Global Insulated Concrete Form Market By Product (Cement-Bonded Wood Fiber, Polyurethane Foam, Polystyrene Foam, Other Products), By Application (Non-residential, Residential), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 14109

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

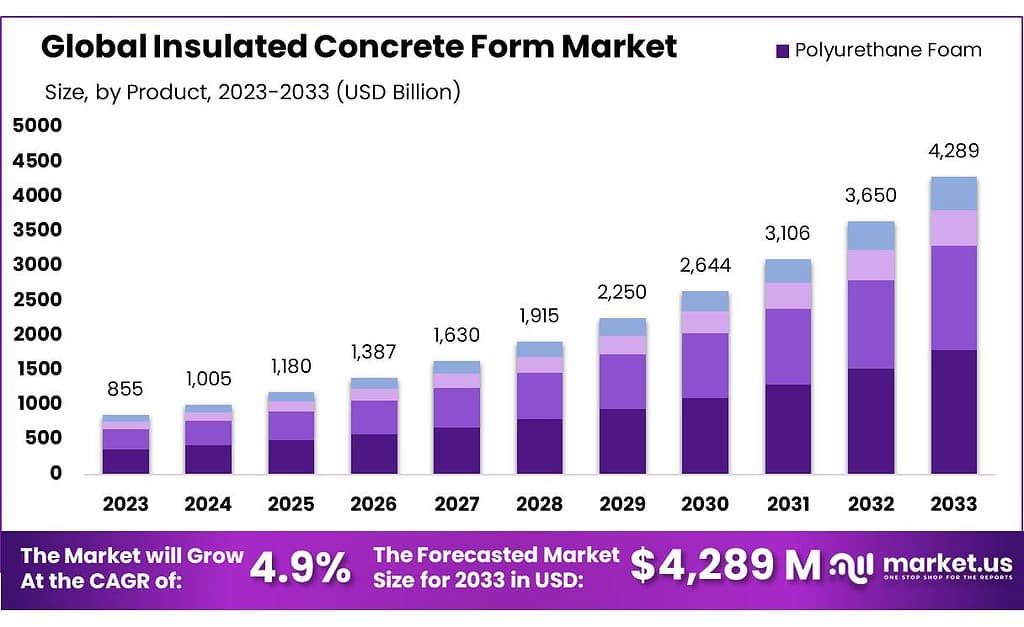

The global Insulated Concrete Form Market size is expected to be worth around USD 1380 Million by 2033, from USD 855 Million in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

Their superior thermal insulation properties will see insulated concrete forms becoming more popular in temperate regions areas, including North America and Europe. An insulated concrete form market is a hollow panel or block made of insulating foam and polystyrene.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth and Projection: The global ICF market size is predicted to reach around USD 1380 Million by 2033, growing from USD 855 Million in 2023, reflecting a CAGR of 4.9% during 2023-2033.

- Product Analysis: Polystyrene Foam dominated with over 40% market share in 2023 due to affordability and good insulation properties.

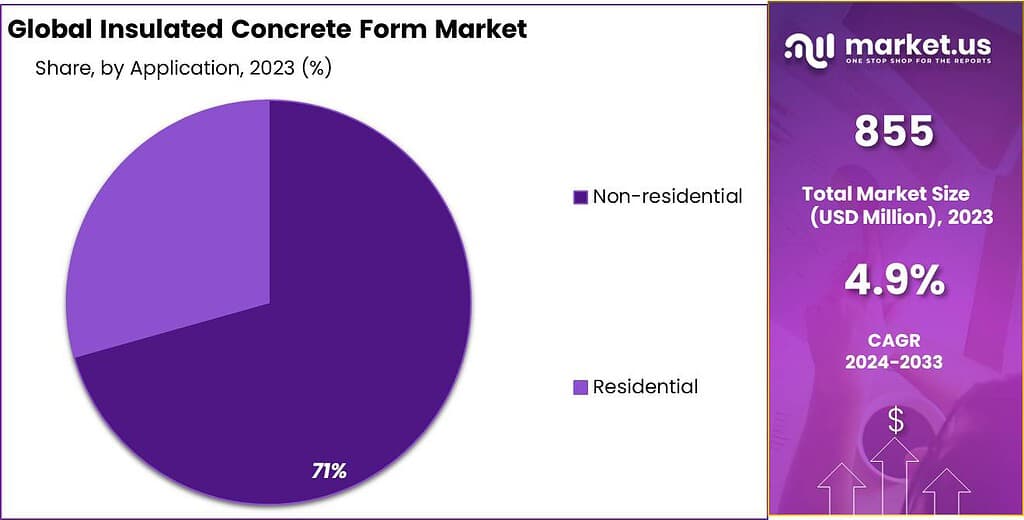

- Application Analysis: Residential projects accounted for over 65% market share in 2023 due to excellent insulation properties, driving their prevalent use. Non-residential construction is forecasted to expand at a 4.1% annual growth rate until 2032, influenced by increasing demands in various sectors like healthcare, hospitality, and education.

- Drivers and Opportunities: Increasing demand for energy-efficient buildings, compliance with environmental regulations, and government initiatives supporting green solutions drive the market. Emerging technologies, newer materials, and governmental support for eco-friendly buildings present growth opportunities.

- Challenges and Restraints: High costs of materials and skilled labor pose challenges, hindering new entrants into the market and limiting widespread adoption. Lack of awareness among builders and customers about the benefits of ICFs restricts market growth.

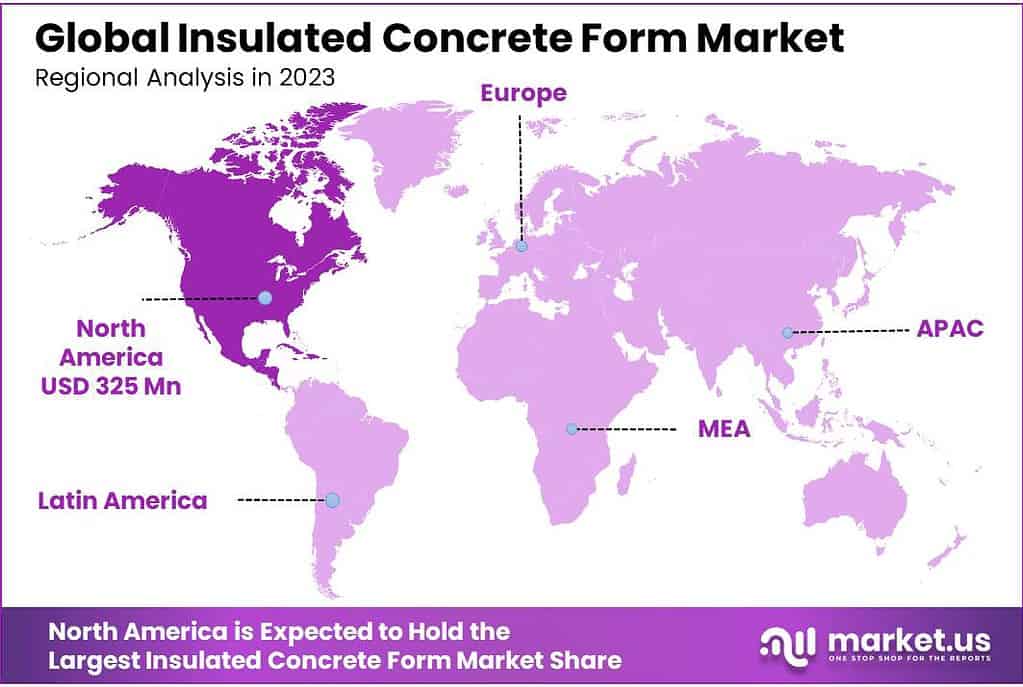

- Regional Analysis: North America led the market in 2023 due to high demand, while Europe and Asia Pacific are projected for substantial growth due to increasing acceptance and demand for green solutions.

- Key Players and Recent Developments: Major market players include BASF SE, Amvic Inc., Nudura Corporation, among others, focusing on product innovation and improvements.

Product Analysis

In 2023, Polystyrene Foam was at the top, having more than a 40% share. This type of foam was widely used because it’s affordable and has good insulation properties, making it a popular choice for construction projects.

They are cost-effective, lightweight, and have superior thermal insulation. Due to their lightweight, low density, improved mechanical properties, and thermal insulation, expanded polystyrene is widely used.

Polystyrene foam-based ICFs are expected to see a 4.5% CAGR from 2023-2032. Expanded polystyrene’s chemical production and shock resistance, as well as its easy recyclability, have all contributed to the increase in demand for insulated concrete forms.

The second largest market share was held by polyurethane-based concrete forms. Products will be in high demand due to the growing demand for flexible and energy-efficient insulation for residential and commercial buildings. Additionally, the increasing demand for rigid walls is expected to drive demand for ICF products that are polyurethane-based.

Because they have a high thermal performance, Cement-bonded wood fibers are popular in residential and commercial constructions. They offer an R-value of 28 or more. ICF market industry growth is expected to be driven by increasing demand for energy-efficient and high-quality insulation material for modern commercial buildings. During the forecast period, the residential segment is projected to be the fastest-growing end-use industry segment of the insulated concrete form market report.

Application Analysis

Residential projects took the lead in 2023, accounting for over 65% of the market share. These forms are favored for homes because they provide excellent insulation, making houses cozy in winter and cool in summer. Builders and homeowners find them reliable, hence their prevalent use in residential construction.

Concrete Form Market forecast from 2023 to 2032, the non-residential construction market is expected to expand at a 4.1% annual growth rate. The construction industry is expected to grow due to the rising number of hospitals, restaurants, and hotels as well as educational buildings. The market is likely to see a rise in product penetration from the construction sector.

Globally, there is positive growth in residential construction and rising investments by public/private partnerships. This will likely increase the market’s growth over the forecast period. Growth in residential constructions and urbanization are key factors that have contributed to their growth, which will support the market for insulated concrete forms.

ICF houses can be constructed quickly and easily because these products are lightweight. Because they are lightweight and portable, ICF houses don’t require much help. They can also be constructed by end-users. ICF will see a positive change in the market if manufacturers make more effort to help their consumers set up these types of systems.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Product

- Cement-Bonded Wood Fiber

- Polyurethane Foam

- Polystyrene Foam

- Other Products

By Application

- Non-residential

- Residential

Drivers

People seek buildings that use less energy while protecting the environment, making insulated concrete forms an effective means of creating these kinds of buildings; their strength, durability, and ability to keep homes warm in winter while keeping them cool in summer are just a few advantages over more conventional methods of construction.

In both Europe and North America, rules require builders to use materials that benefit both energy savings and the environment; programs like the Green Building Program in Europe assist owners with knowledge on saving energy as well as using superior materials in their structures.

As more construction projects emerge around the globe, buildings are rising steadily across many regions such as the Middle East, North America, and Asia. India in particular is seeing government initiatives promote building projects. Although construction had its share of difficulties over recent decades, experts believe it will eventually contribute greatly to global economies by 2030.

Restraints

High Costs Impacting Entry: The insulated concrete form industry has changed a lot because of new technologies. But making these forms costs a lot more than older ways of building. The materials used in these forms are expensive compared to traditional ones.

Besides, paying skilled workers to build with these forms adds to the high expenses. Because it’s costly, new companies find it hard to join the market. This expense acts as a barrier, stopping new players from entering the market, and that slows down how much these forms get used.

Challenges in Affordability: Materials used to make insulated concrete forms cost a lot, and finding skilled workers adds to the expenses. This makes it tough for new companies to start using these forms. Because it’s so expensive, it stops the market from growing more during the forecast period.

Opportunity

More and more people want buildings that are good for the environment. Insulated concrete forms fit this need because they keep buildings cozy and strong while using less energy. As this desire for eco-friendly buildings grows, the market for these forms gets bigger.”

New technology is also helping make these forms better and cheaper. Using newer materials and smarter ways to build can attract more people to use these forms, making the market even bigger.

Governments are supporting eco-friendly buildings too. They’re making rules that encourage using materials like insulated concrete forms, creating more opportunities for these kinds of buildings.

Also, in many places around the world, there’s a lot of building going on. Places like India and some parts of the Middle East are building a ton. That means more chances for using insulated concrete forms in these big construction projects.

Lastly, telling builders and people who want to build about the benefits of these forms can make a difference. When more people know how good they are at saving energy and being strong, more people might want to use them in their buildings.

Challenges

Costs: Building with these forms can be expensive because the materials and skilled workers needed cost a lot. This makes it hard for some builders or projects to use them.

Getting Started in the Market: It’s tough for new companies to join the market because it costs a lot and needs special skills. This makes it hard for new ideas or companies to grow.

Not Enough People Know: Many builders and people who want to build don’t know much about these forms. They might not know that these forms save energy and are strong, which stops more people from using them.

People Stick to What They Know: Some builders or customers might prefer the usual ways of building because they’re used to them. They might think using these forms is too hard or complicated.

Different Rules Everywhere: In some places, the rules about building are different. These rules might not allow the use of these forms, which stops them from being used there.

Regional Analysis

North America dominated this market in 2023 with a revenue share of 38%. The key trend is expected to continue during the forecast period. The high penetration of insulated concrete forms in the U.S. markets and Canada has contributed to their high demand. Due to the significant increase in new construction and renovations in the United States, the residential sector is experiencing economic growth.

The main material used in building houses in the U.S. is wood. The downside is that wooden houses can be prone to fungal infections and degrade due to moisture. These drawbacks are being overcome by a growing demand for new innovative raw materials. This will have a positive effect on the market for insulated concrete forms.

The industry is expected to grow in Europe due to the rapid acceptance of ICF products as well as the increasing demand for green solutions. The Green Building Solutions Program, which is run by the European Commission to increase the energy efficiency in residential and non-residential buildings in Europe, will likely support the Concrete form market growth.

Asia Pacific’s market is expected to grow at 5.4% annually between 2023-2032, due to the increasing use of ICF blocks for commercial construction. The majority of the product’s consumption was in Japan and China, which are both influenced by rising industry trends in modern and environmentally friendly constructions. Low-rise buildings find their extensive application in insulated concrete form buildings.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

-

South America

- Brazil

- Argentina

- Rest of South America

-

MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Global insulated concrete form market trends are characterized by low competition due to the presence of prominent manufacturers and limited penetration around the world. Innovators in the ICF market have patented interlocking blocks to make walls and foundations rigid.

This makes it difficult for competitors to enter the market. Industry players have a lot to gain from the industry. End-users can get installation instructions and assistance from product manufacturers.

To gain a competitive advantage, market players must focus on making product improvements to improve their thermal insulation strength and value. In order to capitalize on the rising consumer demand, particularly in cold regions, there are likely to be new players in this industry.

Маrkеt Кеу Рlауеrѕ

- BASF SE

- Airlite Plastics Company

- Amvic Inc.

- Beco Products Ltd.

- Durisol UK

- Nudura Corporation

- Quad-Lock Building Systems, Ltd.

- BuildBlock Building Systems, LLC.

- Logix Insulated Concrete Forms Ltd.

- Standard ICF Corporation

Recent developments

November 2022: Foam Holdings, a Wynnchurch Capital, L.P. company, announced the acquisition of Amvic Inc. (North America’s leading manufacturer of expanded polystyrene (“EPS”) insulated concrete forms) and Concrete Block Insulating Systems Inc. This acquisition will help the company to get a lead in the insulated concrete form (ICF) market.

September 2022: Amvic Inc. launched the Amvic ICF system, an expanded polystyrene (EPS) building block (graphite enhanced) with unique properties, such as modular interlocking and flame retardance.

Report Scope

Report Features Description Market Value (2023) USD 855 Million Forecast Revenue (2033) USD 1380 Million CAGR (2023-2032) 4.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cement-Bonded Wood Fiber, Polyurethane Foam, Polystyrene Foam, Other Products), By Application (Non-residential, Residential) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Airlite Plastics Company, Amvic Inc., Beco Products Ltd., Durisol UK, Nudura Corporation, Quad-Lock Building Systems, Ltd., BuildBlock Building Systems, LLC., Logix Insulated Concrete Forms Ltd., Standard ICF Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Insulated Concrete Forms (ICFs)?ICFs are construction systems used to create reinforced concrete walls by stacking modular forms made of insulating materials like expanded polystyrene (EPS) or extruded polystyrene (XPS). Once assembled, these forms are filled with concrete, creating a durable and insulated wall structure.

What are the key components of an ICF system?An ICF system typically consists of interlocking foam panels or blocks that serve as formwork for pouring concrete. These panels have a hollow core that can be filled with reinforced concrete, providing structural integrity.

How important is sustainability in the ICF industry?Sustainability is a significant aspect driving the adoption of ICFs, as they contribute to energy savings, reduce greenhouse gas emissions, and promote eco-friendly construction practices compared to conventional building materials.

Insulated Concrete Form MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Insulated Concrete Form MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

-

- BASF SE

- Airlite Plastics Company

- Amvic Inc.

- Beco Products Ltd.

- Durisol UK

- Nudura Corporation

- Quad-Lock Building Systems, Ltd.

- BuildBlock Building Systems, LLC.

- Logix Insulated Concrete Forms Ltd.

- Standard ICF Corporation

-