Global Intelligent Automation Market Size, Share Analysis Report By Component (Solution, Services), By Technology (Machine Learning, Natural Language Processing, Robotic Process Automation (RPA), Virtual Agents, Computer vision, Others), By Organization Size (Large Enterprise, SME), By Application (IT Operations, Business Process Automation, Application Management, Content Management, Security Management, Others), By Industry Vertical (BFSI, Healthcare, Retail, IT & Telecom, Communication and Media & Education, Manufacturing, Logistics, and Energy & Utilities, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150975

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

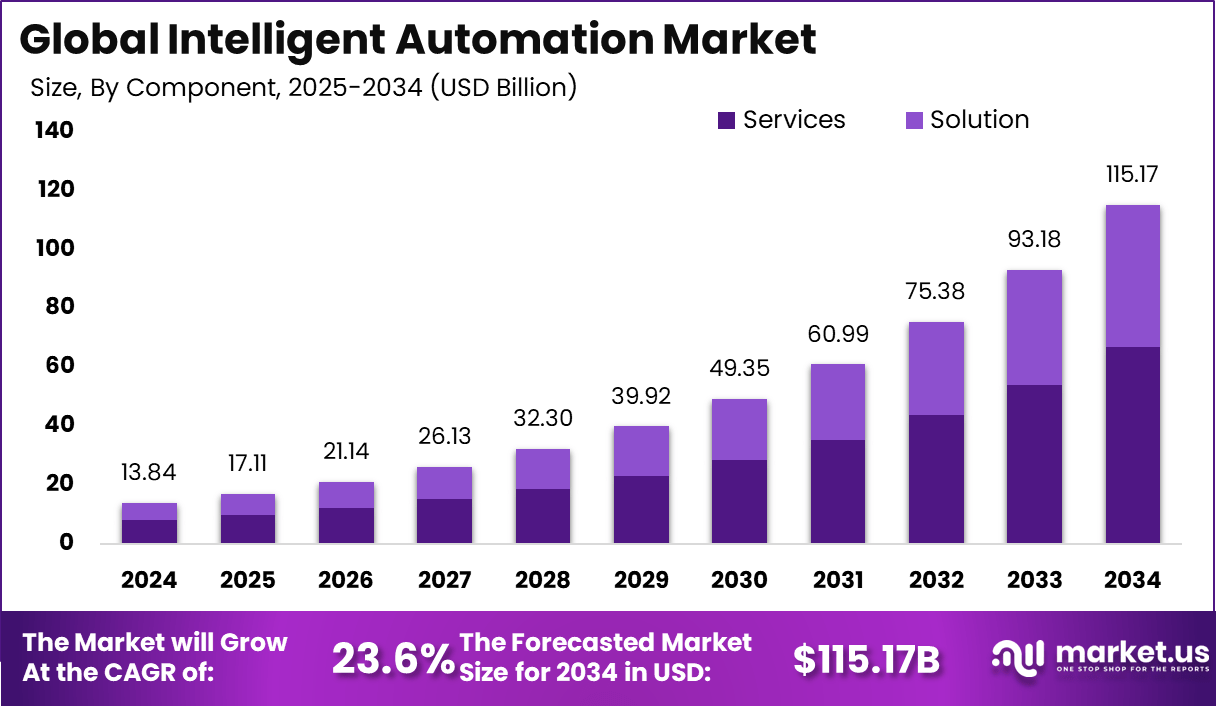

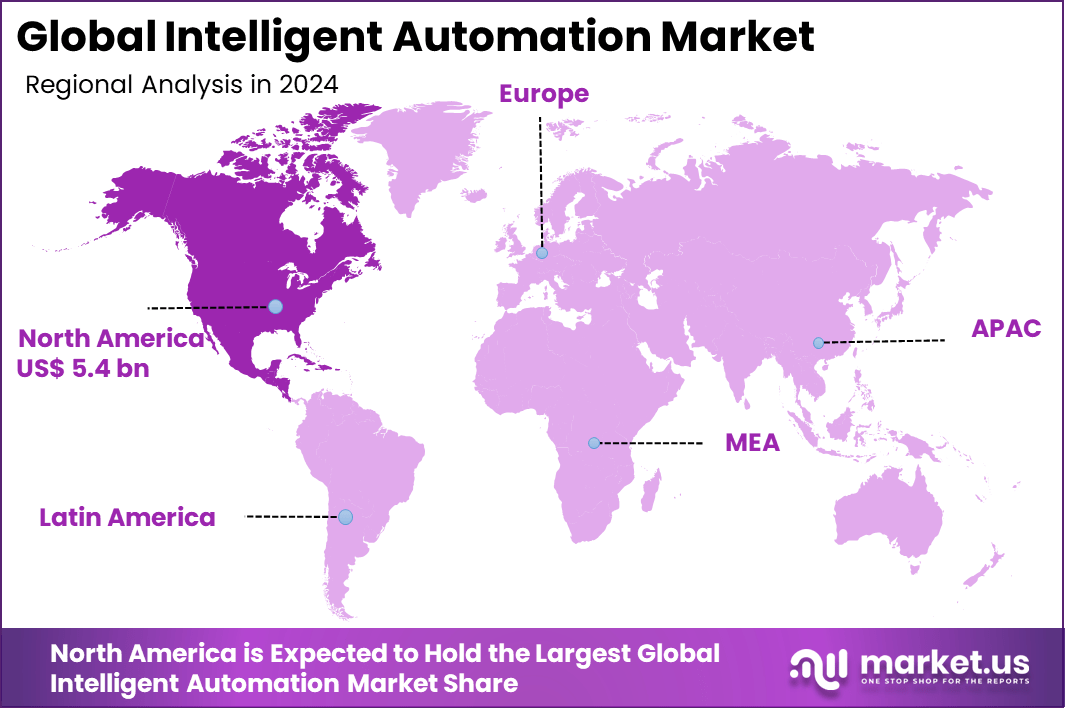

The Global Intelligent Automation Market size is expected to be worth around USD 115.17 billion by 2034, from USD 13.84 billion in 2024, growing at a CAGR of 23.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.6% share, holding USD 5.4 billion in revenue.

The Intelligent Automation Market is witnessing rapid evolution as businesses across industries strive to enhance efficiency, accuracy, and agility. By combining robotic process automation (RPA) with artificial intelligence (AI), machine learning (ML), natural language processing, and computer vision, intelligent automation enables end-to-end process orchestration – converting manual, repetitive tasks into dynamic, self‑optimizing workflows.

The Top Driving Factor is the widespread adoption of RPA across sectors such as BFSI, healthcare, manufacturing, and IT. RPA establishes a foundational layer of efficiency, while the infusion of AI and ML brings cognitive capability – enhancing data processing, anomaly detection, and decision-making. This dual‑layered automation addresses both operational scale and complexity, enabling enterprises to optimize manual workflows and improve compliance and reliability.

In April 2025, ABBYY launched a next-generation OCR API aimed at improving accuracy in intelligent automation workflows. This advanced solution enhances developers’ ability to extract data from documents with higher precision, enabling more reliable and efficient task automation. By embedding this technology, ABBYY seeks to reduce manual efforts and drive greater operational efficiency in document processing and data extraction.

Key Takeaway

- The Services segment led the global intelligent automation market in 2024, accounting for a 58.1% share, driven by rising demand for consulting, deployment, and support solutions.

- Machine Learning emerged as the top technology in 2024, holding a 34.9% share due to its growing role in predictive analytics and cognitive automation.

- Large Enterprises dominated the market structure in 2024, securing a 72.3% share as they aggressively implemented automation to optimize operations at scale.

- Business Process Automation remained the primary application area in 2024, capturing a 29.4% share owing to its ability to streamline repetitive tasks and reduce manual intervention.

- The BFSI sector led industry-wise adoption in 2024, with a 26.5% market share, fueled by automation of compliance, fraud detection, and customer service operations.

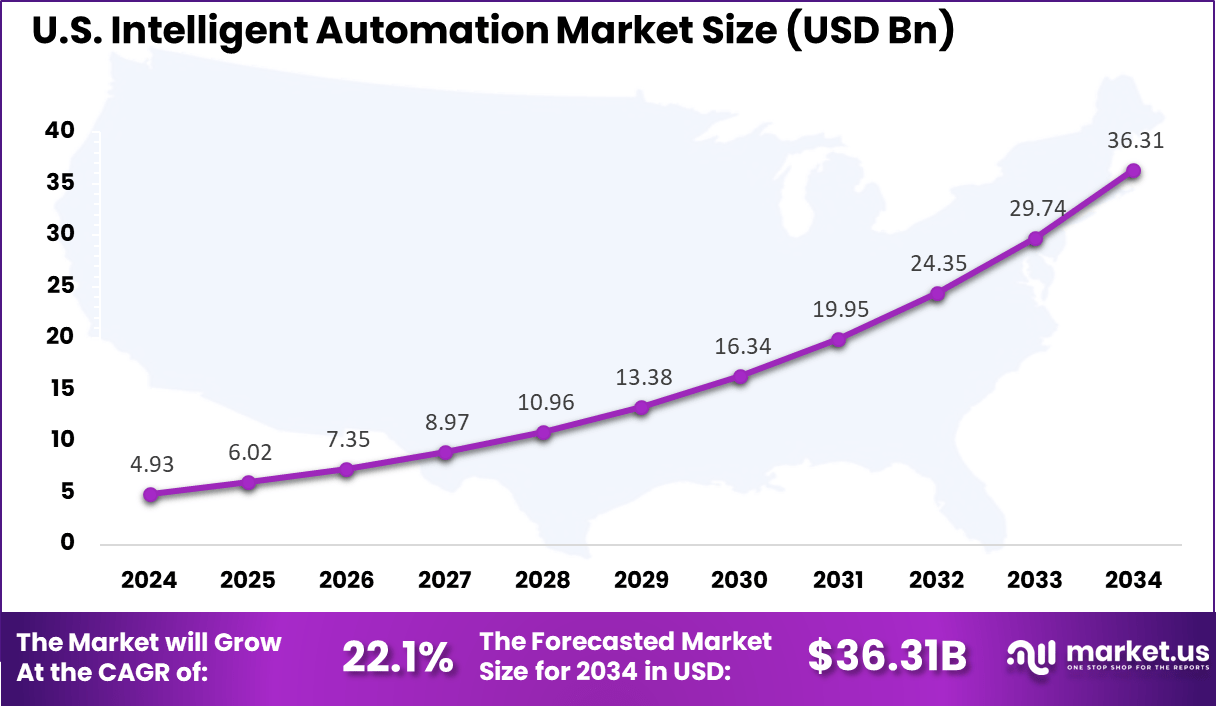

- The United States market was valued at USD 4.93 Billion in 2024, reflecting a strong annual growth rate of 22.1%, supported by rapid technological advancements and enterprise-wide automation initiatives.

- North America maintained leadership in the global landscape in 2024, accounting for over 39.6% of total market share, supported by early adoption and high digital maturity levels.

U.S. Market Size

The market for Intelligent Automation within the U.S. is growing tremendously and is currently valued at USD 4.93 billion, the market has a projected CAGR of 22.1%. This market is experiencing significant growth, fueled by a rising need for operational efficiency, cost savings, and agility in business across various sectors like healthcare, manufacturing, logistics, and finance, with major investments in automation technologies driving rapid advancements and widespread implementation.

For instance, in May 2025, WNS was recognized as a leader in intelligent automation services by ISG (Information Services Group) in the U.S. The recognition highlights WNS’s exceptional capabilities in providing end-to-end automation solutions, helping organizations across various industries optimize processes and enhance operational efficiency.

In 2024, North America held a dominant market position in the Global Intelligent Automation Market, capturing more than a 39.6% share, holding USD 5.4 billion in revenue. Due to federal funding for digital transformation, artificial intelligence, and cloud technologies, as well as public-private partnerships that promote industries like healthcare and manufacturing, North America is the top player in the global intelligent automation market.

In June 2025, Stratasys, in partnership with Automation Intelligence LLC, inaugurated its North American Tooling Center of Excellence to advance additive manufacturing and automation solutions. The facility is designed to support industries across the region by combining state-of-the-art automation with 3D printing capabilities. This initiative aims to optimize production efficiency, shorten lead times, and deliver customized, high-performance tooling solutions to meet rising industrial demands.

Component Analysis

In 2024, The Services segment held a dominant market position, capturing a 58.1% share of the Global Intelligent Automation Market. This dominance is due to the growing demand for consulting, implementation, and support services that help organizations quickly adopt automation solutions. The use of services like customization, training, and system integration is essential for companies to enhance their automation strategies by implementing and fully utilizing intelligent automation technologies.

Furthermore, the rise of GenAI, virtual agents, and AI-powered copilots has amplified demand for specialized consulting and managed services. Enterprises are engaging service providers to design touchless workflows that incorporate machine learning, OCR, and conversational AI – ensuring robust architecture and scalable deployment. Avasant reports a surge in projects leveraging synchronous AI agents, with over 85 % of enterprises increasing spending on intelligent automation services in 2024–2025

For Instance, in May 2025, NTT DATA launched its Smart AI Agent Ecosystem to accelerate intelligent automation services. This innovative ecosystem integrates AI-driven solutions to enhance business process automation, enabling organizations to streamline operations, improve decision-making, and boost efficiency. By combining advanced AI capabilities with automation, NTT DATA aims to provide businesses with scalable, intelligent services that drive digital transformation across industries.

Comparison Summary – Component

Component 2024 Share Key Drivers Services > 58.1% (dominant) High demand for consulting, integration, managed services, and change management support Solution ~41.9% Adoption of AI-enabled platforms, cloud-based automation, prebuilt workflows, and low-code tools Technology Analysis

In 2024, Machine Learning segment held a dominant market position, capturing more than a 34.9% share of the global intelligent automation market. This leadership reflects machine learning’s foundational role in enabling automation systems to analyze patterns, predict outcomes, and continually improve processes.

As organizations sought to move beyond rule-based workflows, machine learning became the catalyst for intelligent decision‑making – allowing systems to adapt based on real‑time data rather than just following static scripts. The momentum behind machine learning was further supported by its expanding application across industries.

By powering advanced analytics, optimization algorithms, and predictive maintenance, machine learning tools enabled businesses to unlock hidden efficiencies and drive cost savings. The ability to automate complex tasks – such as anomaly detection, demand forecasting, and personalized customer interaction – has made machine learning the preferred technology in intelligent automation suites.

For instance, In February 2025, AI-powered DevOps was highlighted as a transformative force for CI/CD pipelines in the context of intelligent automation. By integrating AI and machine learning into the DevOps lifecycle, organizations can automate and optimize software development, testing, and deployment processes. This innovation significantly enhances the speed, accuracy, and efficiency of continuous integration and continuous delivery (CI/CD).

Comparison Summary – Technology

Technology 2024 Share Key Strengths Machine Learning > 34.9% (dominant) Predictive analytics; self-learning; seamless AI integration NLP Moderate–high Enables chatbots, document analysis, sentiment analysis RPA Moderate Automates routine tasks; cost savings; widely adopted Virtual Agents Moderate Handles customer/internal queries; improves UX Computer Vision Moderate–low Image recognition; quality inspection; security automation Others Niche Includes biometric, DL, analytics tools Organization Size Analysis

In 2024, Large Enterprise segment held a dominant market position, capturing more than a 72.3% share of the intelligent automation market. This overwhelming lead can be attributed to the extensive operational complexity and scale within large organizations, which demand robust automation frameworks.

These enterprises benefit from centralized IT infrastructure, abundant resources, and mature digital transformation strategies – conditions that support the implementation of advanced intelligent automation solutions across multiple departments. This enables consistent adoption of AI-driven process optimization, predictive maintenance, and enterprise‑wide workflow automation.

The significant investment power of large enterprises has also led to rapid adoption of cutting‑edge intelligent automation tools. Providers are tailoring solutions to meet complex needs, such as enterprise‑grade security, regulatory compliance, and integration with existing ERP, CRM, and legacy systems.

For Instance, in May 2023, IBM announced its continued efforts to help large enterprises accelerate the adoption of intelligent automation solutions. By leveraging its advanced AI, cloud, and automation technologies, IBM is empowering organizations to streamline complex processes, enhance operational efficiency, and drive digital transformation.

Comparison Summary – Organization Size

Organization Size 2024 Share Key Drivers Large Enterprise > 72.3% (dominant) Complex compliance requirements; global digital infrastructure; strategic AI/RPA investments SMEs < 30% (smaller) Demand for affordable automation; scalable, modular platforms; vendor solutions Application Analysis

In 2024, Business Process Automation segment held a dominant market position, capturing more than a 29.4% share of the global intelligent automation market. This leadership is driven by a strong enterprise focus on reducing manual effort, increasing accuracy, and delivering faster outcomes. Organizations across industries demonstrated that automating repetitive back-office and customer-facing processes yields immediate efficiency gains.

The rise of AI and RPA within BPA further solidified its market position. As of 2024, 74% of organizations were leveraging AI to enhance BPA, while 31% had implemented RPA solutions. This convergence has elevated BPA from simple workflow automation to intelligent, adaptive systems that can learn from data, manage exceptions, and scale across departments.

For Instance, in March 2024, Uber Technologies leveraged Microsoft Power Automate to enhance its business process automation (BPA) and intelligent automation capabilities. By automating routine tasks and workflows, Uber has significantly improved operational efficiency, reduced manual intervention, and accelerated decision-making across its global operations.

Comparison Summary – Application Analysis

Application 2024 Share Key Drivers Business Process Automation > 29.4% (dominant) RPA + AI + OCR efficiency; scalable across finance, HR, procurement, customer service IT Operations Significant growth AIOps-driven monitoring; anomaly detection; self-healing systems Application Management Moderate Automates deployments, testing, and incident response Content Management Moderate–low NLP/OCR-based doc processing, classification Security Management Moderate Threat detection automation; SOAR/XDR frameworks Others Niche, emerging Automation in supply chain, shared services, workflow orchestration Industry Vertical Analysis

In 2024, BFSI segment held a dominant market position, capturing more than a 26.5% share of the global intelligent automation market. This position stems from the financial sector’s complex ecosystem – spanning banking, insurance, and capital markets – which demands rapid, reliable automation to manage high transaction volumes, regulatory compliance, and fraud detection.

The BFSI sector’s leadership is further reinforced by its aggressive deployment of RPA and AI-based process solutions. Major financial institutions have increasingly turned to intelligent automation to reduce error rates, enhance customer satisfaction, and streamline operations, a trend that has elevated BFSI above all other industry verticals.

For Instance, in May 2025, PwC India and Kapture CX partnered to accelerate agentic automation innovation. This collaboration aims to enhance customer experience through advanced automation solutions powered by AI and machine learning. By integrating these technologies into business operations, the partnership seeks to improve operational efficiency, streamline customer service processes, and drive innovation across industries.

Comparison Summary – Industry Vertical

Industry Vertical 2024 Focus Area Key Automation Use Cases BFSI Compliance, fraud detection, virtual agents Loan adjudication, KYC/AML, claim settlement, real-time analytics Healthcare Patient data, billing, claims, telehealth Automated records processing, diagnostics support, claims automation Retail Inventory, pricing, customer engagement Demand forecasting, chatbot interactions, dynamic pricing IT & Telecom Network, service automation, support AIOps, automated provisioning, customer service bots Manufacturing Quality, supply chain, maintenance Visual inspection, predictive maintenance, production coordination Logistics Routing, warehouse, tracking Autonomous routing, inventory bots, shipment monitoring Key Market Segments

By Component

- Solution

- Cloud-based

- On-premise

- Services

- Consulting

- Design & Implementation

- Training & Support

By Technology

- Machine Learning

- Natural Language Processing

- Robotic Process Automation (RPA)

- Virtual Agents

- Computer vision

- Others

By Organization Size

- Large Enterprise

- SME

By Application

- IT Operations

- Business Process Automation

- Application Management

- Content Management

- Security Management

- Others

By Industry Vertical

- BFSI

- Healthcare

- Retail

- IT & Telecom

- Communication and Media & Education

- Manufacturing

- Logistics, and Energy & Utilities

- Others

Emerging Trend

Agentic AI and Hyperautomation

A leading trend is the rise of agentic AI – autonomous software agents that perform tasks, learn, and adapt without human intervention. These agents enable entire workflows to execute end‑to‑end, which evolves beyond traditional RPA into hyperautomation, coordinating AI, ML, RPA, and process mining to manage complex business functions.

This shift supports real‑time decisions and continuous workflow optimization. Simultaneously, integration of AI with industrial IoT and edge computing has given rise to industrial hyperautomation. Smart factories are harnessing sensor data, predictive maintenance, and advanced robotics to minimize downtime and boost productivity – show in scalable and fully autonomous operations

Drivers

Cost Reduction and Efficiency Gains

Companies can reduce operational expenses significantly by automating repetitive and manual tasks, particularly through robotic process automation (RPA) and AI-based solutions. The implementation of automation speeds up workflows, enhances efficiency, and improves resource allocation. Businesses benefit from reduced human error, increased productivity, and scalability, leading to a more efficient and cost-effective operational structure that fosters long-term profitability and competitiveness.

For instance, In June 2025, NewsChannel Nebraska reported on the growing momentum of Intelligent Process Automation (IPA) across various U.S. industries, highlighting its significant impact on cost reduction and efficiency gains. By automating complex processes such as data entry, compliance checks, and customer service, IPA is enabling companies to reduce operational costs, eliminate human errors, and speed up decision-making.

Restraint

Data Privacy and Security Concerns

Data privacy and security concerns are major obstacles to the widespread adoption of intelligent automation. As large amounts of data are needed to train models and improve decision-making in IA systems, it is necessary for organizations to address potential risks arising from data breaches and compliance with the most stringent data protection regulations, including GDPR and CCPA.

For instance, In September 2024, IBM explored the rising concerns surrounding data privacy incidents in the context of intelligent automation and AI. As organizations increasingly implement AI-driven solutions to optimize operations, the potential for privacy breaches grows, particularly when handling sensitive data.

Opportunities

AI-driven Decision Support Systems

AI decision support systems are rapidly evolving, giving businesses the ability to analyze large datasets and generate actionable data in real-time. The use of these systems enhances decision-making by offering predictive analytics, identifying patterns, and improving strategies.

The advancement of AI enables enterprises to make better, data-driven decisions with greater accuracy and precision in various industries by improving operational efficiency, reducing risks, and providing competitive advantages.

For instance, In June 2025, SecureKloud Technologies launched DocuGenie AI, an innovative solution that leverages generative AI to redefine intelligent document automation. This AI-driven platform enhances decision-making by automating the extraction, analysis, and processing of documents, providing real-time insights that support more informed, data-driven decisions.

Challenges

Ethical and Regulatory Implications

The growing prevalence of automated technology raises several ethical and regulatory concerns. These involve concerns about job loss, privacy protections, and the possibility of algorithmic discrimination. Additionally, organizations must ensure compliance with an increasing number of regulations specific to certain industries and regions.

For instance, in June 2025, the Cybersecurity and Infrastructure Security Agency (CISA) released new AI data security guidance to help organizations strengthen their cybersecurity posture as they adopt artificial intelligence and automation technologies. The guidelines focus on ensuring the secure deployment and management of AI systems, emphasizing data privacy, risk mitigation, and compliance with industry regulations.

Key Players Analysis

One of the leading players in the market, ServiceNow has significantly expanded its intelligent automation capability by agreeing in March 2025 to acquire Moveworks, a specialized AI assistant platform for enterprise employees, in a $2.85 billion cash-and-stock deal – its largest acquisition to date.

In March 2025, UiPath bolstered its AI-driven automation capabilities by acquiring Manchester-based Peak, a provider of agentic solutions focused on inventory and pricing optimization. This strategic addition complements UiPath’s existing Orchestrator and Studio ecosystems, enabling seamless bridging between rule-based robotic process automation (RPA) and advanced AI-driven decision engines.

In June 2025, NICE launched CXone Mpower, an enterprise-grade agentic automation platform powered by AWS generative AI and Snowflake’s data cloud. The solution integrates intelligent orchestration across customer experience, middle- and back-office processes, automates AI agent creation, and leverages AWS services like Amazon Q and SageMaker. This positions NICE as a front-runner in conversational and orchestration-led intelligent automation for enterprise service delivery.

Top Key Players in the Market

- Microsoft

- NICE

- Nintex UK Ltd

- Pegasystems Inc.

- UiPath

- Appian

- AntWorks

- Automation Anywhere, Inc.

- Blue Prism Limited

- Celonis

- Fortra, LLC

- IBM

- Tungsten Automation Corporation (Kofax)

- WorkFusion, Inc.

- ThoughtSpot Inc.

- Others

Recent Developments

- In June 2025, Nintex unveiled new generative AI capabilities designed to enhance its business automation platform. These advanced features aim to assist organizations in generating processes, workflows, forms, and integrations more efficiently, addressing key business challenges with ease. By leveraging AI-driven automation, Nintex is empowering businesses to streamline operations, improve decision-making, and accelerate productivity.

- In April 2025, UiPath launched the first enterprise-grade platform for agentic automation, combining AI, robotic process automation (RPA), and human decision-making to deliver smarter, more resilient workflows. This innovative platform is designed to enable businesses to automate complex processes, enhance decision-making, and improve operational efficiency.

Report Scope

Report Features Description Market Value (2024) USD 13.84 Bn Forecast Revenue (2034) USD 115.17 Bn CAGR (2025-2034) 23.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Technology (Machine Learning, Natural Language Processing, Robotic Process Automation (RPA), Virtual Agents, Computer vision, Others), By Organization Size (Large Enterprise, SME), By Application (IT Operations, Business Process Automation, Application Management, Content Management, Security Management, Others), By Industry Vertical (BFSI, Healthcare, Retail, IT & Telecom, Communication and Media & Education, Manufacturing, Logistics, and Energy & Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft, NICE, Nintex UK Ltd, Pegasystems Inc., UiPath, Appian, AntWorks, Automation Anywhere, Inc., Blue Prism Limited, Celonis, Fortra, LLC, IBM, Tungsten Automation Corporation (Kofax), WorkFusion, Inc., ThoughtSpot Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intelligent Automation MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Intelligent Automation MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- NICE

- Nintex UK Ltd

- Pegasystems Inc.

- UiPath

- Appian

- AntWorks

- Automation Anywhere, Inc.

- Blue Prism Limited

- Celonis

- Fortra, LLC

- IBM

- Tungsten Automation Corporation (Kofax)

- WorkFusion, Inc.

- ThoughtSpot Inc.

- Others