily operations and taking on new projects. By converting accounts receivable into instant cash, businesses can better manage their financial health and reduce the uncertainties associated with payment delays.

Restraint

Cost Implications

While invoice factoring offers quick access to funds, it comes at a cost. Factors charge fees for their services, which can be a percentage of the invoice value or a flat fee, depending on the agreement. These costs can add up, especially for small businesses operating on thin profit margins.

Additionally, some factoring agreements may include clauses that hold the business responsible if the customer fails to pay the invoice, known as recourse factoring. This means that if a client defaults, the business not only loses the expected payment but also incurs additional costs associated with the factoring agreement. It’s essential for businesses to carefully assess these costs against the benefits of improved cash flow to determine if factoring is a financially viable option.

Opportunity

Leveraging Technology for Efficiency

The integration of technology into invoice factoring presents significant opportunities for businesses. Modern factoring companies are leveraging digital platforms to streamline the factoring process, making it more efficient and user-friendly. For example, some platforms offer real-time credit assessments, automated invoice submissions, and instant funding decisions.

This technological advancement reduces the time and paperwork traditionally associated with factoring, allowing businesses to access funds even more quickly. Moreover, digital platforms can offer better transparency, enabling businesses to track the status of their invoices and payments in real-time. By embracing these technological solutions, companies can enhance their financial agility and responsiveness in a competitive market.

Challenge

Customer Perception and Relationship Management

Engaging in invoice factoring can sometimes affect how a business is perceived by its customers. When a third-party factor takes over the collection of payments, customers might become aware of the company’s financing arrangements. This awareness could lead to assumptions about the company’s financial stability, potentially impacting the trust and relationship between the business and its clients.

Additionally, if the factor’s collection practices are more aggressive or differ from the company’s usual approach, it could strain customer relationships. It’s crucial for businesses to choose factoring partners carefully and ensure that their collection practices align with the company’s values and customer service standards to maintain positive client relationships.

Emerging Trends

One significant development is the integration of automation and advanced technologies. By leveraging machine learning and artificial intelligence, the factoring process becomes more efficient, allowing for quicker approvals and reducing manual errors.

Another trend is the expansion of invoice factoring into diverse industries beyond its traditional sectors. Fields such as technology, healthcare, and professional services are increasingly adopting factoring solutions to enhance cash flow and minimize financial risks.

Additionally, there’s a heightened focus on customer experience within the factoring industry. Companies are prioritizing client satisfaction by utilizing technology to create seamless user interactions and offering personalized services. This includes improved communication channels, prompt customer support, and tailored factoring solutions, all aimed at building long-term client relationships.

Business Benefits

Invoice factoring offers businesses immediate access to cash by converting outstanding invoices into working capital. This swift cash flow enables companies to manage daily expenses, invest in growth opportunities, and maintain financial stability without waiting for clients to pay their invoices.

Unlike traditional loans, invoice factoring doesn’t require businesses to incur debt. Since it’s not a loan but a sale of receivables, companies can improve their cash flow without adding liabilities to their balance sheets. This approach preserves the business’s credit standing and provides financial flexibility.

Moreover, invoice factoring often involves the factoring company handling collections, which reduces the administrative burden on businesses. This allows companies to focus more on their core operations, such as sales and customer service, rather than on chasing payments.

Key Player Analysis

The invoice factoring market has seen significant growth in recent years, with several key players dominating the industry.

altLINE, a subsidiary of The Southern Bank Company, offers straightforward invoice factoring services with a focus on customer satisfaction. They provide flexible funding options for businesses, including small to medium-sized enterprises (SMEs), without requiring long-term contracts.

FundThrough USA Inc. is a rapidly growing player in the invoice factoring space. Specializing in small businesses, FundThrough offers a user-friendly, tech-driven platform that simplifies the factoring process. Their online system allows businesses to submit invoices and receive funding quickly, making it ideal for companies that need immediate cash.

eCapital is one of the largest and most established players in the invoice factoring market. With over 20 years of experience, eCapital offers customized factoring solutions to businesses of all sizes, including those in industries such as transportation, staffing, and healthcare.

Top Key Players in the Market

- altLINE

- FundThrough USA Inc.

- eCapital

- Riviera Finance

- Breakout Finance, LLC

- Sonovate Limited

- Lloyds Bank

- Porter Capital

- Scale Funding

- Strategic Funding Source, Inc.

- Seacoast National Bank

- 1st Commercial Credit, LLC

- Other Key Players

Top Opportunities Awaiting for Players

- Technological Integration: Leveraging advancements in technology such as AI, machine learning, and blockchain is a major opportunity. These technologies enhance operational efficiencies, reduce risks, and improve the accuracy of credit assessments, thus attracting more clients looking for reliable and swift factoring services.

- Expansion into Emerging Markets: With Asia-Pacific and particularly countries like India and China showing rapid industrialization and an increase in cross-border trade, there’s significant potential for growth. Factoring companies can tap into these markets, where there is a rising demand for alternative financing solutions to address the prevalent cash flow challenges faced by SMEs.

- Development of Digital and Web-Based Platforms: The push towards digital transformation has led to the rise of online factoring platforms which offer quick, easy, and transparent factoring services. These platforms cater to the growing need for user-friendly and efficient financial services, particularly among small and medium-sized enterprises that are increasingly active in e-commerce and online marketplaces.

- Product Innovation and Flexible Solutions: Innovating new factoring models like micro-factoring or seasonal factoring provides tailored solutions that meet the diverse needs of various industries. Additionally, the integration of B2B Buy Now, Pay Later models into factoring services can help businesses manage cash flows better and offer extended payment terms to their clients.

- Strategic Partnerships with Fintech Firms: Collaborations with fintech firms can enable factoring companies to access cutting-edge technologies and innovative financial products. These partnerships help in staying ahead in a competitive market by offering enhanced services that meet the evolving needs of businesses.

Recent Developments

- In July 2024, The State Bank of India has introduced MSME Sahaj, a web-based invoice financing solution designed for microbusinesses and SMBs. This innovative service enables customers to secure funding against their sales invoices in under 15 minutes, from application to disbursement.

- By October 2024, eCapital’s Factoring division reported surpassing $205 million in year-to-date funding commitments, reflecting its ability to provide essential capital to clients across various industries.

Report Scope

Report Features Description Market Value (2024) USD 2,856.4 Bn Forecast Revenue (2034) USD 7,752 Bn CAGR (2025-2034) 10.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Recourse Factoring, Non-Recourse Factoring), By Factoring Category (Domestic Factoring, International Factoring), By Provider (Banks, Non-banking Financial Companies), By Industry Vertical (Manufacturing, Construction, IT and Telecommunications, Healthcare, Energy and Utilities, Transportation and Logistics, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape altLINE, FundThrough USA Inc., eCapital, Riviera Finance, Breakout Finance, LLC, Sonovate Limited, Lloyds Bank, Porter Capital, Scale Funding, Strategic Funding Source, Inc., Seacoast National Bank, 1st Commercial Credit, LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Invoice Factoring MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Invoice Factoring MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- altLINE

- FundThrough USA Inc.

- eCapital

- Riviera Finance

- Breakout Finance, LLC

- Sonovate Limited

- Lloyds Bank

- Porter Capital

- Scale Funding

- Strategic Funding Source, Inc.

- Seacoast National Bank

- 1st Commercial Credit, LLC

- Other Key Players