Global Insurance Software Market By Deployment Model (On-Premises, And Cloud-Based), By Type (Life insurance, Accident and health insurance, Property and casualty insurance, Other Types), By End-User (Insurance Companies, Brokers, Agents), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: March 2024

- Report ID: 14186

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

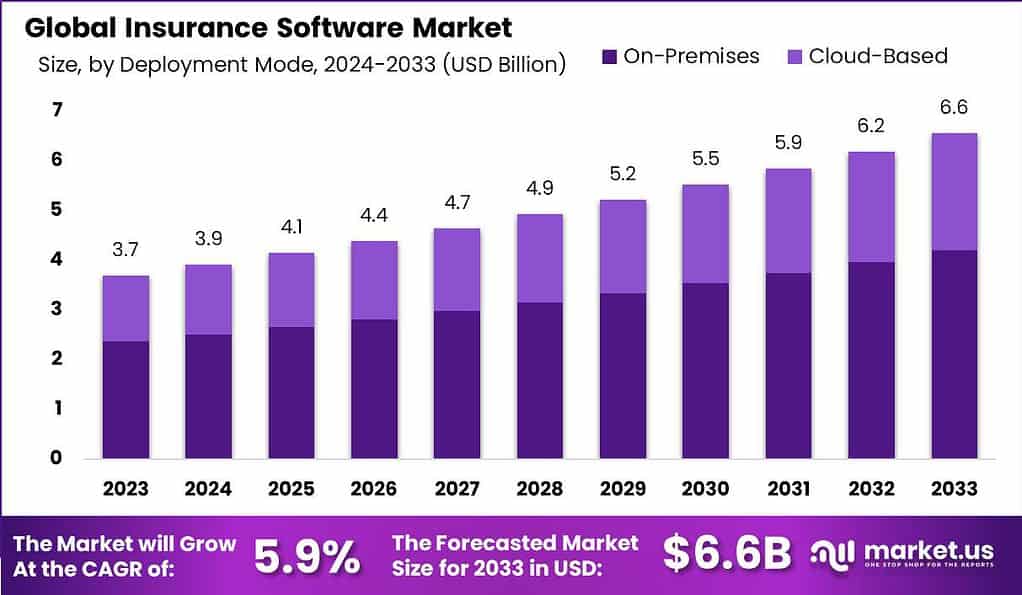

The Global Insurance Software Market size is expected to be worth around USD 6.6 Billion by 2033, from USD 3.7 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

Insurance software refers to computer programs and applications specifically designed to assist insurance companies with various tasks and processes. These software solutions are created to streamline operations, automate manual tasks, improve efficiency, and enhance overall performance within the insurance industry.

The insurance software market is the sector that encompasses the development, distribution, and utilization of these software solutions. It includes both established software providers and emerging startups that cater to the needs of insurance companies, brokers, agents, and other industry stakeholders.

Insurance software offers a range of functionalities, such as policy management, claims processing, underwriting, customer relationship management (CRM), billing and invoicing, document management, and analytics. These solutions help insurance companies manage their policies, track claims, interact with customers, handle financial transactions, and generate reports for analysis.

Analyst Viewpoint

The insurance software market presents a landscape rich in opportunities, driven by a confluence of technological advancements and evolving industry needs. The primary driving factors include the increasing demand for digital and automated insurance processes, the integration of artificial intelligence and big data analytics, and the growing necessity for cloud-based solutions offering scalability and flexibility. These elements are not only enhancing operational efficiencies but are also significantly improving customer experiences.

The market is particularly receptive to new entrants, owing to the continuous evolution of customer expectations and technological capabilities. New players have the opportunity to innovate and disrupt traditional models with agile, customer-focused solutions. This environment fosters a competitive atmosphere where startups and emerging companies can leverage niche technologies or specialize in specific segments, such as cyber insurance or telematics-based insurance products.

Moreover, the current market landscape offers substantial opportunities for collaboration and partnerships between established players and new entrants, leading to the development of more comprehensive and advanced solutions.

Key Takeaways

- The Insurance Software Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.6% and is anticipated to reach a valuation of USD 6.6 billion by 2033, up from USD 3.7 billion in 2023. This significant growth reflects the increasing demand for digital solutions in the insurance industry.

- In 2023, the on-premises deployment model dominated the market with more than a 64% share. On-premises solutions offer control over data and systems, making them attractive to insurance companies concerned with data security and compliance.

- In 2023, life insurance held a dominant market position, capturing over 36% of the market share. The complexity of life insurance products and the need for robust software solutions to manage policy administration, underwriting, and claims processes contributed to its dominance.

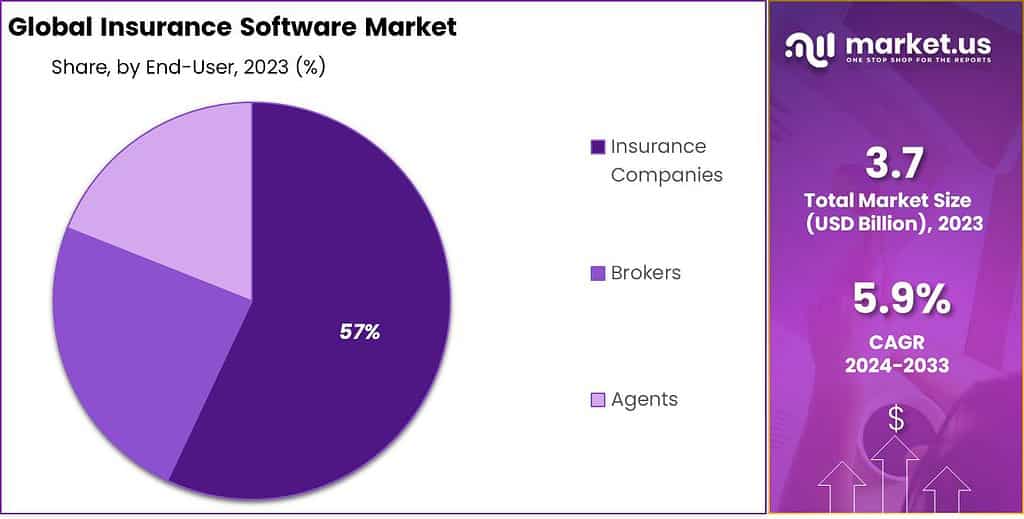

- Insurance companies held the largest market share in 2023, accounting for over 57%. This is because insurance companies require robust software systems to handle complex underwriting processes, regulatory compliance, risk management, and customer relationship management.

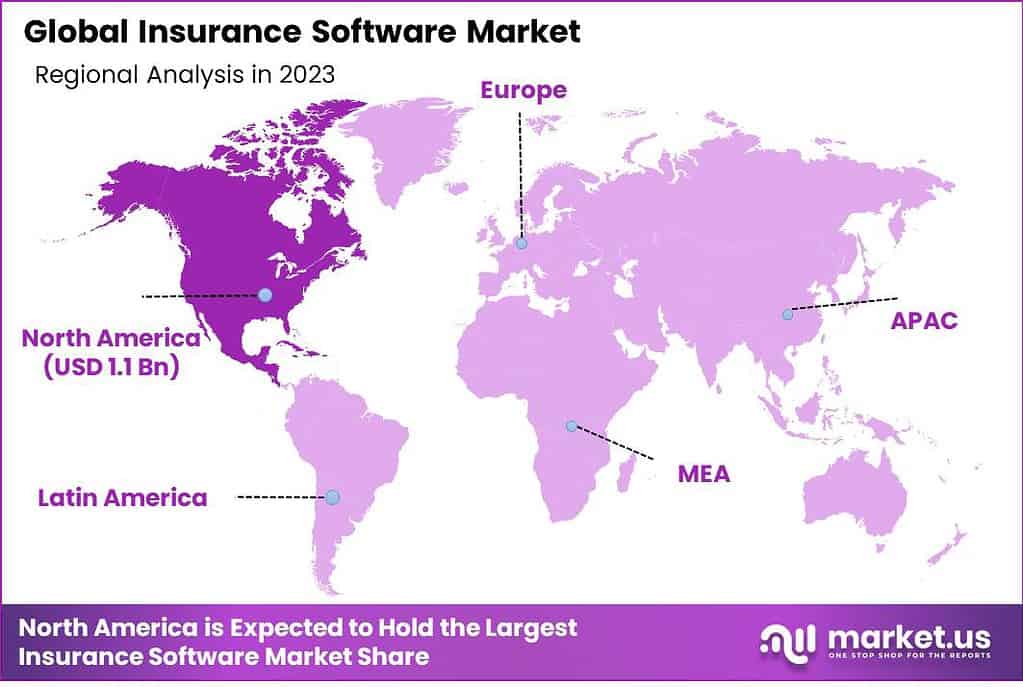

- In 2023, North America dominated the market, capturing over 31% of the market share. The region’s advanced technological infrastructure and a strong emphasis on digital transformation within the insurance sector contributed to its prominence.

Deployment Model Analysis

In 2023, the On-Premises segment held a dominant market position in the insurance software market, capturing more than a 64% share. This dominance can be attributed to several key factors. Firstly, on-premises solutions offer enhanced control over data and systems, which is a critical consideration for many insurance companies concerned with data security and regulatory compliance. These systems are stored and managed internally, providing firms with the ability to closely monitor and safeguard their sensitive information.

Furthermore, the on-premises deployment model has been favored historically due to its reliability and performance stability. Insurance firms, especially larger and more established ones, often have substantial investments in on-premises infrastructure and prefer to maintain these legacy systems due to their proven track record and compatibility with existing workflows.

However, it’s important to note a gradual shift in this trend. With the advent of cloud computing, cloud-based insurance software is gaining traction, driven by its cost-effectiveness, scalability, and flexibility. While the on-premises segment continues to lead, the cloud-based segment is expected to grow at a faster rate in the coming years.

This growth is fueled by the increasing adoption of cloud services among small to medium-sized insurance firms and the ongoing digital transformation in the industry. Cloud-based solutions offer the advantage of regular updates, lower upfront costs, and the ability to access the system from anywhere, which is particularly relevant in the current era of remote work and digital customer engagement.

Type Analysis

In 2023, the Life insurance segment held a dominant market position in the Insurance Software market, capturing more than a 36% share. This segment’s strong market position can be attributed to several factors. Firstly, life insurance is a crucial component of financial planning for individuals and families, providing protection and financial security in the event of a policyholder’s death. The complexity of life insurance products, which often involve multiple policy options, riders, and investment components, necessitates robust software solutions to manage policy administration, underwriting, and claims processes effectively.

Furthermore, the life insurance segment has witnessed significant technological advancements and digital transformation, driving the adoption of insurance software. Insurers are leveraging software solutions to automate policy issuance, improve underwriting accuracy, enhance customer service, and streamline claims management. The ability of insurance software to handle large volumes of data, perform complex calculations, and provide real-time policy and claims information has been instrumental in the dominance of the life insurance segment.

Moreover, the life insurance market is highly regulated, with strict compliance requirements. Insurance software offers features and functionalities that enable insurers to ensure regulatory compliance, maintain accurate records, and generate reports as per regulatory guidelines. This compliance-driven nature of the life insurance segment further emphasizes the need for robust and specialized software solutions.

End-User Insights

In 2023, the Insurance Companies segment held a dominant market position in the insurance software market, capturing more than a 57% share. This significant market share can be attributed to several key factors. Primarily, insurance companies are increasingly adopting advanced software solutions to streamline their operations and enhance customer service. This trend is driven by the need to manage vast amounts of data, improve the efficiency of claim processing, and offer personalized insurance products.

Insurance companies, as the primary providers of insurance policies, inherently have a larger operational scale and customer base compared to brokers and agents. This scale necessitates robust software systems capable of handling complex underwriting processes, regulatory compliance, risk management, and customer relationship management. The integration of artificial intelligence and data analytics in insurance software further empowers these companies to analyze customer data, predict trends, and make data-driven decisions, leading to more efficient and customer-centric operations.

Moreover, the digital transformation in the insurance sector, accelerated by the COVID-19 pandemic, has spurred insurance companies to invest heavily in technology to remain competitive. This includes the adoption of cloud-based solutions, which offer scalability and flexibility, and the implementation of blockchain for secure and transparent transactions.

Key Market Segments

Deployment Model

- On-Premises

- Cloud-Based

Type

- Life insurance

- Accident and health insurance

- Property and casualty insurance

- Other Types

End-User

- Insurance Companies

- Brokers

- Agents

Key Driver

Increased Digitalization and Automation in Insurance Processes

The global insurance software market is significantly driven by the increased digitalization and automation in insurance processes. This trend is a response to the evolving demands of a technologically advanced customer base and the need for operational efficiency in a competitive market. Digitalization in the insurance sector involves the incorporation of various technologies like artificial intelligence, machine learning, and blockchain to automate and optimize processes such as underwriting, claims processing, customer relationship management, and risk assessment.

Automation enables insurance companies to process vast amounts of data more efficiently, reduce the likelihood of human error, and offer more personalized insurance products. This shift not only enhances customer satisfaction by providing faster and more accurate services but also improves the operational agility of insurance providers. As a result, companies that invest in advanced software solutions are better positioned to capitalize on market opportunities, leading to a growth in demand for insurance software.

Key Restraint

Data Security and Privacy Concerns

Data security and privacy concerns stand as a major restraint in the growth of the global insurance software market. Insurance companies deal with a substantial amount of sensitive personal and financial information, making them prime targets for cyber-attacks and data breaches. The implications of such incidents are substantial, including financial losses, damage to reputation, and legal consequences.

Moreover, the insurance industry is subject to stringent data protection regulations, which vary by region and are constantly evolving. Ensuring compliance while safeguarding against sophisticated cyber threats requires substantial investment in secure IT infrastructure and continuous monitoring and updating of security protocols. This challenge often hinders the adoption of new digital solutions, particularly among smaller insurers with limited resources.

Key Opportunity

Growing Demand for Cloud-Based Solutions

The growing demand for cloud-based solutions presents a significant opportunity in the global insurance software market. Cloud computing offers a scalable, flexible, and cost-effective approach to managing IT resources, which is particularly beneficial for insurance companies looking to modernize their operations without heavy upfront investments. Cloud-based insurance software can provide enhanced data storage capabilities, improved data analytics, and easier integration with other digital tools. It also allows for remote access to information, which is vital in today’s increasingly mobile and globalized business environment.

Furthermore, cloud platforms facilitate easier and more frequent software updates, ensuring that insurance providers can quickly adapt to changing market needs and regulatory requirements. This trend towards cloud-based solutions is expected to accelerate as more companies recognize the operational and strategic benefits of cloud computing in the insurance sector.

Key Challenge

Regulatory Compliance

Regulatory compliance remains a key challenge in the global insurance software market. The insurance industry is highly regulated, and these regulations can vary significantly across different countries and regions. Compliance involves adhering to a wide range of rules regarding financial solvency, consumer protection, data privacy, and anti-fraud measures.

As insurance companies expand their digital footprint, they must ensure that their software solutions are not only compliant with current regulations but are also adaptable to future legislative changes. This necessitates a continuous investment in updating software systems and training staff, which can be particularly burdensome for smaller insurers. Additionally, navigating the complex landscape of international regulations can be challenging for insurance companies operating in multiple jurisdictions, making regulatory compliance a continual and evolving challenge in this market.

Regional Analysis

In 2023, North America held a dominant market position in the insurance software market, capturing more than a 31% share. This prominence is largely due to the region’s advanced technological infrastructure, the presence of major insurance and tech companies, and a strong emphasis on digital transformation within the insurance sector. The demand for Insurance Software in North America reached US$ 1.1 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future.

The U.S., in particular, has been a driving force, with its insurance companies rapidly adopting cloud-based solutions, big data analytics, and AI-driven software to enhance customer experience and operational efficiency. The regulatory environment in North America, which encourages innovation while ensuring data security and privacy, has also played a crucial role in fostering market growth.

Europe follows closely, characterized by a strong focus on regulatory compliance, particularly with GDPR, and a growing emphasis on insurtech innovations. European insurance providers are leveraging software solutions to streamline operations and offer personalized insurance products, addressing the diverse needs of a sophisticated customer base. Countries like the UK, Germany, and France are leading in the adoption of insurance software, driven by a combination of regulatory mandates and the need for operational efficiency.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the insurance software market, several key players stand out due to their innovative solutions and strategic market presence. Companies like SAP SE, Oracle Corporation, and Microsoft have been instrumental in driving advancements with their comprehensive and scalable software solutions. These industry giants leverage their extensive technological expertise to offer a range of products from customer relationship management to risk and compliance management tools.

Additionally, InsurTech companies like Guidewire and Applied Systems are making significant inroads, focusing on specialized insurance software that addresses specific industry needs such as claims processing and policy administration. These players, through strategic partnerships, acquisitions, and continuous R&D, are not only enhancing their product offerings but also shaping the future dynamics of the insurance software market. Their ability to innovate and adapt to changing market demands positions them as influential entities in this sector.

Top Key Players

- Oracle Corporation

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Guidewide

- Duck Creek Technologies

- SSP Limited

- Sapiens International Corporation

- Accenture

- Insly

- Prima Solutions

- EIS Group

- Other Key Players

Recent Developments

- In 2023, Oracle: Oracle Cloud for Insurance: Enhanced their cloud-based insurance platform with new features like AI-powered claims processing, automated underwriting, and omnichannel customer experience solutions.

- In 2023, SAP: SAP Cloud for Insurance: Launched their new cloud-based insurance platform, offering core insurance functionalities and pre-built solutions for various insurance lines.

- In 2023, IBM: IBM Cloud for Financial Services: Enhanced their cloud platform with insurance-specific solutions for claims processing, fraud detection, and regulatory compliance.

- In 2023, Microsoft: Microsoft Dynamics 365 for Insurance: Expanded their Dynamics 365 platform with new insurance-specific modules for policy management, claims processing, and customer service.

Report Scope

Report Features Description Market Value (2023) US$ 3.7 Bn Forecast Revenue (2033) US$ 6.6 Bn CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Model (On-Premises, And Cloud-Based), By Type (Life insurance, Accident and health insurance, Property and casualty insurance, Other Types), By End-User (Insurance Companies, Brokers, Agents) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, Guidewide, Duck Creek Technologies, SSP Limited, Sapiens International Corporation, Accenture, Insly, Prima Solutions, EIS Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Insurance Software?Insurance Software refers to specialized applications and platforms designed to streamline and automate various processes within the insurance industry, including policy management, claims processing, and underwriting.

How big is Insurance Software Market?The Global Insurance Software Market size is expected to be worth around USD 6.6 Billion by 2033, from USD 3.7 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

Who are the key players in Insurance Software Market?Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, Guidewide, Duck Creek Technologies, SSP Limited, Sapiens International Corporation, Accenture, Insly, Prima Solutions, EIS Group, Other Key Players are the major companies operating in the Insurance Software Market.

Which region has the highest market share in the Insurance Software market?In 2023, North America held a dominant market position in the insurance software market, capturing more than a 31% share.

What challenges does the Insurance Software Market face?Challenges include concerns related to data security and privacy, integration complexities with existing legacy systems, regulatory compliance, and the need for constant adaptation to evolving market trends.

Insurance Software MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Insurance Software MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle Corporation

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Guidewide

- Duck Creek Technologies

- SSP Limited

- Sapiens International Corporation

- Accenture

- Insly

- Prima Solutions

- EIS Group

- Other Key Players