Global Intelligent Transport Systems Market Size, Share, Growth Analysis By Mode of Transport (Roadways, Railways, Airways, Maritime), By Component (Hardware, Software, Services), By Type (Advanced Traffic Management Systems (ATMS), Advanced Traveler Information Systems (ATIS), Advanced Transportation Pricing Systems (ATPS), Advanced Public Transportation Systems (APTS), Advanced Commercial Vehicle Operations (ACVOS), Cooperative Vehicle-Infrastructure Systems (CVIS)), By Deployment Mode (On-Premise, Cloud, Edge/Fog), By Technology (IoT Sensors and V2X, AI and Machine-Learning Analytics, Digital Twin Platforms, 5G and C-V2X Connectivity), By Application (Traffic Management, Public Transport and Ticketing, Road Safety and Security, Freight and Fleet Management, Environmental and Emission Monitoring, Smart Parking and Guidance, Tolling and Congestion Pricing, Connected and Autonomous Vehicle (CAV) Support, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173831

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Mode of Transport Analysis

- By Component Analysis

- By Type Analysis

- By Deployment Mode Analysis

- By Technology Analysis

- By Application Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Intelligent Transport Systems Company Insights

- Recent Developments

- Report Scope

Report Overview

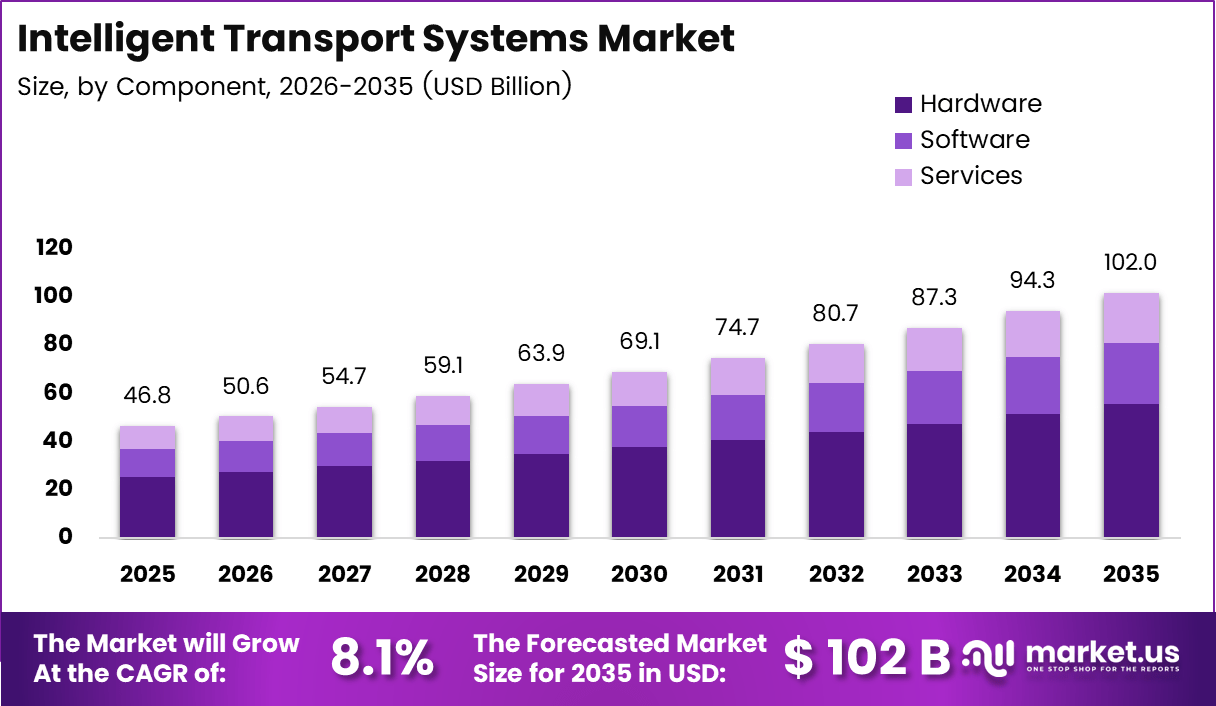

The Global Intelligent Transport Systems Market size is expected to be worth around USD 102 billion by 2035, from USD 46.8 billion in 2025, growing at a CAGR of 8.1% during the forecast period from 2026 to 2035.

The Intelligent Transport Systems Market represents the integration of digital technologies into transport infrastructure to improve mobility efficiency, safety, and sustainability. It combines real-time data analytics, connected infrastructure, and automation to manage traffic flows, public transport, and freight networks. Consequently, ITS increasingly supports smart city mobility strategies and data-driven transport governance.

The market expands as urbanization intensifies and transport networks face capacity constraints. Cities increasingly prioritize intelligent traffic control, adaptive signaling, and integrated mobility platforms. Moreover, digital transformation across transport authorities accelerates adoption, as decision-makers seek measurable reductions in congestion, delays, and operational inefficiencies across multimodal corridors.

Government investment plays a central role in shaping market momentum. National smart city programs, intelligent corridor initiatives, and road safety missions drive large-scale deployments. Simultaneously, regulatory frameworks increasingly mandate digital traffic monitoring, emissions reporting, and safety compliance. As a result, ITS becomes embedded within long-term infrastructure planning rather than treated as an optional technology layer.

Opportunities continue to emerge as ITS expands beyond traffic control into predictive mobility management. Cloud-based platforms, edge analytics, and real-time incident response systems enable scalable deployments. Furthermore, integration with public transport ticketing, congestion pricing, and logistics optimization unlocks recurring revenue models aligned with transport-as-a-service frameworks.

The urgency for Intelligent Transport Systems intensifies when viewed through global safety and environmental outcomes. According to the World Health Organization, road crashes cause over 1.3 million deaths and approximately 50 million injuries annually worldwide. In parallel, the transport sector contributes about 23% of global energy-related carbon dioxide emissions, reinforcing the need for smarter mobility management.

Market maturity is further reflected in investment behavior and consolidation activity. Global M&A momentum within the ITS ecosystem remained robust, with 127 transactions announced or completed in 2023, highlighting sustained strategic interest. These deals accounted for nearly 40% of total activity, while approximately 22.1% reflected platform-driven expansion strategies.

Overall, the Intelligent Transport Systems Market evolves as a foundational enabler of safer, cleaner, and more efficient mobility. By aligning policy objectives, digital infrastructure, and data intelligence, ITS supports measurable public outcomes. Consequently, it continues to attract long-term investment, regulatory backing, and widespread adoption across global transport ecosystems.

Key Takeaways

- Global Intelligent Transport Systems Market is projected to grow from USD 46.8 billion in 2025 to USD 102 billion by 2035, registering a CAGR of 8.1%.

- Roadways segment leads by mode of transport with a dominant share of 67.2%, reflecting the largest deployment base.

- Hardware remains the leading component segment, accounting for 54.6% of the total market value.

- Advanced Traffic Management Systems represent the largest type segment with a share of 39.1%.

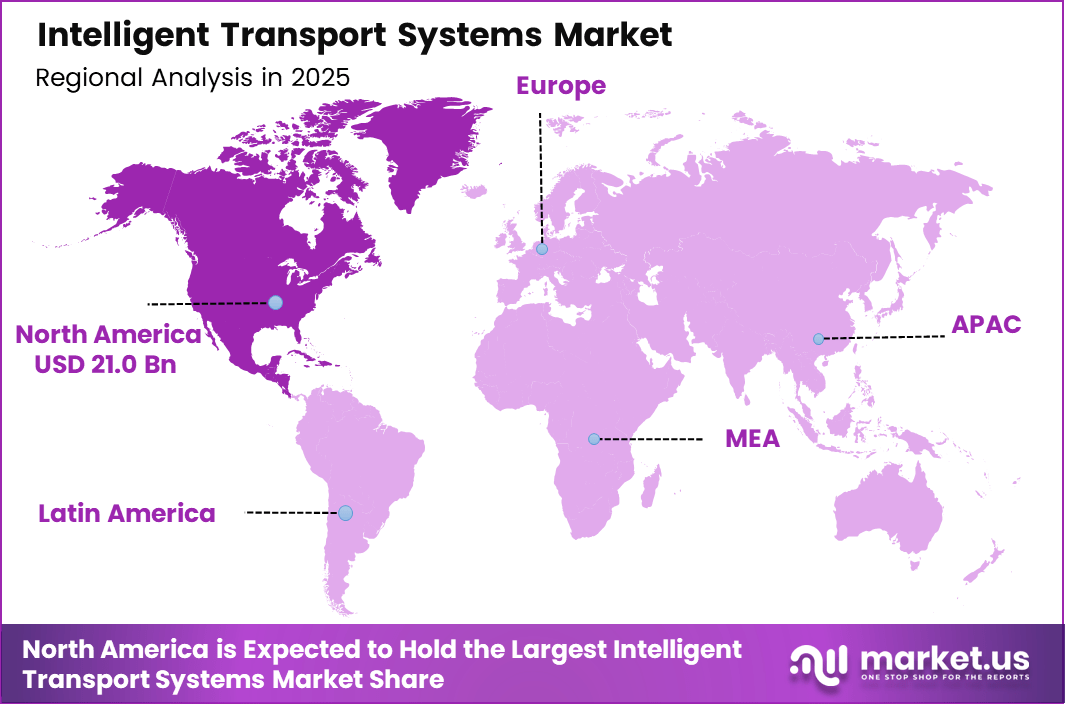

- North America dominates the regional market with a 44.9% share, valued at approximately USD 21 billion.

By Mode of Transport Analysis

Roadways dominates with 67.2% due to its extensive urban and intercity traffic infrastructure and higher digital traffic management adoption.

In 2025, Roadways held a dominant market position in the By Main Segment Analysis segment of Intelligent Transport Systems Market, with a 67.2% share. Urban congestion, highway digitization, and rising vehicle density continue to push governments toward smart signaling, surveillance, and adaptive traffic control. Consequently, road-based ITS deployments remain the primary focus of public investment strategies.

Railways benefit from centralized operations and predictable traffic flows, enabling efficient deployment of signaling automation, train control, and passenger information systems. Moreover, national rail modernization programs increasingly integrate intelligent monitoring to improve punctuality, energy efficiency, and safety. However, deployment scale remains lower compared to road transport networks.

Airways adopt intelligent transport solutions to enhance air traffic management, runway optimization, and passenger flow coordination. Advanced analytics support congestion reduction at major airports, while digital control towers improve operational efficiency. Nevertheless, limited airport numbers and high regulatory complexity restrict broader market share expansion.

Maritime applications focus on port traffic management, vessel tracking, and cargo movement optimization. Smart port initiatives leverage digital navigation aids and real-time monitoring to reduce turnaround times. Despite growing global trade, slower digitization across smaller ports limits overall penetration relative to other transport modes.

By Component Analysis

Hardware dominates with 54.6% due to large-scale deployment of sensors, cameras, controllers, and roadside infrastructure.

In 2025, Hardware held a dominant market position in the By Main Segment Analysis segment of Intelligent Transport Systems Market, with a 54.6% share. Cities prioritize physical infrastructure such as traffic sensors, surveillance cameras, and variable message signs. As a result, upfront capital expenditure remains hardware-intensive across ITS projects.

Software supports data processing, traffic analytics, and decision-making platforms that convert raw inputs into actionable insights. Increasing system complexity accelerates demand for intelligent algorithms and integrated dashboards. However, software spending typically follows hardware deployment, moderating its proportional contribution to overall market value.

Services include system integration, maintenance, consulting, and operational support. Growing system lifecycles drive recurring demand for managed services and upgrades. Still, service revenues trail hardware and software, as many public agencies retain in-house operational capabilities for core transport infrastructure.

By Type Analysis

Advanced Traffic Management Systems (ATMS) dominates with 39.1% due to its central role in congestion control and urban mobility optimization.

In 2025, Advanced Traffic Management Systems held a dominant market position in the By Main Segment Analysis segment of Intelligent Transport Systems Market, with a 39.1% share. Adaptive signaling, real-time monitoring, and incident response capabilities directly address congestion challenges. Therefore, municipalities prioritize ATMS within smart mobility programs.

Advanced Traveler Information Systems enhance commuter decision-making through real-time updates on routes, delays, and incidents. These systems improve travel efficiency and user satisfaction. Nevertheless, reliance on underlying traffic infrastructure limits independent deployment growth compared to core management systems.

Advanced Transportation Pricing Systems support congestion pricing, toll optimization, and demand management. Governments deploy these solutions to regulate traffic volumes and generate infrastructure funding. Adoption grows steadily but remains policy-dependent, constraining faster market expansion.

Advanced Public Transportation Systems focus on fleet tracking, scheduling, and passenger information for buses and mass transit. These systems improve reliability and ridership experience. However, deployment scope remains narrower than citywide traffic management platforms.

Advanced Commercial Vehicle Operations optimize freight routing, compliance monitoring, and fleet efficiency. Logistics digitalization supports gradual adoption, although fragmented commercial fleets slow uniform implementation across regions.

Cooperative Vehicle-Infrastructure Systems enable data exchange between vehicles and roadside units to enhance safety and traffic flow. While technologically promising, limited penetration of compatible vehicles currently restricts large-scale deployment.

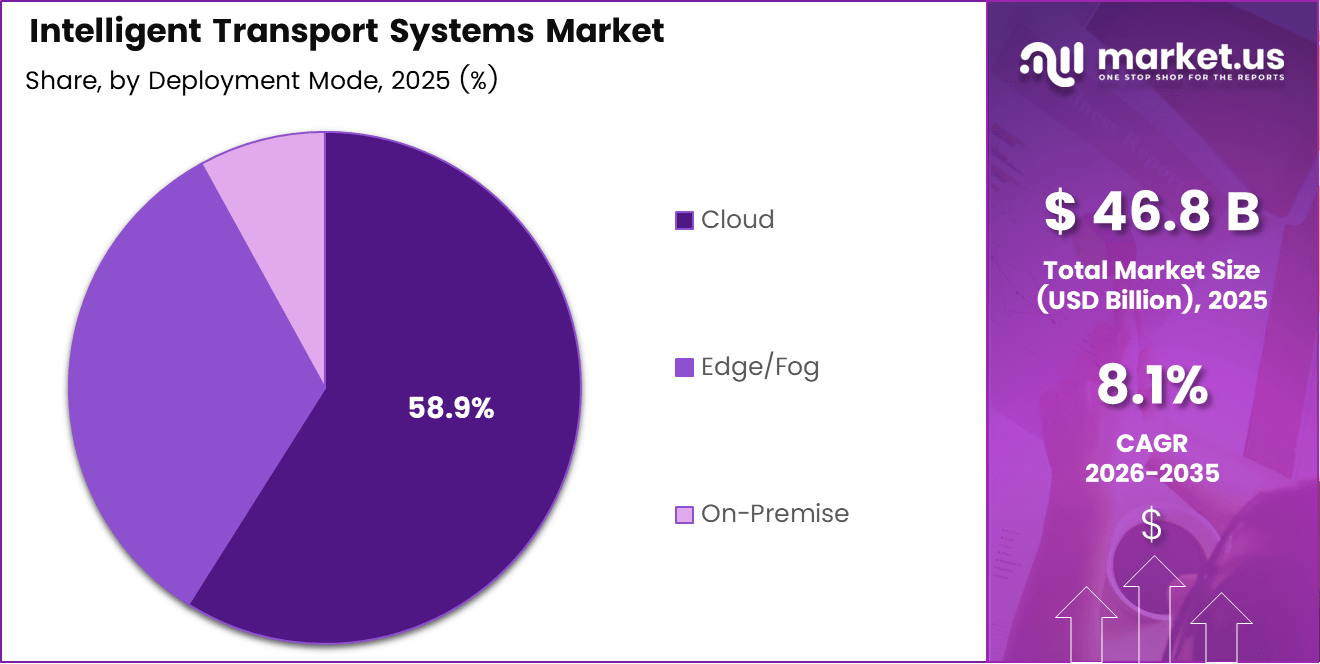

By Deployment Mode Analysis

Cloud dominates with 58.9% due to scalability, centralized analytics, and lower infrastructure complexity.

In 2025, Cloud held a dominant market position in the By Main Segment Analysis segment of Intelligent Transport Systems Market, with a 58.9% share. Cloud platforms enable real-time data aggregation across cities and regions. Consequently, authorities favor cloud-based models for faster deployment and analytics flexibility.

On-Premise deployment remains relevant for legacy systems and security-sensitive environments. Some transport agencies prefer local data control and existing infrastructure compatibility. However, higher maintenance requirements limit new on-premise investments.

Edge and Fog deployment supports low-latency processing near data sources, improving responsiveness for safety-critical applications. Adoption increases gradually, but integration complexity keeps this segment secondary to cloud-centric architectures.

By Technology Analysis

IoT Sensors and V2X dominates with 45.7% due to widespread sensing and real-time connectivity requirements. In 2025, IoT Sensors and V2X held a dominant market position in the By Main Segment Analysis segment of Intelligent Transport Systems Market, with a 45.7% share. These technologies enable continuous traffic monitoring, vehicle-to-infrastructure communication, and real-time responsiveness, forming the core foundation of modern ITS deployments globally.

AI and Machine-Learning Analytics enhance predictive traffic modeling, congestion forecasting, and incident detection across transport networks. Adoption accelerates as data volumes expand from connected assets. However, reliance on high-quality sensor inputs and computing infrastructure moderates fully independent deployment, positioning these tools as complementary intelligence layers.

Digital Twin Platforms simulate transport networks to support long-term planning, capacity optimization, and scenario analysis. These platforms gain traction in smart city and mega-urban projects. Nevertheless, high integration complexity, data standardization challenges, and elevated implementation costs currently restrict large-scale penetration.

5G and C-V2X Connectivity improves bandwidth, reliability, and ultra-low latency for connected mobility ecosystems. These technologies support advanced V2X use cases and autonomous readiness. However, uneven infrastructure rollout, spectrum allocation delays, and capital intensity constrain near-term dominance despite strong long-term potential.

By Application Analysis

Traffic Management dominates with 41.5% due to its direct impact on congestion reduction and mobility efficiency. In 2025, Traffic Management held a dominant market position in the By Main Segment Analysis segment of Intelligent Transport Systems Market, with a 41.5% share. Real-time signal control, adaptive routing, and congestion analytics drive strong municipal investment priorities.

Public Transport and Ticketing applications streamline fare collection, passenger information systems, and fleet coordination. These solutions improve commuter experience and operational efficiency. However, adoption depends heavily on broader public transit modernization programs, funding availability, and integration with legacy transport infrastructure.

Road Safety and Security solutions focus on incident detection, automated enforcement, and emergency response coordination. Increasing road safety regulations and vision-zero initiatives support adoption. Still, deployment intensity varies across regions due to enforcement policies, public acceptance, and budgetary constraints.

Freight and Fleet Management applications improve logistics efficiency, route optimization, fuel monitoring, and regulatory compliance. Adoption grows alongside e-commerce expansion and digital logistics platforms. This segment remains commercially driven, with stronger uptake among private operators compared to public-sector transport systems.

Environmental and Emission Monitoring applications support sustainability targets through real-time pollution tracking and traffic-emission correlation. Cities deploy these systems to guide policy decisions. However, integration complexity, sensor calibration requirements, and data governance challenges moderate the pace of widespread implementation.

Smart Parking System and Guidance systems reduce urban congestion by minimizing vehicle search time. These solutions enhance parking utilization and user convenience. Deployment increases in high-density cities, airports, and commercial zones, but adoption remains localized due to infrastructure costs and fragmented ownership models.

Tolling and Congestion Pricing applications manage traffic demand while generating infrastructure revenue. Electronic toll collection and dynamic pricing improve operational efficiency. Nevertheless, strong dependence on government policy frameworks, public acceptance, and regulatory approvals limits uniform adoption across regions.

Connected and Autonomous Vehicle Support applications enable future mobility readiness through V2X coordination and infrastructure intelligence. Interest remains high among policymakers and automakers. However, early-stage deployment, regulatory uncertainty, and limited autonomous vehicle penetration constrain current market contribution.

Other applications address niche transport challenges such as incident analytics, traveler information services, and specialized urban mobility needs. While individually smaller in scale, these solutions contribute incrementally to ecosystem maturity and support customized ITS deployments across diverse geographic contexts.

Key Market Segments

By Mode of Transport

- Roadways

- Railways

- Airways

- Maritime

By Component

- Hardware

- Software

- Services

By Type

- Advanced Traffic Management Systems (ATMS)

- Advanced Traveler Information Systems (ATIS)

- Advanced Transportation Pricing Systems (ATPS)

- Advanced Public Transportation Systems (APTS)

- Advanced Commercial Vehicle Operations (ACVOS)

- Cooperative Vehicle-Infrastructure Systems (CVIS)

By Deployment Mode

- On-Premise

- Cloud

- Edge/Fog

By Technology

- IoT Sensors and V2X

- AI and Machine-Learning Analytics

- Digital Twin Platforms

- 5G and C-V2X Connectivity

By Application

- Traffic Management

- Public Transport and Ticketing

- Road Safety and Security

- Freight and Fleet Management

- Environmental and Emission Monitoring

- Smart Parking and Guidance

- Tolling and Congestion Pricing

- Connected and Autonomous Vehicle (CAV) Support

- Others

Drivers

Rapid Urban Congestion Escalation Driving Demand for Real-Time Traffic Orchestration

Rapid urbanization continues to place heavy pressure on existing road networks, especially in large and mid-sized cities. Traffic congestion increasingly affects daily commuting, freight movement, and public transport reliability. As congestion worsens, city authorities actively seek real-time, data-driven traffic orchestration solutions to manage flows more efficiently and reduce delays across peak hours.

Public investment further strengthens this demand, as governments allocate funding toward digitally enabled mobility infrastructure and smart transport corridors. These initiatives support intelligent traffic signals, centralized control rooms, and sensor-based monitoring. As a result, Intelligent Transport Systems gain priority within broader smart city development programs focused on long-term urban mobility resilience.

Another key driver is the rising need for multimodal transport integration. Cities aim to connect roadways, railways, and public transit systems into unified platforms that improve commuter experience. Seamless coordination between buses, metros, and traffic systems helps enhance punctuality, reduce transfer time, and improve overall network reliability for daily users.

Road safety concerns also play a strong role in accelerating ITS adoption. Transport authorities increasingly rely on predictive analytics and automated enforcement tools to detect risks early. These systems support accident prevention, faster emergency response, and safer road behavior, strengthening the overall case for intelligent mobility solutions.

Restraints

High Upfront System Integration Costs Across Legacy Infrastructure

One of the main restraints in the Intelligent Transport Systems Market is the high upfront cost of system integration. Many cities operate on legacy transport infrastructure that lacks digital readiness. Upgrading signals, control systems, and communication networks often requires significant capital investment, slowing adoption in budget-constrained regions.

Integration challenges also increase project complexity. Transport agencies must align old hardware with modern software platforms while maintaining uninterrupted operations. This creates longer deployment timelines and higher implementation risks, making decision-makers cautious about large-scale rollouts despite long-term efficiency benefits.

Data privacy and cybersecurity concerns further limit deployment at scale. ITS platforms rely heavily on real-time data from vehicles, commuters, and infrastructure. Protecting sensitive mobility data becomes critical as connected systems expand across cities and regions.

Unclear data governance frameworks and rising cyber threats increase hesitation among public authorities. Without strong security standards and compliance clarity, some cities delay implementation, especially when systems involve cloud connectivity and cross-agency data sharing.

Growth Factors

Expansion of Intelligent Transport Platforms in Emerging Smart Cities

Strong growth opportunities exist as intelligent transport platforms expand into tier-2 and tier-3 smart city programs. These cities experience rapid population growth and rising vehicle ownership, creating early demand for digital traffic management before congestion becomes unmanageable.

Integration of ITS with autonomous mobility pilots and shared mobility ecosystems also creates new opportunity areas. Intelligent infrastructure supports testing of connected vehicles, automated shuttles, and shared transport services, enabling smoother coordination between public and private mobility models.

AI-powered predictive traffic and incident management solutions are gaining attention. These tools help authorities forecast congestion patterns, detect incidents faster, and optimize response planning. As AI adoption increases, ITS platforms become more proactive rather than reactive.

Additional opportunity comes from monetizing mobility data analytics. Transport-as-a-service models allow cities to generate value through traffic insights, congestion pricing, and service optimization, creating sustainable revenue streams alongside public benefits.

Emerging Trends

Shift Toward Cloud-Native Intelligent Transport Architectures

A major trend in the Intelligent Transport Systems Market is the shift toward cloud-native and edge-enabled architectures. These designs support faster data processing, scalability, and cost-efficient deployment across large transport networks without heavy on-site infrastructure.

Deployment of V2X-enabled roadside units and smart intersections is also increasing. These systems enable direct communication between vehicles and infrastructure, improving traffic coordination, safety alerts, and adaptive signal control in real time.

Digital twin models are gaining traction for transport planning and simulation. Cities use virtual replicas of transport networks to test scenarios, assess congestion impacts, and plan infrastructure upgrades before physical implementation.

Additionally, ITS platforms increasingly align with smart energy and sustainability systems. Integration with emission monitoring and energy management tools supports greener transport planning, helping cities meet climate goals alongside mobility efficiency objectives.

Regional Analysis

North America Dominates the Intelligent Transport Systems Market with a Market Share of 44.9%, Valued at USD 21 Billion

North America held a dominant position in the Intelligent Transport Systems Market, accounting for 44.9% share and valued at USD 21 billion. This leadership is supported by advanced digital infrastructure, early adoption of smart mobility platforms, and strong federal and state-level funding for intelligent traffic management. Regulatory focus on road safety, emissions reduction, and congestion control further reinforces regional adoption.

Europe Intelligent Transport Systems Market Trends

Europe represents a mature and policy-driven market for intelligent transport systems, supported by cross-border mobility frameworks and sustainability mandates. Strong emphasis on emission monitoring, multimodal integration, and smart urban mobility drives steady deployment. EU-backed funding programs continue to support intelligent corridor and connected infrastructure development across major cities.

Asia Pacific Intelligent Transport Systems Market Trends

Asia Pacific is emerging as a high-growth region due to rapid urbanization and expanding smart city initiatives. Governments increasingly invest in digital traffic control, public transport optimization, and real-time monitoring systems. Rising vehicle density and large metropolitan populations accelerate demand for scalable and cost-efficient ITS deployments.

Middle East and Africa Intelligent Transport Systems Market Trends

The Middle East and Africa region shows growing adoption of intelligent transport solutions, particularly in urban hubs and smart city projects. Investments focus on traffic surveillance, congestion reduction, and road safety improvement. Large-scale infrastructure modernization and digital transformation agendas support gradual market expansion.

Latin America Intelligent Transport Systems Market Trends

Latin America demonstrates steady progress in intelligent transport adoption as cities address congestion and public transport inefficiencies. Governments increasingly deploy traffic management and fare integration systems to improve commuter mobility. Budget constraints remain, yet phased ITS implementation supports long-term growth potential.

U.S. Intelligent Transport Systems Market Trends

The U.S. continues to play a critical role within the North American ITS landscape, driven by nationwide smart transportation programs and digital highway initiatives. Focus areas include adaptive traffic signals, connected infrastructure, and safety analytics. Federal transportation funding and regulatory mandates sustain consistent system upgrades and innovation.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Intelligent Transport Systems Company Insights

3Harris Technologies, Inc. plays a strategic role in the Intelligent Transport Systems Market by leveraging its strengths in sensing, communication, and mission-critical systems. The company’s focus on advanced traffic surveillance, secure data transmission, and integrated mobility intelligence aligns well with government-led ITS deployments. Its solutions increasingly support road safety, airspace monitoring, and resilient transport infrastructure programs worldwide.

KONGSBERG brings strong expertise in sensor fusion, real-time analytics, and control systems that translate effectively into intelligent transport applications. The company’s technology orientation supports traffic monitoring, tunnel management, and maritime and port traffic systems. Its emphasis on automation and decision-support platforms positions it well for complex, multi-modal transport environments.

NEC Corporation remains a key contributor to global ITS development through its capabilities in AI, biometrics, and digital infrastructure integration. The company supports smart traffic control, urban mobility optimization, and public safety analytics. Its long-standing collaboration with public authorities enables scalable deployments across dense urban and intercity transport networks.

Teledyne Technologies Incorporated strengthens the ITS ecosystem through high-performance sensors, imaging systems, and data acquisition technologies. Its solutions support traffic monitoring, incident detection, and infrastructure diagnostics across road, rail, and aviation domains. The company’s precision-focused technology portfolio aligns with the growing demand for accurate, real-time transport intelligence.

Top Key Players in the Market

- 3Harris Technologies, Inc.

- KONGSBERG

- NEC Corporation

- Teledyne Technologies Incorporated

- Thales Group

- Siemens AG

- Advantech Co., Ltd.

- Aireon

- Indra Sistemas, S.A.

- Hitachi, Ltd.

Recent Developments

- July 2025: In July 2025, the analysis of an IoT-based acquisition system for electronic traffic signals highlighted improved real-time data collection, adaptive signal control, and reduced urban congestion, supporting smarter traffic management frameworks in smart city deployments.

- January 2026: In January 2026, BENTELER Group acquired ioki of Frankfurt to develop Europe’s first integrated autonomous public transport platform, strengthening end-to-end mobility solutions across autonomous fleets, digital operations, and urban transit ecosystems.

Report Scope

Report Features Description Market Value (2025) USD 46.8 billion Forecast Revenue (2035) USD 102 billion CAGR (2026-2035) 8.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Mode of Transport (Roadways, Railways, Airways, Maritime), By Component (Hardware, Software, Services), By Type (Advanced Traffic Management Systems (ATMS), Advanced Traveler Information Systems (ATIS), Advanced Transportation Pricing Systems (ATPS), Advanced Public Transportation Systems (APTS), Advanced Commercial Vehicle Operations (ACVOS), Cooperative Vehicle-Infrastructure Systems (CVIS)), By Deployment Mode (On-Premise, Cloud, Edge/Fog), By Technology (IoT Sensors and V2X, AI and Machine-Learning Analytics, Digital Twin Platforms, 5G and C-V2X Connectivity), By Application (Traffic Management, Public Transport and Ticketing, Road Safety and Security, Freight and Fleet Management, Environmental and Emission Monitoring, Smart Parking and Guidance, Tolling and Congestion Pricing, Connected and Autonomous Vehicle (CAV) Support, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3Harris Technologies, Inc., KONGSBERG, NEC Corporation, Teledyne Technologies Incorporated, Thales Group, Siemens AG, Advantech Co., Ltd., Aireon, Indra Sistemas, S.A., Hitachi, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intelligent Transport Systems MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Intelligent Transport Systems MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- 3Harris Technologies, Inc.

- KONGSBERG

- NEC Corporation

- Teledyne Technologies Incorporated

- Thales Group

- Siemens AG

- Advantech Co., Ltd.

- Aireon

- Indra Sistemas, S.A.

- Hitachi, Ltd.