Global Insurance-as-a-Service (IaaS) Market Size, Share Report By Solution (Software, Services), By Application (Claims Management, Underwriting & Rating, Customer Relationship Management (CRM), Billing & Payments, Data Analytics, Compliance & Reporting, Premium Collection, Sales & Marketing, Property Estimation, Predictive Modeling/Extreme Event Forecasting), By Insurance Type (General Insurance, Life Insurance, Others), By Technology (AI & ML, IoT, Blockchain, Data Analytics & Big Data, Regulatory Technology (Regtech)), By End-user (Insurance Companies, Insurance Agencies & Brokers, Third-Party Administrators (TPAs), Actuaries, Reinsurers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153697

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- US Market Size

- By Solution: Software

- By Application: Claims Management

- By Insurance Type: General Insurance

- By Technology: AI & ML

- By End-user: Insurance Companies

- Key Market Segments

- Emerging Trend

- Key Driver

- Restraint

- Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

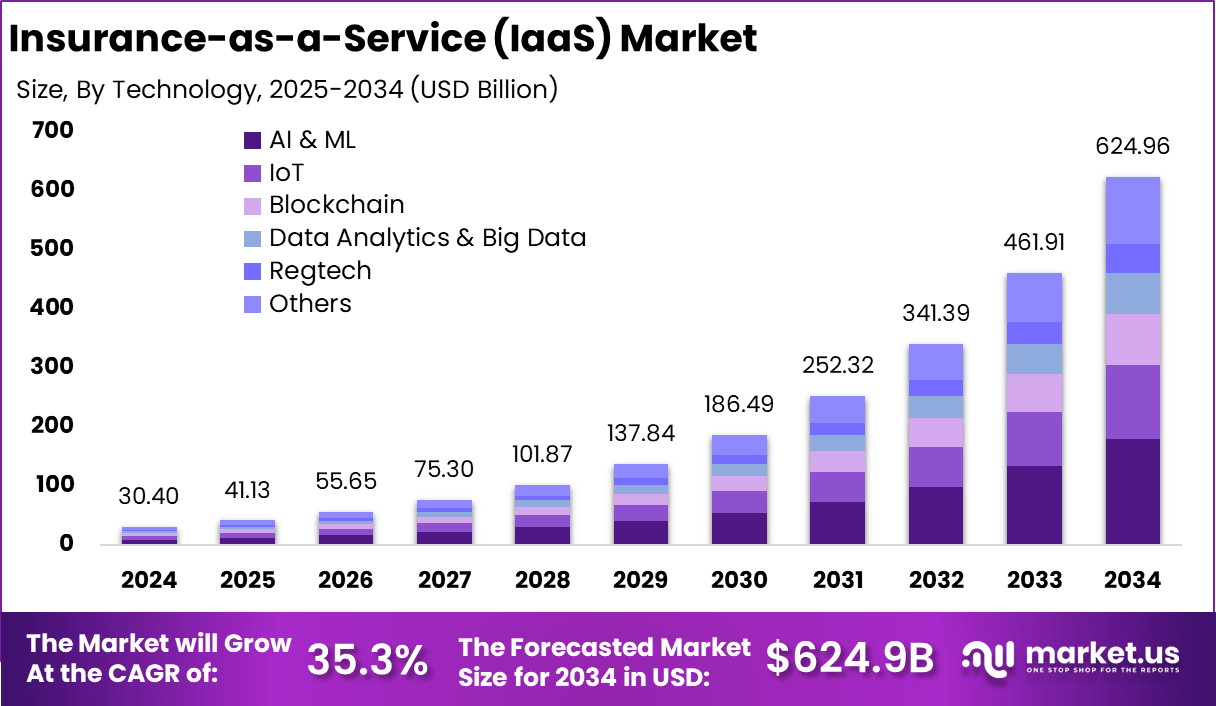

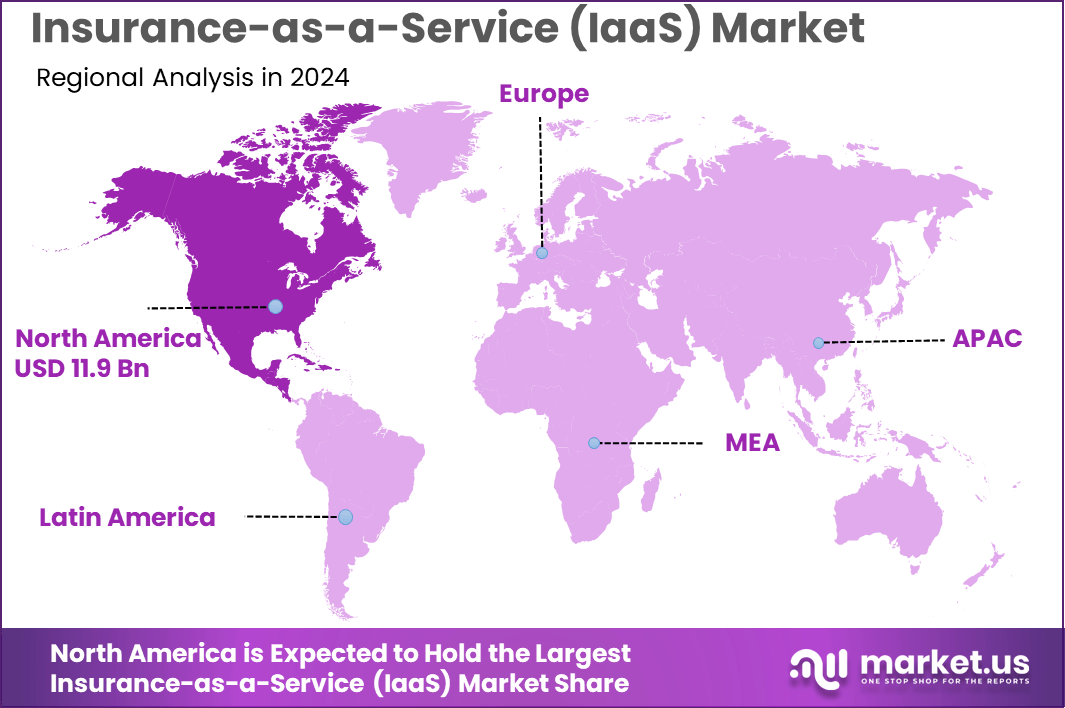

The Global Insurance-as-a-Service (IaaS) Market size is expected to be worth around USD 624.9 Billion By 2034, from USD 30.4 billion in 2024, growing at a CAGR of 35.3% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.4% share, holding USD 11.9 Billion revenue.

The Insurance‑as‑a‑Service (IaaS) market comprises cloud‑based platforms and services that enable insurers and non‑insurance firms to access core insurance functions (such as underwriting, risk assessment, policy issuance, claims processing, fraud detection, and customer service) on a subscription basis. Modular solutions enable quick rollout of insurance products without needing complete infrastructure, supporting both full and partial digitalization.

The key driving factors behind the rise of IaaS are rooted in both technology and evolving consumer expectations. Customers today demand simple, fast, and transparent processes, particularly when it comes to financial protection. Digital-first consumers expect quick onboarding and hassle-free claims, and the traditional insurance sector has been slow to keep up.

Technological advances drive much of the growth in IaaS. Cloud computing, Artificial Intelligence, API-driven integrations, and robust digital onboarding platforms are not just buzzwords – they directly power the scalability and flexibility IaaS offers. These tools automate policy management, underwriting, fraud detection, and even customer support, allowing non-insurance businesses to easily add insurance to their digital offerings.

Key Insight Summary

- In 2024, North America led the global IaaS market. It captured 39.4% share with USD 11.9 billion in revenue.

- The United States contributed USD 9.58 billion, growing at a 32.6% CAGR.

- The global market is expected to grow at a 35.3% CAGR from 2025 to 2034, fueled by digital innovation in insurance delivery.

- By solution, software dominated with a 76.5% share. Insurers prefer flexible, cloud-based platforms to modernize operations.

- Claims management led the application segment, holding 22.7% share. Efficient, automated claims processing is a key driver.

- General insurance was the leading insurance type, with 56.7% share. Demand is rising for scalable coverage across retail and commercial sectors.

- By technology, AI & ML accounted for 28.8%. These tools help in fraud detection, underwriting, and customer engagement.

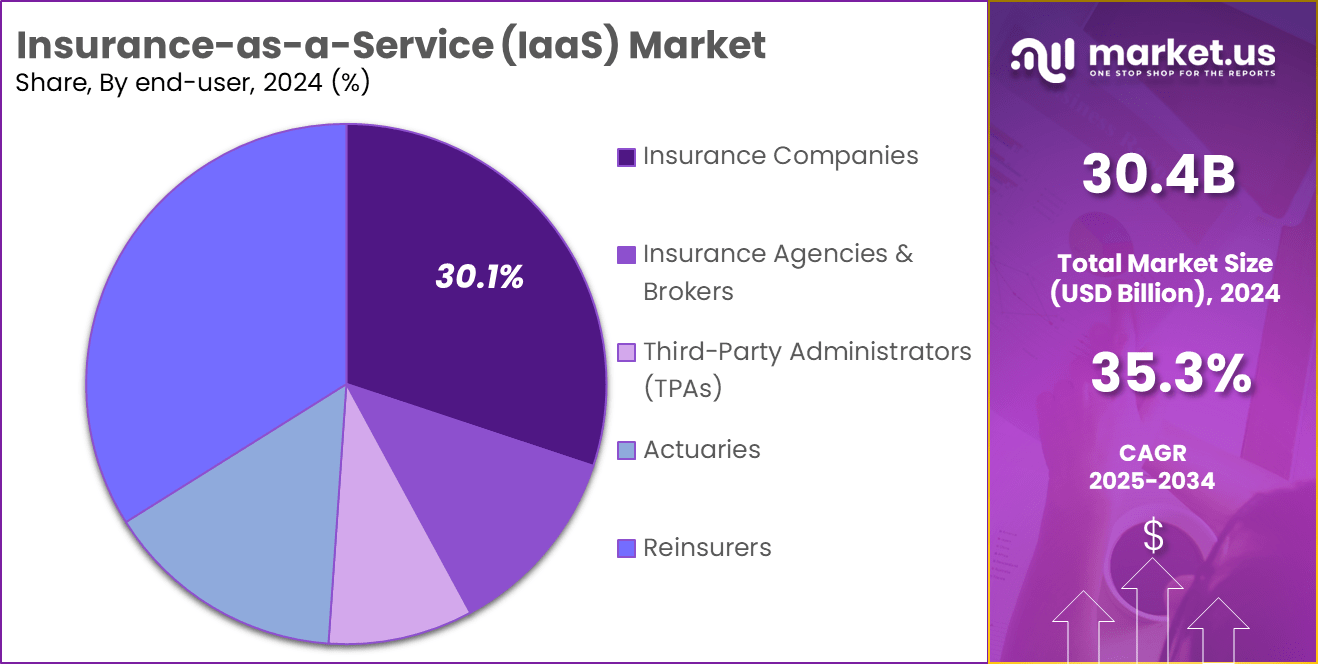

- Insurance companies led among end users, contributing 30.1% share. They are driving adoption to reduce cost and improve service speed.

US Market Size

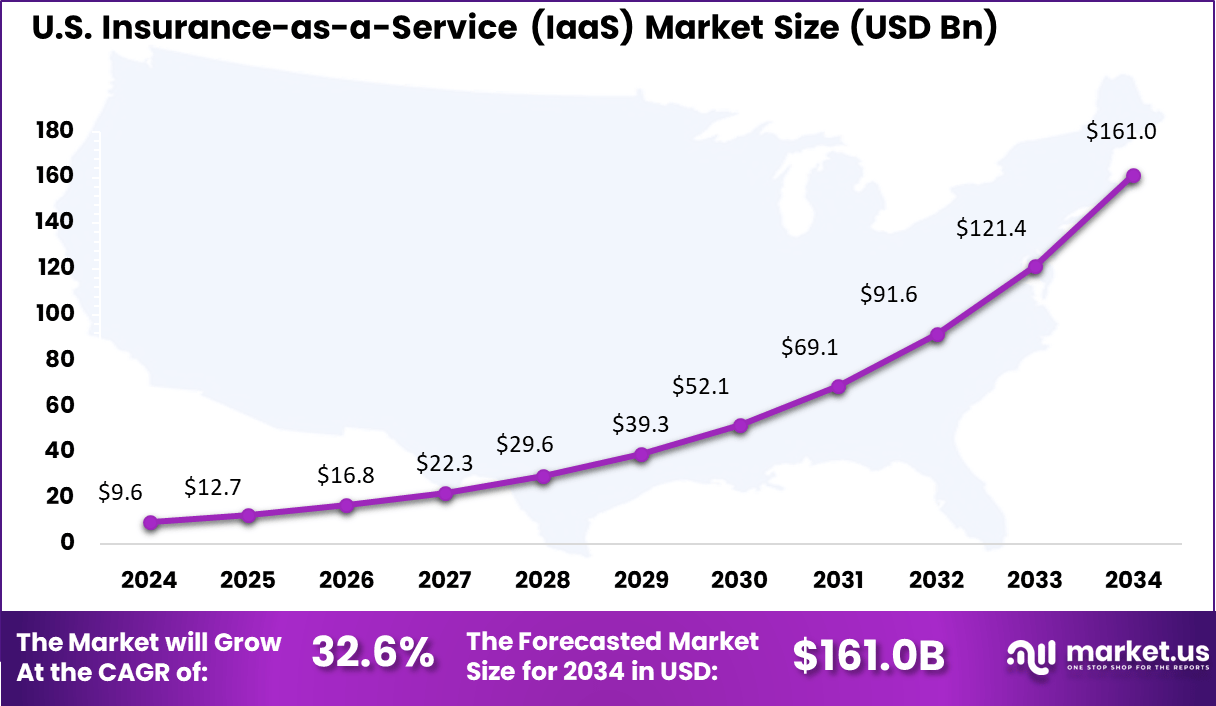

The U.S. Insurance-as-a-Service (IaaS) Market was valued at USD 9.6 Billion in 2024 and is anticipated to reach approximately USD 161 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 32.6% during the forecast period from 2025 to 2034.

In 2024, the U.S. held a dominant position in the Insurance-as-a-Service (IaaS) market, capturing a significant share due to its advanced digital infrastructure, robust insurtech ecosystem, and strong consumer demand for embedded insurance products. The presence of established technology providers and insurance carriers has enabled rapid experimentation and scaling of cloud-native insurance models.

The U.S. market benefits from early adoption of open insurance APIs, which has supported seamless integration of insurance offerings into retail, mobility, travel, and e-commerce platforms. A key reason for U.S. leadership lies in the maturity of its regulatory and innovation frameworks. Regulatory bodies in the U.S., including state-level insurance commissioners, have introduced innovation sandboxes and fast-track licensing options for digital-native insurance solutions.

In 2024, North America held a dominant market position, capturing more than a 39.4% share, holding USD 11.9 Billion revenue in the Insurance-as-a-Service (IaaS) market. This leadership can be attributed to the region’s highly digitized insurance landscape, widespread adoption of cloud-based platforms, and a vibrant ecosystem of insurtech innovators.

The U.S., in particular, has been at the forefront of embedding insurance capabilities into fintech, e-commerce, travel, and gig economy platforms, accelerating demand for modular, API-driven insurance services. The region’s insurers have embraced agile and scalable technologies to modernize legacy systems, reduce costs, and deliver personalized offerings at scale.

By Solution: Software

In 2024, software platforms stand out as the primary solution in the Insurance-as-a-Service market, accounting for 76.5%. Insurers are heavily investing in comprehensive digital tools that enable them to efficiently manage policy lifecycles, automate underwriting, and improve customer experiences. These platforms support integration with emerging technologies, making it easy for insurers to adapt and respond to both regulatory and consumer-driven shifts in the market.

The move toward digital software solutions is driven by the need for agility and scale. Organizations are now able to deploy new insurance products quickly, streamline compliance processes, and make more informed decisions using data analytics. By leveraging customizable software, insurance providers reduce operational costs and deliver services that are more accessible and user-centric.

By Application: Claims Management

Claims management is at the forefront of applications for IaaS in 2024, constituting 22.7% of the market. Insurers are turning to digital claims processing to deliver faster, more accurate settlements while decreasing manual intervention. Modern claims management systems integrate automation and centralized data, resulting in significantly reduced paperwork and processing times.

These advancements enhance the customer experience by ensuring quick and transparent resolution of claims. For insurers, digital claims management leads to greater operational efficiency, lower costs, and heightened customer satisfaction, which are key differentiators in a highly competitive environment.

By Insurance Type: General Insurance

General insurance dominates the IaaS landscape in 2024 with a 56.7% market share. Insurers are leveraging technology to manage and expand diverse offerings, such as property, motor, and health insurance. The flexibility of IaaS platforms empowers companies to modernize their core operations, streamline policy administration, and launch products tailored to evolving client demands.

This shift has enabled providers to access new customer segments, enhance service delivery, and ensure compliance with changing regulations. The move to digital platforms is helping the general insurance segment maintain agility and meet the dynamic needs of both enterprises and individual customers.

By Technology: AI & ML

Artificial intelligence and machine learning are transforming the IaaS sector, representing 28.8% of the technological share in 2024. These technologies enhance core insurance functions such as underwriting, risk assessment, and fraud detection by enabling faster, data-driven decision-making. AI and ML also offer insurers personalized customer interactions and streamlined claims processing.

The adoption of these technologies is enabling providers to optimize workflows, reduce costs, and gain insights from vast data pools. As insurers pursue digital transformation, AI and ML offer a pathway to drive service innovation while maintaining compliance and ensuring customer trust.

By End-user: Insurance Companies

Insurance companies themselves are the predominant end-users of IaaS solutions, with a 30.1% share. These organizations are aiming to modernize their legacy systems and adapt to rapidly changing market expectations. Digital platforms offer new levels of efficiency in policy and claims management and allow insurers to collaborate more effectively with insurtech partners.

The focus on transformation helps insurance companies improve customer engagement, optimize distribution, and ensure regulatory compliance. Their investment in IaaS technologies is supporting both operational resilience and the agility needed for sustainable growth.

Key Market Segments

By Solution

- Software

- Intelligent Document Processing

- Digital Document Depository

- Document Collaboration

- Document Verification

- Document Version Control

- Others

- Insurance Lead Management

- Lead Tracking & Assignment

- Lead Scoring & Nurturing

- Lead Analytics

- Cross-Selling & Upselling

- Others

- Insurance Workflow Automation

- Claims Workflow Automation

- Underwriting Workflow Automation

- Customer Onboarding Automation

- Compliance Workflow Automation

- Others

- Policy Management

- Policy Issuance & Renewal

- Policy Documentation

- Policy Premium Calculations

- Policy Quotation Management

- Others

- Video KYC/eKYC

- Identity & Biometric Verification

- Compliance Reporting

- Audit Trails

- API & Microservices

- API-Driven Insurance Integration Platforms

- Partner Ecosystem Integration Platforms

- API-Enabled Insurance Distribution Platforms

- Microservices

- Rating Microservices

- Document Generation Microservices

- Transaction Microservices

- Workflow Microservices

- Rating Microservices

- Utility Microservices

- Metadata Microservices

- Product Management Microservices

- Others

- Intelligent Document Processing

- Services

- Professional Services

- Consulting & Advisory Services

- Integration & Implementation Services

- Custom Platform Design & Development Services

- Training & Education Services

- Managed Services

- Platform Hosting & Infrastructure Management Services

- Platform Maintenance & Support Services

- Data Management & Backup Services

- Security & Compliance Services

- Professional Services

By Application

- Claims Management

- Virtual Claims Handling

- Claims Processing

- Claims Analytics

- Underwriting & Rating

- Group Insurance Underwriting

- Customer Risk Profiling

- Collaboration & Self-Service

- Pricing & Quote Management

- Customer Relationship Management (CRM)

- Customer Data Management

- Customer Interaction & Engagement

- Customer Support & Service

- Billing & Payments

- Premium Billing & Invoicing

- Online Payment Processing

- Reconciliation & Accounting

- Data Analytics

- Subrogation Analytics

- Performance Tracking & Reporting

- Fraud Detection & Prevention

- Compliance & Reporting

- Regulatory Compliance Management

Reporting Automation

- Regulatory Compliance Management

- Policy Administration, Collection & Disbursement

- Policy Creation & Modification

- Premium Collection

- Payout & Disbursement Management

- Sales & Marketing

- Agent & Broker Management

- Direct-To-Consumer Sales

- Digital Sales Enablement

- Property Estimation

- Property Valuation

- Claims Estimation

- Property Inspection

- Predictive Modeling/Extreme Event Forecasting

- Claims Severity Modelling

- Policy Recommendation Engines

- Extreme Event Analysis

- Catastrophe Modeling

- Others

- Others

By Insurance Type

- General Insurance

- Health Care Insurance

- Individual Health Insurance

- Family Floater Insurance

- Critical Illness Coverage

- Senior Citizen Health Insurance

- Group Health Insurance

- Others

- Automobile Insurance

- Car Insurance

- Bike Insurance

- Commercial Vehicle Insurance

- Homeowners’ Insurance

- Home Building Insurance

- Public Liability Coverage

- Standard Fire & Special Perils Policy

- Travel Insurance

- Trip Cancellation

- Medical Coverage

- Baggage Loss

- Health Care Insurance

- Life Insurance

- Term Life Insurance

- Level Term Life Insurance

- Increasing Term Insurance

- Decreasing Term Insurance

- Return Of Premium Term Insurance

- Convertible Term Plans

- Unit-Linked Insurance Plans (ULIP)

- Type 1 ULIP

- Type 2 ULIP

- Whole Life Insurance

- Indexed Whole Life Insurance

- Guaranteed Issue Whole Life Insurance

- Limited Payment Whole Life Insurance

- Joint Whole Life Insurance

- Modified Whole Life Insurance

- Reduced Paid-Up Whole Life Insurance

- Simplified Issue Whole Life Insurance

- Single-Premium Whole Life Insurance

- Variable Whole Life Insurance

- Whole Life Insurance For Children

- Cybersecurity Insurance

- Data Breach Coverage

- Cyber Extortion & Ransomware Coverage

- Regulatory Fines & Penalties Coverage

- Cyber Terrorism Insurance

- Term Life Insurance

- Others

By Technology

- AI & ML

- AI-Powered Underwriting Platforms

- ML-Based Claims Processing Platforms

- AI-Driven Customer Service & Chatbot Platforms

- Insurance platform-Based Content Marketing

- Robotic Process Automation

- Others

- IoT

- IoT-Enabled Telematics Platforms

- Connected Home & Property Insurance Platforms

- Wearable Device Integration for Health Insurance

- Others

- Blockchain

- Blockchain-Based Insurance Platforms

- Smart Contract Insurance Platforms

- Decentralized Insurance Platforms

- Others

- Data Analytics & Big Data

- Big Data Analytics For Risk Assessment

- Predictive Analytics For Pricing & Underwriting

- Data-Driven Claims Processing Platforms

- Others

- Regulatory Technology (Regtech)

- Regulatory Compliance & Reporting Platforms

- KYC & AML Compliance Solutions

- Regulatory Risk Assessment & Management

- Others

- Others

By End-user

- Insurance Companies

- Large Carriers

- Mid-Sized Carriers

- Small & Startup Insurers

- Insurance Agencies & Brokers

- Independent Agencies

- Brokerage Firms

- Online Aggregators

- Third-Party Administrators (TPAs)

- Claims Handing Firms

- Policy Management Service Providers

- Actuaries

- Reinsurers

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

Embedded Insurance Integration

Insurance-as-a-Service is rapidly embracing embedded insurance, blending protection seamlessly into everyday digital transactions. Platforms are creating ways for insurance to be offered directly at the point of sale, such as when booking travel or making purchases. This approach breaks down old barriers in distribution and allows users to access coverage at a moment’s convenience, reflecting shifting consumer behaviors and the demand for simplicity.

By embedding insurance services within digital ecosystems like e-commerce, fintech apps, or ride-sharing platforms, these solutions are expanding reach and improving the user experience. As digital adoption accelerates, especially in emerging economies, more people expect instant, personalized protection without dealing with traditional, complex insurance channels.

Key Driver

Acceleration of Digital Transformation

One of the primary drivers fueling the rise of Insurance-as-a-Service is the rush to adopt advanced digital technology. Insurers and businesses alike are pursuing digital models to keep pace with heightened consumer expectations for easy-to-access, transparent, and supportive services.

With more customers seeking on-demand, usage-based, or micro-insurance options, legacy ways of working are no longer sufficient to keep customers loyal. This drive toward digitalization means that insurers are revamping core systems, creating APIs, and relying on automation to speed up claims, underwriting, and customer support.

The pressure to innovate rapidly is heightened by competitors leveraging technology in bold new ways, compelling all players in the market to modernize their operations. Adoption of these new tools allows for streamlined processes, sharper customer insights, and faster, more flexible product offering.

Restraint

Complexity of Regulatory Compliance

Despite opportunities, Insurance-as-a-Service faces significant obstacles rooted in regulation. The insurance industry operates within a patchwork of regional, national, and even local legal requirements that make it challenging for digital insurers to scale or introduce unconventional products.

Compliance is particularly demanding for new IaaS models that offer flexible terms or short-term coverage, as these do not always fit within established frameworks designed for traditional policies. This complex regulatory environment slows the rollout of innovative services and discourages some providers from entering new markets or trying new digital approaches.

Navigating diverse and sometimes ambiguous rules takes substantial effort and resources, forcing firms to walk a fine line between innovation and compliance. These hurdles can delay technological progress or limit the availability of certain on-demand products for customers.

Opportunity

Unlocking New Revenue Streams via Digital Ecosystems

The IaaS model offers a powerful opportunity for both insurers and non-insurance companies to generate new sources of revenue. By offering insurance products via digital ecosystems such as e-commerce platforms or lifestyle apps, businesses can attract new segments of customers who may have previously found insurance inaccessible or confusing.

This integration not only simplifies the purchase process but also allows businesses to differentiate themselves with value-added services. For service providers, partnering with digital insurance platforms removes the barriers of traditional infrastructure and regulatory hurdles typically associated with launching insurance products.

Companies can launch custom insurance offerings tailored to unique customer needs quickly, leading to enhanced satisfaction and stronger competitive positioning. As these digital ecosystems grow, providers can scale coverage across borders and introduce innovative risk solutions, capturing greater loyalty as part of customers’ daily lives.

Challenge

Legacy Systems and Tech Talent Gap

A persistent challenge stalling the evolution of Insurance-as-a-Service is the reliance on outdated legacy IT systems. Many providers find it difficult and costly to integrate modern insurance platforms with their existing technology, leading to inefficiencies and delays when introducing new digital offerings.

Customizing and upgrading these systems demands not only large investments but also specialized talent – which is in short supply across the insurance sector. This gap in tech skills and the complexity of system integration slow the adoption of IaaS models, hindering organizations’ ability to move swiftly in response to changing market conditions.

Without sufficient talent to manage advanced digital solutions, insurers risk being outpaced by more agile competitors. Overcoming these internal hurdles is vital for capitalizing fully on the promise of digital insurance but remains an ongoing struggle that shapes the pace of industry transformation.

Key Player Analysis

In the evolving Insurance-as-a-Service (IaaS) market, key technology leaders such as Cognizant, Adobe Inc., Salesforce, Inc., and IBM have built strong digital insurance platforms. These companies are enabling insurance firms to shift from legacy systems to cloud-native environments. Their focus is on improving customer engagement and automating underwriting processes.

Enterprise software giants such as Oracle, SAP SE, and Pegasystems Inc. are expanding their IaaS offerings to address complex insurance workflows. Their platforms offer end-to-end policy lifecycle automation, with embedded analytics and compliance features. Meanwhile, consulting firms like Accenture and DXC Technology Company are providing strategic implementation and cloud integration support.

Specialized vendors such as Guidewire Software, Inc., Duck Creek Technologies, Applied Systems, Inc., and Majesco offer domain-specific IaaS tools for property, casualty, and life insurance segments. Providers like Prima Solutions, Sapiens International, and others are addressing niche requirements in underwriting, distribution, and claims automation.

Top Key Players Covered

- Cognizant

- Adobe Inc.

- Salesforce, Inc.

- International Business Machines Corporation (IBM)

- Oracle

- SAP SE

- Pegasystems Inc.

- Accenture

- DXC Technology Company

- Guidewire Software, Inc.

- Duck Creek Technologies

- Applied Systems, Inc.

- Prima Solutions

- Majesco

- Sapiens International

- Others

Recent Developments

- Accenture acquired Altus Consulting in March 2025 to scale up its expertise and reach within the UK insurance and financial services sector. Altus’s team joined Accenture, enhancing its capacity to deliver digital transformation at scale to insurance clients.

- Cognizant completed the acquisition of Belcan in August 2024 for approximately $1.3 billion. This move expanded its advanced AI-led insurance platforms and technology capabilities, strengthening its presence in cloud transformation and personalized insurance products.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Software, Services), By Application (Claims Management, Underwriting & Rating, Customer Relationship Management (CRM), Billing & Payments, Data Analytics, Compliance & Reporting, Premium Collection, Sales & Marketing, Property Estimation, Predictive Modeling/Extreme Event Forecasting), By Insurance Type (General Insurance, Life Insurance, Others), By Technology (AI & ML, IoT, Blockchain, Data Analytics & Big Data, Regulatory Technology (Regtech)), By End-user (Insurance Companies, Insurance Agencies & Brokers, Third-Party Administrators (TPAs), Actuaries, Reinsurers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cognizant, Adobe Inc., Salesforce, Inc., International Business Machines Corporation (IBM), Oracle, SAP SE, Pegasystems Inc., Accenture, DXC Technology Company, Guidewire Software, Inc., Duck Creek Technologies, Applied Systems, Inc., Prima Solutions, Majesco, Sapiens International, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Insurance-as-a-Service (IaaS) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Insurance-as-a-Service (IaaS) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cognizant

- Adobe Inc.

- Salesforce, Inc.

- International Business Machines Corporation (IBM)

- Oracle

- SAP SE

- Pegasystems Inc.

- Accenture

- DXC Technology Company

- Guidewire Software, Inc.

- Duck Creek Technologies

- Applied Systems, Inc.

- Prima Solutions

- Majesco

- Sapiens International

- Others