Global Industrial Refrigeration Systems Market By Type(Compression Refrigeration Systems, Absorption Refrigeration Systems), By Component(Compressors, Reciprocating Compressor, Screw Compressor, Centrifugal Compressor, Others, Condensers, Evaporators, Controls), Refrigerant Type(Ammonia, Ammonia/CO2, CO2), By Application(Refrigerated Warehouse, Food and Beverage, Fruits and Vegetables, Beverages, Dairy and Dairy Products, Meat, Poultry, and Fish, Others, Refrigerated Transportation, Chemicals and Pharmaceuticals, Petrochemical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 57548

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

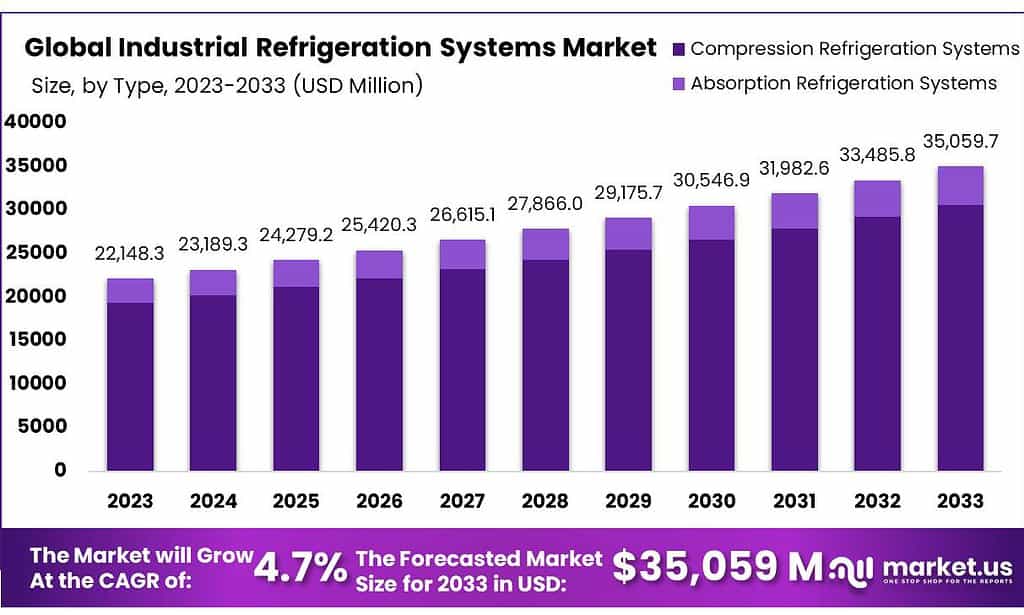

The Industrial Refrigeration Systems Market size is expected to be worth around USD 35,059.7 Million by 2033, from USD 22,148.3 Million in 2023, growing at a CAGR of 4.7% during the forecast period from 2023 to 2033.

Industrial refrigeration systems are specialized cooling setups designed to meet the needs of large-scale operations across various sectors. Unlike residential or commercial refrigeration, which primarily aims at preserving food and beverages at safe temperatures, industrial systems serve a multitude of applications including chemical manufacturing, cold storage, pharmaceuticals, and petrochemicals among others.

The global industrial refrigeration systems market is a critical and dynamic sector that plays a pivotal role in various industries such as food and beverage, pharmaceuticals, chemicals, and logistics. This market has witnessed substantial growth in recent years, driven by several key factors.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The global industrial refrigeration systems market was valued at USD 22,148.3 Million in 2023.

- The global industrial refrigeration systems market is projected to reach US$ 35,059.7 Million by 2033.

- Among system types, Compression Refrigeration Systems accounted for the largest market share of 3%.

- Among components, the Compressors accounted for the majority of the market share with 3%.

- Based on refrigerant type, Ammonia accounted for the largest market share in 2023 with 8%.

- By applications, the Food and beverage industry is anticipated to dominate the market in the coming years. Moreover, in 2023, it accounted for the majority of the share of 6%.

- North America is expected to hold the largest global industrial refrigeration systems market share with 9% of the market share.

- Asia-Pacific is anticipated to register a higher CAGR of 0% with a revenue share of 31.2% in 2023.

By Type

Factors Contributing to The Dominance of Compression Refrigeration Systems Are Their Inherent Characteristics, Efficiency, Scalability, Cost-Effectiveness, And Versatility.

The industrial refrigeration systems market is segmented based on type into compression refrigeration systems and absorption refrigeration systems. Among these, compression refrigeration systems held the majority of revenue share of 87.3% in 2023. Compression refrigeration systems are generally more efficient than absorption systems, especially for large-scale industrial applications.

They are capable of reaching lower temperatures more quickly and maintaining consistent cooling, which is crucial in industries where precise temperature control is necessary, such as in food processing and storage, pharmaceuticals, and chemicals. The efficiency of compression systems converts into better performance for the majority of industrial refrigeration needs.

Component Analysis

Owing to Their Central Role in the Refrigeration Cycle, Compressors Dominate the Market Among Components.

Based on a component, the market is segmented into compressors, condensers, evaporators, controls, and other components. Among these components, the compressors accounted for the majority of the market share with 39.3%. The dominance of compressors in the market share of industrial refrigeration systems can be attributed to their major role in the refrigeration cycle.

They compress the refrigerant, raising its pressure and temperature, and enabling it to circulate through the system to absorb and dispel heat. This process is fundamental to all refrigeration systems, whether used in food storage, pharmaceuticals, or chemical processing. The indispensability of compressors in this process makes them a critical purchase for any industrial refrigeration system.

Compressors account for a major portion of the market share in industrial refrigeration systems due to their central role in the refrigeration process, adaptability to various applications, technological advancements, impact on energy efficiency, maintenance, and lifespan considerations, as well as growing market demand fueled by expanding industrial applications.

By Refrigerant Type

Ammonia Has Excellent Thermodynamic Properties That Make It Highly Efficient as a Refrigerant.

Based on refrigerant types, the market is further divided into ammonia, ammonia/CO2, CO2, and other refrigerant types. Among these refrigerant types, ammonia accounted for the largest market share in 2023 with 59.8%.

This prominence is due to several intrinsic properties of ammonia such as, it has a high latent heat of vaporization, which means it can absorb more heat while vaporizing at a lower volume compared to other refrigerants. This efficiency translates into lower operating costs and smaller equipment requirements, making it a cost-effective solution for large-scale industrial refrigeration.

Ammonia’s refrigeration systems are more energy-efficient compared to systems using other refrigerants. This efficiency is increasingly important in a world where energy conservation and cost reduction are critical operational goals for many industries.

*Actual Numbers Might Vary In The Final Report

Application analysis

Intrinsic Requirement for Refrigeration in Food Processing and Preservation, Food & Beverage Industry Dominate the Market.

Based on applications, the market is further divided into refrigerated warehouse, food & beverage, refrigerated transportation, chemicals & pharmaceuticals, petrochemicals, and other applications. Among these applications, food & beverage accounted for the largest market share in 2023 with 28.6%.

The most fundamental reason for the food & beverage industry’s reliance on refrigeration systems is the necessity to preserve perishable products. Refrigeration slows down bacterial growth, thereby extending the shelf life of perishable items such as fruits, vegetables, dairy products, meats, and seafood. Moreover, the Hazard Analysis and Critical Control Points (HACCP) system emphasizes temperature control as a critical factor in food safety.

The food & beverage industry relies on industrial refrigeration systems to meet HACCP requirements. Hence, the food & beverage industry’s dominance in the industrial refrigeration systems market is a multifaceted phenomenon.

It is driven by the essential role of refrigeration in food safety and quality, regulatory mandates, consumer demands, technological advancements, and the expansion of the retail sector. As the global population grows and consumer preferences evolve, the significance of refrigeration in the food and beverage sector is expected to continue rising.

Key Market Segments

By Type

- Compression Refrigeration Systems

- Absorption Refrigeration Systems

By Component

- Compressors

- Reciprocating Compressor

- Screw Compressor

- Centrifugal Compressor

- Others

- Condensers

- Evaporators

- Controls

- Other Components

Refrigerant Type

- Ammonia

- Ammonia/CO2

- CO2

- Other Refrigerant Types

By Application

- Refrigerated Warehouse

- Food & Beverage

- Fruits & Vegetables

- Beverages

- Dairy and Dairy Products

- Meat, Poultry, and Fish

- Others

- Refrigerated Transportation

- Chemicals & Pharmaceuticals

- Petrochemical

- Other Applications

Drivers

Rapid Growth of the Food & Beverage Industry is Anticipated to Bolster the Demand for Refrigeration Systems

A significant driver propelling the growth of the industrial refrigeration systems market is the burgeoning demand from the processed food and beverage industry. This sector relies heavily on refrigeration systems for various processes, including preservation, processing, and storage, to ensure the safety and longevity of products.

The global rise in the consumption of processed foods can be attributed to changing lifestyle patterns, especially in urban settings. With increasing working populations and busy schedules, there’s a growing preference for quick, convenient, and ready-to-eat food products. This shift has led to a surge in the production of processed foods, thereby necessitating advanced and efficient refrigeration systems to handle increased volumes and maintain quality standards.

Cold storage facilities, refrigerated trucks, and other aspects of cold chain logistics are critical for preserving the quality and safety of perishable goods such as fruits, vegetables, meat, and dairy products. Regulatory requirements concerning food safety further augment the necessity for reliable and efficient refrigeration systems, ensuring that food products meet stringent quality controls throughout the supply chain.

This uptick in demand provides an enormous market opportunity for players in the industrial refrigeration market. To meet the global demand and standards, companies are investing in state-of-the-art refrigeration systems that ensure the freshness and safety of products during transportation and storage in different climatic conditions. This international trade in perishable food products further amplifies the need for robust industrial refrigeration.

Technological Advancements in Refrigeration Systems

Advancements in technology are leading to the development of refrigeration systems with improved energy efficiency, which can significantly reduce operating costs and carbon footprint. Innovations in this field include the use of alternative, eco-friendly refrigerants, advanced compressor technologies, and IoT-enabled smart systems that allow for real-time monitoring and optimization of performance.

Additionally, there is a growing trend towards the customization of refrigeration systems to meet specific industry needs, offering opportunities for manufacturers to innovate and expand their product offerings. These bespoke solutions can cater to the unique requirements of different industries, ranging from intricate temperature controls for pharmaceuticals to large-scale systems for food storage and processing.

- For instance, Energy Star-certified commercial refrigeration equipment is 50% more energy-efficient than non-certified models, according to the U.S. Environmental Protection Agency.

The industrial refrigeration market is also propelled by rapid technological advancements. Innovations such as IoT-enabled temperature monitoring, AI-based system controls, and energy-efficient cooling solutions are changing the dynamics of refrigeration systems. Industries are increasingly seeking solutions that not only meet their cooling requirements but also help in reducing operational costs.

Modern systems offer smart, centralized control, real-time monitoring, and data analytics, enabling businesses to maintain optimal conditions while minimizing energy consumption. With sustainability being a significant concern, companies are more inclined to invest in advanced systems that are both efficient and environmentally friendly. This, in turn, has created a high demand for technologically sophisticated industrial refrigeration solutions.

Restraints

Energy Consumption and Operating Costs of Industrial Refrigeration Systems May Hinder the Growth of the Market

One of the major restraints facing the industrial refrigeration systems market is the high initial investment and operating costs associated with these systems. Installing a comprehensive refrigeration system involves significant capital expenditure, which includes the cost of the equipment, installation, and integration with existing processes. Moreover, the operation of these systems incurs considerable expenses, primarily due to energy consumption.

Refrigeration systems are energy-intensive, and with rising energy prices, this becomes a significant ongoing cost for operators. Additionally, there are maintenance and repair costs that add to the overall operational expenditure. For small and medium-sized enterprises (SMEs), these costs can be particularly daunting, potentially limiting their ability to upgrade to more efficient and advanced refrigeration systems.

This challenge is further compounded in regions with limited access to affordable energy sources or where there are stringent environmental regulations that necessitate the use of more expensive, eco-friendly refrigeration technologies. The high operating costs associated with industrial refrigeration systems are primarily driven by electricity costs, which can be volatile and challenging to predict.

Regular maintenance is crucial to ensure efficient operation, as neglect can lead to costly breakdowns and component replacements. Additionally, strict environmental regulations aimed at reducing greenhouse gas emissions necessitate investments in energy-efficient equipment, increasing upfront expenses.

To address energy consumption challenges and lower operating costs, companies often need to invest in technology upgrades, including more energy-efficient systems, though these investments can involve significant capital expenditures.

Opportunities

Utilization of Sustainable and Energy-Efficient Systems Are Expected To Create Lucrative Opportunities

The world is increasingly becoming conscious of its environmental footprint, with both consumers and governments pushing for more sustainable technologies. This presents a massive opportunity for key players in the industrial refrigeration market to invest in Research and development (R&D) to create energy-efficient and eco-friendly refrigeration solutions.

Newer, more efficient systems have the potential to reduce operational costs significantly over time, offering a strong value proposition for businesses looking to upgrade their existing infrastructure.

The trend toward sustainability is not merely a choice but increasingly becoming a regulatory mandate. Various countries are imposing strict guidelines on energy consumption and greenhouse gas emissions, thereby providing an impetus for the transition to greener technologies.

Companies that can offer refrigeration systems with natural refrigerants, reduced energy consumption, and lower Global Warming Potential (GWP) can not only corner a rapidly expanding market segment but also gain from potential subsidies and incentives offered for sustainable practices.

Moreover, such sustainable systems could open doors to sectors that are particularly sensitive to environmental considerations, such as organic food processing or green manufacturing, thereby expanding the market reach. The key to capitalizing on this opportunity lies in continuous innovation, partnerships with environmental agencies, and robust marketing strategies that highlight long-term cost savings and environmental benefits to the end-users.

Trends

Integration of Artificial Intelligence and IoT

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is a transformative trend in the industrial refrigeration systems market, profoundly impacting its future. As technology continues to evolve, there is a clear trend towards the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) within industrial refrigeration systems.

AI algorithms can analyze large datasets to predict equipment failure, suggest maintenance schedules, and improve overall system efficiency. With IoT sensors continuously monitoring various components, AI can analyze this data to predict equipment failures before they occur. This predictive maintenance approach reduces downtime, extends the lifespan of the equipment, and saves costs associated with emergency repairs.

IoT devices help in real-time monitoring and centralized control. Such smart refrigeration systems are capable of adjusting cooling conditions automatically to meet the specific requirements of stored goods. This level of automation not only enhances operational efficiency but also helps organizations adhere to increasingly stringent regulatory requirements regarding product quality and safety.

Manufacturers are investing heavily in R&D to integrate these technologies, making it a trend that is likely to influence market dynamics substantially.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impact the Growth of the Industrial Refrigeration Systems Market Due to The Halt in Production and Supply Chain Activities

Geopolitical tensions can lead to disruptions in global supply chains. This affects the availability of materials and components essential for manufacturing refrigeration systems. For instance, conflicts or strained relations between manufacturing hubs and consumer markets can lead to delays, increased costs, and scarcity of parts.

Changes in trade policies and the imposition of tariffs can significantly impact the market. For instance, protective tariffs on imported refrigeration components or systems can increase costs for manufacturers and, ultimately, end-users. Conversely, trade agreements that lower tariffs can boost market growth by making products more affordable and accessible.

The industrial refrigeration systems market is closely tied to energy markets. Geopolitical events that affect oil and gas supplies key energy sources for powering refrigeration systems—can lead to fluctuations in energy costs. Increased energy prices can raise operational costs for users of refrigeration systems, impacting their investment capabilities.

Regional Analysis

North America is estimated to be the Most Lucrative Market in the Global Industrial Refrigeration Systems Market

North America held the largest market share, with 34.9% of industrial refrigeration systems market in 2023. This is attributed to the robust industrial base, technological advancements, stringent regulatory frameworks, and a high demand for refrigeration systems across various sectors.

North America, particularly the United States, has a well-established and diverse industrial sector. The region is a hub for numerous industries that heavily rely on refrigeration systems, such as food processing, pharmaceuticals, chemical manufacturing, and cold chain logistics.

The presence of large-scale food processing companies, coupled with a significant emphasis on food safety and quality, drives the demand for advanced refrigeration systems. After North America, Asia-Pacific is anticipated to register a higher CAGR of 6.0% with a revenue share of 31.2% during the forecast period. With countries such as China, India, and Japan being industrial powerhouses, there’s a high demand for industrial refrigeration for various applications such as food processing, chemicals, and pharmaceuticals.

The population in the Asia-Pacific region is increasing rapidly, which results in higher food consumption. This has necessitated better cold storage and transportation facilities, thus boosting the industrial refrigeration market. These factors collectively contribute to the higher CAGR seen in this market compared to other regions.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Strong Focus On Product Portfolio Expansion Through Various Strategies Maintain the Dominance of Industry Leaders

Mergers and acquisitions are common strategies for rapid expansion in this market. Mergers, acquisitions, and strategic partnerships with other industry players or technology providers can help industry leaders broaden their product offerings and market reach. Companies in the industrial refrigeration systems industry are employing various strategic approaches to maintain their dominance as industry leaders.

These strategies are essential for staying competitive, driving innovation, and meeting the evolving needs of customers and the market. Leading companies are shifting towards natural refrigerants, such as ammonia and CO2, which have a lower environmental impact compared to traditional synthetic refrigerants. This aligns with global efforts to reduce greenhouse gas emissions.

Maintaining dominance as an industry leaders in the industrial refrigeration systems sector requires a multifaceted approach that combines innovation, sustainability, global expansion, customer-centricity, regulatory compliance, talent development, and thought leadership. Companies that effectively execute these strategies can not only retain their leadership positions but also drive the evolution of the industry.

Market Key Players

- Mitsubishi Electric Corporation

- Daikin Industries, Ltd.

- Johnson Controls International Plc

- Carrier Global Corporation

- Emerson Electric Co.

- Danfoss A/S

- Ingersoll Rand Inc.

- GEA Group AG

- SPX Technologies, Inc.

- Bitzer SE

- Baltimore Aircoil Company, Inc.

- Frick India Limited

- Other Key Players

Recent development

- In April 2023, Carrier Global Corporation is set to complete the acquisition of Viessmann Climate Solutions for a substantial €12 billion, which will be paid in cash and stock issued directly to the Viessmann Group. This acquisition is accompanied by a significant and enduring commitment to long-term ownership. Carrier Global Corporation intends to divest from its Fire and security and Commercial Refrigeration sectors.

- In June 2023, Johnson Controls acquired M&M Carnot, a prominent player in the natural refrigeration solutions industry. These solutions boast an exceptionally low global warming potential (GWP), positioning them as an ideal choice for customers aiming to align with sustainability objectives and surpass environmental compliance standards.

Report Scope

Report Features Description Market Value (2023) US$ 22,148.3 Mn Forecast Revenue (2033) US$ 35,059.7 Mn CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Compression Refrigeration Systems, Absorption Refrigeration Systems), By Component (Compressors, Condensers, Evaporators, Controls, and Other Components), By Refrigerant Type (Ammonia, Ammonia/CO2, CO2, and Other Refrigerant Types) By Application (Refrigerated Warehouse, Food & Beverage, Refrigerated Transportation, Chemicals & Pharmaceuticals, Petrochemical, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Mitsubishi Electric Corporation, Daikin Industries, Ltd., Johnson Controls International Plc, Carrier Global Corporation, Emerson Electric Co., Danfoss A/S, Ingersoll Rand Inc., GEA Group AG, SPX Technologies, Inc., Bitzer SE, Baltimore Aircoil Company, Inc., Frick India Limited, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are industrial refrigeration systems?Industrial refrigeration systems are large-scale cooling systems used in industries such as food and beverage, pharmaceuticals, chemicals, and more. These systems maintain low temperatures for storage, processing, and preservation of products on an industrial scale.

What drives the growth of the industrial refrigeration systems market?Factors like increasing demand for frozen foods, growth in the pharmaceutical sector, stringent food safety regulations, and technological advancements are driving the market growth.

How important is energy efficiency in these systems?Energy efficiency is crucial due to environmental concerns and operational costs. Companies are investing in technologies that offer better energy efficiency to reduce operational expenses and carbon footprints.

Industrial Refrigeration Systems MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Industrial Refrigeration Systems MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Johnson Controls

- Emerson Electric Co

- Danfoss

- GEA Group Aktiengesellschaft

- MAYEKAWA MFG. CO., LTD.

- BITZER Kühlmaschinenbau GmbH

- DAIKIN INDUSTRIES, Ltd.

- EVAPCO, Inc.

- Other Key Players