Global Intumescent Coatings Market Base(Water-based, Solvent-based, Epoxy-based), Type(Thin-Film, Thick-Film), Substrate(Structural Steel and Cast Iron, Wood), End-use Industry(Building and Construction, Automotive, Oil & Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 16221

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

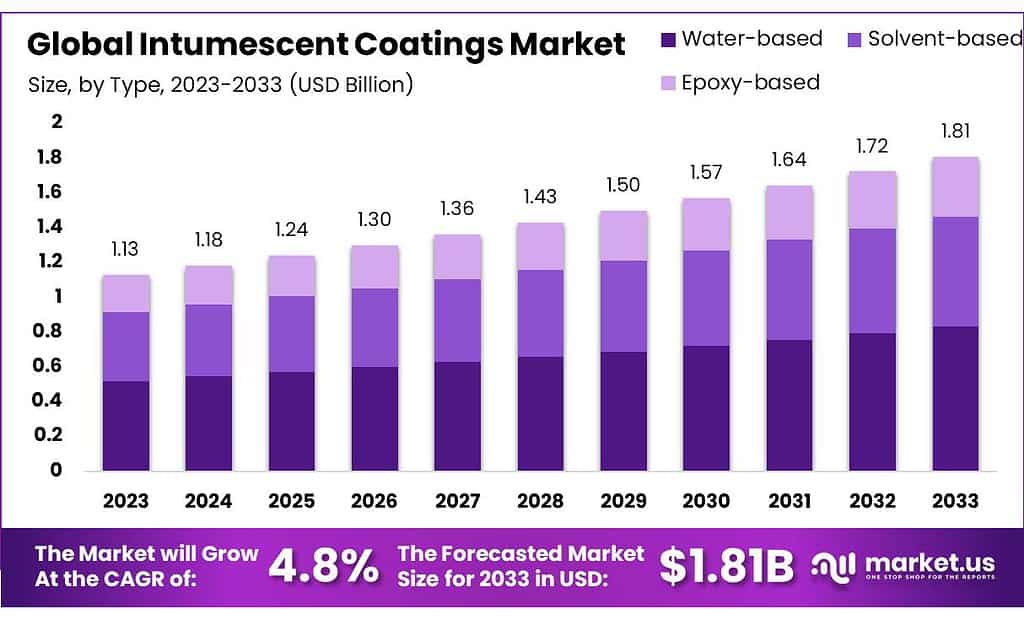

The Intumescent Coatings Market size is expected to be worth around USD 1.81 billion by 2033, from USD 1.13 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2023 to 2033.

The intumescent coating forms a protective layer by chemical reaction and acts as an insulation layer. Intumescent coatings can be used for fireproofing structural membranes and buildings. They are sometimes referred to as intumescent coatings and are used in buildings as a passive fire retardant measure.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Intumescent Coatings Market is set to expand, reaching an estimated value of USD 1.81 billion by 2033, showcasing a projected growth from USD 1.13 billion in 2023, with a compound annual growth rate (CAGR) of 4.8%.

- Intumescent Coatings Overview: These coatings create protective layers through chemical reactions, acting as insulation against fire. Widely used in structural membranes and buildings, they’re recognized for passive fire retardant properties.

- Types and Substrates: Intumescent coatings vary by base (water, solvent, epoxy), type (thin-film, thick-film), and substrate (structural steel, cast iron, wood). Each type offers distinct advantages in fire protection tailored for different materials and applications.

- End-Use Industries: They play a crucial role in multiple sectors such as building and construction, automotive, oil & gas, and more, providing fire protection to materials and equipment critical for safety and compliance.

- Market Drivers: The surge in construction, preference for wooden aesthetics, safety awareness, and the need for lightweight materials in various industries are significant factors driving market growth.

- Challenges Faced: Complex application processes, meeting required thickness for effectiveness without compromising aesthetics, durability issues, and evolving compliance standards pose challenges to widespread adoption.

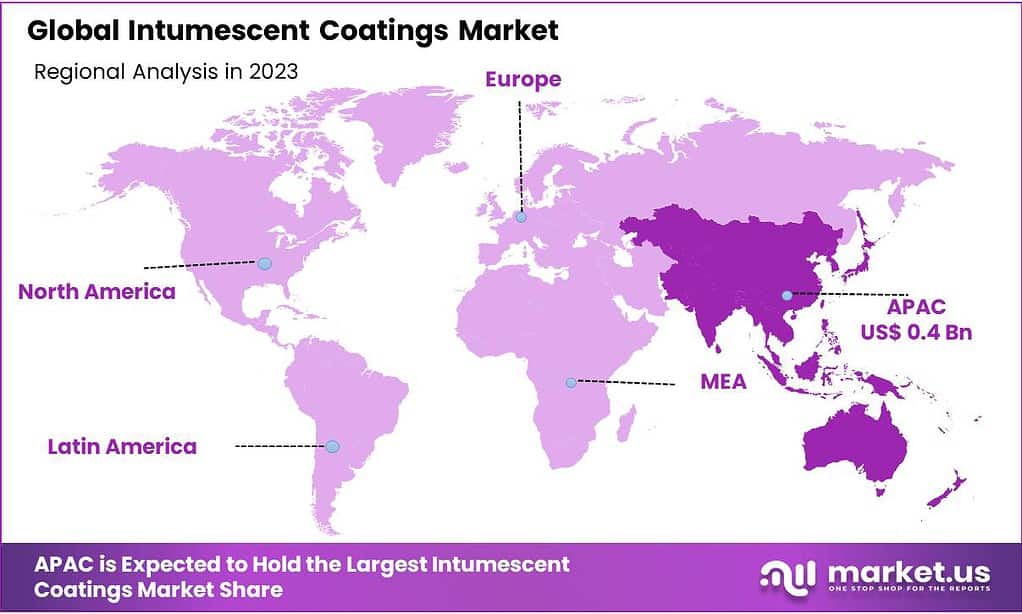

- Regional Analysis: The Asia Pacific dominates the market due to factors like proximity to raw materials, industrialization, and low VOC emissions. Emerging economies with low labor costs contribute significantly to the market’s demand.

- Key Players and Developments: Market competitiveness is high, with players focusing on strategic initiatives like geographic expansion, new product launches, mergers, and acquisitions to strengthen their positions.

- Opportunities and Innovation: Increasing fire safety regulations, architectural trends, automotive demands, and advancements in coatings’ formulations present avenues for market growth and innovation.

Base

In 2023, Water-based intumescent coatings emerged as the leading base in the market, securing over 35.8% of the market share. These coatings gained prominence due to their eco-friendly nature, low VOC content, and ease of application, making them preferred choices across various industries for fire protection and resistance purposes.

Water-based coatings use water as their main solvent, making them eco-friendly solutions that emit less volatile organic compounds (VOCs) and pose less of a health risk than their alternatives. Plus, they dry quickly and require minimal cleanup following application. While they may not be as resistant to high temperatures as other types, they are preferred in situations where VOC emissions are a concern or for interior applications where fire resistance requirements are not extremely high.

Solvent-based coatings and solvents serve as the base. They are recognized for their durability and resistance to harsh environments. While they might contain higher levels of VOCs compared to water-based alternatives, they often perform exceptionally well under extreme conditions, offering superior fire protection. These coatings are commonly used in high-heat areas and outdoor applications where durability is a priority.

Epoxy-based coatings employ epoxy resins as the base material. They are renowned for their strength and toughness, providing robust fire protection. Epoxy-based intumescent coatings are suitable for scenarios where exceptional fire resistance is required, such as structural steel elements in buildings or infrastructure. Their ability to endure high temperatures while maintaining integrity makes them a preferred choice for critical fireproofing applications.By Type

Thin-Film Intumescent Coatings held over 53.8% market share in 2023. Thin-Film coatings are popular due to their thin application and increased fire protection capabilities while remaining visually pleasing – making them suitable for various structures without compromising aesthetic appeal.

Intumescent coatings come in two primary types: thin-film and thick-film variants, each offering distinct advantages in fire protection. Thin-film coatings are applied in relatively slender layers, delivering fire resistance without adding significant bulk. They are particularly useful in spaces where maintaining aesthetics or minimizing coating thickness is essential. Thin-film coatings provide a sleek protective layer that proves beneficial when space or weight considerations are critical.

Thick-film intumescent coatings provide robust fire protection when applied in thick layers, providing a thicker protective barrier and offering additional layers of defense against fire hazards. Thick-film coatings are great for heavy-duty applications where additional protection against fire risks is necessary, including applications involving hazardous environments where high temperatures or fire risks could pose issues.

By Substrate

Structural Steel and Cast Iron held over 59% share in 2023’s Intumescent Coatings market, accounting for almost 69%. These coatings are extensively utilized to protect structural steel and cast iron elements against potential fire hazards in construction settings and industrial settings ensuring safety during operation.

Intumescent coatings cater to distinct substrates, prominently comprising structural steel and cast iron, alongside wood. In the realm of structural steel and cast iron, these coatings serve as a crucial defense mechanism against fire hazards. Their functionality lies in expanding when confronted with elevated temperatures, creating a robust insulating char layer. This layer serves as a barrier that shields the substrate, ensuring enhanced fire resistance. Such coatings find extensive use in commercial and industrial domains, offering a vital protective shield to steel and cast iron structures.

Conversely, intumescent coatings designed for wood aim to provide fire-resistant attributes to wooden surfaces. These coatings respond to fire exposure by swelling, thereby forming a protective layer. This layer effectively retards the advancement of flames, a pivotal characteristic for various settings. Applications span residential and commercial construction, where ensuring fire protection for wooden structures or surfaces is imperative to bolster overall safety standards.

By End-use Industry

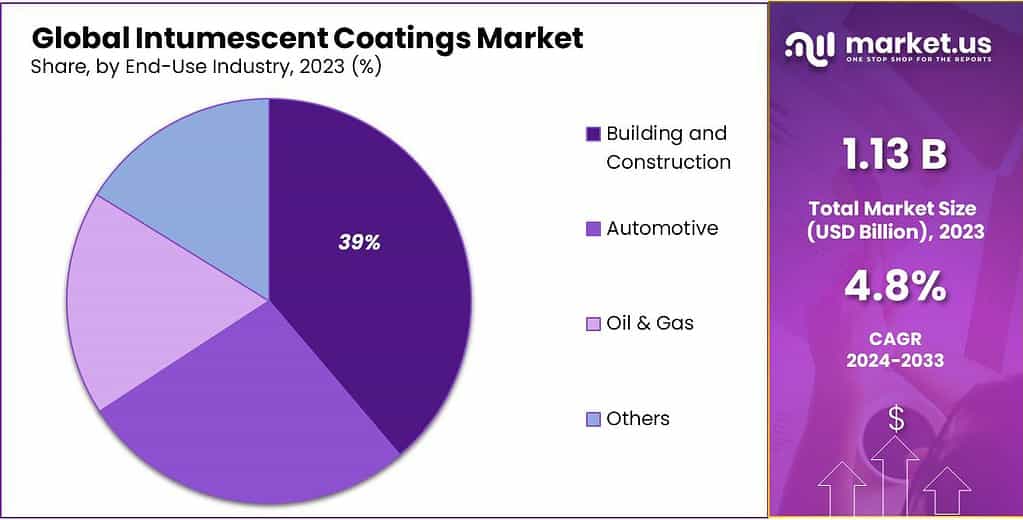

In 2023, Building and Construction emerged as the leading sector in the Intumescent Coatings market, securing over 38.8% share. These coatings play a crucial role in ensuring fire protection and safety measures in various construction projects, contributing significantly to the sector’s dominance within the market.

Intumescent coatings serve a critical purpose across diverse industries. In the building and construction sector, these coatings play a pivotal role in enhancing fire safety. They are applied to structural materials like steel and wood, providing a protective layer that expands when exposed to high temperatures, forming an insulating char layer that helps delay the spread of fire. This application in construction significantly contributes to fireproofing buildings, ensuring enhanced safety standards and compliance with fire regulations.

Within the automotive industry, intumescent coatings find their utility in protecting vehicle parts from extreme heat conditions. Fire-retardant coatings are applied to key components to provide an additional layer of fire protection in case of a fire-related incident, protecting both vehicle occupants and themselves in case of fire damage.

Oil and gas industries face high fire risks, and intumescent coatings have long been used to safeguard structures and equipment against their destructive power. They act as a safeguard, offering a critical layer of defense to prevent structural damage and ensure operational safety. In essence, these coatings have emerged as indispensable solutions across multiple sectors, effectively contributing to fire protection and safety measures in diverse industries. Their ability to withstand high temperatures and provide a protective barrier makes them an integral part of fire safety protocols in various applications.

*Actual Numbers Might Vary In The Final Report

Key Market Segments

Base

- Water-based

- Solvent-based

- Epoxy-based

Type

- Thin-Film

- Thick-Film

Substrate

- Structural Steel and Cast Iron

- Wood

End-use Industry

- Building and Construction

- Automotive

- Oil & Gas

- Others

Drivers

Steel beams are crucial in construction, often coated to lower the risk of fires. This has driven the intumescent market’s growth, riding on the surge in construction worldwide.

The trend towards wooden aesthetics and products means coating the wood with intumescent materials to prevent combustion. As wood becomes more popular in materials and flooring, it’s fueling the intumescent coating market’s expansion.

Increasing safety awareness and regulations are major growth factors for intumescent coatings. They’re seen as safer alternatives due to their lighter weight, unlike other coatings that add heaviness to materials. This demand for lightweight options in the automotive and construction industries has made intumescent coatings a preferred choice.

Intumescent coatings not only offer safety but also reduce the overall weight of structures. This feature aligns well with the increasing demand for lightweight components in industries. These coatings are gaining traction for their ability to enhance safety while contributing to the lighter weight of structures, boosting the intumescent market’s growth.

Restraints

Although intumescent coatings markets are experiencing strong growth, certain restraints remain. One significant obstacle stems from their complex and expensive application process; installing intumescent coatings requires special techniques and skilled labor, making the application more intricate than with conventional coatings and increasing overall costs significantly compared with their counterparts – an obstacle that makes widespread adoption harder in industries that place a premium on cost reduction.

An additional hindrance lies with the thickness required for effective fire protection. Intumescent coatings require a specific thickness to provide sufficient fire resistance, which may compromise the aesthetic appeal of coated surfaces. Achieving this required thickness without altering their visual appeal may prove challenging, thus restricting their application in certain architectural or design-driven projects.

Durability and performance issues associated with intumescent coatings also pose unique challenges over time, due to factors like exposure to harsh environments, weather conditions or mechanical stresses which may compromise their longevity or effectiveness over time. Maintaining their fire protection properties under various environmental conditions remains of great importance.

Regulation changes and compliance standards may also affect the intumescent coatings market. Adherence to evolving regulations related to fire safety and environmental impact may require changes to composition or application methods for these coatings, creating additional challenges for manufacturers and users.

Collectively, these challenges, including application complexities, thickness requirements that affect aesthetics and durability issues as well as compliance with changing regulations impede intumescent coatings market growth and require innovations and advancements to address them.

Opportunities

The intumescent coatings market presents several opportunities as it pursues its expansion trajectory. One significant avenue of this growth lies within an increase in fire safety regulations across industries; with greater attention focused on preventing fire incidents in buildings, infrastructure, and vehicles leading to an increased need for effective fire protection solutions like intumescent coatings – creating an opportunity to expand this sector of the intumescent coatings market.

Architectural trends and practices, particularly those found in urban areas, present an ideal opportunity for intumescent coatings to grow in relevance. As more buildings incorporate cutting-edge designs and materials into their construction plans, there is an increased need for fireproof coatings that integrate seamlessly into contemporary aesthetics – these needs can be met by intumescent coatings with advanced formulations which offer both safety and visual appeal simultaneously.

Automotive markets present another avenue of market growth. With increased emphasis on lightweight materials to enhance fuel-efficiency, intumescent coatings may find greater adoption due to their lightweight properties and fire protection abilities. Their versatility aligns perfectly with industry requirements for safety without compromising weight reduction goals.

Research and development of intumescent coatings also present opportunities for innovation. Advancements in formulations that improve durability, enhance fire protection, or address environmental concerns may open doors for new applications or market expansion.

Overall, the intumescent coatings market offers tremendous opportunities, stemming from increased fire safety awareness, architectural advancements, automotive industry demands, and ongoing innovations. Capitalizing on these opportunities could spur growth and adoption across various sectors.

Challenges

Despite its growth potential, intumescent coatings face several obstacles despite their strong demand. One significant roadblock lies within their complex and costly application process compared to conventional coatings. Applying intumescents requires special techniques and skilled labor that make the application more laborious than usual and increase overall costs, impeding widespread adoption, especially within cost-sensitive industries.

Another challenge involves meeting the necessary thickness for effective fire protection. Intumescent coatings require specific thickness to provide adequate fire resistance, but this can affect their aesthetic qualities and limit their use in certain architectural or design-oriented projects. Achieving this balance is a difficult feat.

Maintaining the durability and performance of intumescent coatings over time presents its own set of difficulties. Factors like exposure to harsh environments, weather conditions or mechanical stresses may diminish their longevity or efficiency, leaving us to contend with maintaining fire protection properties under various circumstances.

Regulator changes and compliance standards can have an enormous effect on the intumescent coatings market. Adjustments must often be made in terms of composition or application methods to remain compliant with regulations regarding fire safety and environmental impact, creating additional challenges for manufacturers and users alike.

Collectively, these challenges – such as application complexity, thickness requirements impacting aesthetics and durability concerns, compliance with emerging regulations, and meeting compliance obligations – impede growth in the intumescent coatings market. Overcoming them requires innovation, technological advances and strategic approaches that foster market expansion and wider adoption.

Regional Analysis

The Asia Pacific dominated intumescent coatings markets and was responsible for 35.6% of the total global revenue in 2023. The region’s proximity to raw materials suppliers and the rapid industrialization and urbanization of India and China are all factors that will likely increase the demand for intumescent coats.

Low VOC emissions and the availability of raw materials have created huge opportunities for the growth of various end-uses in the region. Asia Pacific’s emerging nations have low labor costs, which attracted many foreign investors to invest in their manufacturing facilities. As a result, there is a growing demand for intumescent coatings in the region.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Global players face fierce competition from regional players as well as those with established supply chain networks and are familiar with the regulations and suppliers in their respective markets. Market players are now focusing on strengthening their position through strategic initiatives, such as geographic expansion, new product launches, mergers, and acquisitions, or partnerships. Jotun’s high-performance epoxy intumescent coating Steel Master 1200HPE was launched in April 2022. The new intumescent coat protects the cellulosic flame for infrastructure buildings for 120 minutes.

Market Key Players

- Akzo Nobel N.V.

- Jotun

- Contego International Inc.

- Hempel A/S

- No-Burn Inc.

- Nullifire

- The Sherwin-Williams Company

- Carboline

- Albi Protective Coatings

- Isolatek International

- Rudolf Hensel GmbH

- PPG Industries

- 3M

- Sika AG

- BASF SE

Recent Development

April 2022: Steel Master 1200HPE is a high-performance epoxy intumescent coating that was introduced by Jotun.

Report Scope

Report Features Description Market Value (2023) USD 1.13 Billion Forecast Revenue (2033) USD 1.81 Billion CAGR (2023-2032) 4.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Base(Water-based, Solvent-based, Epoxy-based), Type(Thin-Film, Thick-Film), Substrate(Structural Steel and Cast Iron, Wood), End-use Industry(Building and Construction, Automotive, Oil & Gas, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Akzo Nobel N.V., Jotun, Contego International Inc., Hempel A/S, No-Burn Inc., Nullifire, The Sherwin-Williams Company, Carboline, Albi Protective Coatings, Isolatek International, Rudolf Hensel GmbH, PPG Industries, 3M, Sika AG, BASF SE Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How Do Intumescent Coatings Work?Intumescent coatings work via a chemical reaction when exposed to heat. They expand and form a carbonaceous char, which acts as a thermal insulator. This char layer delays the temperature rise in the substrate, providing fire protection for a certain duration.

Where Are Intumescent Coatings Used?These coatings are commonly used in commercial and industrial buildings, especially in structures where fire resistance is crucial, such as steel structures in high-rise buildings, airports, oil refineries, and warehouses. They are also utilized in infrastructure projects like bridges and tunnels.

What Are Intumescent Coatings?Intumescent coatings are fire-resistant coatings applied to steel and other structural materials. They swell when exposed to high temperatures, creating a layer of insulating char that slows down the transfer of heat, protecting the underlying material from fire damage.

Intumescent Coatings MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Intumescent Coatings MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Akzo Nobel N.V.

- Jotun

- Contego International Inc.

- Hempel A/S

- No-Burn Inc.

- Nullifire

- The Sherwin-Williams Company

- Carboline

- Albi Protective Coatings

- Isolatek International

- Rudolf Hensel GmbH

- PPG Industries

- 3M

- Sika AG

- BASF SE