Global Insulated Packaging Market Size, Share, Growth Analysis By Product Type (Boxes & Containers, Pouches & Bags, Pallet Shippers, Wraps & Liners), By Material (Plastic, Corrugated Cardboards, Metal, Glass, Others), By Application (Food & Beverages, Pharmaceutical, Industrial, Cosmetic, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175793

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

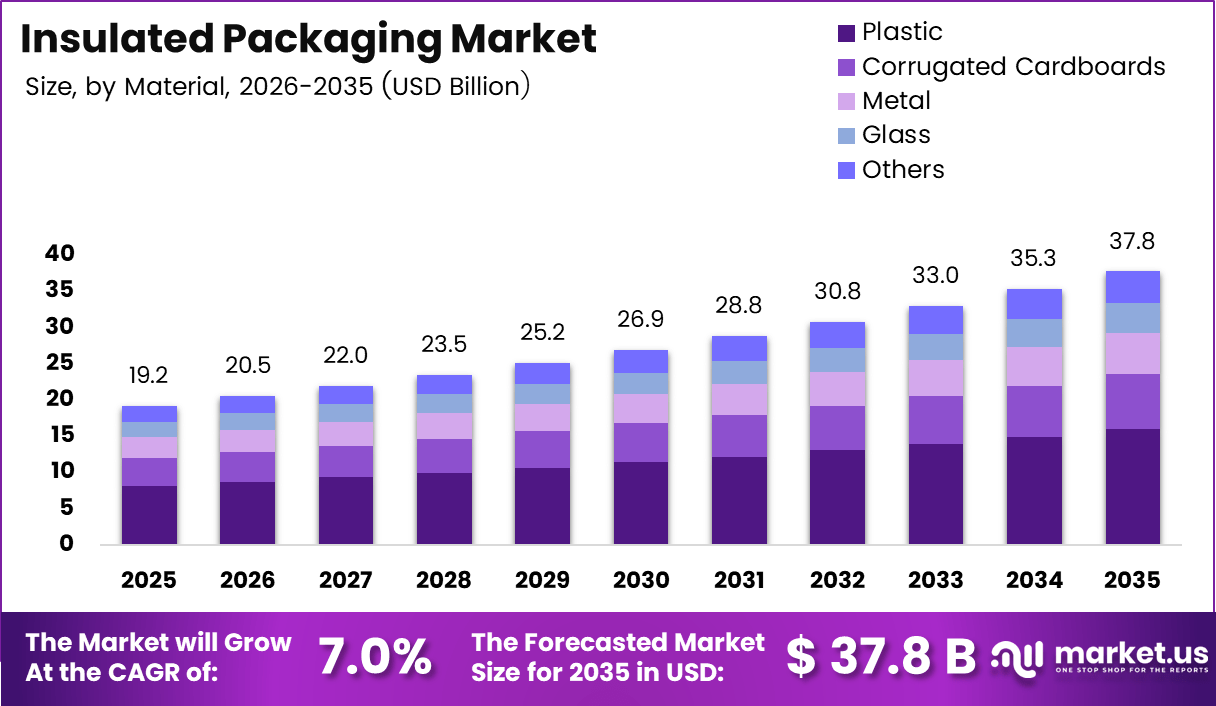

Global Insulated Packaging Market size is expected to be worth around USD 37.8 Billion by 2035 from USD 19.2 Billion in 2025, growing at a CAGR of 7.0% during the forecast period 2026 to 2035.

Insulated packaging refers to specialized protective materials designed to maintain temperature-controlled environments during product transportation and storage. These solutions utilize thermal barriers such as foam, corrugated materials, vacuum panels, and reflective liners to preserve perishable goods. Moreover, they ensure product integrity across pharmaceutical, food, beverage, and industrial applications.

The market experiences significant expansion driven by rising global trade in temperature-sensitive products. Consequently, businesses invest heavily in advanced insulation technologies to meet stringent quality standards. Additionally, growing consumer expectations for fresh and safe products fuel demand across multiple sectors. Therefore, manufacturers continuously innovate packaging designs to enhance thermal performance.

Cold chain logistics infrastructure undergoes rapid development worldwide, supporting market growth. However, companies face challenges balancing performance requirements with sustainability goals. Furthermore, regulatory frameworks increasingly mandate proper temperature maintenance throughout supply chains. Consequently, insulated packaging becomes essential for compliance and product safety assurance.

E-commerce expansion creates substantial opportunities for insulated packaging solutions. Direct-to-consumer delivery models require reliable thermal protection for perishable items. Additionally, meal kit services and online grocery platforms drive demand for innovative packaging formats. Therefore, manufacturers develop customizable solutions addressing diverse shipping requirements and transit durations.

According to IPC, one-piece box liners offer 75% more space efficiency compared to traditional molded coolers, significantly reducing storage costs. Moreover, these solutions provide reliable insulation for 24-hour cold chain shipping applications. Additionally, advanced materials enable compact designs without compromising thermal performance.

According to Sofrigam, polyurethane panels reduce insulating material size by 50% compared to polystyrene in cooling boxes. Furthermore, polystyrene proves efficient for short to medium durations up to 48 hours maximum. However, polyurethane handles medium to long durations between 48 to 96 hours effectively. Consequently, vacuum insulated panels become necessary for periods exceeding 96 hours with extreme temperature profiles.

Key Takeaways

- Global Insulated Packaging Market valued at USD 19.2 Billion in 2025, projected to reach USD 37.8 Billion by 2035

- Market growing at CAGR of 7.0% during forecast period 2026-2035

- Boxes & Containers segment dominates by Product Type with 38.7% market share

- Plastic material segment leads with 42.3% share in material category

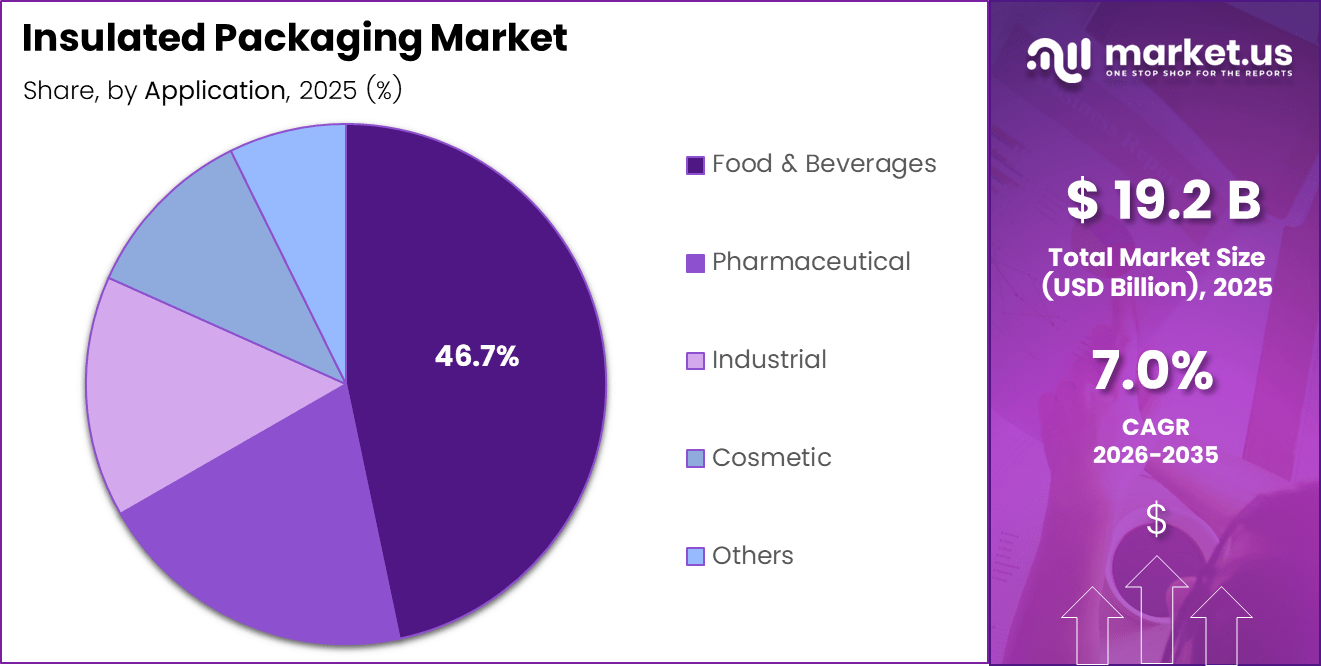

- Food & Beverages application holds largest share at 46.7%

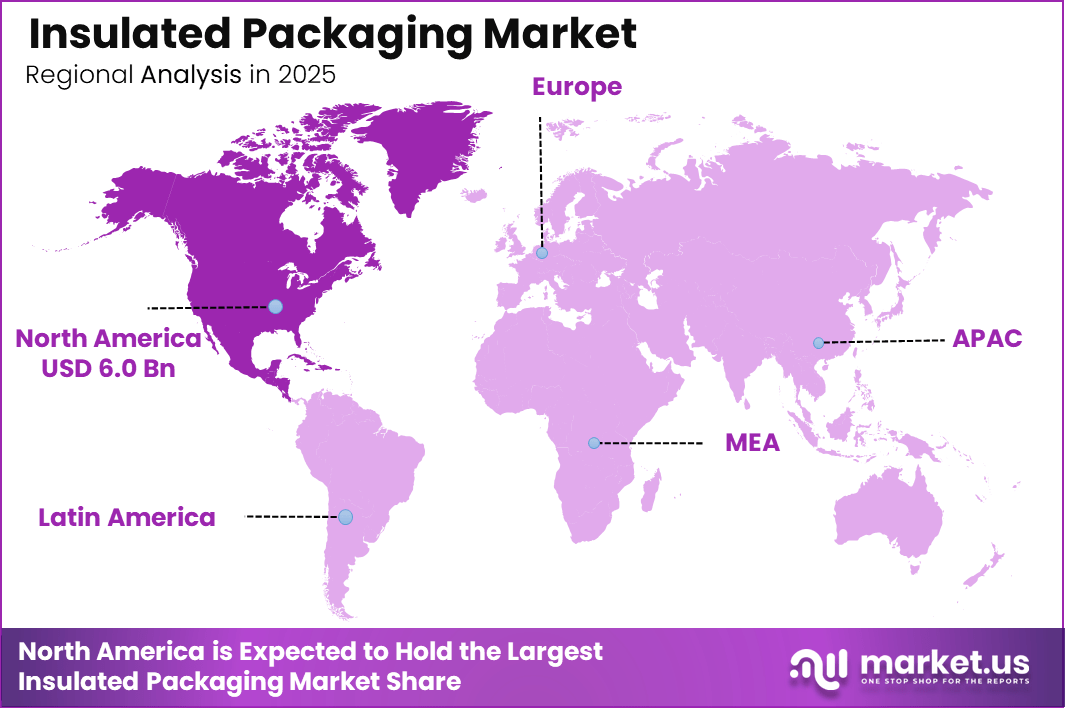

- North America dominates regional market with 34.5% share, valued at USD 6.0 Billion

- Rising cold chain infrastructure and e-commerce growth drive market expansion

- Sustainable packaging solutions and smart technology integration represent key trends

Product Type Analysis

Boxes & Containers dominates with 38.7% due to versatile applications across industries.

In 2025, Boxes & Containers held a dominant market position in the ‘By Product Type’ segment of Insulated Packaging Market, with a 38.7% share. These solutions offer superior structural integrity and stackability for warehouse storage and transportation. Moreover, they accommodate various insulation materials and temperature requirements efficiently. Consequently, businesses prefer boxes and containers for bulk shipments requiring extended thermal protection.

Pouches & Bags gain traction in pharmaceutical and small-format food delivery applications. These lightweight solutions reduce shipping costs while maintaining adequate thermal performance. Additionally, they offer convenience for direct-to-consumer deliveries and medical specimen transportation. Therefore, manufacturers innovate flexible designs addressing diverse size and insulation requirements.

Pallet Shippers serve large-scale distribution needs across industrial and pharmaceutical sectors. These heavy-duty solutions protect bulk quantities during long-distance transportation and warehousing. Furthermore, they integrate seamlessly with existing logistics infrastructure and handling equipment. Consequently, businesses rely on pallet shippers for efficient cold chain management.

Wraps & Liners provide cost-effective insulation for existing packaging configurations and temporary protection needs. These adaptable solutions enhance thermal performance of standard containers without significant investment. Moreover, they offer flexibility for seasonal demand fluctuations and specialized applications. Therefore, companies utilize wraps and liners as supplementary thermal barriers.

Material Analysis

Plastic dominates with 42.3% due to excellent thermal properties and manufacturing versatility.

In 2025, Plastic held a dominant market position in the By Material segment of Insulated Packaging Market, with a 42.3% share. Plastic materials including expanded polystyrene and polyurethane deliver superior insulation performance across temperature ranges. Additionally, these materials enable lightweight designs reducing transportation costs and carbon footprint. Consequently, manufacturers favor plastic for diverse applications requiring reliable thermal protection.

Corrugated Cardboards emerge as sustainable alternatives gaining market acceptance. These renewable materials offer adequate insulation for short to medium transit durations. Moreover, they align with environmental regulations and corporate sustainability initiatives. Therefore, businesses increasingly adopt corrugated solutions for eco-conscious supply chains.

Metal materials provide durable solutions for industrial applications and reusable packaging systems. These robust materials withstand harsh handling conditions and extreme temperature requirements. Furthermore, they offer long-term cost efficiency through multiple use cycles. Consequently, metal packaging serves specialized markets valuing durability.

Glass materials find niche applications in premium pharmaceutical and specialty food packaging. These inert materials prevent contamination and maintain product purity effectively. Additionally, they meet stringent regulatory standards for sensitive biological products. Therefore, glass packaging addresses specific quality assurance needs.

Others category includes innovative bio-based and composite materials addressing sustainability concerns. These emerging solutions combine thermal performance with environmental responsibility. Moreover, they offer differentiation opportunities for brands emphasizing green credentials. Consequently, research focuses on developing commercially viable sustainable alternatives.

Application Analysis

Food & Beverages dominates with 46.7% due to massive cold chain requirements.

In 2025, Food & Beverages held a dominant market position in the By Application segment of Insulated Packaging Market, with a 46.7% share. This sector requires extensive temperature control for perishable products including fresh produce, dairy, and frozen foods. Moreover, growing consumer demand for quality and freshness drives packaging innovation. Consequently, food and beverage companies invest heavily in advanced insulated solutions.

Pharmaceutical applications demand stringent temperature maintenance for drugs, vaccines, and biological products. These temperature-sensitive items require precise thermal control preventing efficacy degradation. Additionally, regulatory compliance mandates validated packaging systems for pharmaceutical distribution. Therefore, manufacturers develop specialized solutions meeting rigorous industry standards.

Industrial applications utilize insulated packaging for chemicals, electronics, and sensitive components requiring climate control. These products face damage risks from temperature fluctuations during transportation and storage. Furthermore, industrial users prioritize durability and reusability for cost efficiency. Consequently, packaging solutions emphasize robust construction and thermal reliability.

Cosmetic products increasingly require temperature protection maintaining formulation stability and product quality. Premium cosmetics contain active ingredients sensitive to heat exposure and temperature variations. Moreover, luxury brands prioritize packaging aesthetics alongside functional performance. Therefore, cosmetic packaging balances thermal protection with visual appeal.

Others category encompasses diverse applications including diagnostic specimens, biotechnology samples, and specialty goods. These niche markets demand customized packaging solutions addressing unique temperature requirements. Additionally, they often require specialized certifications and validation protocols. Consequently, manufacturers offer tailored solutions for specialized applications.

Key Market Segments

By Product Type

- Boxes & Containers

- Pouches & Bags

- Pallet Shippers

- Wraps & Liners

By Material

- Plastic

- Corrugated Cardboards

- Metal

- Glass

- Others

By Application

- Food & Beverages

- Pharmaceutical

- Industrial

- Cosmetic

- Others

Drivers

Rising Demand for Temperature-Controlled Packaging Across Food, Beverage, and Pharmaceutical Supply Chains

Global trade expansion in perishable goods necessitates robust temperature-controlled packaging solutions maintaining product integrity. Food safety regulations mandate proper thermal protection throughout distribution networks preventing spoilage and contamination. Moreover, pharmaceutical products including vaccines and biologics require precise temperature maintenance ensuring therapeutic efficacy. Consequently, businesses invest significantly in advanced insulated packaging technologies.

E-commerce growth accelerates demand for reliable temperature control in direct-to-consumer deliveries. Online grocery shopping and meal kit services require packaging maintaining freshness during last-mile delivery. Additionally, consumer expectations for product quality drive adoption of superior insulation solutions. Therefore, companies prioritize packaging innovations addressing diverse temperature requirements and transit durations.

Cold chain infrastructure development supports market expansion across emerging economies and established markets. Governments invest in modern logistics facilities enabling perishable product distribution to remote areas. Furthermore, international trade agreements facilitate cross-border movement of temperature-sensitive goods requiring standardized packaging solutions. Consequently, insulated packaging becomes essential for global supply chain operations.

Restraints

High Material and Manufacturing Costs Associated with Advanced Insulated Packaging Solutions

Premium insulation materials including vacuum insulated panels and advanced polymers command substantial pricing premiums. Manufacturing processes for high-performance packaging require specialized equipment and technical expertise increasing production costs. Moreover, customization demands for specific applications add complexity and expense to packaging development. Consequently, cost-sensitive businesses hesitate adopting advanced solutions despite performance benefits.

Small and medium enterprises face financial constraints limiting investment in sophisticated insulated packaging systems. Initial capital requirements for transitioning from conventional packaging create adoption barriers particularly in developing markets. Additionally, volume requirements for cost-effective production disadvantage smaller businesses. Therefore, price sensitivity restricts market penetration across certain customer segments and geographic regions.

Environmental disposal costs for conventional insulation materials add financial burden to packaging lifecycle expenses. Regulations increasingly impose extended producer responsibility requiring manufacturers fund recycling and waste management programs. Furthermore, sustainable alternative materials often carry higher procurement costs compared to traditional options. Consequently, businesses balance performance requirements with economic viability and environmental compliance obligations.

Growth Factors

Development of Sustainable and Recyclable Insulated Packaging Materials for Green Supply Chains

Environmental consciousness drives innovation in bio-based and recyclable insulation materials reducing ecological footprint. Manufacturers develop compostable packaging solutions addressing waste management concerns and regulatory pressures. Moreover, circular economy principles encourage designing packaging systems enabling material recovery and reuse. Consequently, sustainable packaging options attract environmentally responsible businesses and consumers.

Healthcare sector expansion particularly vaccine distribution and biopharmaceutical shipments generates substantial packaging demand. COVID-19 pandemic highlighted critical importance of reliable temperature-controlled packaging for vaccine deployment globally. Additionally, personalized medicine growth requires specialized packaging solutions for individual patient therapies. Therefore, pharmaceutical applications represent significant growth opportunities for insulated packaging manufacturers.

Fresh meal kit services and ready-to-eat food delivery platforms create new market segments requiring innovative packaging. These services demand compact, efficient insulation maintaining food quality during variable transit times. Furthermore, subscription-based models generate recurring packaging demand supporting consistent market growth. Consequently, food delivery innovation drives packaging technology advancement and market expansion.

Emerging Trends

Shift Toward Bio-based, Compostable, and Reusable Insulated Packaging Solutions

Sustainability mandates accelerate development of environmentally friendly insulation materials derived from renewable resources. Manufacturers explore mushroom-based, cellulose, and agricultural waste materials offering biodegradability without sacrificing thermal performance. Moreover, reusable packaging systems gain traction reducing single-use waste and long-term costs. Consequently, green packaging solutions differentiate brands and meet regulatory requirements.

Smart technology integration enables real-time temperature monitoring throughout supply chains enhancing product safety assurance. IoT sensors embedded in packaging provide continuous data transmission alerting stakeholders to temperature excursions. Additionally, blockchain integration creates transparent tracking systems building consumer trust and regulatory compliance. Therefore, digital transformation revolutionizes cold chain management and accountability.

Customization capabilities allow businesses tailoring packaging solutions to specific product requirements and brand identities. Advanced manufacturing technologies including 3D printing enable rapid prototyping and small-batch production. Furthermore, modular designs provide flexibility adapting to varying shipment sizes and temperature profiles. Consequently, personalized packaging solutions address diverse market needs efficiently.

Regional Analysis

North America Dominates the Insulated Packaging Market with a Market Share of 34.5%, Valued at USD 6.0 Billion

North America leads the global market driven by advanced cold chain infrastructure and stringent food safety regulations. The region hosts major pharmaceutical manufacturers and food processors requiring sophisticated temperature-controlled packaging solutions. Moreover, e-commerce penetration and consumer demand for fresh products fuel market growth. Consequently, North America maintains 34.5% market share valued at USD 6.0 Billion, with continued innovation in sustainable packaging technologies.

Europe Insulated Packaging Market Trends

Europe demonstrates strong market growth supported by comprehensive environmental regulations promoting sustainable packaging solutions. The region emphasizes circular economy principles driving innovation in recyclable and bio-based insulation materials. Additionally, pharmaceutical industry strength and organic food consumption generate substantial packaging demand. Therefore, European manufacturers focus on eco-friendly solutions meeting stringent sustainability standards.

Asia Pacific Insulated Packaging Market Trends

Asia Pacific exhibits rapid market expansion fueled by growing middle class and increasing cold chain infrastructure investment. Emerging economies develop modern logistics networks supporting perishable product distribution across vast geographic areas. Moreover, pharmaceutical manufacturing growth and food safety concerns drive adoption of advanced packaging solutions. Consequently, the region represents significant growth opportunities for insulated packaging providers.

Middle East & Africa Insulated Packaging Market Trends

Middle East and Africa experience gradual market development as nations invest in cold chain capabilities addressing food security concerns. Harsh climate conditions necessitate robust temperature-controlled packaging protecting products during transportation and storage. Additionally, pharmaceutical imports and healthcare infrastructure improvements generate packaging demand. Therefore, market growth accelerates with economic development and infrastructure modernization.

Latin America Insulated Packaging Market Trends

Latin America shows promising market potential driven by agricultural exports and growing pharmaceutical sector. Countries invest in cold chain infrastructure enabling fresh produce distribution to international markets. Moreover, expanding middle class and urbanization increase demand for temperature-controlled food delivery services. Consequently, insulated packaging adoption rises supporting economic development and trade expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Amcor plc stands as a global packaging leader offering comprehensive insulated packaging solutions across multiple industries. The company leverages extensive manufacturing capabilities and innovation expertise developing sustainable temperature-controlled packaging systems. Moreover, Amcor’s global presence enables serving diverse customer needs with customized solutions addressing specific regional requirements. Consequently, the company maintains strong market position through continuous product development and strategic partnerships.

Sealed Air Corporation delivers advanced protective and insulated packaging solutions emphasizing sustainability and performance excellence. The company pioneered temperature assurance packaging technologies serving pharmaceutical, food, and industrial applications. Additionally, Sealed Air invests heavily in circular economy initiatives developing recyclable and reusable packaging systems. Therefore, the company drives industry innovation while addressing environmental concerns and customer requirements.

Cryopak Industries Inc. specializes in temperature-controlled packaging solutions for pharmaceutical and life sciences applications. The company offers comprehensive cold chain systems including insulated shippers, phase change materials, and temperature monitoring devices. Moreover, Cryopak’s recent acquisition of Gel-Pack manufacturing capabilities strengthens its market position and product portfolio. Consequently, the company expands service offerings addressing growing demand for reliable pharmaceutical packaging solutions.

Pelican BioThermal LLC focuses on high-performance reusable temperature-controlled packaging systems reducing environmental impact and operational costs. The company’s rental programs provide cost-effective solutions for businesses requiring reliable cold chain packaging. Additionally, Pelican BioThermal emphasizes data-driven insights through temperature monitoring and supply chain analytics. Therefore, the company differentiates through sustainability leadership and comprehensive service offerings.

Key players

- Amcor plc

- Sealed Air Corporation

- Cryopak Industries Inc.

- Innovative Energy Inc.

- Providence Packaging Corporation

- The Wool Packaging Company Ltd

- Thermal Packaging Solutions Ltd

- Cold Chain Technologies LLC

- Pelican BioThermal LLC

- Packaging Corporation of America

- Storopack Hans Reichenecker GmbH

- Sonoco ThermoSafe

- Smurfit Westrock

- Lifoam

- Ranpak

- Other Key Players

Recent Developments

- July 2024 – Cryopak acquired the Gel-Pack manufacturing segment of Garden State Cold Storage, marking the company’s second acquisition in eight months. The company also announced stock buyback initiatives and capability investments in its Atlanta facility to enhance production capacity and operational efficiency.

- July 2024 – Fenzi Group SpA, a Milan-based chemical company specializing in glass processing solutions acquired Thermoseal, This strategic transaction represents a significant milestone for both organizations, expanding Fenzi’s portfolio and market presence in specialized insulation applications.

Report Scope

Report Features Description Market Value (2025) USD 19.2 Billion Forecast Revenue (2035) USD 37.8 Billion CAGR (2026-2035) 7.0% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Boxes & Containers, Pouches & Bags, Pallet Shippers, Wraps & Liners), By Material (Plastic, Corrugated Cardboards, Metal, Glass, Others), By Application (Food & Beverages, Pharmaceutical, Industrial, Cosmetic, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor plc, Sealed Air Corporation, Cryopak Industries Inc., Innovative Energy Inc., Providence Packaging Corporation, The Wool Packaging Company Ltd, Thermal Packaging Solutions Ltd, Cold Chain Technologies LLC, Pelican BioThermal LLC, Packaging Corporation of America, Storopack Hans Reichenecker GmbH, Sonoco ThermoSafe, Smurfit Westrock, Lifoam, Ranpak, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor plc

- Sealed Air Corporation

- Cryopak Industries Inc.

- Innovative Energy Inc.

- Providence Packaging Corporation

- The Wool Packaging Company Ltd

- Thermal Packaging Solutions Ltd

- Cold Chain Technologies LLC

- Pelican BioThermal LLC

- Packaging Corporation of America

- Storopack Hans Reichenecker GmbH

- Sonoco ThermoSafe

- Smurfit Westrock

- Lifoam

- Ranpak

- Other Key Players