Global Infrastructure Solution Market Size, Share and Analysis Report By Solutions (Collaboration & Communication Platforms, HR & Talent Management Systems, Workplace Analytics & AI Tools, Physical Workspace Technology (IoT, Smart Office), Others), By Service Type (Consulting Services, Technology Integration Services, Managed Services, Others), By Organization Size (Large Enterprises, Small & Medium Businesses), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, Retail & Consumer Goods, Manufacturing & Industrial, Government & Public Sector, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173375

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- U.S. Infrastructure Solution Market Size

- Solution Analysis

- Service Type Analysis

- Organization Size Analysis

- End-User Industry Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

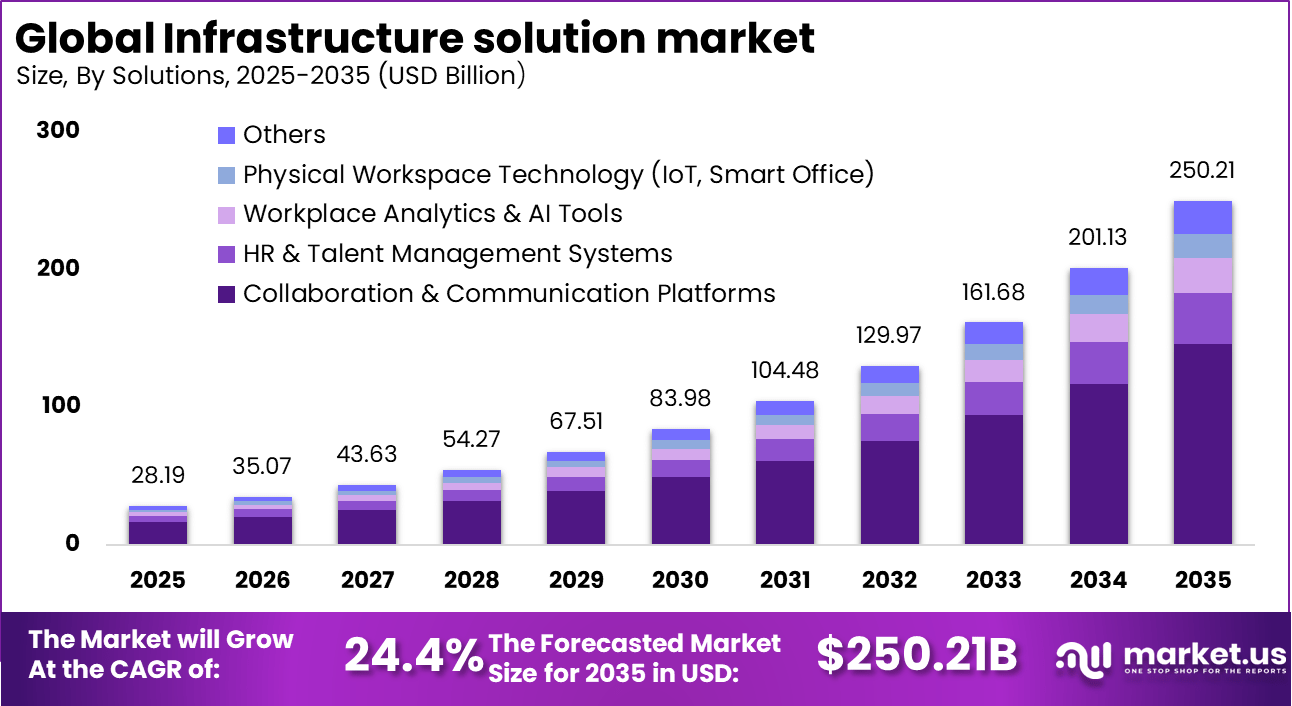

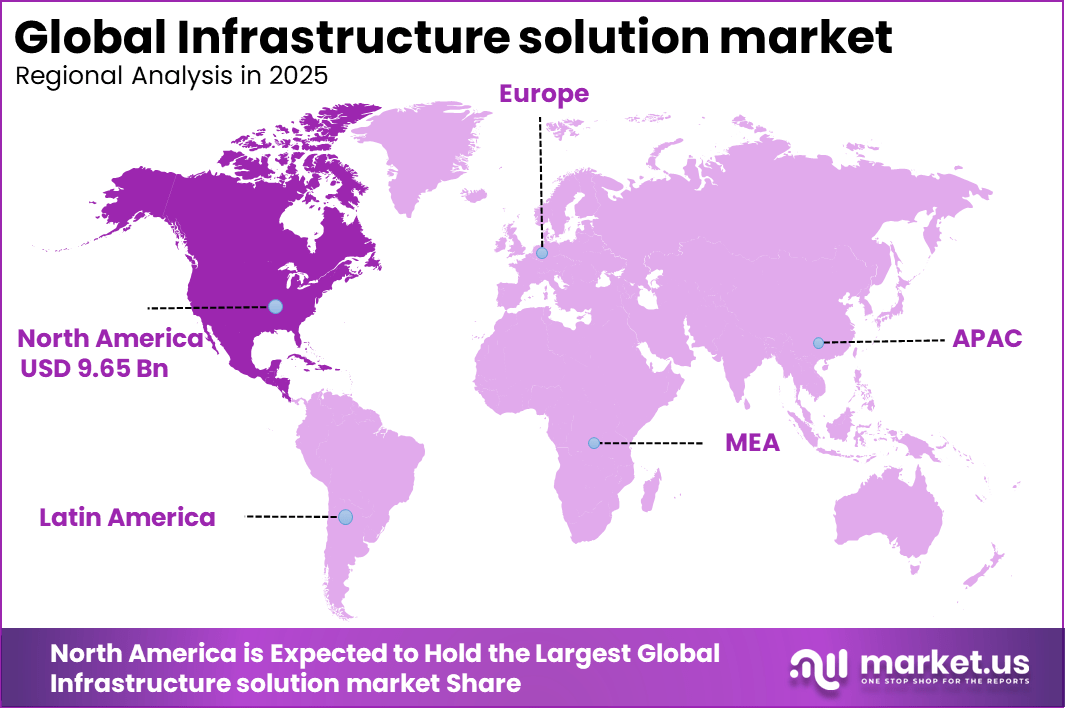

The Global Infrastructure solution market size is expected to be worth around USD 250.21 billion by 2035, from USD 28.19 billion in 2025, growing at a CAGR of 24.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 34.26% share, holding USD 9.65 billion in revenue.

The infrastructure solution market refers to the range of technologies, services, and systems that support the planning, construction, operation, and maintenance of physical and digital infrastructure. These solutions encompass networking equipment, computing platforms, data centers, power systems, transportation frameworks, and cloud based services that enable business and public operations.

Adoption is seen across public sector projects, corporate campuses, industrial facilities, and digital enterprises seeking scalable and resilient infrastructure foundations. The market is characterized by continuous innovation, standards driven integration, and cross-sector demand for reliable infrastructure solutions. Growth in this market has been shaped by expanding digital transformation initiatives and modernization efforts across industries.

Organizations are investing in infrastructure solutions to support increased data traffic, remote work, automation, and secure communications. Government initiatives focused on smart cities, renewable energy, and critical infrastructure upgrades have also stimulated market activity. As enterprises pursue operational efficiency and agility, the role of integrated infrastructure solutions has become more strategic and essential.

For instance, in June 2025, at HPE Discover 2025, HPE expanded its GreenLake portfolio with new “agentic infrastructure” capabilities and fault‑tolerant NonStop services delivered as a cloud model. The updates target always‑on, regulated, and AI‑intensive workloads, strengthening HPE’s hybrid infrastructure value proposition.

Key Takeaway

- Collaboration and communication platforms emerged as the leading solution category with a 58.3% share, as enterprises prioritized unified tools to support hybrid work, real-time collaboration, and digital workplace modernization.

- Technology integration services accounted for 48.6%, reflecting strong demand for connecting cloud platforms, legacy systems, security layers, and enterprise applications into a single operational framework.

- Large enterprises dominated adoption with a 68.9% share, driven by their need to manage complex IT environments, large user bases, and geographically distributed infrastructure.

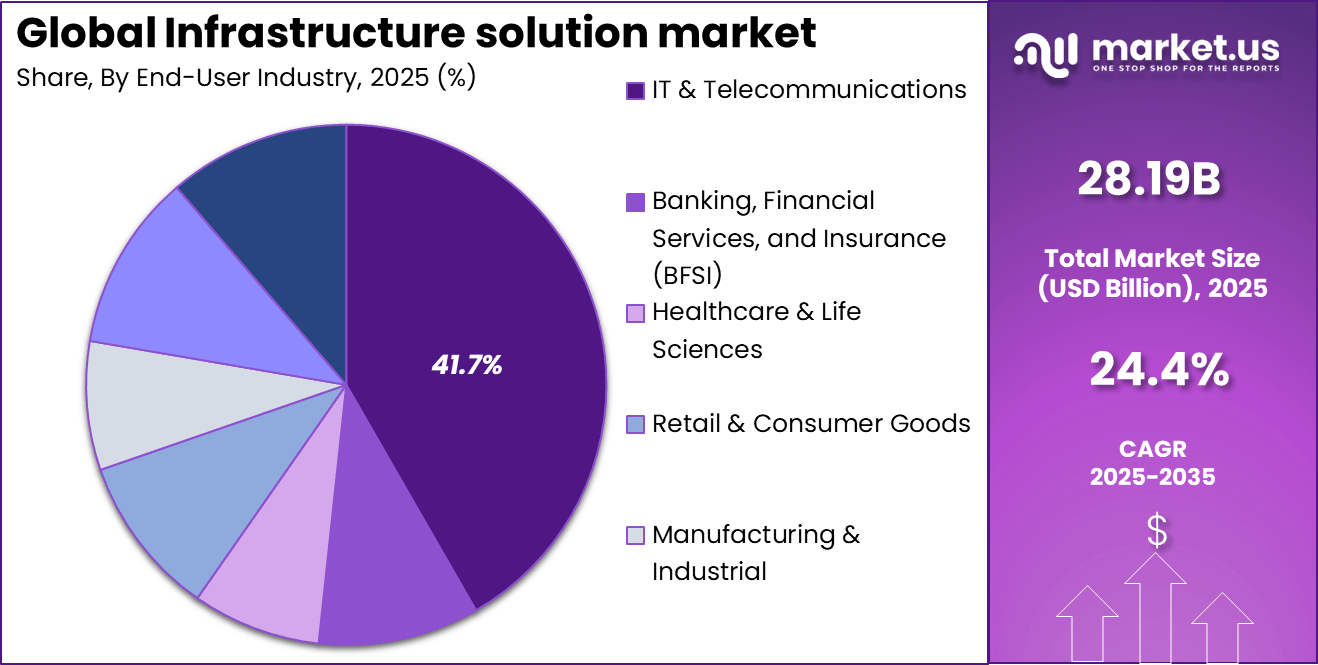

- The IT and telecommunications sector held 41.7% of market demand, supported by continuous investments in network upgrades, data centers, and scalable digital infrastructure.

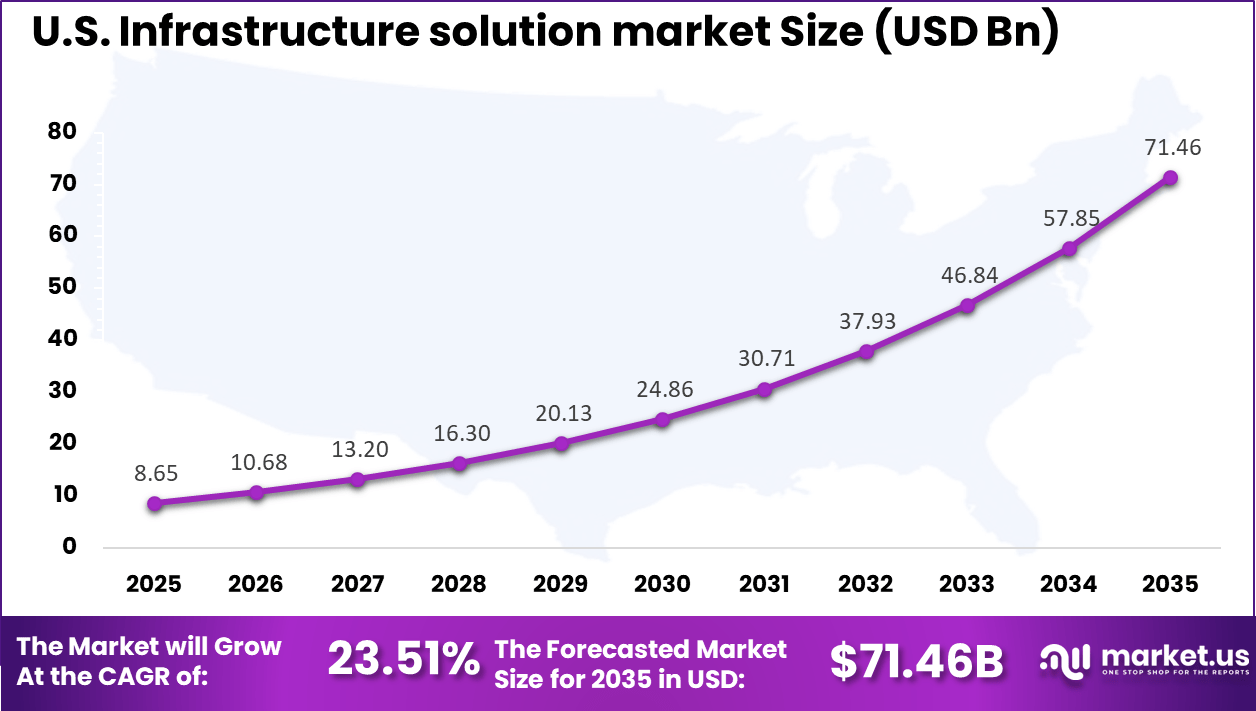

- The U.S. infrastructure solution market reached USD 8.65 billion in 2025 and is expanding at a strong 23.51% CAGR, fueled by accelerated digital transformation and cloud migration initiatives.

- North America maintained a leading position with over 34.26% share, underpinned by advanced IT infrastructure, early technology adoption, and sustained enterprise spending.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Digital transformation initiatives Enterprises modernizing IT and operational infrastructure ~6.4% North America, Europe Short to Mid Term Smart infrastructure investment Adoption across transport, utilities, and public systems ~5.3% Asia Pacific, Middle East Mid Term Cloud migration acceleration Shift from on premise to scalable infrastructure ~4.9% Global Short Term Demand for system resilience Need for secure and reliable infrastructure ~4.1% Global Long Term Edge and distributed systems Growth in localized processing needs ~3.7% Global Mid Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Cybersecurity threats Increased attack surface across connected infrastructure ~4.6% Global Short Term Integration complexity Challenges combining legacy and modern systems ~3.8% Global Mid Term Capital intensity High upfront deployment costs ~3.2% Emerging Markets Short Term Regulatory constraints Compliance across infrastructure sectors ~2.5% Europe, North America Mid Term Vendor dependency Reliance on limited solution providers ~1.9% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Budget limitations Delayed infrastructure modernization projects ~4.8% Emerging Markets Short Term Skills shortage Lack of infrastructure and cloud specialists ~3.9% Global Mid Term Long deployment cycles Extended implementation timelines ~3.1% Global Mid Term Interoperability issues Difficulty integrating multi vendor systems ~2.4% Global Long Term Unclear ROI Difficulty quantifying benefits upfront ~1.8% Global Short Term U.S. Infrastructure Solution Market Size

The market for Infrastructure solutions within the U.S. is growing tremendously and is currently valued at USD 8.65 billion, the market has a projected CAGR of 23.51%. The market expands due to surging demand for cloud-native setups, AI-driven data centers, and 5G rollouts that handle massive workloads.

Businesses push for seamless integration to support remote teams and real-time analytics. Government incentives boost digital connectivity, while cybersecurity needs rise with cyber threats. Large enterprises lead adoption, fueling investments in scalable networks across tech hubs.

For instance, in October 2025, IBM unveiled Project Infragraph at TechXchange, a unified control plane for hybrid cloud infrastructure management, integrating HashiCorp acquisitions to streamline observability and automation across multi-cloud environments. This advancement reinforces U.S. leadership in enterprise AI and infrastructure solutions by addressing tool fragmentation and enhancing security posture for global enterprises.

In 2025, North America held a dominant market position in the Global Infrastructure solution market, capturing more than a 34.26% share, holding USD 9.65 billion in revenue. Tech powerhouses in the US and Canada lead with massive data center builds to handle cloud and AI demands.

Early adoption of 5G and edge computing speeds up connectivity needs. Strong investments from enterprises fuel network upgrades across industries. Government programs back digital infrastructure growth. Skilled talent pools drive cutting-edge deployments. Urban centers push for reliable systems to support daily operations smoothly. This edge keeps the region ahead worldwide.

For instance, in December 2025, Microsoft announced an $80 billion capital expenditure plan for FY2025 focused on AI data centers and power infrastructure, including major U.S. investments like the Wisconsin AI data center. These initiatives solidify North America’s dominance in scalable AI infrastructure through strategic energy partnerships and massive expansion.

Solution Analysis

In 2025, collaboration and communication platforms captured a 58.3% share, showing their dominant role in the market. These platforms support messaging, video conferencing, file sharing, and real-time collaboration. Organizations rely on them to improve internal coordination and decision-making. Centralized communication tools reduce delays and information gaps. This makes them essential for modern operations.

The dominance of this segment is driven by hybrid and remote work practices. Teams require seamless communication across locations and time zones. Collaboration platforms integrate with other enterprise systems easily. They improve productivity and workflow transparency. Continued digital workplace adoption supports sustained demand.

For Instance, in October 2025, Salesforce expanded its partnership with OpenAI, integrating Agentforce 360 into ChatGPT for seamless CRM data access during chats. This move enhances collaboration by bringing Salesforce insights directly into conversational tools, helping teams work faster across Slack and other platforms.

Service Type Analysis

In 2025, technology integration services accounted for 48.6%, making them the leading service type. These services focus on connecting new platforms with existing enterprise systems. Integration ensures smooth data flow across applications. Organizations depend on integration to avoid operational disruptions. Proper system alignment improves efficiency.

Demand for technology integration services is driven by complex IT environments. Enterprises use multiple digital tools across departments. Integration services reduce system silos and manual processes. They also improve system reliability and performance. This keeps integration services in high demand.

For instance, in September 2025, Deloitte launched a global AI Infrastructure Center of Excellence to help clients build AI data centers with advanced cybersecurity and optimization tools. The CoE focuses on integrating networks and ensuring compliant environments, easing technology stack unification for enterprises.

Organization Size Analysis

In 2025, large enterprises held a 68.9% share, highlighting their strong market presence. These organizations operate at scale with complex workflows and large teams. They require advanced platforms to manage communication and operations. Large enterprises prioritize structured and secure systems. Scale increases dependency on digital solutions.

Adoption among large enterprises is driven by digital transformation strategies. These organizations invest heavily in integrated platforms. Centralized systems support governance and compliance. Large enterprises also have higher budgets for technology adoption. This sustains their dominant position.

For Instance, in December 2025, HPE announced AI-native networking advances after acquiring Juniper, targeting large enterprise AI factories with high-speed routing for data centers. The updates unify AIOps across portfolios to handle complex, scalable infrastructure for big organizations.

End-User Industry Analysis

In 2025, the IT and telecommunications sector captured a 41.7% share, making it the leading end-user industry. This sector relies on continuous communication and coordination. Platforms support service delivery, network operations, and customer engagement. Real-time collaboration is critical for system uptime. Digital tools improve operational efficiency.

Growth in this segment is driven by rapid technology evolution. IT and telecom companies manage distributed teams and infrastructure. Collaboration platforms support faster issue resolution. Integration with technical systems improves workflow control. This sustains strong adoption within the industry.

For Instance, in December 2025, Microsoft committed $17.5 billion to AI infrastructure in India, including new data centers in Hyderabad for telecom workloads. Partnering with Airtel, it boosts sovereign AI capabilities and 5G connectivity for the IT and telecom sectors.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Enterprises Very High ~41% Operational efficiency and scalability Long term contracts Government bodies High ~26% National infrastructure development Public funding Infrastructure providers High ~18% Service portfolio expansion Capital intensive System integrators Moderate ~10% Digital transformation projects Project based Startups Low to Moderate ~5% Niche infrastructure solutions Agile adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Cloud infrastructure Scalable computing and storage ~6.1% Mature Edge computing Low latency local processing ~4.8% Growing AI driven infrastructure management Predictive maintenance and optimization ~4.2% Developing IoT platforms Connected asset monitoring ~3.6% Growing Automation and orchestration Resource efficiency and uptime ~2.9% Developing Emerging Trends

In the infrastructure solution market, a significant trend is the integration of digital and automated technologies into core infrastructure planning and management. Infrastructure projects are increasingly supported by technologies such as remote monitoring, digital modelling, and predictive analytics, which improve planning accuracy and long-term performance tracking. These digital layers help organisations manage operations with greater visibility, reduce manual oversight, and optimise resource deployment in real time.

Another emerging trend is the focus on sustainable and resilient design practices. Infrastructure solution providers are embedding environmental and resilience criteria into their offerings to address climate variability, regulatory pressure, and community expectations. Designs increasingly prioritise energy efficiency, reduced emissions, and adaptability to extreme weather conditions, reflecting a broader shift toward infrastructure that supports sustainability objectives and long-term network integrity.

Growth Factors

A key growth factor in the infrastructure solution market is the expanding demand for modernised public and private infrastructure assets. Governments and enterprises are investing in upgrades to transportation networks, utilities, digital communications, and industrial facilities to support economic activity and address ageing systems. This drive for renewal stimulates demand for comprehensive solutions that span planning, construction, integration, and lifecycle maintenance.

Another important factor supporting growth is the rise of connected and intelligent systems within infrastructure ecosystems. The proliferation of sensors, Internet of Things (IoT) devices, and edge computing capabilities generates data that infrastructure solutions can harness to improve maintenance scheduling, asset performance, and operational safety. This data availability enhances the value proposition of infrastructure solutions that enable real-time insights and more effective decision making.

Opportunity

A strong opportunity exists in the development of solutions tailored to urbanisation and smart city needs. Rapid urban growth is creating demand for infrastructure systems that support mobility, energy management, waste management, and public safety. Infrastructure solutions designed to address urban challenges such as congestion, pollution, and resource scarcity can attract investment and support long-term city planning goals.

Another opportunity lies in the expansion of lifecycle-oriented services such as predictive maintenance and performance optimisation. Solutions that support ongoing asset health monitoring, risk assessment, and maintenance scheduling can extend infrastructure lifespan and reduce unexpected failures. These capabilities add strategic value that resonates with organisations seeking efficient asset stewardship.

Challenge

One of the main challenges for the infrastructure solution market is ensuring data security and privacy as connected systems expand. Infrastructure systems increasingly depend on networked sensors, control mechanisms, and remote access tools. Protecting sensitive data and operational integrity against unauthorised access or cyber threats requires robust security frameworks and continuous monitoring.

Another challenge involves navigating diverse regulatory and compliance environments across regions. Infrastructure projects are often subject to complex local, national, and international regulations related to safety, environmental impact, permitting, and public engagement. Compliance demands can extend project timelines and increase implementation costs, requiring specialised expertise to manage effectively.

Key Market Segments

By Solutions

- Collaboration & Communication Platforms

- HR & Talent Management Systems

- Workplace Analytics & AI Tools

- Physical Workspace Technology (IoT, Smart Office)

- Others

By Service Type

- Consulting Services

- Digital Strategy & Roadmapping

- Change Management

- Workplace Experience Design

- Technology Integration Services

- Unified Communications Deployment

- Cloud Migration & Management

- Security & Compliance Integration

- Managed Services

- IT Support & Maintenance

- End-User Computing Management

- Analytics & Continuous Optimization

- Others

By Organization Size

- Large Enterprises

- Small & Medium Businesses

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Manufacturing & Industrial

- Government & Public Sector

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Accenture plc and Deloitte Touche Tohmatsu Limited hold a strong position in the infrastructure solution market through consulting led digital and infrastructure transformation. Their focus remains on strategy alignment, system integration, and enterprise scale deployment. International Business Machines Corporation and Microsoft Corporation support complex infrastructure needs with hybrid cloud, automation, and enterprise platforms.

Citrix Systems, Inc. and VMware, Inc. play a key role in virtualization and hybrid infrastructure management. Their offerings improve flexibility, access control, and operational efficiency. Google LLC contributes through scalable cloud infrastructure, analytics, and AI enabled services. Adobe Inc. supports infrastructure demand through digital experience platforms.

Atlassian Corporation supports infrastructure teams with collaboration and project management platforms. These tools improve coordination across IT and operations teams. Slack Technologies, LLC enables real time communication within distributed infrastructure environments. Zoom Video Communications, Inc. adds value through secure communication infrastructure. Other players address niche requirements and regional needs.

Top Key Players in the Market

- Accenture plc

- Deloitte Touche Tohmatsu Limited

- International Business Machines Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Company

- Citrix Systems, Inc.

- VMware, Inc.

- Google LLC

- Adobe Inc.

- Salesforce, Inc.

- ServiceNow, Inc.

- Atlassian Corporation

- Slack Technologies, LLC

- Zoom Video Communications, Inc.

- Others

Recent Developments

- In September 2025, Deloitte launched a global AI Infrastructure Center of Excellence in New York to help clients design and optimize cloud and data center architectures for AI workloads, with a strong focus on cybersecurity, compliance, and efficiency. The CoE translates complex infrastructure choices into business value, underscoring Deloitte’s push to lead large‑scale, AI‑first infrastructure transformations.

- In October 2025, IBM introduced new AI‑driven infrastructure capabilities, including enhanced observability and automation across hybrid cloud, to cut tool sprawl and improve security. The portfolio is aimed at enterprises running mission‑critical workloads across on‑prem and public cloud, reinforcing IBM’s position in intelligent infrastructure management.

Report Scope

Report Features Description Market Value (2025) USD 28.1 Bn Forecast Revenue (2035) USD 250.2 Bn CAGR(2026-2035) 24.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solutions (Collaboration & Communication Platforms, HR & Talent Management Systems, Workplace Analytics & AI Tools, Physical Workspace Technology (IoT, Smart Office), Others), By Service Type (Consulting Services, Technology Integration Services, Managed Services, Others), By Organization Size (Large Enterprises, Small & Medium Businesses), By End-User Industry (IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, Retail & Consumer Goods, Manufacturing & Industrial, Government & Public Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture plc, Deloitte Touche Tohmatsu Limited, International Business Machines Corporation, Microsoft Corporation, Cisco Systems, Inc., Hewlett Packard Enterprise Company, Citrix Systems, Inc., VMware, Inc., Google LLC, Adobe Inc., Salesforce, Inc., ServiceNow, Inc., Atlassian Corporation, Slack Technologies, LLC, Zoom Video Communications, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Infrastructure Solution MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Infrastructure Solution MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture plc

- Deloitte Touche Tohmatsu Limited

- International Business Machines Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Hewlett Packard Enterprise Company

- Citrix Systems, Inc.

- VMware, Inc.

- Google LLC

- Adobe Inc.

- Salesforce, Inc.

- ServiceNow, Inc.

- Atlassian Corporation

- Slack Technologies, LLC

- Zoom Video Communications, Inc.

- Others